A trading strategy is a set of predetermined rules that define the timing of entries, exit conditions, and capital management.

In addition to specifying entry and exit points, this framework also includes stop-loss placement, take-profit levels, and the risk-to-reward ratio (R/R).

For this reason, the trading strategy definition can be considered a trader’s operational roadmap in the market, and in response to the question what is a trading strategy, it can be said that a strategy is a set of clearly defined principles for guiding trading decisions.

Designing a trade strategy in Forex can be based on various approaches. In technical analysis, tools such as moving averages, Fibonacci levels, and candlestick patterns are used.

In fundamental analysis, the focus is on economic indicators or a company’s financial data. Many beginner traders first ask what is strategy in trading and then proceed to choose the most suitable method.

At a more advanced level, algorithmic trading with mathematical models increases the speed of execution.

Moreover, liquidity-based approaches such as Order Blocks (OB) and Fair Value Gaps (FVG) play an important role in strategies in trading in modern markets.

What is a Trading Strategy?

A trading strategy is a specific and consistent plan for controlling emotions, trading style, position size, entry and exit points, as well as risk and capital management.

Using this plan allows traders to make the best decision under different market conditions. This is the same concept often referred to in many sources as trading strategy explained or even trading strategy meaning.

According to the trading strategy education article on Investopedia, trading strategies can be based on technical analysis, fundamental analysis, or quantitative analysis.

Becoming familiar with main trading strategy types helps traders choose the option that best fits their personality.

Difference Between Trading Strategy and Trading Style

Many beginner traders often confuse a trading strategy with a trading style, even though these are two completely different concepts.

For example, choosing between short-term trading, a day trading strategy, scalping, or holding positions. This section is actually related to trading style.

A trading style refers to the trader’s overall framework such as choosing between scalping, day trading, or long-term investing. The style defines the timeframes used and the level of involvement the trader has with the market.

In contrast, a trading strategy is a set of specific rules for trade entries, exits, stop-loss and take-profit placement, and risk management.

For instance, in a technical trading strategy for scalping, precise timing of entries on lower timeframes is crucial.

Comparison Table of Trading Strategy and Trading Style:

Concept | Definition | Role in the Trading Process |

Trading Style | Trader’s framework defining timeframe choice and market involvement level | Defines the overall context and approach to market interaction |

Trading Strategy | A set of precise rules for entries, exits, stop-losses, take-profits, and risk management | Specifies the exact timing and conditions for trade execution |

Why Do We Need a Trading Strategy?

In financial markets, prices change under the influence of supply and demand, economic news, and investor decisions.

Entering trades without a clear set of rules leads to impulsive decision-making. For this reason, traders aim to design or follow the best trading strategy.

In fact, strategy in trading acts as a roadmap and prevents many mistakes.

Applications of a Trading Strategy:

- Capital Management and Risk Control: Determining the portion of capital allocated to each trade and using stop-loss orders helps reduce unexpected losses and preserve capital. This is what educational resources refer to as capital management in trading;

- Avoiding Random and Emotional Decisions: A well-defined strategy prevents decisions based on fear, greed, or market hype;

- Consistency and Repeatability in Trades: Applying the same method across all trades allows traders to evaluate performance, refine their strategy, and avoid irregular results;

- Ability to Test and Optimize Before Live Execution: A trading strategy is tested on historical data before going live to determine profitability, win rate, and weaknesses. This process is often referred to as trading strategy analysis in many resources.

Aligning Strategy with Trader Psychology

One of the most overlooked factors in strategy design is its alignment with the trader’s personality.

If a person is risk-averse, implementing highly volatile strategies will be challenging. Conversely, a trader with a high risk tolerance may feel dissatisfied with conservative approaches.

This is where choosing the right type of trading strategy becomes essential.

The selected strategy must match the trader’s personality and psychological traits to ensure long-term commitment.

This increases the chances of long-term success and allows the trader to trade with strategy without being derailed by momentary emotions.

Key Components of a Trading Strategy

A strategy of trading must include clear and repeatable rules that determine entry and exit points, the level of risk, and the amount of capital allocated to each trade.

This is exactly what many mentors refer to as trading strategy components.

Entry Conditions

For entering a trade, there must be a predefined trading setup. These signals enable decision-making based on price patterns, key level breakouts, volume data, or indicators, thereby creating a structured trading plan.

This step is a crucial part of building a trading strategy.

Example: In a volume trading strategy based on ICT style, trade entry occurs when the price retraces into a Fair Value Gap (FVG).

