The Interest Rate is the cost of borrowing money; that is, for borrowing money for a specified period, how much interest the borrower must pay. The Interest Rate can be simple, compound, or variable, which changes the total repayment amount.

In the simple case, the Interest Rate in each period is applied only to the principal; but in the compound case, in each period, in addition to the principal, the interest earned in the previous period also earns interest.

Therefore, the return on deposits in the compound case is significantly higher than in the simple case; also, investors, based on their expectations of future changes in Interest Rates, can borrow at Fixed Rate or variable rates.

What is the Interest Rate?

The Interest Rate is the cost that the borrower pays to the lender in exchange for receiving funds over a specific period; in fact, it can be said that the Interest Rate is the cost the borrower incurs to obtain a loan.

The longer the debt repayment period, naturally the higher the Interest Rate, because the borrower repays the debt later.

For example, if the annual Interest Rate is 5% and the borrower takes a loan of $1,000, they must repay $1,000 plus $50 (the loan interest), totaling $1,050 to the lender at the end of the year. Here, the $50 is the borrowing cost for the borrower.

You can view the Interest Rates of different economies through the Interest Rate Tool provided by Trading Finder. For a visual tutorial on Interest Rates, you can also refer to the video from the International Monetary Fund channel:

History of the Interest Rate

The Interest Rate is one of the oldest financial concepts, with roots in the ancient civilizations of Sumer, Babylon, and Egypt, where loan contracts with interest were recorded.

In ancient Greece and Rome, interest was also used to finance trade and public works, although philosophers like Aristotle regarded it as unnatural and unethical.

In the Middle Ages, the Christian Church and Islamic jurisprudence declared receiving interest to be usury and prohibited it, but the need for investment led to indirect forms continuing.

With the Renaissance and the emergence of modern banking, interest was officially accepted, and in Elizabethan England, paying it was permitted under a specified legal ceiling.

During the Industrial Revolution, the Interest Rate became a main pillar, and in the modern economy it also plays an important role as a monetary policy tool to control inflation, guide business cycles, and maintain financial stability.

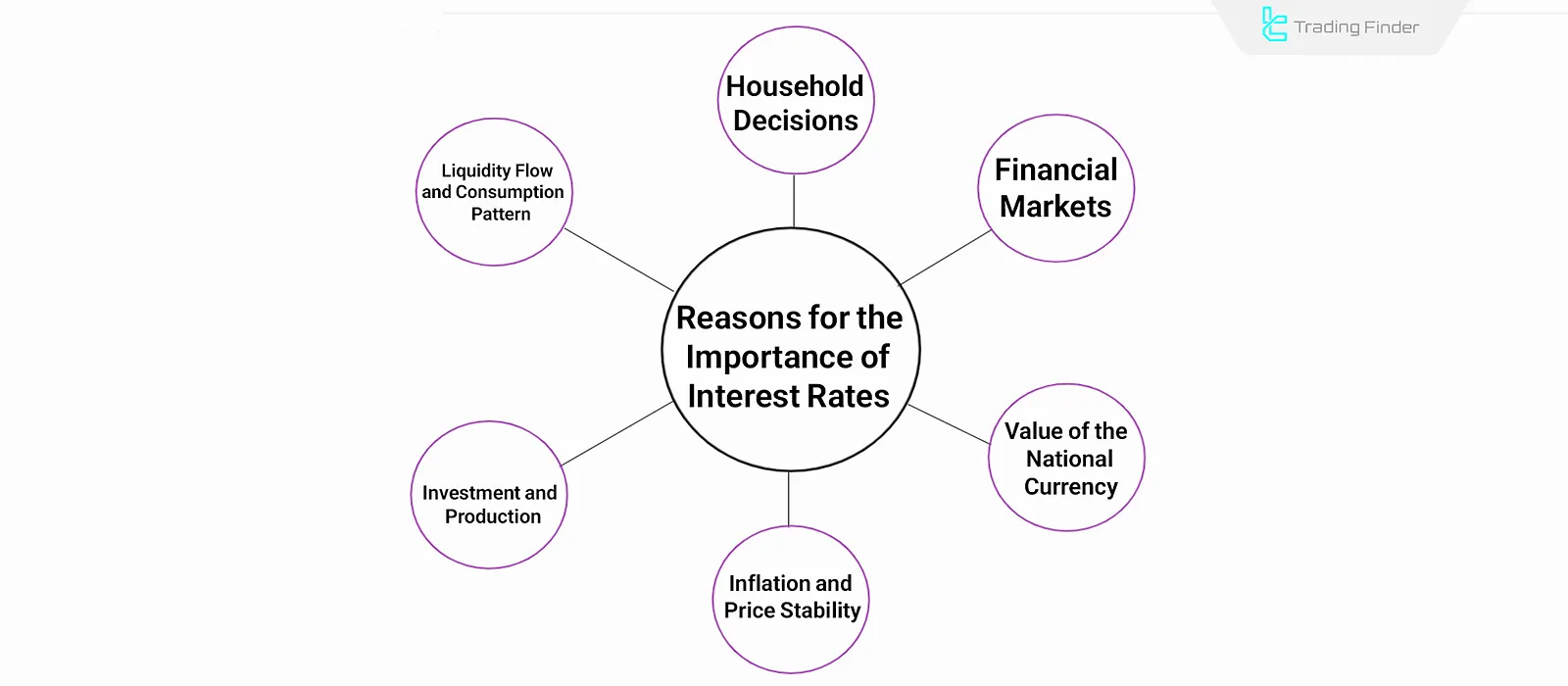

Why is the Interest Rate important?

As the price of money, the Interest Rate is one of the most important macroeconomic variables, with impacts visible across multiple dimensions. Reasons for its importance include:

- Liquidity flow and consumption pattern: Changes in the Interest Rate determine the direction of capital movement in the economy and consumer behavior;

- Investment and production: Lower Interest Rates reduce financing costs for businesses, making new investments more attractive;

- Inflation and price stability: Higher Interest Rates serve as a tool to reduce inflationary pressures and control credit growth;

- Impact on the value of the national currency: Differences in Interest Rates compared to other countries directly influence the attractiveness of foreign investment and, consequently, exchange rates;

- Financial markets: The level of Interest Rates is a key factor in bond yields, deposit attractiveness, and the inflow or outflow of capital from stock markets;

- Household decisions: Choices between current consumption and savings depend on the Interest Rate.

