Azbit offers spot trading services on 150+ trading pairs with USDT, USDC, BTC, ETH, and BNB as base currencies. The exchange also offers a staking program with a minimum deposit requirement of $100 and up to 45% annual yield.

Azbit is an exchange with an average daily trading volume of $1.3B

Azbit is an exchange with an average daily trading volume of $1.3B

Is Azbit a Regulated Exchange?

Seychelles-registered AZ Markets Limited has gained 561,546 registered users since its launch on February 01, 2018. The crypto exchange has 2M+ monthly visitors and is ranked among the top 50 exchanges. Key features of Azbit:

- Advised by Bitcoin.com founder Roger Ver

- Android / iOS application

- An exclusive Visa debit card

Azbit CEO

Sergei Ermolitski has been the Chief Executive Officer of Azbit Limited since 2019, following the leadership transition from Max Zmitrovich.

Based in Saint Vincent and the Grenadines, he combines fintech expertise with strong marketing and management experience.

- CEO of Azbit Exchange since 2019, previously VP of Marketing at FXCASH OÜ (2009–2019);

- Holds a Master’s degree in HR Management from Belarusian State Technological University (2001–2006);

- Brings expertise in management, project leadership, strategic planning, and sales;

- Continues to focus on product development, marketing leadership, and community-driven growth at Azbit.

Azbit Specific Details

A to Z Crypto exchange has partnered with some of the most reputable projects, such as BitcoinCash, Coinspeaker, TradingView, and Bloxy. Let’s take a closer look at Azbit’s offerings.

Exchange | Azbit |

Launch Date | 2018 |

Levels | None |

Trading Fees | Variable based on the token |

Restricted Countries | Puerto Rico, Palestinian Territory, Occupied, Libyan Arab Jamahiriya, Myanmar, United States, United States Minor Outlying Islands, Uzbekistan, Venezuela, Virgin Islands, Yemen, Singapore, Somalia, Sudan, Syrian Arab Republic, Canada, Cuba, Afghanistan, Belarus, Hong Kong, Iran, North Korea, Guam |

Supported Coins | 110+ |

Futures Trading | No |

Minimum Deposit | $0 |

Deposit Methods | Crypto, Fiat |

Withdrawal Methods | Crypto, Fiat |

Maximum Leverage | 1:1 |

Minimum Trade Size | 1 USDT |

Security Factors | N/A |

Services | Affiliate, Earn services, Azbit Card |

Customer Support Ways | Email, Telegram Group |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | AZ |

Azbit Exchange Pros & Cons

The exchange has no minimum deposit requirements and offers no leverage options. However, it has a comprehensive affiliate program. Let’s see some other upsides and downsides of Azbit.

Pros | Cons |

Wide range of cryptocurrencies | Limited regulatory oversight |

Staking and passive income opportunities | Geo-restrictions |

User-friendly interface | Lack of copy trading services |

Innovative features (Launchpad, AZ Card) | No futures trading |

Users can begin trading withas little as 1 USD/USDT, making the platform accessible for beginners and micro-investors.

Azbit User Levels

Crypto exchanges usually allocate various levels to users with different ranges of trading volume or holdings of the platform’s native token. The higher your level, the more perks you receive, including reduced trading fees and exclusive features.

Note that Azbit doesn’t offer any user levels to reward clients’ activities. However, it puts certain restrictions on unverified accounts, which we will discuss later on in this Azbit exchange review.