Exit Conditions

A Trade strategy should clearly define when to lock in profits and how to minimize losses in case of incorrect analysis. The two most common exit methods:

- Take Profit: Closing a trade at predefined levels, such as key resistance or swing highs

- Stop Loss: Exiting a trade if the price falls below a support level or if there are false breakouts

These rules are considered part of the trading strategy rules.

Capital Management and Position Sizing

A trade management strategy must specify what percentage of the total capital should be allocated to each trade.

This aspect is also discussed in educational resources under the term capital management trading.

Example: A trader with a $10,000 capital who risks 50% per trade will lose the entire account after two unsuccessful trades. However, if the risk is limited to 2% per trade, the trader can recover even after multiple consecutive losses.

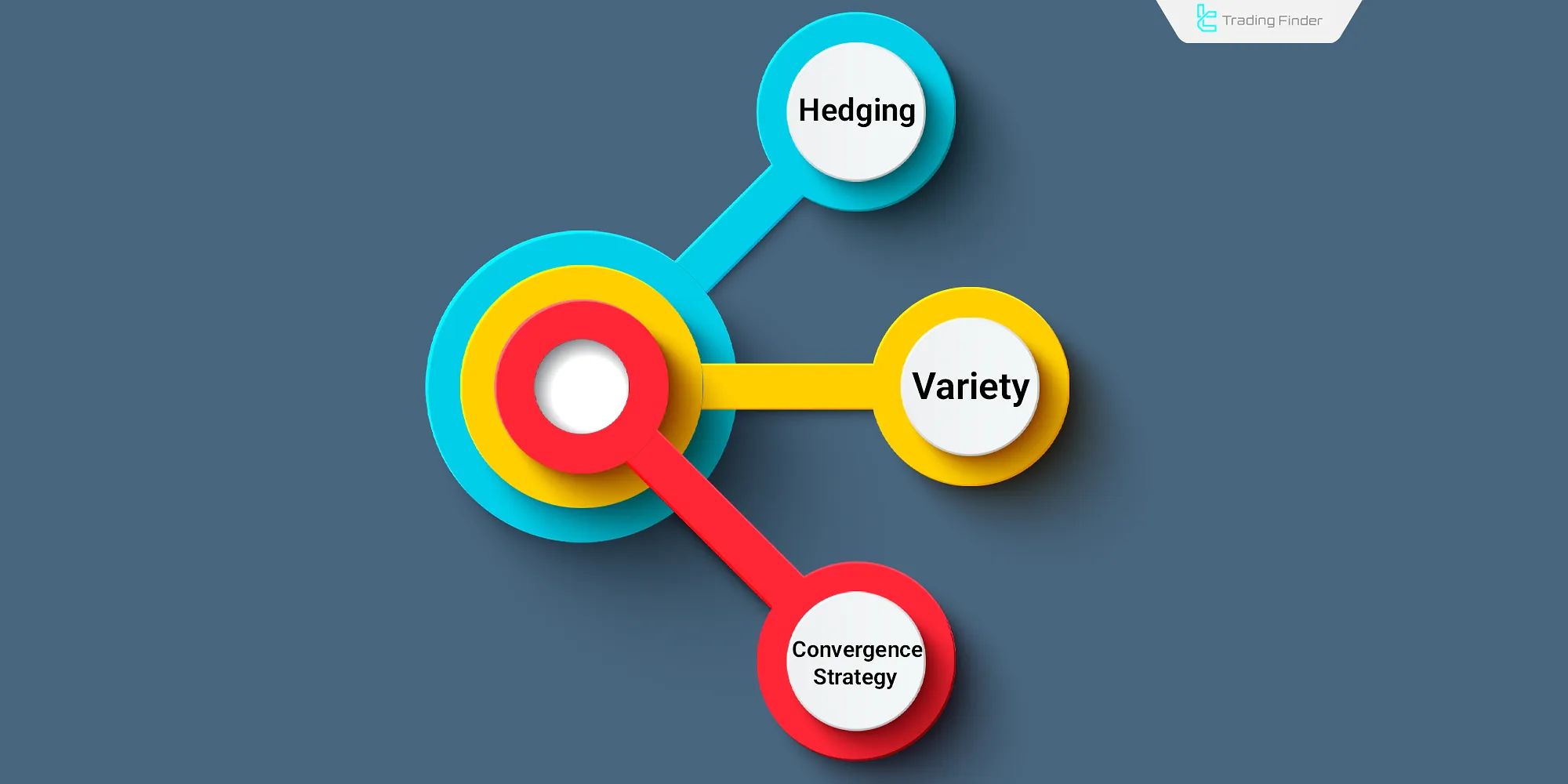

Advanced Risk Management in Strategies

Risk management is not limited to setting stop-loss levels or applying the 2% rule.

