MetaTrader 5 (MT5) is an advanced trading platform developed and released by the Russian company “MetaQuotes” in 2010. It was introduced as an upgraded version of MetaTrader 4, aimed at overcoming the limitations of the previous release.

MetaTrader 5 provides advanced tools such as technical indicators, a built-in economic calendar, algorithmic trading, and backtesting.

The platform supports the MQL5 programming language, which facilitates the design of trading robots and custom analytical tools.

What is MetaTrader 5?

MetaTrader 5 (MT5) is a modern, multi-purpose trading software developed for markets such as forex, stocks, indices, and cryptocurrencies.

With features like diverse indicators, multi-timeframe analysis, algorithmic trade execution, and the ability to test trading strategies, it provides traders with these capabilities.

Support for the MQL5 language also enables the creation of Expert Advisors (EAs), custom indicators, and advanced analytical tools in MT5.

Educational video on MetaTrader trading platform from the Disciplined Trader YouTube channel:

History of MetaTrader 5

MetaTrader 5 (MT5) was released in 2010 by “MetaQuotes Software”. Its primary development goal was to address MT4’s technical constraints and provide a unified environment for access to a wider range of markets.

While MT4 was designed mainly for forex, MetaTrader 5 also enabled trading in stocks, commodities, crypto, indices, and futures contracts.

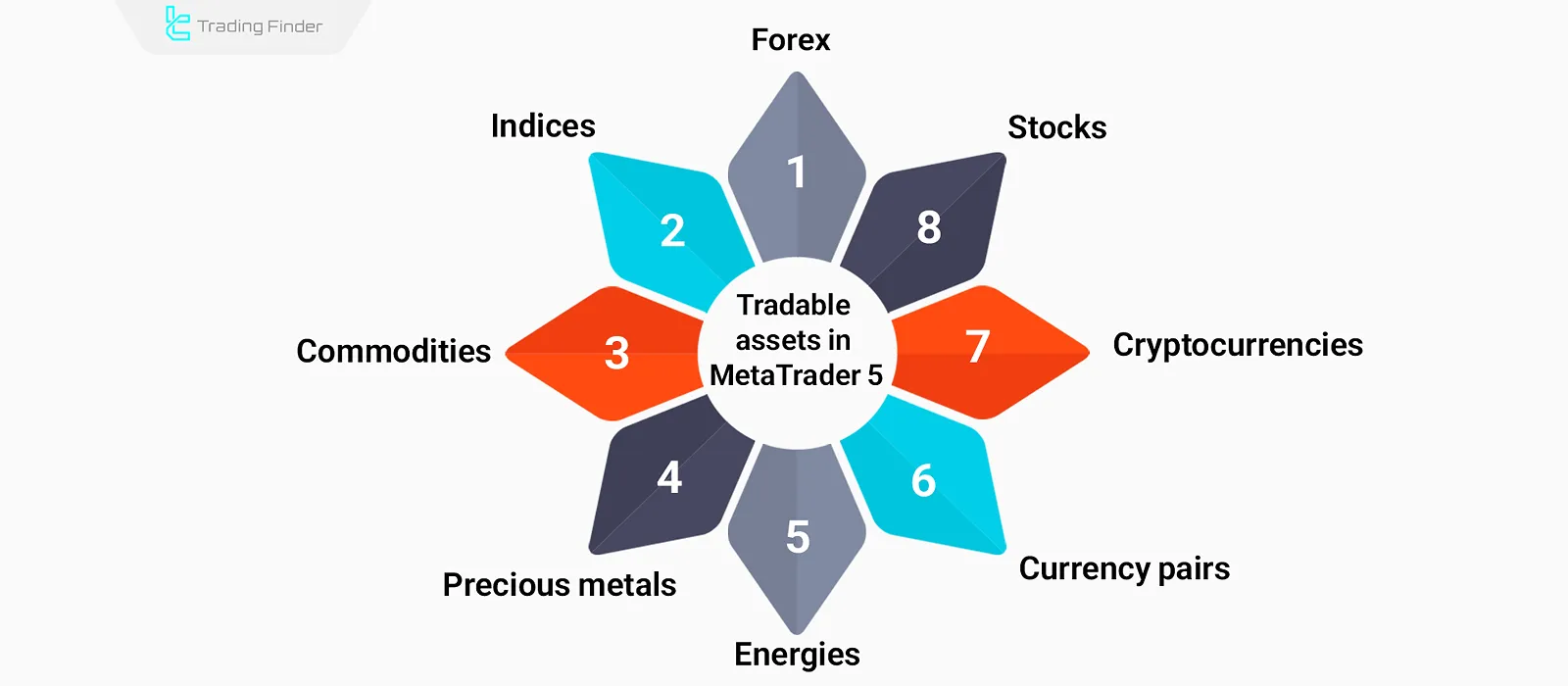

Account Types and Tradable Assets in MetaTrader 5

In MetaTrader 5, depending on the broker, a variety of account types are available to the user, which may include a demo (practice) account for risk-free learning, and live accounts with different spreads (fixed or floating), commissions, and minimum capital requirements.

Some brokers even offer Islamic (Swap-Free) accounts for users who prefer not to pay overnight interest. From the perspective of tradable instruments, MT5 is a multi-market platform.

Traders can access a wide range of financial tools from forex and currency pairs to stocks, indices, commodities, energies, and precious metals offered in MetaTrader 5.

Additionally, many brokers have provided cryptocurrency trading through this platform.

Differences Between MetaTrader 4 and MetaTrader 5

MetaTrader 4 and MetaTrader 5 are both among the most widely used trading platforms, but they differ fundamentally in features and architecture.

The table below compares the most important features of these two versions so traders can choose according to their needs.

Pros and cons table of MetaTrader 5:

Features | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

Release year | 2005 | 2010 |

Market types | Mainly forex | Forex, stocks, commodities, indices, crypto |

Programming language | MQL4 | MQL5 (more advanced) |

Number of timeframes | 9 timeframes | 21 timeframes |

Indicators | About 30 built-in indicators | More than 80 built-in indicators |

Drawing tools | Limited | 44 diverse drawing tools |

Order systems | Hedging only | Hedging and netting |

Strategy backtest | Single-threaded (slower) | Multi-threaded, faster |

Economic calendar | Not available | Available |

Depth of Market (DOM) | Not supported | Supported |

User-friendliness | Simpler and popular for beginners | More advanced, suitable for professional traders |

