CoinMate offers16 crypto trading pairs in three markets, including CZK, EUR, and BTC. Maker fees range from -0.04% to 0.40%, and taker fees range from 0.10% to 0.60%.

The exchange provides API services and trading bots for automated trading. It supports various projects, including Štosuj.cz, Bitrobot Pro, and DCA Bot.

CoinMate; The Exchange's Information and Introduction

Coinmate.io was founded in 2014 by Roman Valihrach and Daniel Houška as the first Czech crypto exchange.

CoinMate received funding from the Miton C crypto fund company in 2020. It provides institutional crypto services to companies like Tipsport and Web3Hub ZLIN. Key features of CoinMate:

- Member of the Czech Fintech Association

- ISO/IEC 27001:2022 certified

- Offices in Prague and Zlín

- Crypto purchase from €2

CoinMate CEO

As the Founder and CEO of CoinMate, Roman Valihrach has shaped the exchange into one of the most reliable and user-centric cryptocurrency platforms in the region.

With over a decade of combined experience in finance and IT, his leadership is defined by a clear vision: building a safe, seamless, and accessible environment for anyone stepping into the world of digital assets.

His approach to running CoinMate is grounded in security, transparency, and long-term value for users.

The platform’s growth is driven by a mission to empower individuals on their journey toward financial independence, offering frictionless and borderless payment solutions while embracing the transformative potential of digital currencies.

Based on the Roman Valihrach LinkedIn profile, before launching CoinMate in 2021, he co-founded Confirmo in 2014, a crucial phase that strengthened his expertise in digital currency operations, peer-to-peer technologies, and crypto-focused consultancy.

CoinMate Exchange Specifications

The crypto exchange offers various services, including API, Trading Bots, and Recurring Buy. Here's a detailed look at the exchange's specifications:

Exchange | CoinMate |

Launch Date | 2014 |

Levels | 8 Levels |

Trading Fees | Maker from -0.04% to 0.40% Taker from 0.10% to 0.60% |

Restricted Countries | United States, Iran, North Korea, Myanmar, Syria, Iraq, Yemen, Venezuela, Sudan, Afghanistan |

Supported Coins | 26 |

Futures Trading | No |

Minimum Deposit | €2 |

Deposit Methods | VISA, MasterCard, SEPA, CZK Bank Transfer, Crypto |

Withdrawal Methods | VISA, MasterCard, SEPA, CZK Bank Transfer, Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | €2 |

Security Factors | Cold Storage, Two-Factor Authentication (2FA), Advanced Custody Solutions, Segregated Accounts, Bug Bounty Program |

Services | OTC Market, Spot Trading, Recurring Buy |

Customer Support Ways | Email, Ticket |

Customer Support Hours | Available on weekdays |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

CoinMate Advantages and Disadvantages

The exchange comes with its own set of strengths and weaknesses. Understanding these can help potential users make an informed decision about whether to use the platform.

Pros | Cons |

Fast transaction processing | Limited number of cryptocurrency pairs available for trading |

Robust security measures, including cold storage and 2FA | Lack of advanced trading features like leverage |

User-friendly interface for beginners | No mobile applications |

Competitive fee structure | Limited customer support options |

CoinMate User Levels

The platform offers fee discounts based on 30-day trading volume in a tiered structure with 8 levels.

Level | 30 Day Trading Volume (EUR) | Maker Fee | Taker Fee |

1 | < 10,000 | 0.40% | 0.60% |

2 | < 100,000 | 0.20% | 0.30% |

3 | < 250,000 | 0.12% | 0.23% |

4 | < 500,000 | 0.09% | 0.21% |

5 | < 1,000,000 | 0.05% | 0.18% |

6 | < 3,000,000 | 0.03% | 0.15% |

7 | < 15,000,000 | 0.02% | 0.12% |

8 | >= 15,000,000 | -0.04% | 0.10% |

Note: The negative fee is credited to the client’s account as a rebate. The user level is updated hourly.

