CoinDCX offers P2P Crypto trading with a fixed 0.17% commission. INR trading pairs come with fees ranging from 0.03% to 0.50%. Leverage options of up to 1:6 (Margin trading) on 400+ pairs, a minimum deposit requirement of INR 100, and IMPS/NEFT payment methods are some of the exchange’s offerings.

CoinDCX; Company Introduction

CoinDCX is a private, venture capital-backed cryptocurrency exchange founded in 2018 and headquartered in Mumbai, India. It rose to prominence as India’s first crypto unicorn in 2021, earning a valuation exceeding $1 billion.

Some key facts about the company:

- 500+ cryptocurencies

- More than 16M users

- INR 796B+ in quarterly trading volume

- Registered with Financial Intelligence Unit-India (FIU-IND)

CoinDCX CEO

Sumit Gupta is the CEO and visionary behind CoinDCX, one of India’s leading cryptocurrency exchanges, and a driving force in the country’s Web3 ecosystem.

Recognized in Fortune 40 Under 40 and Forbes 30 Under 30, Gupta is also an active angel investor supporting innovative blockchain startups.

A strong advocate for financial independence, he believes in the transformative power of finance to empower individuals. Gupta champions Blockchain Technology (DLT) and the role of cryptocurrencies in promoting financial inclusion.

Based on the Sumit Gupta LinkedIn profile, he sees DeFi (Decentralized Finance) as a tool that leverages technology to create stronger economic systems, benefiting a broader segment of the population than ever before.

Under his leadership, CoinDCX continues to focus on delivering secure, accessible, and technologically advanced crypto services to millions of users across India.

CoinDCX Specific Features

The Crypto exchange offers a robust set of features, such as a B2B API solution and CoinDCX Pro, catering to both crypto beginners and experienced traders.

Exchange | CoinDCX |

Launch Date | 2018 |

Levels | from Regular 1 to VIP 7 |

Trading Fees | Variable based on user level |

Restricted Countries | None |

Supported Coins | 500+ |

Futures Trading | Yes |

Minimum Deposit | IDR 100 |

Deposit Methods | Crypto, Fiat |

Withdrawal Methods | Crypto, Fiat |

Maximum Leverage | 1:100 |

Minimum Trade Size | INR 100 |

Security Factors | Proof of Reserves, Cold Storage, 2FA |

Services | Futures/Margin Trading, Staking, P2P/OTC Markets, API Trading |

Customer Support Ways | Ticket, Chatbot |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

CoinDCX Exchange Pros & Cons

Here's a balanced look at some of the key advantages and potential drawbacks of using CoinDCX:

Pros | Cons |

User-friendly interface for beginners | High fees compared to some global exchanges |

Advanced trading features for experts | Limited support channels |

Strong security measures and insurance | Poor trust score |

Wide selection of 500+ cryptocurrencies | Reported withdrawal issues |

User Levels on CoinDCX

We must mention in this CoinDCX review that the platform implements a tiered membership system based on 30-day trading volume, offering increasing benefits at higher levels.

User Level | Monthly Spot Trading Volume (INR) | Monthly Futures Trading Volume (USDT) |