Getting Familiar with the MetaTrader 5 Interface

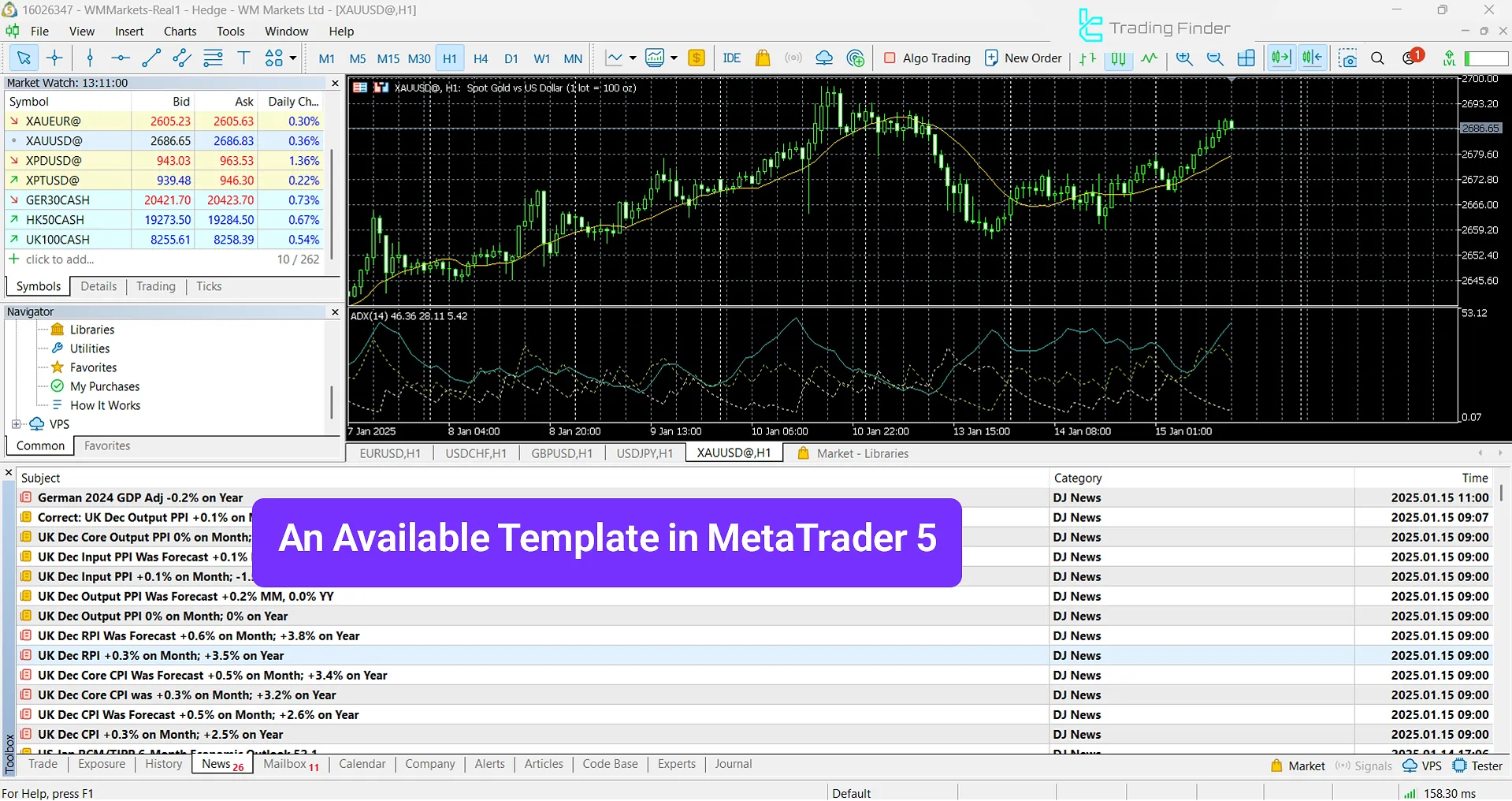

The MetaTrader 5 user interface is designed on a modular structure so that traders can manage multiple markets, analytical tools, and positions simultaneously. MetaTrader 5 interface areas:

Main Toolbar

In MetaTrader 5, users can customize price charts according to their needs and analyze market conditions more precisely. Main toolbar features:

- Changing timeframes (from one minute to one month);

- Adding indicators and drawing tools such as Fibonacci or trendlines;

- Selecting chart type (candlestick, bar, line);

- Quick chart management like zoom, color scheme changes, and switching between symbols.

