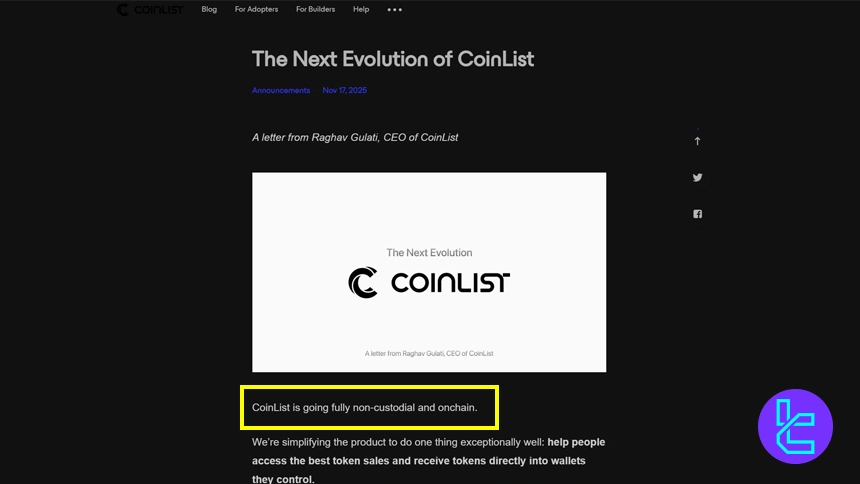

In our latest examination of the company's website. We noticed there have been some changes. Therefore, we dug further and found out that CoinList no longer operates as a crypto exchange; instead, it is now a non-custodial wallet provider with token sales. Here's the CoinList blog post confirming the change:

CoinList provides access to 70+ cryptocurrencies for OTC and Spot trading. Transactions in the OTC market incur a 0.50% fee. The minimum deposit and the minimum trade size are $10 and $5, respectively.

CoinList; About the Crypto Exchange

CoinList was founded in 2017 as a centralized exchange by Andy Bromberg, Brian Tubergen, Graham Jenkin, Joshua Slayton, Kendrick Nguyen, and Paul Menchov.

CoinList is the brand name of Amalgamated Token Services Inc. CoinList Markets LLC (NMLS #1785267) is registered with FinCEN as a Money Services Business (MSB).

The company has acquired licenses as a money transmitter in 6 US states and Puerto Rico. The exchange primarily focuses on accelerating new projects by raising funds for them.

CoinList Key Features

The crypto exchange offers the OTC Desk for simple buying and selling and the CoinList Pro platform for Spot and Perpetual (BETA Test) trading.

Exchange | CoinList |

Launch Date | 2017 |

Levels | 8 levels |

Trading Fees | OTC Trading 0.50% Pro Trading Maker 0.00% - 0.25% Pro Trading Taker 0.025% - 0.40% |

Restricted Countries | Afghanistan, Angola, Canada, Central African Republic, Congo, Cuba, Côte d'Ivoire, Guinea-Bissau, Iran, Iraq, Korea (North), Lebanon, Liberia, Libya, Mali, Myanmar, Nicaragua, Somalia, South Sudan, Sudan, Syrian Arab Republic, Venezuela, Virgin Islands of the United States, Yemen, Zimbabwe, Crimea region of Ukraine, Donetsk People's Republic (DNR), Luhansk People's Republic (LNR), Somaliland |

Supported Coins | 70+ |

Futures Trading | No |

Minimum Deposit | $10 |

Deposit Methods | Bank Wire, ACH, Crypto |

Withdrawal Methods | Bank Wire, ACH, Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | $5 |

Security Factors | MFA, 2FA, Encryption of Data, BCrypt Password Hashing, Employee Background Checks |

Services | OTC Market, Spot Trading, Staking, Testnets & Rewards |

Customer Support Ways | Chatbot, Ticket |

Customer Support Hours | N/A |

Fiat Deposit | Yes |

Affiliate Program | No |

Orders Execution | Market |

Native Token | No |

CoinList Exchange Upsides and Downsides

CoinList’s Launch platform enables users to invest in new projects before listing in any other exchanges.

However, the limited support channels and the lack of services like copy trading can be considered letdowns in this CoinList review.

Pros | Cons |

Staking services | No mobile application |

Early access to new tokens | Strict KYC requirements |

Strong regulatory framework | Geo-restrictions |

Low trading fees for high-volume traders | Limited fiat currency options |

User Level and Fee Reduction

CoinList implements a tiered fee structure that rewards high-volume traders with reduced fees. The platform offers 8 levels of fee discounts for Pro Trading, including:

User Level | 30D Trade Volume (USD) |

Level 1 | 0 – 10K |

Level 2 | 10K – 25K |

Level 3 | 25K – 50K |

Level 4 | 50K – 100K |

Level 5 | 100K – 500K |

Level 6 | 500K – 1M |

Level 7 | 1M – 5M |

Level 8 | 5M+ |

Cloinlist also offers a Karma-based 5-tier structure (Rust to Platinum) used for token sale participation, where higher tiers increase odds of presale allocations.

