Bitazza provides access to Spot and Futures markets with a maker/taker fee of 0.15%/0.25%. The exchange offers leverage options of up to 1:20 and referral fees of up to 40%.

The platform requires a minimum crypto deposit of $10, whereas fiat transactions are only possible starting at $30,000.

Its strong regulatory backing comes from the Securities and Exchange Commission of Thailand and the Ministry of Finance, making it one of the few Southeast Asian exchanges to operate under direct government oversight.

Bitazza; Exchange's Background and Information

Headquartered in Thailand, Bitazza International Limited was founded in 2016 by co-founders Kevin Heng and Kavin Phongpandecha.

Thecentralized exchange is regulated by the Securities and Exchange Commission (SEC) and the Ministry of Finance of Thailand. Bitazza key features:

- 90+ cryptocurrencies

- CEO and Director: Wei Yee

- Futures trading with USDT trading pairs

- Primary focus on the ASEAN market

Bitazza offers a suite of services, including spot trading, OTC desk access, a proprietary Visa card program, and the Freedom Wallet (a Web3 solution with token and NFT functionality).

The platform uses a KYC-based tier system, where users are classified into levels based on their account's verification level.

It also features FDM holding-based user levels, granting benefits such as discounted fees, referral rewards, and voting rights.

Bitazza CEO and Co-Founder

Tanawat Sutuntivorakoon is a Thai entrepreneur and the Chief Executive Officer of Bitazza. He co-founded the company in 2019 and has been leading its expansion across Southeast Asia.

Based on Tanawat Sutuntivorakoon LinkedIn page, he is recognized for his vision of making digital assets accessible to both retail and institutional investors.

He has played a central role in securing regulatory compliance for the platform, including licensing from the Thai SEC.

With a background in finance and technology, Sutuntivorakoon has positioned himself as one of the notable figures in Thailand’s blockchain ecosystem.

He frequently speaks about the future of decentralized finance and the integration of blockchain in emerging markets.

Bitazza Exchange Table of Specifications

Bitazza offers a range of products, including Spot, Futures, and OTC markets, as well as an NFT marketplace built on the Fuse blockchain.

Let’s take a quick look into the crypto exchange’s offerings.

Exchange | Bitazza |

Launch Date | 2016 |

Levels | BRONZE, SILVER, GOLD, PLATINUM, DIAMOND, EMERALD, EARLY ADAPTORS |

Trading Fees | Taker 0.25% Maker 0.15% |

Restricted Countries | North Korea, Iran, Crimea, Cuba, Russia, Syria, Somalia, Sudan, Yemen, Afghanistan, Iraq, Venezuela |

Supported Coins | 90+ |

Futures Trading | Yes |

Minimum Deposit | Fiat $30,000 |

Deposit Methods | Bank Wire, Crypto |

Withdrawal Methods | Bank Wire, Crypto |

Maximum Leverage | 1:20 |

Minimum Trade Size | OTC Market THB 300,000 Spot $10 |

Security Factors | Cold Wallet, Hot Wallet, 3rd Party Custodian |

Services | Spot Trading, OTC Market, Futures, Freedom VISA Card, NFT Marketplace |

Customer Support Ways | Email, Live chat |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | FDM |

Bitazza Upsides and Downsides

Every exchange has its pros and cons, and Bitazza is no exception. Let's weigh the good against the not-so-good:

Pros | Cons |

Regulated by Thailand's SEC | Primarily focused on the ASEAN market |

User-friendly platform suitable for beginners | Limited asset offerings (90+ cryptocurrencies) |

Competitive trading fees with discounts available | Fiat deposits and withdrawals available only for $30,000 or higher |