Regular 1 | < 200,000 | < 2M |

Regular 2 | < 500,000 | < 2M |

VIP 1 | < 7,500,000 | < 5M |

VIP 2 | < 50,000,000 | < 15M |

VIP 3 | < 100,000,000 | < 50M |

VIP 4 | < 250,000,000 | < 100M |

VIP 5 | < 1,000,000,000 | < 500M |

VIP 6 | < 5,000,000,000 | < 1B |

VIP 7 | > 5,000,000,000 | > 1B |

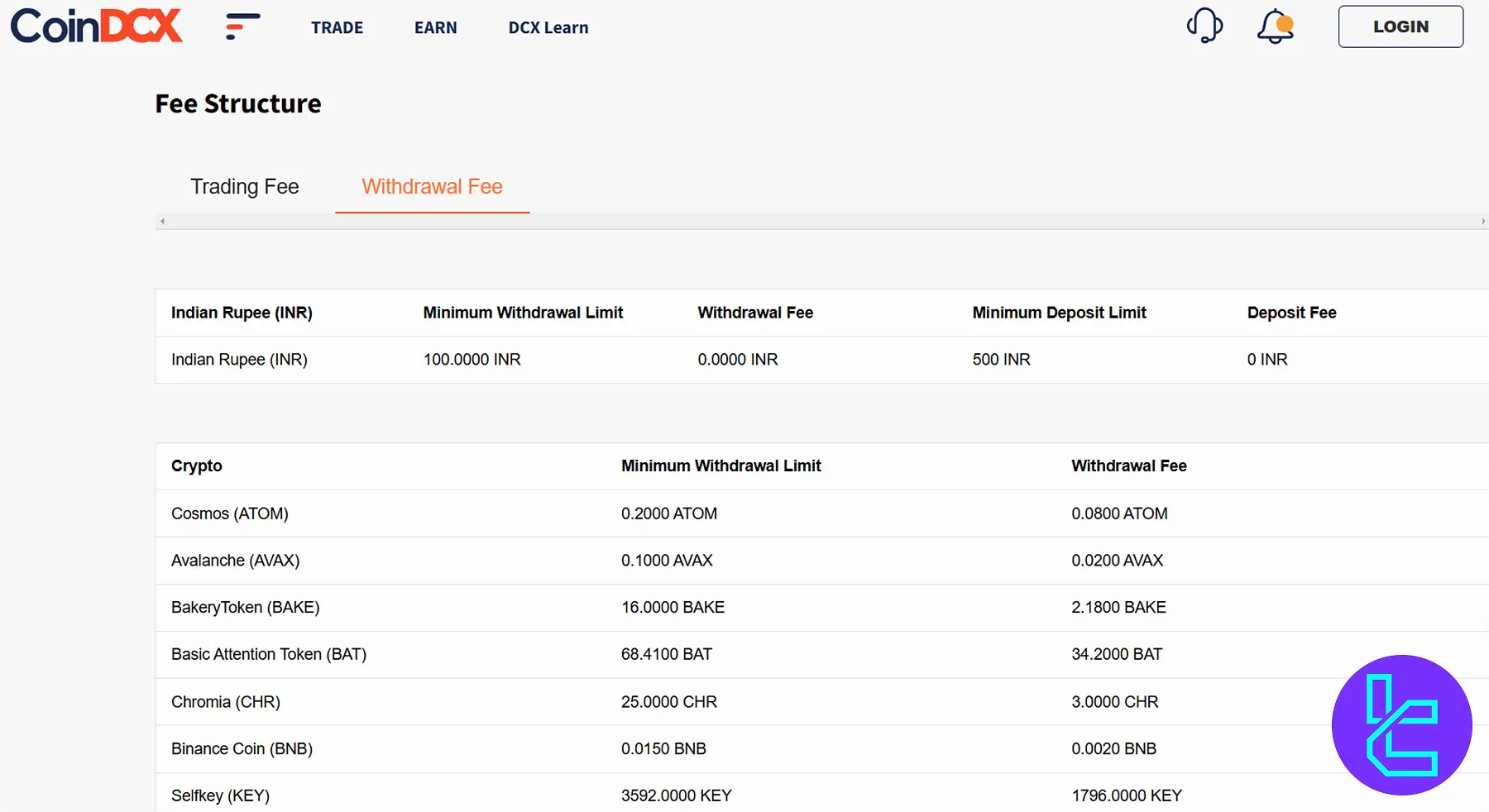

Trading and Non-Trading Fee

CoinDCX charges no fees for deposits, and while INR withdrawals are free, it charges a fee for Crypto withdrawals based on the asset.

