Economic and political news plays a key role in market direction and sentiment. Due to the surge in volume and volatility during news releases, specific trading strategies have been developed for news trading, and traders use various techniques to profit from market movements at such times.

Risk management and discipline in executing trading strategies are the most critical components of success in news trading.

In today’s trading, fundamental data analysis and the speed of reaction to news play a crucial role. The use of algorithmic trading systems and market sentiment analysis enables traders to instantly detect the impact of news and make faster decisions.

What is News Trading?

News trading is a strategy based on reacting to economic and political news releases to predict and profit from market volatility.

This strategy is mainly used in the forex market due to the high impact of news on currency pairs and commodities. It revolves around how news affects price action.

The most influential news events in the market are central bank interest rate decisions, especially from the U.S. Federal Reserve, which offer significant trading opportunities.

Advantages and Disadvantages of News Trading

News trading offers substantial profit potential but also comes with notable risks. Here are the pros and cons:

Advantages | Disadvantages |

High profit potential | High risk |

No need to predict market trend | Requires fast and accurate analysis |

Ability to benefit from surprises | Spread widening and slippage during news |

Deeper experience and insight | Increased psychological pressure |

Higher reward-to-risk ratios | Challenging risk and capital management |

Reliable Tools and Sources for News Trading

The most important aspect of news trading is access to accurate and up-to-date sources. Key criteria for choosing news sources include:

- Reliability of the source

- Speed of news delivery

- High accuracy and comprehensiveness

- Insightful analysis related to news

Top Sources for News Trading

News sources are categorized into general/analytical and forex-specialized sources. Below are the most trusted and widely used:

General and Analytical News Sources:

- Bloomberg: Leading source for economic and financial news with real-time analysis;

- Reuters: Popular and reliable for financial and economic news;

- CNBC: Comprehensive coverage of financial and economic updates;

- Investing: News, economic calendar, and market analysis;

- FxStreet: Extensive forex and financial market news and analysis.

Forex-Specific News Sources:

- Forex Factory: Popular among forex traders with real-time news, tools, and economic calendar;

- DailyFX: Focused on forex news and analysis;

- FXStreet: Accurate forex news and analysis;

- Action Forex: Daily/weekly technical and fundamental analysis of major pairs.

Platforms and Technical Tools Required for News Trading

Quick analysis and decision-making require the right tools for trading with news, including:

- Credible news platforms: e.g., Bloomberg for economic updates;

- Charting tools: Platforms like TradingView for technical analysis;

- Economic calendars: Highlight key economic events and impactful news;

- Risk and capital management tools: Forex calculators, trading journals, risk-management EAs;

- Stable internet connection: For real-time and uninterrupted execution;

- News Alert Plugins: Tools such as NewsCal or Autochartist provide real-time alerts for major economic news events;

- Live News Feed Services: Platforms like Ransquawk and LiveSquawk deliver news updates several seconds earlier than public websites.

Difference Between News Trading and Other Trading Styles

Understanding the difference between news trading and other trading methods helps you choose your strategy more precisely:

Feature | News Trading | Day Trading | Swing Trading |

Trade Holding Period | A few minutes to a few hours | Several hours | Several days |

Main Decision Factor | Reaction to economic and political data | Price action and trend | Long-term technical structure |

Rapid Volatility Risk | Very high | Medium | Lower |

Speed of Decision-Making Required | Instant (within seconds) | Fast but manageable | Slower |

News trading suits individuals who thrive on quick decision-making, high pressure, and instant reactions, while swing and day trading require more patience and continuous analysis.

For further details on trading with news, refer to the article news trading for traders available on the website corporatefinanceinstitute.com.

News Trading Strategies in Forex

Strategies suitable for news trading in the forex market require high speed and precision, and are designed with these needs in mind. Below are some of the main types of news trading strategies.

Types of news trading strategies in forex:

- Directional Strategies

- Non-Directional Strategies

- Breakout Strategies

- Trend-Following Strategies

Directional Strategies

In this method, the trader predicts how the news (e.g., interest rate, employment report, GDP) will affect the price after release.

The trade is opened in the anticipated direction either before or immediately after the news release. Success in this strategy requires a deep understanding of the market and accurate expectation analysis.

Non-Directional Strategies

These strategies are designed based on the intense volatility following news events. The trader quickly anticipates market movement; therefore, by placing buy stop and sell stop orders above and below the price, they profit from price movement in either direction.

In another variation of this strategy, two trades (one buy and one sell) are opened before the news. As price moves in either direction, the stop loss of the losing trade is triggered, and the trader profits from the winning trade.

