BTC Direct charges a 2% fee for buying Bitcoin and a 1.5% commission for selling the asset. The cost is higher at 3% for buying other tokens/coins. The minimum trading amount on this exchange is 30 EUR.

The company operates under the legal name BTC Direct Europe B.V., headquartered at Kerkenbos 1025 in Nijmegen, and has maintained strong compliance within the European crypto regulatory framework.

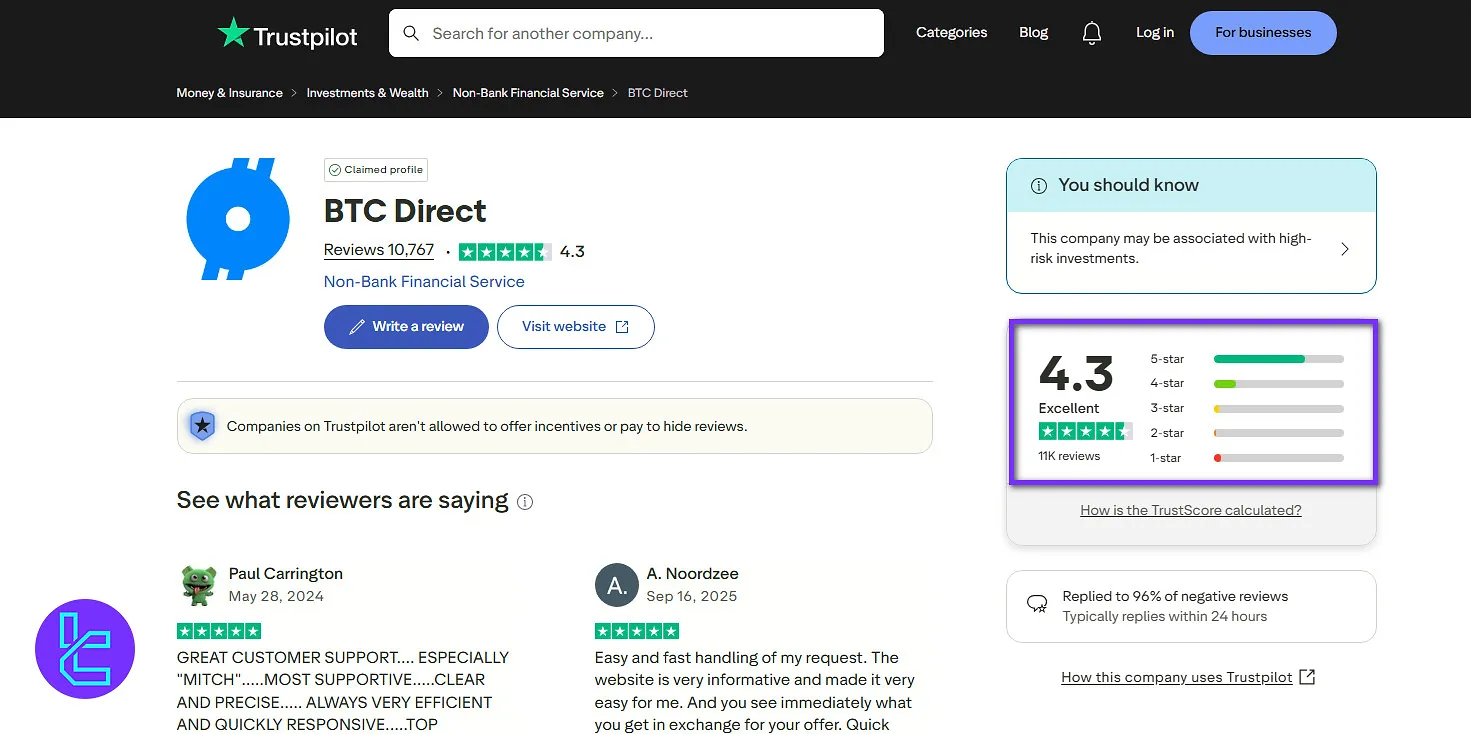

With customer support operating 7 days a week and trust scores of 4.3/5 from 10,000+ Trustpilot reviews, the platform has proven reliability in an industry where credibility is often questioned.