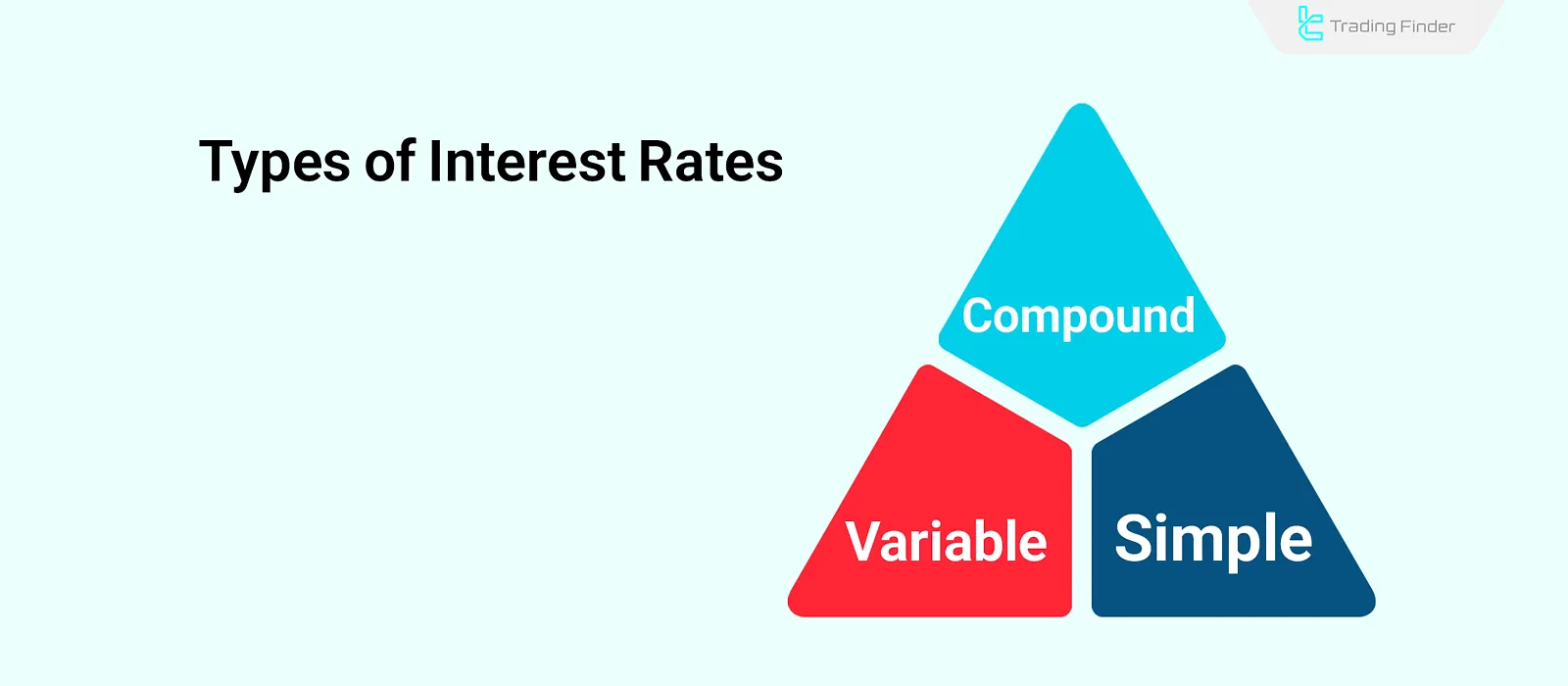

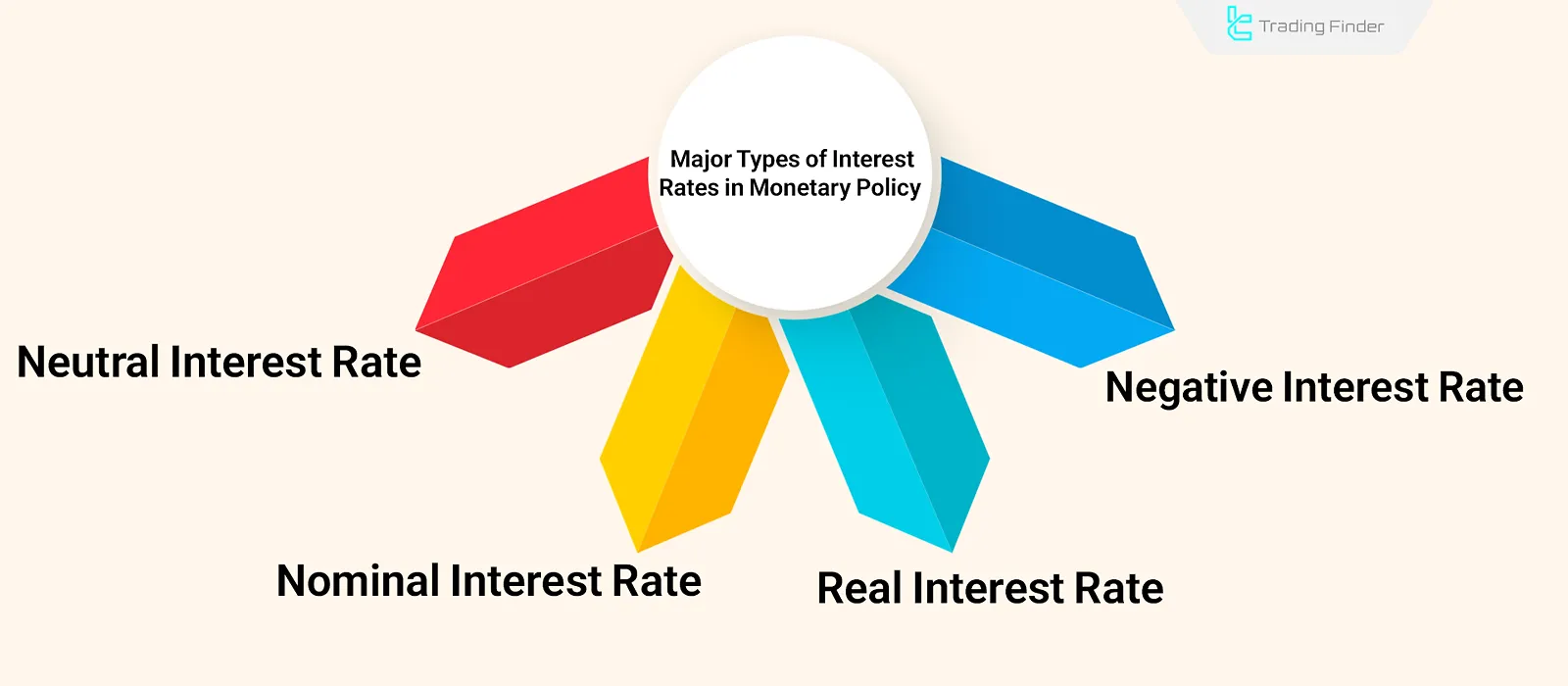

Types of Interest Rates

Interest Rates come in simple, compound, and variable forms; these create significant differences in deposit returns.

