Bitcoiva provides 280+ digital assets available for trading with some of them offered for staking.

The APY on staking with this exchange goes up to 60% in 360-day periods on 16 coins/tokens [BCA, BTC, ADA, SHIB, SOL, and so on].

With India being home to more than 115 million crypto users (second only to the U.S. and China), Bitcoiva’s focus on INR fiat gateways and accessible entry points (starting from as little as 10 INR deposits) positions it uniquely in one of the fastest-growing markets.

While its global headquarters are registered in Morocco, the platform serves a diverse international base, supported by over 1 million registered traders.

Bitcoiva Exchange Information & Regulation

Bitcoiva is acryptocurrency exchange founded in June 2020 by Aries Wang, located in 62 marina business center, Boulevard de la corniche, Casablanca 20250, Morocco.

Operated by HYPERUX TECHNOLOGIES PRIVATE LIMITED, Bitcoiva has amassed an impressive user base of over 1 million registered users.

Similar to most other crypto exchanges in the industry, the company isnot regulated by any financial authorities.

Bitcoiva CEO

There is no publicly available information about the current CEO of Bitcoiva. This is fairly common among cryptocurrency exchanges, as many platforms prioritize operational transparency for their services over sharing personal details about their leadership.

While this can make it harder for users to research the team behind the platform, it does not necessarily reflect on the exchange’s functionality or security.

Users should always focus on verifiable factors such as trading fees, security measures, and regulatory compliance when evaluating such platforms.

Bitcoiva Features and Specifications

Here's a summary of the key features that Bitcoiva operates based on:

Exchange | Bitcoiva |

Launch Date | 2020 |

Levels | N/A |

Trading Fees | 0.2% - 0.4% |

Restricted Countries | Iran, North Korea, Cuba, United States, etc. |

Supported Coins | 280+ |

Futures Trading | No |

Minimum Deposit | 0.0001 BTC |

Deposit Methods | Bank Transfers, E-Payments, Crypto |

Withdrawal Methods | Bank Transfers, E-Payments, Crypto |

Maximum Leverage | 1x |

Minimum Trade Amount | From Zero |

Security Factors | 2FA, Cold Wallets, Omnitrix, Security Audits, Bug Bounty |

Services | Staking, Instant Swap, BCA Club, Calculator |

Customer Support Ways | Email, Phone Call, Ticket |

Customer Support Hours | 24/7 |

Fiat Deposit | INR |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | BCA |

Noteworthy Benefits and Drawbacks

The significant pros and cons of using Bitcoiva are listed in the table below:

Benefits | Drawbacks |

Wide Range of Cryptocurrencies (280+) | No Futures/Margin Trading |

Strong Security Measures | No Copy Trading Option |

Fair Trading Fees | - |

User Levels Model

There is no indication that Bitcoiva employs user-level tiers or loyalty rewards based on trading volume. All users appear to access the same trading conditions, suggesting a flat-fee environment without VIP incentives.