BTC Direct Information + Regulation

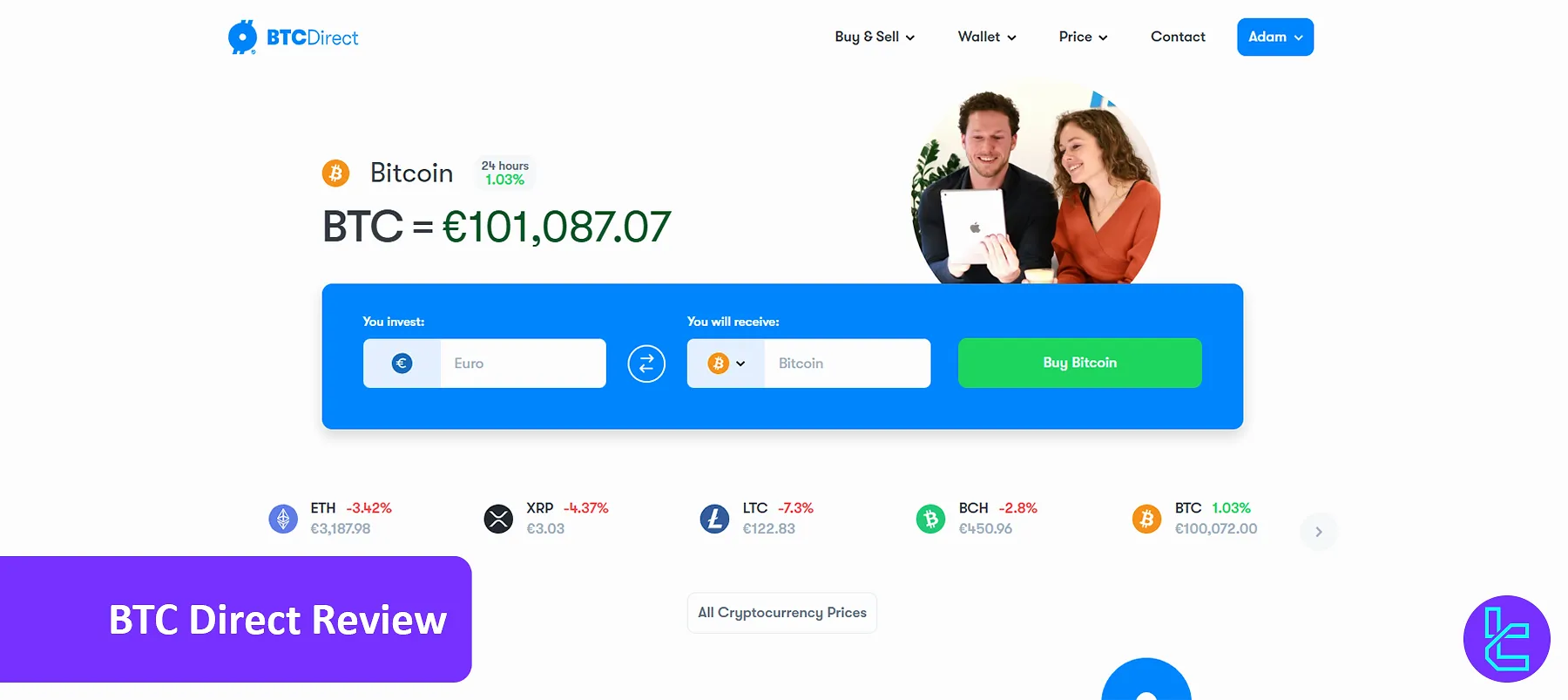

BTC Direct is a cryptocurrency exchange founded in 2013 in Nijmegen, Netherlands, by entrepreneurs Davy Stevens and Mike Hutting. Here are the key points:

- Team Size: Over 30 people

- Mission: To increase the acceptance of Bitcoin in Europe

- Last Funding Type: Series A

- Legal Name: BTC Direct Europe B.V.

- Address: Kerkenbos 1025, 6546 BB Nijmegen, Netherlands

- User Base: 1M+ traders

BTC Direct is among the earliest crypto brokers in Europe. Over the years, it has built a strong reputation with a large European user base.

The new model now focuses on ease-of-use for beginners, providing built-in wallets and listing only major cryptocurrencies.

BTC Direct CEO and Co-Founder

Mike Hutting is the CEO and Co-Founder of BTC Direct, a leading European cryptocurrency platform.

Under his leadership, the company has expanded its services to over 1 million registered users, providing access to buying, selling, and storing digital assets securely.

Hutting has overseen BTC Direct’s growth into a trusted platform that processes hundreds of thousands of transactions annually and partners with regulated financial institutions to maintain compliance within the European market.

Based on Mike Hutting LinkedIn Profile, with more than a decade of experience in the crypto sector, his focus has been on combining user-friendly solutions with strict security standards.

BTC Direct Key Features and Specifics

This company, like any other crypto exchange, operates based on a set of specifications. Here is a summary of the key features:

Exchange | BTC Direct |

Launch Date | 2013 |

Levels | None |

Trading Fees | 2% for Buying Bitcoin, 1.5% for Selling Bitcoin 3% for Buying Other Assets, 2% for Selling Other Assets |

Restricted Countries | Any Countries or Regions Outside of SEPA |

Supported Coins | 14 |

Futures Trading | No |

Minimum Deposit | N/A |

Deposit Methods | Bank Transfers (SEPA), Bancontact, iDEAL, Credit/Debit Cards, giropay, Sofort, Apple Pay |

Withdrawal Methods | Bank Transfers (SEPA), Bancontact, iDEAL, Credit/Debit Cards, giropay, Sofort, Apple Pay |

Maximum Leverage | None |

Minimum Trade Amount | 30 EUR |

Security Factors | 2FA |

Services | None |

Customer Support Ways | Ticket, Email |

Customer Support Hours | 09:00-22:00 During Weekdays 10:00-18:00 Over Weekends and Bank Holidays |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | None |

Benefits and Drawbacks

Like any financial company, BTC Direct has its strengths and weaknesses. We will mention the worthy advantages and disadvantages in the table below:

Benefits | Drawbacks |

Fiat Deposits | Limited Number of Tradable Cryptocurrencies |

Long History in the Industry | No Advanced Trading Features Like Futures Market |

Multiple Payment Options | No Copy Trading or Passive Income Options |

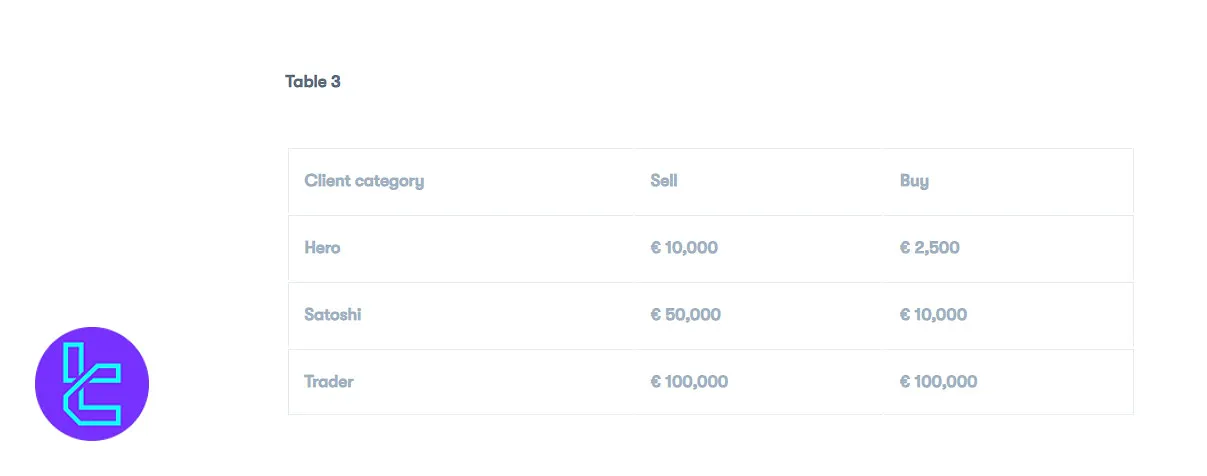

User Levels Structure on BTC Direct Exchange

The mentioned platform does not operate with a traditional exchange model that typically includes various user levels.

