When the account balance is not sufficient to cover open losses, the broker or exchange issues a call margin alert.

This warning indicates that the margin level has reached the minimum required threshold, and continuing account activity without any adjustment may lead to the forced closure of positions .

At this stage, the trader must make an immediate decision to bring the account out of its critical state. The usual solution in such situations is either to add new margin funds to the account or to close part of the open positions, especially those with higher risk.

By taking one of these actions, the free margin level increases, and the probability of reaching stop out is reduced.

Call margin meaning

Contrary to popular belief, a Margin Call in the forex market does not mean the loss of a trading account. When the account approaches critical conditions, a message is issued by the broker to take necessary actions to prevent a Stop Out.

Some of the key concepts affecting Margin Call include:

- Balance: The funds deposited into the account and available for trading;

- Leverage: Borrowing money from the broker to conduct trades larger than the actual balance of the account;

- Margin: The amount that the broker deducts and locks from the account balance as collateral for the trade;

- Margin Level: Shown as a percentage, it reflects margin relative to open positions, assessing risk and position sustainability;

- Equity: Equity is The real-time balance of the account, including profits or losses from open trades;

- Stop Out: When the balance can't cover open trade losses, trades close automatically, triggering a Stop Out.

According to Investopedia in its call margin tutorial article, acall margin occurs when the value of a margin account (maintenance margin) falls below the level set by the broker.

In this situation, the broker requires the investor to deposit additional cash or securities into the account.

On ClayTrader’s YouTube channel, the concept of a call margin is explained in a video format:

Call margin formula

A call margin occurs based on the decline in the ratio of Equity to Used Margin. The main criterion for assessing this situation is the Margin Level. The call margin calculation in Forex is performed with the following formula:

When the value of this ratio reaches the specific threshold set by the broker (for example, 100%), the call margin alert is triggered.

In this condition, the trader faces reduced flexibility, and the possibility of opening new positions disappears.

The importance of the call margin formula lies in the fact that the account status is not only dependent on the balance, but also the direct relationship between floating losses and the amount of capital tied in trades determines the approach to the call margin threshold.