Under a simple Interest Rate, interest applies only to the principal, and this interest does not change across different periods; but under compound interest, each period’s interest is added to the principal, and then interest accrues on that new total in subsequent periods.

this leads to a significant difference in total interest received over the long term.

Also, borrowers, based on their expectations about future changes in Interest Rates, can take loans with a fixed or variable Interest Rate; for example, if a producer expects Interest Rates to decline, by taking a loan with a variable Interest Rate they can benefit from that situation.

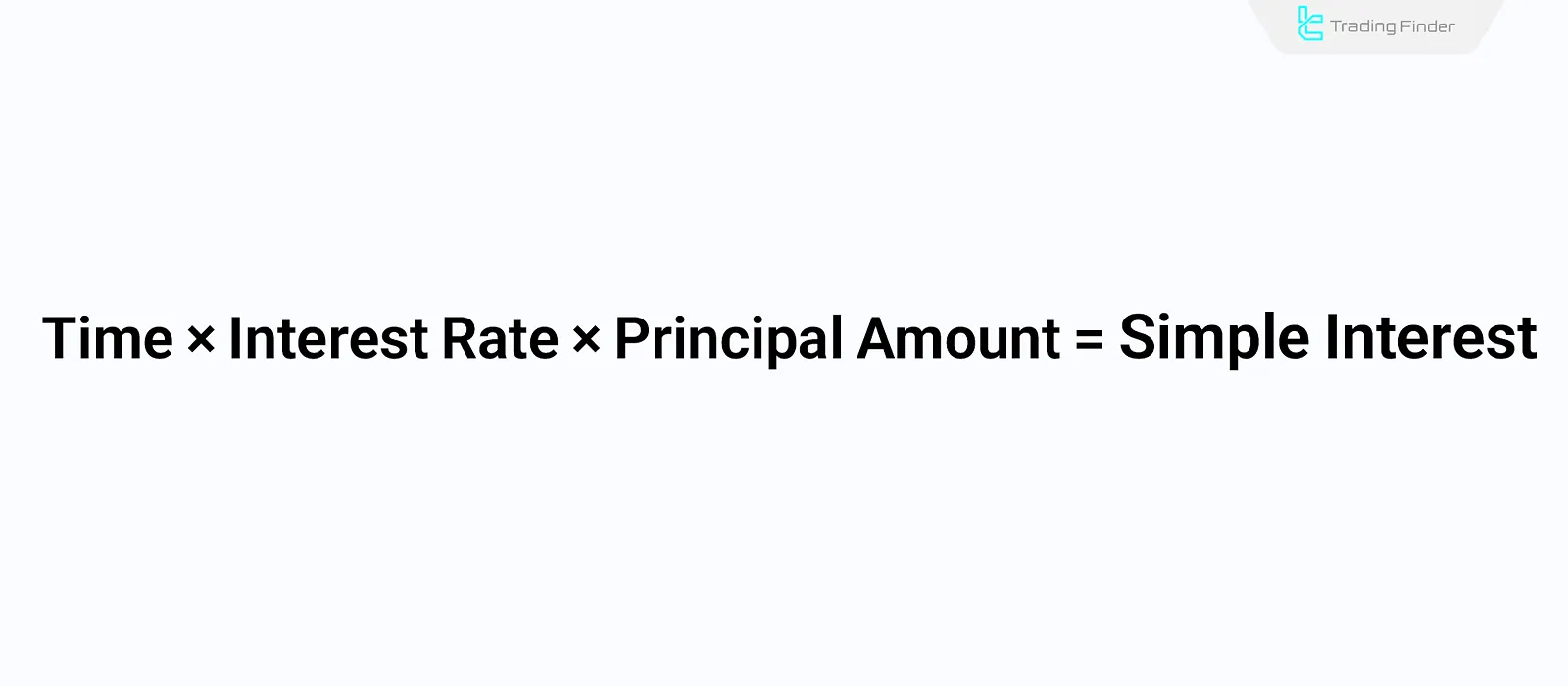

Simple Interest Rate

Under simple interest, only the interest on the principal is applied in each period, and there is no compounding effect.

The number of investment or borrowing periods is not accounted for in the simple Interest Rate; the simple Interest Rate is calculated using the following formula:

For example, if a depositor places 1000$ (initial capital) at an annual simple interest of 10% (the decimal Interest Rate in the formula), after three years, 300 dollars in interest will be due to them according to the formula.