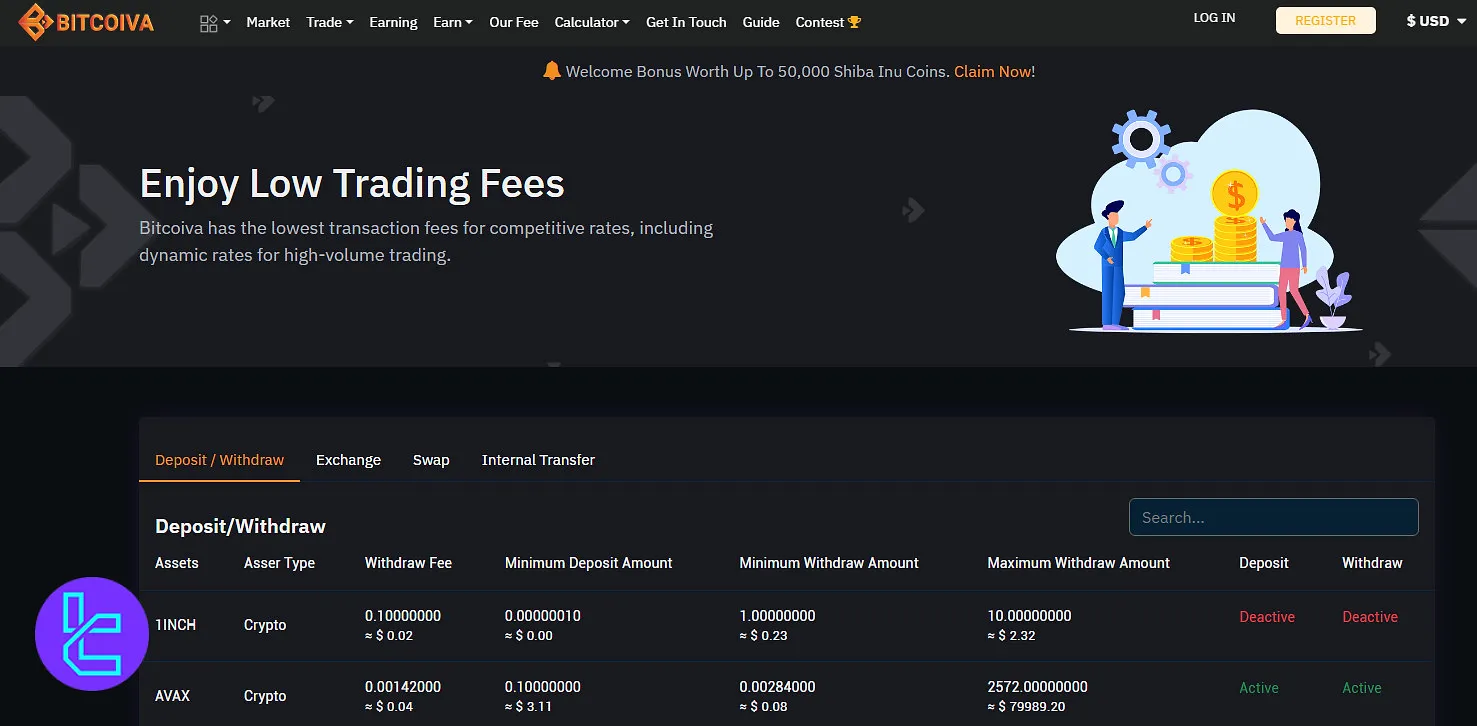

Commissions and Fees

The company does not have a discount system for traders with high volumes or asset balances. Bitcoiva fee structure:

- Trading Fees: 0.2% - 0.4%

- Fiat Transaction Fees: 10 INR

Crypto withdrawal fees vary based on the blockchain network; for example,Bitcoin withdrawals incur a 0.0008 BTC fee.

How Many Digital Assets Are Available for Trading?