For example, if price moves upward, the stop loss of the sell trade is hit, and continued movement in that direction generates profit from the buy trade.

Breakout Strategies

In this method, traders identify key support and resistance levels before the news release. As soon as one of these levels is broken after the announcement, a trade is entered. This strategy requires fast execution and considerable trading experience.

Trend-Following Strategies

After the market’s initial reaction to the news stabilizes, the trader enters a position in the direction of the new trend. The goal of this conservative approach is to capitalize on the second wave of the market movement after the initial volatility.

Practical Execution of the News Trading Strategy

Understanding the theory behind news trading strategies is not enough; success comes when a trader can implement them effectively at the exact moment data is released.

To truly master how to trade news, one must combine theoretical knowledge with practical timing, risk control, and fast decision-making. The following steps provide a structured framework for precise execution of news trading:

#1 Pre-News Preparation

The goal of this stage is to fully understand market conditions and define the expected volatility range before the data release.

- Identify the type of news and key indicators such as interest rate, NFP, or CPI;

- Compare market expectations (Forecast) with previous (Previous) and actual (Actual) data;

- Analyze the price volatility range prior to release and mark the major support and resistance levels.

#2 Trade Execution During the Release

At this stage, the focus is on fast and accurate reaction to the published data.

- Use pending orders slightly above and below the pre-release range;

- For high-impact news events, avoid manual entry and rely on auto-execution systems;

- If the actual figure differs from the forecast by more than a certain threshold (e.g., 0.5%), enter in the dominant market direction.

#3 Post-News Trade Management

After the market’s initial reaction, risk control and profit protection become the main priorities.

- Set the stop loss at a reasonable distance around 2 to 3 pips for scalping and 10 to 15 pips for higher timeframes;

- Secure partial profits quickly and use a trailing stop for the remaining position;

- Once the market volatility subsides, avoid holding positions for extended periods.

