Recession is a phase in the economic cycle characterized by rising unemployment rates and weak consumer demand. During this period, the government and central bank adopt expansionary policies to restore economic growth, which has corrective effects on markets. Consequently, demand for safe-haven assets increases.

What is a Recession?

By academic definition, an economy enters a recession period when negative economic growth is recorded for two consecutive quarters.

In this period, gross domestic product declines and companies begin to lay off employees; this leads to an increase in the unemployment rate, slower wage growth, a sharp drop in demand, and reduced consumer confidence.

Negative Consequences of Economic Recession:

- Increased Unemployment: Reduced demand and sales force companies to lay off employees;

- Slower Wage Growth: A cooling labor market suppresses wage increases;

- Reduced Demand: Higher unemployment and lower wages drastically cut consumer spending;

- Eroded Consumer Confidence: Trust in the current and future economic outlook weakens;

- Higher Savings: Economic uncertainty prompts consumers to save rather than spend.

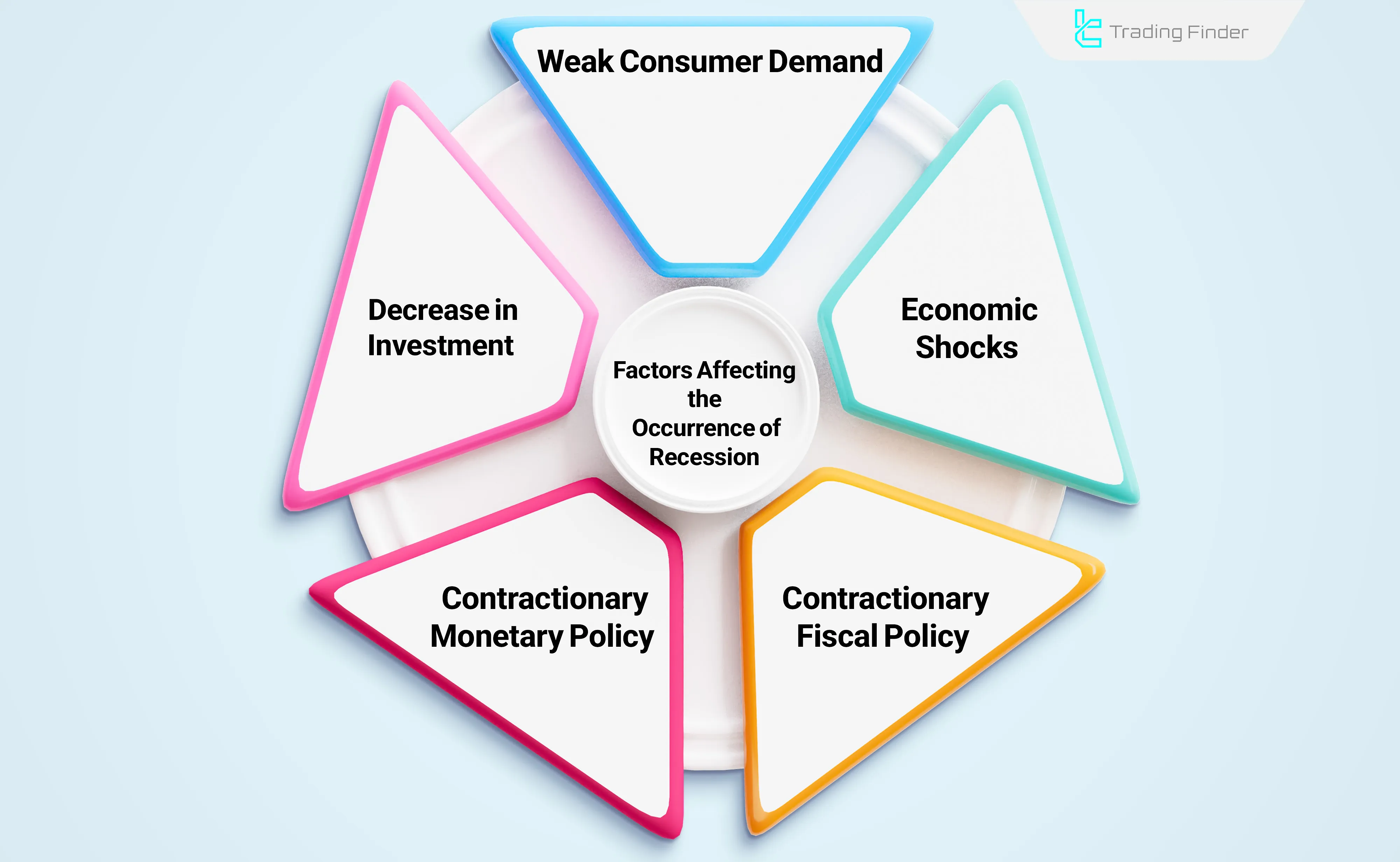

How Does an Economic Recession Form?

Multiple factors can trigger a recession, including monetary/fiscal policies, economic shocks (wars, supply chain disruptions, pandemics), currency appreciation, and weak consumer demand.

Contractionary Monetary Policy

Tight monetary policies like interest rate hikes are primary drivers of recession. Higher rates reduce liquidity by discouraging business borrowing (due to high borrowing costs).

While rate hikes aim to curb economic inflation, prolonged tightening can cause a recession.

Currency Appreciation

Countries facing persistent currency strength and deflation (e.g., Japan, Switzerland) experience weak demand, sluggish growth, and occasional recession risks.

Fiscal Policies

In certain periods when the government increases taxes, economic growth declines due to the pressure placed on producers.

Economic Shocks

Shocks like wars, supply shortages, or pandemics (e.g., COVID-19) reduce production and increase unemployment, sparking recessions.