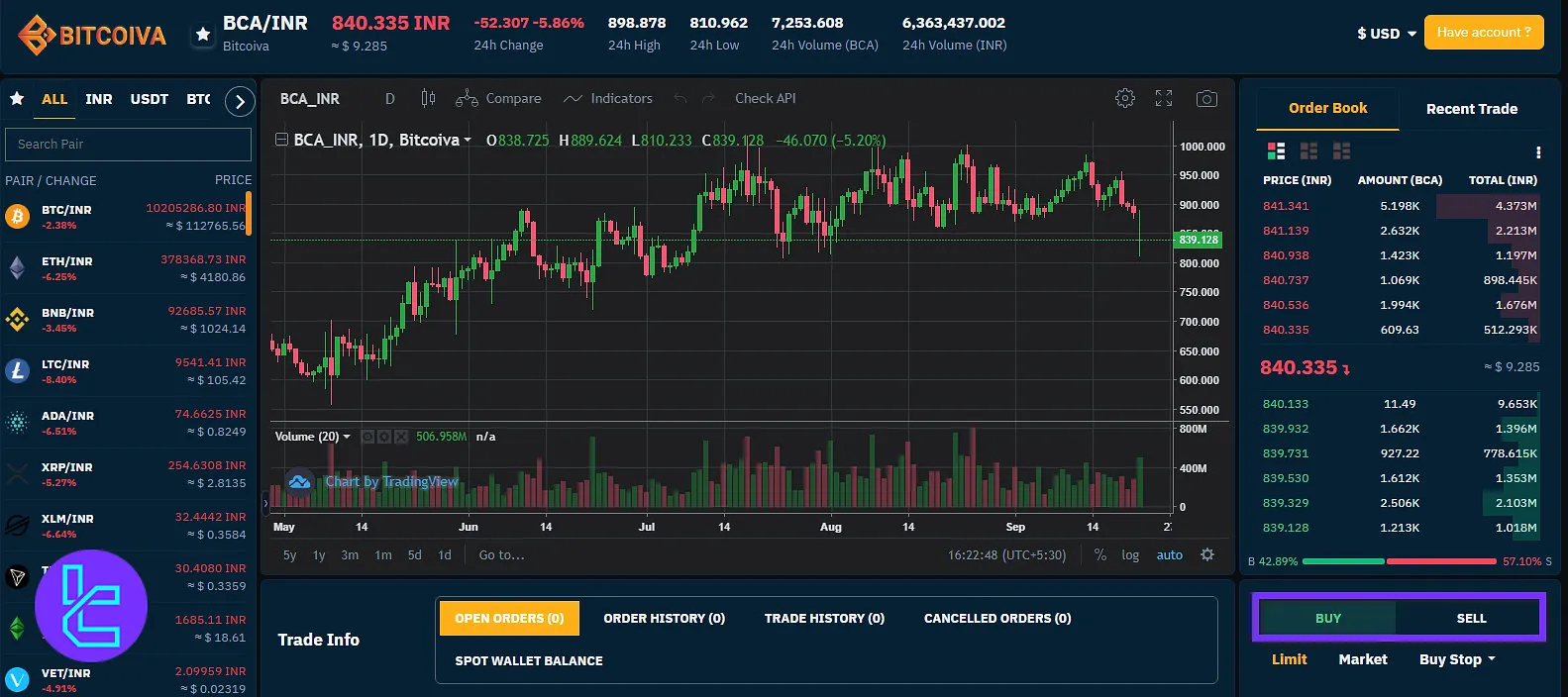

Bitcoiva offers access to a broad range of over 280 cryptocurrencies, including more than two-thirds of the top 30 tokens by market cap.

Major coins such as BTC, ETH, USDT, BNB, and XRP are actively traded, alongside emerging assets like PEPE, HYPE, and USDe.

- Bitcoin [BTC]

- Ethereum [ETH]

- Binance Coin [BNB]

- Cardano [ADA]

- Ripple [XRP]

- Stellar [XLM]

- Dogecoin [DOGE]

- Chiliz [CHZ]

This range enables traders to diversify across leading assets and niche tokens within one unified platform.

Futures/Margin Trading Options

Currently, Bitcoiva does not offer futures or margin trading services. The platform focuses on spot trading, instant swaps, P2P transactions, and OTC trading.

Signing Up And Identity Authorization On Bitcoiva

We will guide you through the Bitcoiva registration and verification processes.

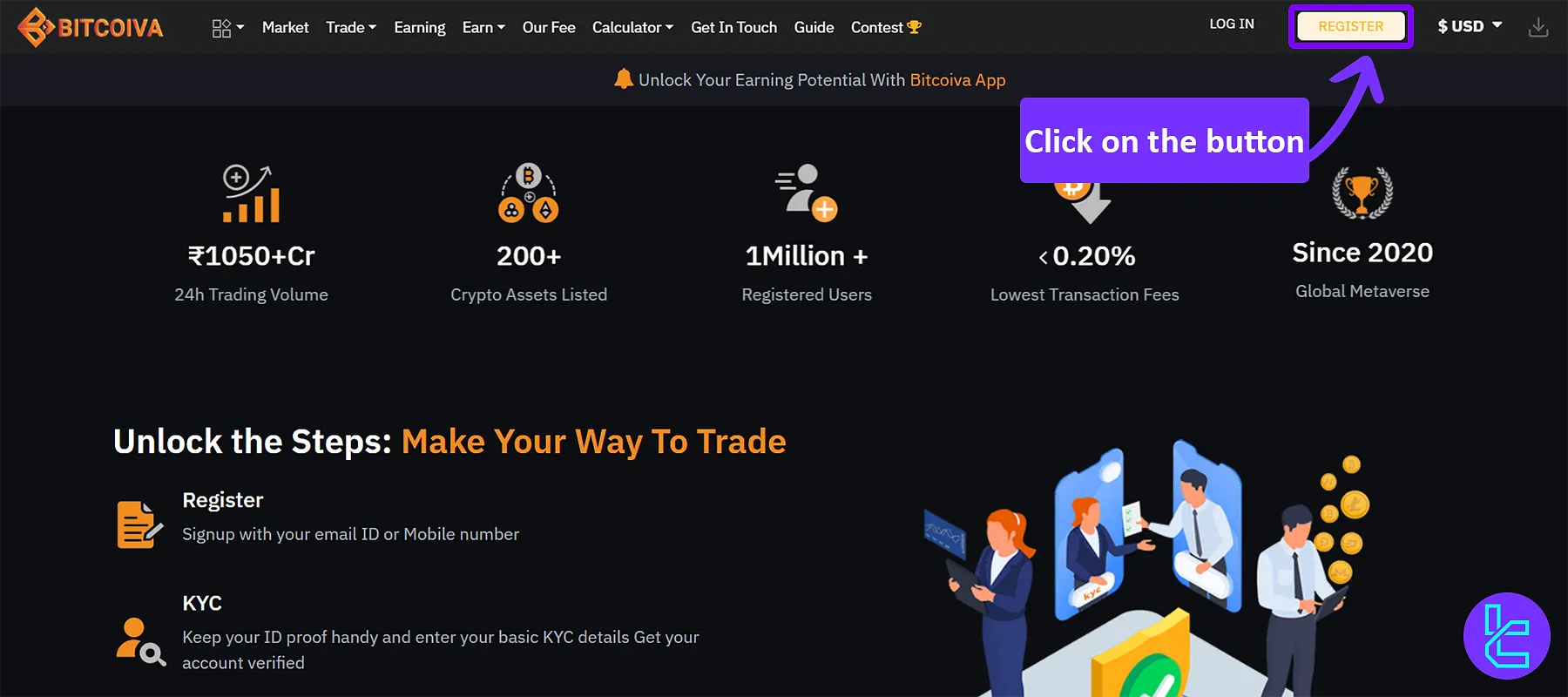

#1 Visit the Bitcoiva Website

Visit the official website and click on the "Register" button to reach the application form.