Signs of Approaching a Margin Call

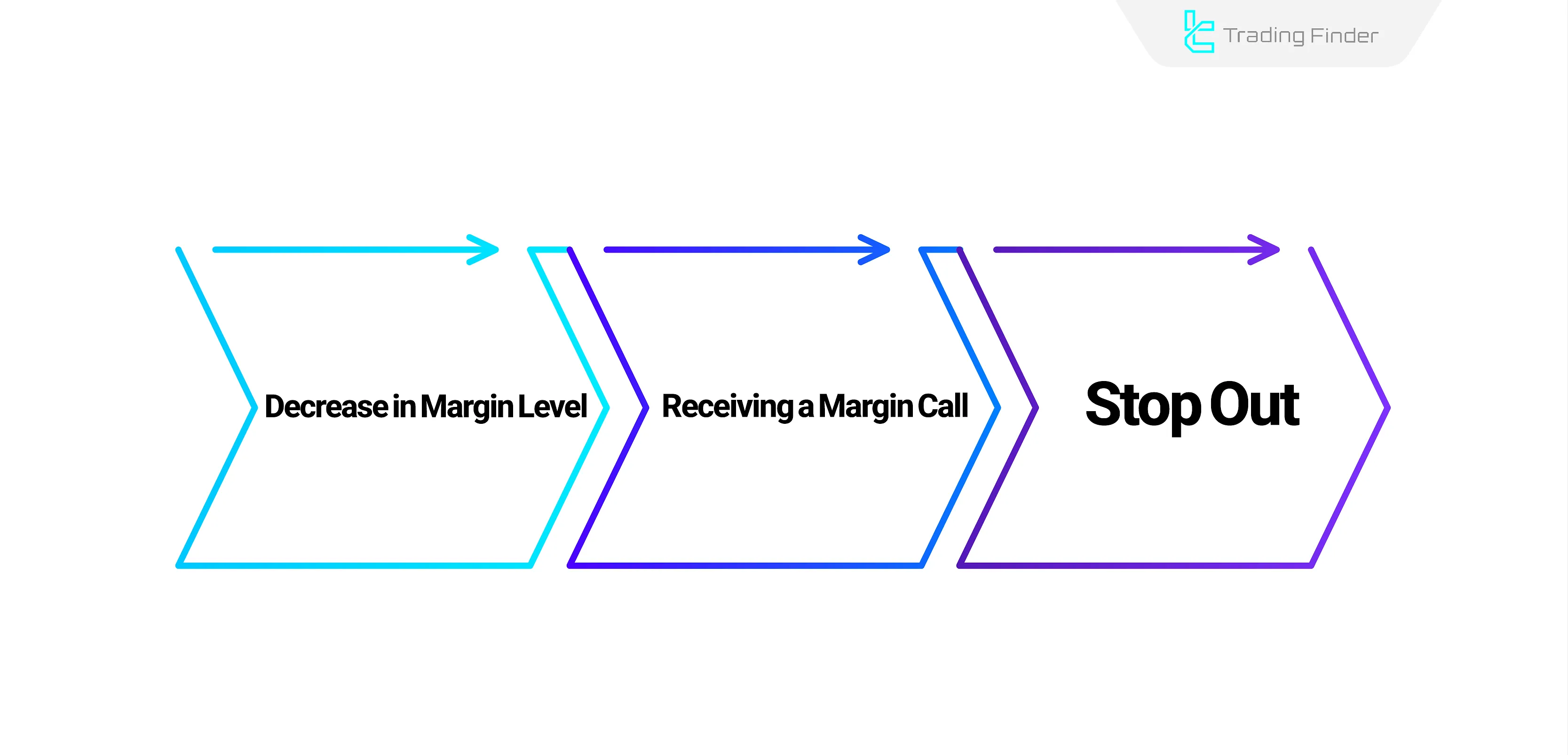

A Margin Call occurs when the trader's account balance decreases to a level where it can no longer cover the losses of open trades.

In this case, the broker issues a warning to deposit more funds into the account to cover further losses.

Decrease in Margin Level to Critical Levels

When the Margin Level reaches a critical point, it indicates insufficient funds to cover the losses of open trades. In fact, a Margin Level of 100% indicates that the funds to cover the losses of open trades are running out.

Receiving a Warning from the Broker

When the Margin Level reaches a critical level, brokers warn about insufficient funds to cover losses. In this situation, by increasing the account balance, the Margin Level moves away from the critical level, and the account returns to normal.

However, if the account balance is not increased and losses continue to grow, the broker closes all open trades, and a Stop Out becomes inevitable.

Call margin in different markets (Forex, Futures, Crypto)

The concept of call margin finance exists in all markets where leverage and trading credit are used. Depending on the amount of Margin Loan provided by the trading platform, its application and intensity vary across markets.

- Call margin forex: The call margin level in Forex is usually set between 100% and 50%, depending on Broker Authority. This range indicates that if a trader’s equity equals or falls below the used margin, the call margin alert will be issued;

- Call margin futures: In futures contracts, the margin is adjusted daily based on price changes. This feature causes call margins in the futures market to be triggered faster and more severely than in Forex, since price fluctuations directly affect the initial and maintenance margin;

- Call margin crypto: In cryptocurrency trading, a call margin is often equated with the stage close to liquidation. At this point, when losses reach a specified threshold, the system issues an alert similar to a call margin, and if no action is taken, the positions are automatically closed.

Ways to Prevent a Call margin

Following a few simple principles can reduce the likelihood of a Margin Call. A Margin Call is merely a warning for the user to manage the losses of open trades.

Ways to Prevent a Margin Call:

- Capital Management: By adhering to capital management in all trades, the likelihood of a Margin Call is reduced;

- Using Appropriate Leverage: High leverage boosts profit potential but also increases losses;

- Emotional Management: Controlling emotions during critical moments prevents irrational decisions leading to a Margin Call.