CoinList Trading and Non-Trading Costs

The platform charges 0.50% per transaction for OTC trading with a minimum fee requirement of $0.25 or crypto-equivalent. However, the spot market fees are calculated based on 30 days USD trade volume in an 8-tier user level system.

User Level | Maker Fee | Taker Fee |

Level 1 | 0.250% | 0.400% |

Level 2 | 0.250% | 0.300% |

Level 3 | 0.150% | 0.250% |

Level 4 | 0.100% | 0.150% |

Level 5 | 0.075% | 0.125% |

Level 6 | 0.060% | 0.100% |

Level 7 | 0.000% | 0.075% |

Level 8 | 0.000% | 0.025% |

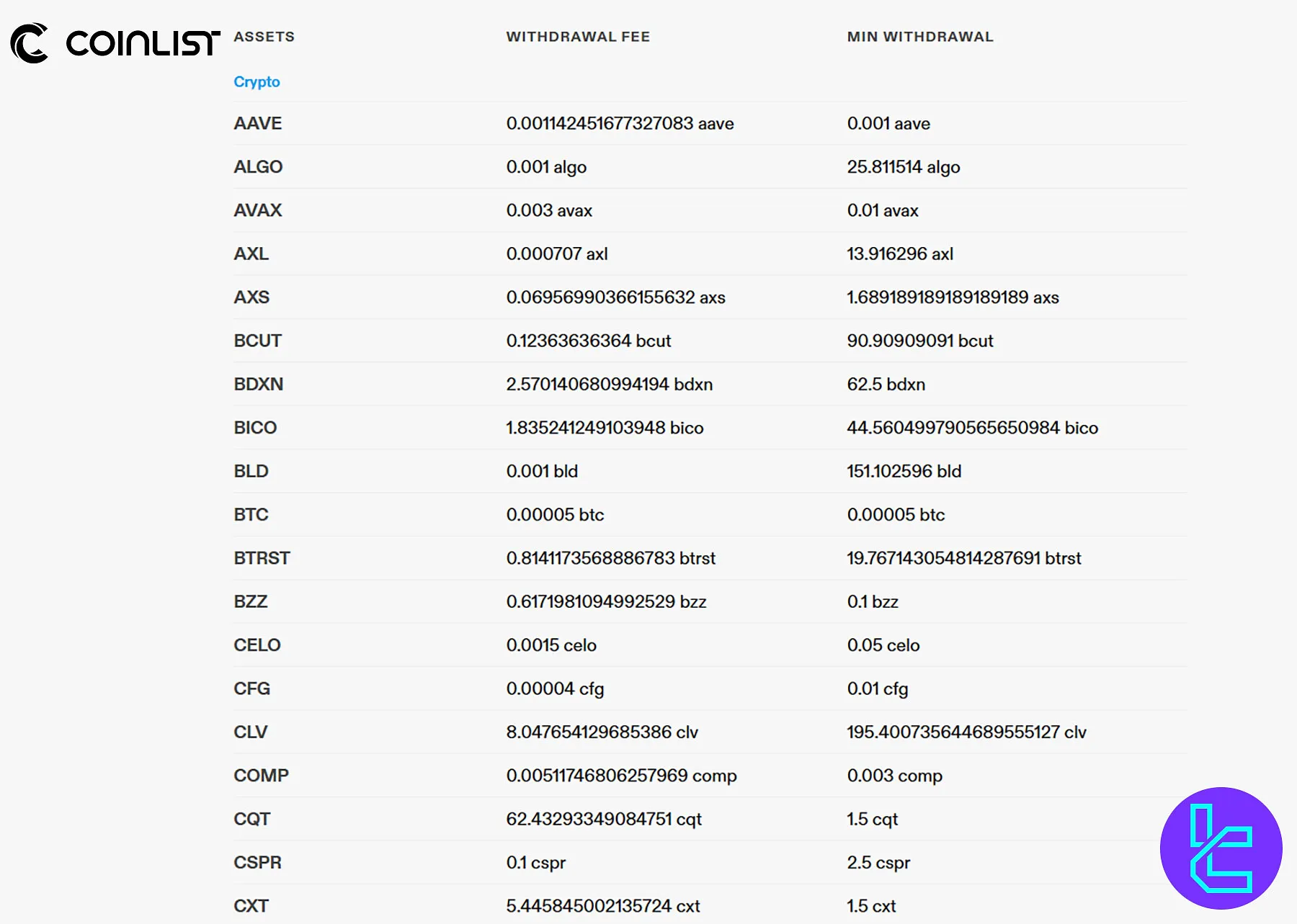

While USD transfers are unavailable at the moment, fees for US Wires and Foreign Wires are $10 and $30, respectively. Note that crypto deposits are free of charge. However, cryptocurrency withdrawals incur a network fee.