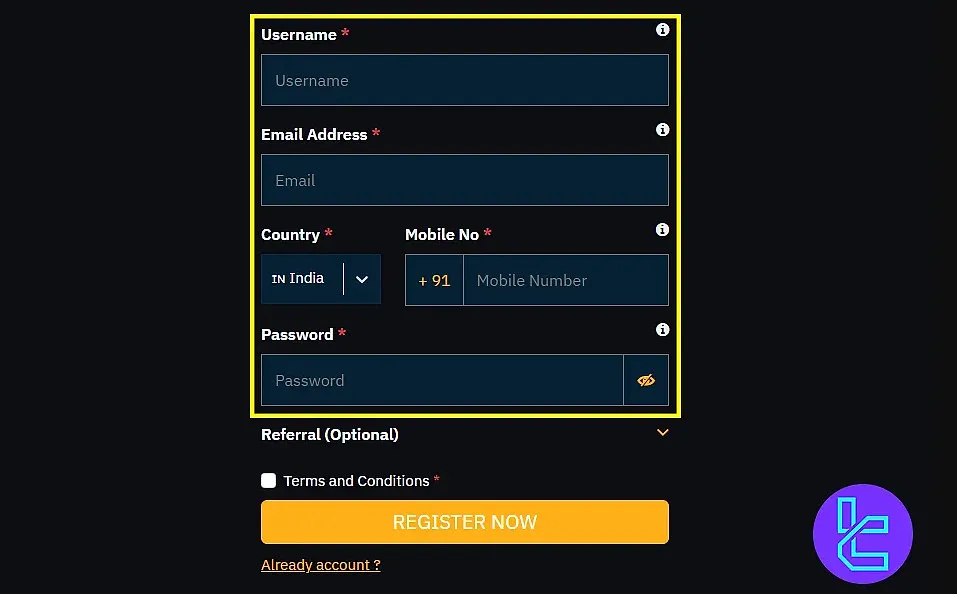

#2 Complete the Registration Form

Fill out the application form with the following information:

- Username

- Password

- Phone number

Click on the activation link sent to your email and activate your account.

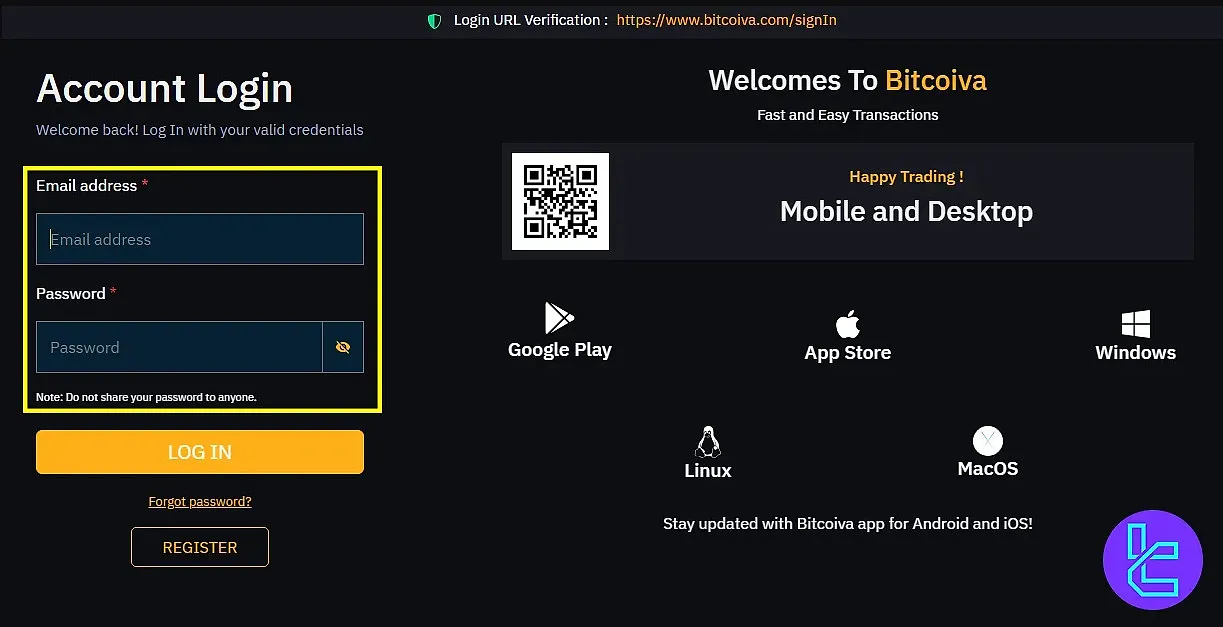

Now, your account is created on the platform, and you can log in with your credentials.