Instead, it functions more as a brokerage service, providing a straightforward platform for buying and selling cryptocurrencies.

BTC Direct’s entry-level users can buy up to €2,500 and sell up to €10,000 daily.

Higher tiers, Satoshi and Trader, allow trading up to €10,000 and €25,000 respectively, requiring address verification and a Skype interview.

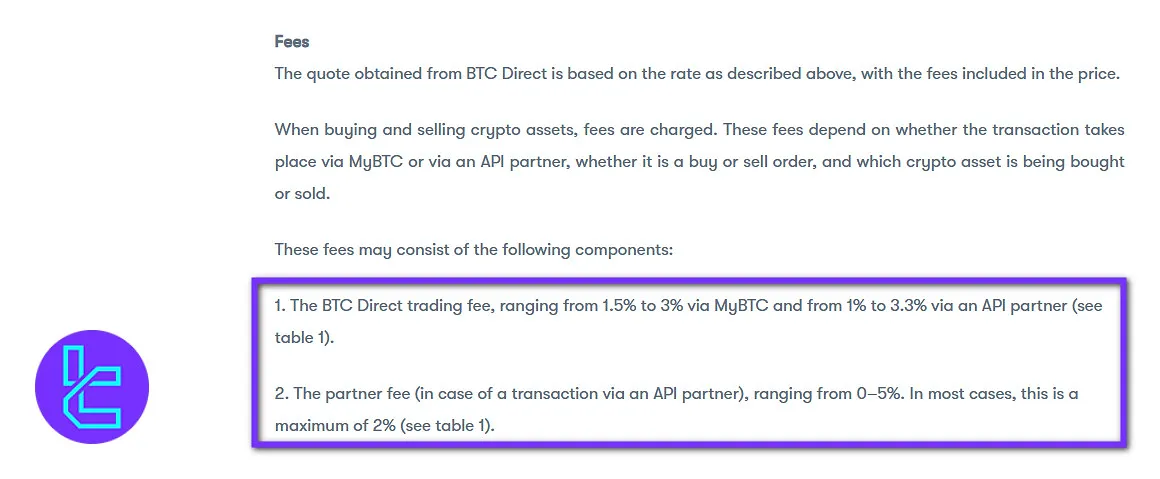

Commissions And Costs

Understanding the fee structure is crucial when choosing a cryptocurrency platform. BTC Direct's fee structure is straightforward but tends to be higher than some competitors:

Cryptocurrency | Fee | |

Buy | Sell | |

BTC | 2% | 1.5% |

ETH | 3% | 2% |

LTC | 3% | 2% |

BCH | 3% | 2% |

XRP | 3% | 2% |

Unfortunately, the website does not provide any information on commissions for trading other assets.

This company recommends traders to use its "Private Trading Service" for €50,000+ orders for reduced fees.