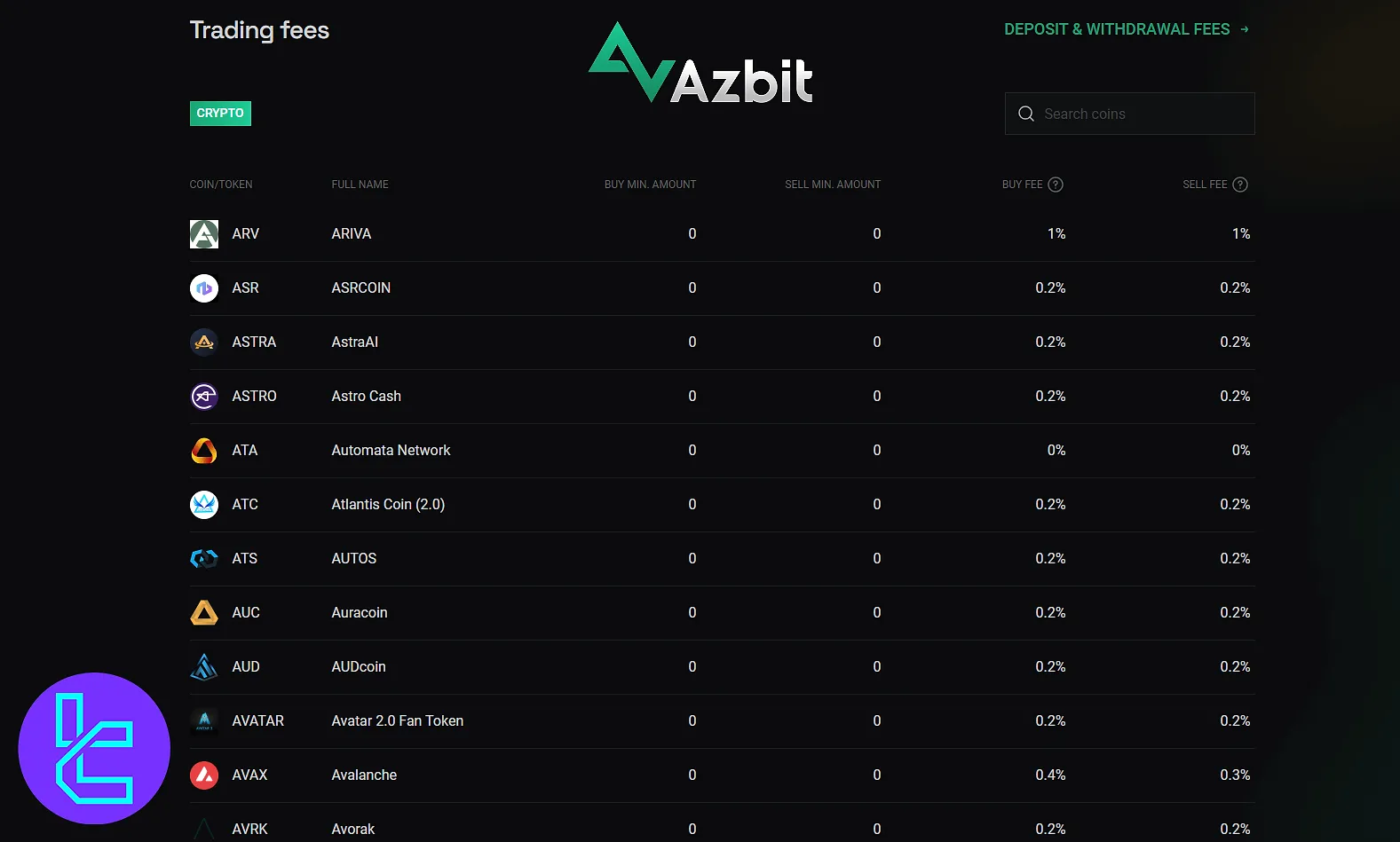

Azbit Fees and Commissions

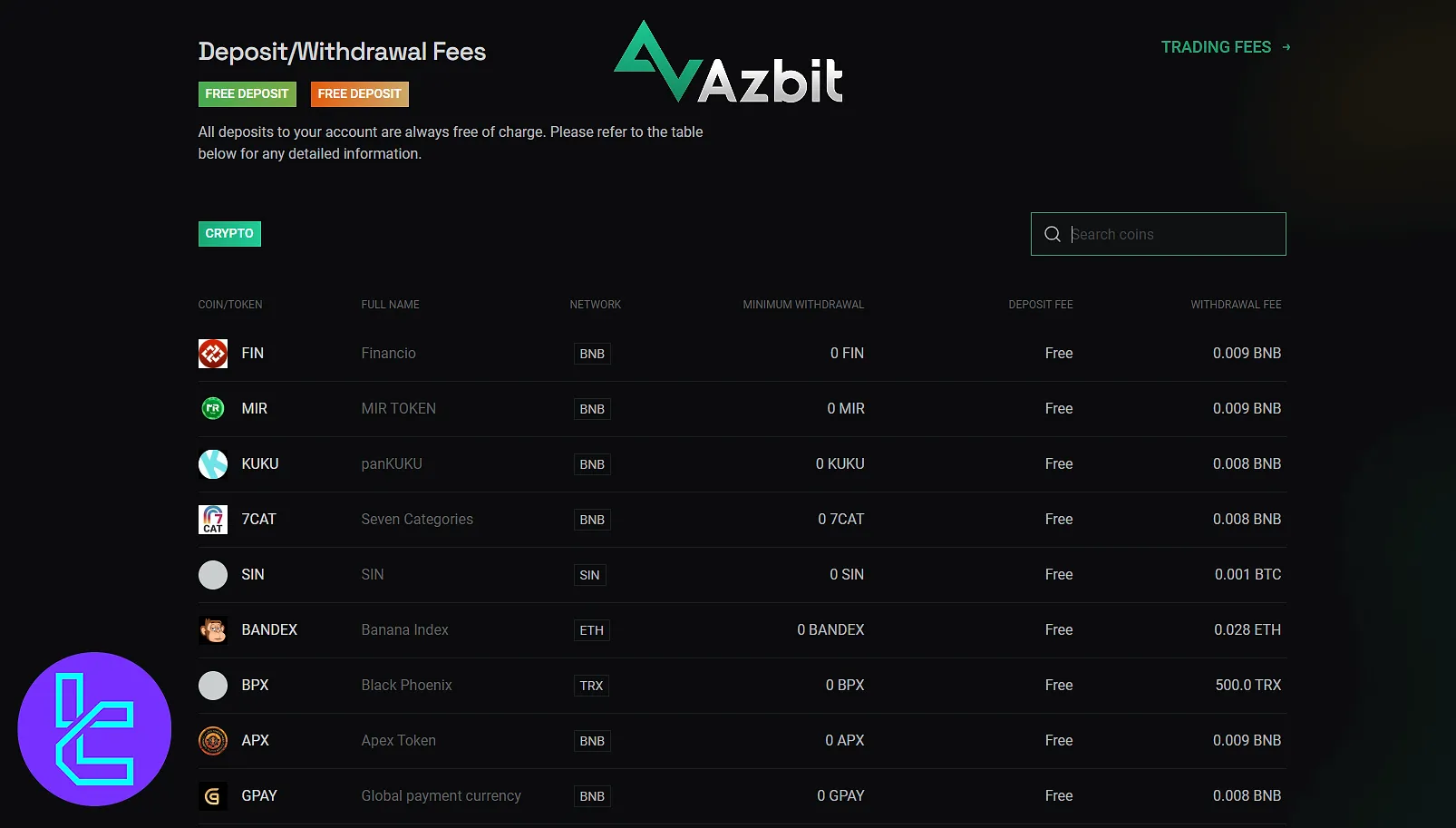

The company prides itself on offering competitive rates. The fee structure mainly consists of Spot trading and withdrawal commissions. Note that deposits are free of charge.