#3 Bitcoiva Verification

Access the exchange client area, complete your profile with additional personal details, and then upload the required documents to pass the KYC, including:

- Aadhar front and back

- PAN Card

- Selfie with any one of your Aadhar or PAN card in your hand

Bitcoiva Trading Guide

In order to trade on Bitcoiva, you need to follow these simple steps after registration and verification processes.

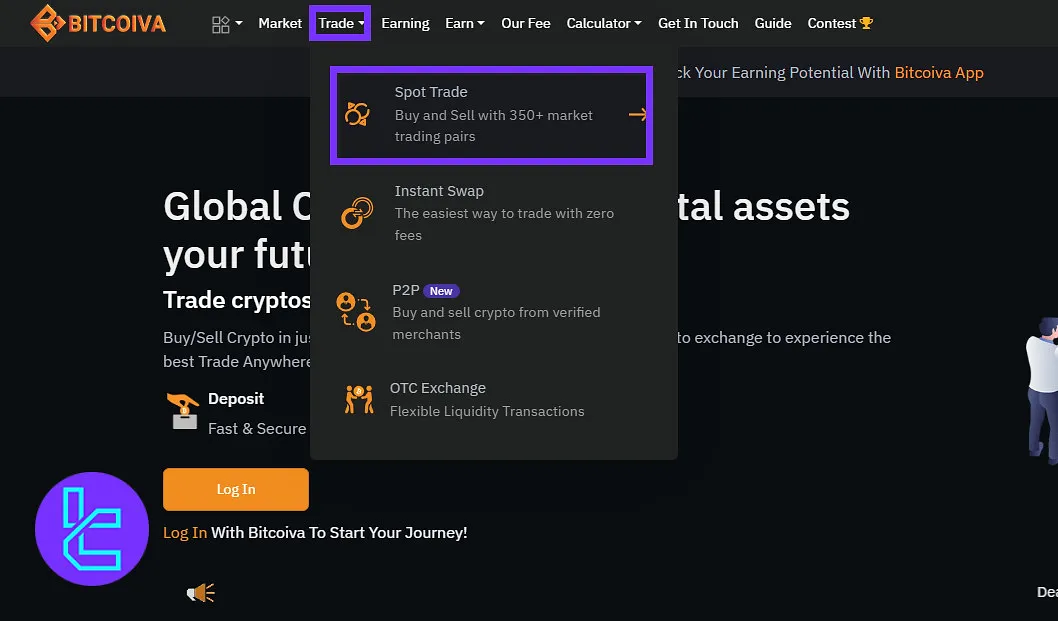

#1 Enter Spot Trading

On the main page of the exchange, from the top of the page, select “Trade” and then select “Spot Trade”.

