BitMEX is a crypto exchange founded by Arthur Hayes, Samuel Reed, and Ben Delo, with +110 coins/tokens for futures, margin, and spot trading.

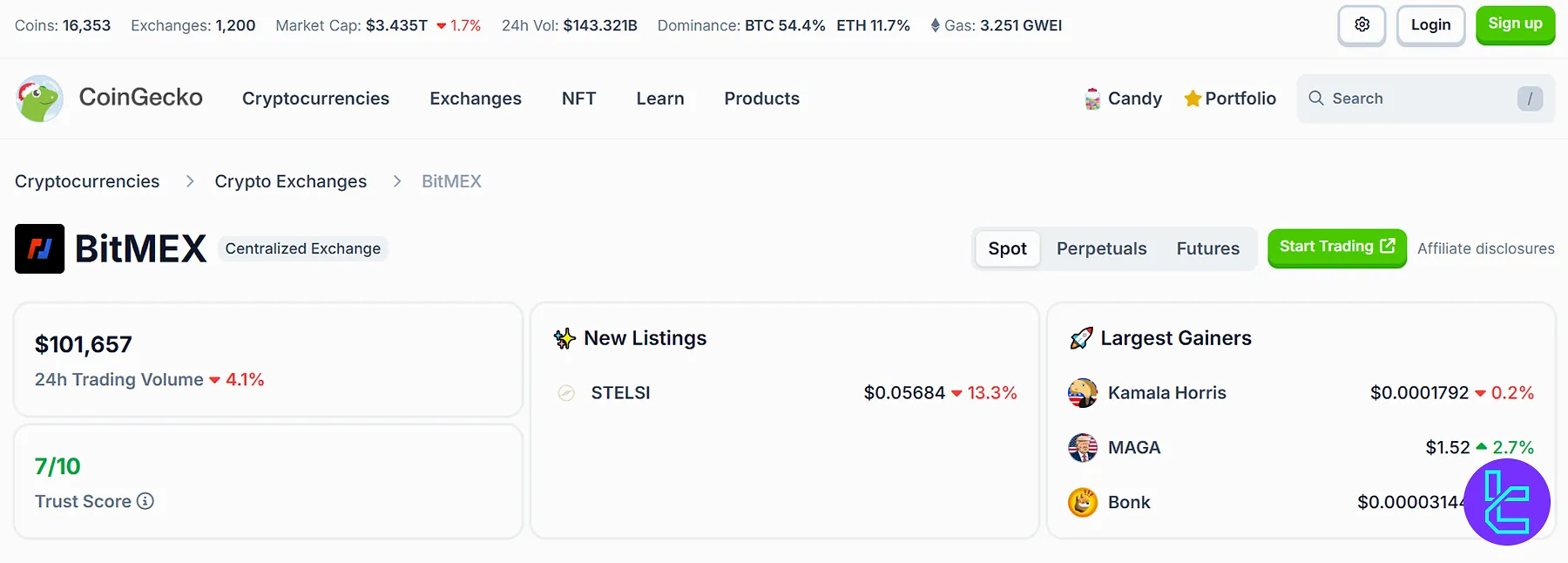

The platform, with its domain registered in 2003, has received a 7/10 trust score on the CoinGecko website.

BitMEX Information + Regulation

BitMEX was established in 2014 in Hong Kong by Arthur Hayes, Samuel Reed, and Ben Delo.

The crypto exchange is owned by HDR Global Trading Limited and is registered in the Seychelles.

At the time of writing this article, the exchange's 24-hour trading volume is less than $200,000.

CEO of BitMEX

Stephan Lutz is the CEO and CFO of BitMEX. He joined the company in 2021 as CFO and was later appointed as CEO in late 2022, during one of crypto’s most turbulent periods.

Under his leadership, BitMEX has reinforced its position as a leading force in the crypto derivatives market.

You can connect with him Through Stephan Lutz's LinkedIn page

Summary of Specifications and Details

Here's a concise overview of BitMEX's features and specifics in its services and aspects:

Exchange | BitMEX |

Launch Date | 2014 |

Levels | None |

Trading Fees | 0.045% to 0.1% for Spot 0.032% to 0.05% for Derivatives |

Restricted Countries | United States, Cuba, Iran, Syria, North Korea, Crimea and Sevastopol, Seychelles, Bermuda, Hong Kong SAR, Canada, Myanmar, Russia |

Supported Coins | 110+ |

Futures Trading | Yes |

Minimum Deposit | Varies Based on the Asset, 10 USDT for Tether |

Deposit Methods | BTC |

Withdrawal Methods | BTC |

Maximum Leverage | 100x |

Minimum Trade Amount | Varies Based on the Asset |

Security Factors | Intrusion Proof, Bitcoin Custody, Custody for Other Assets, Transaction Protection, Segregation of Funds, Insurance Fund |

Services | Futures Trading, Bots |

Customer Support Ways | Email, Ticket, Live Chat |

Customer Support Hours | 24/7 |

Fiat Deposit | No |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | BMEX |

Notable Advantages and Disadvantages

BitMEX, similar to many other exchanges, offers several advantages for cryptocurrency traders, but it's important to consider both the pros and cons before using the platform:

Advantages | Disadvantages |

High Leverage Trading (Up to 100x) | No Trading Without Verification |

Perpetual Contracts | No Fiat Currency Support |

Long Time of Presence in the Industry | - |

User Levels

Verification levels are found in some platforms for determining the limitations of an account based on its authorization status.

Based on the data from the official website and our chats with the support team, BitMEX doesn't employ any leveling system for verified users.

It maintains a flat account structure, offering the same trading features and fee model to all users, regardless of their trading volume. Unlike exchanges that implement VIP tiers or token-based discounts, BitMEX does not operate such a system.

However,institutional clients may request custom setups, including enhanced API limits and operational support.