Professional traders use techniques such as hedging, diversification, and convergence. This stage is an important part of developing a trading strategy .

- Hedging: Opening opposite positions on the same asset or using derivatives to offset potential losses;

- Diversification: Allocating capital across multiple assets or markets to reduce unsystematic risk;

- Convergence Strategy: Exploiting the price difference between the spot market and futures contracts until expiration.

Implementing these methods helps traders avoid significant losses during periods of high market volatility.

Risk Management and Loss Control

Every trade should have a predefined risk exposure, and trades should not be executed if the risk is unreasonable.

There are various tools for managing trade risk, which are considered part of strategic trading and trading techniques and strategies.

Common risk management tools:

- Trailing Stop: Adjusting stop-loss levels as the price moves toward the take-profit target;

- Risk-Reward Ratio: Evaluating the risk exposure compared to the potential profit.

For example, if a trader risks $1 per trade to gain $2, the risk-reward ratio is 1:2.

Market Conditions and Suitable Timeframes

Price movement is not the same under different market conditions. This is what specialized texts describe as trading methods and trading tactics.

For scalping, lower timeframes are used, which is an example of a technical strategy forex, whereas swing trading relies on higher timeframes one of the most popular recommendations among trading strategies for beginners.

Example of Choosing the Right Timeframe

- Scalping: Analyzing small market movements where decisions are made quickly, with low risk-reward ratios and lower timeframes;

- Swing Trading: Examining larger market movements where trades may remain open for weeks, using higher timeframes and higher risk-reward ratios.

Types of Trading Strategies

Applications of a Trading strategy vary based on analysis methods, market types, and usage goals.

In many sources, these categories are referred to as different trading strategies or trading strategy types .

Technical Analysis-Based Trading Strategy

In this analytical approach, the trader uses price charts, trading volume, candlestick structures, and tools such as indicators to try to predict the market’s next moves.

In technical analysis, the entire focus is on price behavior and the repetition of identifiable patterns in the market. This method is particularly popular in highly liquid markets such as Forex, cryptocurrencies, and certain futures markets.

This is what is known as a technical trading strategy, and choosing a basic trading strategy is important for beginners.

On the Data Trader YouTube channel, different types of trading strategies are introduced in video format:

Types of Price Action Trading Strategies

Price action is an analytical strategy that does not rely on indicators and works directly with raw price data.

In this method, the trader analyzes price behavior based on candlestick structures, reactions to support and resistance levels, false breakouts, and reversal moves.

Swing structure, the concept of liquidity, and candlestick confirmations play a key role in determining entry and exit points. Price action requires a high level of skill and experience but, in return, provides more precise and lower-risk signals.

