Currency.com provides access to 100+ cryptocurrencies for simple buy and sell with EUR and USD. The minimum deposit and minimum trade size are $20.

The exchange operates in 100+ countries, including Europe and the United States.

Currency.com; Exchange's Information and Regulation

Currency.com is a centralized global exchange with offices in the United States, Gibraltar, and Poland.

The company was founded in 2018 by Vitaliy Kedyk, the former CEO. The exchange operates in more than 100 countries through two legal entities, including:

- Currency Com EU Sp z o.o. incorporated in Poland (Company No. 529690593)

- Currency Com Limited incorporated in Gibraltar (Company No. 117543)

The exchange is registered with the Financial Supervision Commission (FSC) of Poland under the number RDWW-1547 and the Gibraltar Financial Services Commission (FSC) with license number 25032.

Also, its legal operations are authorized under Presidential Decree No. 8, which enables registered entities to provide cryptocurrency-related services in Belarus legally.

Currency.com Key Offerings

The crypto exchange provides a regulated framework for cryptocurrency/fiatwallet services, transfer services, and buying/selling digital assets.

Exchange | Currency.com |

Launch Date | 2018 |

Levels | None |

Trading Fees | 1% |

Restricted Countries | N/A |

Supported Coins | 100+ |

Futures Trading | No |

Minimum Deposit | $20 |

Deposit Methods | Crypto, ACH, SWIFT, SEPA, Credit/Debit Cards |

Withdrawal Methods | Crypto, ACH, SWIFT, SEPA, Credit/Debit Cards |

Maximum Leverage | 1:1 |

Minimum Trade Size | $20 |

Security Factors | Data Encryption, Multi-Signature Wallets, Secure Socket Layer (SSL) Technology, Regular security audits, Two-Factor Authentication (2FA) |

Services | Crypto Buy/Sell, Crypto Wallet |

Customer Support Ways | Email, Phone, Ticket |

Customer Support Hours | N/A |

Fiat Deposit | Yes |

Affiliate Program | No |

Orders Execution | Market |

Native Token | No |

Currency.com Exchange Upsides and Downsides

While trading with Currency.com has the advantage of supporting multiple fiat currencies (EUR and USD), the lack of a live chat feature can be disappointing.

Pros | Cons |

Limited support channels | Limited asset offerings (100+) |

User-friendly interface | Lack of advanced trading features (Spot market or Futures contracts) |

Regulated platform | No live chat feature |

Great trust score | No copy trading, social trading, or API services |

Does Currency.com Offer User Levels?

When writing this Currency.com review, the exchange does not appear to offer a tiered user level system or fee reductions.

Instead, the platform provides a uniform experience for all users, focusing on delivering a comprehensive range of features and services.

Fees and Commissions

Currency.com implements a flat fee structure for the crypto exchange service and withdrawals. Note that all deposits are free of charge.

- Exchange: 1% transaction fee in the account’s currency (USD or EUR)