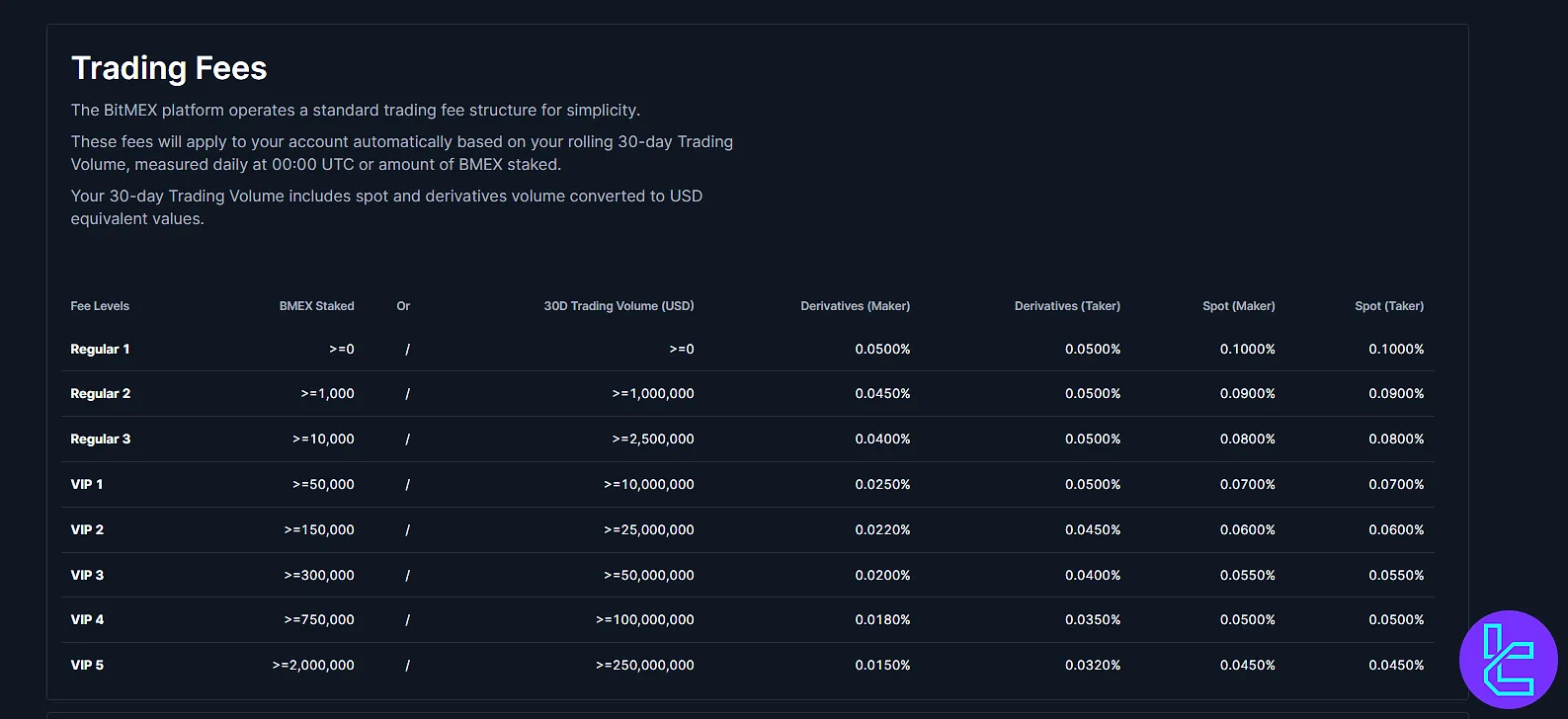

Commissions And Costs

BitMEX operates with a low-cost fee structure tailored for spot and derivative traders. It charges a taker fee of 0.075%, while market makers often benefit from rebates or extremely low maker fees.

Deposits in Bitcoin (BTC) and Tether (USDT) are free, and withdrawal costs vary depending on the blockchain network congestion.

Here's a breakdown of BitMEX's commissions and costs inspot trading:

Fee Level | BMEX Staked | or | 30D Trading Volume (USD) | Spot (Maker/Taker) |

Regular | 0+ | / | 0+ | 0.1% |

VIP 1 | 10M+ | 10M+ | 0.07% | |

VIP 2 | 25M+ | 25M+ | 0.06% | |

VIP 3 | 50M+ | 50M+ | 0.055% | |

VIP 4 | 100M+ | 100M+ | 0.05% | |

VIP 5 | 250M+ | 250M+ | 0.045% |

You can see the fees for derivativesin the table below:

Fee Level | BMEX Staked | or | 30D Trading Volume (USD) | Derivatives (Maker) | Derivatives (Taker) |

Regular | 0+ | / | 0+ | 0.05% | 0.05% |

VIP 1 | 10M+ | 10M+ | 0.025% | 0.05% | |

VIP 2 | 25M+ | 25M+ | 0.022% | 0.045% | |

VIP 3 | 50M+ | 50M+ | 0.02% | 0.04% | |

VIP 4 | 100M+ | 100M+ | 0.018% | 0.035% | |

VIP 5 | 250M+ | 250M+ | 0.015% | 0.032% |

As stated by the platform, there are no costs on deposits and withdrawals.

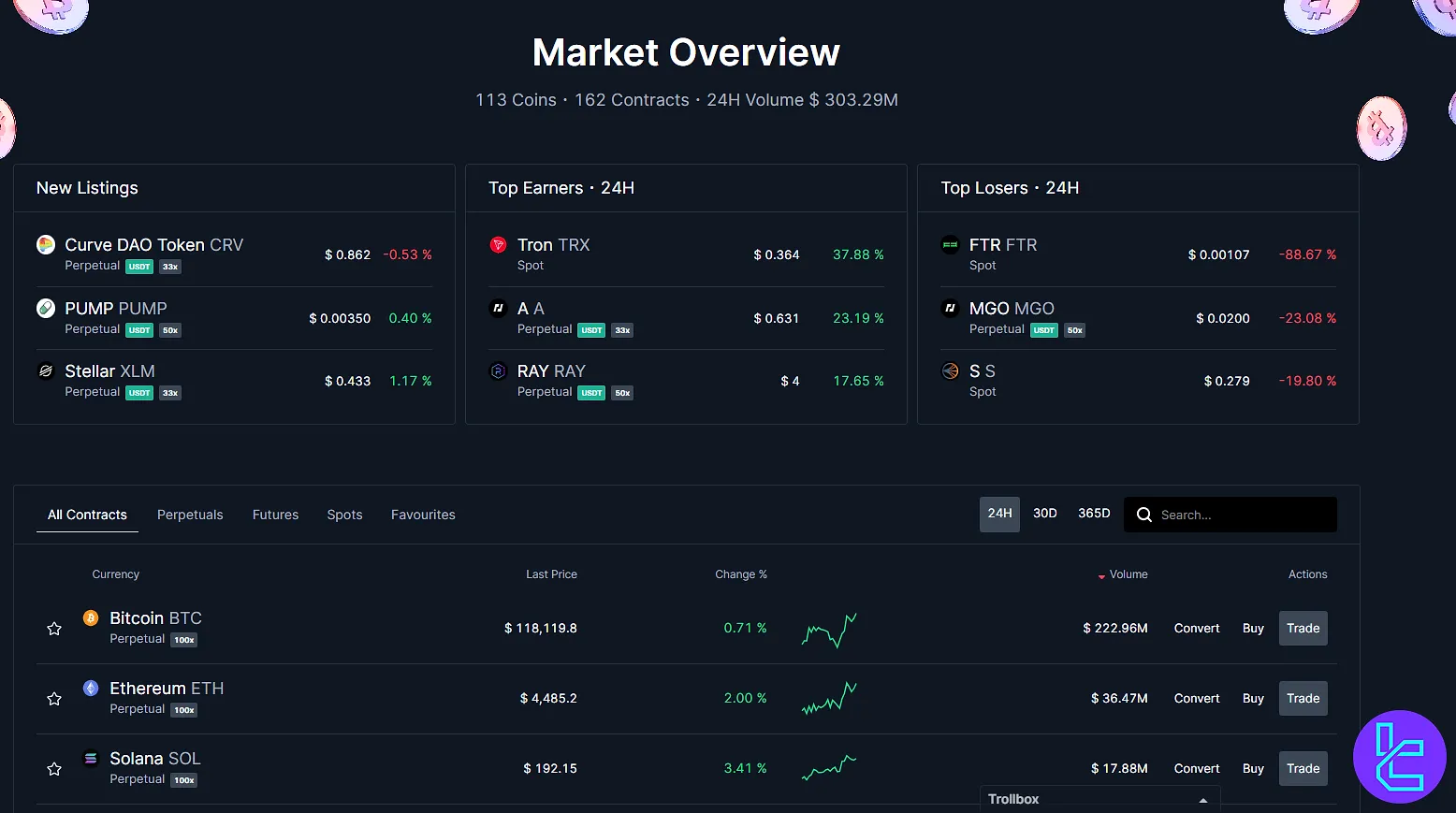

How Many Tradable Coins and Tokens Are Available?

BitMEX is one of those exchanges with an average list of asset offerings, providing access to 110+ cryptocurrencies at the time of writing this review, based on our conversation with the support team.

The exchange supports a focused selection of cryptocurrencies, primarily catering to traders of derivatives. Users can trade popular assets, including Bitcoin (XBT), Ethereum (ETH), Litecoin (LTC), and XRP.

In addition to these, the platform provides access to perpetual swaps and futures on a broader set of tokens, expanding exposure without requiring the user to hold the underlying asset. Here are some of the available cryptocurrencies:

- Bitcoin [BTC]

- BitMEX Native Token [BMEX]

- Avalanche [AVAX]

- Pepe [PEPE]

- Cardano [ADA]

- Litecoin [LTC]

- Axie Infinity [AXS]

Note that the list of available assets on the spot market is much shorter compared to the derivatives.

Futures and Margin Trading

BitMEX Exchange offers two types of margin trading [isolated and cross-margin], with a leverage of up to 100x on some assets, including Bitcoin.

The leverage makes it possible for traders to amplify their potential profit at the cost of a higher risk.