Azbit applies a flat fee structure for spot trading, charging both makers and takers the same price. Trading fees vary based on the asset you’re trading.

In the table below, we’ve gathered the associated charges for trading the most popular cryptocurrencies on Azbit.

Token | Buy Fee | Sell Fee |

AAVE | 0% | 0% |

BCH | 0.2% | 0.2% |

BTC | 0.4% | 0.5% |

BNB | 0.5% | 0.5% |

DOGE | 0.4% | 0.4% |

ETH | 0.5% | 0.5% |

XRP | 0.5% | 0.5% |

While average trading costs on Azbit are close to the industry standard, withdrawal fees may be comparatively higher.

Supported Tokens on Azbit Exchange

Azbit has successfully listed 110+ cryptocurrency projects in the past seven years, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Dogecoin (DOGE)

- Tron (TRX)

- Binance Coin (BNB)

- Ripple (XRP)

Trading pairs are categorized by quote currencies such as USDT, Bitcoin, and ETH, giving users broad access to major cryptocurrencies and trending niche assets like meme coins.

The diversity enables users to explore a wide range of investment opportunities directly on the platform, without needing to rely on external exchanges.

Does Azbit Offer Futures and Margin Trading?

While A to Z Crypto Exchange offers various services, including spot trading and staking, it doesn’t support leveraged, futures, or margin trading.

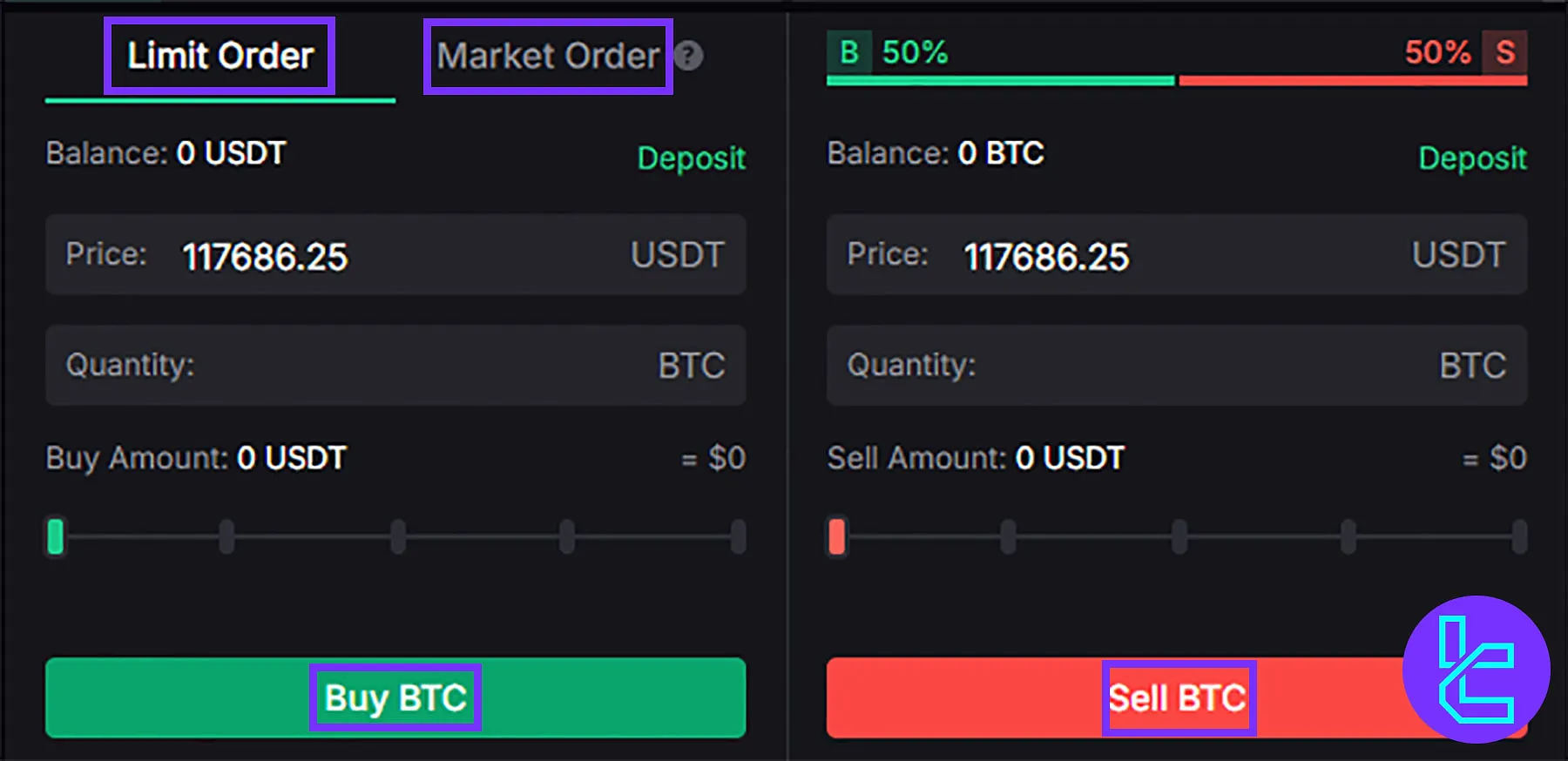

Azbit primarily focuses on the spot market, providing two types of orders, including Market and Limit.

