Catex provides access to 37 cryptocurrency trading pairs across three major markets: USDT, BTC, and ETH, with a flat trading fee of 0.1% per transaction.

Traders can start with a minimum deposit of $5, while participation in the platform’s FREE, VOZ, and XDN faucets requires at least $10.

The platform’s native token, CATT, plays a pivotal role, offering benefits such as fee reductions and staking rewards.

Catex’s ecosystem includes 24 supported cryptocurrencies and a tiered user level system spanning 11 levels, granting withdrawal fee reductions from 0% up to 100% for high-volume holders.

Catex; An Introduction to the Exchange

Catex, short for "Cat Exchange", is a centralized cryptocurrency trading platform founded in 2018.

It is an unregulated cryptocurrency exchange with no oversight from a recognized financial authority.

Catex's focus on community-driven development, along with its unique transaction mining model, sets it apart.

The platform's native token, CATT, plays a central role in its ecosystem, offering various benefits to holders.

Although Catex’s online activity has grown rapidly, concerns remain regarding non-transparent pricing, inconsistent customer support, and weak backlink credibility.

Its domain age reflects some operational stability, but legitimacy should be verified via formal regulatory sources.

Catex Exchange Specific Features

The platform has a track record of more than 7 years. Let’s see if it has what it takes to be among the crypto exchanges.

Exchange | Catex |

Launch Date | 2018 |

Levels | 11 Levels |

Trading Fees | 0.1% |

Restricted Countries | The United States of America, China, Singapore, Canada, France, Germany, Malaysia, Malta, Cuba, Iran, North Korea, Sudan, Syria, Crimea Region, Spain, Luhansk, Donetsk, Netherlands, Bolivia, UK, Myanmar, Venezuela, Uzbekistan, Austria |

Supported Coins | 24 |

Futures Trading | No |

Minimum Deposit | $5 |

Deposit Methods | Crypto |

Withdrawal Methods | Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | N/A |

Security Factors | Cold Storage, Firewalls, Professional Penetration Test |

Services | Crypto Faucet, Staking, Spot Market |

Customer Support Ways | Ticket, Telegram Group |

Customer Support Hours | N/A |

Fiat Deposit | No |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | CATT |

Catex Pros & Cons

The platform offers various passive income opportunities. However, the lack of advanced services like futures trading is a letdown in this Catex review.

Pros | Cons |

Fee discounts for CATT token holders | No support for fiat deposits |

Daily dividends for CATT token holders | No mobile trading |

Referral program | No live chat support |

Solid security measures (2FA, cold storage, penetration test) | Mixed user reviews |

Does Catex Offer User Levels?

The exchange offers a tiered user level system based on CATT token holdings, offering withdrawal fee reductions.