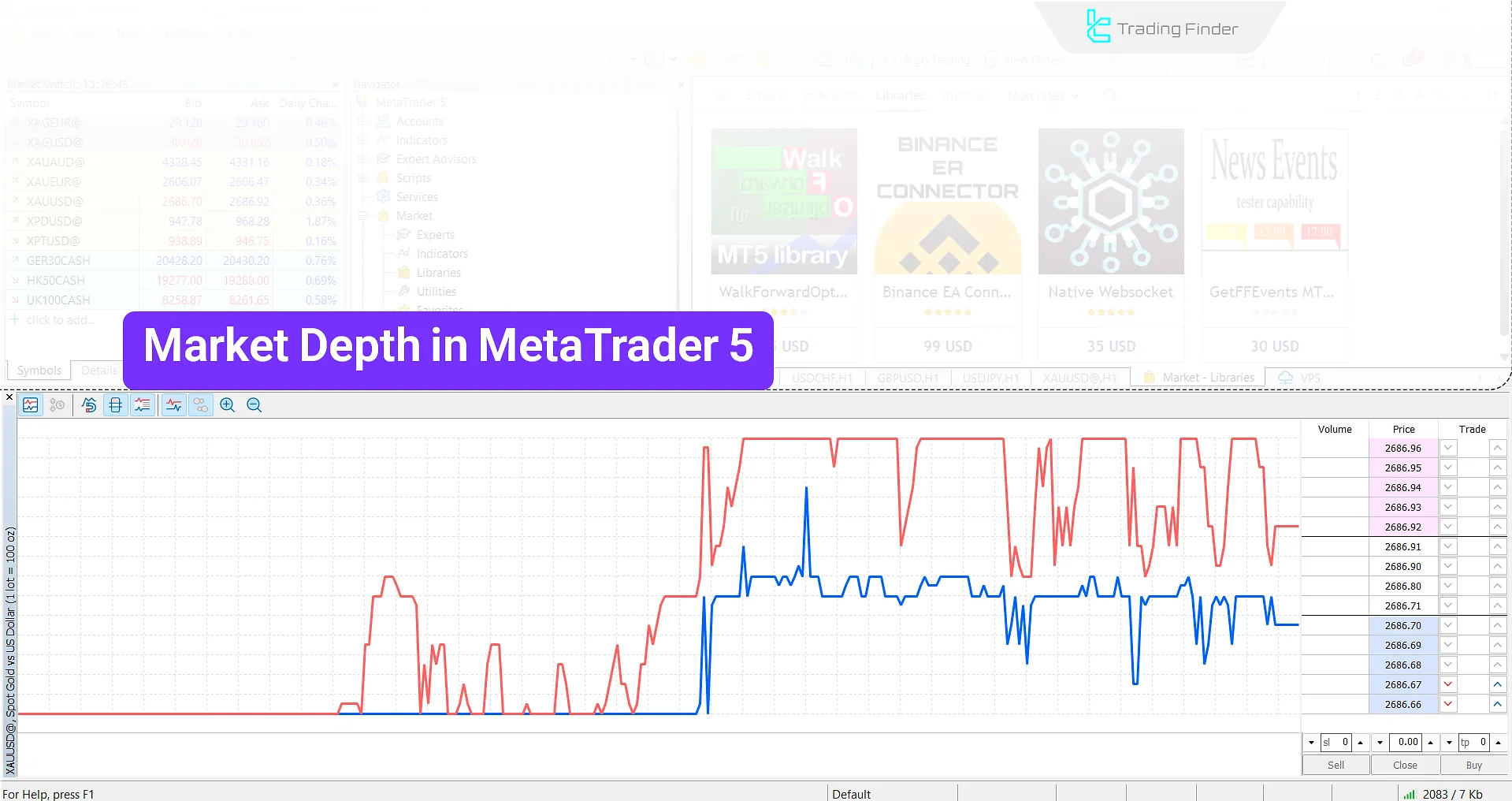

Market Watch Window

In the “Market Watch” section of MetaTrader 5, traders can access key, real-time data. From viewing bid/ask prices to checking market depth and managing symbol lists, Every tool is accessible for making fast and informed decisions Market watch features:

- Display of real-time bid and ask prices;

- Ability to view Depth of Market (DOM) showing volume and number of orders at different prices;

- Adding or removing symbols for quick access to desired currency pairs or assets.

Accounts Management “Navigator”

In MetaTrader 5, the Accounts management section, “Navigator”, allows users to connect to multiple demo or live accounts simultaneously and switch between them.

In addition, a trader can activate built-in or installed indicators on the chart. Navigator features:

- Account management (log in to multiple live or demo accounts);

- Ability to use built-in indicators along with installed ones;

- Running Expert Advisors (trading robots) on charts;

- Using scripts to quickly perform a specific action (such as closing all open trades).

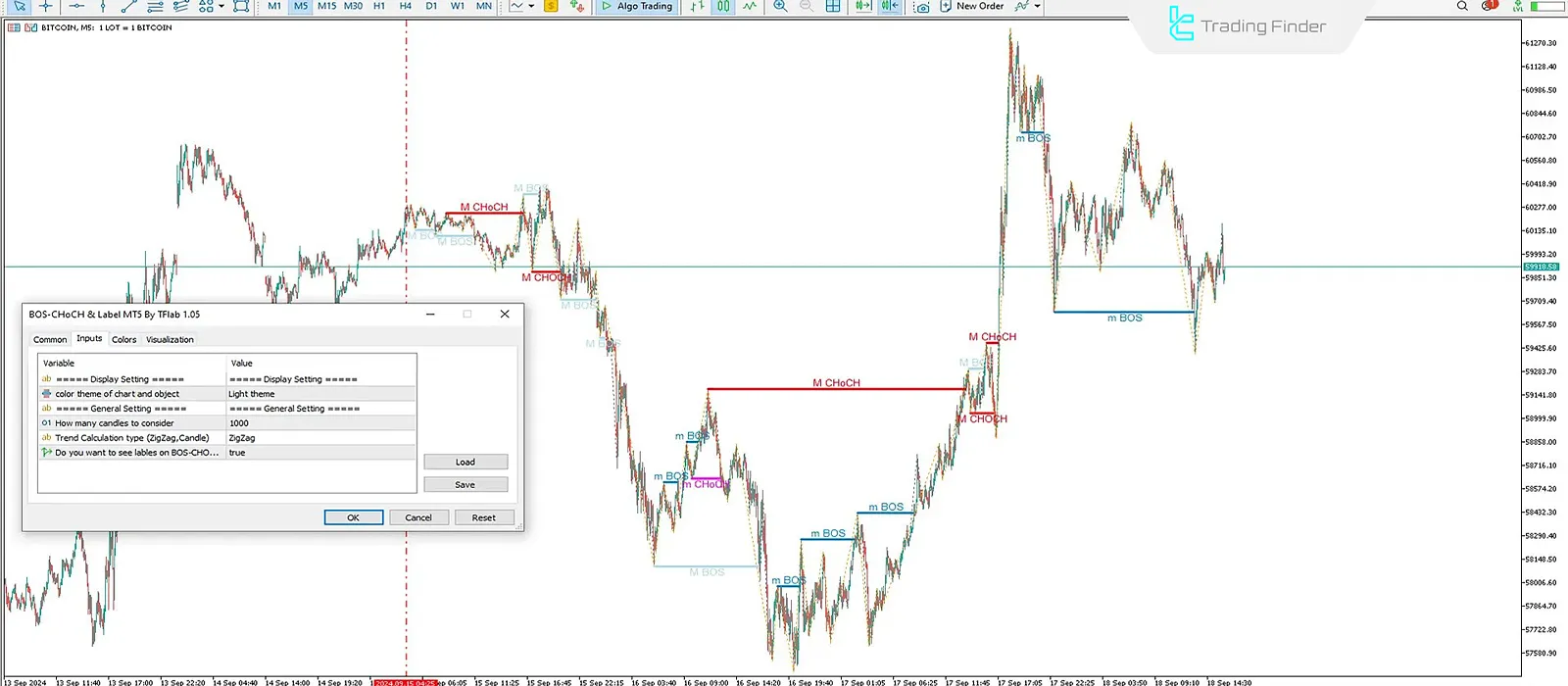

Example of Using an Indicator in MetaTrader 5

The BOS-CHOCH with Label indicator in MetaTrader 5 is one of the advanced, specialized tools for analyzing market structure, widely used among ICT and Smart Money traders.

Educational videos on using the Break of Structure and Change of Character indicator:

This indicator is designed to automatically identify key market points and precisely plots the two important concepts of break of structure and change of character on the chart.

A break of structure occurs when price breaks its previous high or low and forms a new level. This movement indicates trend continuation and confirms market strength in the same direction.

In contrast, a change of character happens when the level that caused the break of structure is broken again. This event signals a trend change and a shift in market direction.

The BOS-CHOCH indicator uses intelligent algorithms to automatically detect these points and labels the type of move on the chart.

One of the most important advantages of this indicator is its ability to detect both primary and secondary structures. This helps traders monitor not only major trends but also minor and short-term changes.

In addition, using different colors for BOS and CHOCH makes it easier and faster for users to spot trend changes.

This indicator falls under reversal tools, breakouts, trading cycles, and multi-timeframe analysis, and it is flexible across different timeframes.

Whether in day trading and scalping or in swing trading, BOS-CHOCH can be a reliable tool for market analysis.

It is also applicable to various markets such as forex, cryptocurrencies, and indices, and is not limited to a specific asset.

In the settings, users can customize the look and behavior of the indicator to their needs.

These settings include choosing a theme (light, dark, or auto), specifying the number of candles to analyze, selecting the trend calculation method based on different algorithms like ZigZag, and enabling or disabling labels.

Overall, the BOS-CHOCH with Label indicator is a powerful tool for identifying key moments in market movements.