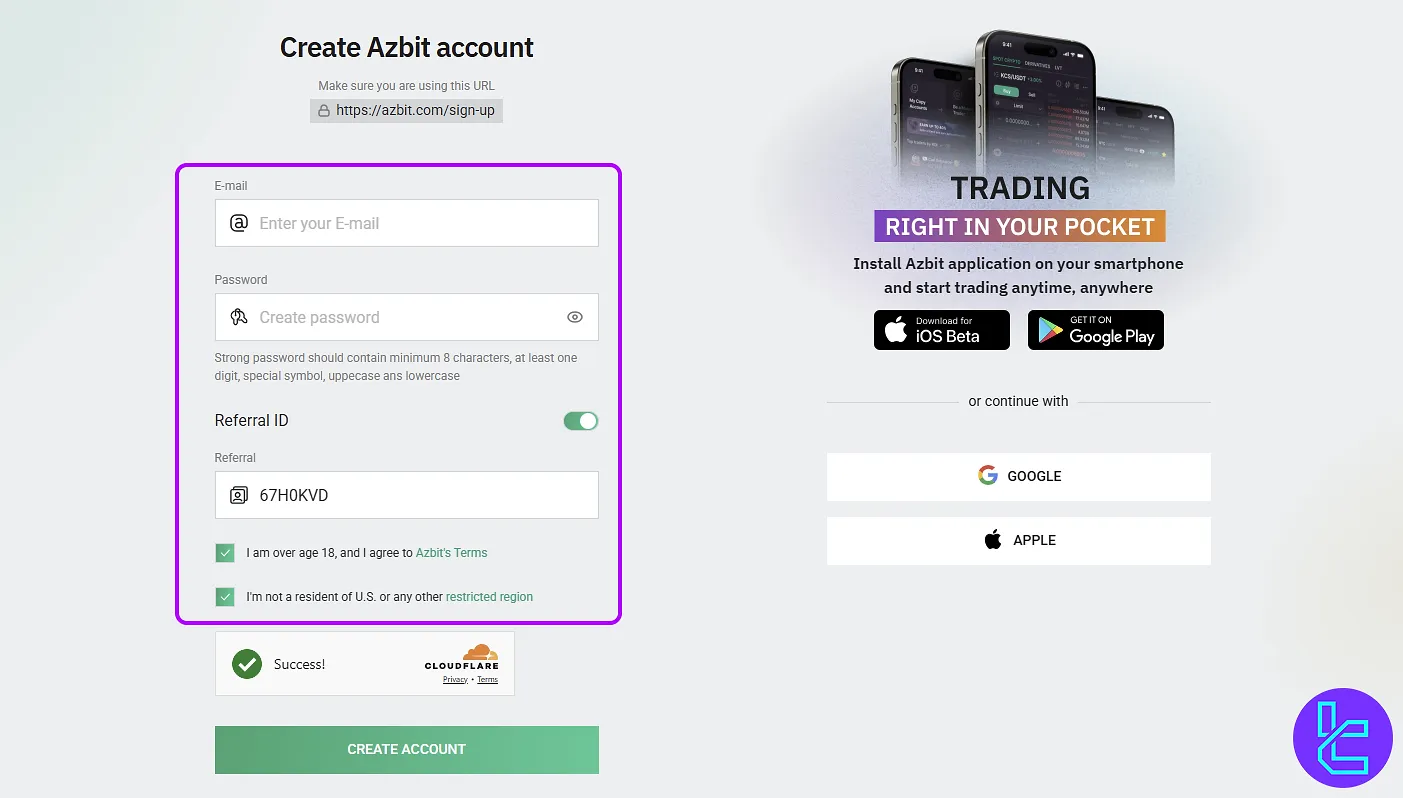

Azbit Exchange Sign Up and Verification

A to Z Exchange has a simple and straightforward registration process followed by an optional KYC verification.

While the KYC procedure is not mandatory, unverified accounts will face certain restrictions regarding fiat deposits/withdrawals and maximum withdrawal amounts. Steps to Azbit registration:

#1 Azbit website

Visit the exchange's official website and click "Join Now" on the home page.

#2 Registration form

Fill out the sign up application with the following details:

- Email address

- Account password

Azbit sends you an email with a confirmation link. Click the link to activate your account.

#3 Azbit KYC verification

Log in to your client area, navigate to "Settings", "Identity Verification". Fill in the personal information form, provide a selfie, and upload supporting documents, including:

- Proof of ID: Passport or ID card

- Proof of Address: Utility bill or Bank statement)

How to Trade on Azbit?

Trading on Azbit’s spot market is simple, secure, and designed for both beginners and advanced traders. By following a step-by-step process, you can efficiently buy or sell cryptocurrencies while taking advantage of real-time market prices.

#1 Deposit Funds into Your Wallet

Navigate to the crypto wallet section, select your preferred cryptocurrency or stablecoin, and generate a deposit address. Transfer funds from your external wallet or exchange to your Azbit account to begin trading.

#2 Access the Spot Market Interface

Open the “Exchange” tab on the platform, where you can view real-time charts, order books, and available trading pairs across different cryptocurrencies and stablecoins.

#3 Select Your Trading Pair

Identify and select the trading pair that matches your deposit. For example, if you deposited USDT, choose a pair like BTC/USDT to start trading. Ensure you check liquidity and spreads before execution.