User Level | CATT Holdings | Withdrawal Fee Reduction |

Tier 0 | 0 | 0% |

Tier 1 | 10K | 10% |

Tier 2 | 100K | 20% |

Tier 3 | 300K | 30% |

Tier 4 | 500K | 40% |

Tier 5 | 1M | 50% |

Tier 6 | 2.5M | 60% |

Tier 7 | 5M | 70% |

Tier 8 | 7.5M | 80% |

Tier 9 | 10M | 90% |

Tier 10 | 20M | 100% |

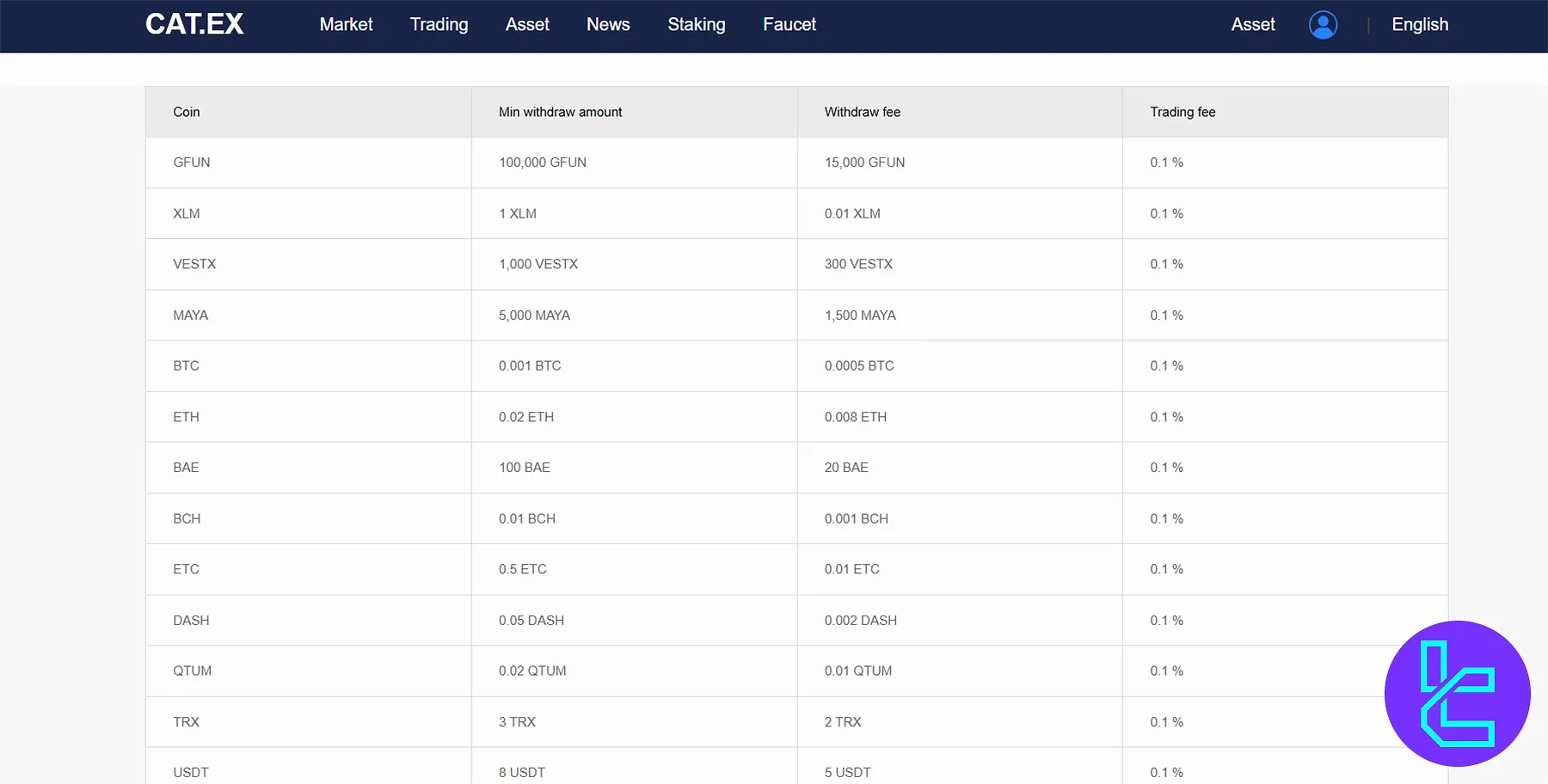

Catex Exchange Trading & Non-Trading Costs

While the trading fees are a flat 0.1% for all trading pairs, withdrawal commissions differ based on the cryptocurrency asset.

Withdrawal fees of some popular digital assets:

Coin | Min Withdrawable Amount | Withdraw Commission |

XLM | 1 XLM | 0.01 XLM |

BTC | 0.001 BTC | 0.0005 BTC |

MAYA | 5,000 MAYA | 1,500 MAYA |

ETH | 0.02 ETH | 0.008 ETH |

CATT | 50,000 CATT | 12,000 CATT |

TRX | 3 TRX | 2 TRX |

USDT | 8 USDT | 5 USDT |

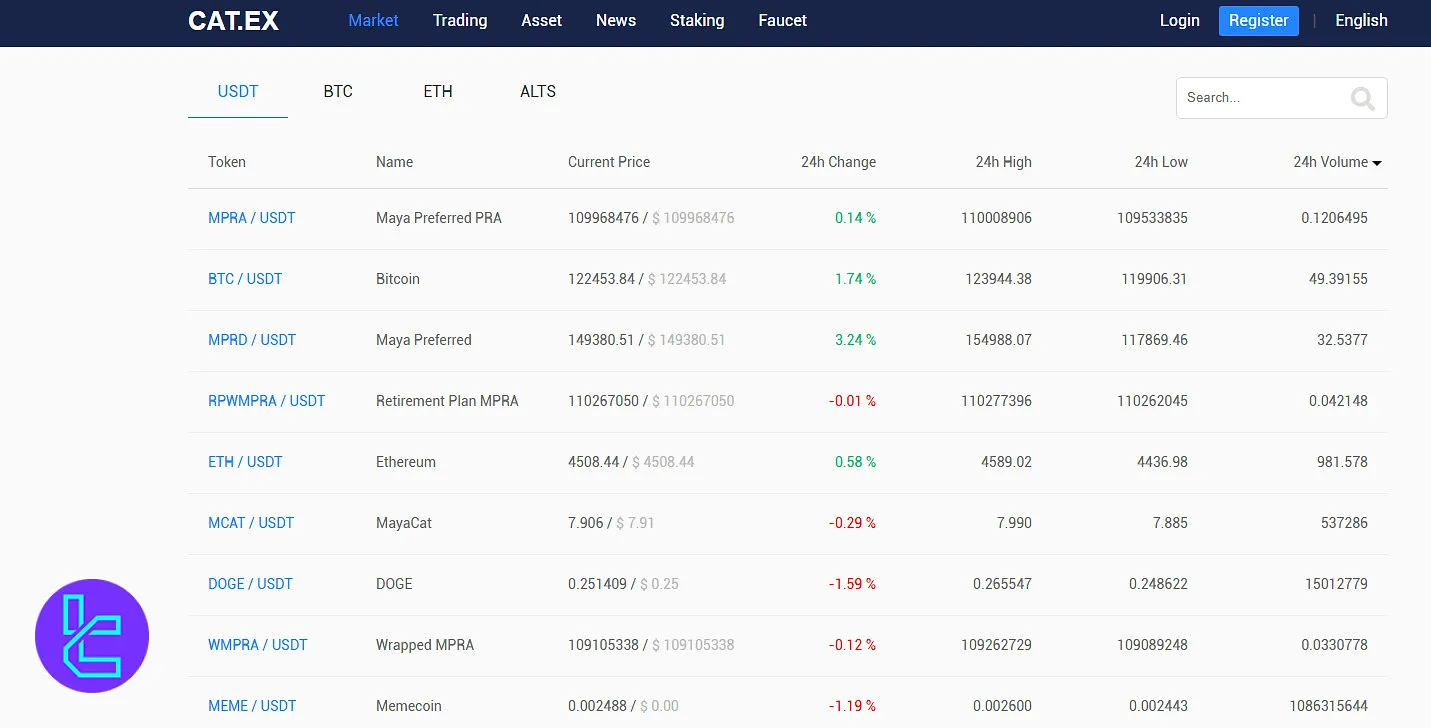

Available Cryptocurrencies on Catex

The exchange supports24 cryptocurrencies and 37 trading pairs in USDT, BTC, and ETH markets. Some of the available digital assets on Cat.Ex:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- TRON (TRX)

- Dogecoin (DOGE)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

Margin and Futures Trading

Catex does not offer margin or futures trading. The platform primarily focuses on spot trading with a 1:1 leverage option.

While this may limit options for advanced traders seeking leveraged positions, it also reduces the risk profile for the average user.

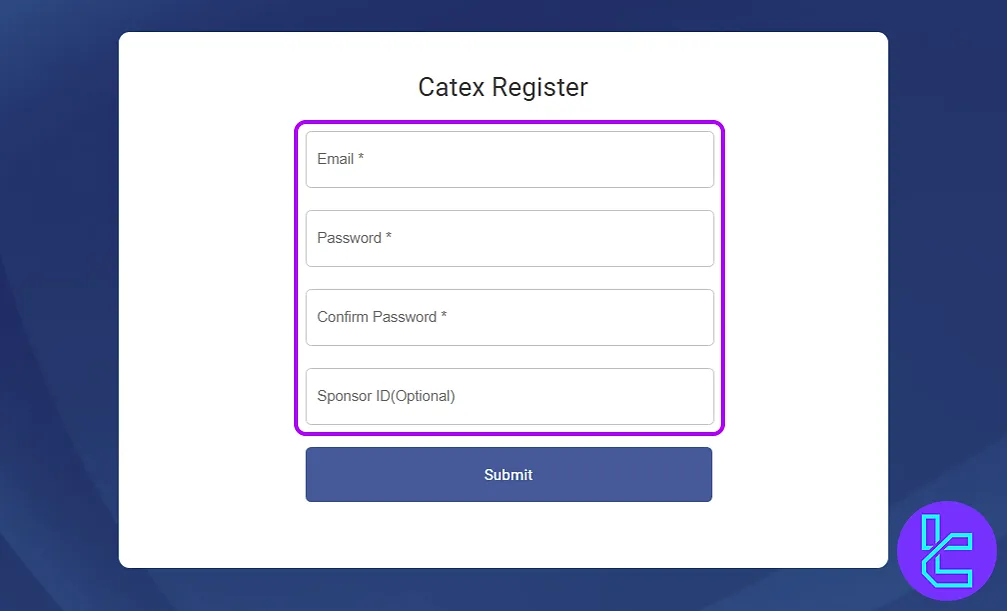

Catex Exchange Registration and Verification

Registering on the platform is straightforward and requires less stringent KYC procedures. The entire Catex registration process takes just a few minutes and only requires a valid email address and a secure password.

#1 Visit the Catex Website

Go to the official Catex homepage and click on the “Register” option found prominently at the top-right to initiate your account creation.

#2 Enter Email, Password, and Optional Referral

Provide a valid email address and set a strong password that includes upper/lowercase letters, numbers, and symbols.

If you have a referral code, you can enter it to unlock potential signup bonuses.