The exchange has also implemented a tiered fee structure for various markets, including:

User Level | Spot (INR) Fee | Spot (P2P) Fee | Futures (SDT-M) Fee | |

Maker | Taker | |||

Regular 1 | 0.50% | 0.17% | 0.02% | 0.05% |

Regular 2 | 0.42% | 0.17% | 0.02% | 0.05% |

VIP 1 | 0.17% | 0.17% | 0.02% | 0.048% |

VIP 2 | 0.13% | 0.17% | 0.0175% | 0.048% |

VIP 3 | 0.10% | 0.17% | 0.015% | 0.047% |

VIP 4 | 0.08% | 0.17% | 0.012% | 0.045% |

VIP 5 | 0.07% | 0.17% | 0.010% | 0.041% |

VIP 6 | 0.05% | 0.17% | 0.008% | 0.034% |

VIP 7 | 0.03% | 0.17% | 0.007% | 0.030% |

CoinDCX Exchange Digital Assets

The platform offers a wide range of 500+ digital assets for trading and investment, including:

- Major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC)

- DeFi tokens: Uniswap (UNI), Aave (AAVE), and Compound (COMP)

- Stablecoins: Tether (USDT) and USD Coin (USDC)

- Platform tokens: CoinDCX Token (CCD) and Binance Coin (BNB)

- Altcoins: Polkadot (DOT), Cardano (ADA), and Solana (SOL)

Does CoinDCX Offer Leverage Options?

The exchange provides Margin and Futures trading through CoinDCX Pro with the following key features:

- 270+ Futures trading pairs

- 400+ Margin trading pairs

- Leverage options of up to 1:100 on Futures contracts

- Margin trading with leverage of up to 1:6

Sign up and KYC on CoinDCX Exchange

Registering and completing KYC on CoinDCX is a straightforward and mandatory process. The onboarding process includes account creation and KYC verification to comply with regulatory standards.

#1 Create Your Account

Go to the official CoinDCX website and select “Create Account”. Enter your email and complete the registration form.

#2 Verify Email & Phone

Input the one-time code (OTC) sent to your email. Then, provide your mobile number and confirm it with the SMS-based OTC.

#3 Complete KYC

Upload identification documents:

- Indian Residents: PAN (Tax ID), Aadhaar card, passport, and a live selfie

- International Users: Passport and a valid proof of address (e.g., utility bill or bank statement)

How to Trade on CoinDCX

Trading on CoinDCX is straightforward. After completing registration and verification, you can start trading by following these steps:

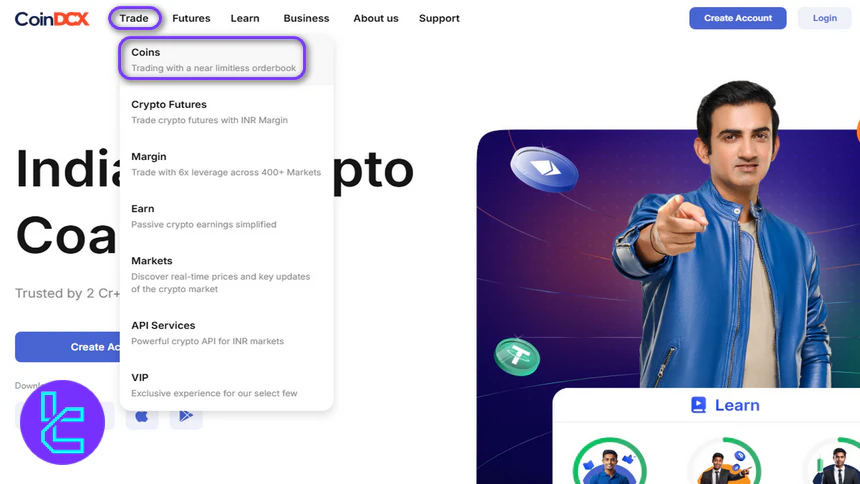

#1 Start Trading

To begin, go to the CoinDCX homepage, click on “Trade,” and then select either “Coins”.

#2 Choose a Trading Pair

On the left-hand side, select the pair you want to trade from the available list or look for it using the search box.