Advanced charting tools for technical analysis enthusiasts | - |

Bitazza User Levels

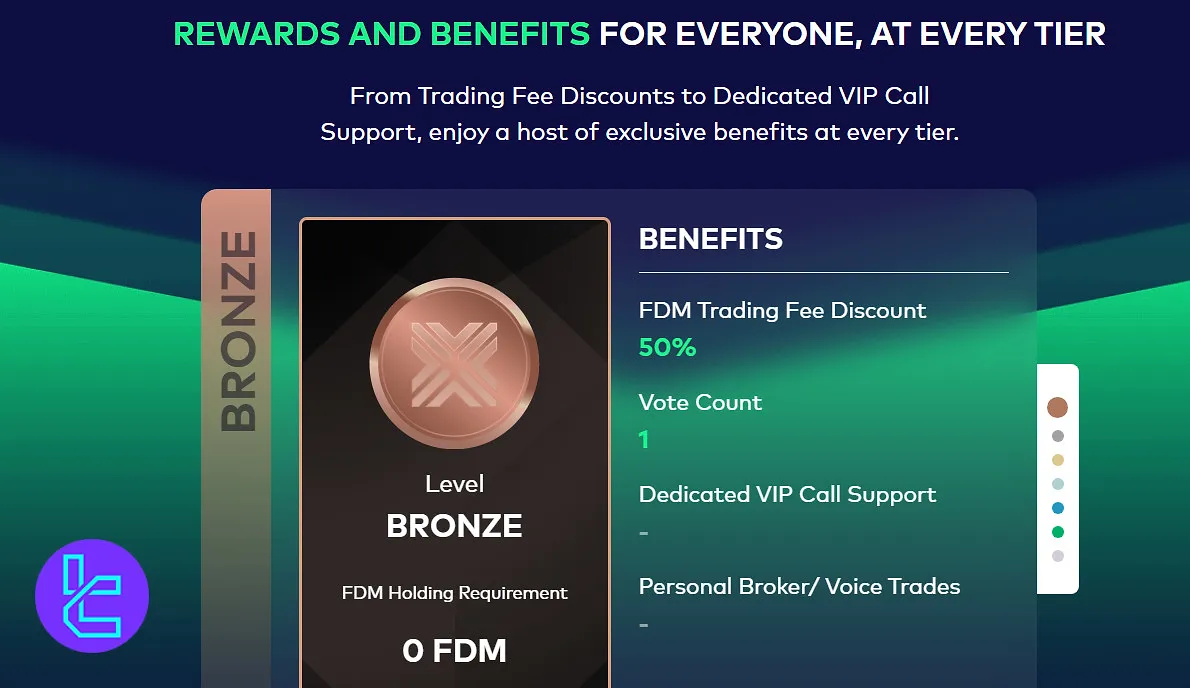

We must mention in this Bitazza review that the exchange offers fee discounts for FDM holders up to 70%.

The platform also has a 50% discount for those who pay the trading fees with FDM.

User Level | FDM Holding | FDM Trading Fee Discount | Vote Count |

BRONZE | 0 | 50% | 1 |

SILVER | 50K | 50% | 2 |

GOLD | 150K | 55% | 5 |

PLATINUM | 500K | 60% | 10 |

DIAMOND | 1.5M | 65% | 25 |

EMERALD | 3M | 70% | 50 |

EARLY ADAPTORS | 5K | 5% | 10 |

Users are automatically classified into loyalty tiers, from Bronze to Emerald and EARLY ADAPTORS (for new clients), based on their FDM balances.

Higher-tier users receive greater fee reductions and enjoy governance privileges within the platform’s ecosystem.

Fees Explained

Bitazza does not charge fees for crypto deposits, and the only charge for crypto withdrawal is the blockchain network fee.

Bitazza employs a tiered fee system tied to user holdings of its native FDM token. The base trading fees are as follows:

- Maker: 0.15%

- Taker: 0.25%

However, users can receive substantial discounts up to 70% depending on the number of FDM tokens they hold.

This incentivized model enables traders to progressively reduce costs while gaining access to platform-wide perks, including airdrops and voting rights.

