MetaTrader 4 (MT4) is an advanced trading platform that was designed and released in 2005 by the Russian company “Meta Quotes”.

This platform has been developed for traders in financial markets such as forex, precious metals, indices, and energy, and it offers a variety of tools for analysis, risk management, and executing trading strategies.

What is MetaTrader 4?

MetaTrader 4 (MT4) is a professional online trading platform used for forex, indices, metals, and energy. This software enables chart analysis, the use of technical indicators, and the automated execution of trading strategies.

MetaTrader 4 is also equipped with a built-in economic calendar that displays important economic events within the chart.Even Expert Advisors and indicators can process the data from this calendar.

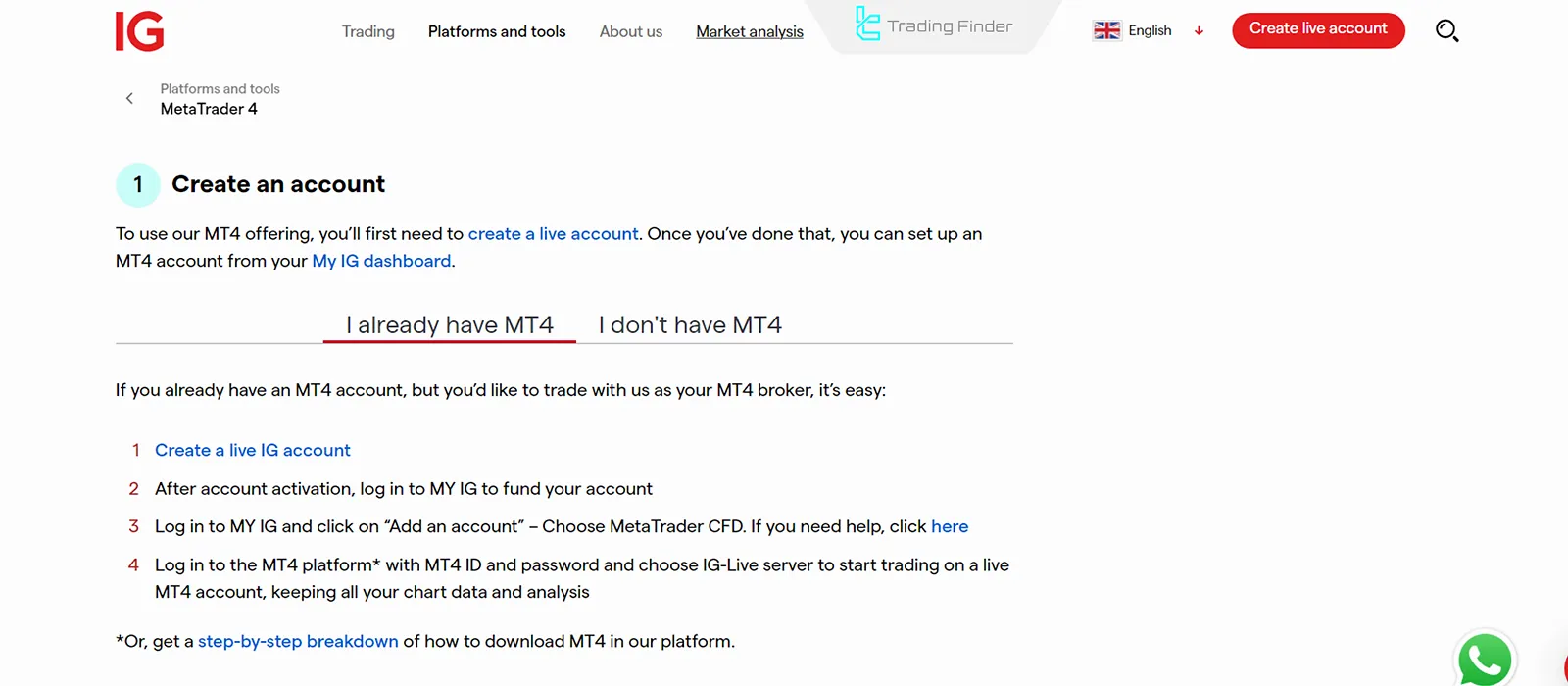

To use this trading platform, you must first open an account. Tutorial for creating a MetaTrader 4 account on IG.com:

Key Features of MetaTrader 4

MetaTrader 4 brings together indicators, automated trading via Expert Advisors, and backtesting tools, providing traders with a dynamic space to design and implement trading systems.

Important features and capabilities of MetaTrader 4:

Advanced analytical tools in MT4

MetaTrader 4 offers 30 built-in technical indicators and 24 charting tools, such as Fibonacci, trendlines, and channels for market analysis.

In addition, users can add custom indicators to the platform and, by saving settings as a Template, personalize their analytical environment for future use.

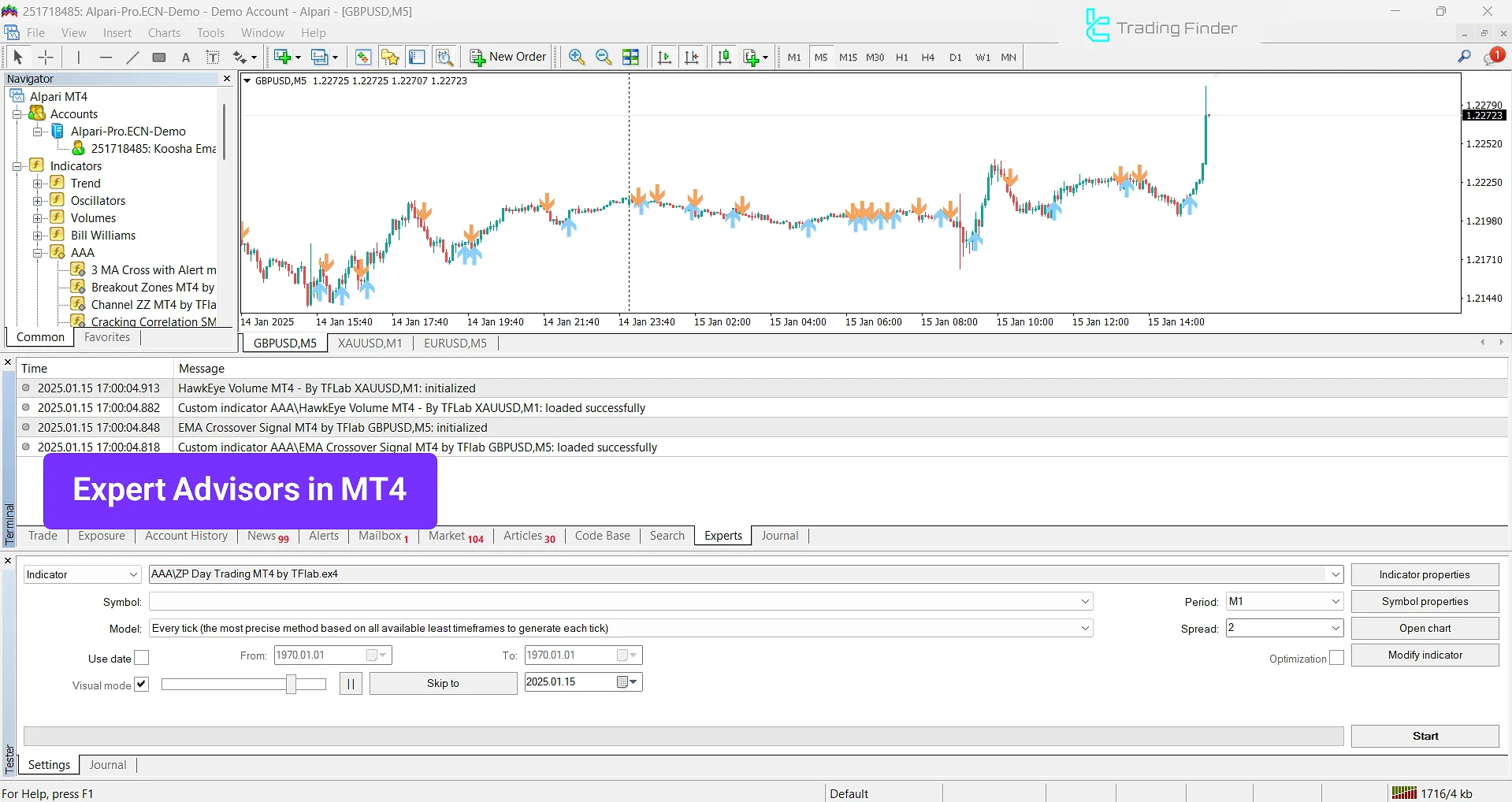

Automated Trading with Expert Advisors (EAs)

One of the most appealing features of this platform is the ability to use Expert advisors.