Trading and Non-Trading Costs

As mentioned in this CoinMate review, the broker has a default maker/taker fee of 0.40%/0.60%. It charges spreads for quick buying and selling. CoinMate's other charges:

- Compliance Fee: 1% of the value of the transaction

- Administrative Fee: €10 or CZK 250

- CZK/EUR Card Payment Deposit: CZK (4.90%) and EUR (1.90%)

- EUR SEPA Transfer: €1

Listed Cryptocurrencies on CoinMate Exchange

The platform lists26 cryptocurrencies for quick buy/sell and offers 16 trading pairs across 3 markets, includingEUR, CZK, and BTC. Available digital assets on CoinMate:

- Bitcoin (BTC)

- Solana (SOL)

- XRP

- USDC

- Ethereum (ETH)

- Cardano (ADA)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Binance Coin (BNB)

- Avalanche (AVAX)

- Chainlink (LINK)

- Polkadot (DOT)

- NEAR Protocol (NEAR)

- Filecoin (FIL)

- Dogwifhat (WIF)

- Sonic (S)

- Injective (INJ)

- Cosmos (ATOM)

- Uniswap (UNI)

- net (IO)

- Jito (JTO)

- Pepe (PEPE)

- Shiba Inu (SHIB)

- Tron (TRX)

- Polygon (POL)

- Worldcoin (WLD)

Does CoinMate Offer Leverage Options?

The exchange does not offer leverage options for trading. It has chosen to focus on providing a straightforward and secure platform for spot trading of cryptocurrencies without the added complexity and risk associated with leveraged trading.

CoinMate Sign Up and Verification

To begin trading with CoinMate exchange, follow these CoinMate registration and verification steps below:

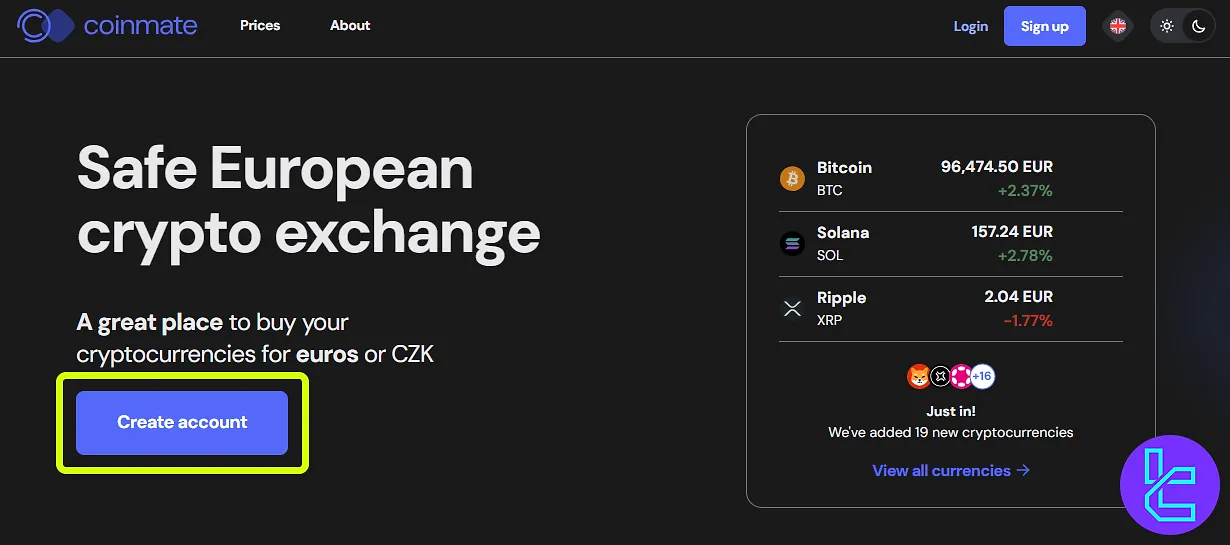

#1 Access the Official CoinMate Website

Search for CoinMate on your favorite browser and enter it. Once there, click on the "Create account" button.