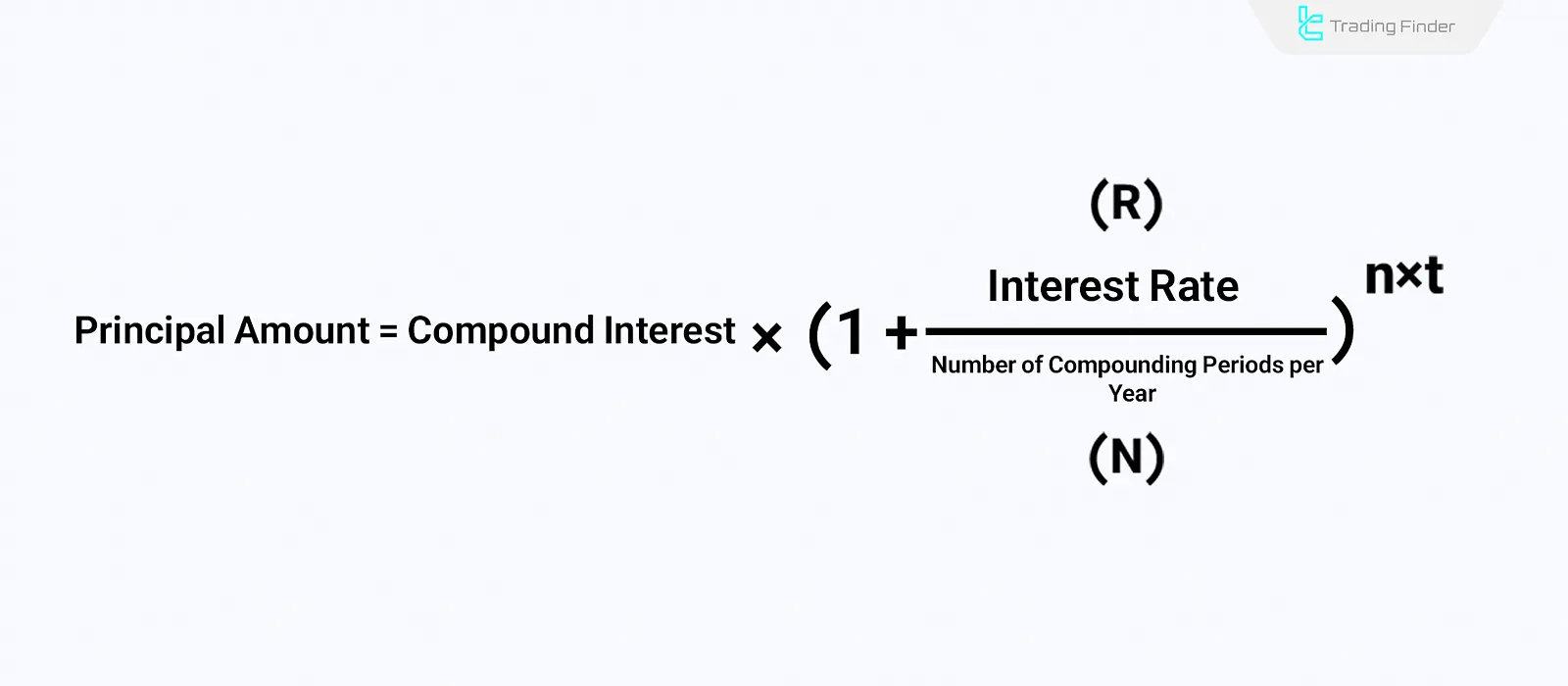

Compound Interest Rate

In compound interest, each period’s interest is also included when calculating the return for the next period, and that is the difference from simple interest. Thus, compound interest is calculated according to the following formula:

As is clear, including the number of compounding periods per year (n) in this formula is what differentiates compound interest from the simple type.

For example, if an investor deposits 1000 dollars for three years at an annual interest of 10 percent, compounded annually (1 time), after three years they receive 1331$ in proceeds.

Thus, the difference in return compared to simple interest is 1031 dollars, showing that simple and compound interest produce markedly different returns.

Note: In compound interest, banks usually limit the number of compounding periods, because the more frequent the compounding,the more return they are obliged to pay.

Interbank Interest Rate

The interbank rate (interbank Rate) is the short-term lending rate between banks in the repo market (Repo Market); this rate reflects banks’ financing costs.

An increase in the repo rate means higher risk; in financial crises, due to reduced trust, the interbank Interest Rate usually increases sharply.

Note: In the repo or interbank market, banks issue short-term loans backed by securities; this market is used to regulate the banking system’s liquidity; it is also a source of income for financial institutions from securities interest.

Prevailing Interest Rate

yields and Interest Rates move in the same direction; in other words, when Interest Rates rise, bond yields also increase. Conversely, when Interest Rates fall, bond yields decline as well.

Bond prices, however, have an inverse relationship with bond yields. This is because the bond’s face value at maturity is fixed, while its market price fluctuates based on supply and demand. Naturally, if the price of a bond increases, its yield decreases.

When Interest Rates rise, demand for lower-yield bonds falls. As a result, lower demand reduces their price, and this continues until bond yields align with the new Interest Rate.

The reverse happens when Interest Rates fall. With lower rates, demand for higher-yield bonds rises, increasing their price. The price continues to rise until the bond yield adjusts to the prevailing Interest Rate.

Because of this direct relationship between bond yields and Interest Rates, bond yields are also used to forecast future Interest Rates. In fact, market expectations of Interest Rate trends are reflected in the bond market.

Application of the Interest Rate in monetary policy

Monetary policy is conducted with the aim of controlling inflation and unemployment, and the Interest Rate is the main tool for implementing it; with changes in Interest Rates, borrowing costs and returns in low-risk markets (bonds, investment funds, etc.) broadly change.

affecting money supply, demand for loans and deposits, market operations, and high-risk markets (such as stocks or cryptocurrency).

Nominal Interest Rate

The nominal Interest Rate is the official rate set by the central bank at the Interest Rate meeting (for example, the FOMC in the United States); this rate is adjusted according to changes in economic indicators. The central bank adopts two different approaches to Interest Rates to support economic growth or control inflation:

Rate cuts in expansionary monetary policy

In expansionary monetary policy aimed at supporting economic growth, the Interest Rate is reduced.

lower borrowing costs increase loan demand and bring prosperity to production and, in turn, the labor market; also, because bank interest and return in low-risk markets decline, credit risk markets attract liquidity.

Rate cuts are implemented alongside other monetary policy tools such as open market operations, credit ceilings, or yield curve control.

Rate hikes in contractionary monetary policy

In contractionary monetary policy, the Interest Rate increases; as borrowing costs rise, returns in other low-risk markets also increase in parallel, and people are no longer willing to invest in risky markets to obtain returns.

Higher borrowing costs make financing more challenging for producers, especially small companies. Therefore, the labor market and consumer demand weaken; for this reason, higher Interest Rates constrain economic growth.

Negative Interest Rate in monetary policy

With a negative Interest Rate, the depositor must pay the bank at the end of the period; the bank, in turn, is obliged to pay the central bank for the deposited money.

Therefore, under negative rates, individuals are not inclined to deposit and prefer to buy goods (higher demand) or invest in production (higher investment); for this reason, a negative Interest Rate is considered an ultra easy monetary policy (Ultra easy monetary policy).

Also, in a negative-rate period.

the cost of borrowing drops sharply; however, it usually does not reach zero, but a significant reduction in borrowing costs encourages people to take loans.

This policy is usually implemented to prevent deflation, recession, or a disinflation crisis (over-strengthening of fiat money). Central banks usually, due to public dissatisfaction, are not inclined to implement negative rates and only do so if compelled.

Real Interest Rate in monetary policy

The real Interest Rate is obtained by subtracting inflation from the nominal rate and is a hidden tool of monetary policy. For example, if the nominal rate is 5% and inflation is 2%, the real Interest Rate is a positive 3 percent.