#3 Buy or Sell

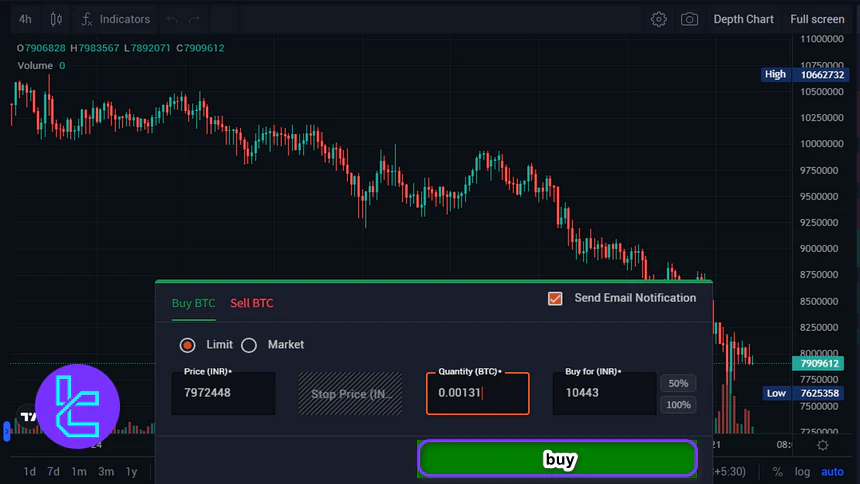

From the right-side corner of the screen, click on “buy” or “Sell” to open the trading tab.

#4 Pick an Order Type

Next, choose an order type. CoinDCX supports limit and market orders.

#5 Specify the Amount

Enter the amount you want to trade in the “Quantity” field.

#6 Confirm the Trade

Finally, click on “Buy” or “Sell” to complete the trade.

CoinDCX Apps and Platforms

The exchange provides a web-based platform with access to TradingView charts and tools and a dedicated feature-rich mobile app.

Check TradingFinder’s list of TradingView indicators to access additional analytical tools.

CoinDCX Trading Volume

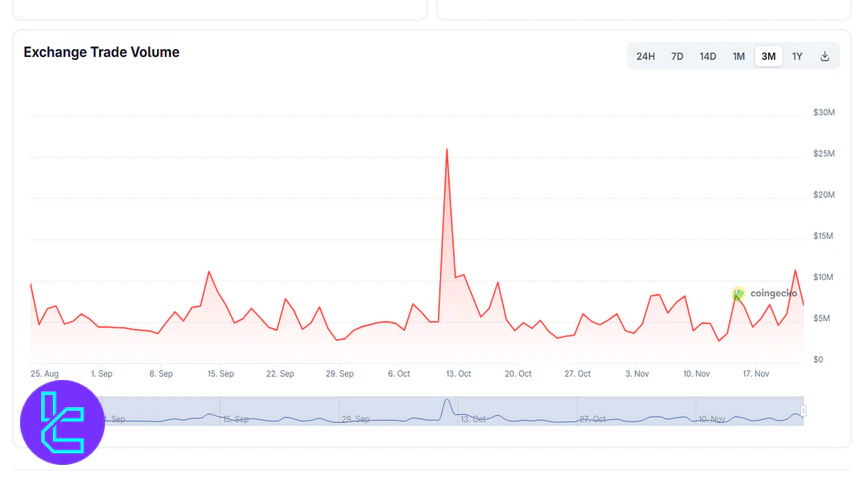

CoinDCX has demonstrated a consistently active trading environment over the last three months, with trading volumes generally ranging between $3 million and $8 million. This steady activity reflects the platform’s reliability and continued engagement from its growing user base.

Based on the CoinDCX CoinGecko chart, the peak trading volume was recorded on October 11, reaching a maximum of $25 million. Aside from this notable spike, the platform has maintained consistent daily activity, showcasing both stability and potential for high-volume trading periods.

CoinDCX Services

It’s time to check out the availability of popular trading services on CoinDCX:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Is CoinDCX Safe?