- Fiat Withdrawal: From €5 / $5

- Crypto Withdrawal: Variable based on the digital asset

Currency.com Exchange Digital Assets

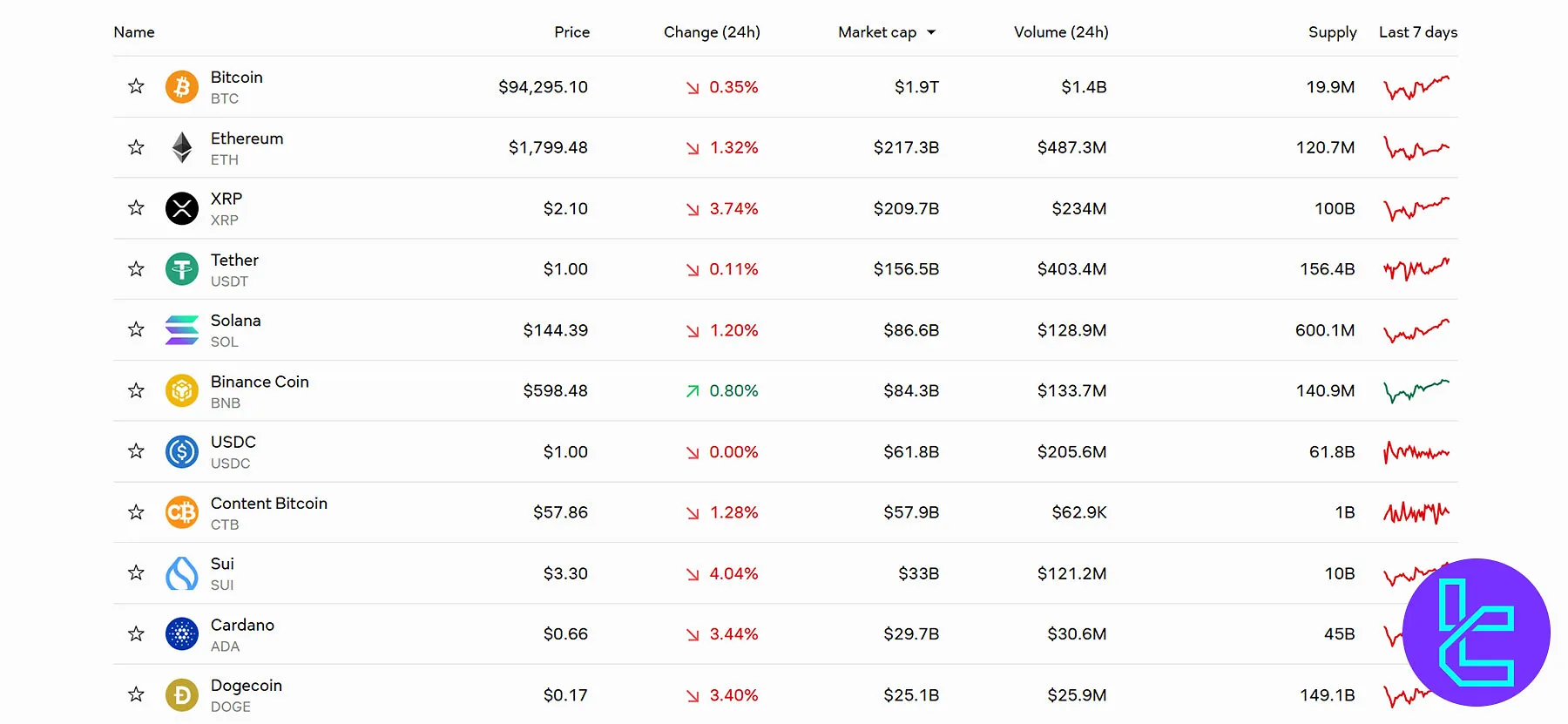

The platform has listed 100+ crypto assets for buy and sell with EUR and USD. Popular digital assets on Currency.com:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP (XRP)

- Tether (USDT)

- Solana (SOL)

- Binance Coin (BNB)

- Sui (SUI)

- Cardano (ADA)

- Dogecoin (DOGE)

- Tron (TRX)

- Chainlink (LINK)

- Toncoin (TON)

Margin and Futures Trading on Currency.com

While the exchange offered access to margin and futures markets, at the time of writing this Currency.com review, the platform doesn’t support leveraged trading or perpetual instruments.

Currency.com Registration and KYC

To register with the exchange, you must be above 18 and undergo a comprehensive KYC verification process. There are 3 steps to the account creation and verification, and each will be explained in this section:

#1 Go to the Official Website

Visit the exchange’s genuine site, then find and click on "Sign Up". It will navigate you to the form.

#2 Fill Out the Form

Enter your email address and choose your country of residence, then set a password for your account in the registration form.

Afterwards, provide the verification code sent to your email. Also, verify your phone number via the OTC sent by SMS.