If the real rate is positive as in the example above, it means that the producer earns less, relative to low-risk returns or borrowing costs, than inflation (the average price increase of the product)

which is why taking loans with rates above inflation is not cost-effective. Thus, a positive real rate is a constraining or contractionary policy.

Conversely, a negative real Interest Rate means the cost of borrowing is below inflation; therefore, borrowing at a rate below inflation benefits producers and supports economic growth (expansionary monetary policy).

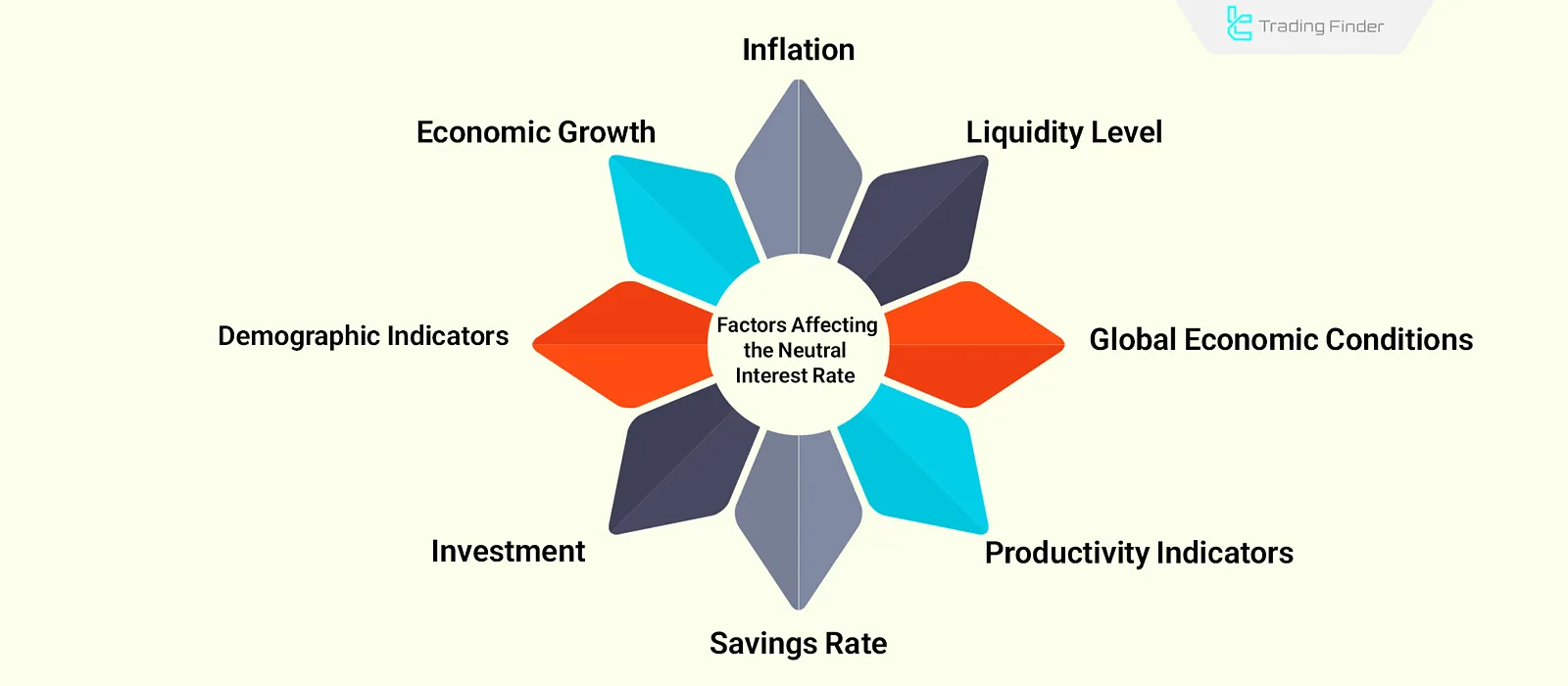

Neutral Interest Rate

The neutral Interest Rate is a level of monetary policy at which economic growth continues at a steady level; in fact, at the neutral level, monetary policy is neither restrictive nor stimulative for economic growth.

The neutral Interest Rate is a key metric for implementing monetary policy; if the rate is above the neutral range, policy is contractionary, and if it is below the neutral range, policy is expansionary.

The neutral rate is not a specific level, and its range is estimated by the central bank.

Factors affecting the estimation of the neutral rate range:

- Inflation

- Level of liquidity

- Economic growth

- Savings and investment

- Global economic conditions

- Demographic indicators (population structure and the society’s average age)