Signing Up and Authorization

BitMEX has implemented a stringent verification process to ensure compliance with regulatory requirements. Here's an overview of the steps to Bitmex registration:

However, the registration process is still simple and quick. Here's your guide:

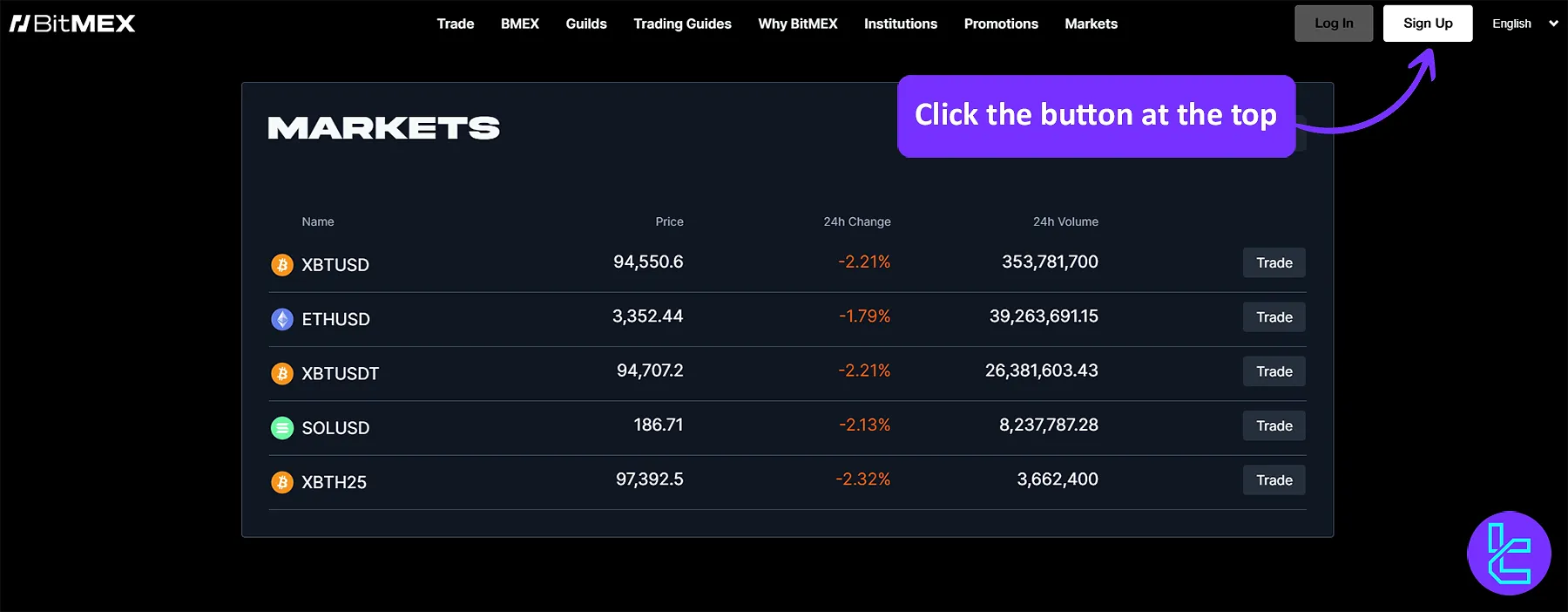

#1 Visit the Exchange's Website

Head to the BitMEX official website and click "Sign Up" to reach the sign up form.

Click the "Sign Up" button and enter the registration form on BitMEX

Click the "Sign Up" button and enter the registration form on BitMEX

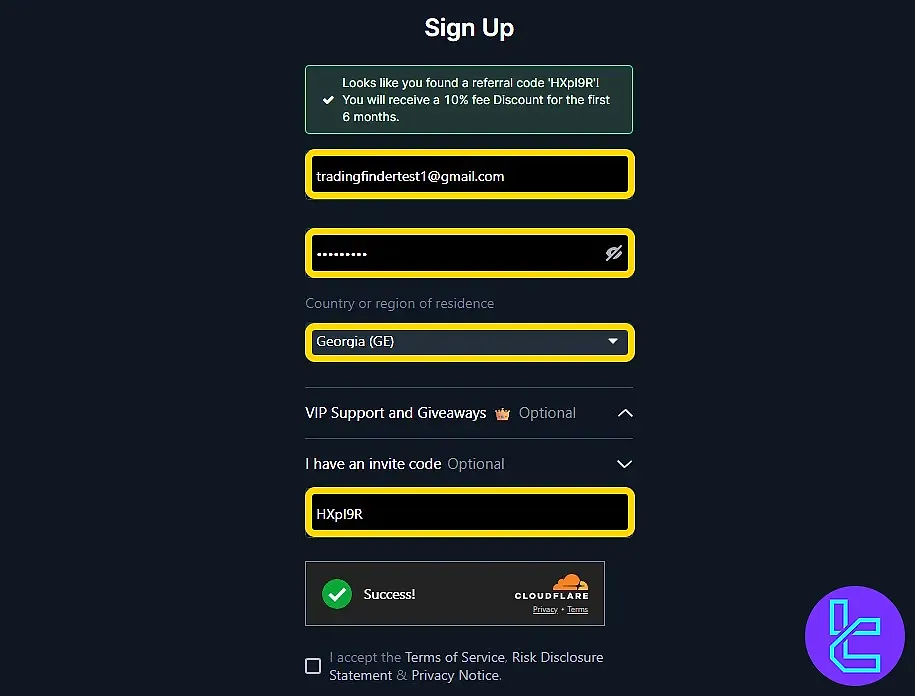

#2 Complete the Registration Form

Enter the following information on the application form:

- Email address

- Password

- Country of residence

Check the captchaand confirm the statement below the form.

#3 BitMEX Verification

Now, your account on the exchange is ready. For BitMEX verification, follow these steps:

- Choose your account type in the next page, then click "Get Started";

- Provide personal details, including your full name, date of birth, nationality, and birthplace;

- Upload proof of identity;

- Answer the questionnaire.