Listed Cryptocurrencies on CoinList

The exchange offers a diverse range of 70+ cryptocurrencies and 80+ trading pairs in 7 markets, including USDT, USDC, USD, ETH, DAI, CUSD, and BTC. Popular available digital assets on CoinList:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Filecoin (FIL)

- Celo (CELO)

Leveraged Trading

In this CoinList review, we must mention that the exchange doesn’t currently support leveraged trading. In an exciting development, it has introduced perpetual futures trading to its platform. However, it's important to note that at the time of writing, this feature is only available in beta access.

How to Sign Up with the CoinList Exchange

To open an account with the CoinList exchange, traders must follow an easy process. CoinList registration:

#1 Access the CoinList Website

First, search for CoinList on your favorite browser and enter the official website. Then, click on the "Sign Up" button.

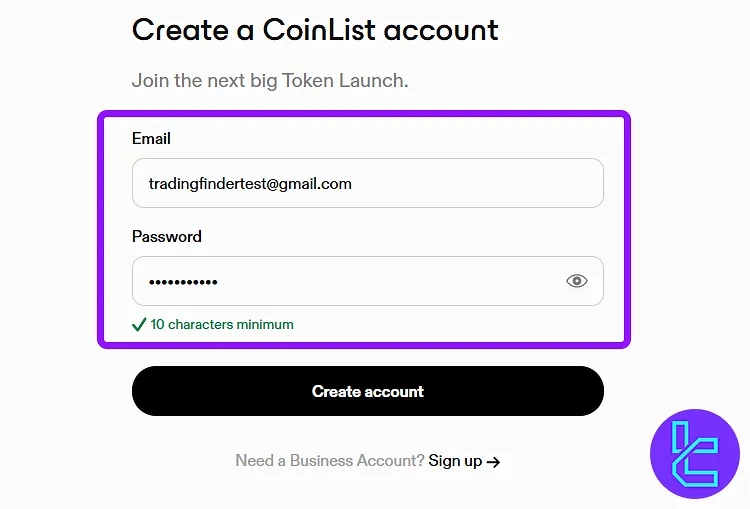

#2 Complete the Registration Form

Enter your email address and create a strong password for your account.

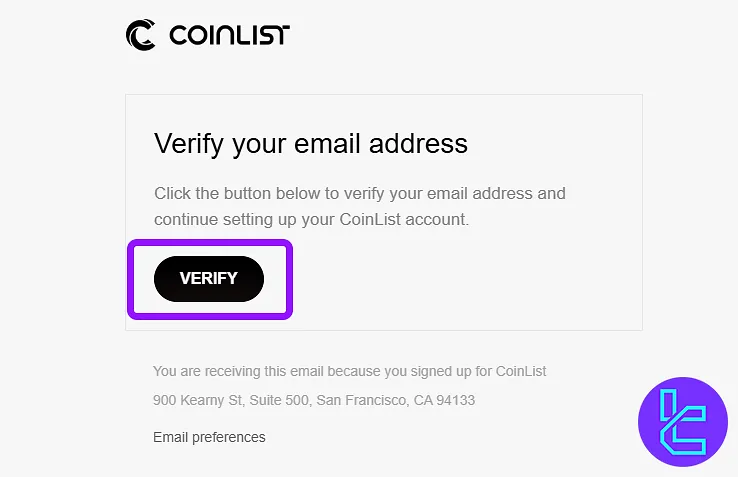

#3 Verify Email Address

Open your inbox and find the email verification link sent by the CoinList exchange. Click on the "Verify" button to activate your email address.