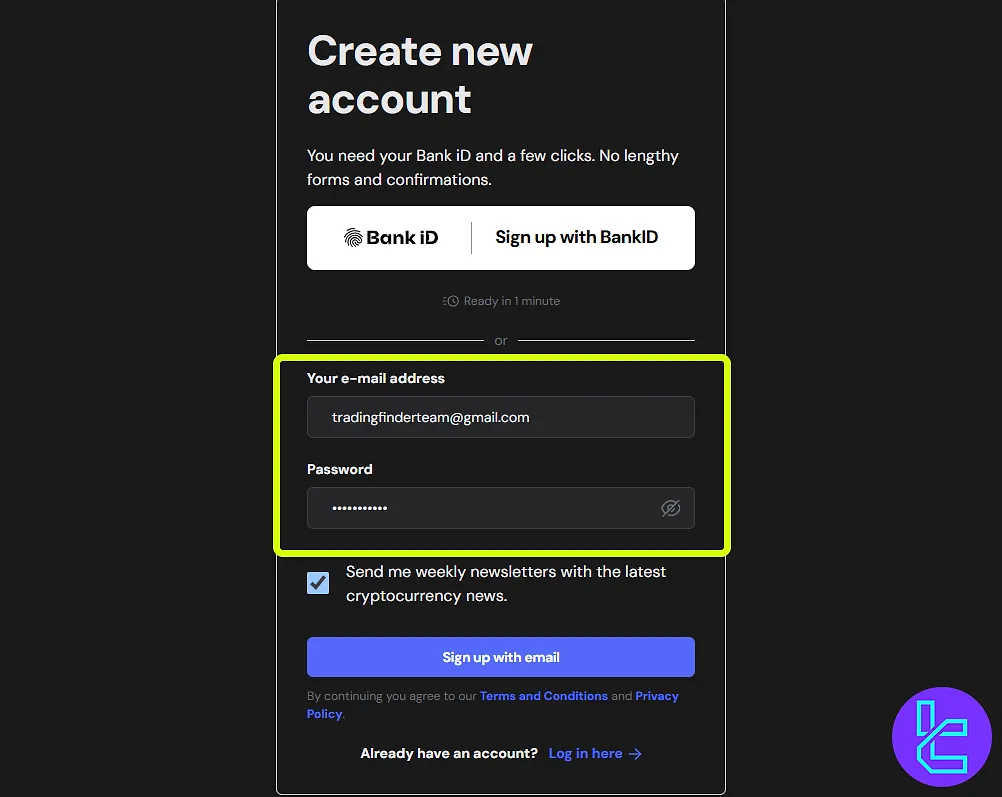

#2 Enter Your Email and Create a Password

Input your email address in the required field and create a strong password with at least 8 characters for your account.