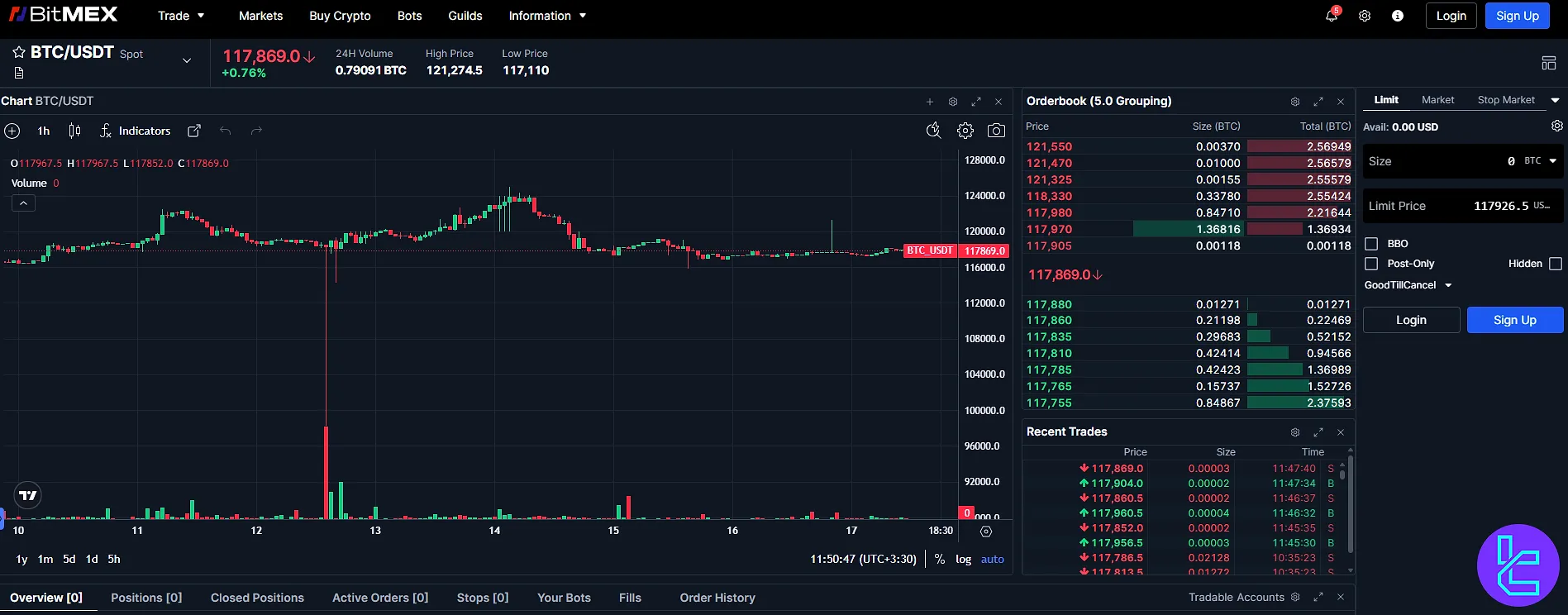

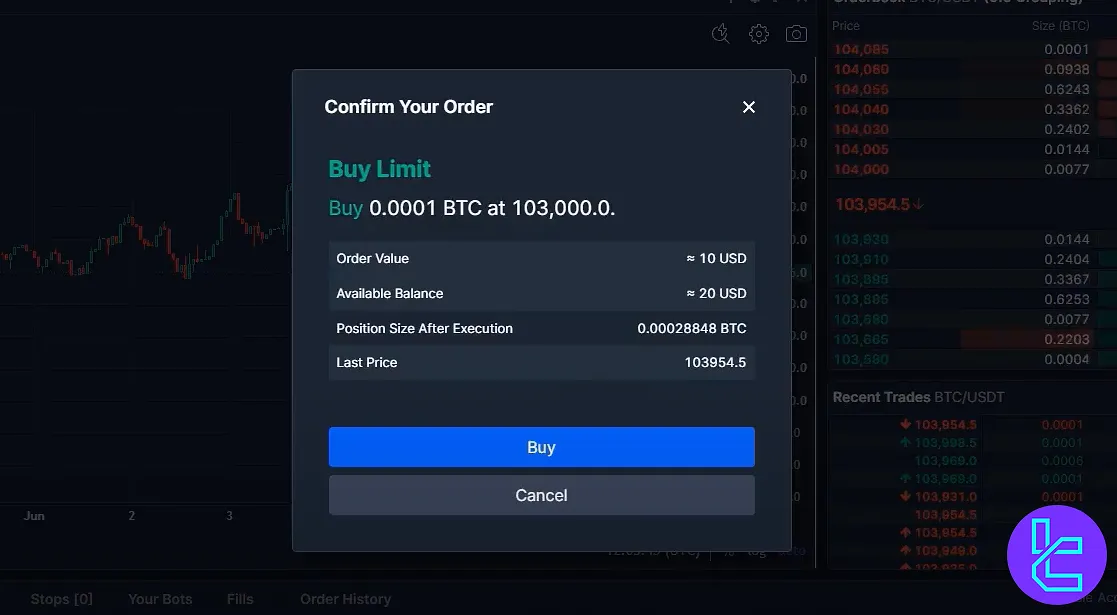

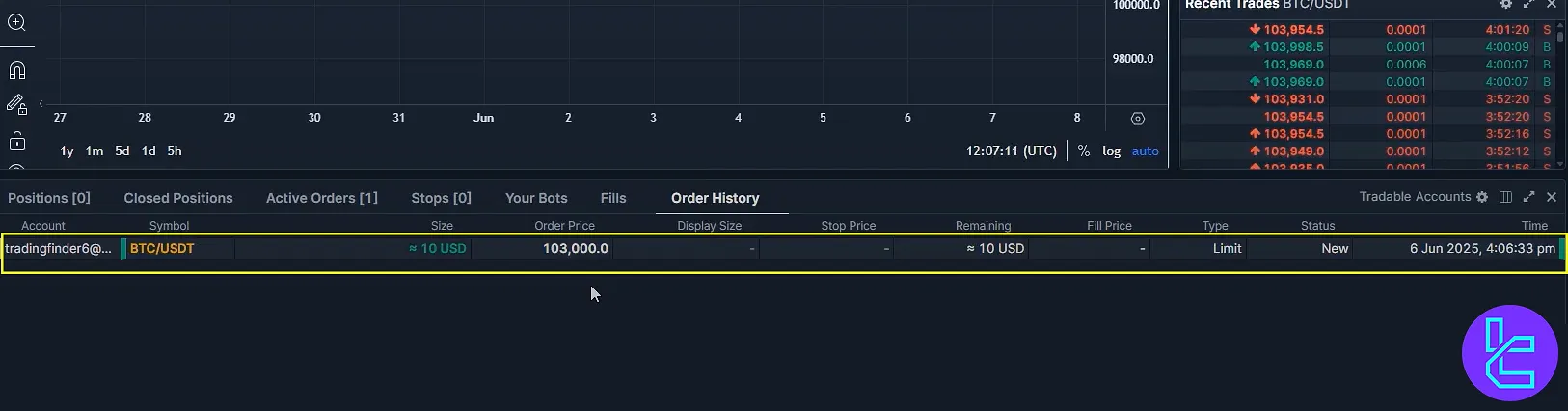

How to Trade

Before opening a trade on BitMEX Spot, you must ensure sufficient funds are available. Pairs are quoted in USDT or BTC; coins marked with the green USDT tag can be traded against Tether, while BTC-denominated pairs require Bitcoin in your wallet.

For example, a Bitcoin/USDT position can be initiated if you hold USDT.

Orders are placed through the panel on the right, where notional values can be displayed in either Tether or Bitcoin. Many traders prefer calculating in USDT for simplicity.

A position size, such as $500, can be entered and executed as a Market Order, Limit Order, or Stop Market Order. Market execution fills at the best available bid–ask price, whereas Limit Orders provide greater control over entry.

Selecting post-only ensures maker status, often reducing or even reversing trading fees through BitMEX’s rebate structure.

Choosing whether to go long or short determines profit direction: long positions gain from price increases, while shorts benefit from declines.

Technical indicators like the Bollinger Band can guide short-term bias, and trades can be placed directly from the chart by dragging orders.

Once confirmed, details such as entry price, market price, margin used, wallet balance, and unrealized P&L are displayed in the position table.

Active positions can be managed quickly with either market or limit closes. Margin requirements are minimal—for instance, a $500 Bitcoin trade may require less than $3 collateral.

Display currency can also be switched from BTC to USD for easier tracking of position value.

Because trades are leveraged derivatives, protecting capital is critical.

BitMEX offers multiple risk tools: a Stop-Loss can be set via chart trading or order controls, with the trigger commonly tied to the Index Price, which aggregates data from several exchanges for stability.

Traders often complement this with a Stop-Limit Order for precision and a predefined Take-Profit to secure gains.

BitMEX Trading Platform

This company takes a typical approach toward the trading facility for its users, but offers advanced features that are suitable for professional traders on its platform. The terminal is available via these systems:

The application hasn’t received any reviews on the Apple App Store, and has seen under 600 ratings on the Google Play Store, averaging 4.7 out of 5.