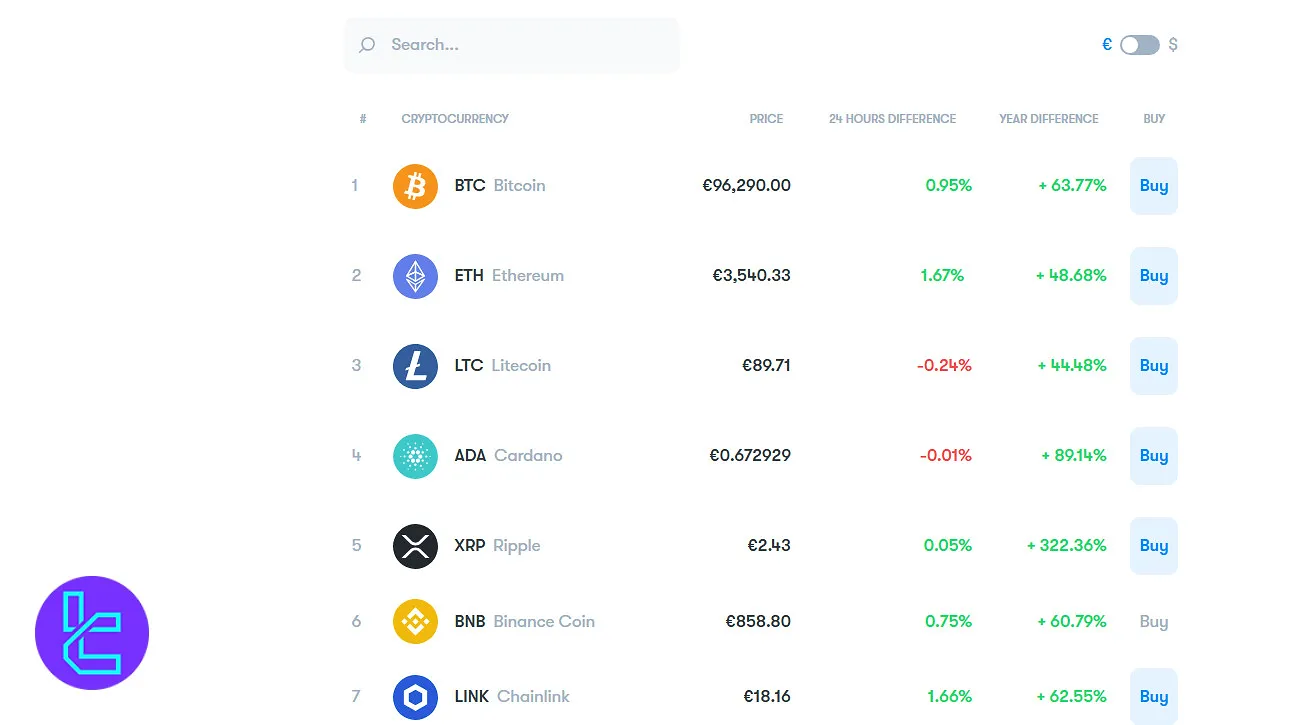

Which Coins/Tokens Are Tradable on BTC Direct?

The exchange offers a limited list of cryptocurrencies for buying/selling.

At the time of writing this article, users can trade14 cryptocurrencies on the platform. Some of those include:

- Bitcoin [BTC]

- Ethereum [ETH]

- Ripple [XRP]

- Litecoin [LTC]

- Bitcoin Cash [BCH]

- Cardano [ADA]

- Basic Attention Token [BAT]

- Monero [XMR]

The platform focuses on mainstream coins rather than niche tokens and NFTs.

All assets are purchasable using built-in wallets, and users must sell them back on the same platform since crypto withdrawals are not available.

Futures Trading and Margin Options

Futures trading is a way to earn amplified profit on trading assets in financial markets.

BTC Direct does not offer futures markets or margin trading options, and if you are looking for these services, we recommend that you use other exchanges.

Registration and Verification Tutorial

BTC Direct offers a simple onboarding process for crypto investors.

To access trading and wallet features securely, users must complete account creation and identity verification (KYC). Registration requires just basic personal details and email confirmation.

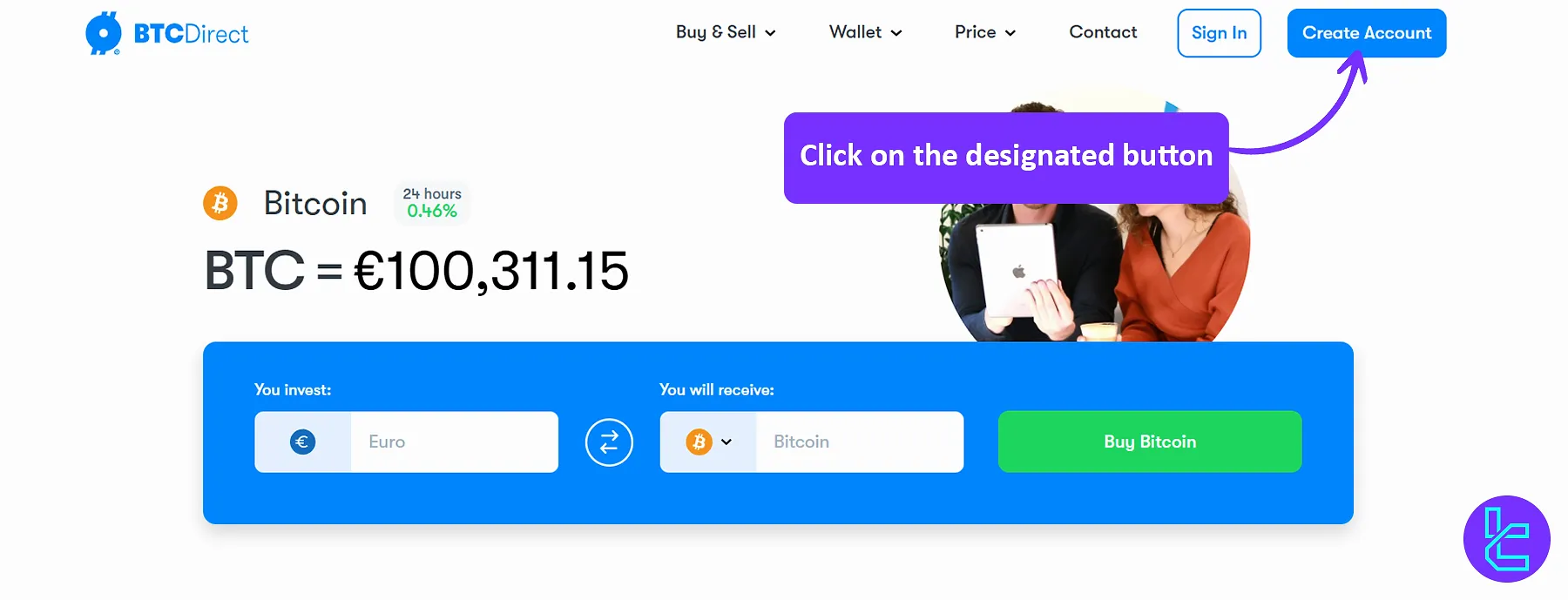

#1 Create Your Account

Visit the BTC Direct website and click “Create Account”. Fill in the following details:

- Full name

- Email address

- Nationality

- Password

Agree to the terms of service and privacy policy.

Clicking on the specified button will lead you to the registration with BTC Direct

Clicking on the specified button will lead you to the registration with BTC Direct

#2 Confirm Your Email

An email with a verification code will be sent to your inbox. Enter the code to activate your account.

#3 Verify Your Identity (KYC)

To unlock full access, upload a valid government-issued ID (passport or ID card) through your account dashboard.

Once verified, you can start buying, selling, or storing cryptocurrencies on the BTC Direct platform.