Founded by Sumit Gupta and Neeraj Khandelwal, the exchange isISO27001-certified and implements various security measures to protect user funds and data, including:

- Cold Storage: 100% of user funds stored in multi-signature cold wallets

- Two Factor Authentication: Mandatory for all accounts

- Regular Security Audits: Conducted by reputable third-party firms

- Proof of Reserves: Verifiable availability and security of all clients’ funds

- AML/CFT Compliance: Strict adherence to regulatory guidelines

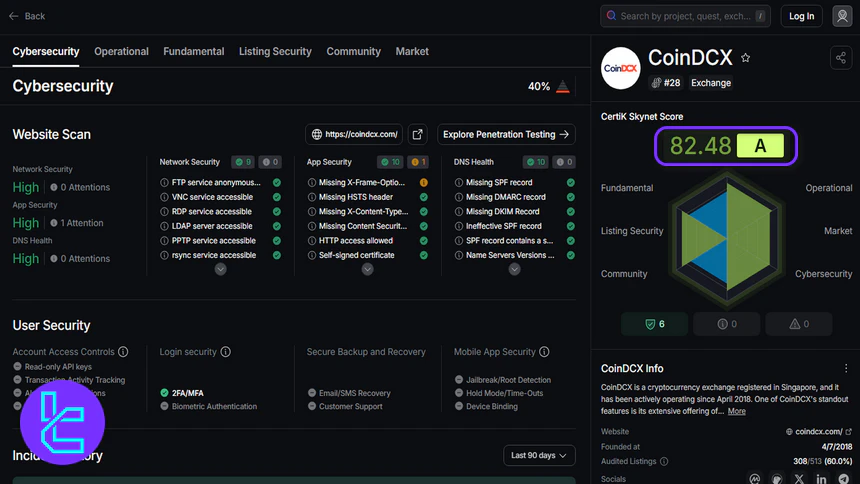

CoinDCX Security Rankings

CoinDCX achieved an overall score of 82.48/100 (A) on CertiK Skynet, reflecting strong security fundamentals and robust operational practices. The platform performs particularly well in operational management and listing security, with scores of 88.99 and 88.77, respectively.

Based on this CertiK Skyent CoinDCX review, cybersecurity measures are solid at 83.28, while market and community metrics, at 84.14 and 71.61, show the exchange maintains stable trading conditions and engages its users in security awareness.

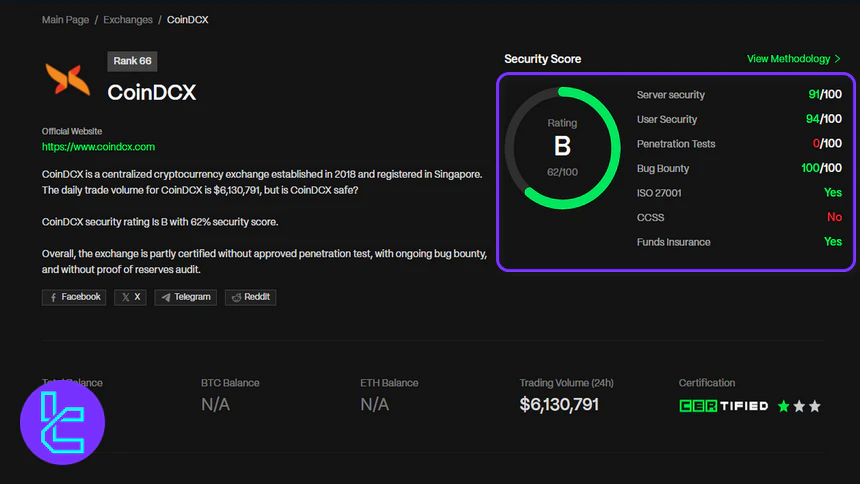

On CER.live, CoinDCX earned an overall score of 62% (B). Acording to this CER.live CoinDCX review, server and user security are excellent, scoring 91/100 and 94/100, demonstrating that both infrastructure and account protection are prioritized.

The bug bounty program is fully active, scoring 100/100, which encourages responsible disclosure of vulnerabilities. However, penetration testing scored 0/100, indicating that publicly available testing is limited.

These results show strong protective measures, with room to expand testing transparency.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 82.48 / 100 (A) |

Fundamental | 75.50 | |

Operational | 88.99 | |

Listing Security | 88.77 | |

Market | 84.14 | |

Community | 71.61 | |

Cybersecurity | 83.28 | |

CER.live Score | Overall Score | 62% (B) |

Server Security | 91/100 | |

User Security | 94/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

Deposits and Withdrawals

The exchange supports crypto and fiat payments. INR deposits are commission-free and processed through two options, including IMPS (Immediate Payment Service) and NEFT (National Electronic Funds Transfer) systems. INR withdrawals are done via bank transfers.