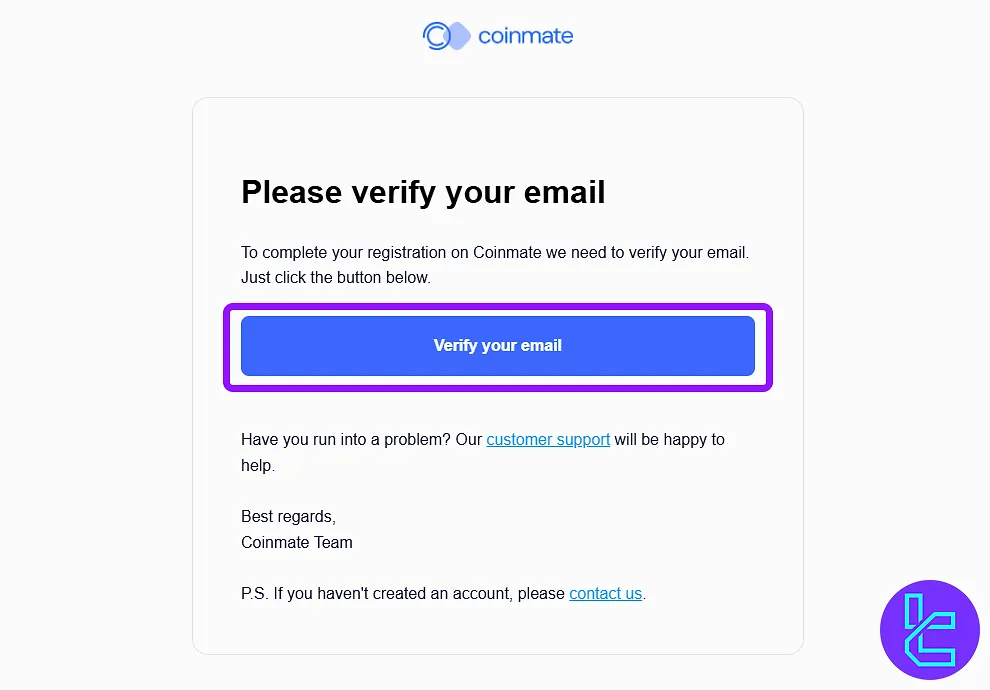

#3 Verify Your Email

Now, open your email and look for the verification link sent by the CoinMate exchange. Once found, click on the "Verify your email" button.

Now that your account is ready, you must choose your account type, provide your phone number, enter your residential address, and verify your identity to use this cryptocurrency exchange features.

CoinMate Trading Guide

Trading on CoinMate is simple and user-friendly. Once you complete your registration and account verification, you can start trading by following these steps:

#1 Start Trading

To begin, after registration and verification, open the CoinMate homepage and click on “Start Investing”

#2 Choose the Base Currency

On this page, simple click on the highlighted currency field and choose from Euro or Czech crowns based on your account balance. Make sure you have enough funds in your accounts.

#3 Choose a Cryptocurrency

Now click on the lower field, and select the cryptocurrency you want to buy or sell from the available list or look for it using the search box.

#4 Specify the Amount

Enter the exact amount of cryptocurrency you want to trade in the “I Get” field.

#5 Confirm the Trade

Now you only need to click on “Buy” or “Sell” to complete your transaction.

CoinMate Exchange App and Trading Platform

CoinMate provides two trading interfaces, including aQuick Buy/Sell module for beginners and an advanced TradingView-integrated terminal for experienced users. While no dedicated mobile app exists, the platform is fully responsive and performs well on smartphone browsers.

CoinMate Services

In the table below you can check out the availability of trading services on this exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