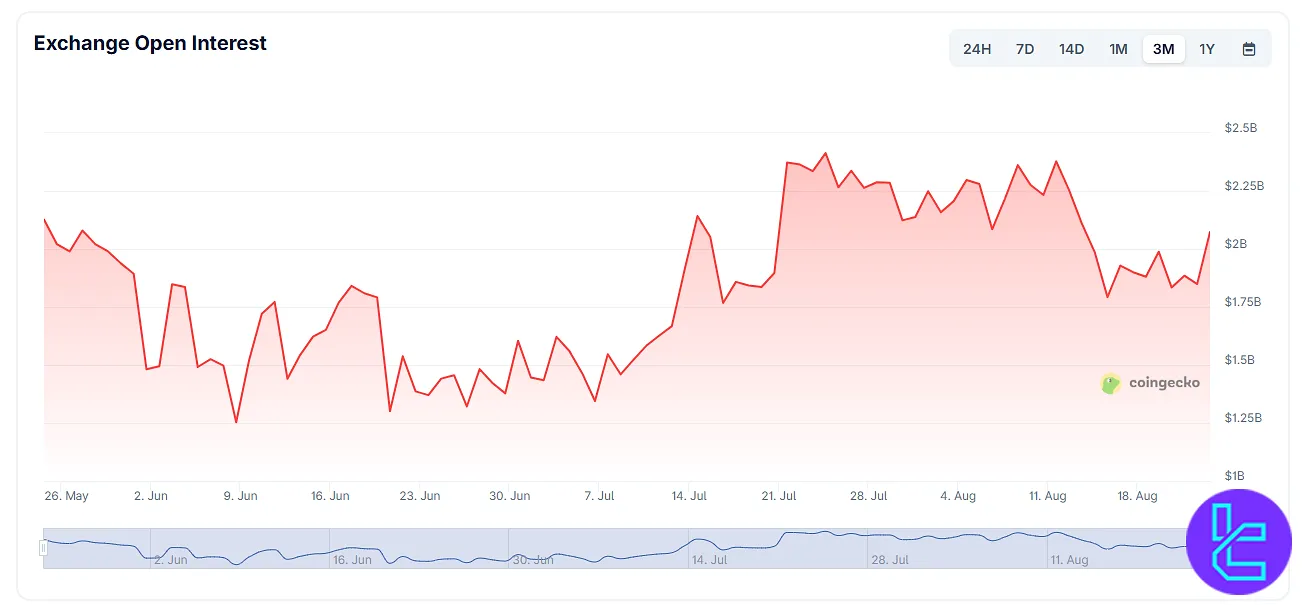

BitMEX Trade Volume

The chart shows that open interest across exchanges fluctuated between $1.5B and $2.5B over the past three months. After a decline in early June, the trend shifted upward from mid-July, with values peaking above $2.2B. However, since mid-August, a pullback has been observed, with current levels hovering close to $2B.

Services

BitMEX combines features found in both professional trading platforms and retail exchanges.

Beyond its core focus on P2P trading, the platform provides API access for developers, supports execution through TradingView integration , and offers a Testnet demo environment for simulated trades.

Some services—such as OTC trading and an affiliate referral program are available, while others like a Launchpad , NFT marketplace or DEX trading are not part of the exchange’s offering.

The table below outlines the full service availability in detail.

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No native bots; automation possible via API / TradingView alerts & Pine Script (third-party). |

API Access | Yes (REST & WebSocket APIs) |

P2P Trading | Yes |

OTC Trading | Yes — via BitMEX Link (OTC brokerage) |

Demo Account | Yes — BitMEX Testnet (simulated trading) |

Launchpad | Not available |

NFT Marketplace | Not available |

Referral Program | Yes — Affiliate/Partner programmes |

DEX Trading | Not available |

Auto-Invest (Recurring Buy) | No official feature published |

Safety Measurements

BitMEX has maintained a robust security track record, relying oncold wallet storage, multi-signature transaction protocols, and manual withdrawal review processes. These systems have helped the platform avoid major breaches.

However, its compliance history includes regulatory settlements, highlighting the need for transparency and continual governance improvements.

Track Record:

- No customer funds lost since inception in2014

- Strong focus on security and reliability

Intrusion Proof Measures:

- Positions and margins checked multiple times per minute

- Balances cross-checked against on-chain records every 10 minutes

- Bug bounty program to identify and address security issues

Bitcoin Custody:

- Multi-signature wallets used

- Set of private keys required for any transfers

- Private keys never stored on cloud servers

Custody for Other Assets:

- Non-Bitcoin assets secured using secure multi-party computation (MPC)

- No single private key held in one place

Transaction Protection:

- Multiple layers of security

- Segregation of duties

- Multiple signatures and interactions with hardware security modules required

Segregation of Funds:

- Client funds segregated from company assets

- Ring-fenced and not lent, staked, or traded

Insurance Fund:

- One of the highest insurance funds in the industry

- Protects traders from deleveraging events

- Ensures exchange solvency

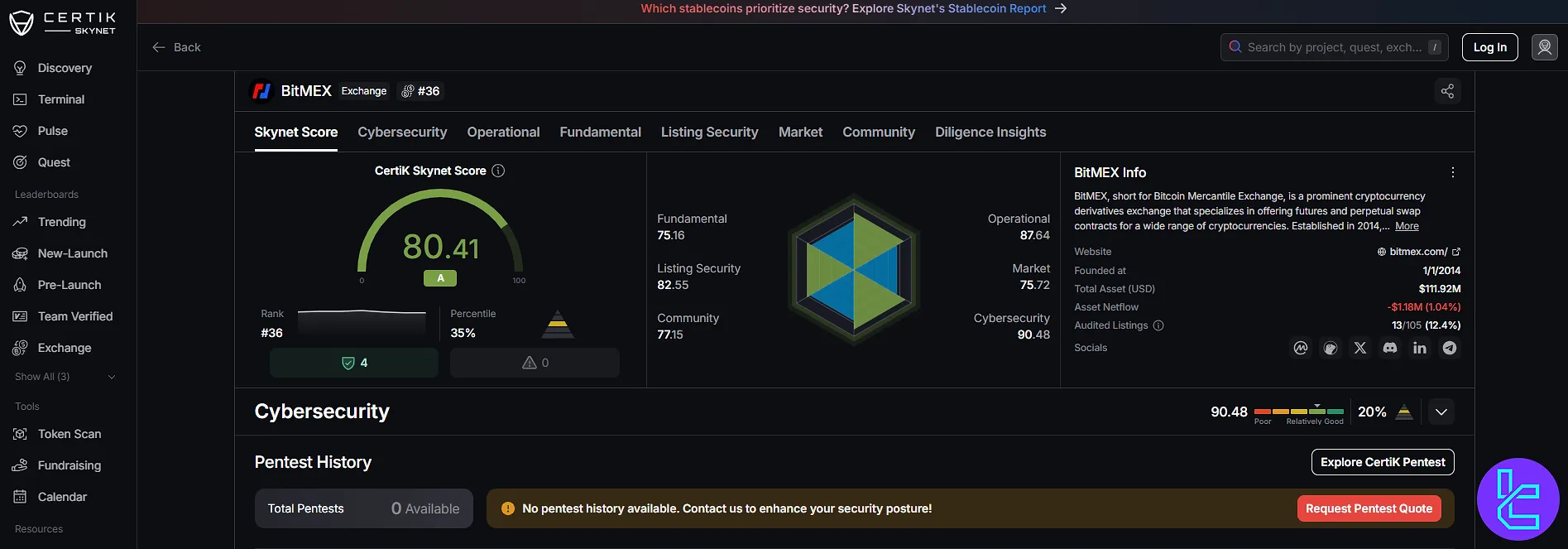

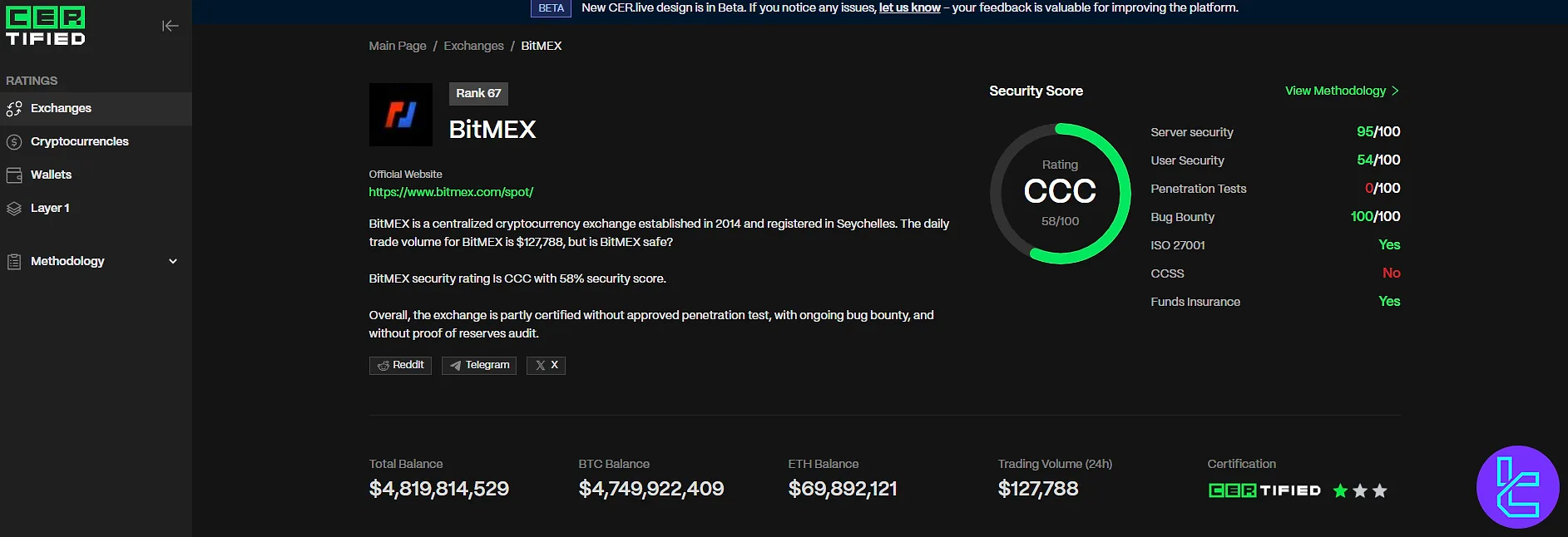

Security Rankings

The security profile of BitMEX shows mixed results across different evaluations. CertiK Skynet assigns an overall score of 80.41 (A) with stronger performance in cybersecurity (90.48) and operational metrics (87.64), while fundamentals and community scores are lower.