#4 Place a Buy or Sell Order

Azbit offers two main order types:

- Market Order: Executes instantly at the current market price. Best for traders who prioritize speed over price precision;

- Limit Order: Lets you set a specific price at which you want to buy or sell. The order is only filled when the market reaches your chosen price.

#5 Monitor and Manage Your Orders

Track your open orders in the “Orders” tab. You can cancel pending limit orders anytime or review your trading history to analyze past trades and improve your trading strategy.

What Is Azbit App?

At the time of writing this Azbit exchange review, the company offers its trading services via a proprietary web-based platform accessible through its official website, which provides access to TradingView charts and tools.

The exchange has also developed an Android application, which you can download directly from its website. The Azbit iOS app is still in the Beta phase, and you can test it by installing TestFlight.

To access additional analytical tools, check TradingFinder’s list of TradingView indicators.

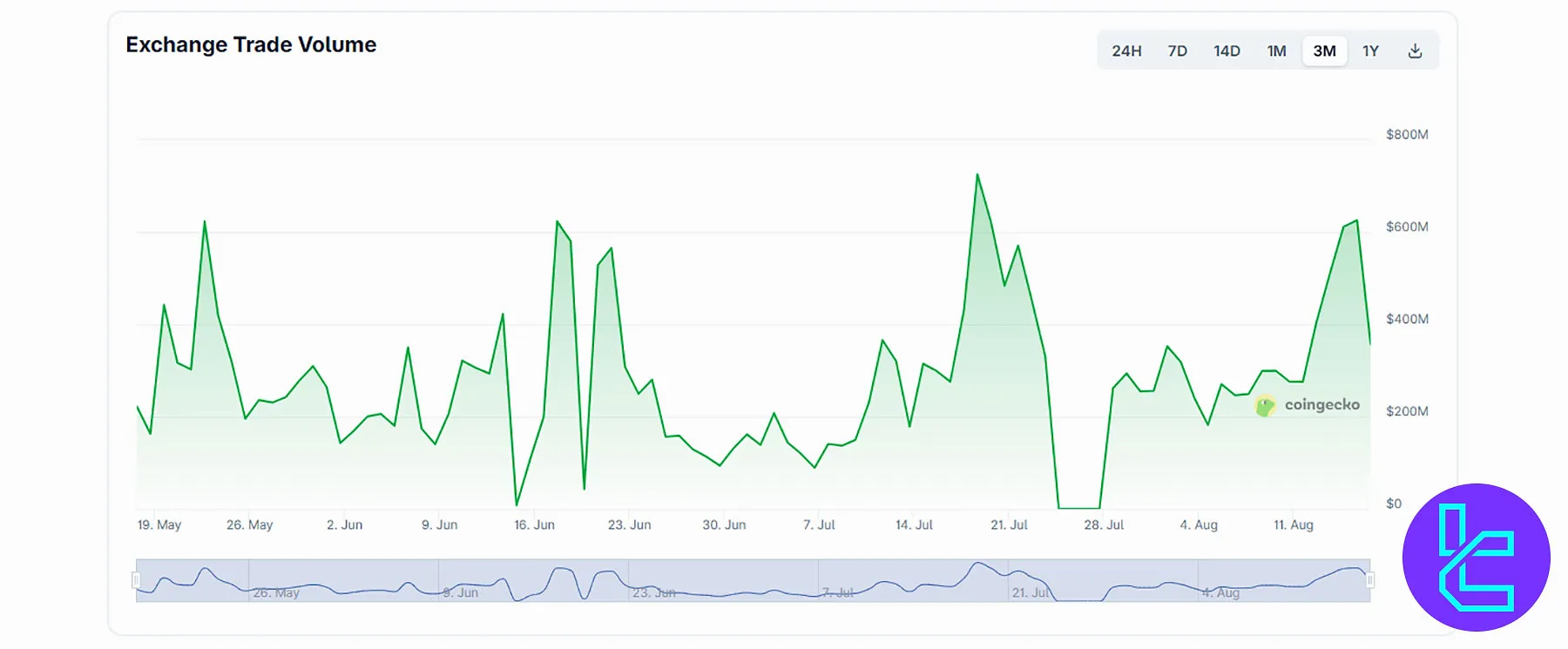

Azbit Trading Volume

Azbit Trade Volume over the past three months has shown strong fluctuations, with daily activity ranging from near zero to highs above $600M, reflecting inconsistent but occasionally sharp spikes in market participation across June, July, and August 2025.

- Peak daily volume: Above $600M in July

- Lowest dips: Close to zero at multiple points

- Average range: $150M – $400M daily

- Pattern: Highly volatile with sharp spikes and deep drops

Azbit Services

Azbit provides traders with TradingView integration, API access, OTC trading, a launchpad, and referral programs, ensuring essential functionality.

However, the exchange lacks advanced tools like auto-trading bots, demo accounts, P2P trading, DEX access, NFT marketplace, and auto-invest options.

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

| No | |

Launchpad | Yes |

NFT Marketplace | No |

Referral Program | Yes |

DEX | No |

Auto-Invest (Recurring Buy) | No |

Azbit Security Measures

Azbit places a strong emphasis on platform security. It utilizes a Merkle Tree–based proof of reserves to demonstrate full collateralization of user assets while maintaining privacy.

Security measures include two-factor authentication (2FA), multi-signature wallets, encryption, and routine audits. These safeguards ensure that user funds are secure and readily accessible for withdrawal at all times.