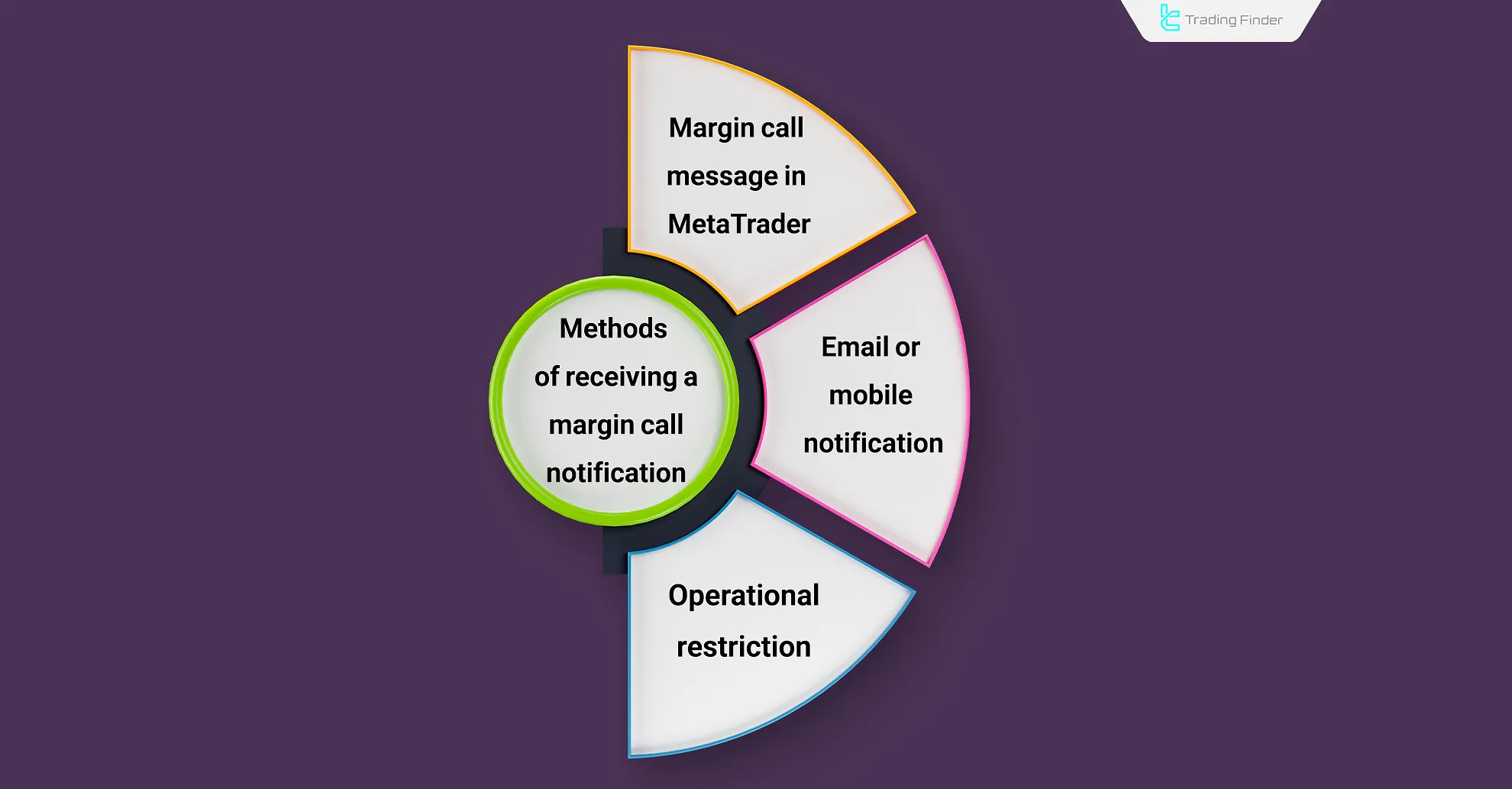

Methods of receiving call margin notifications

Activation of a call margin is not just a number on the account chart but is accompanied by specific notification mechanisms that alert the trader of the critical condition.

- Call margin message in MetaTrader: In MetaTrader or other platforms, as soon as the margin level reaches the call margin threshold, a warning appears on the screen informing the trader about the new limitations;

- Email or mobile notification: Many brokers and exchanges automatically send call margin alerts through email or app notifications;

- Operational restrictions: In some cases, the system blocks the ability to open new trades before reaching stop out. This limitation is a clear sign that the account has entered the call margin phase, and only management or capital injection can rescue it.

This notification path is designed so that the trader realizes the risk in the shortest time possible and has the opportunity to fix the situation before stop out occurs.

What should I do if I get into a call margin?

Taking necessary actions to manage capital when receiving a Margin Call warning from the broker or exchange makes it possible to exit the critical state and preserve capital.

- Reducing Trade Volume: Closing high-loss trades or partially closing profitable ones raises the Margin Level, reducing Margin Call risk;

- Increasing Account Balance: Depositing funds raises the balance, increasing the Margin Level and exiting the Margin Call zone;

- Hedging Trades: Floating losses and the Margin Level remain stable by opening a trade in the opposite direction.

TradingFinder Margin Calculator: Fast Calculation of Required Margin in Leveraged Trading

The TradingFinder Margin Calculator is an online tool for accurately determining the required margin and diversification in leveraged trading.

It is enough to enter the trading symbol, account currency, trade volume, and leverage level (from 1:5 to 1:1000) to display the required margin.

This tool, covering Forex, stocks, indices, cryptocurrencies, and commodities with real-time prices, enables capital management and prevents call margin.

Formula of TradingFinder Margin Calculator:

With this tool, the user can instantly observe the effect of leverage changes on margin.

In addition, the ability to search among symbols, reset inputs, and access complementary tools such as live spreads allows leveraged trading management in MetaTrader or other platforms to be faster and more precise.