BTC Direct Trading Guide

You can start trading on BTC Direct in 3 easy steps:

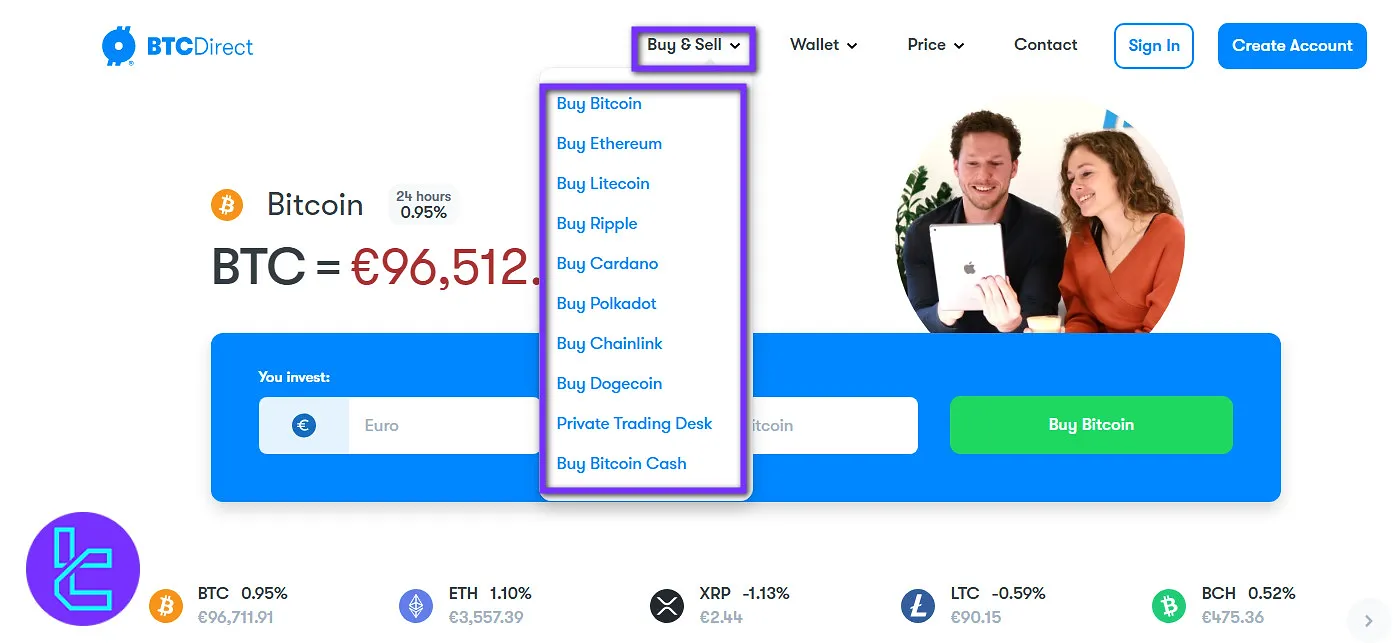

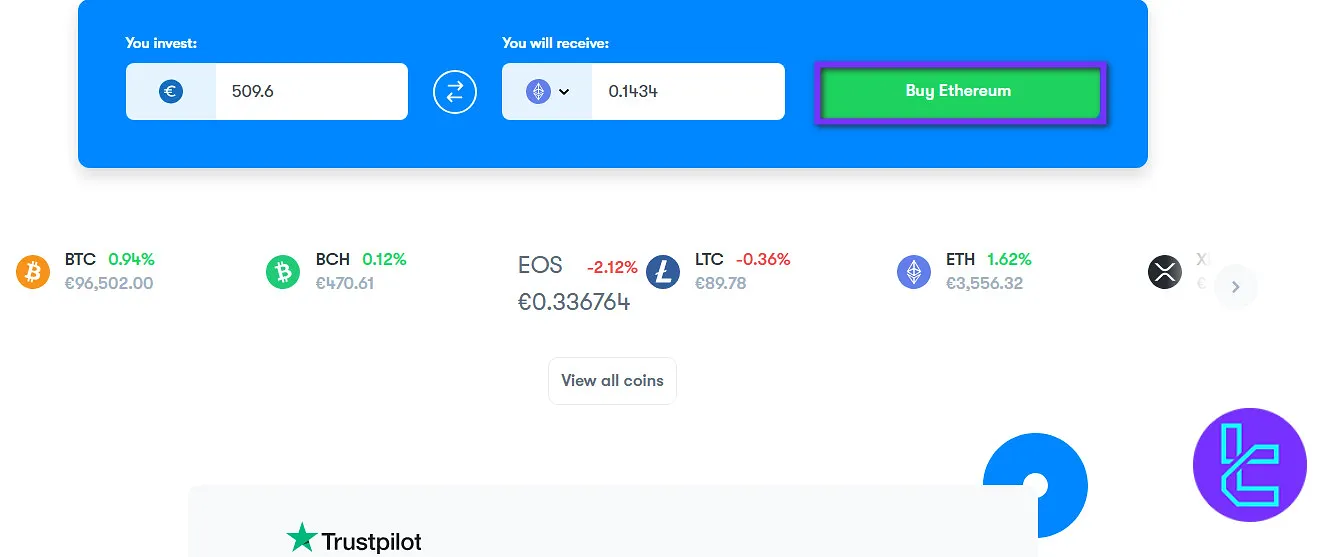

#1 Choose the Cryptocurrency

Directly from the main page of the BTC Direct website, hover your mouse over “Buy & Sell”, then choose one of the cryptocurrencies to buy or sell.