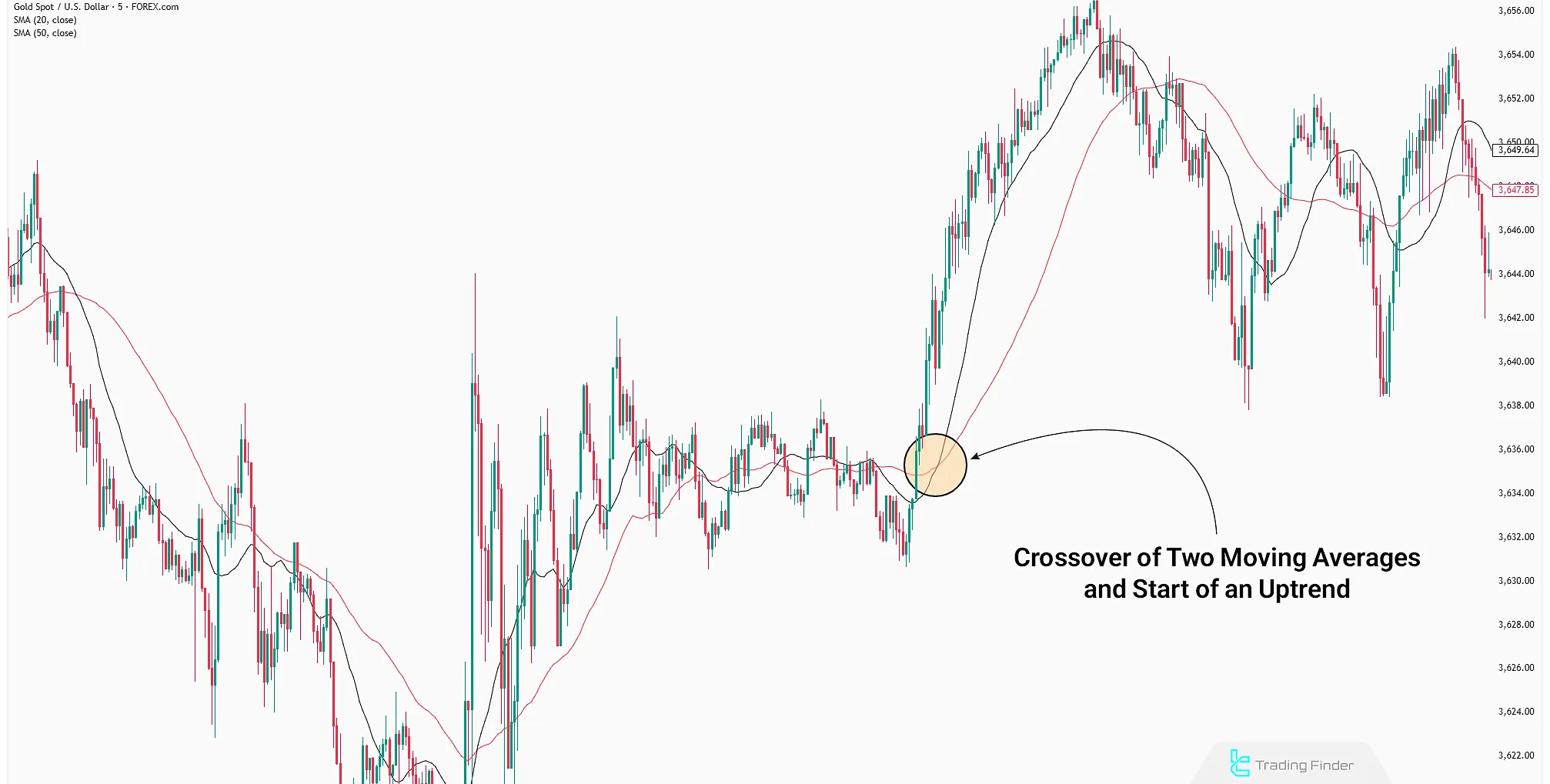

Moving Averages

Using moving averages is one of the most fundamental tools for trend identification in technical analysis. Typically, two or more moving averages with different time periods are used to detect trend reversals.

For example, when the EMA 20 crosses above or below the EMA 50, it may signal the start of a new bullish or bearish trend. These moving averages are also used as dynamic support or resistance levels.

Divergence

Divergence occurs when the direction of price movement does not align with the direction of an indicator such as RSI, MACD, or OBV.

This usually signals weakness in the current trend or the potential for a price reversal. Divergences are classified into two types — classic and hidden — and are often seen at major tops and bottoms on the chart.

Proper divergence analysis requires a precise understanding of trend structure and overbought/oversold zones.

Breakout Trading

This strategy focuses on key chart areas such as trendlines, range zones, or support and resistance levels.

When the price breaks through these areas with strong momentum and confirms with high volume, the likelihood of continuation in the breakout direction increases.

Distinguishing real breakouts from false ones and properly managing the position after entry are crucial in this approach.

Tools for Confirming Technical Breakout Strategies

Many technical strategies become more powerful when multiple tools confirm the same level or signal. Some of the most common tools used for confirmation include:

- Pivot Points: To identify daily support and resistance levels;

- Fibonacci Retracements and Extensions: To predict potential reversal or continuation areas;

- PRZ (Potential Reversal Zones): Key turning points in harmonic patterns.

When multiple tools confirm a shared level, the probability of a successful trade significantly increases.

Candlestick-Based Strategies

Candlestick patterns are one of the most essential elements of technical analysis, revealing signals of trend reversals or continuations.

In candlestick-based strategies, traders focus on the shape and location of candles to extract trade signals.

Table of Candlestick-Based Strategies:

Pattern | Application |

Bullish and Bearish Engulfing | Indicates potential trend reversal |

Morning Star and Evening Star | Signals trend change at the end of strong moves |

Inverted Hammer and Shooting Star | Shows weakness in the current trend |

Doji Pattern | Reflects market indecision and the possibility of a new move |

Classical Chart Patterns

Patterns such as Head and Shoulders, Triangles, Flags, Double Tops, and Double Bottoms are structures commonly observed in trend reversals or continuations.