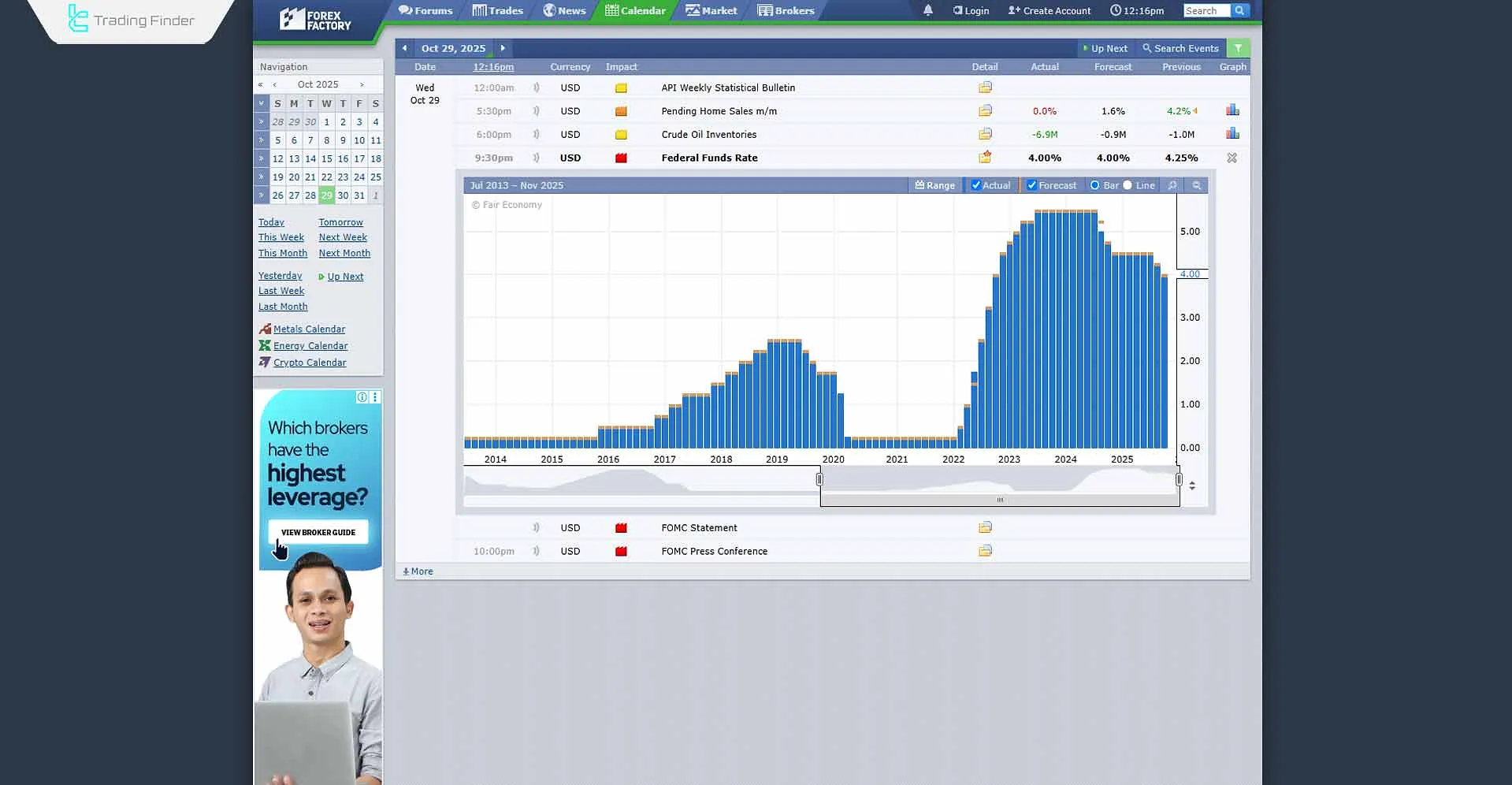

Example of a News-Based Trade in the Forex Market

On October 29, 2025, the U.S. Federal Reserve reduced the interest rate to a range of 3.75%–4.00%. This decision initially shifted market expectations toward a weaker U.S. dollar and a rally in non-yielding assets such as gold.

However, the Fed’s cautious tone in its post-meeting statement indicated that further rate cuts were not guaranteed, suggesting a continuation of conservative monetary policy.

This cautious stance led to a strengthening of the U.S. Dollar Index and downward pressure on gold prices.

Under such conditions, entering a short position on gold at the time of the announcement could have been a logical decision because:

- The rate cut initially generated expectations of a weaker dollar;

- The Fed’s cautious statement reversed market sentiment toward dollar buying;

- Consequently, gold prices came under pressure as the dollar gained strength.

If a trader had entered a short position on gold following the announcement, and the price dropped from around $4,000 to approximately $3,960 per ounce, the trade would have yielded about a 1% return, equivalent to $40 per ounce.

This scenario illustrates the direct impact of Federal Reserve monetary policy decisions on global liquidity flows, currency expectations, and the price behavior of precious metals in international markets.

Major Pairs and Symbols for News Trading

For news trading in the forex market, major pairs, some minor pairs, and precious metals such as gold (XAU/USD) are closely monitored.

Major pairs and symbols for news trading:

- XAU/USD

- XAG/USD

- EUR/USD

- GBP/USD

- AUD/USD

- USD/JPY

- USD/CAD

- USD/CHF

- EUR/GBP

- EUR/AUD

In addition to currencies and commodities, indices like the Dow Jones (DJI), Nasdaq (NQ100), S&P 500, and the U.S. Dollar Index (DXY) are frequently traded during major economic news.