#2 Pick the Trading Pair

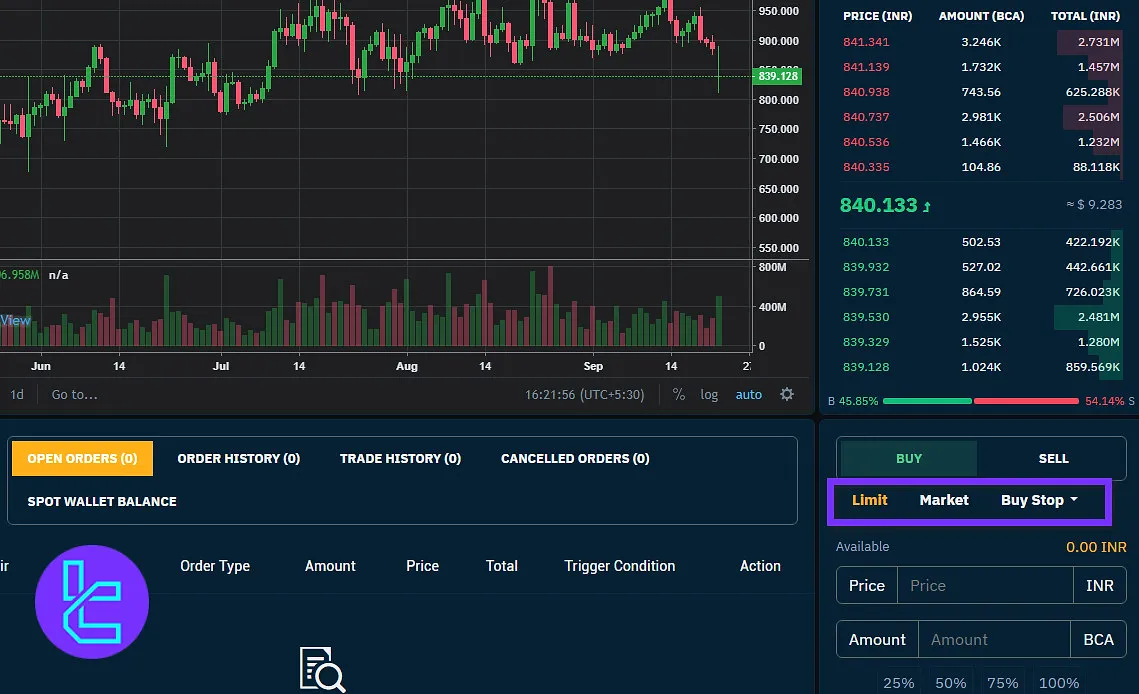

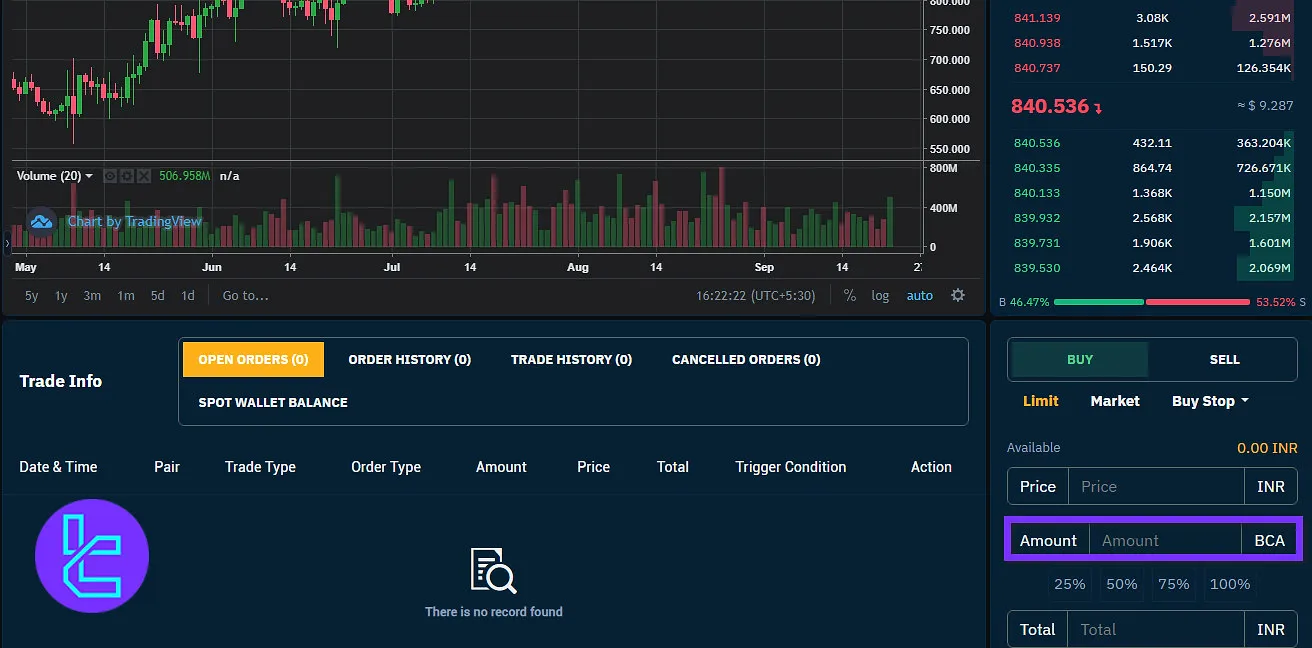

From the left side of the screen, select a trading pair or use the search bar to find a pair.

#3 Select an Order Type

Now it’s time to select an order type. Bitcoiva offers market, limit, and buy stop orders. You can select one from the right side menu.

#4 Enter the Amount

In this step, you should enter the amount of cryptocurrency you are buying or selling. The amount section is under the order type section.

#5 Confirm the Trade

Now, you should double-check the trading details and select “Buy” or “Sell” to confirm the trade.

Trading Platform and Software

Similar to most other crypto exchanges, Bitcoiva offers a proprietary trading platform with everything necessary for trading digital assets, including analytical tools, technical indicators, etc. Access it through these links:

The platform’s mobile interface mirrors the desktop version, providing instant exchange, trading charts, and wallet functionality directly from a smartphone.