These trading robots are developed using the MQL4 programming language and can execute trading strategies automatically.

You can check out TradingFinder MQL4 page for the most up-to-date EAs.

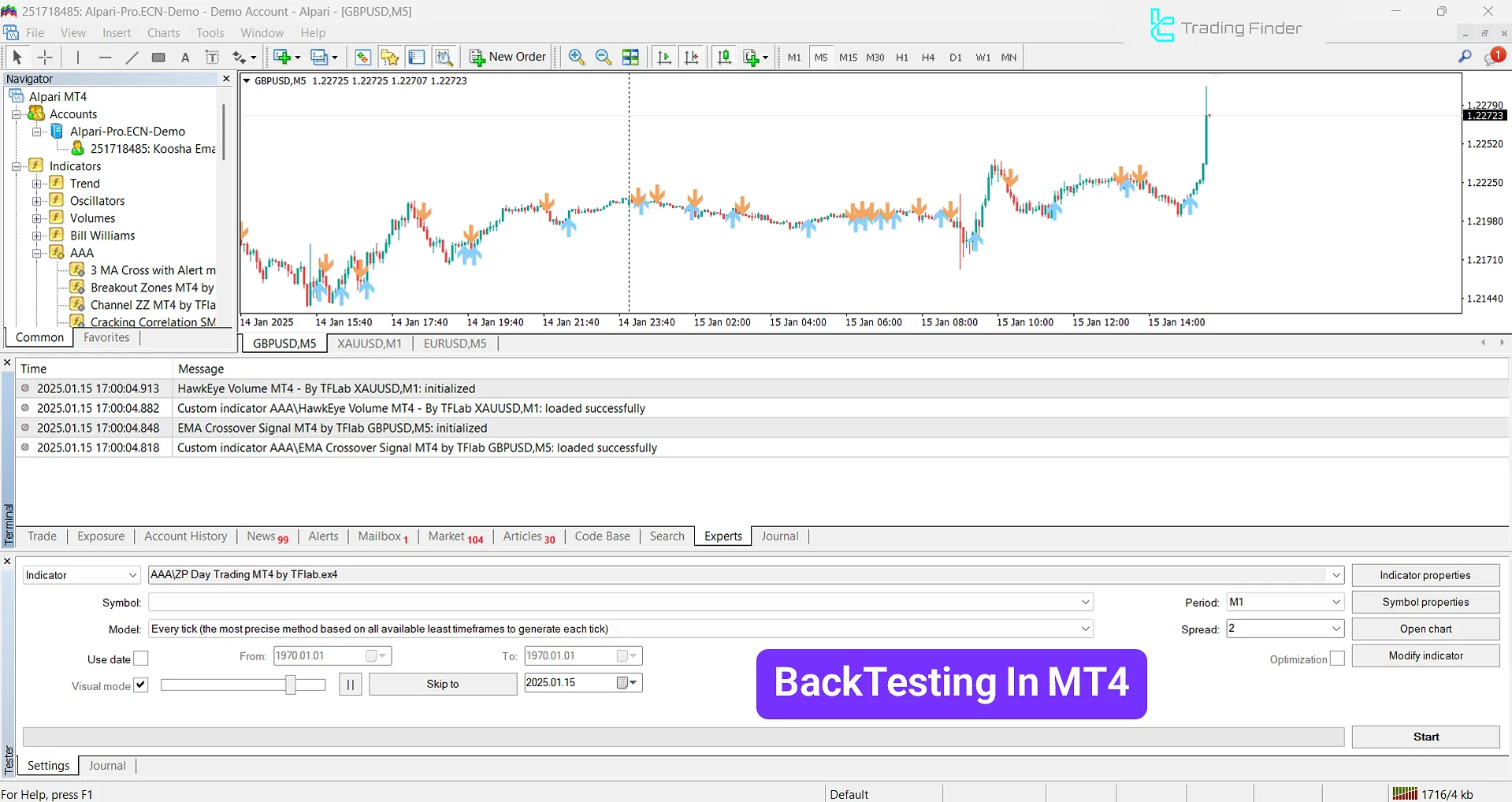

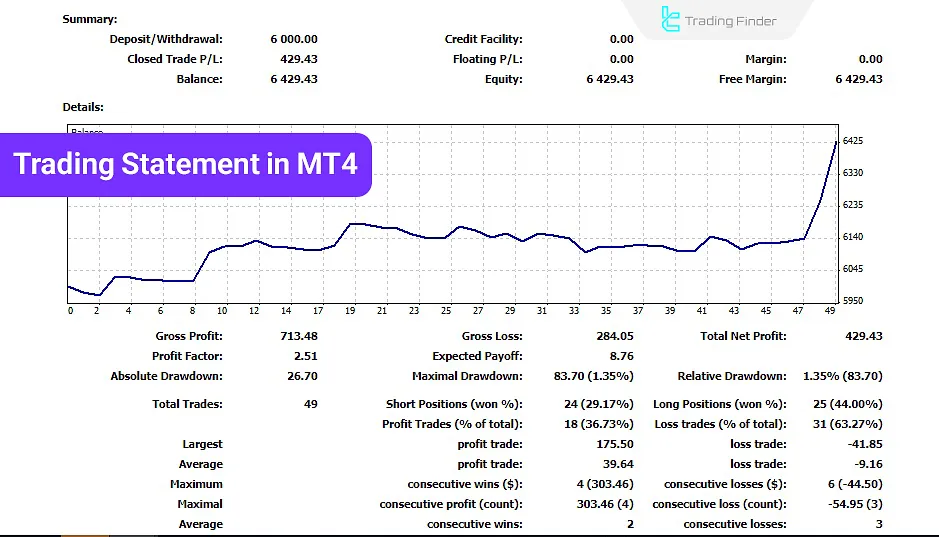

Strategy Backtesting

The MetaTrader 4 platform allows users to test their trading strategies based on historical data. Backtesting is a feature for improving trading strategies prior to deployment in live trading.

The trader can review precise results including win rate, maximum drawdown, average profit and loss, and the risk-to-reward ratio, and determine the strategy parameters to achieve the best return.

Access across device types

This software is offered in three versions: desktop, mobile, and web trader. The desktop version provides the most analytical tools and support for Expert Advisors.

The MT4 in mobile version (Android and iOS) enables the trader to monitor the market and execute orders quickly anywhere, and the web version can be used without installation, only through a browser.

Thus, users can connect to their trading account and manage trades anytime and on any device.

Precise Order Management

This platform supports various types of orders, including market orders, pending orders, stop loss, take profit, and trailing stop.

Order types in MetaTrader 4

In MetaTrader 4, the trader is not limited to instant orders and can use Pending Orders to predefine entry and exit points. Order types in MetaTrader 4:

- Buy Limit: An order to buy at or below the current market price

- Buy Stop: An order to buy above the current market price

- Sell Limit: An order to sell above the current market price

- Sell Stop: An order to sell at or below the current market price

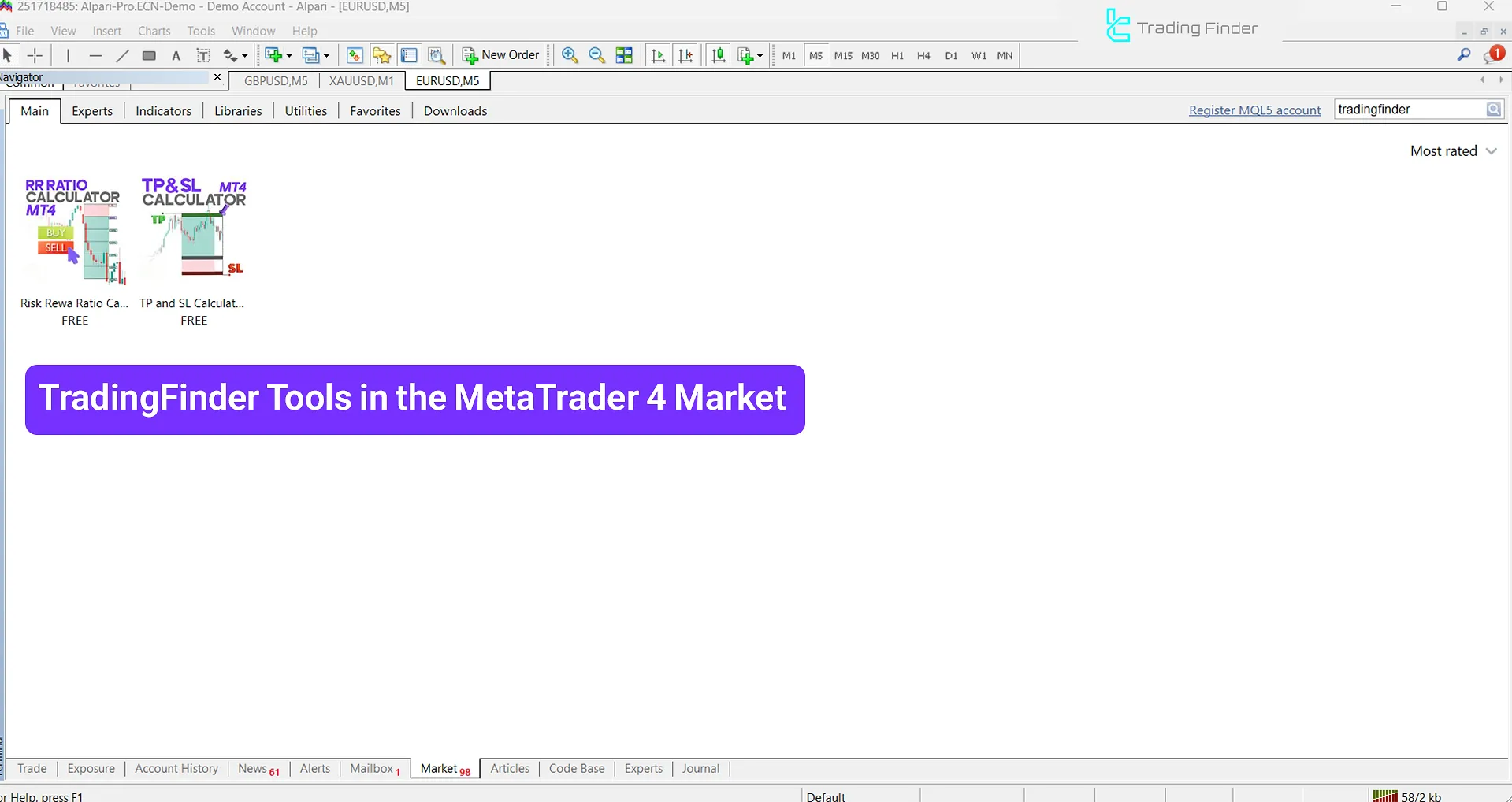

MetaTrader’s internal market

The MT4 platform includes an internal marketplace for purchasing ready-made indicators, Expert Advisors, and scripts. In addition to this market, users also have access to a vast library of free tools.

This internal store is directly connected to the MQL5 account and enables automatic installation and updating of tools on the platform.

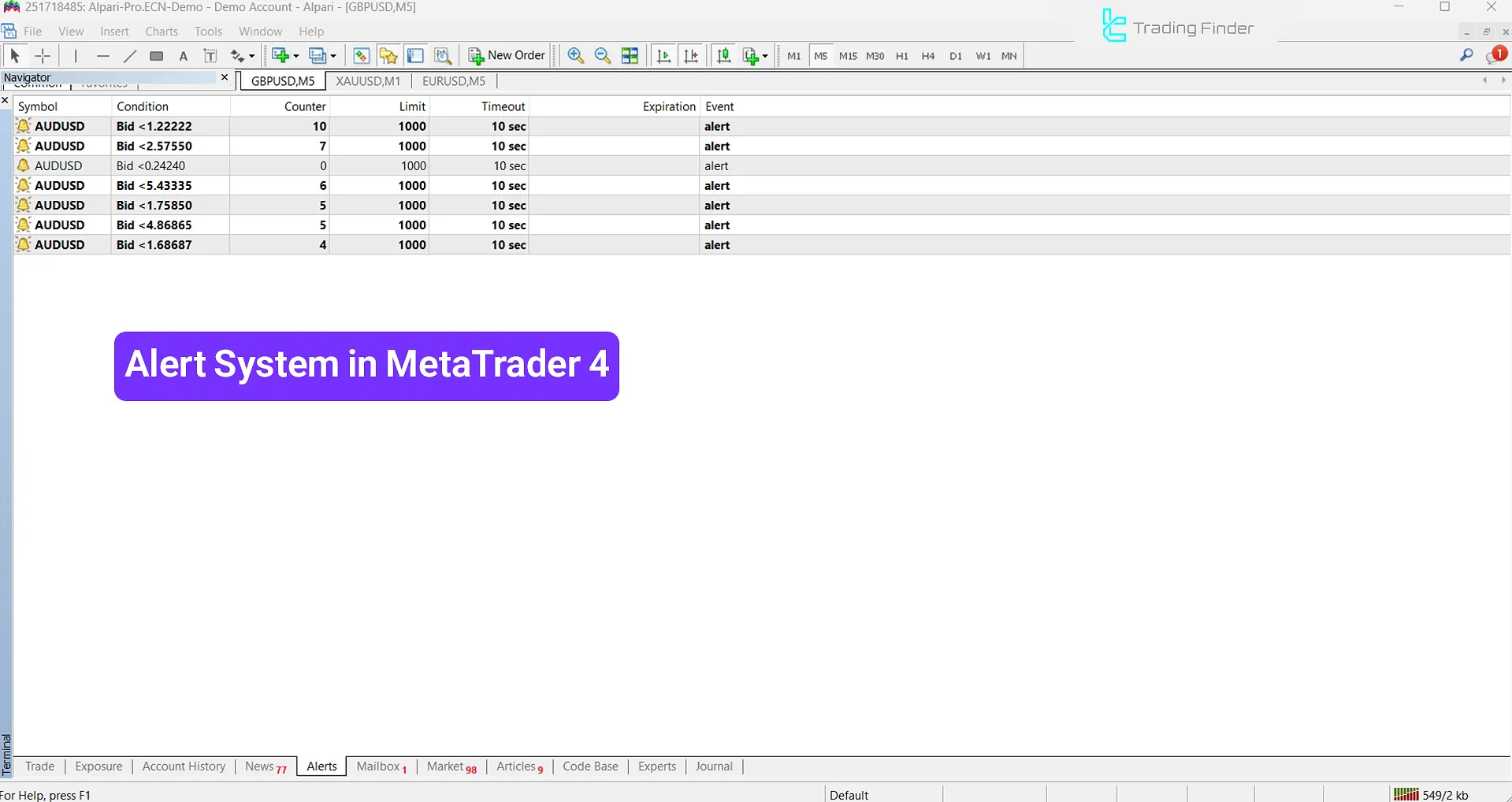

Alert and Notification System

It is possible to set alerts for specific market conditions in MetaTrader 4 so that traders, by receiving mobile notifications, are informed of important market changes.

These alerts can be defined based on price levels, indicators, or a specified time and, once triggered, are sent as a pop-up message, email, or mobile notification.