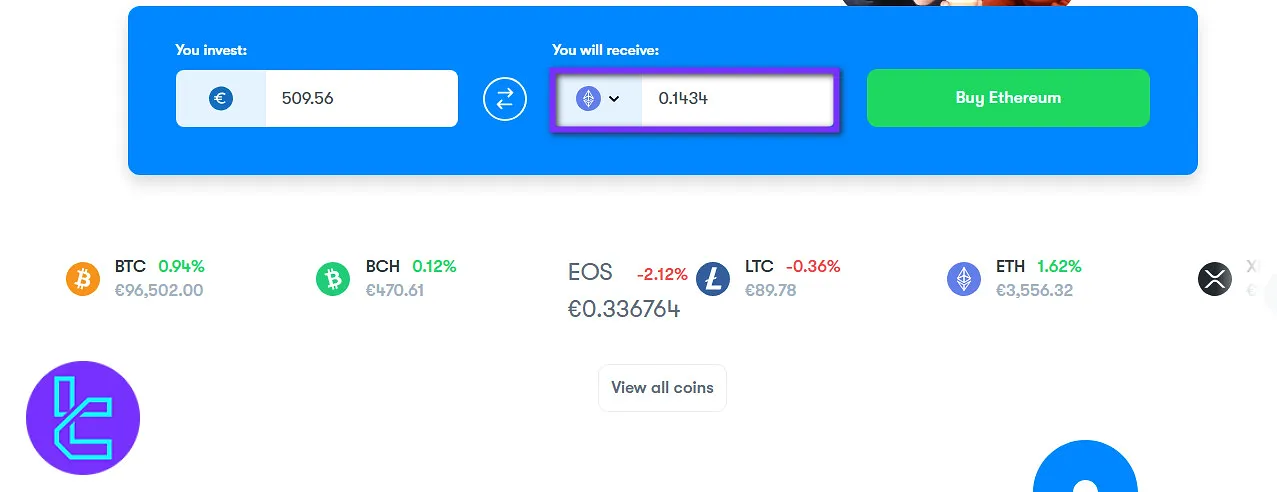

#2 Enter the Volume

Now, enter the amount of cryptocurrency you want to buy or sell. You can change the direction of trade to sell the cryptocurrency.

#3 Confirm the Trade

Lastly, you can click on “Buy” to confirm the trade and go through the payment steps.

Which Trading Platforms Are Employed By BTC Direct?

This exchange offers a proprietary terminal designed for ease of use with a set of trading tools.

The platform is available only through web browser; therefore,no mobile applications are available.

This platform provides buying/selling assets directly via the exchange, and no P2P trading is offered.

BTC Direct Services

Using the table below, you can ensure the specific trading services you are looking for is actually available at BTC Direct or not:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Security and Safety Measurements

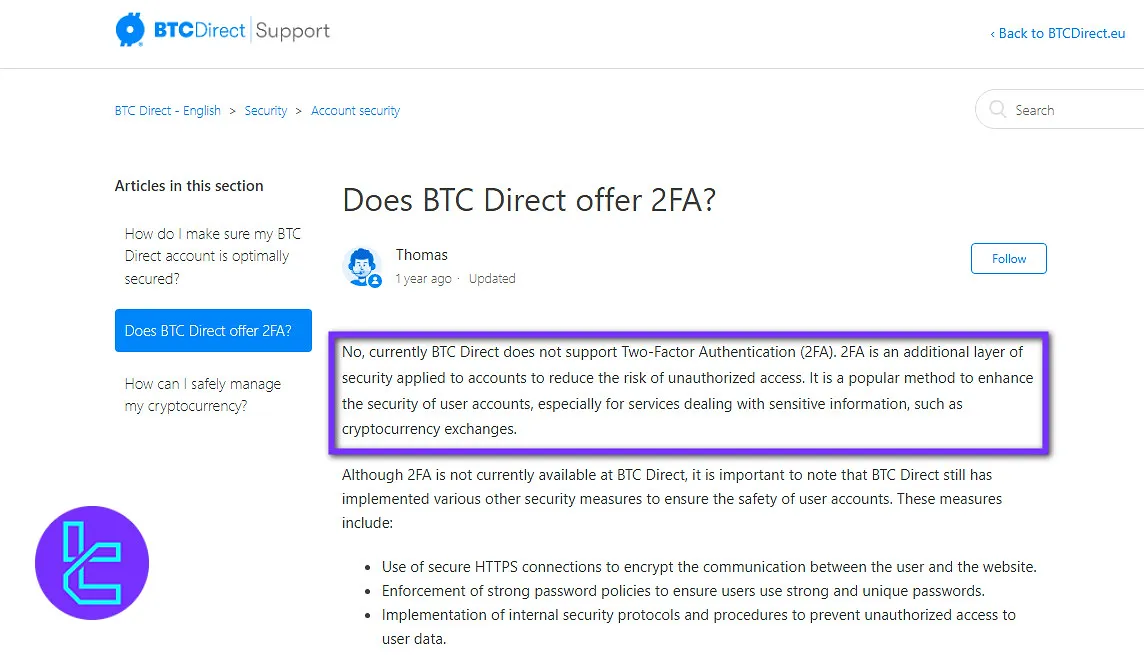

BTC Direct platform, similar to many other crypto exchanges, does not provide much detail about its security measures on its website; the only known thing regarding the matter is users can enable two-factor authentication for higher safety of their accounts.

The platform doesn’t offer two-factor authentication.