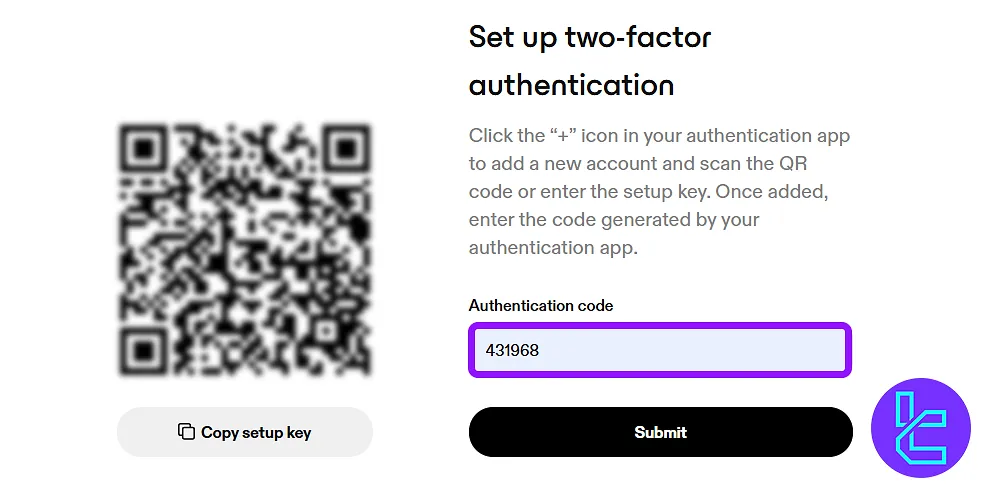

#4 Activate 2FA and Verify Your Account

Scan the provided QR code and activate 2-factor authentication using an app like Google Authenticator.

Now, upload the necessary identity and address documents to verify your account and access the trading dashboard.

CoinList Exchange App and Platform

As a disappointment in this CoinList review, the exchange hasn’t developed a mobile application. It only offers a web-based platform for spot trading.

CoinList Security and Safety

CoinList employs a multi-layered security framework that integrates industry-leading safeguards, including:

- Strict access controls

- End-to-End encryption

- BCrypt hashing

- Multi-factor authentication (MFA)

- Employee background checks

CoinList Payment Methods

While the exchange typically supports bank wire and ACH for USD transactions, at the time of writing this CoinList review, these options are not available. The platform is in the process of upgrading its systems and expanding its banking partnerships.

Users should be aware that they can only deposit and withdraw cryptocurrencies using various blockchain networks, which may be a limitation for those looking to use fiat currencies.

Minimum order size for trading on CoinList starts from $1 for USD/USDT pairs. Overall, the platform sets a minimum trade amount of $5 and requires at least a $10 deposit to begin trading activity.