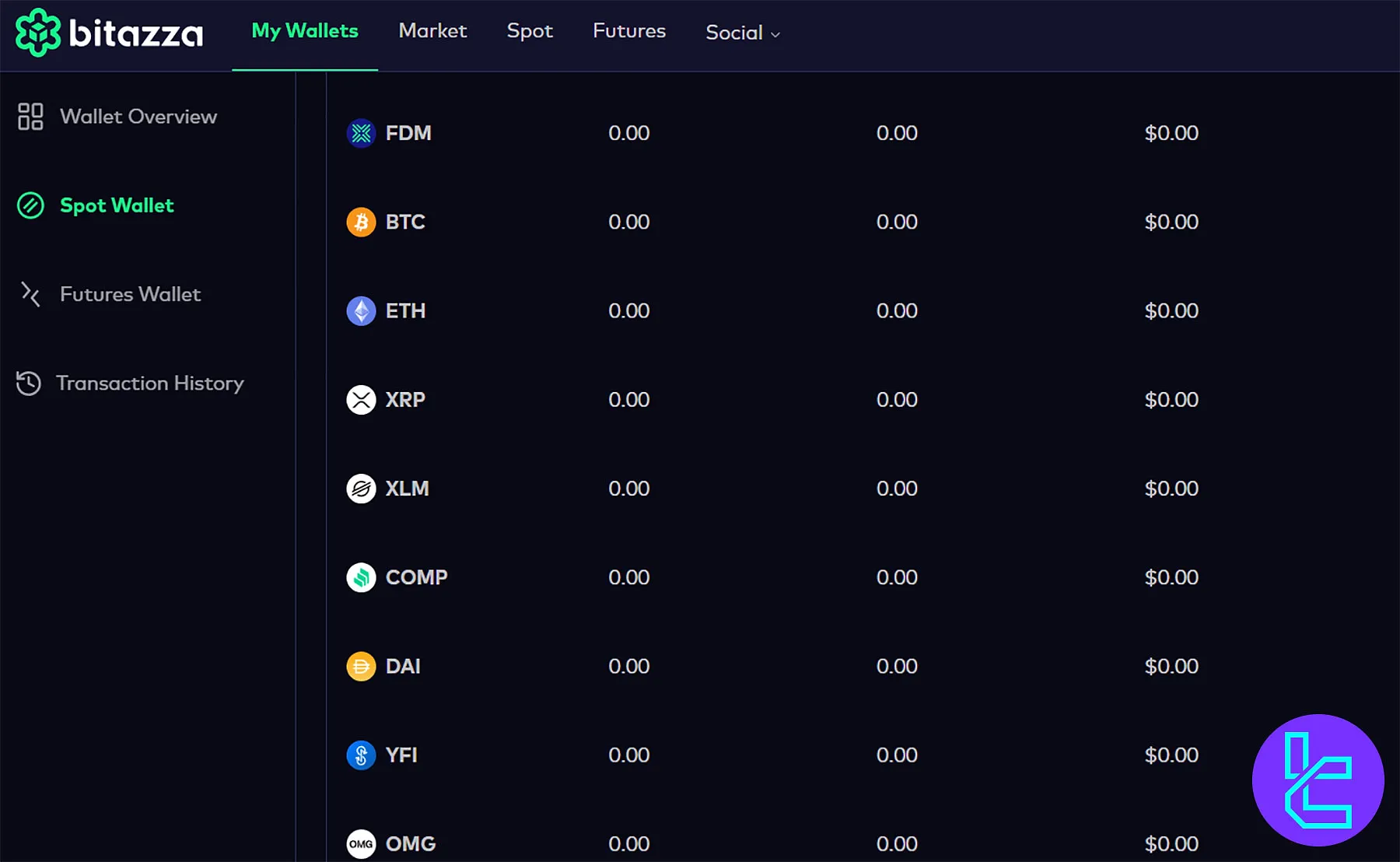

Bitazza Exchange Markets

Bitazza lists 90+ cryptocurrencies for trading, along with one supported fiat currency. The platform enables both crypto-to-crypto and crypto-to-fiat transactions.

- BTC

- ETH

- AVAX

- SHIB

- XRP

- COMP

- LINK

- UNI

- SUSHI

- SOL

- DOT

- CAKE

With an even spread in trading volume and no dominance by a single asset, Bitazza provides a diverse landscape for asset rotation.

However, the relatively small number of supported coins and pairs may limit trading opportunities for professionals.

Does Bitazza Offer Leverage Options?

The exchange offers Futures perpetual contracts with leverage options of up to 1:20 in the USDT market on various cryptocurrencies, including:

- BTC

- BCH

- EOS

- TRX

- ETC

- DASH

- BNB

- ATOM

- NEO

- ALGO

- DOGE

- STORJ

Bitazza Exchange Registration and KYC

The platform offers a streamlined sign-up and a structured three-tier KYC system to ensure both compliance and security for all users, whether local or international.

#1 Quick Account Registration

Go to the official website, click “Sign Up”, and enter your details:

- Email address

- Strong password

Confirm your email by clicking the verification link sent to your inbox.

#2 Bitazza KYC Level 1

Submit ID documents to complete the initial verification, including:

- Thai national ID (for locals)

- Passport (for foreigners)

- Additional identity document

#3 Bitazza KYC Level 2

Provide additional supporting documents for the KYC level two:

- Proof of Funds: Bank statement

- Proof of Address: Utility bill or official correspondence

#4 Bitazza KYC Level 3

Attend a live interview conducted by the platform’s compliance team to finalize identity verification and access full account privileges.