Options for Depositing/Withdrawing on the Platform

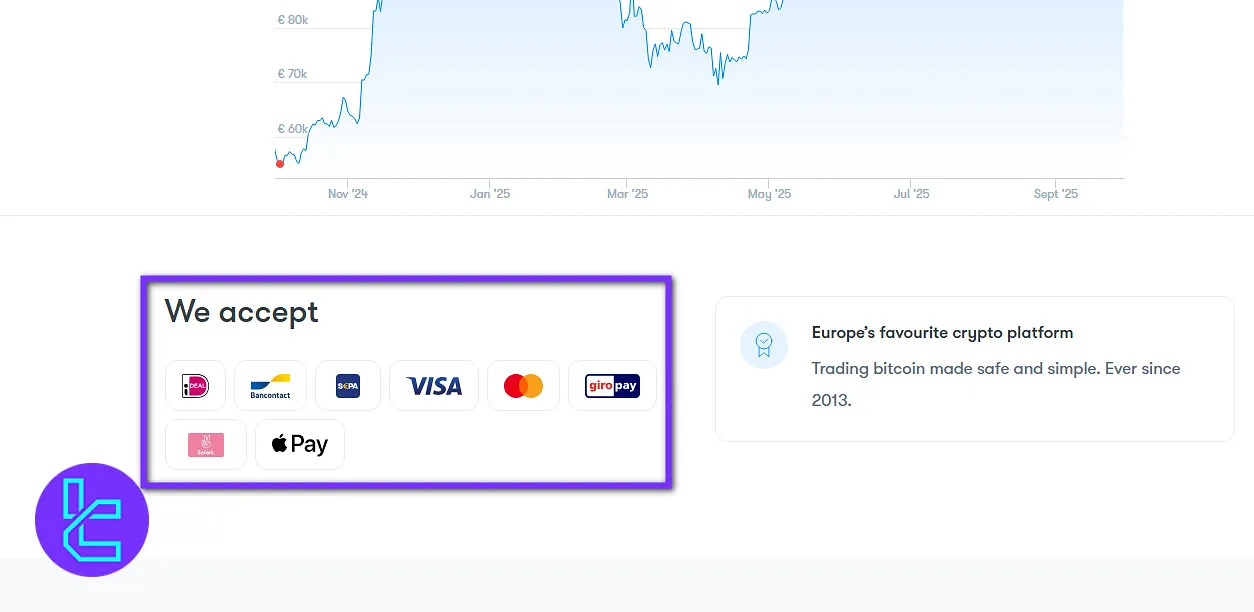

BTC Direct offers a decent range of 8 payment methods. Available options include:

- Bank Transfers (SEPA)

- Bancontact

- iDEAL

- Credit/Debit Cards (Visa and MasterCard)

- Giropay

- Sofort

- Apple Pay

As it seems, based on the funding methods, the exchange accepts fiat deposits. Note that some of these payment methods might not be available depending on your location.

This variety caters to users across Europe, but payment method fees may apply depending on the option selected.

BTC Direct provides integrated wallets for all supported coins. However, users cannot withdraw crypto to external wallets.

This design ensures simple custody for beginners but limits flexibility for advanced users who prefer self-custody or participation in DeFi and staking.

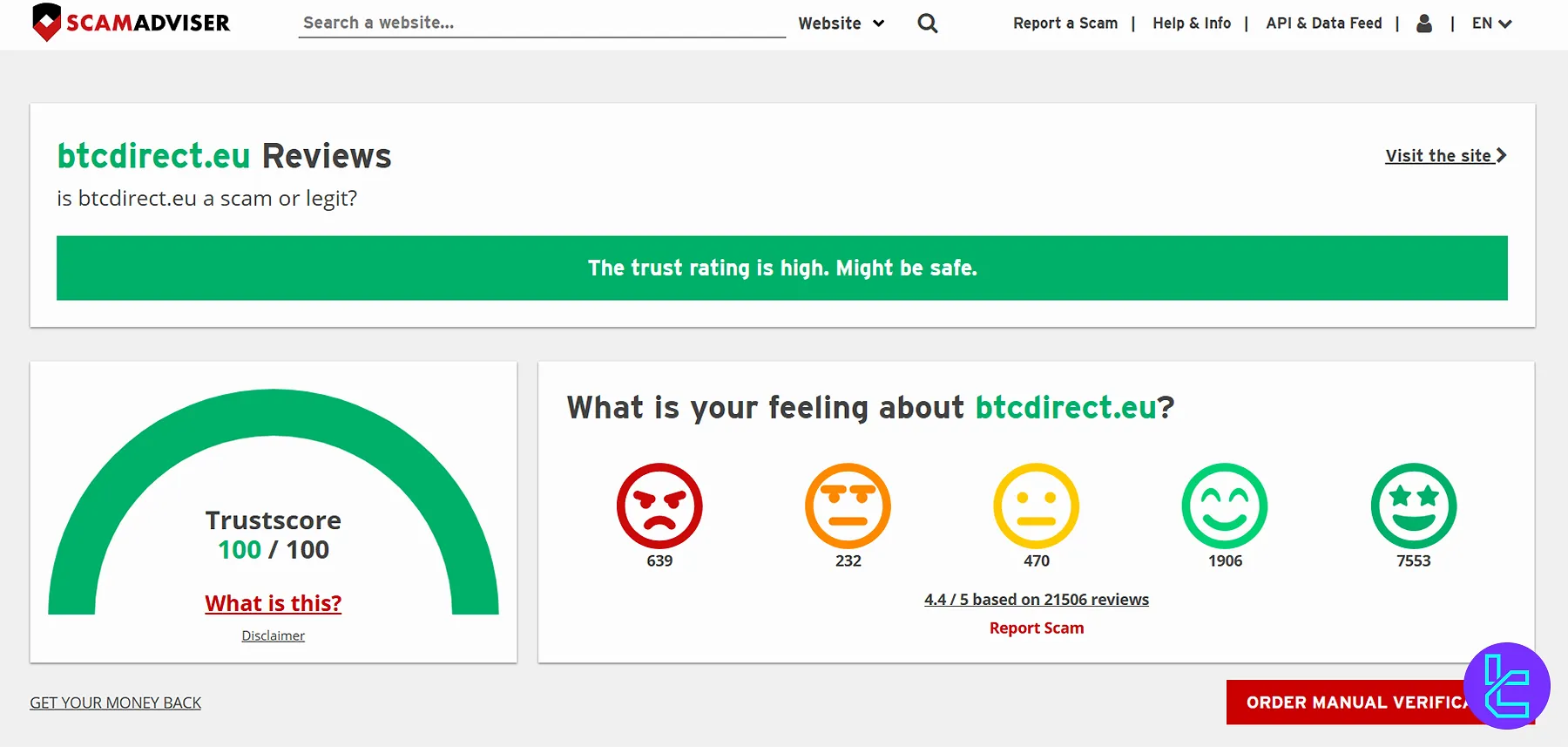

Trust Scores and Evaluation Ratings

BTC Direct has garnered positive reviews and trust scores from users and third-party review sites:

- Trustpilot: 4.3/5 stars based on over 10,000 reviews

- BTC Direct ScamAdviser: 100/100 Trustscore, with a 4.4/5 rating based on 21,000+ user opinions

Many crypto exchanges have low scores on relevant sources across the web, but the mentioned platform is in a different situation.