#3 Identity Verification

Now that you’ve created your account, you must provide supporting documents to access Currency.com's full features, including:

- Identification Documents: Driver’s license, passport, ID card, or residence permit

- Address Verification: Bank statement, utility bill, residence certificate, or tax statements

Does Currency.com Exchange Have Mobile Applications?

The lack of a dedicated mobile application is one of the biggest letdowns in this Currency.com review.

The exchange provides services via its web-based platform with access to real-time market data, account management, and a crypto wallet.

Currency.com Security Measures

The company has implemented various internal security measures and third-party integrations to protect clients’ funds and information, including:

- Data encryption protocols

- Multi-signature wallets

- Secure Socket Layer (SSL) technology

- Regular security audits

- Mandatory two-factor authentication (2FA)

Client funds are held in segregated bank accounts that are entirely separate from the platform’s operational capital. Notably, Currency.com maintains full reserves, explicitly prohibiting the lending or rehypothecation of customer funds, even for margin trading purposes.

Currency.com Payment Methods

The exchange supports crypto and fiat payments for crypto buy and sell through various methods, including:

Payment Method | Min Deposit | Min Withdrawal | Withdrawal Fee |

EUR (Domestic SEPA) | €20 | €20 | €5 |

EUR (International SWIFT) | €100 | €250 | 0.1% min €50 max €250 |

USD (Domestic ACH/Wire) | $20 | $20 | $5 |

USD (International SWIFT) | $100 | $250 | 0.1% min $50 max $250 |

Bitcoin | 0.0001 BTC | 0.0002 BTC | 0.0001 BTC |

Ethereum | 0.003 ETH | 0.008 ETH | 0.002 ETH |

USDT (ERC20) | 10 USDT | 20 USDT | 5 USDT |

USDC (ERC20) | 10 USDC | 20 USDC | 5 USDC |

Solana | 0.01 SOL | 0.1 SOL | 0.01 SOL |

Tron | 1 TRX | 50 TRX | 1 TRX |

The exchange also accepts Credit/Debit Card payments. However, the fee schedule is not disclosed on its website.

