Risk management refers to the identification, analysis, and control of harmful factors, applicable in all financial markets such as stocks, cryptocurrencies, and forex.

When properly executed, financial risk management makes it easier and more accurate to predict future events.

What is Risk Management?

Risk management represents a systematic management process involving evaluation and control to minimize losses and follows specific standards.

In other words, it comprises a set of actions aimed at preventing unwanted events or minimizing damage if they occur.

Types of Risk in Financial Markets

Risk is generally categorized into two main groups:

- Systematic

- Unsystematic

This classification is not only essential for better understanding investment risk but also forms the foundation for professional portfolio management, hedging, and loss control strategies.

Systematic Risks

Systematic risk refers to threats affecting the entire market or large parts of the economy, making them unavoidable. These originate from macroeconomic or political factors.

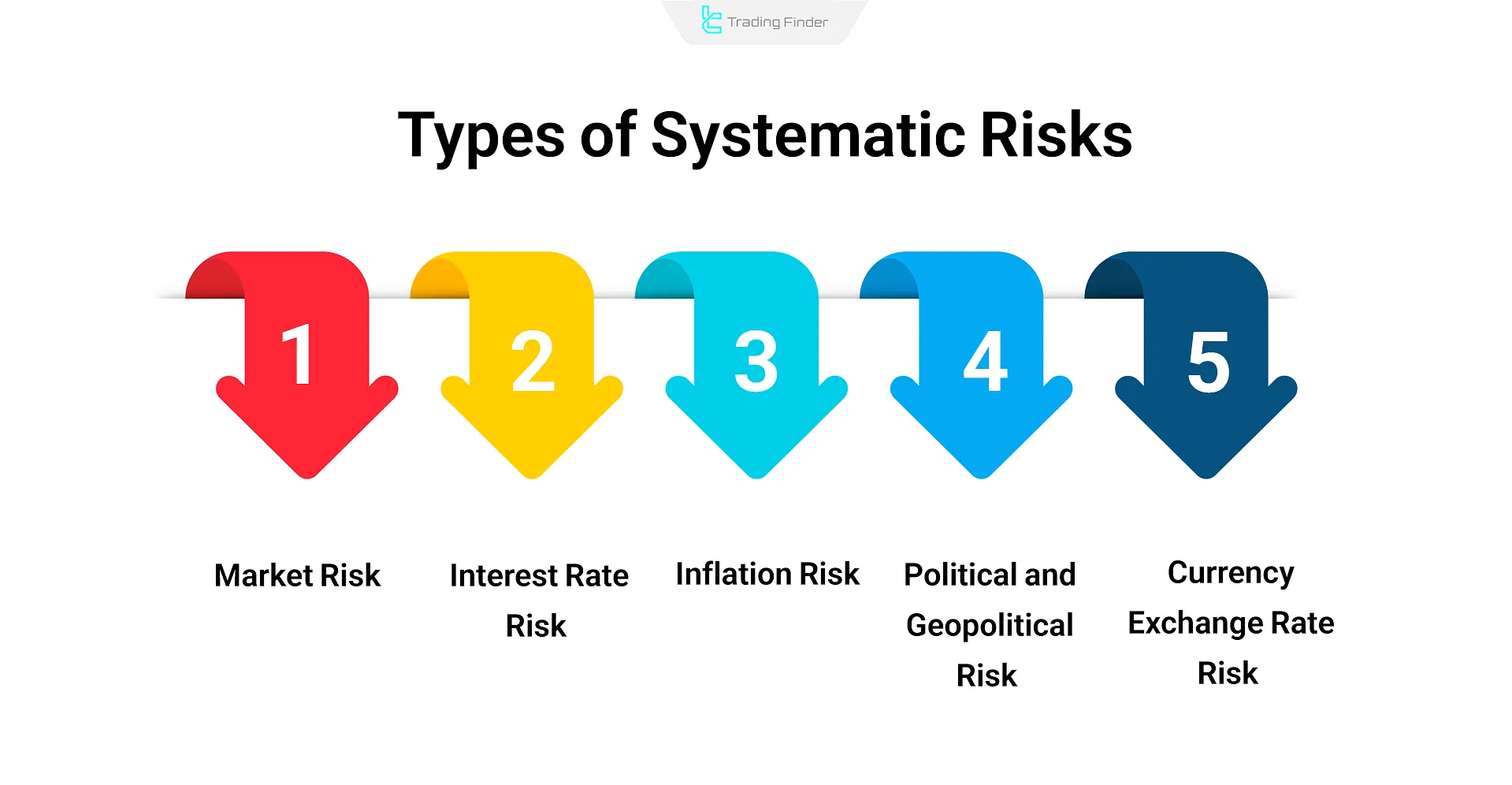

Types of Systematic Risks in Financial Markets:

- Market: Overall price fluctuations;

- Interest Rate: Central bank rate changes and their effects;

- Inflation: Declining currency value impacting profitability;

- Political/Geopolitical: Sanctions, wars, and political changes;

- Currency Rate: Exchange rate volatility and asset value effects.

Unsystematic Risks

Unsystematic risks refer to those related to a specific company, industry, or sector. Unlike systematic risks, these can be controlled or eliminated through portfolio diversification.

Key Unsystematic Risks:

- Business: Operational performance and market-related factors;

- Financial: Capital structure and company debt;

- Managerial: Leadership decisions and management team efficiency;

- Operational: Internal process and system failures;

- Legal/Regulatory: Law changes and legal disputes;

- Technological: Outdated or inefficient technology use;

Liquidity Risk

Liquidity risk refers to the investor's inability to convert assets into cash. In simpler terms, the investor cannot liquidate portfolio assets at a reasonable price and in a timely manner.