- Proof of Reserve: 100% of users’ funds are held in warm and cold wallet reserves;

- Withdrawal Password: Set an 8-digit password used to confirm withdrawal requests;

- 2FA: Activate it by scanning the QR code in your client area and using the Google Authenticator;

- Anti-Phishing Code: A code that will be shown in all the messages sent by Azbit to prevent fraud.

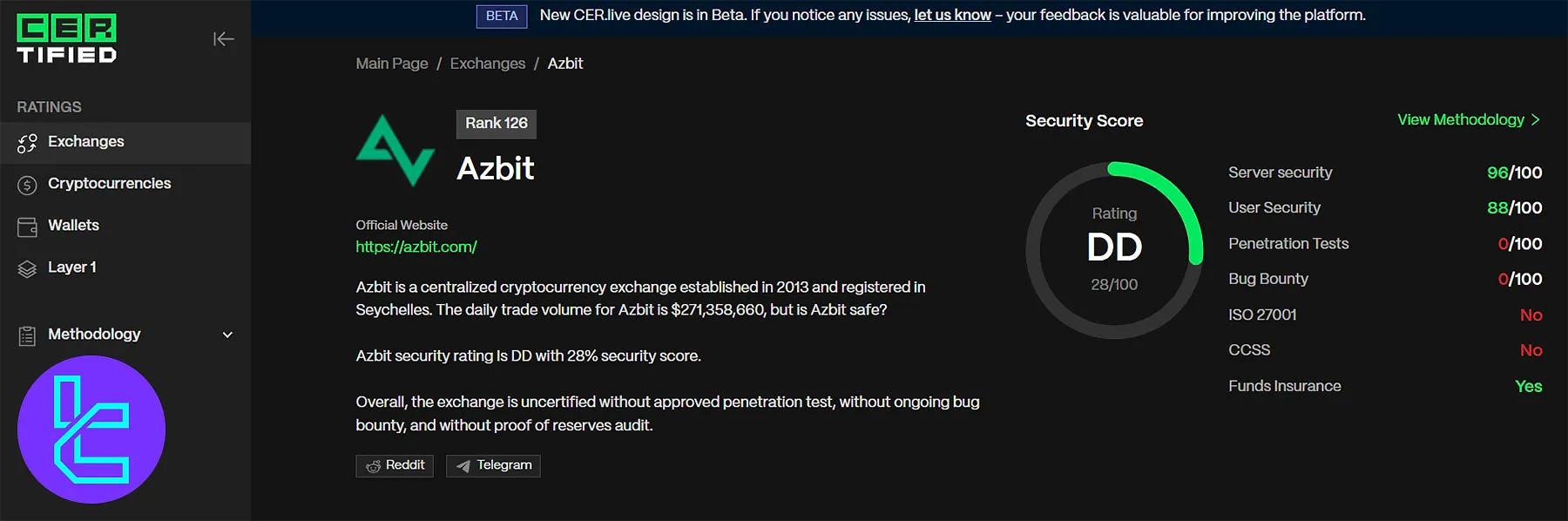

Azbit Security Rankings

Azbit Security Rankings on CER show a DD rating with a 28% score, highlighting strong server security (96/100) and user security (88/100), but critical gaps such as no penetration tests, no bug bounty programs, and missing ISO/CCSS certifications.

According to Azbit CertiK profile, the exchange achieved a 73.96 Skynet score (BBB), reflecting moderate code security (56.06) but stronger governance (84.85) and community engagement (86.76), positioning Azbit as relatively stable yet with clear areas needing improvement.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 73.96% (BBB) |

Operational | 72.72% | |

Market | 75.90% | |

Code Security | 56.06% | |

Fundamental | 79.50% | |

Governance | 84.85% | |

Community | 86.76% | |

CER.live Security Score | Overall Score | 28% (DD) |

Server Security | 96% | |

User Security | 88% | |

Penetration Tests | 0% | |

Bug Bounty | 0% | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | Yes |

Azbit Withdrawal / Deposit

While the exchange claims it supports Fiat transactions, the only available option on its dashboard is Crypto. Almost every listed coin on Azbit is available.

There are no minimum requirements or transaction fees for deposits on Azbit

There are no minimum requirements or transaction fees for deposits on Azbit

Note that withdrawals come with fees and limitations, which are variable based on the selected asset.