Bitcoiva Services

Let’s check out the availability of popular trading services on Bitcoiva:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Security Factors and Measurements

Bitcoiva implements robust security measures, including the use of industry-standard crypto wallets and multilayer infrastructure to protect against hacking attempts.

While no specific protocols (like 2FA or cold storage ratios) are mentioned, the platform emphasizes a commitment to safeguarding user funds and data.

- Two-Factor Authentication (2FA)

- 98% of funds stored in cold wallets

- Robust firewall systems

- Proprietary Omnitrix security protocol

- Regular security audits by internal and external experts

- Hot wallet transactions signed across multiple cloud platforms

- Bug bounty program to identify and fix vulnerabilities

What Payment Options Are Provided?

Bitcoiva supports fiat deposits/withdrawals, accepting INR via several payment methods, such as:

- IMPS

- NEFT

- RTGS

- UPI

- And so on

Although Bitcoiva does not disclose a fixed minimum purchase threshold, the exchange facilitates low-entry investments by supporting micro deposits starting from 10 INR. Furthermore, crypto payments are supported by this platform.

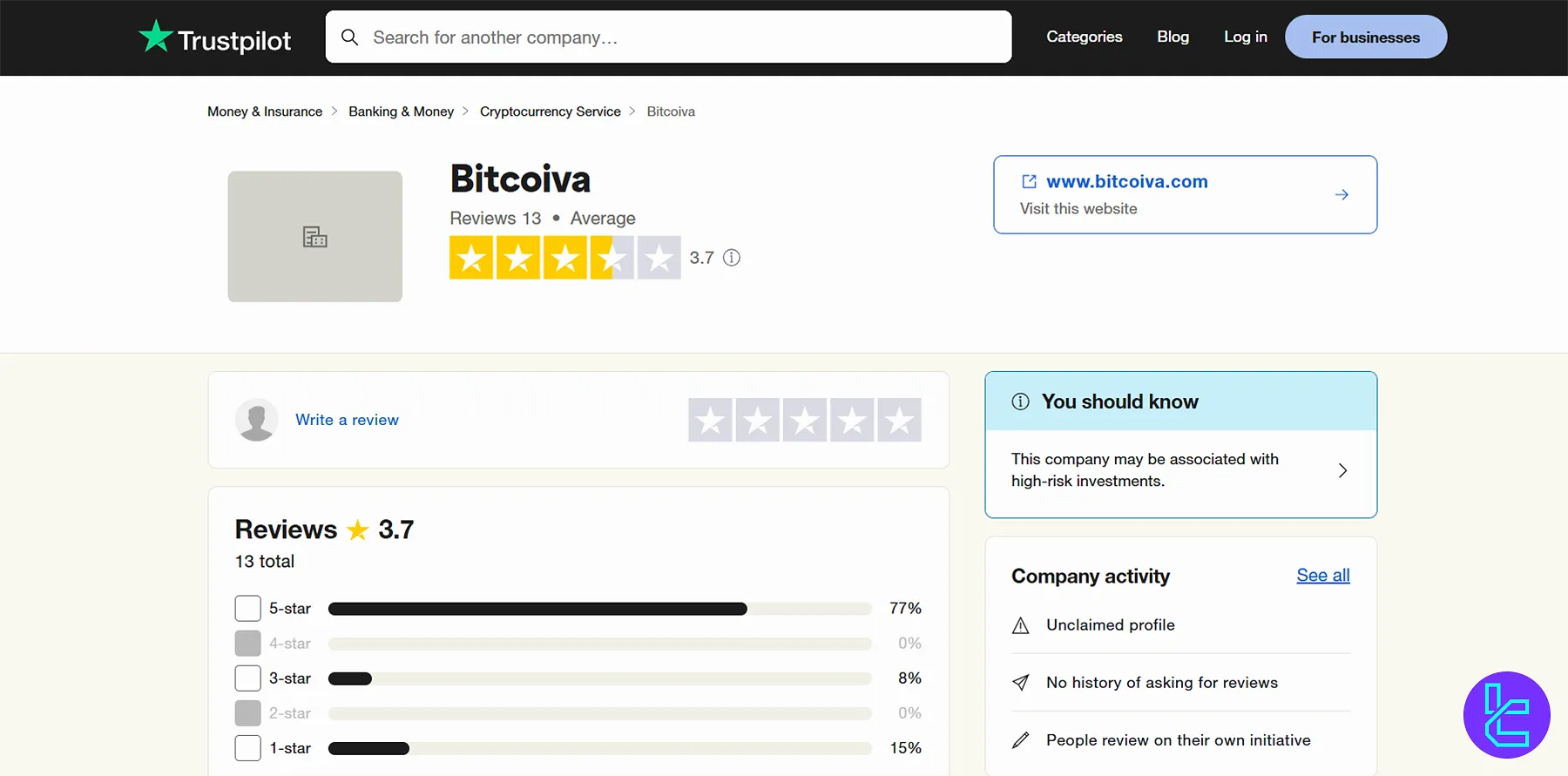

Trust Scores and Evaluations

Bitcoiva Trustpilot score and ScamAdviser show a generally positive level of reviews from users:

- Trustpilot: 3.7/5 stars (based on 10+ reviews)

- ScamAdviser: 100/100 Trustscore, 4.2/5 user rating (out of 15+ reviews)

Although the number of user scores is too low, Trustscore given by the latter indicates a good level of reliability.