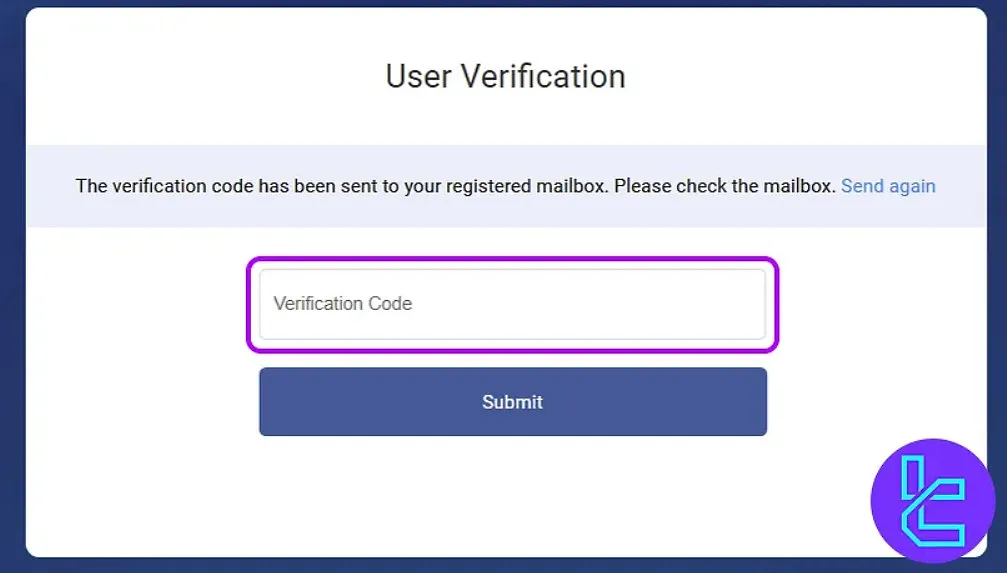

#3 Confirm Email and Access Dashboard

Check your inbox for the verification code from Catex. Enter the code on the website to activate your account and get redirected to your personal dashboard.

#4 Do the KYC and Finalize the Process

For identity authorization, provide proof of ID (passport or driving license) and other required documents to the exchange.