CoinList Exchange User Experience

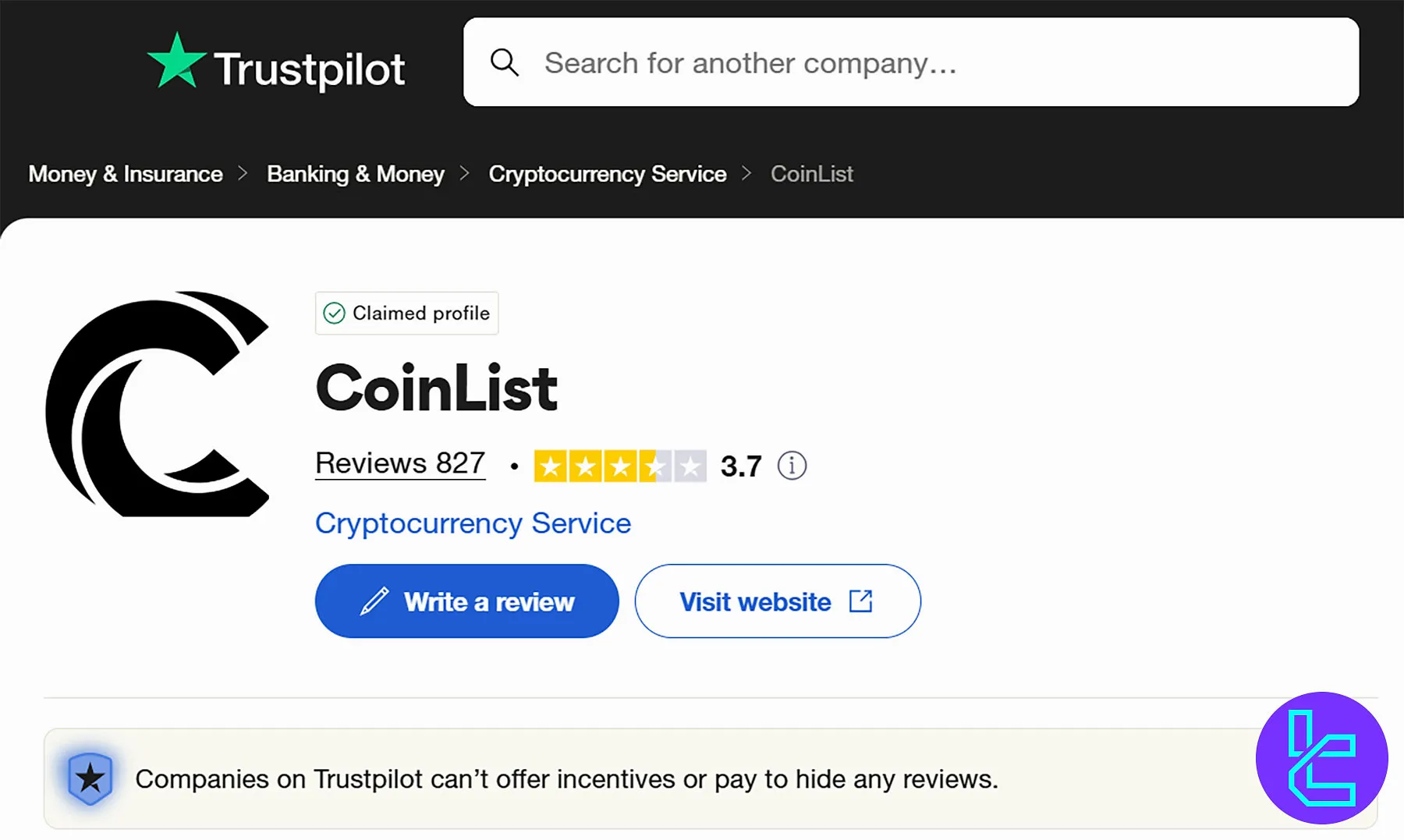

The platform has an average standing in experts' and users’ eyes. There are 827 CoinList reviews on Trustpilot.

CoinGecko | 6 out of 10 |

3.7 out of 5 |

57% of comments on the exchange’s TP profile are negative (1-star and 2-star), while only 41% are positive (4-star and 5-star).

Coinlist Features

CoinList exchange provides various features to traders and allows them to use all sorts of cryptocurrency-related features.

Feature | Availability |

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | Yes |

Gift Card | No |

How to Reach CoinList Support?

The lack of a live chat feature and a call center is a big disappointment in this CoinList review. The platform only offers a ticket system and a chatbot as support channels.

- Ticket: Trough the “Help Center”;

- Chatbot: Available on the official website.

CoinList Exchange Investment and Growth Plans

While the platform doesn’t offer copy/social trading and a referral program, it provides staking services on various cryptocurrencies. Users can earn:

- Mina (up to 13.84%)

- Threshold (up to 12.75%)

- Solana (up to 6.97%)

- NEAR Protocol (up to 6.96%)

- Ethereum (up to 3.76%)

- SUI (2.5%–3.35%)

- Casper (6.8%)

- Axelar (7%)

CoinList also rewards its community for testing new products like GVNR, ZEROBASE, Moseiki, Atlas Network, and OpenLedger.

CoinList Exchange Red Flag Countries

The platform provides its services in 9 states of America, including California, Delaware, Florida, Hawaii, Illinois, Montana, New Jersey, Vermont, and Washington. Other states of America are restricted, in addition to the following regions:

- Afghanistan

- Angola

- Canada

- Central African Republic

- Congo

- Congo (Dem. Rep.)

- Cuba

- Côte d'Ivoire

- Guinea-Bissau

- Iran

- Iraq

- Korea (North)

- Lebanon

- Liberia

- Libya

- Mali

- Myanmar

- Nicaragua

- Somalia

- South Sudan

- Sudan

- Syrian Arab Republic

- Venezuela

- Virgin Islands of the United States

- Yemen

- Zimbabwe

- Crimea region of Ukraine

- Donetsk People's Republic (DNR)

- Luhansk People's Republic (LNR)

- Somaliland

CoinList Services Compared to Other Exchanges

Here's a detailed comparison of CoinList features and services compared to top cryptocurrency exchanges:

Parameters | Coinlist Exchange | |||

Number of Assets | 70+ | 400+ | 1300+ | 7800+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:10 For Margin Trading/1:12 for Futures Trading |

Minimum Deposit | $10 | $1 | Varies by Cryptocurrency | Varies on Payment Method |

Trading Fees | From 0.00% Maker, 0.025% Taker | From 0.02% Maker, 0.04% Taker | From 0.015% Maker, 0.005% Taker | From -0.01% Maker, 0.03% Taker |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

CoinList has a Spot market with 80+ trading pairs in 7 markets, including USDT, USDC, USD, ETH, DAI, CUSD, and BTC. The exchange has a score of 3.7 out of 5 on Trustpilot. The platform offers rewards for participating in GVNR and ZEROBASE testnets.