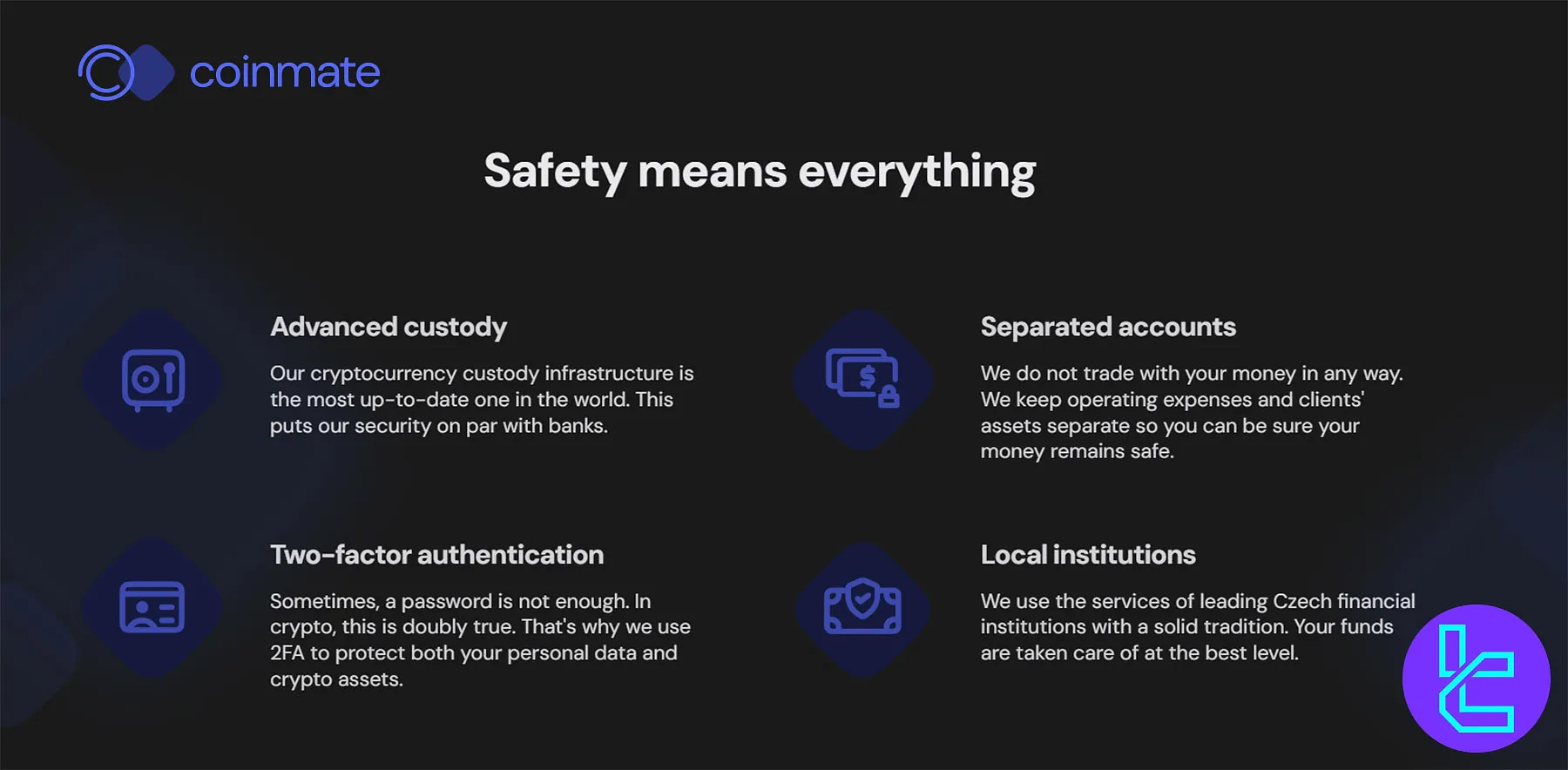

Security Measures to Protect User Funds

CoinMate places a strong emphasis on security to protect users' data and funds. The exchange has implemented several robust measures to ensure the safety of its platform, including:

- Cold Storage: 98% of user funds stored in offline and cold wallets

- Two-Factor Authentication (2FA): 2FA feature for additional account security

- Advanced Custody Solutions

- Segregated Accounts: Keeping client funds in segregated accounts

- Local Institutions: Backed by leading Czech financial institutions

- Bug Bounty Program

CoinMate Security Rankings

CoinMate’s latest CER.live security evaluation places the exchange in a BBB rating tier with an overall score of 72.74/100, reflecting a generally solid security posture supported by strong technical foundations.

So based on the CERlive CoinMate review, the platform performs particularly well in Listing Security (83.42) and Cybersecurity (83.28), indicating robust protection mechanisms and reliable asset-listing standards.

While its Market (76.90) and Community (67.85) metrics show healthy ecosystem stability and user engagement, the results also highlight areas with room for improvement, most notably the Fundamental score (60.50) and Operational score (67.27).

These suggest that although CoinMate is structurally secure and technically competent, it has opportunities to strengthen internal processes and foundational safeguards.