It helps traders find more reliable entry and exit points, improve risk management, and more accurately recognize true market trends.

Download link for the Break of Structure and Change of Character indicator:

Break of Structure and Change of Character indicator in MetaTrader 5

Charts

In MetaTrader 5, the Charts section gives traders high flexibility for detailed analysis.

Prices are displayed live, and users can open multiple charts for different assets simultaneously. MetaTrader 5 chart features:

- Live display of price movements;

- Ability to add multiple charts for different assets at the same time;

- Candlestick charts for price action, line charts for the simplest view, bar charts for OHLC detail;

- Personalization of colors, indicators, and saving as Templates.

For customizing charts and viewing more details, you can use the charting MetaTrader 5 tutorial on the DOMINION MARKETS website:

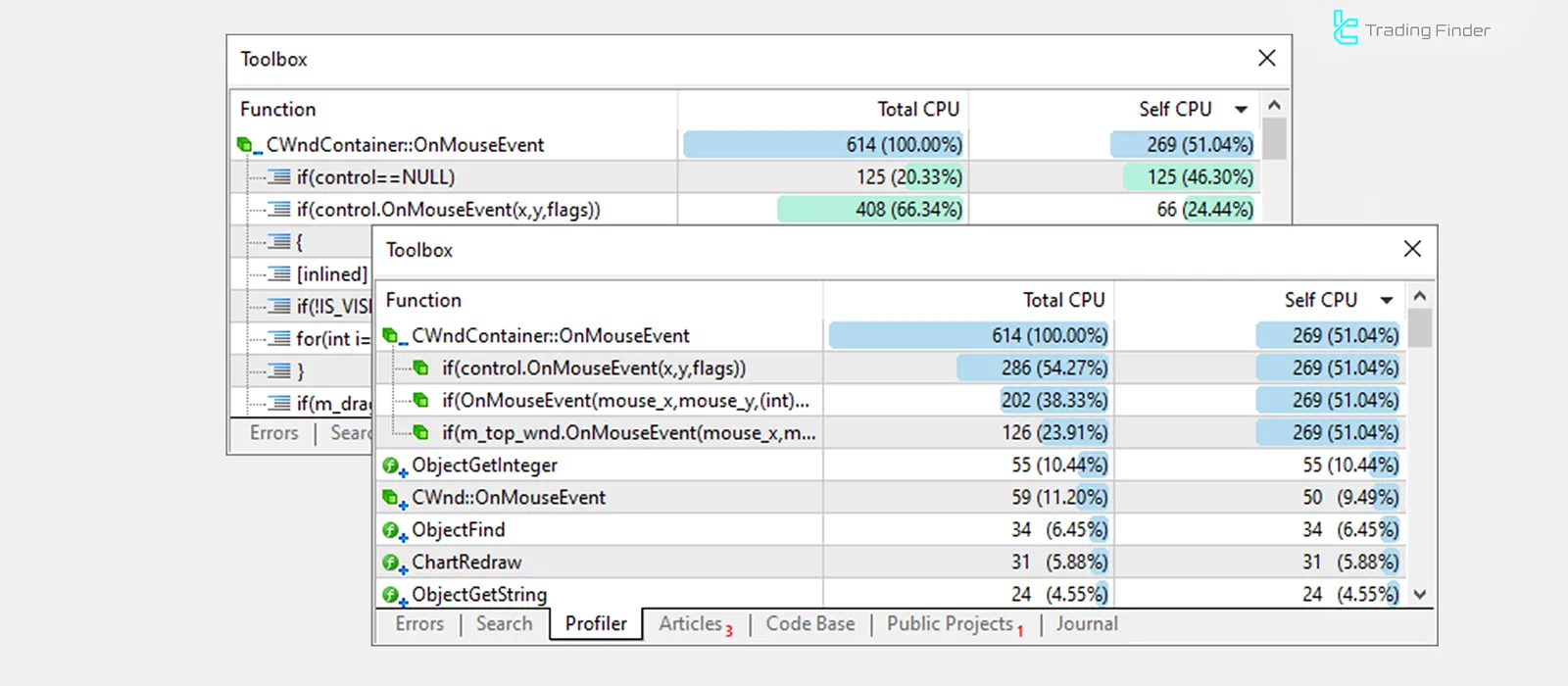

Terminal (Toolbox)

In MetaTrader 5, the “Terminal” (Toolbox) acts as the center for managing account information and trades. The Trade tab displays open trades, position sizes, and real-time profit/loss.

The Exposure section provides a view of capital engaged in each asset and the level of risk. Terminal features in MetaTrader 5:

- Trade: display of open trades, volume, entry price, real-time P/L;

- Exposure: a summary of risk and capital engaged in each asset;

- Account History: full history of closed trades with profit/loss;

- News: important market-related economic news;

- Alerts: price alerts set by the user for specific prices or conditions.