On the other hand, CER.live rates the exchange at 58% (CCC). It highlights solid server security (95/100) and a fully active bug bounty program (100/100), but records weaker user security (54/100) and no completed penetration tests.

The table below provides a consolidated view of both assessments:

Category | Metric | Value |

Certik Skynet Score | Overall Score | 80.41 (A) |

Operational | 87.64 | |

Market | 75.72 | |

Cybersecurity | 90.48 | |

Fundamental | 75.16 | |

Listing Security | 82.55 | |

Community | 77.15 | |

CER.live Security Score | Overall Score | 58% (CCC) |

Server Security | 95/100 | |

User Security | 54/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

Funding Options and Methods

BitMEX primarily operates as a crypto-to-crypto exchange, with Bitcoin (BTC) serving as the main currency for deposits and withdrawals.

Therefore, there's no option for making anyfiat deposits on the platform. Thus, we can say that BitMEX deposit & withdrawal options are very limited.

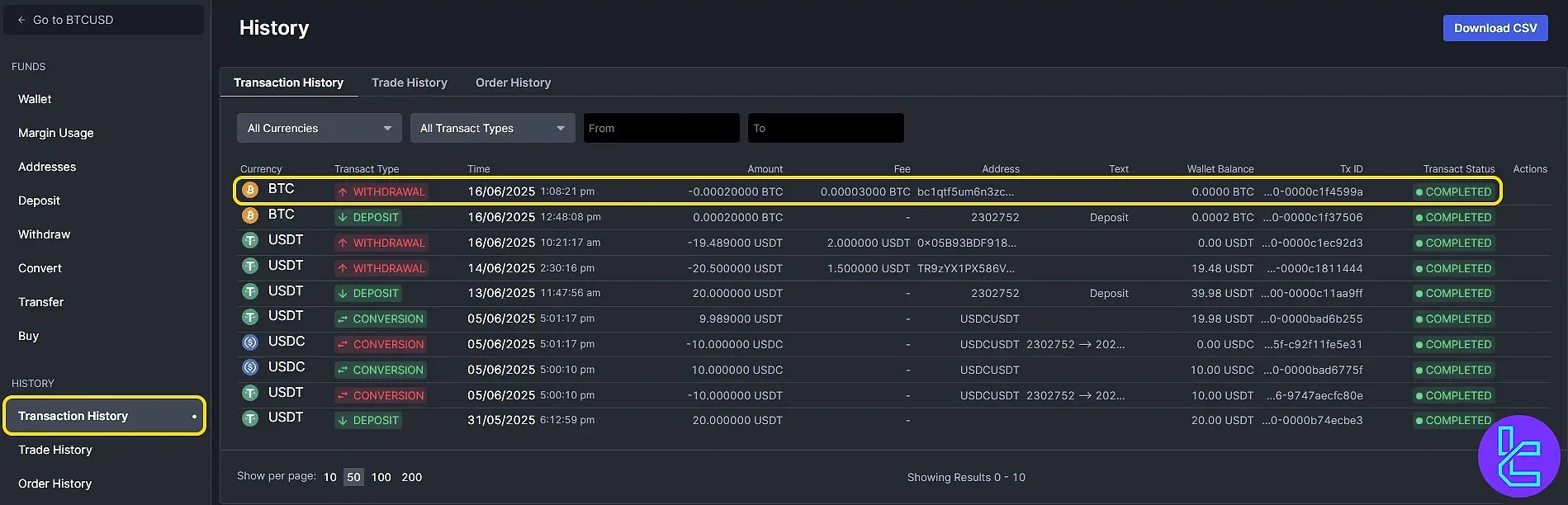

BitMEX BTC Withdrawal

Withdrawing Bitcoin from BitMEX is designed to be fast and secure, usually completed in around 10 minutes. Every transaction carries a fixed network fee of 0.00003 BTC, and users must complete the platform’s verification process before requesting payouts.

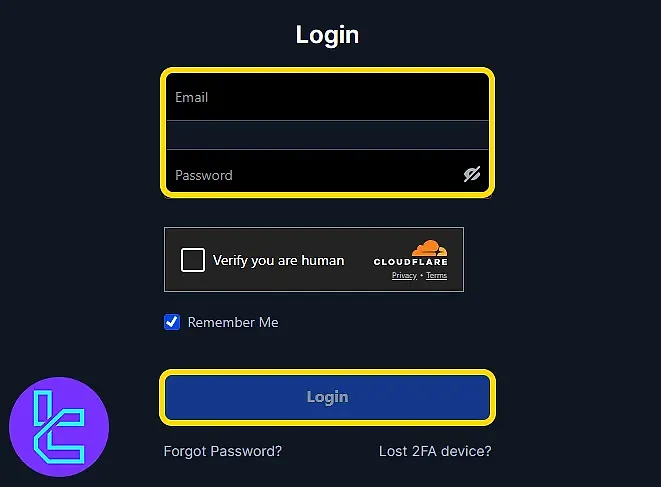

The withdrawal flow follows five key steps. First, log into your BitMEX account and activate two-factor authentication (2FA) using Google Authenticator through the Security Center. Next, open the Wallet section and select Withdrawal.

From there, choose Bitcoin (BTC) , enter the correct wallet address, and confirm the fee before submitting your request.

Once submitted, a verification email will be sent. Users must approve the request by clicking the Confirm Withdrawal link. Finally, the transaction can be monitored under Transaction History, where it appears as completed once confirmed on the Bitcoin blockchain.