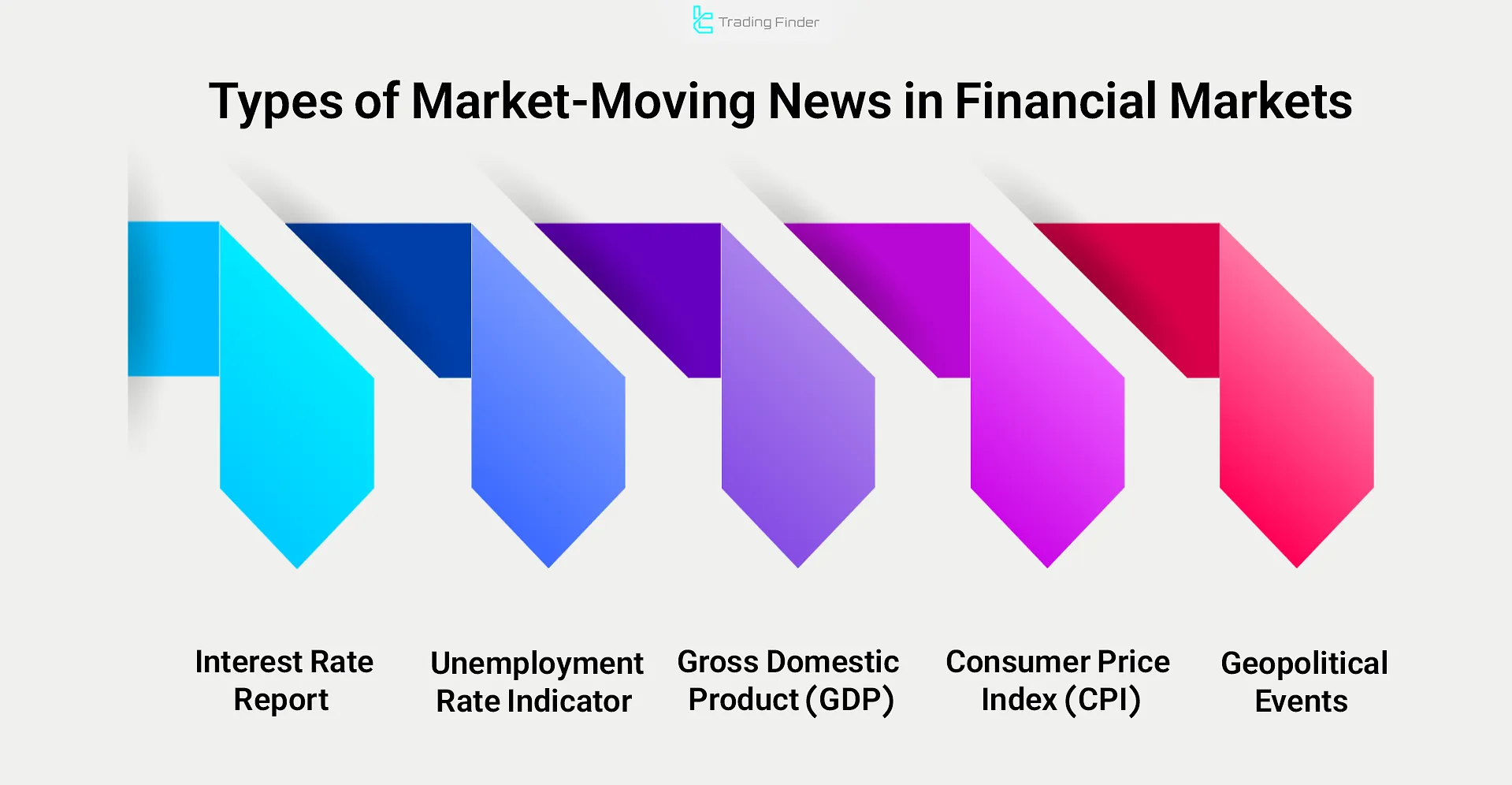

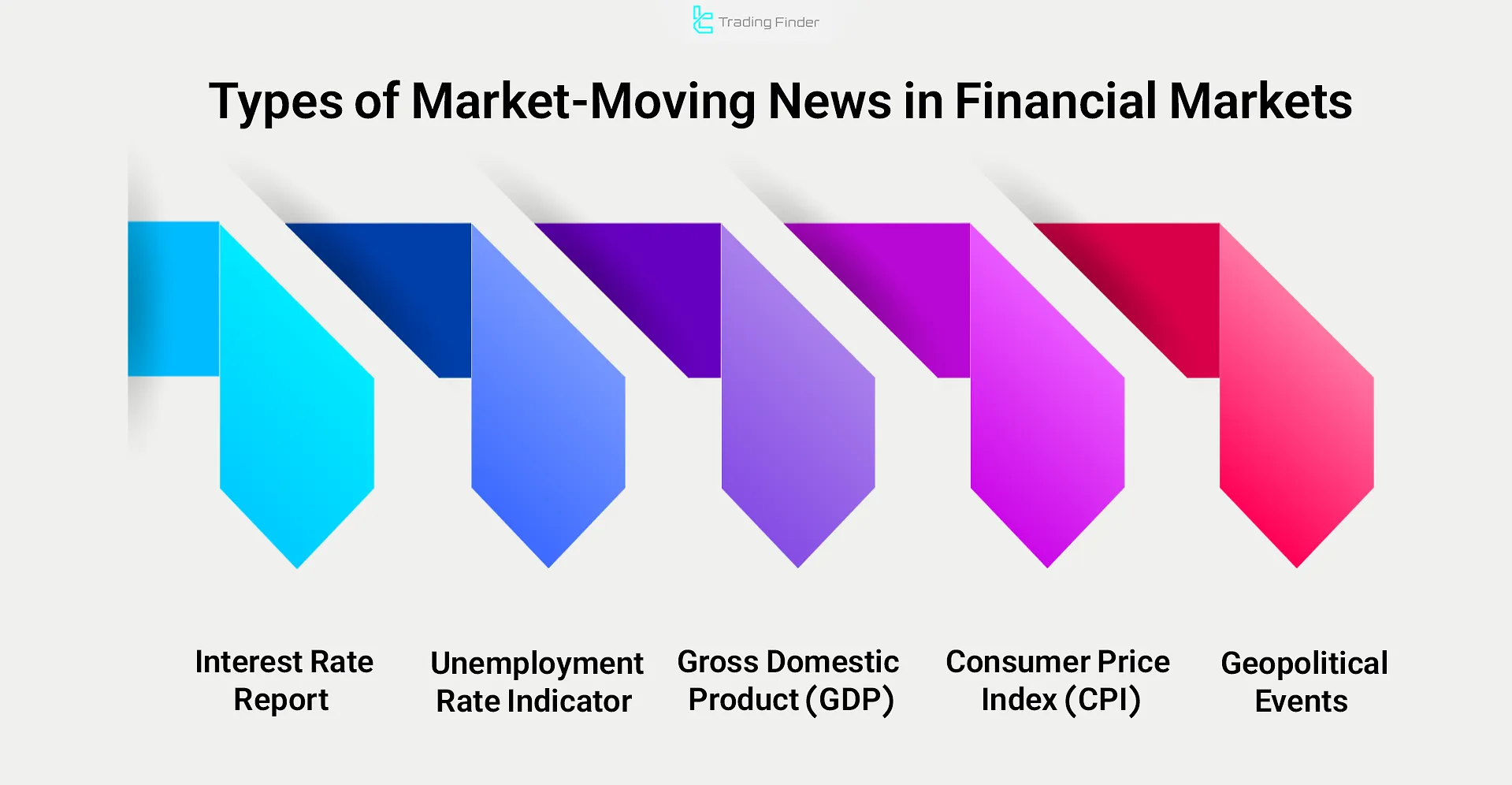

Types of Market-Moving News

Before designing a trading strategy for news trading, it’s essential to understand which news events are worth trading and which ones generate the most market volatility.

Forex traders who want to learn more about trading with major impactful news can refer to the educational video on the Trader Nick YouTube channel:

Types of Market-Influencing News in Financial Markets:

- Interest Rate Reports

- Unemployment Rate

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- Geopolitical Events

Interest Rate Reports

Central banks of each country use various tools to increase or decrease interest rates. Through this mechanism, they control domestic economic conditions, inflation, and liquidity, guiding them toward target markets.

The most significant interest rate changes are related to the United States, which also influences the decisions of other central banks. During the release of the U.S. central bank's interest rate decision, the forex market experiences the highest level of volatility making it an ideal opportunity for news traders.

Unemployment Rate

The unemployment rate reflects the ratio of unemployed individuals to the total active workforce in a society. This indicator is considered a key metric for assessing a country's economic health.

The unemployment rate has a direct impact on a country's currency value and, upon release, leads to market volatility and increased trading volume in forex instruments.

The most important measure for evaluating unemployment is the Non-Farm Payrolls (NFP), which is calculated by dividing the number of unemployed individuals by the total labor force. The highest volatility in the market typically occurs at the moment when the news is released.

Gross Domestic Product (GDP)

Gross Domestic Product (GDP) is the total value of all final goods and services produced within a country over a specific period (typically annually). This indicator is used as the primary measure for assessing economic growth and the overall health of a country.

Economic growth is directly linked to the value of the national currency; therefore, when GDP figures are announced, volatility and trading volume increase in currency pairs related to the reported rate.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a metric that measures the changes in the average price of a basket of consumer goods and services over time.

It serves as a gauge for tracking price fluctuations in goods and services consumed by average households. CPI is used as a key indicator for measuring inflation.

Geopolitical Events

Geopolitical events refer to occurrences that influence international relations, the global economy, and financial markets.

These events can have either positive or negative impacts on the markets and typically include issues such as politics, wars, sanctions, natural disasters, and economic shifts.

Political and geopolitical developments can alter price trajectories by creating uncertainty and shifting market sentiment.

- War or Military Conflict: Increases global risk sentiment and typically drives up the prices of safe-haven assets such as gold and the Japanese yen;

- Sanctions or Political Decisions: Exert additional pressure on national currencies and export-oriented commodity markets;

- Statements from Central Bank Governors: Even without the release of official data, a single key remark can sometimes shift the entire market direction.