Practical call margin example

Studying numerical examples helps gain a clearer understanding of how a call margin works.

- Numerical example 1 of call margin: A trading account with a balance of $1,000 and a leverage of 1:100 is considered. The trader opens a position with $500 margin. If the floating loss causes the account equity to drop to $500, the margin level will be exactly 100%. This point is the Call margin Trigger; at this stage, the broker sends a Call margin Notification, and the trader must act immediately to prevent stop out;

- Numerical example 2 of call margin: Another investor with $2,000 has several open positions that together consume $1,000 margin. As losses increase, equity falls to $800. In this case, the margin level is calculated at 80%. Since this level is below the threshold set by the broker, the Risk of Ruin is created, and the account enters the call margin state with an official warning issued.

Difference between liquidation and call margin

To understand the difference between call margin and liquidation, attention must be paid to the account structure including equity , used margin, and margin level.

Table of Comparison between liquidation and call margin

Features | Call margin | Liquidation |

Nature | Warning stage of capital shortage | Final and irreversible stage |

Trader’s control | The trader can manage the account by closing positions or depositing funds | No control; positions are automatically closed by the broker or exchange |

Time of occurrence | When the equity-to-used margin ratio reaches the critical range | When losses exceed the threshold and equity falls below the allowed level |

Purpose | Warning to correct the situation and prevent stop out | Protection of broker/exchange against the trader’s potential debts |

Result | Opportunity for correction exists | Forced closure of positions and loss of a large portion of capital |

Difference between call margin and stop out

To better understand the difference between call margin and stop out, one must consider the mechanics of a trading account.

Both stages are triggered based on changes in margin level and the ratio of equity to used margin, but their roles and consequences are entirely different.

Table of Comparison between call margin and stop out

Features | Call margin | Stop Out |

Nature | Warning from the broker about insufficient funds to cover open trades | Forced Liquidation of Positions by the broker in case of Delay in Covering Call margin |

Activation time | When margin level reaches a specified threshold (e.g., 100%) | When margin level falls to a lower level (e.g., 20%) |

Trader’s control | Trader can act: deposit funds or close some trades | No control; positions are closed to protect the broker |

Purpose | Warning to the trader to prevent total loss | Preventing trader’s debt and preserving broker’s financial security |

Account impact | Restriction on opening new positions | Possible loss of all balance and forced closure of all or part of open trades |

How to avoid call margin in prop trading?

In the world of proprietary trading, maintaining strict adherence to risk parameters is not optional; it is the very foundation of survival. Prop firms typically design their funding programs with rigid rules, often centered around maximum drawdown limits or daily loss restrictions.

These conditions are non-negotiable, and even a minor breach can result in immediate account termination or disqualification from the challenge.

For this reason, traders must implement flawless risk management practices to safeguard both their positions and their opportunity to trade with firm capital.

While personal discipline is the first line of defense, technology provides an additional safeguard. This is where advanced supporting tools, such as the Prop Capital Protection Expert Advisor (EA), become invaluable.

Built specifically for MetaTrader platforms, this EA is engineered to monitor account equity in real time and enforce risk management rules automatically, reducing the chance of human error.

Among its standout features are the dynamic trailing stop, which locks in profits while allowing trades room to grow, and the break-even function, designed to secure trades once they reach a certain profit threshold.

The EA also supports multi-symbol management, enabling traders to monitor several instruments simultaneously without losing control. Additionally, the automated order execution ensures that trades align perfectly with predefined rules, removing hesitation and emotional decision-making from the process.

In highly volatile market conditions; whether in Forex, indices, commodities, or cryptocurrencies; capital can erode rapidly if trades are not managed effectively.

By preventing accounts from drifting toward the margin call zone, the Prop Capital Protection EA acts as a safety net, allowing traders to focus more on strategy and less on constant monitoring.

When personal risk management principles are combined with the automation and reliability of this EA, traders achieve a multi-layered defense system.

This not only preserves trading capital but also significantly increases the probability of passing prop firm challenges and maintaining long-term consistency. For serious traders aiming to secure a funded account, adopting such protective tools is no longer a luxury it is a necessity.

- Download link for Prop Capital Protection EA for MetaTrader 5

- Download link for Prop Capital Protection EA for MetaTrader 4

- Download link for Prop Capital Protection EA for TradingView

Conclusion

By reducing trade volume, selecting appropriate leverage, and using stop-loss and Take-profit orders, one can prevent approaching the Margin Call level.

Solutions such as increasing the balance or hedging trades can prevent a Stop Out if faced with a Margin Call.