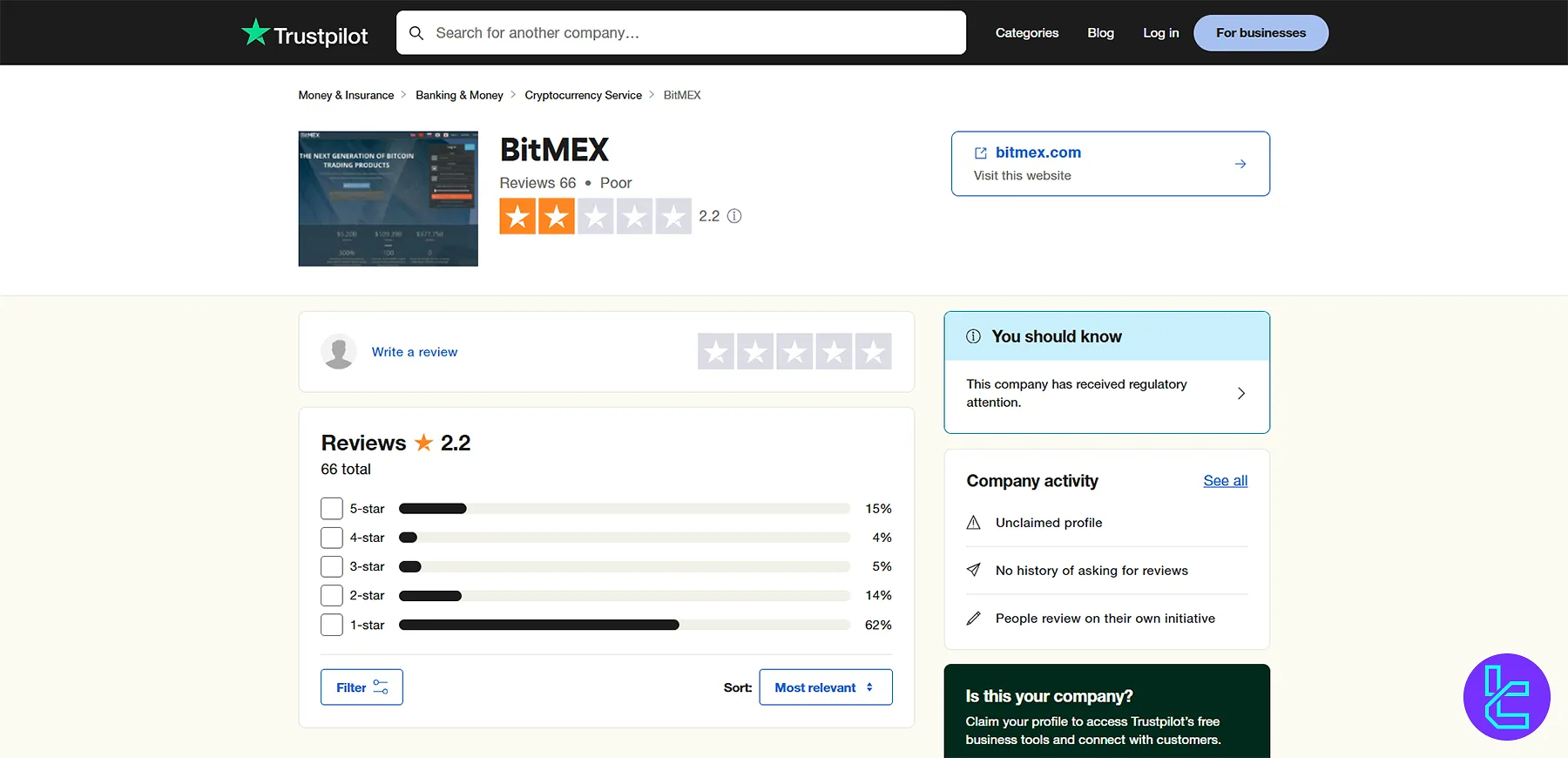

BitMEX Trust Scores

Evaluations from various review platforms such as Trustpilotand CoinGecko present a mixed picture of user satisfaction and platform reliability. Let's look at the details:

- Trustpilot: 2.2/5, with +60 reviews (+60% 1-star ratings);

- Reviews.io: 1.8/5, based on more than 70 ratings, 16% of reviewers recommend the platform;

- BitMEX CoinGecko: 7/10, evaluated by an algorithm developed by CoinGecko.

BitMEX Features

Does BitMEX offer copy trading, staking, or other special services?

Staking | No |

Yield Farming | No |

Social Trading | Yes |

Liquidity Pool | Yes |

Crypto Cards | No |

BitMEX Bonus

BitMEX has introduced several campaigns and product features in 2024–2025, each with specific timelines, rewards, and target audiences.

The table below outlines the core details of these initiatives for quick reference.

Campaign / Programme | Period | Key Rewards / Features | Eligibility & Conditions |

Wundertrading x BitMEX Campaign | 1 Aug – 30 Sep 2025 | Up to 50,000 USDT rebates; tiered from $25 (at $500k volume) up to $5,000 (at $1bn) | Opt-in via Missions page; derivatives volume only |

Friday Frenzy Trading Campaign | Weekends, 27 Jun – 31 Aug 2025 | $5,000 weekly pool: $4,000 for trading volume, $1,000 for first 50 new users hitting $50k volume | Verified users; rewards paid weekly on Tuesdays |

Welcome Package | 1 Jul – 31 Aug 2025 | Up to $5,110: Starter Quest (10 USDT) + Welcome(-Back) Offer (up to $5,000 BMEX based on deposits & trading) | New or returning users; KYC required; rewards tiered by deposit & volume |

GinArea x BitMEX Campaign | 1 Jul – 31 Dec 2025 | Up to 100,000 USDT rebates; tiered from $50 (at $500k) to $10,000 (at $1bn) | New & existing users via GinArea referral; rewards tracked in real time |

Fee Matching Offer | Ongoing | Matches competitor derivatives fees (min taker 0.020%, maker 0.015%); extra: up to 5,000 BMEX for referrals | New/returning users (inactive since 1 Jan 2024); must submit proof to support@bitmex.com |

Unblinked x BitMEX Campaign | 27 May – 30 Sep 2025 | Up to 100,000 USDT rebates (50 USDT at $500k to 100,000 USDT at $1bn); VIP fees (0.03% taker, 0.005% maker) for ≥$50m volume | Verified users via Unblinked software; instant wallet credits |

Affiliate Programme | Ongoing (since 2014) | Up to 60% lifetime commissions; daily payouts; VIP perks (custom campaigns, swag, Guilds access) | Content creators, trading groups, community leaders; application reviewed within 24h |

Wundertrading x BitMEX Trading Campaign – Up to 50,000 USDT in Rebates

BitMEX has partnered with Wundertrading to launch a trading campaign running from 1 August to 30 September 2025, offering traders the chance to earn up to 50,000 USDT in cumulative rebates.

By creating a bot on the Wundertrading platform and opting into the campaign via the BitMEX Missions page, users can qualify for rewards based on their total derivatives trading volume.

The rebate structure follows a tiered model, starting with $25 at 500,000 USD in volume and scaling up to $5,000 at 1 billion USD in volume, with rewards credited directly to BitMEX wallets.

Progress can be tracked in real time through the Missions page, and any missed payouts will be processed within 10 days after the campaign concludes.

Friday Frenzy Trading Campaign – Weekly $5,000 Prize Pool

BitMEX has introduced the Friday Frenzy Trading Campaign , running every weekend from 27 June to 31 August 2025, with a total prize pool of $5,000 USDT each week.

Verified users can participate by trading selected altcoin and memecoin derivative contracts between Friday and Sunday.

The campaign includes two reward tracks: a 4,000 USDT poolfor all traders based on weekly trading volume, and a 1,000 USDT bonus for the first 50 newly registered users who reach a $50,000 trading volume in the designated contracts.

Rewards are distributed weekly to BitMEX wallets, with payouts made every Tuesday. Both new and existing users can join, making it a recurring opportunity to earn prizes throughout the campaign period.

BitMEX Welcome Package – Over $5,000 in Rewards

Between 1 July and 31 August 2025 , BitMEX is running a Welcome Package campaignfor both new and returning users, offering rewards of up to $5,110 .

The package consists of two parts: a Starter Quest, where newly registered users can complete KYC and simple missions to earn 10 USDT, and a Welcome(-Back) Offer, which grants up to $5,000 in BMEX Tokens to those who deposit and trade within 30 days of verification.

Rewards are distributed in tiers based on deposit size and trading volume, ranging from $25 up to $5,000.

All eligible rewards are credited directly to BitMEX wallets once the requirements are met, making this campaign a structured entry point for traders beginning or restarting their activity on the exchange.

GinArea x BitMEX Trading Campaign – Up to 100,000 USDT in Rebates

From 1 July to 31 December 2025, BitMEX is running a six-month trading campaign in partnership with GinArea, offering cumulative rebates of up to 100,000 USDT.

Participants who connect their accounts and place derivatives trades through the GinArea platform can unlock rewards across 29 tiers, starting with 50 USDT at $500,000 in trading volume and scaling up to 10,000 USDT at $1 billion in trading volume.

All earned rebates are deposited directly into users’ BitMEX wallets and can be tracked in real time via the Missions page.

The campaign is open to both new users registering via GinArea’s referral link and existing BitMEX traders who opt in, with rewards processed immediately upon reaching each threshold and finalized within 10 days after the campaign ends.

BitMEX “Fee Matching” Offer — Derivatives Only

BitMEX will match your derivatives trading feesfrom select competitor exchanges for new or returning users who haven’t traded on BitMEX since 1 Jan 2024 .

To apply, email support@bitmex.com with your BitMEX Account ID plus a dated screenshot showing the competitor’s fee schedule and your last 30-day volume.

Fees are matched under the same thresholds/conditions as the originating exchange and are limited to venues in BitMEX Price Indices: Binance, Bitfinex, Bybit, Coinbase, Gateio, Huobi, Itbit, Kraken, Kucoin, LBank, OKX .