Major Historical Recessions

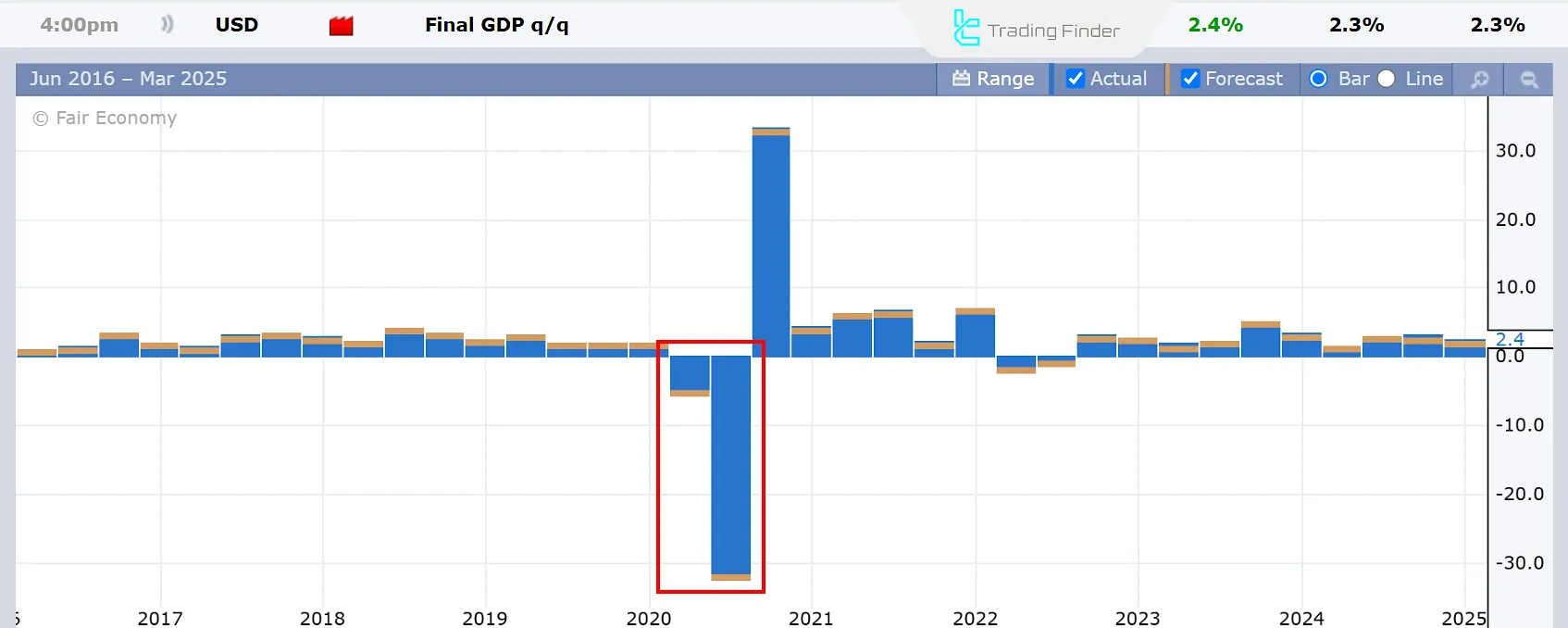

In the history of economics, there have been severe recessionary crises that led to the bankruptcy of many businesses.

However, with the advancement of economic science and the expansion of central bank tools for controlling monetary policy and liquidity, recession cycles have