- Productivity indicators

Interest Rate Detection Indicator

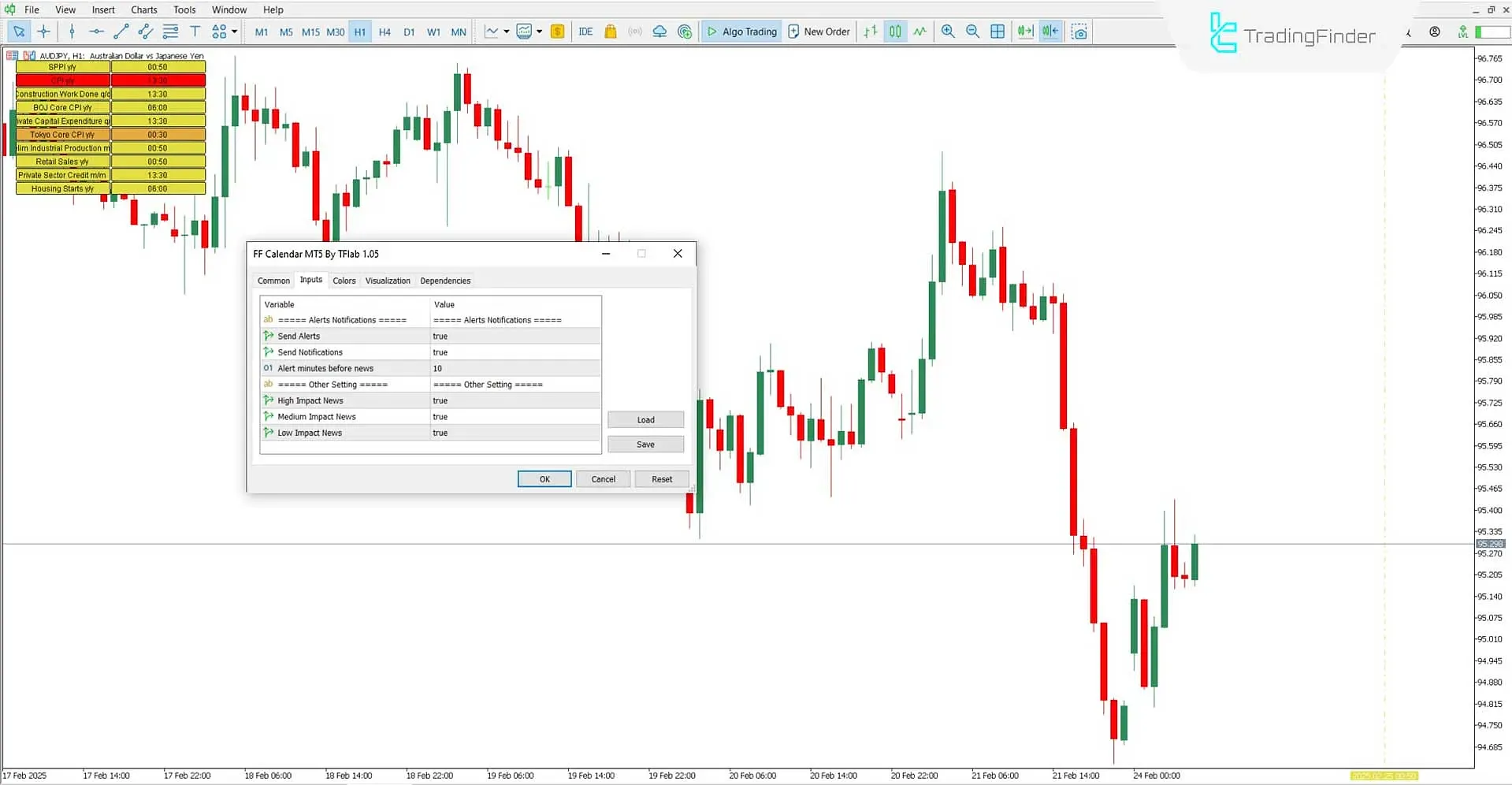

To identify Interest Rate timing, traders can use the Forex Factory Calendar indicator in Trading Finder. The Forex Factory Calendar indicator is a practical tool that directly imports major economic events from the Forex Factory website and displays them on the chart.

Data such as employment statistics, inflation rates, and the GDP index are delivered in real time, allowing traders to analyze news alongside price movements. Video tutorial for the Forex Factory Calendar indicator:

To activate the indicator, simply copy the CSV weekly calendar link from the Forex Factory website’s Calendar section and add it to Options > Expert Advisors > Allow Web Request for listed URL in MetaTrader.

After this step, the indicator automatically loads the news onto the chart.

A key feature of this tool is the display of news in a timeline format with colored vertical lines. The colors indicate the importance of the news: red (high impact), orange (medium impact), and yellow (low impact).

The indicator settings also include options such as alerts, notifications, and the ability to set time intervals before the news release.

The usefulness of this tool is evident across different markets. For example, on the EUR/CAD chart, an Interest Rate announcement can trigger a strong price reaction.

How to adjust the Forex Calendar indicator settings for detecting Interest Rates

In summary, the Forex Factory Calendar indicator builds a bridge between technical and fundamental analysis, enabling traders to better understand the impact of economic news on forex, stocks, and commodities, and make more precise decisions.

Links for using the Forex Factory Calendar indicator:

- Forex Factory Calendar indicator in MetaTrader 4

- Forex Factory Calendar indicator in MetaTrader 5

- Forex Factory Calendar indicator in TradingView

Example of Interest Rate comparison across different countries

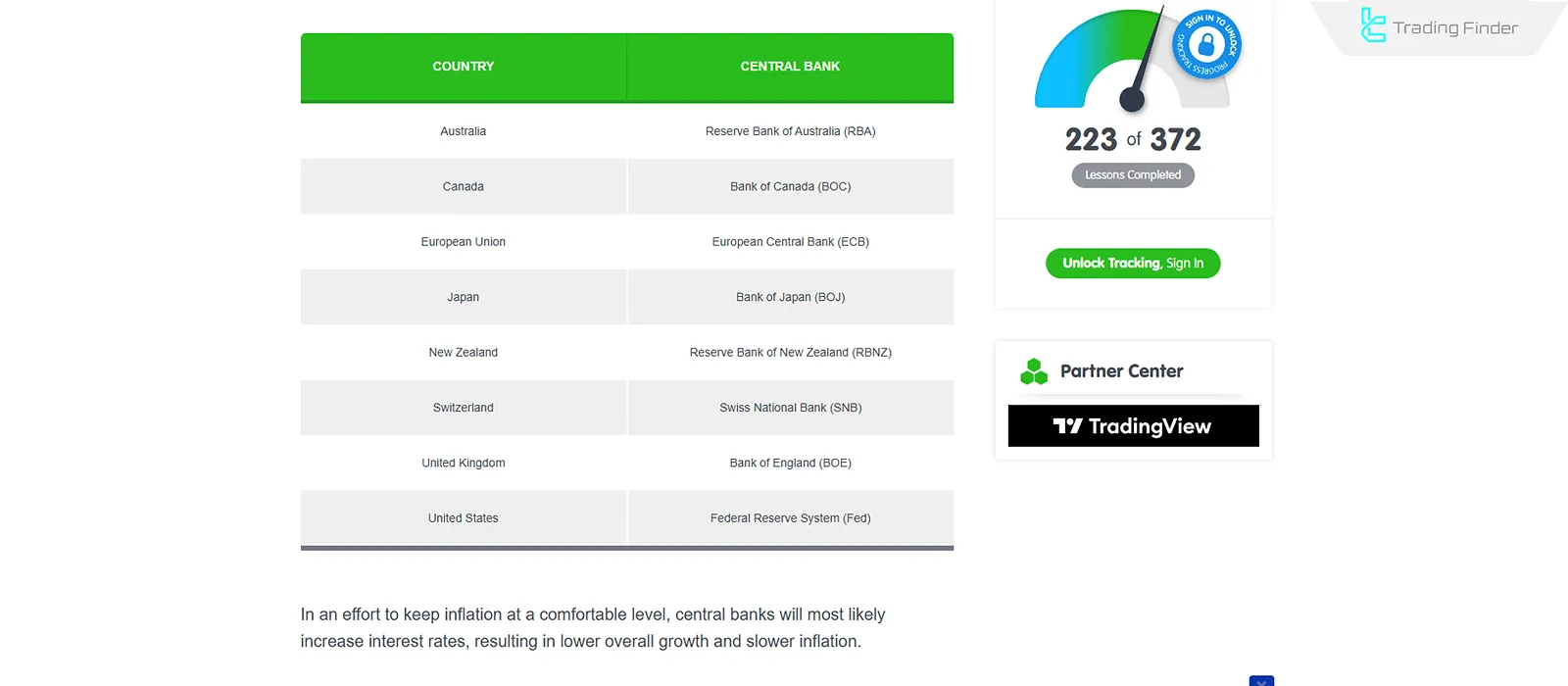

The level of Interest Rates in each country reflects its economic conditions, monetary policies, and central bank objectives.