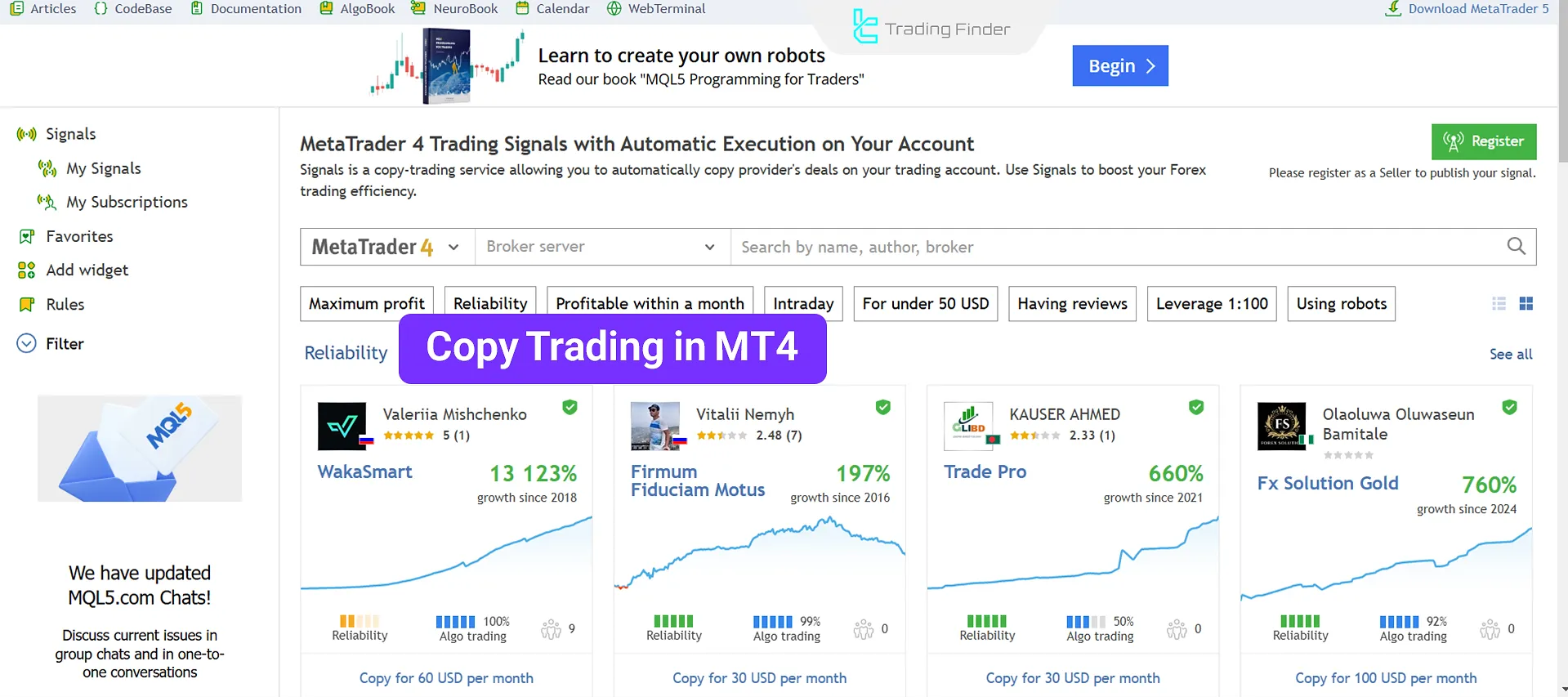

Copy Trading

MetaTrader 4 enables copying the trades of professional traders. You can use the trading signals of other traders and copy others’ trades automatically.

This feature is activated via the “Signals” section in the platform, and the user can select a signal provider based on criteria such as risk level, performance history, and success rate.

Trading History

The MetaTrader 4 platform stores all past trades. Users can view them in the trading report section and clearly see entry and exit points.

MT4 trading statement (Statement)

MetaTrader 4 records trades and position results; by analyzing the outcomes, this platform provides performance metrics (such as win rate, average profit and loss, etc.).

In addition to the overall report, users can view the details of each trade including entry and exit time, trade size, stop loss and take profit levels, and the final profit or loss.

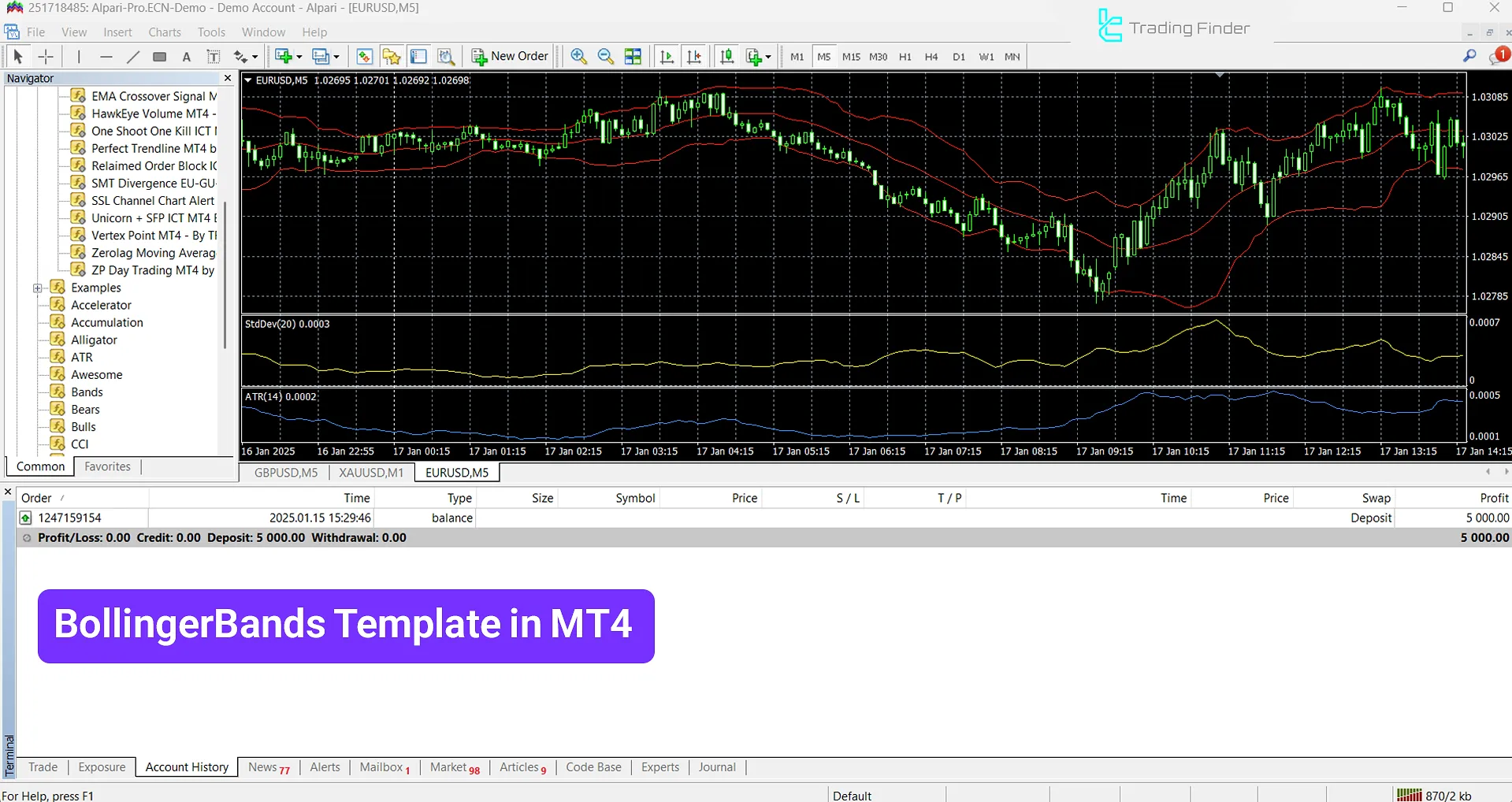

Templates

MT4 templates are a set of parameters that you can save and use on any chart without paying any additional fees.

You can create a template with your unique settings and quickly use it in subsequent trades.