While the company claims that it supports crypto payments, it has suspended all crypto withdrawals due to tax requirements and activates them only through raising a support ticket by the customer (if eligible), according to The Hindu. However, crypto withdrawals are still in place.

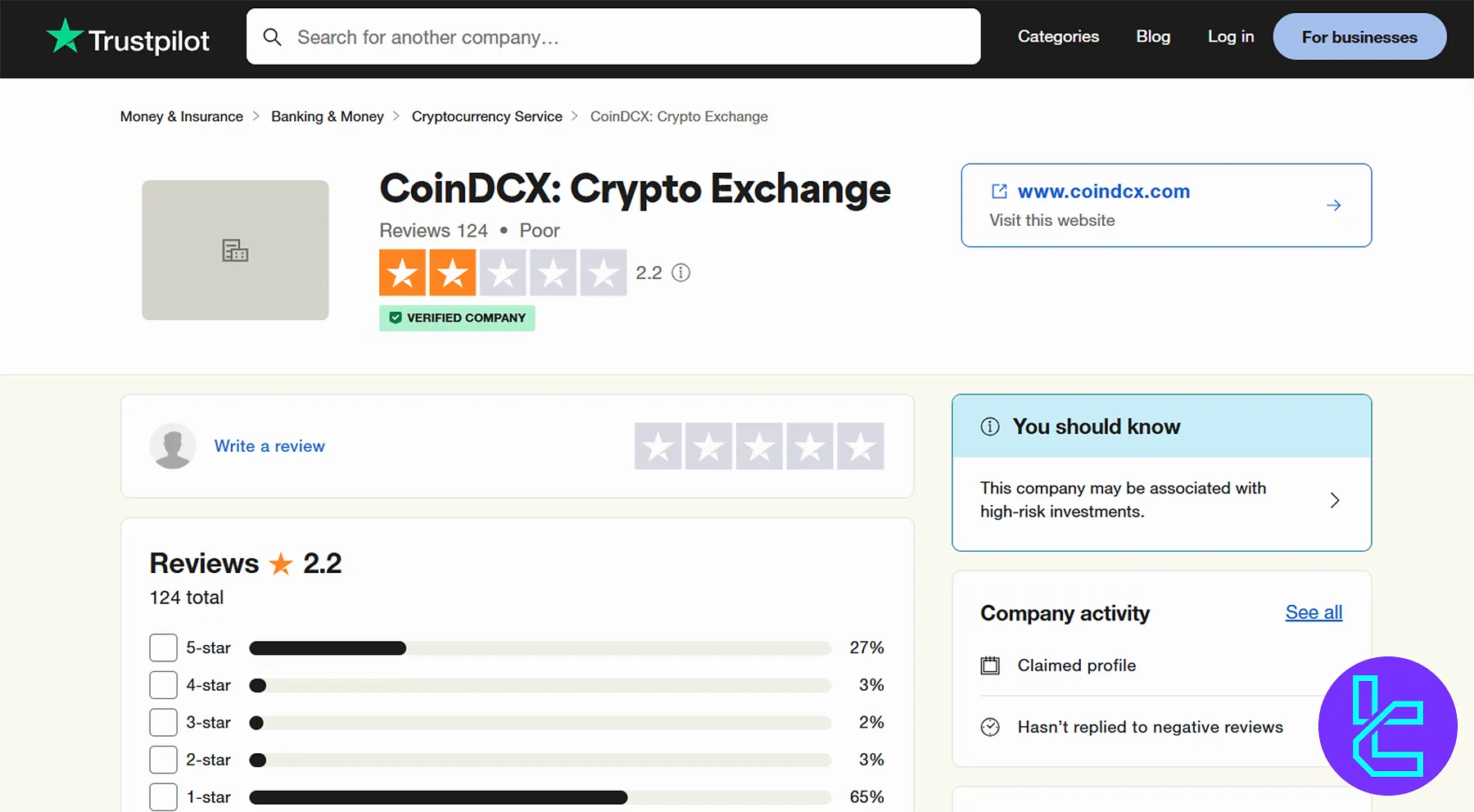

CoinDCX Exchange User Satisfaction

The platform has gained mixed user feedback across various platforms. There are 124 reviews on CoinCDX TrustPilot profile.