Reviewing and comparing these rates shows how the interest tool is used to curb inflation, stimulate growth, or manage liquidity, and why differences in this metric affect capital market flows and global financial stability. Example comparison of Interest Rates:

Region | Central Bank | Interest Rate Trend | Main Objectives | Outlook / Challenges |

United States (USA) | Federal Reserve | Near-zero after 2008 crisis; sharp hikes in 2022–2023 up to 5.25%–5.5% | Control inflation, support full employment, financial stability | Rate hikes to curb inflation; gradual cuts expected from 2024 |

Euro Area | European Central Bank (ECB) | Sharp cuts after financial crisis; negative rate period; recent hikes to control inflation; challenges due to differing conditions across member states | Price stability, support for economic growth, eurozone financial integration | Divergent economic conditions create complexity in policymaking |

Impact of Interest Rate differentials on global trade

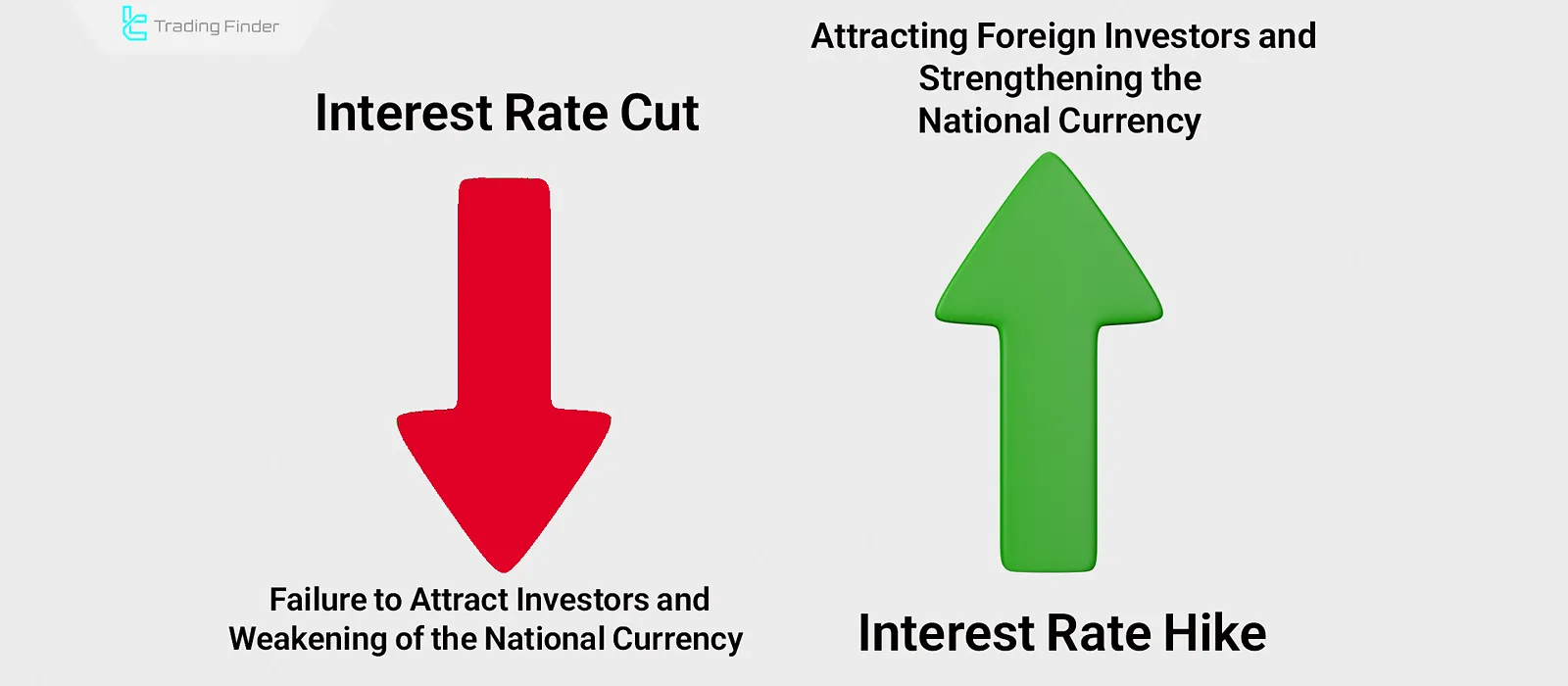

Interest Rate differentials among countries are one of the important factors in capital flows and exchange rate changes. When a country offers higher rates than other economies, foreign investors seeking higher returns are attracted to that country.

as a result, the national currency strengthens and export goods become more expensive. Conversely, cutting rates can weaken the currency and increase the competitiveness of export goods, but it raises import costs.

These differences affect not only exchange rates but also export and import volumes, short-term capital flows, and even the decision-making of multinational companies.

In effect, the Interest Rate indirectly shapes the structure of global trade, and countries’ monetary policy can alter the balance of external transactions.

The impact of Interest Rates on financial markets

Changes in Interest Rates influence liquidity levels and the demand for borrowing or depositing; this also affects financial markets and market sentiment; specifically, if data point toward easing policy, market sentiment becomes risk-on.

Expansionary monetary policy (rate cuts) is beneficial for risk markets; this is due to easier borrowing conditions, reduced returns in risky markets, and increased liquidity.

In contrast, contractionary monetary policy (rate hikes), aimed at curbing economic growth and controlling inflation, steers sentiment toward risk aversion. On the BabyPips website, the impact of Interest Rates on financial markets is explained:

The impact of Interest Rates on gold

Gold prices usually rise gradually during rate-cut cycles, because gold’s price is closely related to the value of fiat money; however, gold’s rise during easing cycles tends to be gradual and usually not as sharp as stocks or cryptocurrency.