Identifying these patterns and their breakout points helps traders find low-risk trade opportunities. Combining these patterns with volume analysis or price action further enhances the reliability of the analysis.

Fundamental Analysis-Based Strategies

Fundamental analysis evaluates the intrinsic value of assets and medium and long-term price trends based on macroeconomic parameters.

- News Trading Strategy: Predicting medium and long-term trends based on economic reports such as employment data and GDP;

- Financial Ratio Analysis: Evaluating stocks using P/E ratio, Earnings Per Share (EPS), Book Value metrics, and many more;

- Monetary Policy Strategy: Assessing the impact of central bank interest rate changes;

- Capital Flow Strategy: Analyzing the effects of foreign investments, industrial trends, and supply-demand changes.

This category is referred to in educational literature as financial trading strategies and helps the trader design a solid strategy for trading .

Algorithmic and Quantitative Trading Strategy

Algorithmic strategies employ mathematical equations, big data, and machine learning to optimize trade entry and exit points.

- High-Frequency Trading (HFT): Executing thousands of trades simultaneously to profit from small price differences;

- Machine Learning Trading: Using AI and quantitative models to identify recurring patterns;

- Arbitrage Trading: Buying and selling an asset in different markets simultaneously to capitalize on price discrepancies;

- Volatility Trading: Trading high-risk assets in volatile market conditions for higher profitability.

This category represents algorithmic trading strategies and is part of the modern world of trading systems, helping traders become professional strategy traders .

Liquidity and Institutional Trading Strategy (ICT & SMC)

The strategies identify trading opportunities based on liquidity flow, institutional orders, and the behavior of banks and large investors.

- Smart Money Concept (SMC): Entering trades at levels where banks and institutions place orders

- ICT Trading: Trading in line with market liquidity flow by identifying Order Blocks and price breakouts

Identifying the entry point and stop-loss using order blocks and fair value gaps in the ICT style on the Dow Jones chart

This method is an example of an institutional trading strategy and part of liquidity-based trading strategies, helping the trader follow a precise path in strategy trading .

Fair Value Gap (FVG-IFVG + SFP) Combo Indicator

The Fair Value Gap combo indicator (FVG-IFVG + SFP) is one of the advanced tools in ICT trading style, designed for professional financial market analysts.

This indicator integrates three key concepts Fair Value Gap (FVG), Inverse Fair Value Gap (IFVG), and Swing Failure Pattern (SFP) into a single visual display.

Its main objective is to identify areas where liquidity is likely to be absorbed and where trend reversals may occur.

In this tool, bullish FVG zones are highlighted in blue and bearish FVG zones in pink. SFP patterns are shown as green arrows for bullish failures and red arrows for bearish failures.

This visual representation allows traders to spot high-risk, high-probability market areas more quickly and enter trades with greater confidence.

One of the key features of this indicator is its ability to combine all three analytical structures. For example, when a bearish FVG zone forms, it may later convert into an IFVG, followed by an SFP pattern signaling liquidity re-entry and the start of a new trend.

This process is clearly visible on currency pairs such as USD/CAD or AUD/USD and generates powerful trading signals.

The indicator’s settings panel is highly flexible. Users can adjust the number of retracement candles, customize how FVG and IFVG zones are displayed, and enable or disable SFP pattern detection.

Even the colors of support and resistance zones can be customized, allowing traders to adapt the indicator to their personal style and trading preferences.

Overall, this indicator falls under the category of liquidity-based indicators and is suitable for multiple markets, including Forex, cryptocurrencies, stocks, and commodities.

Due to its nature, it is particularly effective on lower timeframes and for intraday strategies.

In summary, the FVG-IFVG + SFP Combo Indicator is a multi-dimensional tool that not only clarifies entry and exit points but also plays a crucial role in understanding market liquidity behavior.

For traders seeking precise setups with a high probability of success, this indicator can serve as a powerful complement to other analytical methods.

- Download Fair Value Gap Combo Indicator (FVG-IFVG + SFP) for MetaTrader 5

- Download Fair Value Gap Combo Indicator (FVG-IFVG + SFP) for MetaTrader 4

Trading Strategy in Different Financial Markets

In financial markets, there are various trading methods that differ based on the specific characteristics of each market and are collectively referred to as types of trading strategies.