Token | Network | Withdrawal Fee | Min Withdrawal |

BTC | BTC | 0.0002 BTC | 0.0002 BTC |

ETH | BASE | 0.001 ETH | 0.001 ETH |

USDT | SOL | 0.0 USDT | 0.0 USDT |

LTC | LTC | 0.01 LTC | 0.01 LTC |

DOGE | DOGE | 25.0 DOGE | 25.0 DOGE |

XRP | BNB | 0.0 XRP | 0.0 XRP |

BNB | BNB | 0.007 BNB | 0.0 BNB |

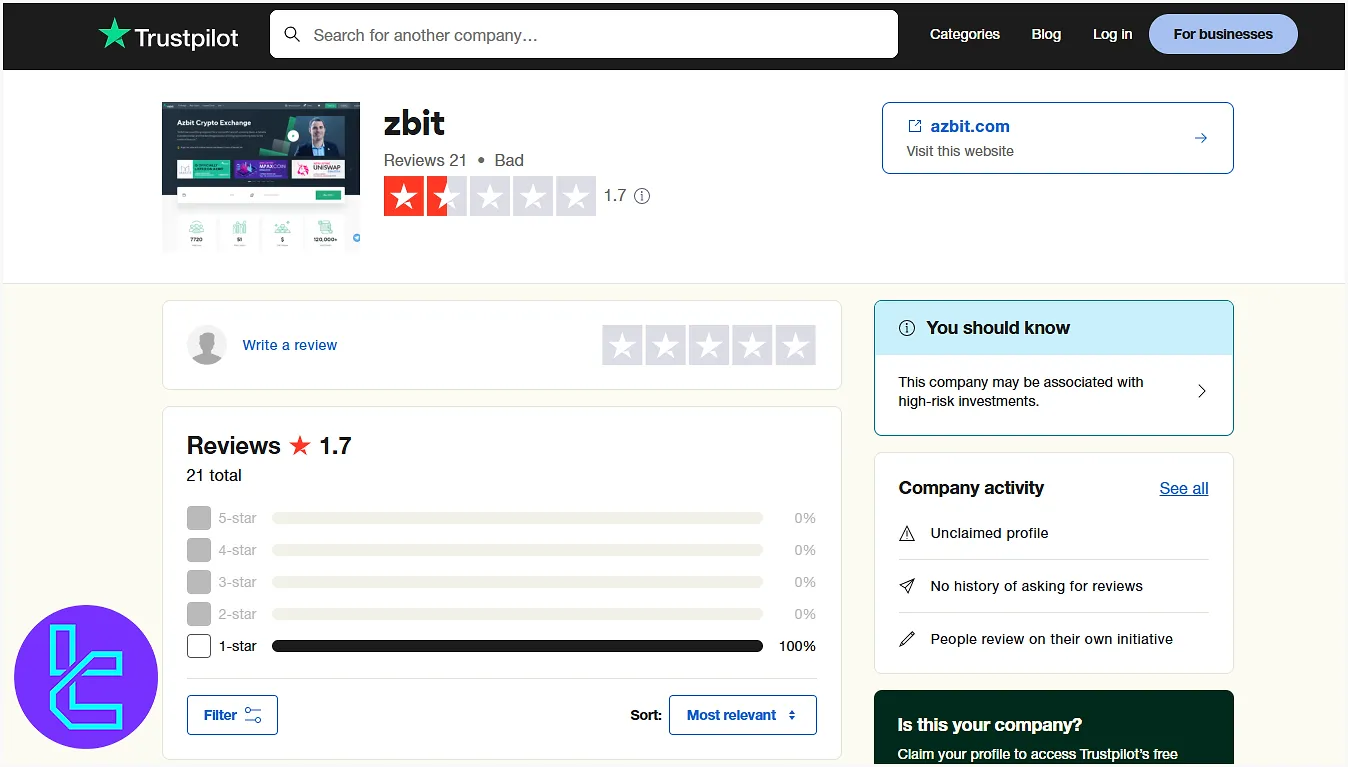

Azbit Exchange Trust Score

Unfortunately, we can’t give the company a good trust score in this Azbit exchange review due to low user satisfaction. However, you should note that A to Z Crypto Exchange has received a good rating from CoinGecko experts.

Reviews.io | 2.0 out of 5.0 based on 32 reviews |

CoinGecko | 8 out of 10 |

1.7 out of 5.0 based on 21 comments |

Azbit Features

Does Azbit offer crypto copy trading software or staking opportunities? Let's check it out.