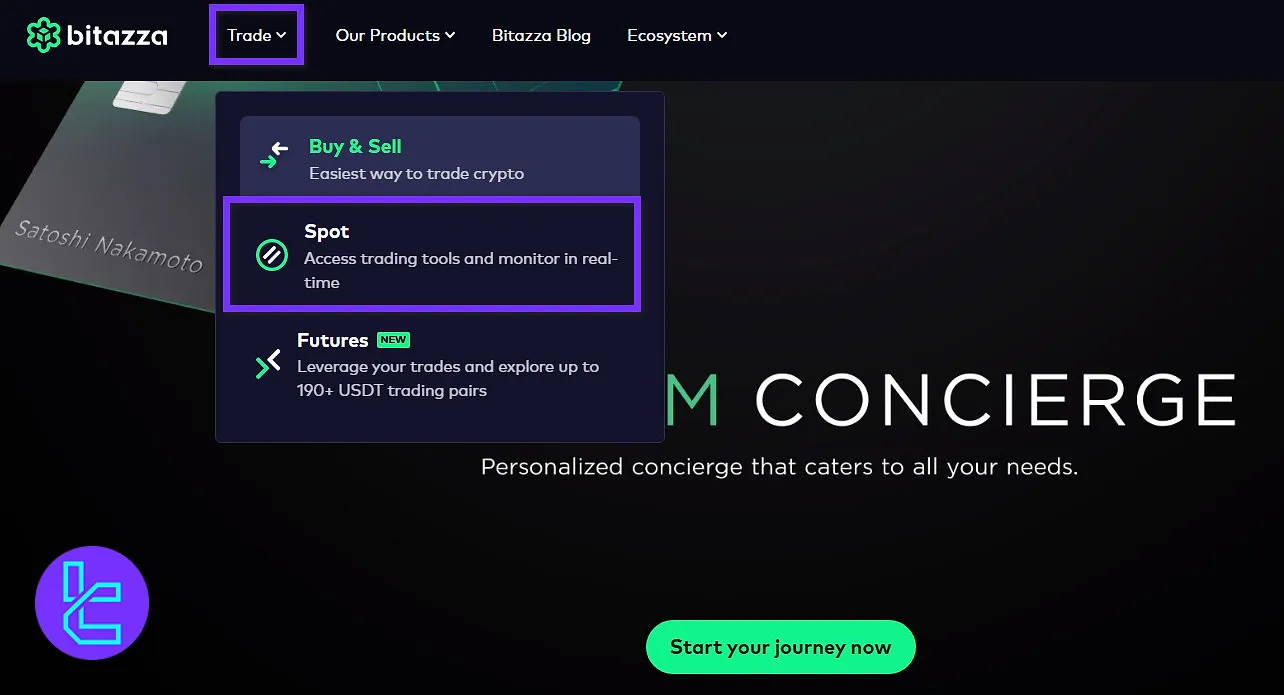

Bitazza Trading Guide

Trading on Bitazza is simpler than it looks. Just follow these steps, and you’ll be ready to place your trades in no time.

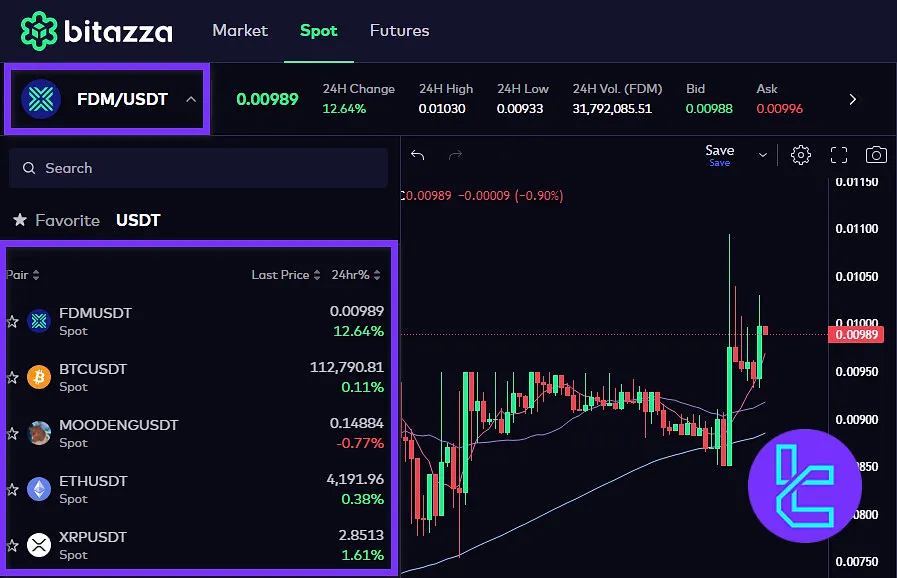

#1 Access the Exchange

From the Bitazza homepage, click on “Trade” in the top menu. Then, click on the “Spot”.

#2 Pick Your Trading Pair

In the upper left corner, click on the displayed trading pair. A drop-down list will appear where you can search and select your desired pair.