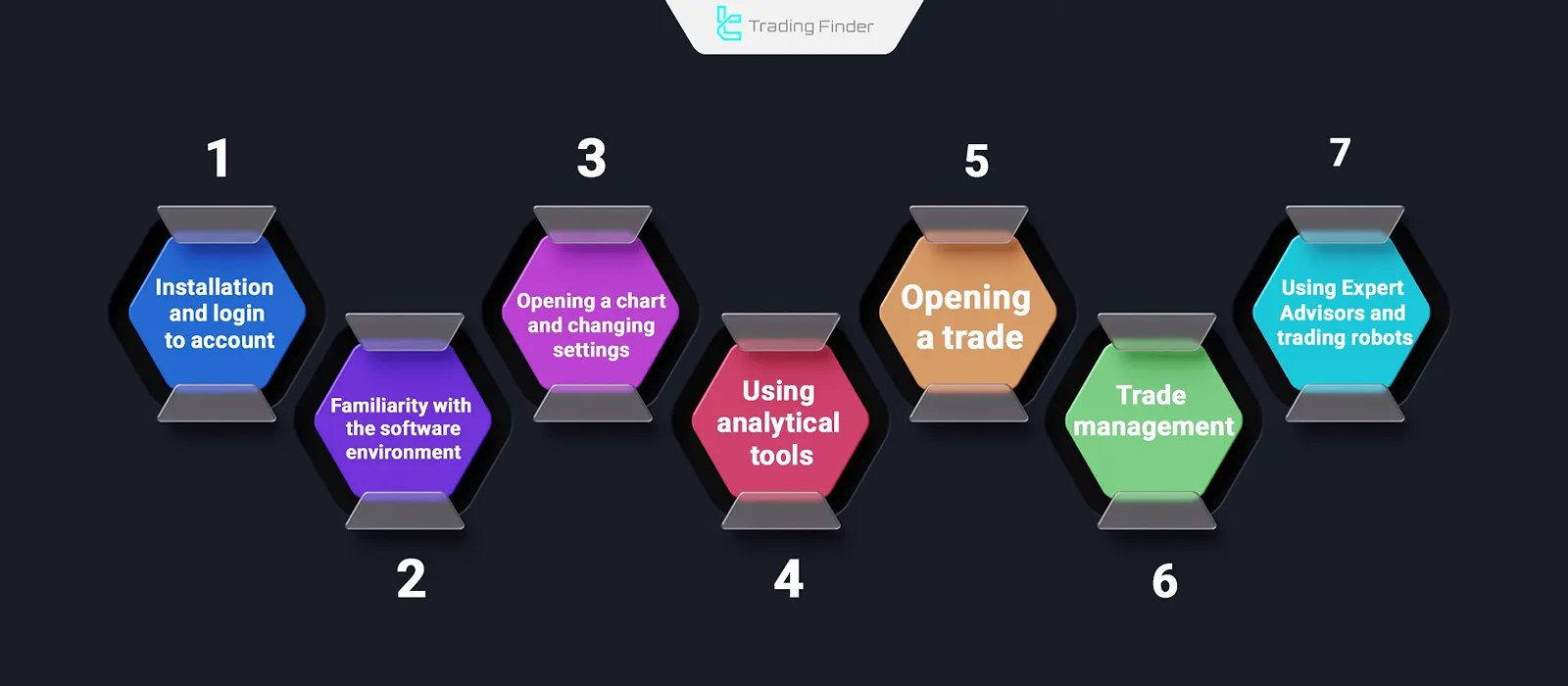

How to use MetaTrader 4

MetaTrader 4 involves managing charts, applying indicators, executing orders, and configuring analytical tools to conduct trades. Steps of using MetaTrader 4:

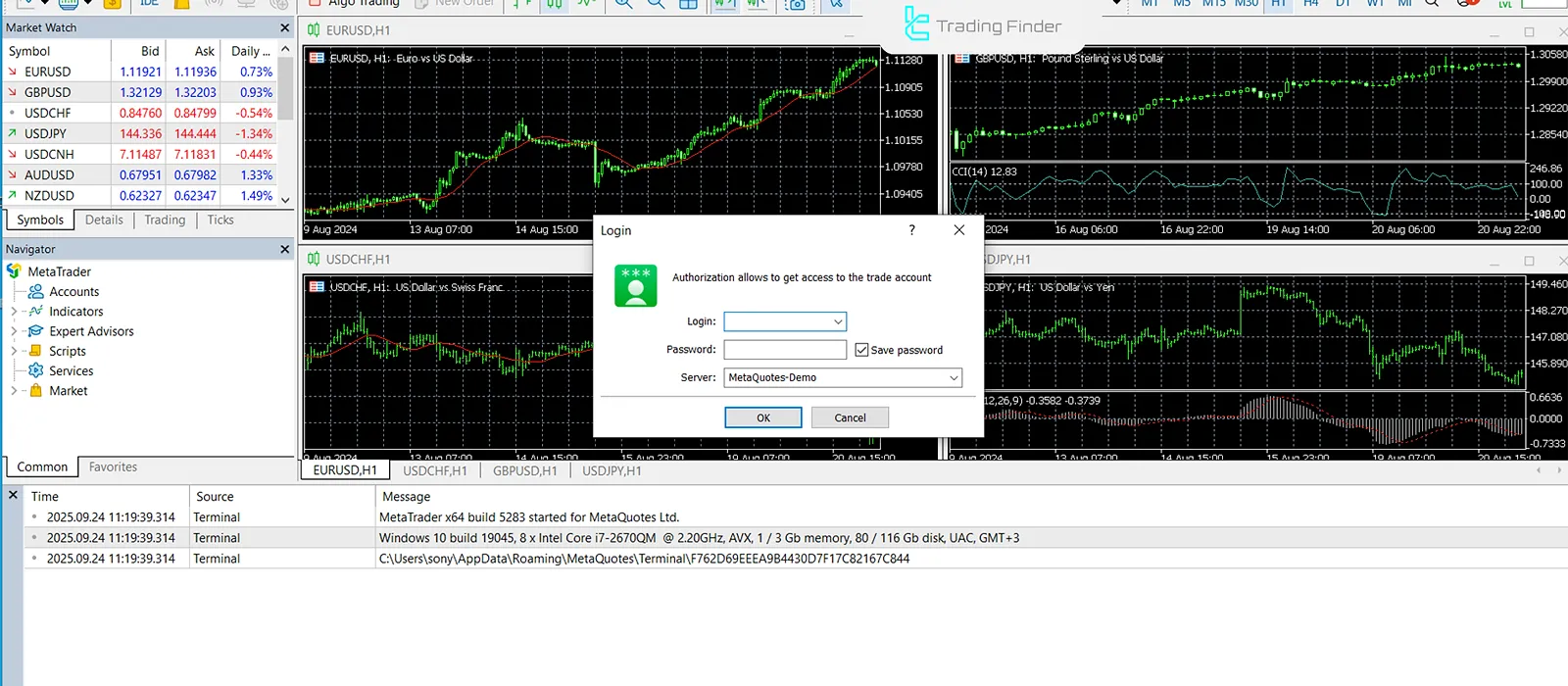

#1 Installation and logging in

Without installing MetaTrader 4 and successfully connecting to the broker’s server, accessing charts, executing orders, and managing trades will not be possible. Installation and login steps:

- First, download and install the MetaTrader 4 version from your broker’s website;

- After launching, to log in, select (Login to Trade Account) from the File menu, then enter the Login, Password, and Server provided by your broker;

- If the connection is successful, the status “Connected” or the ping speed is displayed in the lower right corner of the software.

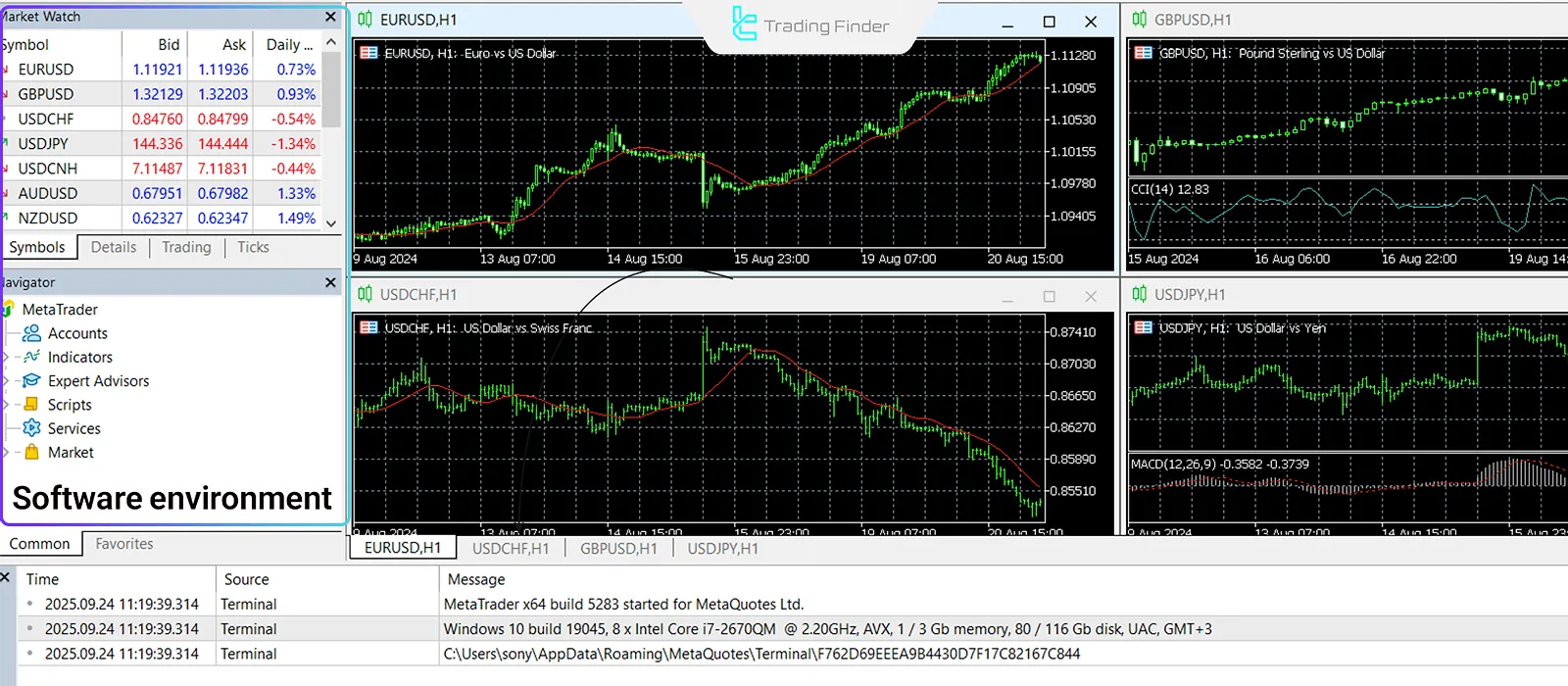

#2 Getting to know the software interface

Understanding the main components of the MetaTrader 4 interface is essential for managing trades and market analysis.