Reviews.io | 2.7/5 based on 138 comments |

TrustPilot | 2.2/5 based on 124 ratings |

While 30% of CoinDCX reviews on TrustPilot are positive, 68% are 1-star and 2-star (negative).

CoinDCX Features

Here's a table demonstrating the additional features and services provided by the exchange:

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

CoinDCX Bonus

Through its referral and trading programs, CoinDCX provides multiple opportunities to earn cryptocurrency simply by sharing, trading, and engaging with the platform:

Bonus Type | Requirement / Condition | Reward | Notes |

Referral Program | Friend joins, completes KYC, and deposits crypto | ₹100 worth of BTC per friend | Friend also gets 2% bonus on deposits before Jan 18, 2024; unlimited referrals allowed |

Trade & Win Program | Minimum deposit ₹1500 and achieve trading volume milestones | Up to 2000 USDT based on trading volume | Rewards credited same day in USDT; multiple reward levels apply |

CoinDCX Referral Program

The CoinDCX Referral Program allows you to invite friends and earn rewards when they deposit crypto. Share your unique referral link, ensure your friend completes KYC, and watch your ₹100 BTC reward appear in your account within 48 hours. Your friend also benefits with a 2% guaranteed bonus on crypto deposits made before January 18, 2024.

No minimum deposit is required for you to earn referral rewards. You can earn up to ₹500 for referring five friends, and there is no limit to how many people you can refer. Your friend must complete KYC and claim the offer on the app to qualify for the bonus.

CoinDCX Trade & Win Program

CoinDCX also offers the Trade & Win program, where users can trade in Crypto Futures and win rewards of up to 2000 USDT. Eligible users must be Indian residents, use a coupon code, and make a minimum deposit of ₹1500 to participate. Rewards are distributed based on trading volume levels, providing an incentive to trade more and earn more.

Rewards are credited on the same day in USDT, allowing users to track and utilize them immediately. CoinDCX reserves the right to modify or terminate the program at any time without prior notice, ensuring flexibility and fairness for all participants.

Customer Support

CoinDCX exchange offers 24/7 support through various channels, including a Ticket system and a chatbot.

Ticket | Through the “Client Area” |

Chatbot | Available on the official website |

Copy Trading or Investment Plans on CoinDCX

While the platform doesn’t offer direct copy trading features, you can use its API service to use customized or third-party EAs. CoinDCX also provides comprehensive solutions for passive income, including:

- Earn: Staking cryptocurrencies

- Affiliate: Up to 50% daily commissions on trading fees

Geo-Restrictions on CoinDCX

The company discloses in its “Terms & Conditions” that it accepts clients from all countries. However, to avoid future conflicts with regulatory authorities, it probably doesn’t provide services to countries like Iran, North Korea, and Yemen.

CoinDCX Compared to Its Competitors

The table in this section is a comprehensive fair comparison between the reviewed platform and its peers:

Features | CoinDCX Exchange | Bitget Exchange | MEXC Exchange | |

Number of Assets | 500+ | 400+ | 10000+ | 2800+ |

Maximum Leverage | 1:100 | 1:125 | 1:125 | 1:200 |

Minimum Deposit | 100 IDR | $1 | $15 | $1 |

Spot Maker Fee | 0.03% - 0.5% | 0.02% - 0.1% | 0.10% | 0.05% |

Spot Taker Fee | 0.03% - 0.5% | 0.04% - 0.1% | 0.10% | 0.05% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's opinion and conclusion

CoinDCX provides access to Spot, P2P, and OTC trading on 500+ cryptocurrencies in 9 markets, including BTC, USDT, XRP, ETH, and TRX. The exchange supports INR and Crypto deposits with no transaction costs.

CoinDCX has suspended all crypto withdrawals due to regulatory compliance, a matter that has caused numerous negative CoinDCX reviews. The platform has gained a poor 2.2 score on TrustPilot.