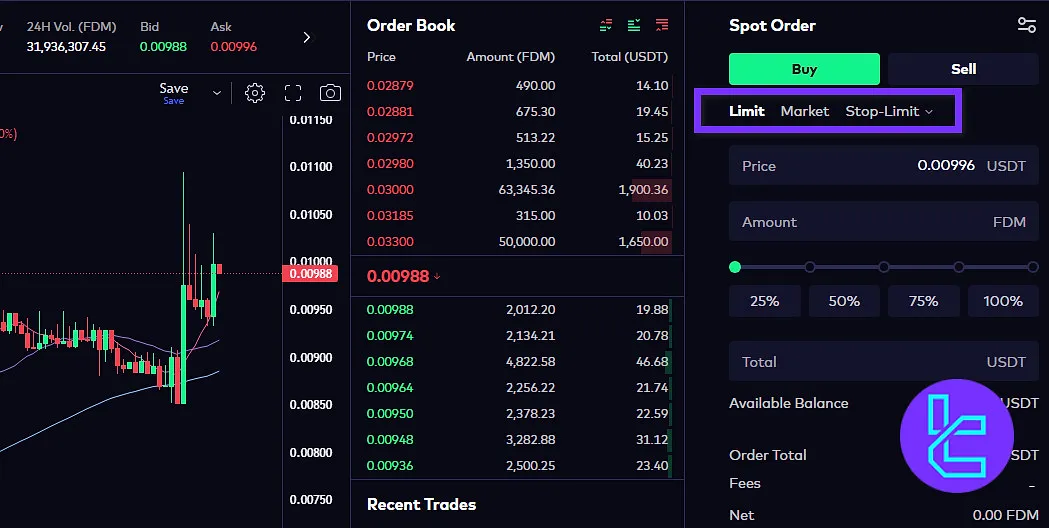

#3 Select the Order Type

Next, decide on the type of order you want to use. Bitazza supports limit, market, stop-limit, and stop-market orders.

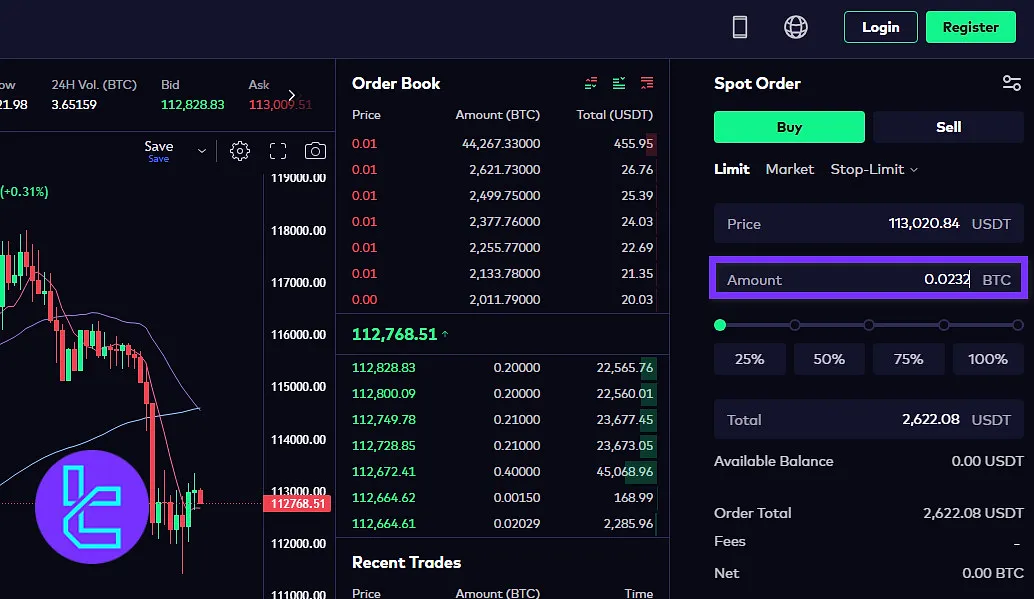

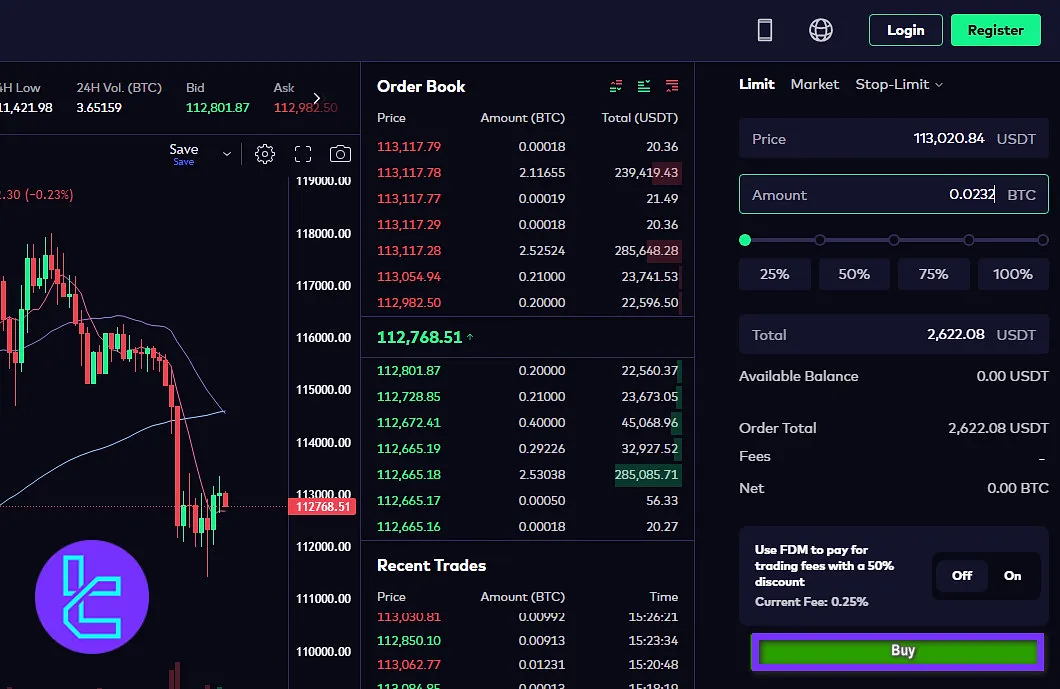

#4 Set Trade Amount

Enter the volume of your trade in the “Amount” field provided.