This is due to gold’s risk-averse nature (contrary to risk-on sentiment in easing policy). Therefore, in expansionary cycles, gold shows distinct behavior given its nature and dollar pricing (as opposed to fiat money).

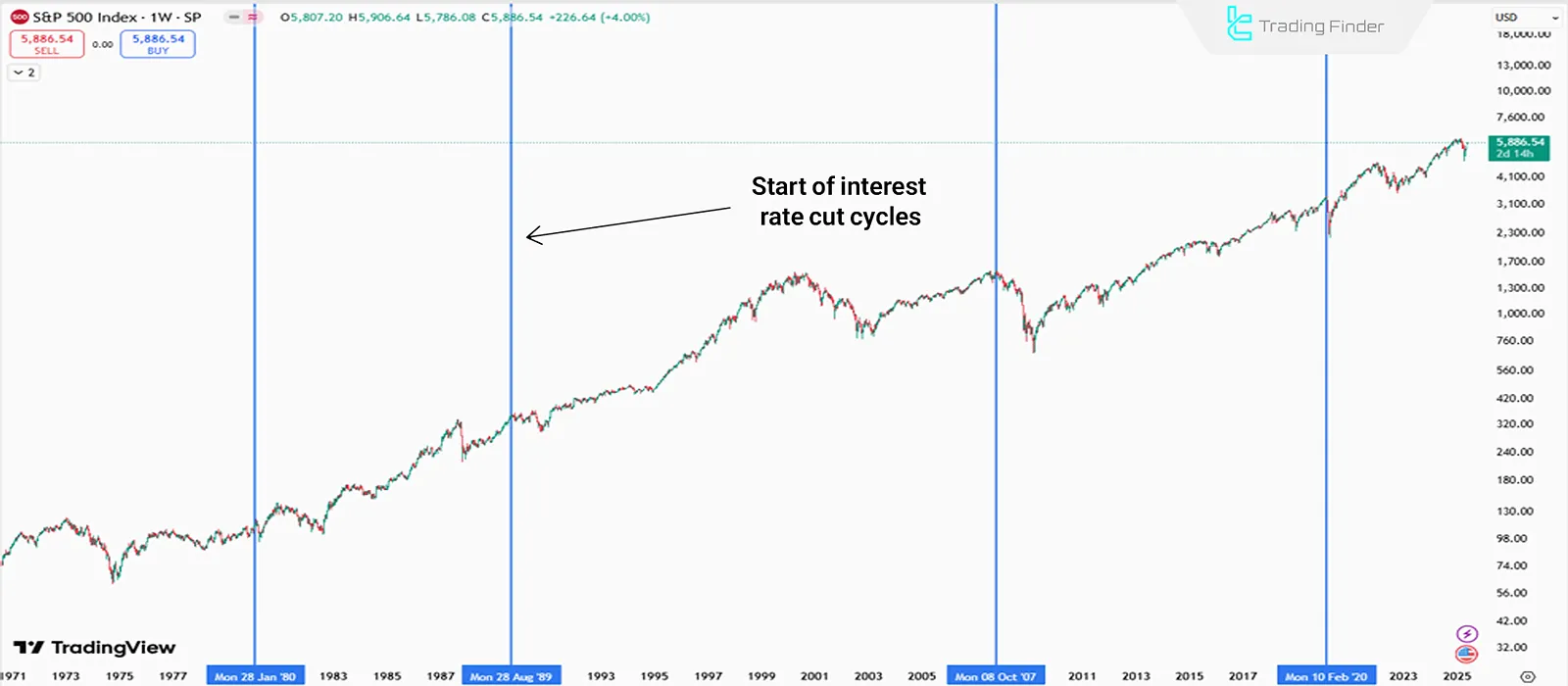

The impact of Interest Rates on stocks

The relationship between Interest Rates and the stock market is theoretically very clear and transparent; with lower Interest Rates, the stock market is supported.

This aligns with equities’ risk-taking nature, and financing for companies is easier during easing cycles, benefiting the labor market and production.

In the image, the relationship between the S&P 500 and historical rate-cut cycles is shown; aside from the 2008 financial crisis period, the stock market has mostly trended upward after rate cuts.

Note: Markets’ reactions to rate cuts usually come with a lag; because the impact of expansionary policy on the economy and corporate performance becomes evident with a delay of several months.

The impact of Interest Rates on the cryptocurrency market

Given its risk-taking nature, the cryptocurrency market benefits from rate cuts.

This occurs due to increased liquidity levels; in expansionary cycles, household finances improve, and beyond daily expenses, money is allocated to investment; this behavior is much weaker during recessions.

The above image shows Bitcoin’s behavior during the rate-cut cycles of 2020 and 2024; in each series, notable returns were recorded. Of course, in 2024, the notion of rate cuts was largely priced in before the Federal Reserve’s official reductions, due to expectations of rate cuts.

Advantages and disadvantages of different Interest Rate types

Some structures provide more stability and predictability, while others create greater flexibility or long-term returns.

Understanding these advantages and disadvantages helps individuals and businesses choose the right option for investment according to economic conditions and risk tolerance. Table of advantages and disadvantages of different types of Interest Rates:

Type of Interest Rate | Advantages | Disadvantages |

Fixed | Predictable installments and stable repayment – protection against rising rates | No benefit from rate cuts – higher initial cost compared to floating rates |

Floating (Variable) | Possibility of lower repayment costs if rates fall – starts with a lower rate | Risk of higher installments in rising cycles – difficulty in long-term financial planning |

Simple | Easy and transparent calculation – suitable for short-term loans | Low returns in long-term investing – low attractiveness for investors |

Compound | Higher long-term returns – exponential capital growth | Heavy financial burden in long-term loans – calculation complexity for borrowers |

Conclusion

The Interest Rate is the cost of borrowing money, and its changes have a significant impact on financial markets.

Therefore, the Interest Rate is the main tool of monetary policy; cutting rates is an expansionary policy (to support economic growth), and raising rates is a contractionary policy (to limit economic growth).

Implementing expansionary monetary policy and cutting rates, through increased liquidity and easier borrowing conditions for producers, benefits risk markets like stocks and crypto. Conversely, these markets are harmed in the contractionary cycle of rate hikes.

Also, in the forex market, changes in Interest Rates affect the medium-term trend of currency pairs through capital movements by carry traders.