By using CFD contracts (Contract for Difference), traders can profit from price fluctuations without the need for physical asset ownership.

Thanks to this feature, investors under a Contract for Difference are not subject to asset holding costs or Capital Gains Tax; however, they also do not receive dividends, bonds, or voting rights.

What is CFD Contract?

A CFD contract (Contract for Difference) is a financial instrument that allows traders to speculate on price differences of assets without physical ownership.

The advantage of a Contract for Difference is that it enables profit from price volatility without physical investment in commodities.

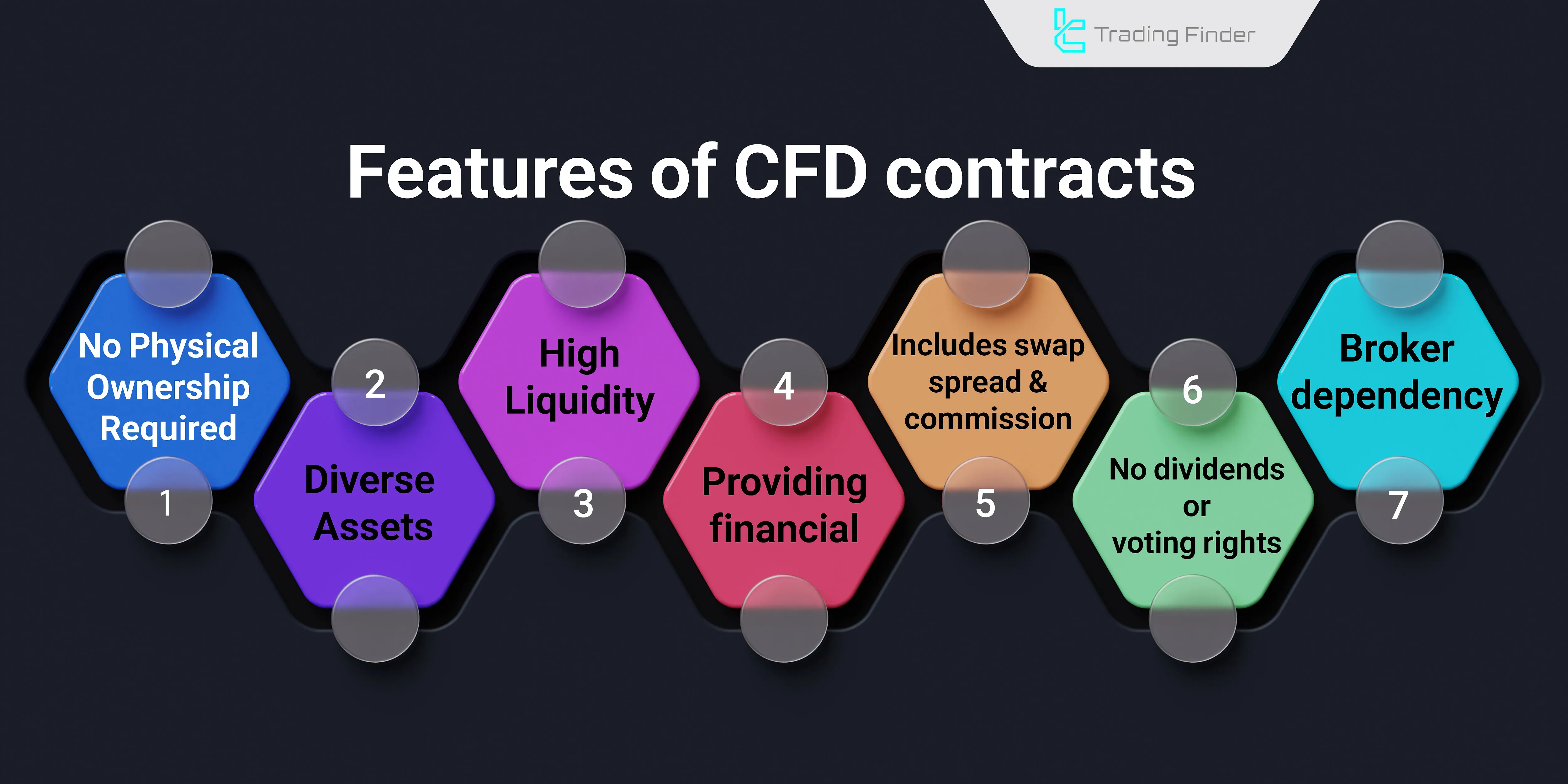

What Are the Features of a CFD Contract?