#5 Finalize Your Trade

Click on either “Buy” or “Sell” to execute and confirm your trade.

Bitazza App and Platform

The exchange offers a web-based platform that is integrated with TradingView charts, in addition to a dedicated mobile application.

TradingFinder has developed multiple TradingView indicators that you can access for free.

Bitazza Trading Volume

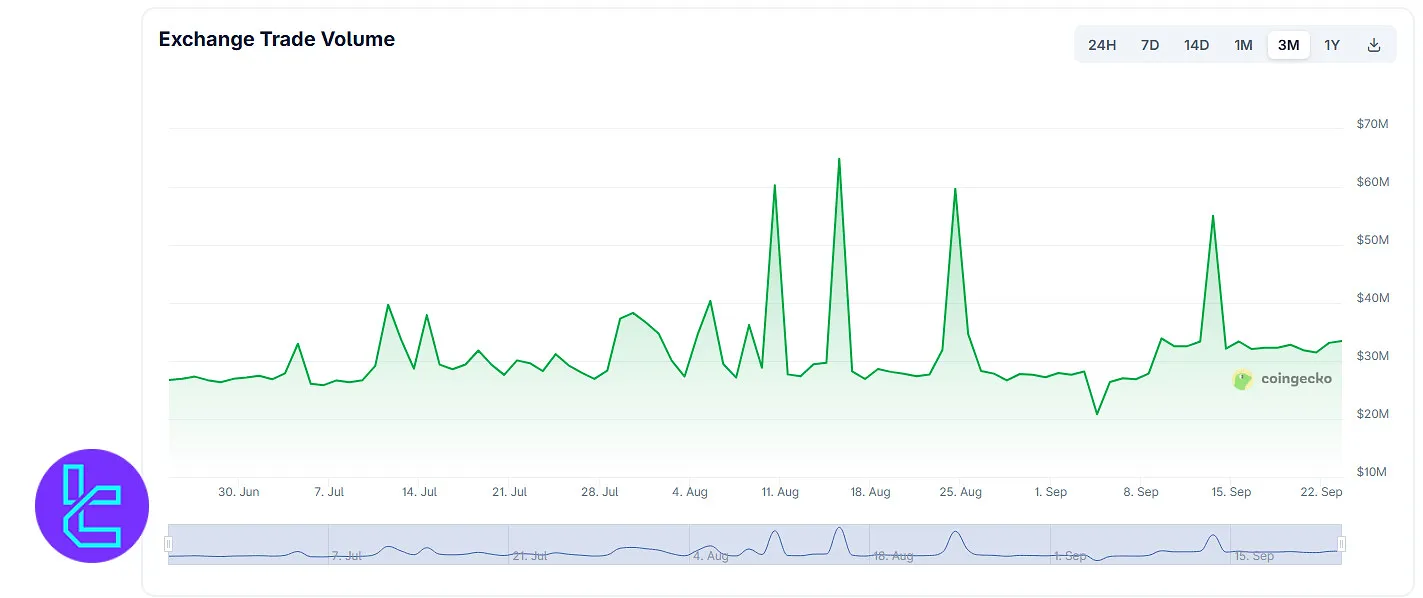

Based on the Bitazza CoinGecko chart, over the past three months, Bitazza’s trading activity has shown a dynamic pattern with noticeable peaks and corrections.

Daily exchange volumes mostly ranged between $20 million and $40 million, with occasional spikes reaching above $60 million, indicating sudden bursts of liquidity and market participation.

From late June through early July, trading stayed relatively stable near the $25M mark, followed by mid-July surges where volume briefly exceeded $35M.

The most striking movements occurred in mid-August, when Bitazza recorded multiple sharp increases, pushing volumes to the $65M–$67M range, before quickly normalizing.

In September, activity remained steadier compared to the volatility of August.

Average daily volume stayed closer to $30M–$32M, with a notable spike around September 15th, where it climbed past $50M.

Since then, trading levels have consolidated, suggesting a more consistent market rhythm.

Bitazza Services

Let’s see how many popular trading services are available on the Bitazza exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

Yes | |

Launchpad | No |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Safety and Security

Top-tier security is one of the bright sides in this Bitazza review. The exchange is regulated under Thai law but lacks Tier-1 regulatory oversight from global bodies like the FCA or MAS.

It enforces mandatory KYC for all users and stores the majority of funds in cold crypto wallets. The exchange has no known history of security breaches, supports 2FA for login protection, and offers 3rd party custodian solutions.