Psychological Risks

Psychological risks in financial markets refer to types of threats that arise from emotional reactions and false beliefs during financial decision-making.

Examples of Psychological Risks in Financial Markets:

- Fear

- Greed

- OverTrading

- Herd Mentality

- Cognitive Biases

Differences Between Systematic and Unsystematic Risks

Systematic and unsystematic risks in financial markets differ in characteristics such as scope of impact, controllability, and management approach. These differences are outlined in the table below:

Differences Between Systematic and Unsystematic Risks:

Systematic Risk | Unsystematic Risk |

Affects entire market/economy | Affects specific company/industry |

Cannot be eliminated | Can be eliminated via diversification |

Interest rate hikes as an Example | Company bankruptcy as an example |

Managed via hedging, insurance, macro analysis | Managed via diversification |

Risk Management Strategies

These strategies represent a set of essential actions for professional trading, aimed at controlling losses amid price volatility. Below are the most effective approaches to risk management:

- Diversifying portfolio assets

- Setting stop-loss levels for trades

- Hedging

- Scaling into positions

- Managing position size

Portfolio Diversification

Diversifying portfolio assets helps reduce the impact of the volatility or loss of a single asset on the investor’s overall portfolio. Allocating capital across various asset classes (such as stocks, currencies, gold, bonds, etc.) significantly decreases the negative effect of individual losses on the portfolio.

Stop-Loss Strategy

Using a stop loss is a fundamental principle for protecting capital and controlling potential losses. Defining a clear exit point helps manage risk in trades when the price moves against the position.

Hedging

A set of techniques aimed at reducing or neutralizing potential risks arising from asset price fluctuations—typically by opening a position opposite to the original asset. The hedging strategy is commonly used by most financial institutions as a core method of managing risk on their assets.

Scaling Into Trades

To better control risk and reduce vulnerability to volatility, professional traders use a method called scaling into a trade.

Instead of entering a position with the full capital at once, they allocate the capital in several stages at different price levels.

Position Sizing

An inappropriate trade size can invalidate even accurate analyses, while controlled position sizing leads to consistent returns and profitability.

Managing trade volume helps reduce emotional and psychological pressure, promotes discipline in trading, and increases the trader’s ability to stay in financial markets over the long term.

Steps of Risk Management

One of the most crucial steps in the systematic management process is risk acceptance. The evaluation of risk is carried out through six stages:

- Risk Identification

- Risk Assessment & Analysis

- Risk Prioritization

- Risk Response Planning

- Implementation of the Risk Management Plan

- Monitoring & Review

Risk Identification

In this stage, all potential risks related to the asset, market, or trading strategy—such as market risk, liquidity risk, psychological risk, or legal risk—are identified.

Risk Assessment & Analysis

Quantitative and qualitative analysis of the severity and likelihood of risks, along with their impact on capital, enhances precision in managing asset-related threats.

Risk Prioritization

Risks with higher probability and greater impact require immediate attention and are prioritized in the risk management process. Prioritizing risks helps reduce the likelihood of losses over shorter time frames.

Risk Response Planning

This step involves selecting appropriate methods to control or reduce identified risks. Common risk response strategies include:

- Risk avoidance

- Risk reduction (via stop-loss, diversification, and hedging)

- Risk transfer (through insurance or contracts)

- Risk acceptance (if the risk level is minimal)

Implementation

To implement the plan, selected tools and strategies must be applied in real trades or portfolios. A well-executed risk management plan accelerates the path to consistent profits from a trading strategy.

Monitoring & Review

Continuous monitoring of the risk management system’s performance and making adjustments based on new market conditions and past experiences is a key priority in trade risk control.

Monitoring refers to the ongoing observation of market status, open positions, economic variables, and trade performance.

Review involves the periodic reassessment and updating of risk management plans and strategies to reflect changing conditions.

Risk Management vs. Capital Management

Risk management acts as a safeguard for each trade, ensuring losses remain controlled in case of failure. In contrast, capital management protects the trader’s overall financial structure from price fluctuations.

Precise and simultaneous execution of both is the foundation of a stable, intelligent, and structured trading system.

Below is a detailed comparison between risk management and capital management:

Criteria | Risk Management | Capital Management |

Main Objective | Reduces trade vulnerability to sudden losses | Preserves capital and ensures long-term market presence |

Point of Focus | Each trade individually | Entire trading portfolio or investment account |

Key Tools | Stop-loss, risk analysis, hedging, risk identification | Trade size, risk percentage, portfolio diversification, scaling in |

Timing of Execution | Before entry and during position holding | Before entry and continuously throughout investment process |

Type of Controlled Risk | Trade-specific and environmental risks | Overall account risk and loss accumulation |

Common Mistakes in Risk Management

Traders in financial markets often make mistakes in risk management that lead to irreversible losses. Common risk management mistakes include:

- Ignoring hidden risks: Focusing only on obvious threats while neglecting underlying risks such as psychological or operational issues;

- Insufficient diversification: Concentrating investments in a few similar assets without proper portfolio spread;

- Not using protective tools: Overlooking tools like stop-loss, futures, or options contracts;

- Emotional decision-making: Following fear, greed, or market hype instead of logical, data-driven analysis;

- Lack of a risk management plan: Failing to create and adhere to a defined strategy for loss control and capital protection;

- Underestimating liquidity risk: Ignoring the ability to liquidate assets during critical market conditions.

Conclusion

Risk management in financial markets is the process of identifying, assessing, and controlling both systematic and unsystematic risks.

By utilizing tools such as diversification, hedging, and setting stop-loss orders, financial risk management helps minimize losses and optimize traders’ asset portfolios.

Addressing psychological risks and avoiding emotional decisions are key components of effective risk management.