Bitcoiva Features

While Bitcoiva doesn't offer copy trading services, it supports crypto staking.

Staking | Yes |

Yield Farming | Yes |

Social Trading | No |

Liquidity Pool | Yes |

Crypto Cards | No |

Bitcoiva Bonus and Promotions

Bitcoiva offers users attractive opportunities to maximize their trading experience through its Referral Program and Trading Competitions:

Promotional Program | Description | Benefits | Rewards/Prizes |

Referral Program | Traders can invite friends to register and trade on Bitcoiva | Inviter earns passive income, and the invitee receives incentives to join. | Trading fee discounts, bonus tokens, and commission-based rewards |

Trading Competitions | Users compete based on trading volume or profit within a set timeframe | Adds a competitive edge to trading and boosts profits for high-volume traders. | Bitcoin, Ethereum, BCA tokens, and prize pools worth thousands of dollars |

Referral Program

Bitcoiva’s referral system allows traders to invite friends and earn rewards whenever those friends register and trade on the platform.

The program is structured to benefit both the inviter and the invitee, often through trading fee discounts, bonus tokens, or commission-based rewards.

This creates a win-win situation: new users get an incentive to join, while existing users generate a passive stream of income from their network’s trading activity.

Trading Competitions

In addition to referrals, Bitcoiva frequently hosts trading competitions, where users compete based on their trading volume or profit during a set period.

Prizes can include popular cryptocurrencies like Bitcoin, Ethereum, or Bitcoiva’s native token (BCA), with rewards sometimes reaching thousands of dollars in total prize pools.

These competitions are usually announced in advance on Bitcoiva’s website, app, or Telegram channel, and they add a competitive edge to regular trading.

For high-volume traders, this can be a way to significantly increase profits beyond normal market gains.

Support Contacts And Schedule

Bitcoiva offers 3 common channels for customer support:

- Email: support@bitcoiva.com

- Ticket: In "Get In Touch" section

- Phone: 1800 2023 677

Unlike most similar companies, Bitcoiva does not provide access to any live chat option. As stated on the exchange's home page, the support agents are available 24/7.

Copy Trading And Other Earning Options on Bitcoiva

While the company doesn't offer crypto copy trading software, it provides access to a crypto staking service, which allows traders to earn passive income by staking their crypto assets. Key Features:

- APY up to 60%

- A fixed 360 days period for locking assets

- Varying minimum deposit for different tokens/coins

Bitcoiva Restricted Countries And Regions

Almost all crypto exchanges in the industry restrict some countries from accessing their services, and this is because of sanctions, local regulations, etc.

Bitcoiva does not provide an explicit list, but these are likely the banned regions:

- Iran

- North Korea

- Afghanistan

- Iraq

- Syria

- Cuba

- China

- United States

- And so on

Bitcoiva vs Other Exchanges

To have a balanced view on Bitcoiva exchange, let's compare its services with three popular platforms:

Features | Bitcoiva Exchange | Binance Exchange | Bybit Exchange | |

Number of Assets | 280+ | 400+ | 1300+ | 2,800+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:200 |

Minimum Deposit | 10 INR | $1 | Varies by Cryptocurrency | $1 |

Spot Maker Fee | 0.2% - 0.4% | 0.02% - 0.1% | 0.005% - 0.1% | 0.05% |

Spot Taker Fee | 0.2% - 0.4% | 0.04% - 0.1% | 0.015% - 0.1% | 0.05% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion And Conclusion

Bitcoiva has carved out its place in the market by offering a wide selection of 280+ assets, competitive spot trading, and staking services with industry-leading yields.

While it does not support margin or futures trading, and its trading fees (0.2%–0.4%) are higher than top-tier exchanges, it compensates by providing free instant swaps, strong INR integration, and robust 24/7 support.

Globally, crypto adoption continues to rise, with reports estimating 700 million users expected by 2028 and daily spot trading volume surpassing $90 billion across exchanges.

In this landscape, Bitcoiva’s 100/100 ScamAdviser Trustscore, combined with 98% cold crypto wallet storage and multiple security audits, gives it credibility as a safer option among mid-tier exchanges.