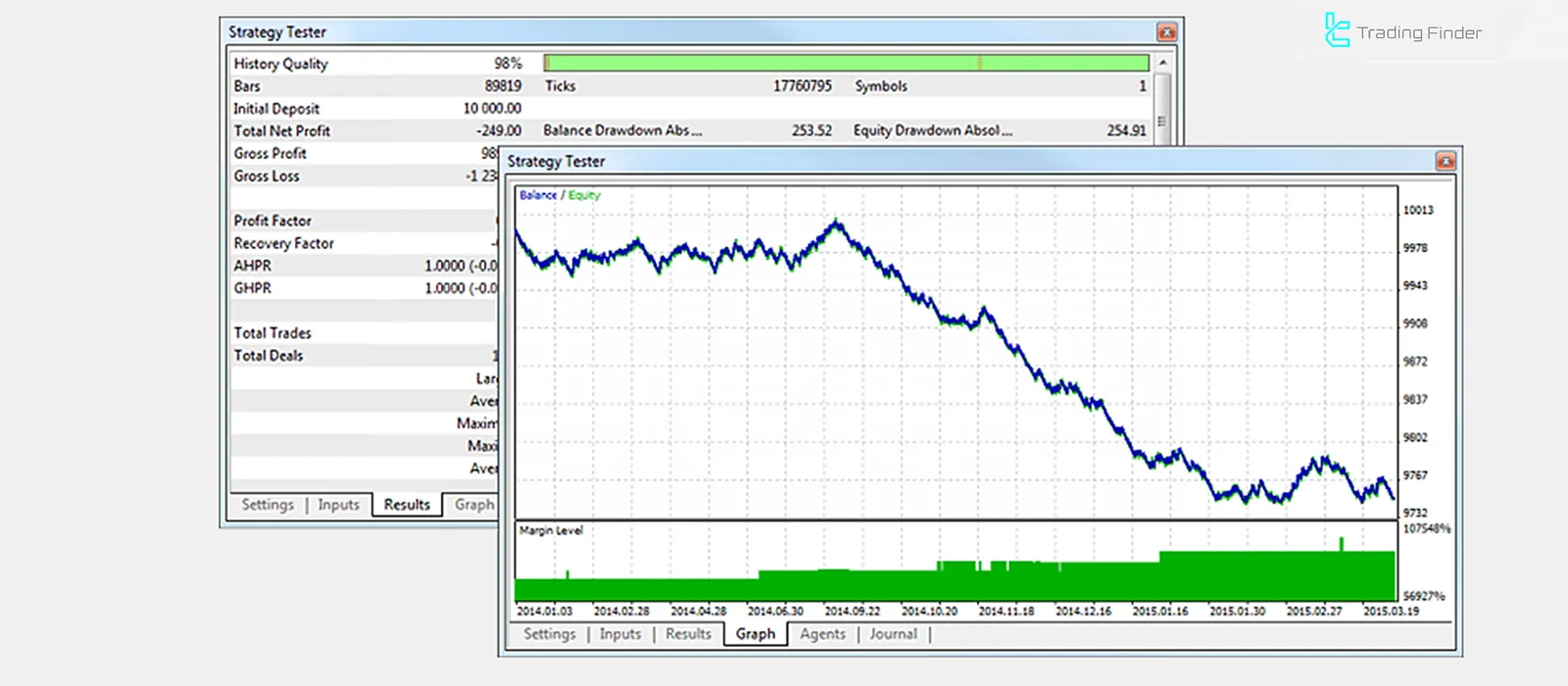

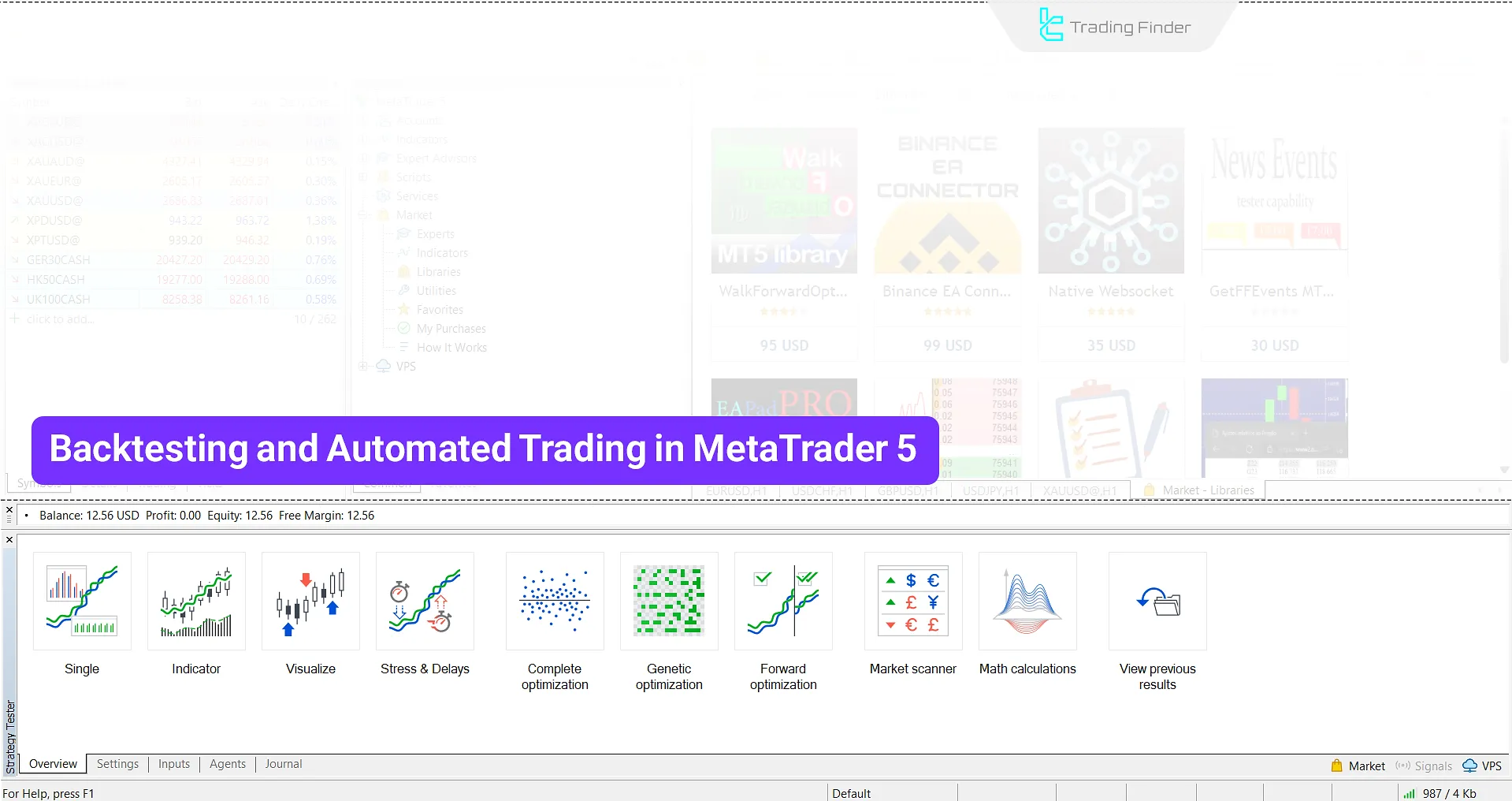

Strategy Tester

In MetaTrader 5, the "Strategy Tester" section is designed to evaluate and assess trading strategies.

With this tool, you can run precise backtests on historical data and apply forward tests on new data. Strategy Tester features in MetaTrader 5:

- Executing backtests on historical records with high efficiency and accuracy;

- Ability to forward-test to assess strategy performance on new data;

- Support for multi-threaded testing to save time;

- Providing a complete report including profit, loss, win rate, and strategy risk.

Key Features of MetaTrader 5

MetaTrader 5 is known for features such as multiple charts, diverse timeframes, advanced indicators, and the ability to run Expert Advisors.

The platform also offers tools like market depth and simultaneous multi-account management, making it a practical choice for professional traders. Key features of MetaTrader 5:

Automated Trading with Advanced Algorithms

MetaTrader 5 enables automated trading using algorithms designed in the MQL5 programming language.

This feature allows users to create custom trading robots and indicators.

Diverse Analytical Tools

There are more than 80 technical indicators and 44 chart-drawing tools available on this platform; these tools include Fibonacci, trendlines, channels, and many others.

Having this many analytical tools allows traders to implement everything from simple price-action reviews to complex statistical analyses directly on the chart.

Multi-threaded Backtesting

The platform allows users to test trading strategies in a multi-threaded environment by using historical data.

This feature allows traders to identify strengths and weaknesses before going live and optimize trading strategy in MT5parameters for better performance.

Support for Market Depth

This feature provides access to detailed trading volume data and market dynamics.

It allows traders to see order sizes across various price levels and spot zones of strong demand or supply, helping them make more accurate decisions.