become less intense. For example, during the COVID-19 crisis, only a mild recession occurred in the United States, and the economy quickly returned to its growth path.

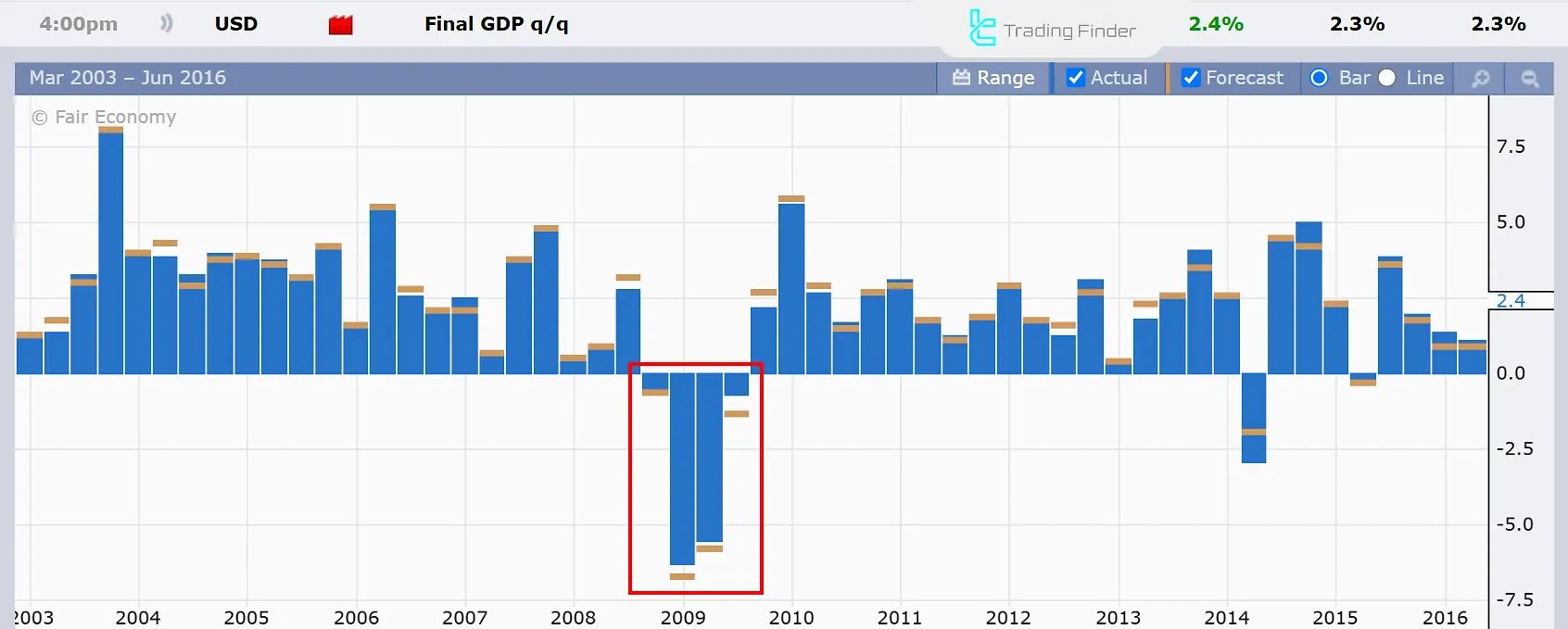

The 2008 Financial Crisis

The 2008 economic recession was one of the worst modern crises, originating in the U.S. with global repercussions.