Aminimum $1,000 total volume (maker/taker) is required to activate the new fees; validation typically <72h, and the schedule is reviewed after 60 days against BitMEX tiers. Floors apply: ≥0.015% maker and ≥0.020% taker ; one participation per user.

As an extra, you can earn up to 5,000 BMEX for referrals, plus up to 20% revenue share (per referral terms).

BitMEX x Unblinked Campaign – Up to 100,000 USDT in Rebates

From 27 May to 30 September 2025, BitMEX is partnering with Unblinked to run a high-volume trading campaign with total rebates of up to 100,000 USDT.

Participants who connect through the Unblinked software and place derivatives trades on BitMEX can unlock tiered rewards, starting from 50 USDT at $500,000 in trading volume and scaling up to 100,000 USDT at $1 billion.

Rewards are credited directly to BitMEX wallets as soon as each threshold is reached and can be monitored in real time via the Missions page.

Traders surpassing $50 million in volume during the campaign will also be eligible for VIP fee rates for three months, including a taker fee of 0.03% , a maker fee of 0.005%, and higher rate limits.

Qualifying users will be contacted by the BitMEX sales team, or they can reach out directly via partnerships@bitmex.com. This campaign is open to all verified accounts, with USDT deposits processed instantly once milestones are met.

BitMEX Affiliate Programme – Up to 60% Lifetime Commissions

BitMEX runs one of the industry’s oldest and most established referral programmes, first launched in 2014. Affiliates can earn up to 60% commission – with lifetime payouts – by promoting the platform and inviting new traders.

Applications take only a few minutes, are reviewed within 24 hours, and affiliates gain access to a dedicated dashboard to create custom referral links, track performance, and receive daily payouts.

The programme is designed for content creators, community leaders, trading groups, and BitMEX enthusiasts, offering scalable commissions and exclusive privileges such as dedicated account managers, customisable campaigns, free Guilds access, and VIP BitMEX merchandise.

High-performing affiliates may also receive support for hosting local events and promoting unique BitMEX products such as Guilds, Margin+, welcome offers, and trading bots.

With a proven legacy, reliable payouts, and strong support infrastructure, the BitMEX Affiliate Programme remains one of the most competitive opportunities for those looking to monetise their networks in the crypto trading space.

Support Options and Schedule

BitMEX offers the same level of support services as most of other crypto platforms in the industry, with3 main contact channels:

- Live Chat: Available for everyone on the website;

- Email: support@bitmex.com;

- Ticket: Submittable via the "Contact Support" page.

The company offers its support services in English, Chinese, Turkish, and Russian, 24/7.

Copy Trading and Other Investment Services on BitMEX Exchange

One of the attractive additional features in the crypto exchanges industry is the possibility to earn passive income besides the profits from trading.

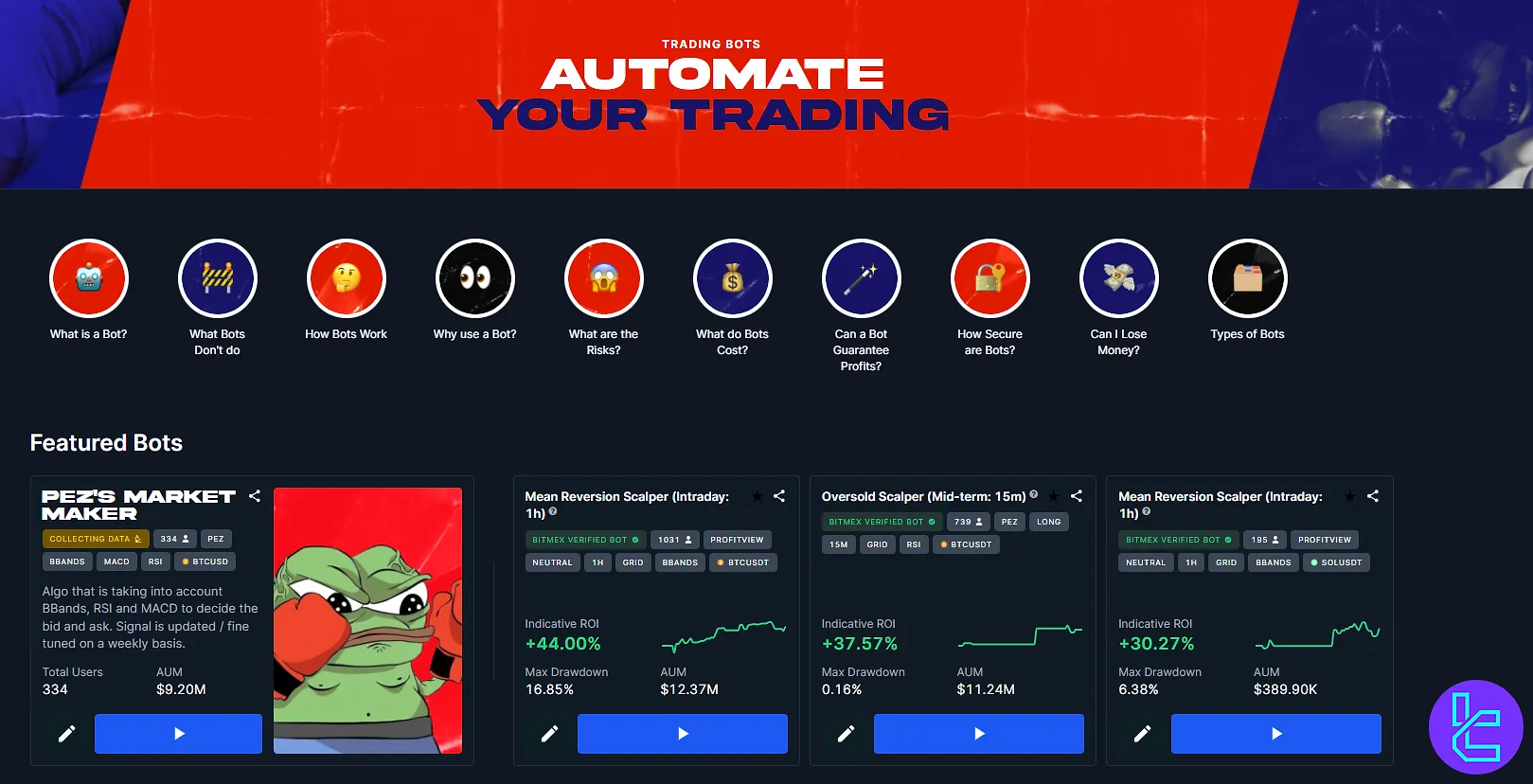

The mentioned exchange provides access to "bots" as a way of automating the trading process and making passive profits through it.

The platform lists bots with essential statistics and parameters. You can filter the list based on the contract type, direction, interval, strategy, indicator, and creator.

Which Countries and Regions are Restricted from the Exchange's services?

The company offers its services to most regions across the globe, but some countries are banned from the exchange's services. Here is a list of some of these regions:

- United States

- Cuba

- Iran

- Syria

- North Korea

- Crimea and Sevastopol

- Seychelles

- Bermuda

- Hong Kong SAR

- Canada

- Myanmar

- Russia

- And more

BitMEX vs Other Exchanges

The table below compares BitMEX features with other crypto exchanges:

Features | BitMEX Exchange | |||

Number of Assets | 110+ | 400+ | 1300+ | 700+ |

Maximum Leverage | 1:100 | 1:125 | 1:100 | 1:125 |

Minimum Deposit | 10 USDT | $1 | Varies by Cryptocurrency | N/A |

Spot Maker Fee | 0.045% - 0.1% | From 0.02% Maker, 0.04% Taker | From 0.015% Maker, 0.005% Taker | 0.1% |

Spot Taker Fee | 0.045% - 0.1% | Yes | Yes | 0.1% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | No | Yes | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | Yes | Yes | Yes | Yes |

Writer's Final Words

BitMEX charges fees ranging from 0.045% to 0.1% for spot trading and commissions in the range of 0.032% to 0.05%.

The fee is dependent on the user's trading volume in the last 30 days. All users on this platform must complete the verification and there's no tier system for KYC.