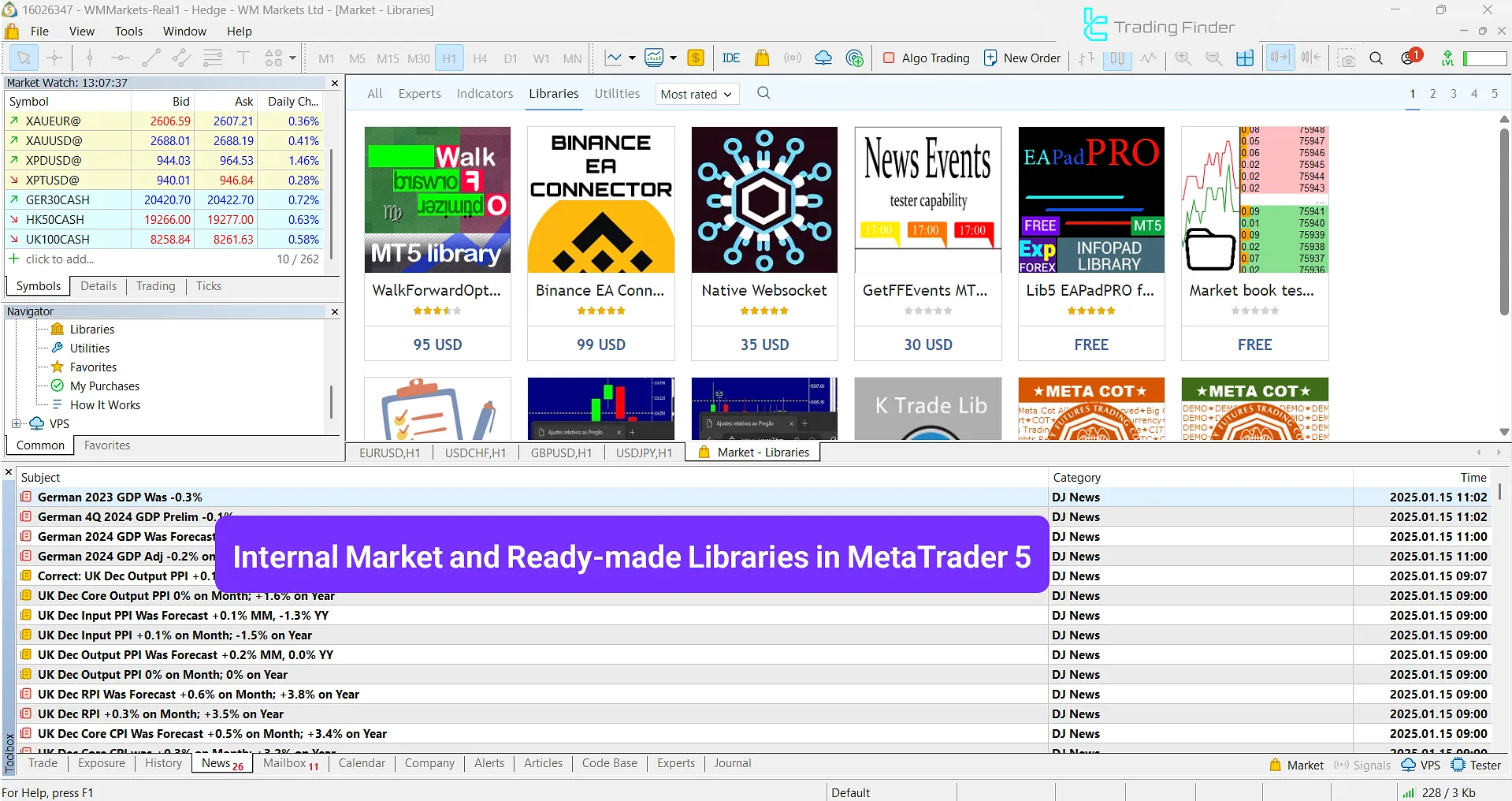

Internal Market and Ready-made Tool Library

With MT5’s built-in market, you can purchase or download ready-made tools and various indicators.

This section also provides access to Expert Advisors, scripts in MetaTrader, and even trading signals, so users can have a complete set of practical tools without relying on external sources.

Detailed Performance Reports

The platform allows you to review trade performance from various angles, including win rate and average profit/loss.

In addition, precise statistical reports are generated to help traders identify strategy weaknesses and make decisions to improve risk management.