The toolbar, the Market Watch and Navigator windows, the main chart, and the Terminal window each have specific functions, and by understanding how they work, the trader can execute orders quickly.

Getting to know the MetaTrader 4 software interface:

- Top toolbar: includes main options such as opening a chart, adding indicators, and drawing tools;

- Market Watch window: a list of symbols and currency pairs with real-time bid and ask prices;

- Navigator window: access to accounts, indicators, and Expert Advisors;

- Main chart: where the price chart is displayed along with indicators and analyses;

- Terminal window: displays open trades, trade history, news, and messages.

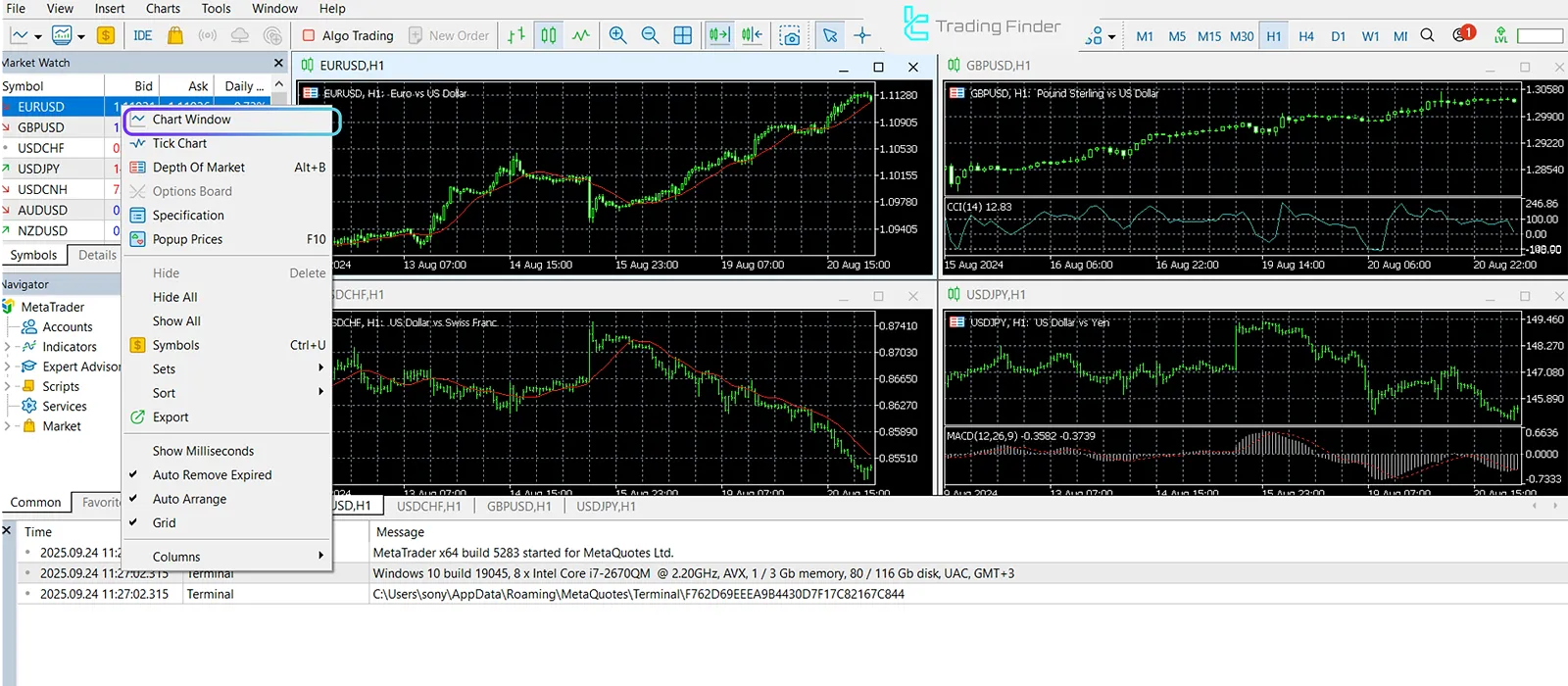

#3 Opening a chart and changing settings

Configuring charts in the MetaTrader 4 tutorial is an important part of the technical analysis process. Choosing a symbol, changing the timeframe, and determining the chart type allow the trader to review the market and evaluate trading conditions more precisely.

Steps to open a chart and change settings:

- Right-click on the desired symbol in the Market Watch window and select Chart Window;

- In the Timeframes section, you can set the desired timeframe (such as M1, H1, or D1);

- To change the chart appearance (candlestick, line, or bar), use the top toolbar of the software.

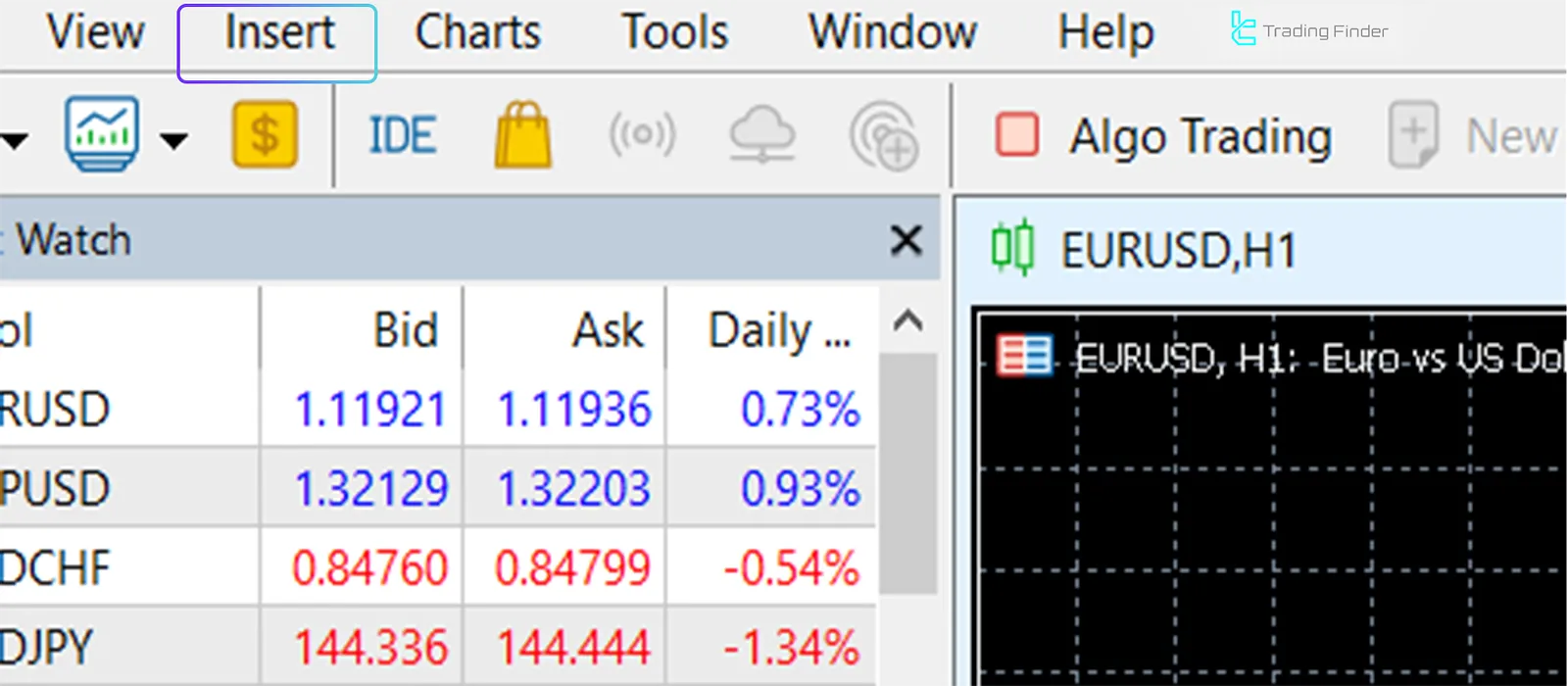

#4 Using analytical tools

Employing analytical tools in the MetaTrader 4 platform enables the trader to personalize charts. Adding indicators, using drawing tools, and saving templates helps create an organized and efficient trading environment.