BTC Direct Crypto Services

Does BTC Direct offer copy trading, crypto staking, or other special services?

Look at the table below for details:

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

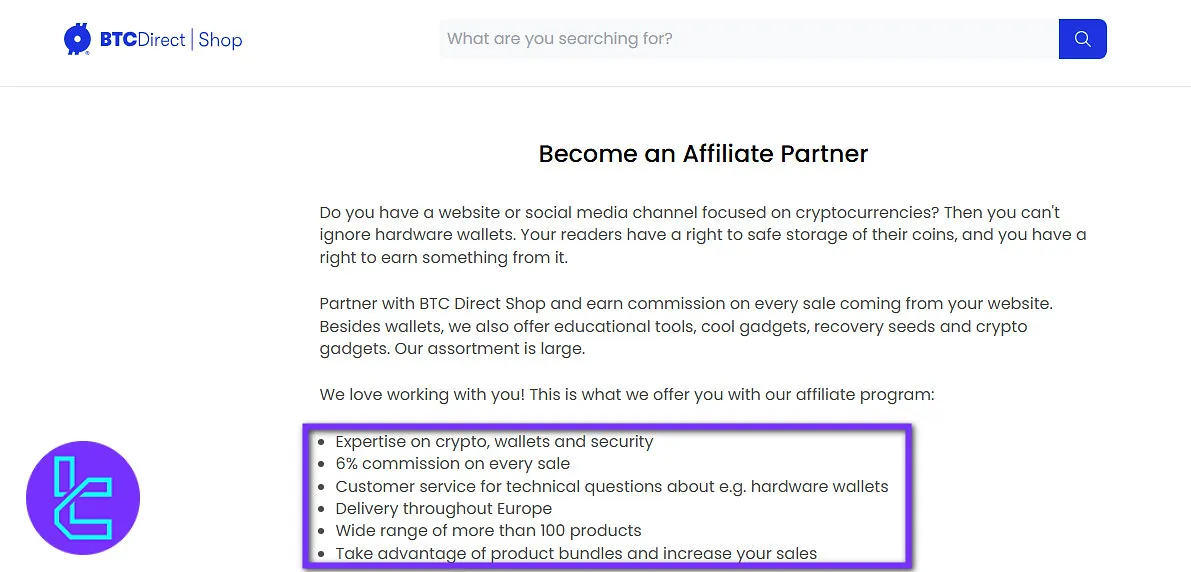

BTC Direct Promotions

Currently, the only promotion available at BTC Direct is an affiliate bonus. Let’s find out more about the program:

Bonus Type | Details | Reward |

Affiliate Program | Suitable for website owners and crypto-focused social media channels | 6% Commission |

BTC Direct Affiliate Program

BTC Direct offers an affiliate program for website owners and crypto-focused social media channels.

Partners earn a 6% commission on every sale generated through their referral link.

The BTC Direct Shop features over 100 products, including hardware wallets, recovery seeds, educational tools, and crypto gadgets.

Delivery is available across Europe, and all customer service questions are handled directly by the BTC Direct team.

Support Department Contact Channels and Opening Hours in BTC Direct

This exchange offers customer support through limited contact channels:

- Email Address: support@btcdirect.eu

- Ticket System: Available on the website

This company does notprovide any live chat options with support agents, unlike most other crypto platforms.

As stated on the website, the customer services team works from 09:00 to 22:00 during weekdays and from 10:00 to 18:00over weekends and bank holidays.

Are Any Copy Trading / Investment Services Offered?

Unfortunately for those looking to earn passive income, BTC Direct does not currently offer copy trading or investment options such as staking or lending.

These services have become popular as a means of earning additional profits besides trading.

Banned Countries and Regions

BTC Direct serves customers within theSEPA (Single Euro Payments Area), which means all countries in the European Union, in addition to Norway, Iceland, Liechtenstein, Switzerland, Monaco, and San Marino.

Therefore, clients from any region outside the EU and the mentioned countries are not accepted. Restricted regions include:

- United States

- Canada

- Japan

- China

- Iran

- North Korea

- Argentina

- Brazil

- And so on

BTC Direct Compared to Other Exchanges

The table below compares BTC Direct features with other crypto exchanges:

Features | BTC Direct Exchange | Binance Exchange | Bybit Exchange | OKX Exchange |

Number of Assets | 14 | 400+ | 1300+ | 7800+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:12 |

Minimum Deposit | N/A | $1 | Varies by Cryptocurrency | N/A |

Spot Maker Fee | From 1.5% | 0.02% - 0.1% | 0.005% - 0.1% | -0.01% - 0.14% |

Spot Taker Fee | From 1.5% | 0.04% - 0.1% | 0.015% - 0.1% | 0.03% - 0.23% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion And Conclusion

The platform’s reputation is reinforced by strong external evaluations, including a 100/100 trust score on ScamAdviser based on more than 21,000 reviews, in addition to its 4.3/5 Trustpilot score.

Furthermore, BTC Direct offers a Private Trading Service for orders above €50,000, which provides reduced fees and personalized support for high-volume traders.

The affiliate program also adds value for content creators, with 6% commission per sale on more than 100 crypto-related products in its shop.