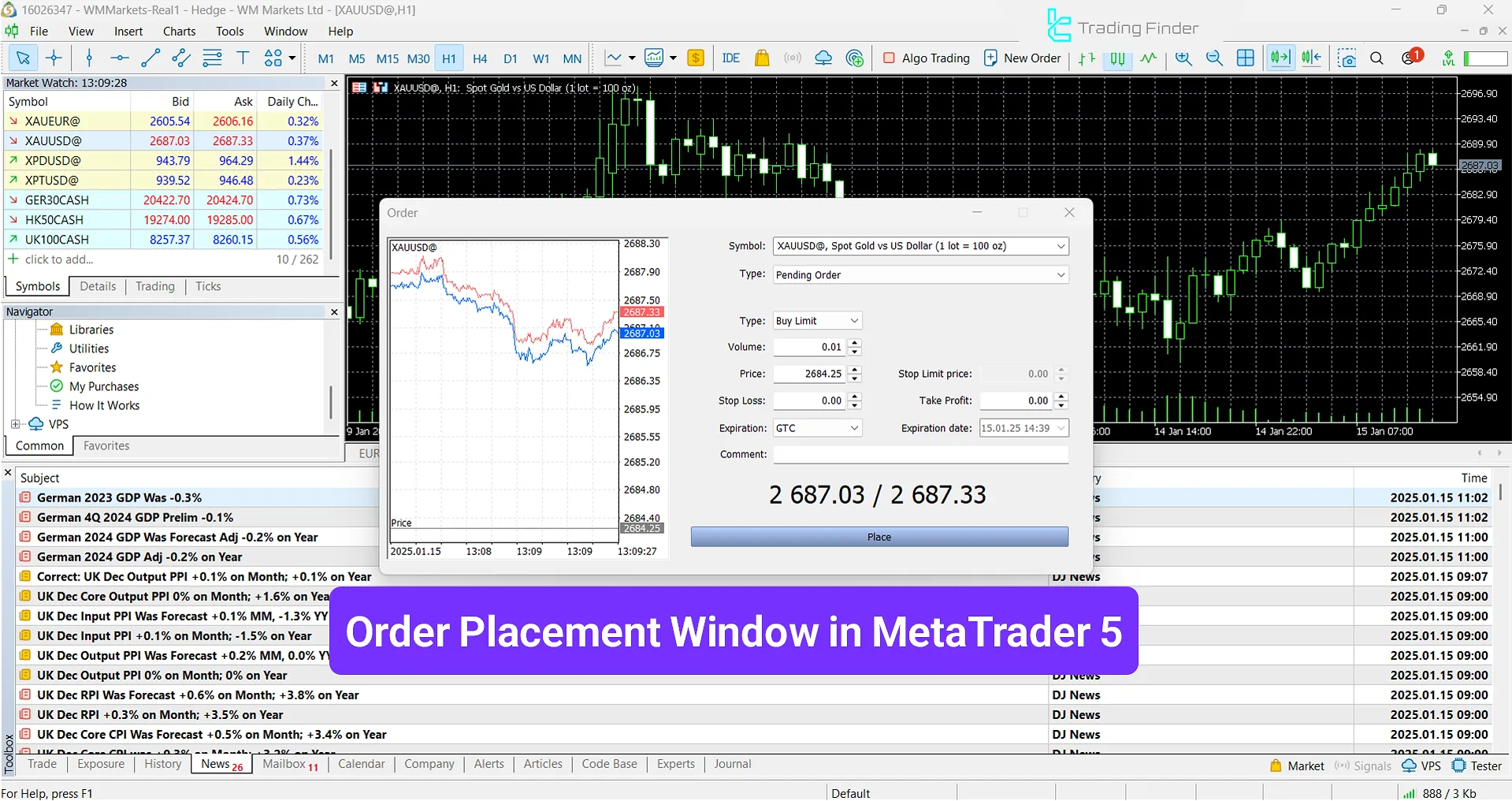

Order Types

MetaTrader 5 supports various market order types and pending orders, including:

- Buy Limit

- Sell Limit

- Buy Stop

- Sell Stop

- Buy Stop Limit

- Sell Stop Limit

- Trailing Stop

Take Profit and Stop Loss

With these tools, users can automatically close a trade upon reaching a stop loss or take profit.

This capability enables more precise risk control without constant market monitoring.

Traders can also define different position-specific capital management levels and execute a more customized strategy.

Hedging and Netting Systems

These two systems help users either keep multiple positions open simultaneously or aggregate all open positions into a single net position.

In hedging mode, a user can open multiple trades on one asset (even in opposite directions), whereas in netting mode all trades on a symbol are combined into a single overall position.

Templates

MetaTrader 5 supports templates to simplify and optimize the analysis and trading process.

Templates are collections of settings and parameters including indicators, chart color schemes, trendlines, and other analytical tools that can be saved and applied to any new chart.

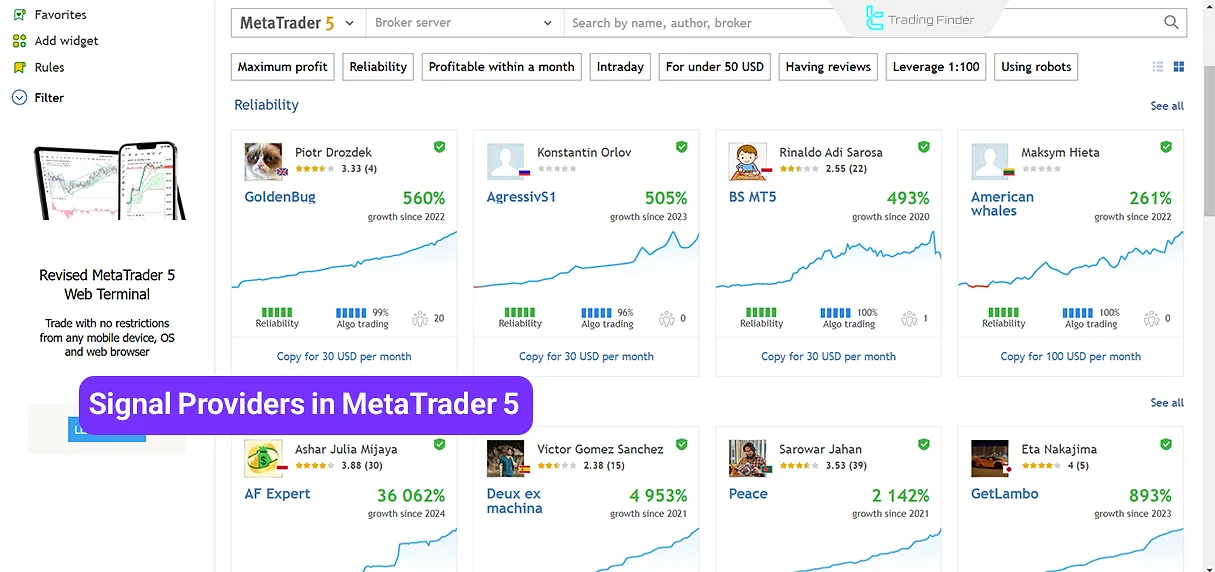

Copy Trading

Copy trading is an appealing feature that allows you to copy trades executed by other professional traders.

This is especially useful for less experienced individuals or those without enough time for market analysis and can be a quick way to follow successful strategies.