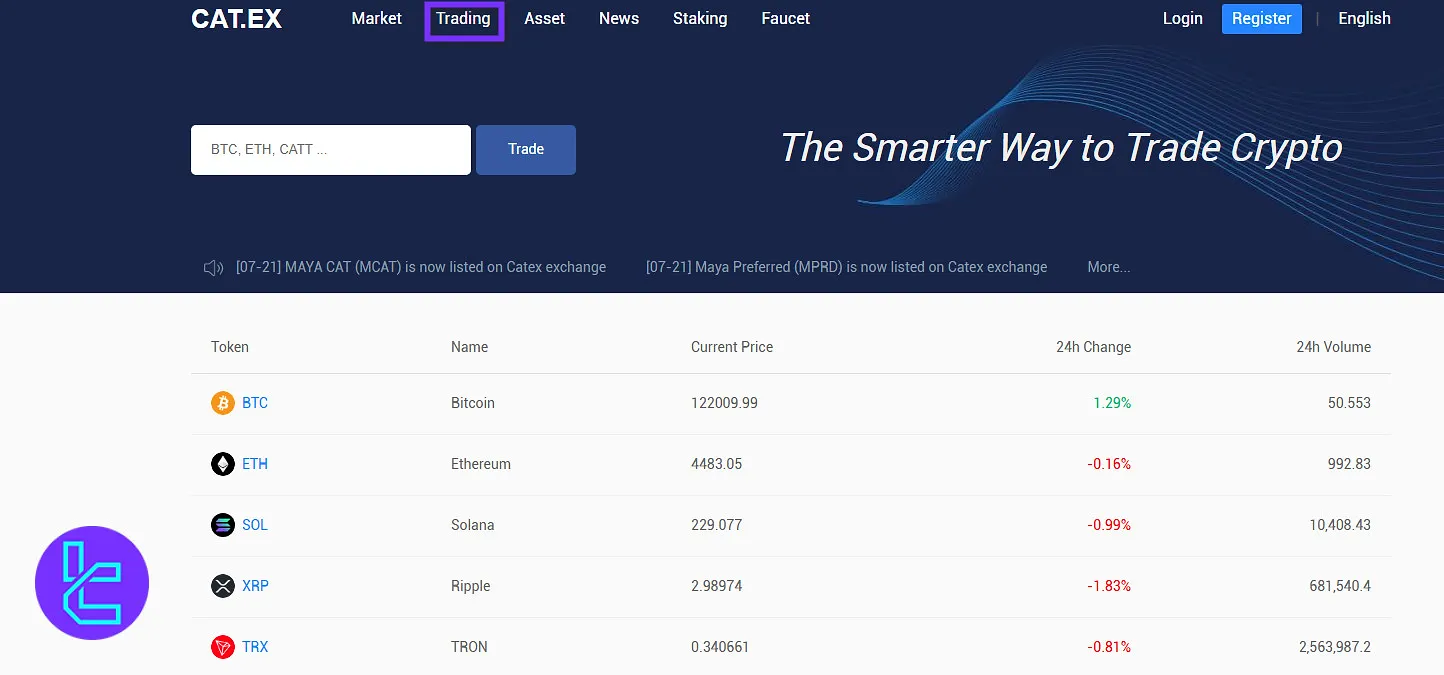

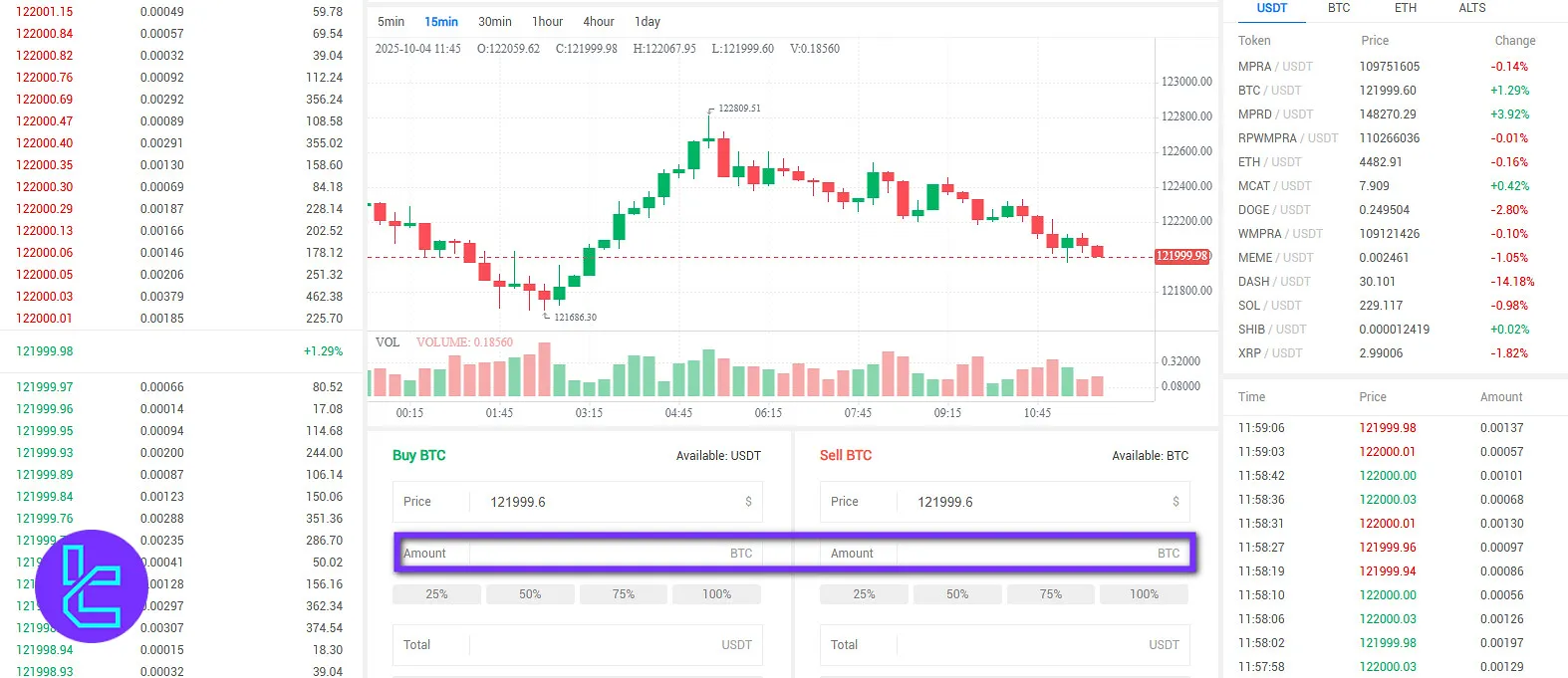

Catex Trading Guide

If you want to start trading on Catex, you can easily follow these simple steps:

#1 Start Trading

To begin, on the Catex homepage, click on “Trading” to access the trading interface.