Each of these methods varies depending on the market type and the trader’s objectives.

- Forex Trading Strategy: Includes strategies based on indicators, price action, and a combination of technical and fundamental analysis. One example is a gold trading strategy in Forex, which is designed around gold price fluctuations and its correlation with the US dollar;

- Cryptocurrency Trading Strategy and Crypto Strategy: These strategies are often based on on-chain data analysis, market cycles, and fundamental analysis of different projects.

Choosing the Right Strategy for Different Market Conditions

Each market requires a different strategy depending on its state. In trending markets, methods like trend-following or breakout strategies are highly effective.

In contrast, in range-bound markets, strategies such as trading between support and resistance or using oscillators (like RSI or Stochastic) are more suitable.

Correctly identifying market conditions is a prerequisite for selecting the right strategy and improving the probability of successful trades.

Steps to Build a Trading Strategy

Follow this step-by-step guide to create a trade strategy:

- Select Market and Timeframe: Choose the market type and timeframe based on volatility, liquidity, and trading volume;

- Define Trading Analysis Style: Select a market analysis style based on your expertise;

- Determine Entry and Exit Conditions: Set all criteria for placing trade orders, including entry points, stop-loss, and take-profit levels;

- Capital and Risk Management: Define trade volume, risk-reward ratio, and maximum allowable risk per period;

- Backtesting and Optimization: Test the strategy on past market data and refine it in a demo account to minimize weaknesses;

- Evaluate Performance in a Live Account: Start real trading and maintain a trading journal to track and improve strategy weaknesses.

Following trading strategy rules and trade management strategies in this section is mandatory.

Practical Examples of Strategy Execution on Charts

To better understand strategies, observing their execution on charts is very helpful. For example:

- Using the 20 and 50 moving averages to identify bullish and bearish crossovers;

- Identifying an entry point with the 61.8% Fibonacci retracement level after an upward move;

- Checking RSI divergence along with the breakout of a support level to take a short position.

Difference Between Trading with and Without a Strategy

The most significant difference is systematic capital management, but there are other distinctions as well.

Professional traders always prefer to trade with strategy and follow the rules.

Parameter | Trading with a Strategy | Trading Without a Strategy |

Entry & Exit | Based on predefined rules | Based on emotions, news, or others' recommendations |

Capital Management | Defined risk per trade, use of stop-loss | Unstructured trade volume and improper risk allocation |

Long-Term Performance | Measurable and improvable based on real data | Dependent on luck and short-term market conditions |

Common Mistakes in Designing a Trading Strategy

Many traders incur losses due to repeating a few common mistakes in designing or executing a strategy, such as overtrading. The most important of these mistakes include:

- Using multiple indicators simultaneously without evaluating their actual effectiveness;

- Ignoring capital management in trading and frequently changing the strategy without analyzing the reasons for failure;

- Constantly switching strategies after a few consecutive losses without investigating the cause;

- Neglecting trading psychology and the effect of emotions on decision-making.

Final Trading Strategy Checklist

To ensure the designed strategy covers all necessary aspects, having a trading strategy checklist is essential. This checklist should include:

- Style Selection: For example, choosing between a day trading strategy, a holding (Hold) strategy, or a scalping strategy;

- Market Structure: Analyzing market structure using price action or indicators;

- Risk Management: Setting a precise risk-to-reward ratio and stop-loss for each trade;

- Trading Journal: Recording all trades in a journal and reviewing them regularly;

- Trader Psychology: Matching the strategy to individual personality traits and psychology.

This checklist not only helps traders avoid impulsive decisions during volatile market moments but also simplifies the long-term process of optimizing the strategy.

It serves as a guide to trading strategy types and, when combined with trading style, techniques, and complete trading strategy analysis, becomes a comprehensive framework for consistent performance.

Conclusion

Types of trading strategies play a crucial role in market execution and risk management.

Having clear rules for entries and exits whether in the form of a Forex strategy or a crypto trading strategy is essential.

Some traders prefer to focus exclusively on types of Forex trading strategies to find their path, while others combine multiple methods to create a personalized framework.

Ultimately, each individual can design a comprehensive trading strategy (CTS) or even a multi-timeframe trading strategy based on their needs and experience.

Having a forex strategy or even using institutional trading strategies helps make the trading process more transparent.

For beginners, trading strategies for beginners provide an excellent starting point, and by combining algorithmic trading strategies with fundamental strategies, traders can build a complete trading system.