- Adding indicators: by selecting the Insert menu and then Indicators, you can add indicators such as Moving Average or RSI to the chart;

- Drawing tools: with the icons above the chart, you can draw trendlines, Fibonacci, and various shapes;

- Saving a Template: after personalizing the chart, you can save it to use later on other symbols as well.

Example of using an indicator in MetaTrader 4

The Liquidity Finder (LF) indicator in MetaTrader 4 is a specialized tool for ICT and smart money-style traders whose main function is to identify Liquidity Levels on price charts. Educational video on using the Liquidity Finder indicator:

This indicator identifies liquidity pools by drawing two types of lines: Dynamic liquidity lines and Static liquidity lines. In this structure, blue lines are displayed as liquidity highs and red lines as liquidity lows.

Static lines are often seen in the form of patterns such as Double Top or Double Bottom and indicate key points of liquidity collection to the trader.

This indicator falls under the categories of ICT, Smart Money, Liquidity, and Strength indicators for MetaTrader 4 and is designed for traders with an intermediate skill level.

Since it belongs to the leading and breakout indicator class, it can reveal potential market moves for liquidity grabs earlier.

It is also usable across different timeframes from M1 to H4 and is applicable to day trading, scalping, and intraday styles.

The settings section (LF MT5) is fully customizable; from changing the sensitivity of dynamic and static lines to the color and style of each line.

The trader can enable or disable the display of high or low liquidity lines and adjust the chart based on their strategy.

Overall, the Liquidity Finder indicator is an effective tool for identifying points where there is a high probability of large orders being present.

This helps analysts better understand market direction, liquidity zones, and smart money behavior, and execute their trades with greater precision. Download link for the Liquidity Finder indicator:

Liquidity Finder indicator for MetaTrader 4

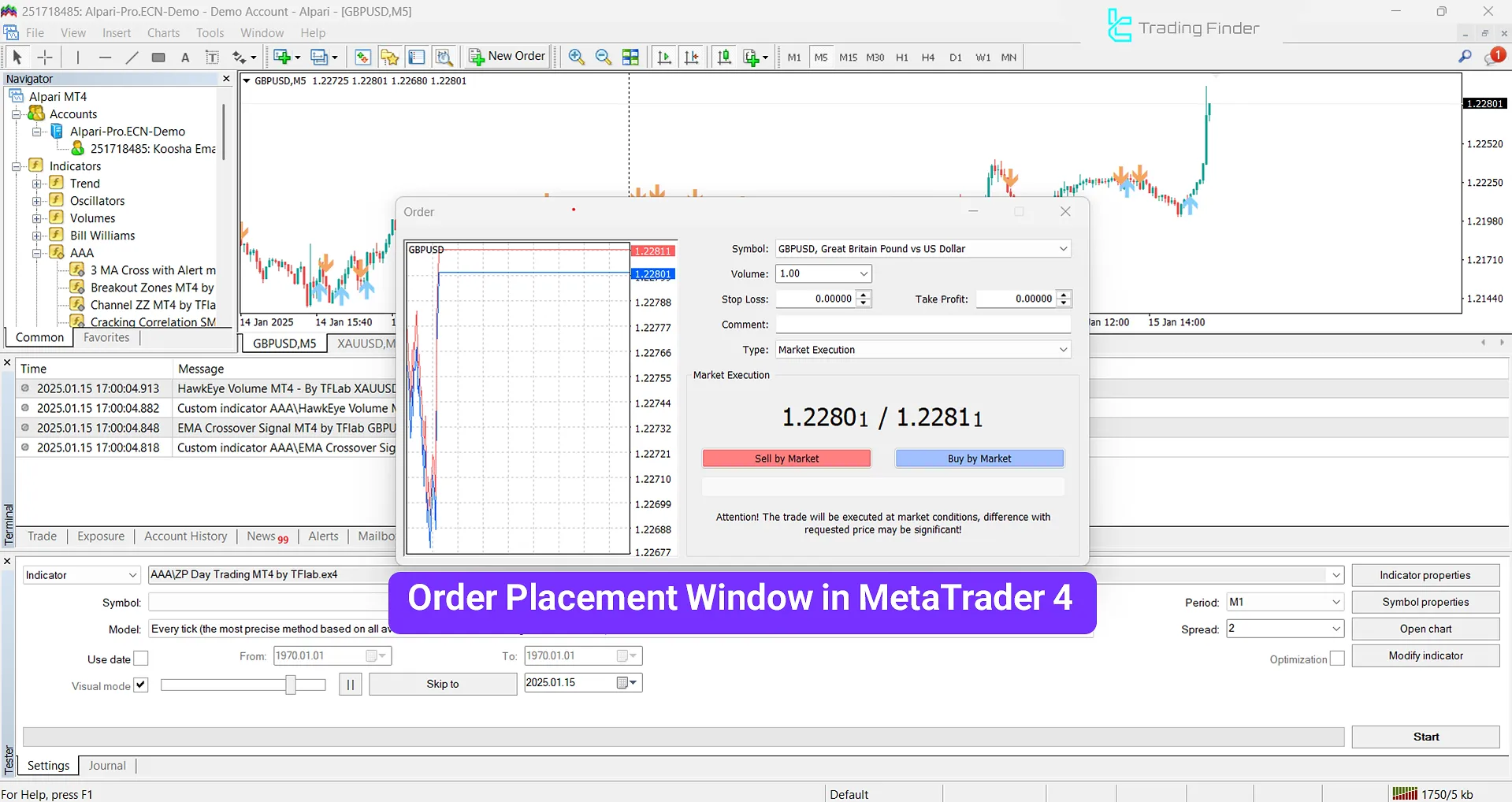

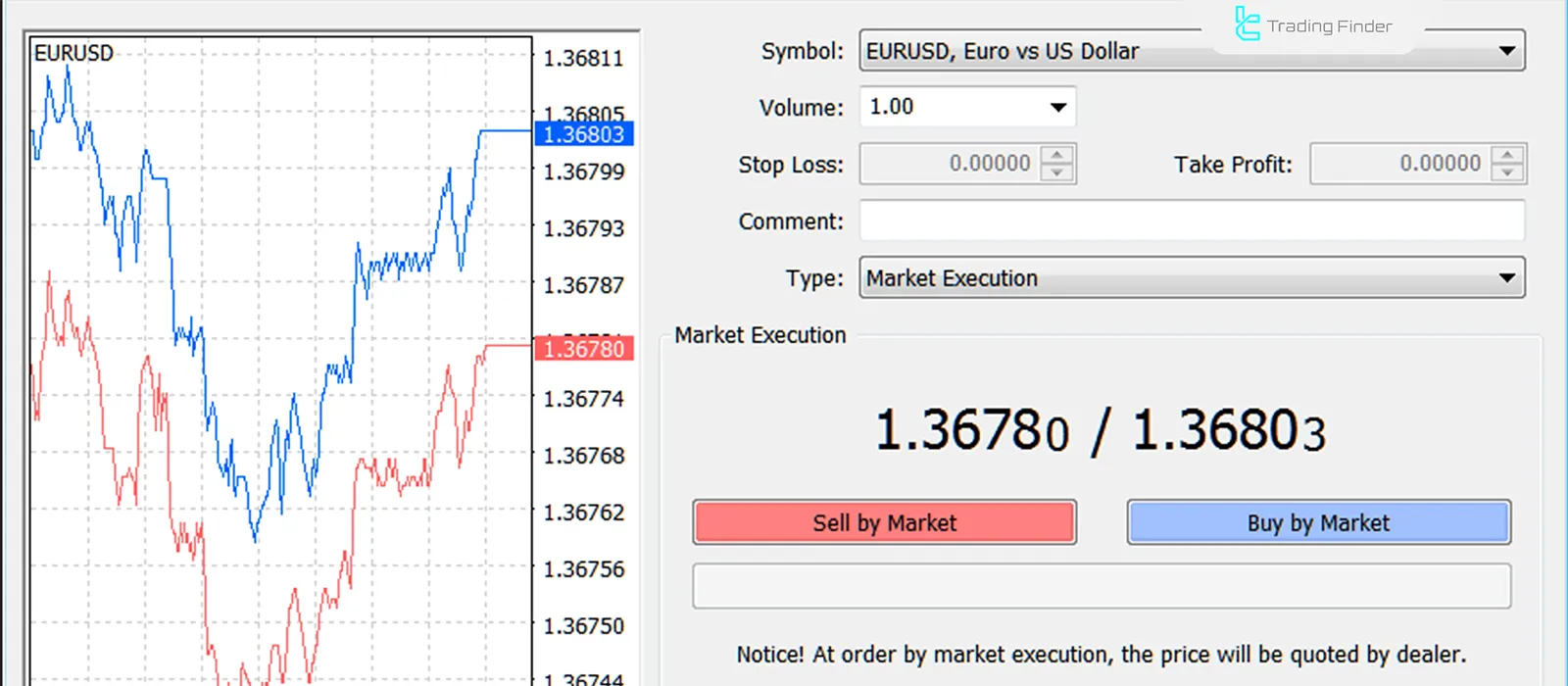

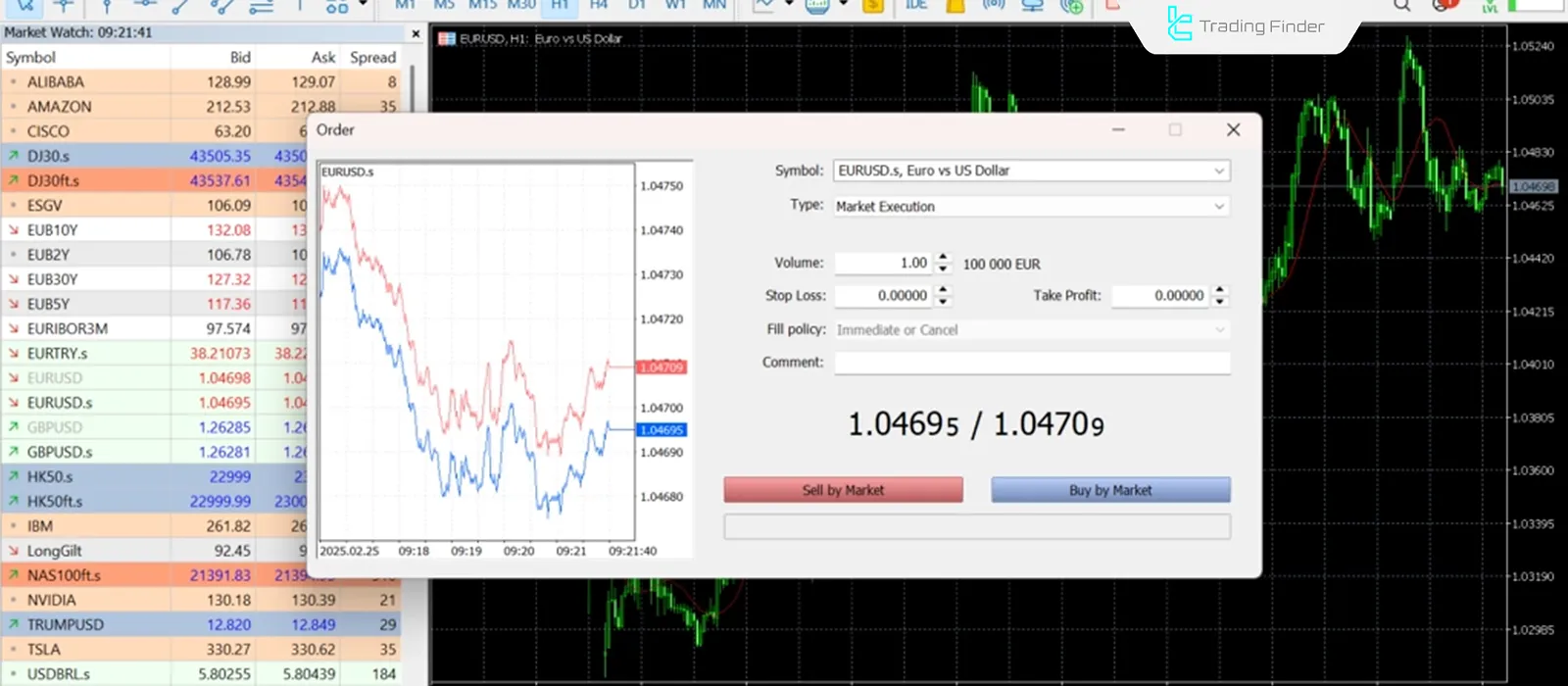

#5 Opening a trade

Opening a trade in MetaTrader 4 is the most important practical step for entering the market.

In this section, the trader must determine the symbol, size, and risk management levels such as stop loss and take profit, and finally execute the order by choosing buy or sell.

- Right-click on the chart or Market Watch and select New Order;

- Select the desired symbol;

- Specify the trade size (Lot Size);

- If you want to set a Stop Loss or Take Profit, enter the values;

- By selecting ” Buy" or “Sell” your trade will be opened.

Example of opening a trade in MetaTrader 4

For example, if you want to open a buy trade on the EUR/USD pair, click on the symbol in the Market Watch window and choose New Order.

Specify the trade size, set a stop loss and take profit if needed, and then execute the order by selecting Buy by Market. After that, the position will be visible and manageable in the Trade section.

#6 Managing trades

Managing trades in MetaTrader 4 allows the trader to monitor the status of open orders, modify stop loss and take profit settings, and review the history of trading activities in detail.

This section is essential for risk control and evaluating trading performance. How to manage trades in MetaTrader 4:

- All open trades are displayed in the “Terminal” window;

- By double-clicking on a trade, you can close it or modify the stop loss and take profit;

- The history of previous trades is also visible in the “Account History” tab.

#7 Using Expert Advisors and forex trading robots

The Experts section in MetaTrader 4 enables the automated execution of trading strategies.

By adding an EA or scripts to the chart, the trader can improve the process of analysis and order execution.

- In the Navigator section, you can add Expert Advisors (EA) or scripts to the chart;

- These tools are used to automatically execute strategies and save the trader time.

Differences between MetaTrader 4 and 5

The main difference between MetaTrader 4 and MetaTrader 5 lies in the types of tradable markets, analytical tools, and their technical architecture.

While MT4 is primarily designed for the forex market, MT5 offers more advanced tools for trading stocks, commodities, and futures. Comparison table of MT4 and MT5:

Features | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

Release year | 2005 | 2010 |

Target market | Primarily forex | Forex, stocks, commodities, futures, and indices |

Execution speed | Suitable for forex | Faster and more optimized for multiple markets |

Timeframes | 9 timeframes | 21 timeframes |

Default MT4 indicators | 30 indicators | 38 indicators |

Analytical tools | More limited | More extensive (including economic calendar and depth of market) |

Programming language | MQL4 | MQL5 (more advanced and faster) |

Advantages and Disadvantages of MetaTrader 4

MetaTrader 4 remains a favorite among brokers due to its intuitive interface and robust features.

However, its limitations in advanced analysis tools and lack of support for newer markets can pose challenges.

MT4 pros and cons:

Pros | Cons |

Simple user interface: Easy access to tools and quick trade execution | Limited support for new tools: Like options trading |

High security: Uses 128-bit encryption to protect user information | Low processing power in some conditions: When using numerous indicators or experts |

Multi-language support: Allows software use in various languages | Limitations compared to MetaTrader 5: Advanced tools are available in the newer version |

Multi-account management: Suitable for professional traders with diverse strategies | - |

Final word

the MetaTrader 4 trading platform, more than 30 indicators and 24 charting tools are available by default to the trader and can be used for market analysis.

Additionally, this platform provides important capabilities including the use of Expert Advisors (EAs) and strategy backtesting, which are tools for precise trade management.