The 2008 economic crisis stemmed from deep-rooted problems in the banking system, particularly in the mortgage sector. Banks had issued adjustable-rate mortgage loans without adequate oversight and on a large scale.

As interest rates rose, borrowers were unable to repay their loans, triggering the crisis.

The recessionary crisis expanded globally, as many foreign financial institutions had also invested in securities linked to U.S. mortgage loans.

Following the 2008 financial meltdown, unemployment rates increased, businesses struggled, and millions of people lost their homes.

The crisis was eventually resolved through drastic interest rate cuts, expansionary monetary policies, and major structural reforms in the banking and regulatory systems.

Japan’s Lost Decade

In the 1990s, known as Japan's "Lost Decade," a prolonged recession took shape as a result of the aftermath of the Plaza Accord, the appreciation of the yen, and a decline in Japanese exports.

In the early 1990s, the Bank of Japan sharply raised interest rates to combat inflation, which led to the bursting of the stock and real estate bubbles. During this period, many companies faced financial crises.

How to Overcome an Economic Recession?

Governments and central banks deploy expansionary monetary/fiscal policies and production support to mitigate recessions.

Policy Tools Against Recession:

- Expansionary monetary policy

- Expansionary fiscal policy

- Political stabilization

Expansionary Monetary Policy

The central bank uses its tools to increase liquidity in order to restore economic growth.

The tools of expansionary monetary policy include:

- Interest rate cuts: Lowering interest rates increases liquidity in the banking system. It also encourages producers to borrow more;

- Bond purchases: Through quantitative easing (QE), the central bank boosts liquidity by purchasing bonds;

- Reduction of the reserve requirement: By lowering the reserve requirement, the central bank increases banks’ liquidity, which in turn leads to more lending.

Expansionary Fiscal Policy

The government supports production and businesses through expansionary fiscal policies.

These policies include:

- Increased government spending: Government investment in infrastructure projects boosts economic growth by creating jobs and increasing demand;

- Tax cuts: Reducing taxes leads to higher disposable personal income (DPI) and encourages more investment in production;

- Support for producers: Government support for the private sector and the development of new technologies helps improve productivity and create new markets.

Political Stabilization

Political tensions reduce economic growth by lowering consumer confidence and causing foreign investors to withdraw. The government can foster domestic demand and attract foreign investment by establishing political and economic stability.

Recession Forecasting Tools

In general, predicting a recession is uncertain and complex, but signs of weakening economic growth can be observed in economic data before a recession occurs.

During warning signals such as a weakening labor market, declining demand, and deteriorating consumer sentiment, central banks take preventive measures to avoid a recession.

PMI Data

Purchasing Managers’ Index (PMI) reflects production health. Downturns hint at recession.

Employment Data

A weakening labor market is a serious warning sign of a recession. If job-related data such as Non-Farm Payrolls (NFP), ADP reports, and the unemployment rate—show significant deterioration, it can substantially impact on economic growth.

Consumer Sentiment

If consumers are under financial pressure, it will be reflected in consumer sentiment surveys.