- Cold storage wallets

- Two-factor authentication (2FA)

- 3rd party custodian solutions: Utilizing a third-party provider of storage and security services for cryptocurrencies

However, there is no investor protection fund, and features like biometric verification are absent, limiting trust levels compared to platforms with more robust global compliance.

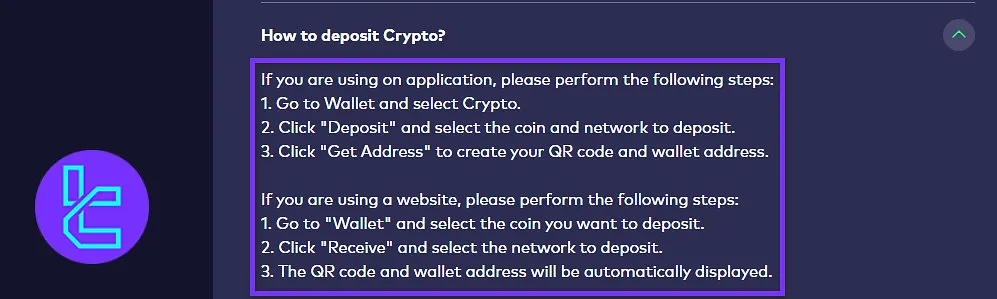

Bitazza Withdrawal and Deposit Options

The exchange only supports fiat transactions for amounts of $30,000 or higher. It also accepts crypto payments with a $10 minimum requirement.

At Bitazza, the minimum deposit and trade size both start from $10 or 0.001 BTC. While the platform doesn’t charge deposit fees, users may incur withdrawal fees based on the asset, for instance, 0.0005 BTC or 0.005 ETH.

Fiat deposits via bank card and wire are supported, but PayPal and P2P are not available. The platform’s fiat coverage remains limited and is mostly tied to local Thai infrastructure, which could be restrictive for global users.

Bitazza Exchange Trust Scores

There are only two reviews on the Bitazza Trustpilot profile, both of which are 1-star and complain about non-responsive support and the theft of personal information.

Trustpilot | 2.9 out of 5 |

CoinGecko | 6 out of 10 |

The limited online reviews and lack of proper support channels can be alarming for potential clients.

Bitazza Features

Let's check crypto-special services offered by the Bitazza exchange:

Staking | Yes |

Yield Farming | Yes |

Social Trading | No |

Liquidity Pool | Yes |

Crypto Cards | Yes |

Bitazza Bonus

Bitazza provides users with multiple ways to earn beyond regular trading, making participation on the platform more rewarding.

Two of the most attractive benefits are the Referral Program and the Freedom Levels Rewards system:

Feature | Referral Program | Freedom Levels Rewards |

How to Join | Share referral link/code with friends | Hold FDM tokens (0–3M+ depending on tier) |

Main Benefit | Earn lifetime commission on referral trades | Receive tiered rewards and exclusive benefits |

Reward Range | 15% to 40% trading fee commission | 50% trading fee discount (Bronze) to full VIP services (higher tiers) |

Extra Benefits | Scales with Freedom Level status | Voting rights, dedicated support, personal broker, more ways to earn FDM |

Growth Method | More referrals lead to higher passive earnings | More FDM holdings lead to higher tier and stronger benefits |

Bitazza Referral Program

Bitazza’s referral program allows users to generate lifetime earnings by inviting friends to join the platform. By sharing a referral code or link, users can earn a percentage of their referrals’ trading fees forever.

The referral bonus starts at 15% for entry-level users and scales up to 40% as the user’s account tier increases.

Bitazza Freedom Levels Rewards

The Freedom Levels program is a tier-based rewards system that depends on holding Bitazza’s FDM tokens.

Users progress through levels, from Bronze (0 FDM) to Emerald (3M FDM), with additional recognition for Early Adopters (5k FDM). Each level unlocks higher-value benefits such as:

- Trading fee discounts (up to 50%)

- Community voting rights

- VIP call support and personal broker access at upper tiers

FDM can be earned not only through holding and purchasing but also via contests, partner support, and referral activity, making the program flexible and engaging.

Customer Support

Operated by local partners and teams in each country, clients have direct access to a dedicated personal broker for their trading accounts.

The exchange claims to provide support via email, chat, and a Telegram community.

- Email: support@bitazza.com

Note that the link to the Telegram community is not disclosed on the website.

While the platform claims 24/7 support availability, the lack of transparency and poor feedback may deter high-volume or institutional traders.