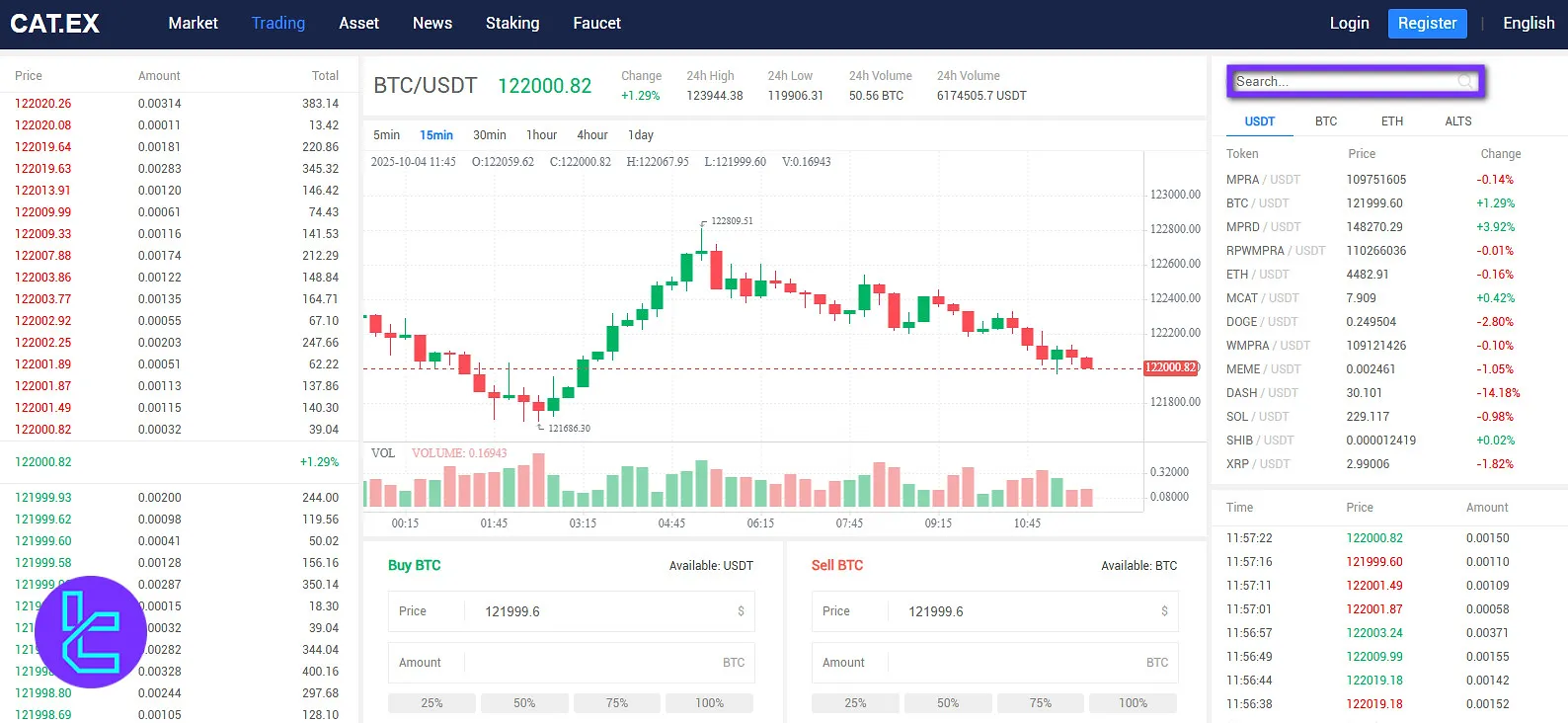

#2 Choose a Trading Pair

Next, from the right side menu, use the search option to find your preferred trading pair.

#3 Specify the Amount

Enter the trading volume in the “Amount” field to set how much you want to trade.

#4 Confirm the Trade

Finally, click “Buy” or “Sell” to execute your order.

The Platform and Apps

The lack of a dedicated mobile application is one of the biggest disappointments in this Catex review.

The platform primarily operates through its web-based platform, optimized for desktop and mobile browsers.

Catex Trading Volume

Based on the Catex CoinGecko chart, the exchange has shown a consistent trading activity over the past three months, with daily trade volumes fluctuating between $20 million and $120 million.

July recorded the most notable spikes, crossing the $100 million mark multiple times, signaling strong market participation and liquidity during that period.

In contrast, August and September maintained steadier ranges, mostly between $40 million and $70 million, indicating a more stable flow of trading interest across spot and crypto pairs.

Catex Services

The availability of popular trading services in Catex is important to traders. So, using the table below, you can check out the available trading services in Catex:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | No |

P2P Trading | No |

OTC Trading | No |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | Yes |

Auto-Invest (Recurring Buy) | No |

Security and Safety

The exchange takes several measures, from cold wallets to penetration tests, to ensure the security of user funds and data.

- Cold Storage: storing the majority of user funds in offline, secure vaults

- Two-Factor Authentication (2FA): Adding an additional layer of security to clients’ accounts

- Penetration Test: Regular authorized cyberattacks to evaluate the system’s security