Metric | Value |

Overall Score | 72.74 / 100 (BBB) |

Fundamental | 60.50 |

Operational | 67.27 |

Listing Security | 83.42 |

Market | 76.90 |

Community | 67.85 |

Cybersecurity | 83.28 |

Deposit and Withdrawal Methods

CoinMate accepts both fiat transactions and cryptocurrencies. It supports EUR and CZK payments via various methods, including:

- SEPA Transfer

- VISA

- MasterCard

While CZK bank transfers incur no deposit fees, they come with a CZK 75 withdrawal fee. CoinMate maintains a low entry threshold with a minimum deposit of just 1 EUR, 25 CZK, or 0.001 BTC. This makes the exchange suitable for retail investors starting with smaller amounts.

Trust Scores

There are 1,030 CoinMate reviews on Trustpilot, with the majority being positive, resulting in a great score of 3.8 out of 5.

The exchange’s profile has no rating on CoinGecko. 84% of comments on the CoinMate Trustpilot profile are 4-star and 5-star, and only 10% are negative (1-star and 2-star).

CoinMate Exchange Features

The table below provides information about the availability of certain features on the CoinMate exchnage.

Feature | Availability |

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | No |

CoinMate Bonus

CoinMate provides two straightforward bonus opportunities designed to reward both new users and those who bring friends to the platform.

Each bonus is structured with clear conditions, fast processing, and a focus on encouraging long-term engagement with cryptocurrency investing:

Bonus Type | Reward | Credit Time |

Welcome Bonus | 500 CZK | 14 days after requirements are met |

Referral Bonus | 500 CZK (for both users) | 14 days after requirements are met |

Welcome Bonus

CoinMate offers all new users a 500 CZK bonus simply for starting their crypto journey on the platform. The process is quick: register, complete the verification steps, and purchase at least 5,000 CZK worth of cryptocurrencies within your first 30 days.

Once these conditions are met, the bonus will be credited to your account 14 days later.

This reward is meant to give beginners a smooth entry into digital assets while benefiting from CoinMate’s secure environment, Czech ownership, and high-quality support.

Referral Bonus

Users can also earn an additional 500 CZK for each friend they invite to CoinMate, and the friend earns the same amount.

There is no limit to how many people you can refer. Your invited friend must register using your unique referral link, complete identity verification, and purchase at least 5,000 CZK of crypto within 30 days. After the conditions are met, both accounts receive 500 CZK after 14 days.

This referral program rewards community building while helping more users start investing with a trusted Czech exchange.

CoinMate Customer Service

Led by CEO Roman Valihrach, the exchange boasts a reply time of less than 24 hours. The support channels are limited to an email address and a ticket system.

- Email: support@coinmate.io

- Ticket: Through the “Contact” page

Investment and Growth Plans

CoinMate doesn’t offer staking or anyEarn program. However, the platform features a “Recurring Buy” option, which enables users to set up automatic, periodic purchases of cryptocurrencies.

CoinMate Exchange Restricted Countries

The platform, although generally accessible to users from most countries, has some restrictions in place due to regulatory requirements. CoinMate’s restricted countries:

- United States

- Iran

- North Korea

- Myanmar

- Syria

- Iraq

- Yemen

- Venezuela

- Sudan

- Afghanistan

CoinMate Comparison with Other Exchanges

The table below helps you better understand the quality of CoinMate services compared to well-knwon cryptocurrency exchnages.

Parameters | CoinMate Exchange | |||

Number of Assets | 26 | 700+ | 2500+ | 2800+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:200 |

Minimum Deposit | €2 | Varies by Cryptocurrency | Varies by Payment Method | $1 |

Trading Fees | From -0.04% Maker, 0.1% Taker | 0.02% | From -0.005% Maker, 0.025 Taker | 0.05% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer’s Opinion and Conclusion

CoinMate offers access to 26 cryptocurrencies for quick buying and selling with fixed spreads.

The exchange accepts VISA, MasterCard, SEPA, and CZK Bank Transfer methods. It has a score of 3.8 out of 5 on Trustpilot.