Professional traders monitor these events alongside economic indicators through calendars such as Forexfactory and Investing.

Difference Between Predictable and Unexpected News in the Market

Economic news can generally be divided into two categories: predictable and unexpected. Understanding the difference between them plays a key role in trading strategy planning.

- Predictable News (Scheduled News): Includes data releases with predetermined times, such as interest rate decisions, unemployment rate, or CPI;

- Unexpected News (Unscheduled Events): Refers to events that occur without prior warning, such as military conflicts, a bank collapse, or a sudden statement by the Federal Reserve Chair.

Professional traders prepare for both types of news; by using logical stop losses, maintaining strong mental flexibility, and avoiding unplanned entries, they capitalize on market volatility in a structured manner.

Example of Predictable and Unexpected News in the Market

When inflation is expected to rise, traders may strengthen the related currency (for example, the U.S. dollar) in advance this is considered predictable behavior.

In recent years, however, even a single tweet from an official figure has occasionally moved financial markets such as Forex, crypto, and others by several hundred pips this type of news is entirely unpredictable.

Risk and Capital Management in News Trading

Risk and capital management in news trading involves using information and analysis related to economic news and major events to make trading decisions in the market.

Risk management in trading with news includes the following steps:

- Identifying important news

- Analyzing potential impact

- Defining a strategy

- Managing capital accordingly

Emotional Management in News Trading

Trading during news releases is one of the most stressful situations in the market, where emotions such as fear of missing out (FOMO), greed, or anxiety can easily disrupt decision-making. To effectively manage these emotions, it is essential to follow the principles below:

- Pre-News Planning: Clearly define in advance under what conditions you will enter a trade and at which price levels you will exit;

- Limited Trade Size: During highly volatile news events, reduce your position size so that decisions are based on logic rather than emotion;

- Use a Trading Journal: Recording your decisions and emotions for each trade is a powerful tool for gradually improving trading behavior;

- Avoid Revenge Trading: After a loss, do not immediately enter a new position; allow your mind to calm down first, then make decisions based on analysis rather than reaction.

Managing emotions in such moments distinguishes professional trading from impulsive trading and forms the foundation of psychological stability during high-volatility market conditions.

Key Tips for Trading News

The news trading strategy is based on analyzing and predicting market reactions to major economic and political news and events. This trading style involves significant psychological pressure and high risk, requiring advanced knowledge and trading experience for success.

Key tips for trading with news include:

- Focus on key news

- Analyze thoroughly

- Manage risk and capital

- Choose optimal entry times

- Stick to your strategy

- Use demo accounts for practice

Forex Factory Calendar Indicator for MetaTrader

The Forex Factory Calendar Indicator (FF Calendar) is one of the most practical news-based tools available on the MetaTrader platform.

It is designed for financial market analysts who wish to integrate fundamental data impact into their trading decisions alongside technical analysis.

Using the Web Request feature, this indicator directly fetches economic event data such as employment reports, inflation rates, GDP figures, interest rate decisions, and other key metrics from the Forex Factory website and displays them on the chart.

- Download Forex Factory Calendar Indicator for MetaTrader 5

- Download Forex Factory Calendar Indicator for MetaTrader 4

Installation and Activation Steps:

- Go to the Forex Factory website and open the Calendar section;

- Copy the link from the Weekly Export (CSV) section;

- In MetaTrader, go to Tools → Options → Expert Advisors;

- Enable Allow Web Request for listed URL and use Add New URL to paste the copied link;

- After saving the settings, the indicator will be ready to run, automatically displaying economic data on the chart;

Key Features:

- The indicator visually highlights the importance level of news using colors; red for high-impact events, orange for medium-impact, and yellow for low-impact;

- Vertical lines appear at each event’s release time, helping traders visually correlate price movements with economic data.

For example, on an hourly chart of a currency pair, a bullish reaction to positive news may be observed, while on a 30-minute chart, negative news might trigger a downward price reaction.

The FF Calendar settings panel includes options such as Alerts, Notifications, Alert Before News, and filters for High/Medium/Low Impact News, allowing full customization of notifications.

In conclusion, the Forex Factory Calendar Indicator is an essential tool for traders who aim to combine technical and fundamental analysis for more informed and strategic trading decisions.

Conclusion

Due to the complexity of analyzing economic news and market sentiment, news trade strategies demand quick decision-making and solid skills.

Interest rate, unemployment, GDP, and CPI are among the most impactful economic events. To succeed, traders must master risk management and follow their strategies closely.