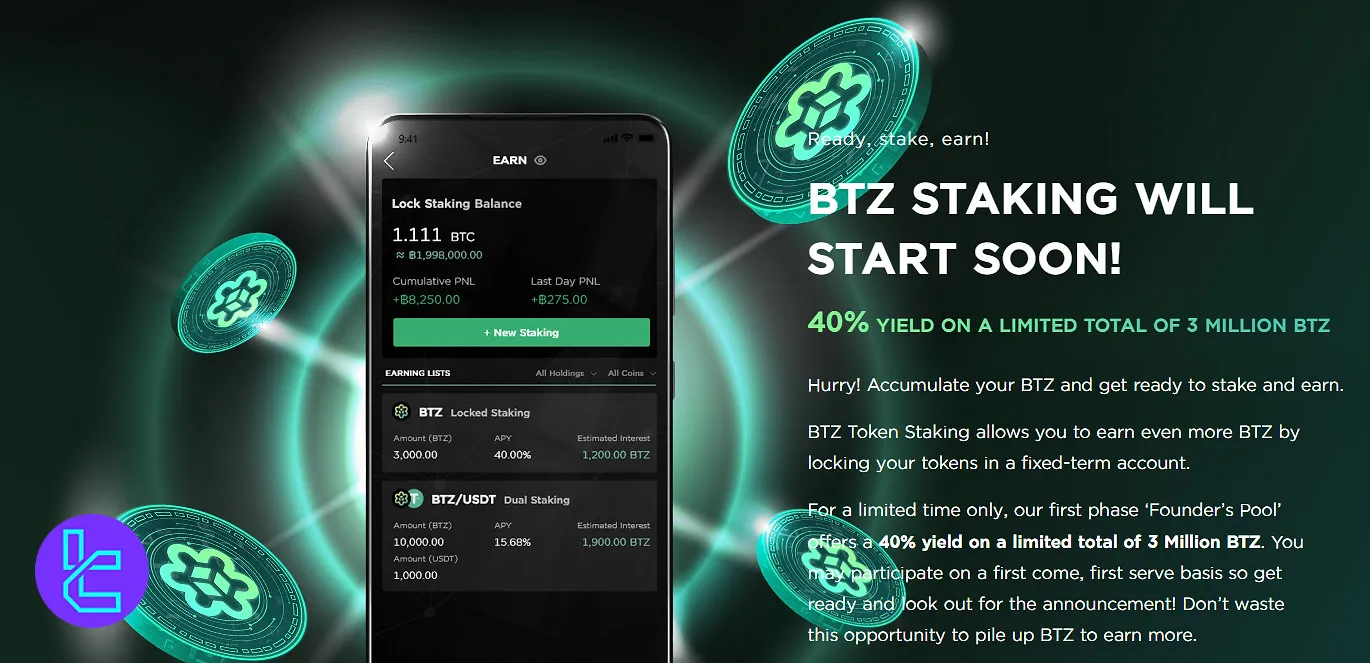

Bitazza Staking Service

The exchange features an Earn program offering crypto staking opportunities on its utility token, FDM, with the following features:

- Minimum staking period: 90 days

- APY-based returns

- Staking up to 9,999,999 FDM in a 365-day period

- Unable to unlock the staked assets until the end of the period

While this staking model may appeal to long-term investors, the lack of flexible staking options or diverse staking assets limits its attractiveness compared to broader platforms.

Bitazza does not currently offer copy trading or integrated trading bots, placing it behind more feature-rich competitors. However, it supports advanced order types and provides API access for custom integrations.

Bitazza Exchange Prohibited Countries

The platform doesn’t provide services to individuals or countries listed on the Office of Foreign Assets Control (OFAC), EU, FATF, and United Nations sanction lists, including:

- North Korea

- Iran

- Crimea

- Cuba

- Russia

- Syria

- Somalia

- Sudan

- Yemen

- Afghanistan

- Iraq

- Venezuela

The platform also doesn’t accept clients from the USA.

Bitazza Comparison Table

The table below compares Bitazza features and services with popular exchanges:

Features | Bitazza Exchange | OKX Exchange | HTX Exchange | LBank Exchange |

Number of Assets | 90+ | 7800+ | 700+ | 700+ |

Maximum Leverage | 1:20 | 1:12 | 1:200 | 1:125 |

Minimum Deposit | $10 | N/A | $1 | Varies by Cryptocurrency |

Spot Maker Fee | 0.045% - 0.15% | -0.01% - 0.14% | From 0.02% | 0.02% |

Spot Taker Fee | 0.075% - 0.25% | 0.03% - 0.23% | From 0.02% | 0.02% |

Mandatory KYC | Yes | Yes | Yes | No |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's opinion and conclusion

Bitazza has listed over 90 cryptocurrencies and 190 trading pairs in the USDT market. The exchange accepts fiat deposits and withdrawals from $30,000 and above. The platform has a 2.9/5 rating on Trustpilot and a 6/10 on CoinGecko.

Its staking service allows users to lock up to 9,999,999 FDM tokens over a 365-day period, while the referral program offers between 15% and 40% lifetime commission.

Moreover, Bitazza’s ability to handle daily trading volumes of $20M–$67M with liquidity spikes above $60M reflects its growing relevance in the regional market.