Currency.com Trust Scores

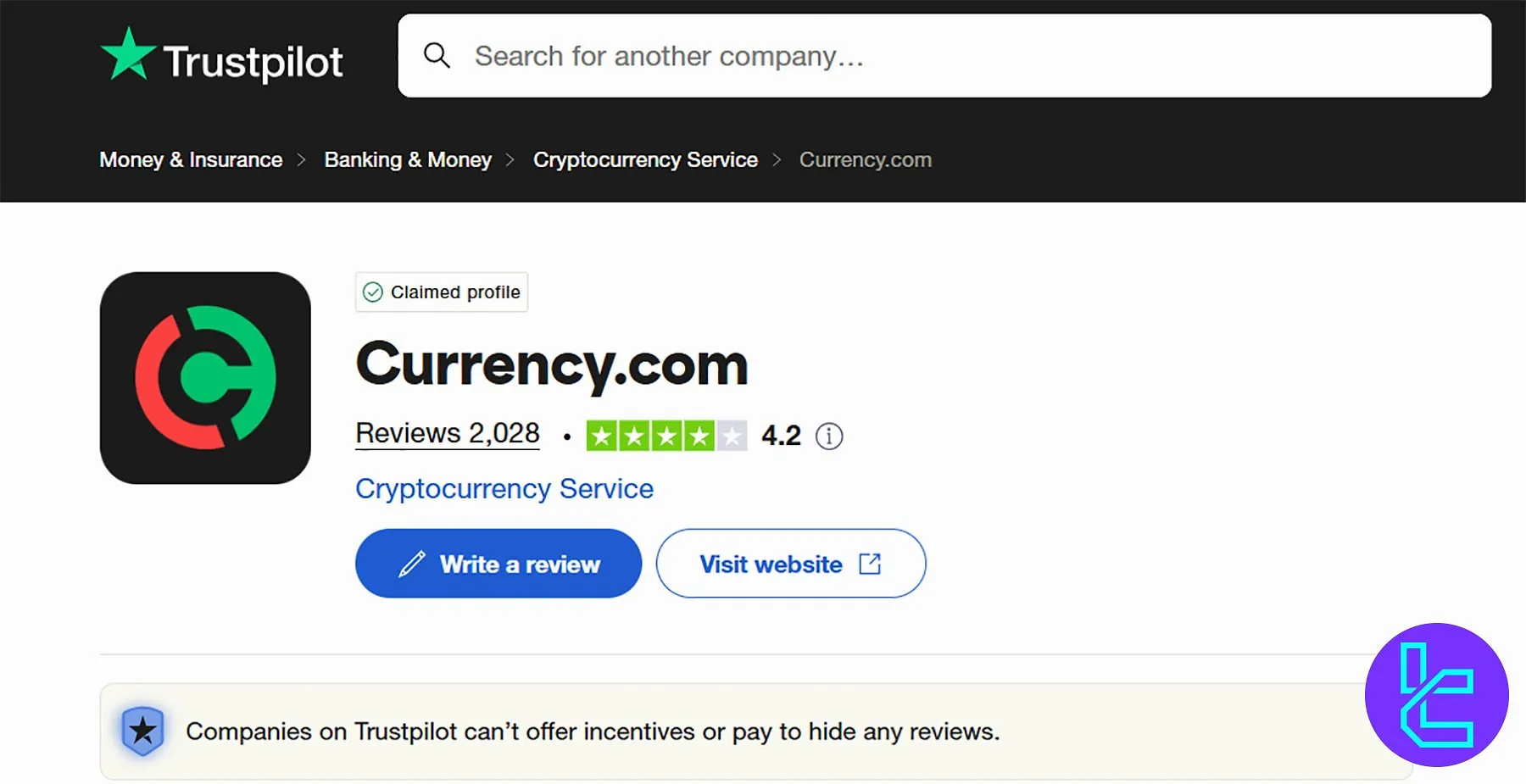

There are 2,028 Currency.com reviews on Trustpilot, most of which are positive, praising good customer support and the user-friendly interface.

82% of comments on the Currency.com Trustpilot profile are positive (4-star and 5-star) and only 12% are negative (1-star and 2-star), resulting in a score of 4.2 out of 5.

Currency.com Features

Here, you can see a table of additional services provided by the discussed exchange:

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

Support Channels

Currency.com exchange provides user assistance primarily through a comprehensive Help Center and a ticket system.

- Email: support@currency.com

- Phone: 888-462-7202

- Ticket: Through the “Contact Us” button from the “Help Center”

Does Currency.com Offer Investment and Growth Plans?

The exchange doesn’t offer crypto copy trading software, staking opportunities, or an affiliate program.

Currency.com primarily provides a platform for trading cryptocurrencies and tokenized assets rather than offering specific investment or growth plans.

Currency.com Exchange Restricted Countries

The platform offers services in 100+ countries but is prohibited in various countries due to regulatory requirements.

However, the Currency.com official website hasn’t disclosed a specific list of restricted jurisdictions.

Table of Comparison Between Currency.com and Major Exchanges

This section compares Currency.com with 4 of the main players in the crypto industry based on important parameters:

Parameters | Currency.com Exchange | |||

Number of Assets | 100+ | 700+ | +2,800 | 150+ |

Maximum Leverage | 1x | 200x | 200x | 125x |

Minimum Deposit | $20 | 1 USDT | $1 | $1 |

Spot Maker Fee | 1% | 0.0126% - 0.2% | 0.05% | 0.02% - 0.1% |

Spot Taker Fee | 1% | 0.0218% - 0.2% | 0.05% | 0.04% - 0.1% |

Mandatory KYC | Yes | Yes | No | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Currency.com supports crypto buy/sell via various payment methods, including ACH, SWIFT, SEPA, and Credit/Debit Cards.

While SEPA and ACH withdrawals incur a $5 / €5 fee, SWIFT transfers come with a 1% commission. The exchange has a great score of 4.2 out of 5 on Trustpilot.