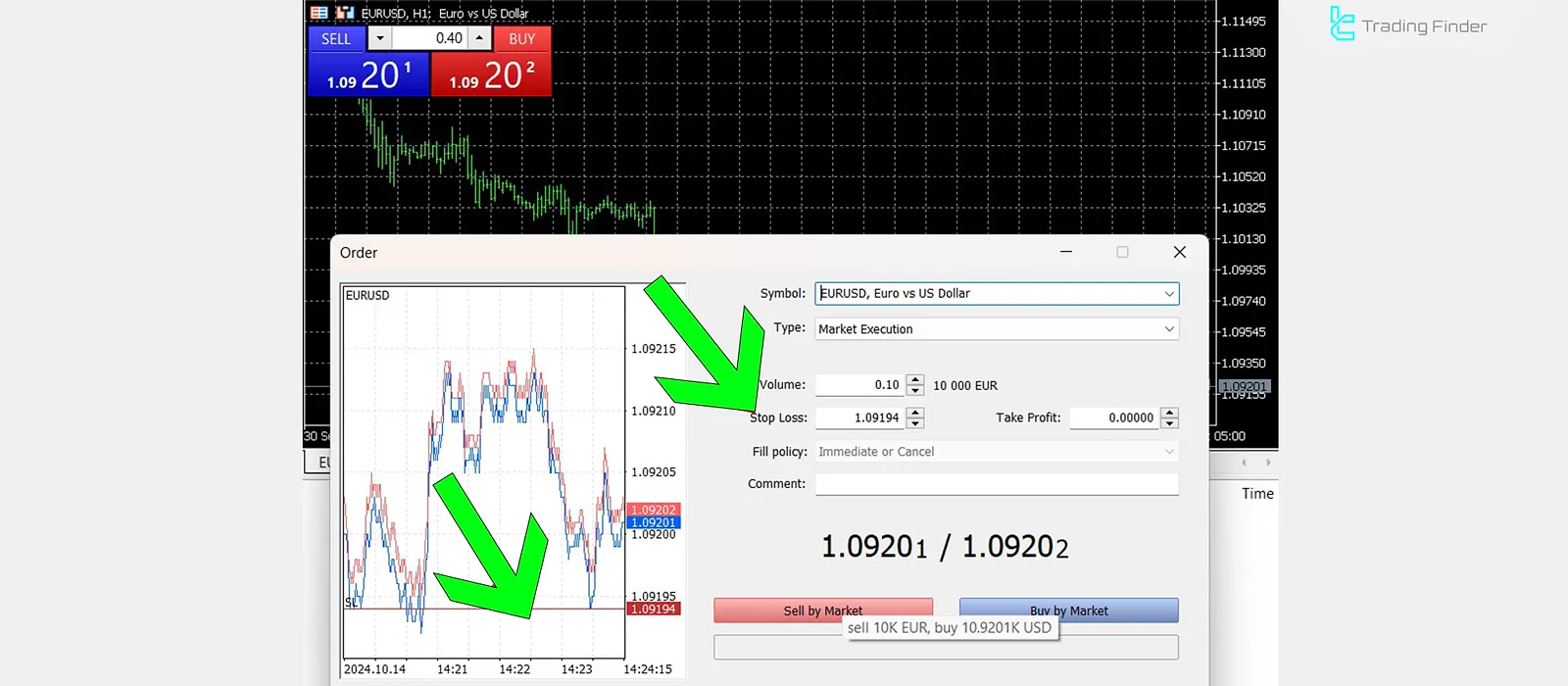

Trade Example in MetaTrader 5

Suppose you’re trading the EUR/USD pair. The current price is at 1.09201, and you anticipate an uptrend. On the MetaTrader 5 platform, you open a Buy trade at this level.

For risk management, you set the Stop Loss at 1.09194 so that if the market moves against your analysis, your loss is limited.

Conversely, you set the Take Profit at 1.09320 so that if price reaches this level, the trade closes automatically and locks in your profit.

Accordingly, if price rises to 1.09320, your trade closes in profit and you don’t need to be glued to the chart. But if the market falls and price reaches 1.09194, the trade closes to prevent further loss.

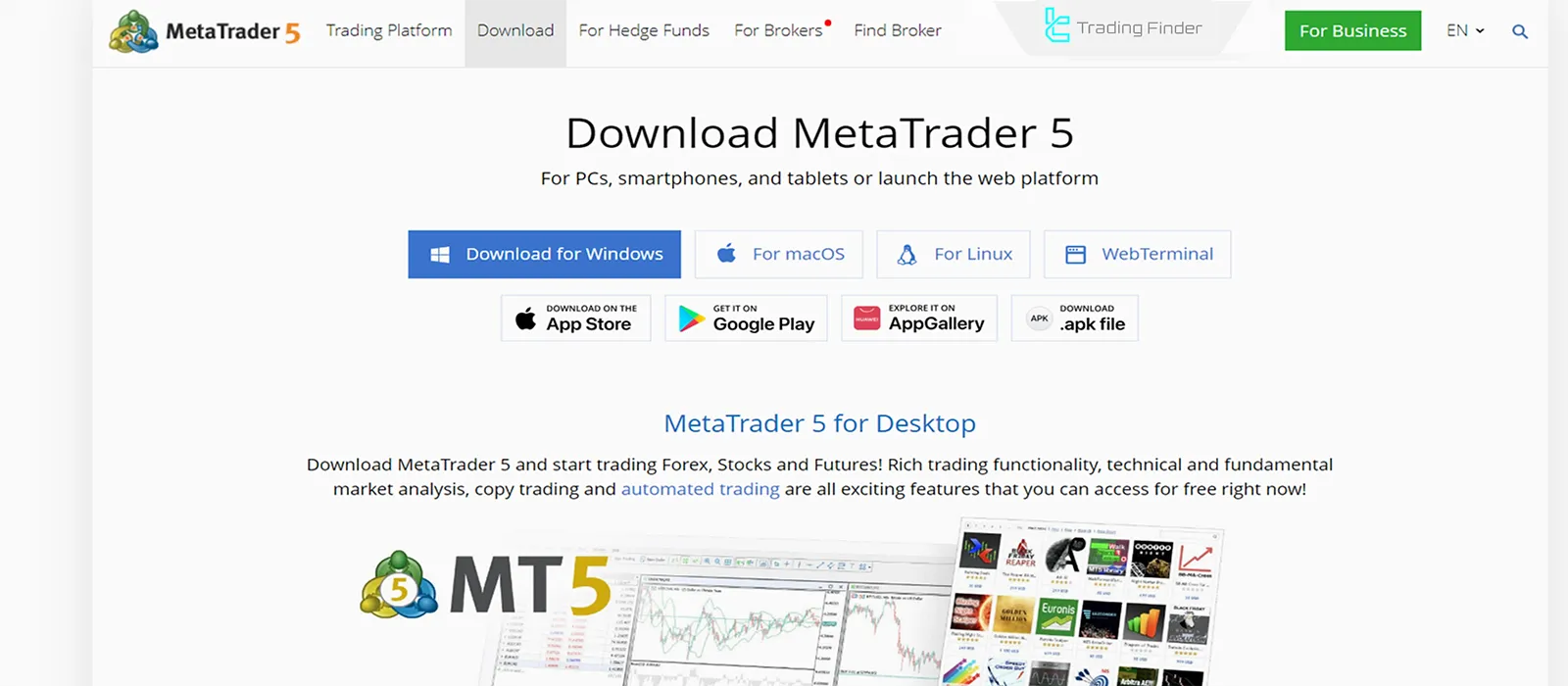

How to Download MetaTrader 5

The MetaTrader 5 (MT5) platform is available for most devices and operating systems, and users can easily download and install it.

The Windows version is offered as desktop software and provides full analysis capabilities, EA execution, and advanced trade management.

For those who trade mainly on mobile, Android and iOS MT5 versions are also available. These versions feature a simple, optimized interface for quick access to charts, order placement, and account status.

By downloading MetaTrader 5 on your phone or computer, you can connect to the market anytime, anywhere, manage your trades, and use the same core tools as the desktop version.

This makes MetaTrader 5 a suitable option for traders who need flexibility and continuous access to their trading accounts.

Advantages and Disadvantages of MetaTrader 5

MetaTrader 5 offers features like fast order execution, advanced analytical tools, and support for multiple asset classes.

At the same time, it has limitations such as the learning curve for MQL5 and differences from version 4. Pros and cons table of MetaTrader 5:

pros | cons |

Modern and flexible design | Complex interface for beginner traders |

High security | Higher minimum system requirements compared to MT4 |

Support for diverse markets | Incompatibility with MetaTrader 4 |

MQL5 programming language and custom robot development | - |

High speed and reliable performance | - |

Integrated economic calendar | - |

Multi-threaded and precise backtesting | - |

Final Word

MetaTrader 5 (MT5) provides advanced algorithmic trading, extensive analytical tools (38 built-in indicators), and multi-threaded backtesting.

The platform allows trading in various markets, including Forex, stocks, commodities, indices, and futures contracts using custom trading robots and tools.