Contracts for Difference, with their high leverage, two-way trading, and high liquidity, have become attractive tools for market participants—though high leverage also increases trading risks.

Key Features of CFD Contracts:

- No Physical Ownership Required: In CFD contracts, traders agree to profit solely from price changes;

- Two-Way Trading: CFDs allow both long (buy) and short (sell) positions;

- Leverage: Leverage lets you trade larger positions with less capital;

- Diverse Assets: CFDs cover a wide range of assets, including stocks, forex pairs, cryptocurrencies, and stock indices;

- High Liquidity: Ensures faster executions and tighter spreads;

- Trading Costs: CFD trades incur spreads, swaps, and sometimes commissions. To compare brokers, visit Broker Reviews on TradingFinder;

- No Dividends or Voting Rights: Since CFDs involve no asset ownership, traders do not receive dividends or voting rights;

- Trading Hours: CFDs are traded 24/5 (24 hours a day, 5 days a week);

- Broker Dependency: brokers offer CFDs, making the choice of a reliable broker critical.

Pros and Cons of CFD Contracts

Since CFD traders do not own the underlying asset, they avoid holding costs like taxes but forfeit dividend payouts or voting rights.

The image below summarizes the advantages and disadvantages of CFDs:

It is worth noting that the tax regulations for CFDs may vary depending on the country:

- Exemption from Capital Gains Tax: In countries like the UK, CFD profits are not taxed as they do not constitute asset ownership;

- Income Tax: CFD profits are subject to income tax in some European countries.

Types of CFD Contracts

CFDs are available for nearly all financial assets, though some (e.g., cryptocurrencies) are newer and less diverse.

Types of CFD Contracts:

- Forex CFDs (Currency Pairs): Profit from forex pair fluctuations. The Forex Market is the largest financial market, prized for its analyzability;

- Stock CFDs: Exclude holding costs but omit dividends and voting rights;

- Index CFDs: Track indices like S&P500 or Nikkei225; overnight swaps apply;

- Commodity CFDs: Trade gold, oil, silver, etc., without physical storage;

- Crypto CFDs: Relatively new, with limited variety among brokers;

- Bond CFDs: Profit from price changes in bonds (low volatility; no coupon payments);

- Interest Rate CFDs: Speculate on central bank rate changes. Monitor rates via the Central Bank Interest Rates Tool;

- ETF CFDs: Gain exposure to asset baskets (performance tied to the fund, not individual assets).

CFD Trading Example

For example, a trader predicts that Nvidia stock will rise. He buys 100 shares of Nvidia for $110, making the total value of the trade $11,000.

If the broker offers 1:10 leverage, the trader can enter the position by paying only 10% of the trade’s value (i.e., 10% of $11,000, which is $1,100).

Now, assuming the stock price rises to $120, the trader makes a profit of $1,000. On the other hand, if the stock price falls to $100, the trader incurs a loss of $1,000.

CFD Cost Breakdown:

- Spread cost: If the spread is considered $0.10, buying 100 shares would reduce the trader’s profit by $10;

- Swap cost: In stock trading, swap fees are charged daily—so if Nvidia's daily fee is \$2 and a position is held for 3 days, the total cost will be $6..

Conclusion

CFDs cover forex pairs, stocks, cryptocurrencies, bonds, and ETFs. Traders use Contracts for Difference to speculate on price movements without physical ownership.

Market diversity, leverage, and liquidity make CFDs ideal for short- and long-term traders.