Staking | Yes |

Yield Farming | Yes |

Social Trading | No |

Liquidity Pool | Yes |

Crypto Cards | No |

Azbit Promotions

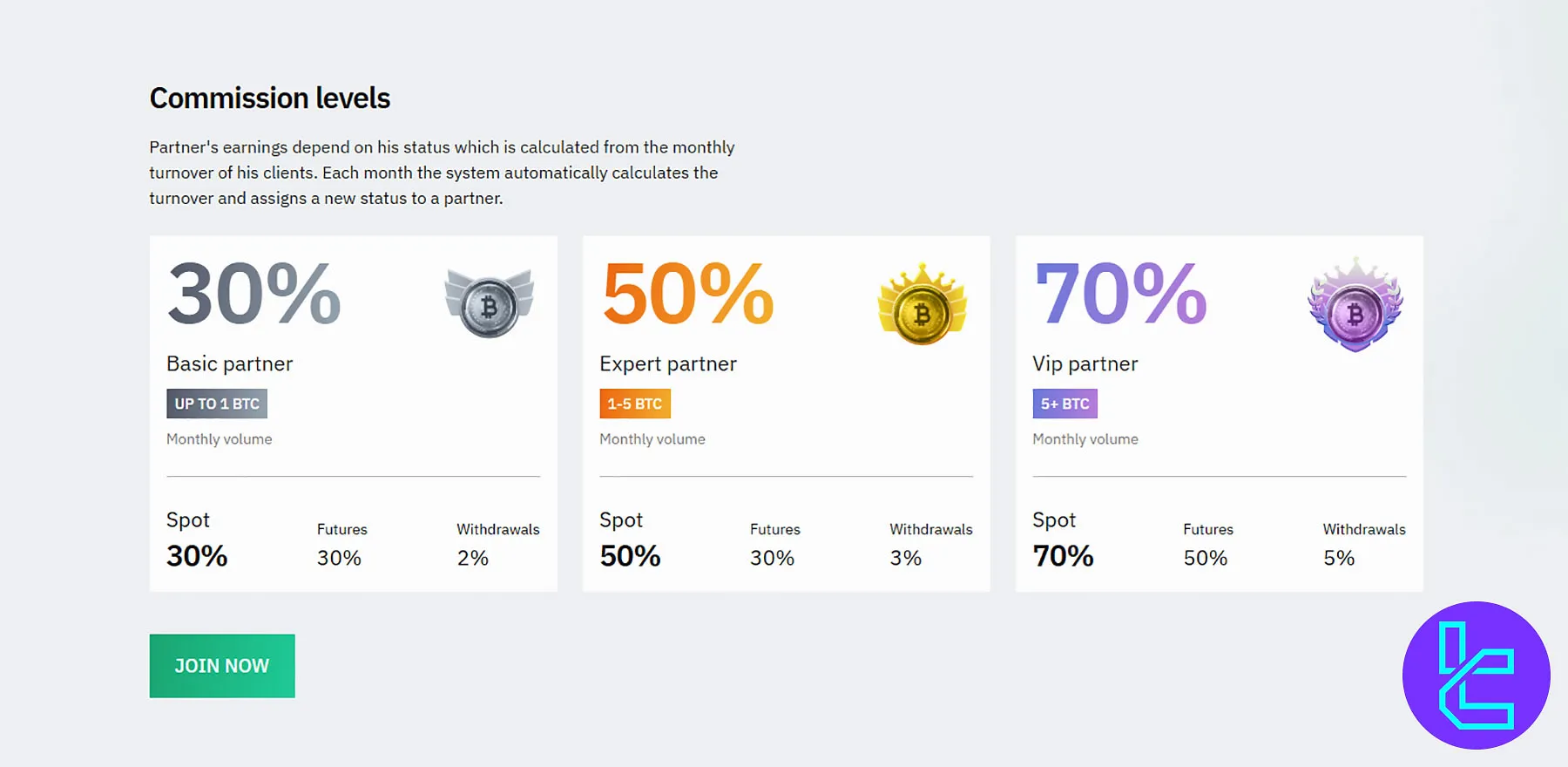

Azbit offers only an affiliate program, providing exclusive rewards, lifetime commissions, instant payouts, and monthly prizes.

Azbit Affiliate Program

The Affiliate Program offers up to 50% lifetime commissions, instant payouts, and advanced tracking tools. Partners earn based on monthly client turnover, with transparent levels from Basic to VIP.

- Basic Partner (≤1 BTC monthly turnover of the invitee): 30% spot, 30% futures, 2% withdrawals commissions

- Expert Partner (1–5 BTC monthly turnover of the invitee): 50% spot, 30% futures, 3% withdrawals commissions

- VIP Partner (5+ BTC monthly turnover of the invitee): 70% spot, 50% futures, 5% withdrawals commissions

- Real-time stats, banners, widgets, and rebate service

- Dedicated personal manager and monthly prizes for top affiliates

- Commission auto-updated monthly based on client turnover

How to Reach Azbit Support?

The company offers 24/7 support through two main channels, including email and multiple telegram groups for different languages, such as Korean, Russian, Indonesian, and English.

support@azbit.com | |

Telegram (English) | https://t.me/azbit_com |

Telegram (Other Languages) |

Azbit Earn Program

Azbit exchange offers three main earning plans for investors. Crypto Staking, holding the native token, and Launchpad are your options to earn passive income.

- Staking: Receive interest on your locked assets, such as TELE, FRX, and ETCM;

- Launchpad: Invest in newly listed and prominent projects;

- AZ Token: Purchase the platform’s native currency and enjoy discounts on trading and listing fees;

Azbit Staking

Azbit offers staking options under its “Azbit Earn” program, allowing users to generate passive income on select assets with flexible withdrawal conditions and daily reward distribution.

While the selection is limited to niche cryptocurrencies like FRX, ETCM, and UR, the estimated annual yields range from 20% to 45%, depending on the asset. There are no lock-up periods, and minimum deposits vary per token.

Azbit Affiliate

Azbit features a multi-tiered affiliate program to reward users who refer new traders to the platform. Commissions range up to 30% of trading fees, with payout levels determined by the trading volume generated by referred users.

The three-tier system — Basic, Expert, and VIP — recalculates each month, and referrals also benefit from fee rebates.

Restricted Countries on Azbit Exchange

A to Z Crypto imposes restrictions on users from certain countries due to regulatory factors. Red flag countries on Azbit:

- Puerto Rico

- Palestinian Territory, Occupied

- Libyan Arab Jamahiriya

- Myanmar

- United States

- United States Minor Outlying Islands

- Uzbekistan

- Venezuela

- Virgin Islands

- Yemen

- Singapore

- Somalia

- Sudan

- Syrian Arab Republic

- Canada

- Cuba

- Afghanistan

- Belarus

- Hong Kong

- Iran

- North Korea

- Guam

Azbit vs Top Exchanges

Let's compare Azbit's features and services with popular crypto exchanges.

Features | Azbit Exchange | |||

Number of Assets | 110+ | 700+ | 1300+ | 2,800+ |

Maximum Leverage | 1:1 | 1:100 | 1:100 | 1:200 |

Minimum Deposit | $0 | $1 | N/A | $1 |

Spot Maker Fee | N/A | -0.005% - 0.1% | 0.005% - 0.1% | 0.05% |

Spot Taker Fee | N/A | 0.025% - 0.1% | 0.015% - 0.1% | 0.05% |

Mandatory KYC | No | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | No | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

While Azbit gets a great score of 8/10 from CoinGecko experts, users don’t agree and have rated the platform as a bad exchange with a score of 1.7/5 on TrustPilot.

The higher than average commission of buying and selling BTC, which is 0.4% and 0.5%, could be one of the reasons for the poor Azbit reviews.