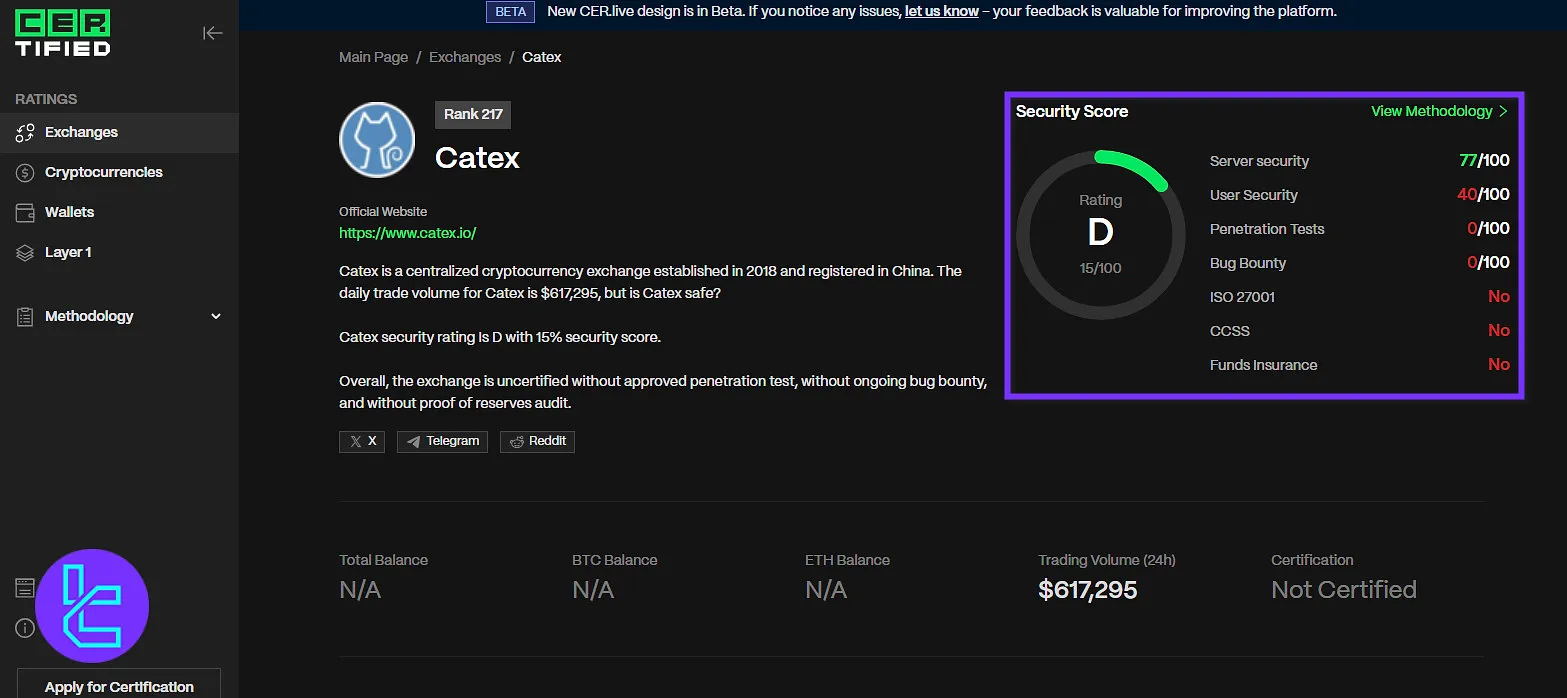

Catex Security Rankings

According to the Catex CER.live security evaluation, Catex received an overall score of 15% (Grade D), placing it among the lower-ranked exchanges in terms of cybersecurity readiness.

The report highlights notable disparities across different protection areas, with server security scoring a relatively solid 77/100, indicating decent backend infrastructure safeguards.

However, user security was rated at only 40/100, suggesting limited measures to protect customer accounts and data.

More concerning are the 0/100 ratings in both penetration testing and bug bounty programs, meaning there are no active vulnerability assessments or public reward systems to encourage responsible disclosure of security flaws.

Additionally, Catex lacks key industry certifications such as ISO 27001 and CCSS, and does not provide funds insurance, leaving user assets potentially exposed in the event of a breach.

Overall Score | 15% (D) |

Server Security | 77/100 |

User Security | 40/100 |

Penetration Tests | 0/100 |

Bug Bounty | 0/100 |

ISO 27001 | No |

CCSS | No |

Funds Insurance | No |

Catex Payment Methods

Unfortunately, the platform doesn’t support fiat transactions, and cryptocurrencyis the only option for funding Catex accounts and withdrawing from them.

It’s important to note that some cryptocurrencies might be available only for deposits or withdrawals.

For example, while you may deposit XRP, you can’t withdraw it. Some of the available digital assets for payment on Catex:

Cryptocurrency | Deposit | Withdrawal |

EOS | Yes | Yes |

LTC | Yes | No |

IOST | No | Yes |

DOGE | Yes | Yes |

MAPR | No | Yes |

MATIC | Yes | Yes |

ETC | No | Yes |

Catex Exchange User Experience

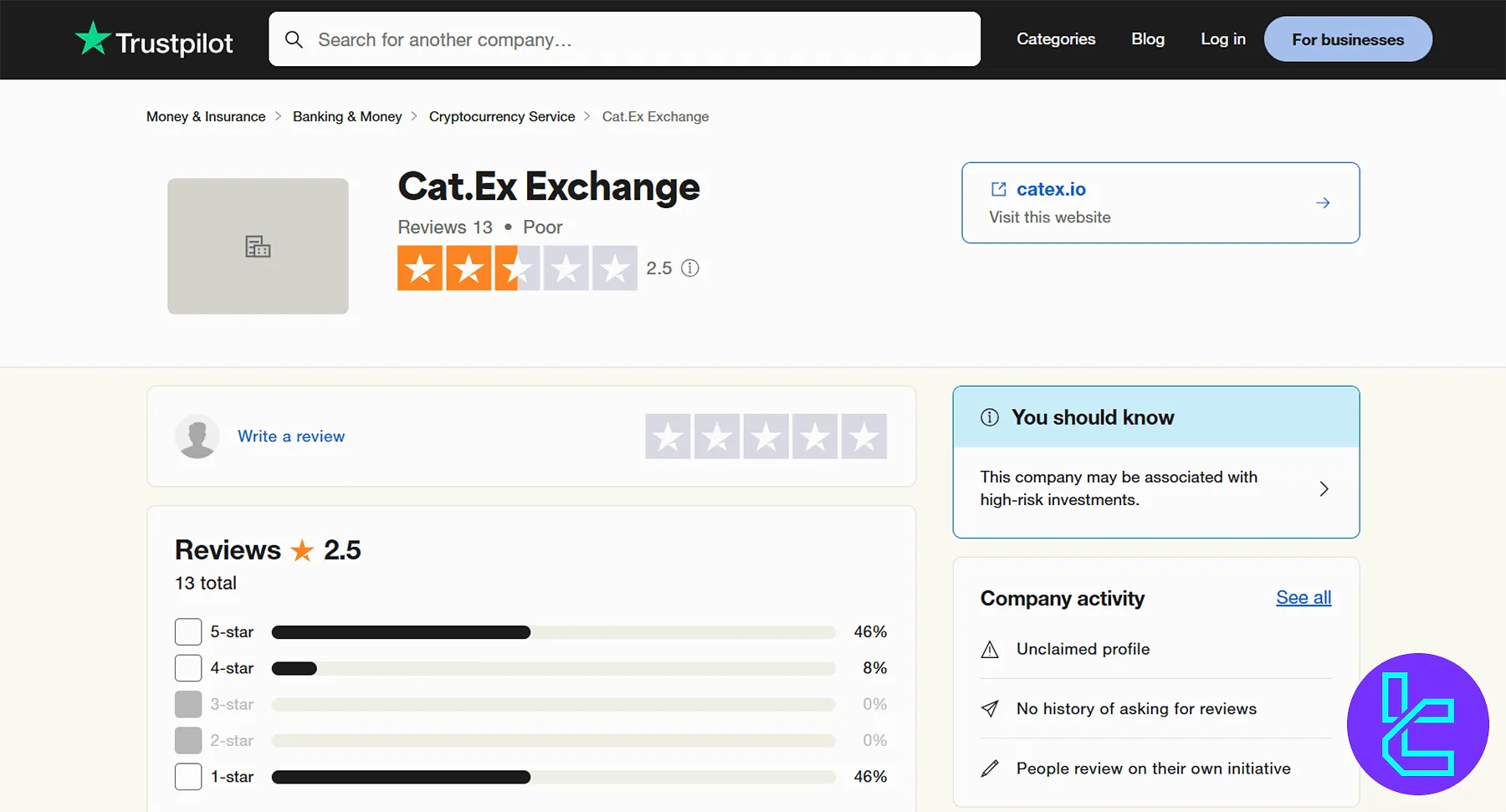

The platform has a weak standing between users and market experts. CoinGecko analysts have rated the exchange 4/10.

There are also 13 Catex reviews on TrustPilot, which earned an average score.

Catex TrustPilot profile has a score of 2.5 out of 5. While 46% of user reviews are negative (1-star), 54% have given positive feedback.

Catex Features

This table is a summary of additional features provided by Catex:

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

Catex Exchange Bonus

Catex Exchange currently offers a single bonus opportunity through its Referral Program. Below you can check out the details:

Bonus Type | Reward |

Referral Program | 50% Commission |

Catex Referral Program

Users can earn 50% commission when they refer new traders to the platform. To participate, simply generate your referral link from your account dashboard and share it with others.

Every time your referral trades, you’ll receive a portion of their trading fees, making it an easy and continuous way to earn rewards while helping others discover Catex.

How to Reach Customer Support?

The lack of appropriate support channels is among the top disappointments in this Catex review.

The exchange offers a ticket system and a Telegram group for traders needing assistance. The platform claims that it replies to clients’ emails within24 hours.

Does Catex Provide Investment Plans or Copy Trading Services?

While the exchange doesn’t offer a copy trading feature, it has developed multiple investment options and growth plans.

Catex enables users to stake digital assets and participate in crypto faucets.

- Crypto Staking: Invest in other staking plans or create your plan and pay the participants;

- Faucet: 3 faucets for earning FREE, VOZ, and XDN by solving simple puzzles.

To be eligible for crypto faucets, you must deposit more than $10 worth of BTC, ETH, TRX, or USDT and maintain a balance of $10 or more.

Catex Exchange Geo-Restrictions

The platform operates globally, but there are some restrictions on who can use the services. Prohibited countries on Cat.Ex:

- United States of America

- China

- Singapore

- Canada

- France

- Germany

- Malaysia

- Malta

- Cuba

- Iran

- North Korea

- Sudan

- Syria

- Crimea Region

- Spain

- Luhansk

- Donetsk

- Netherlands

- Bolivia

- United Kingdom

- Myanmar

- Venezuela

- Uzbekistan

- Austria

Catex in Comparison to Its Competitors

A comparison always helps users to have a better perspective at the quality and the quantity of products and services offered by an exchange:

Features | Catex Exchange | HTX Exchange | Gate.io Exchange | CoinEx Exchange |

Number of Assets | 24 | 700+ | 2800+ | 1200+ |

Maximum Leverage | 1:1 | 1:200 | 1:100 | 1:100 |

Minimum Deposit | $5 | $1 | Varies by Payment Method | 0.0005 BTC |

Spot Maker Fee | 0.1% | From 0.02% | From -0.005% | 0.1% - 0.2% |

Spot Taker Fee | 0.1% | From 0.02% | From 0.025% | 0.1% - 0.2% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | No | No | No | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

While Catex does not provide futures or margin trading, it focuses on spot trading with 1:1 leverage, keeping risk low for everyday users.

The exchange maintains a referral program offering 50% commission and provides staking options, which incentivize active participation.

Security measures include cold storage for most user funds, two-factor authentication, and periodic penetration testing, though the overall cybersecurity rating is low at 15% (Grade D) according to CER.live.