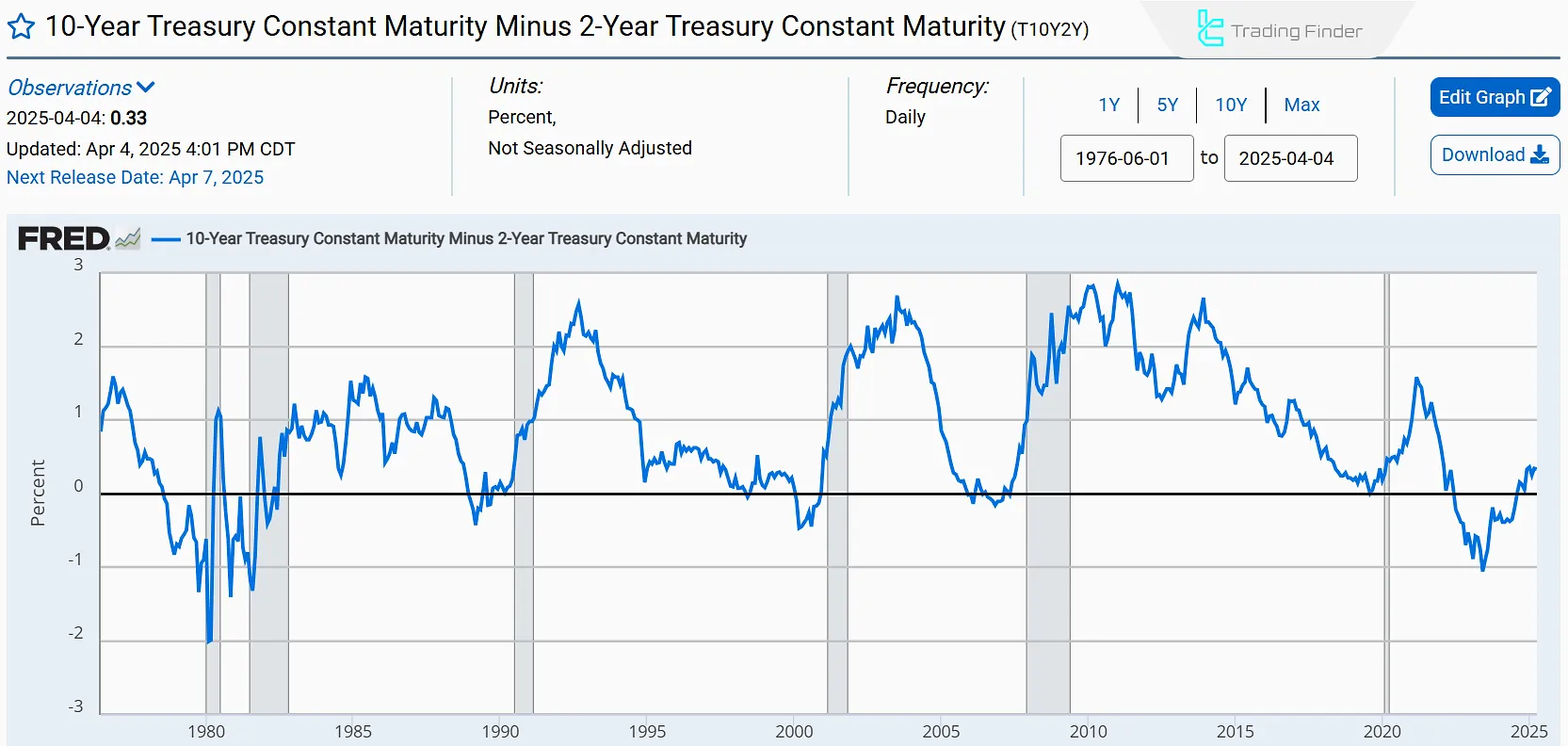

Yield Curve Inversion

When the yield curve becomes downward-sloping or inverted, it is considered a serious warning sign of a recession, as it indicates rising demand for long-term bonds driven by fears of a specific crisis.

Note: An inverted yield curve does not necessarily mean a recession is imminent, but when it occurs, it should be taken as a strong warning signal.

Assets That Perform Best During Economic Recessions

Due to weakened production and reduced liquidity during a recession, risky assets such as stocks or cryptocurrencies tend to decline sharply. In contrast, investors turn to safe-haven assets. In fact, market sentiment during a recession is characterized by risk aversion.

Gold and Precious Metals

Due to limited supply, gold is inflation-resistant, gaining long-term value. Lower interest rates also boost gold prices.

Note: Other precious metals like silver and platinum behave similarly but are more volatile due to industrial uses.

Government Bonds

Government bonds are ultra-low-risk assets in high demand during recessions. Governments can honor bond payments even during severe crises, making them ultra-safe.

Safe-Haven Currencies

Weak demand during recessions typically lowers or stabilizes inflation (except stagflation). Holding fiat currencies becomes attractive.

Currencies like USD, JPY, and CHF strengthen during recession fears (risk-off sentiment) in the forex market.

Conclusion

Recession is an unfavorable phase of the economic cycle that occurs as a result of contractionary monetary and fiscal policies or other contributing factors.

Economic recession leads to a rise in unemployment and a decline in inflation due to weak demand. During this period, safe-haven assets such as gold, bonds, and low-risk currencies become more sought after.