The DigiFinex verification involves 5 steps. Begin by logging into your account dashboard, entering your personal details, uploading a valid identification document, and submitting the "Ultimate Beneficial Owner" (UBO) form to finalize the process.

After completing your DigiFinex KYC, you'll gain access to more than 700 cryptocurrencies, enabling spot trading with maker fees of roughly 0.15% and taker fees near0.20%, depending on your account level.

Overview of DigiFinex KYC Steps

After completing the KYC process on DigiFinex exchange, you'll unlock full access to all trading features and financial services available on the platform. DigiFinex verification process:

- Log in to your account and navigate to the KYC section;

- Submit your identification document for personal POI;

- Complete your personal account information;

- Add details for representatives and users, if applicable;

- Upload the "Ultimate Beneficial Owner" (UBO).

Before beginning, ensure you have reviewed all required documents and eligibility criteria to guarantee a smooth KYC process.

Verification Requirement | Yes/No |

Full Name | Yes |

Country of Residence | Yes |

Date of Birth Entry | Yes |

Phone Number Entry | No |

Residential Address Details | Yes |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | No |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | No |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | Yes |

Trading Knowledge Questionnaire | No |

Restricted Countries | No |

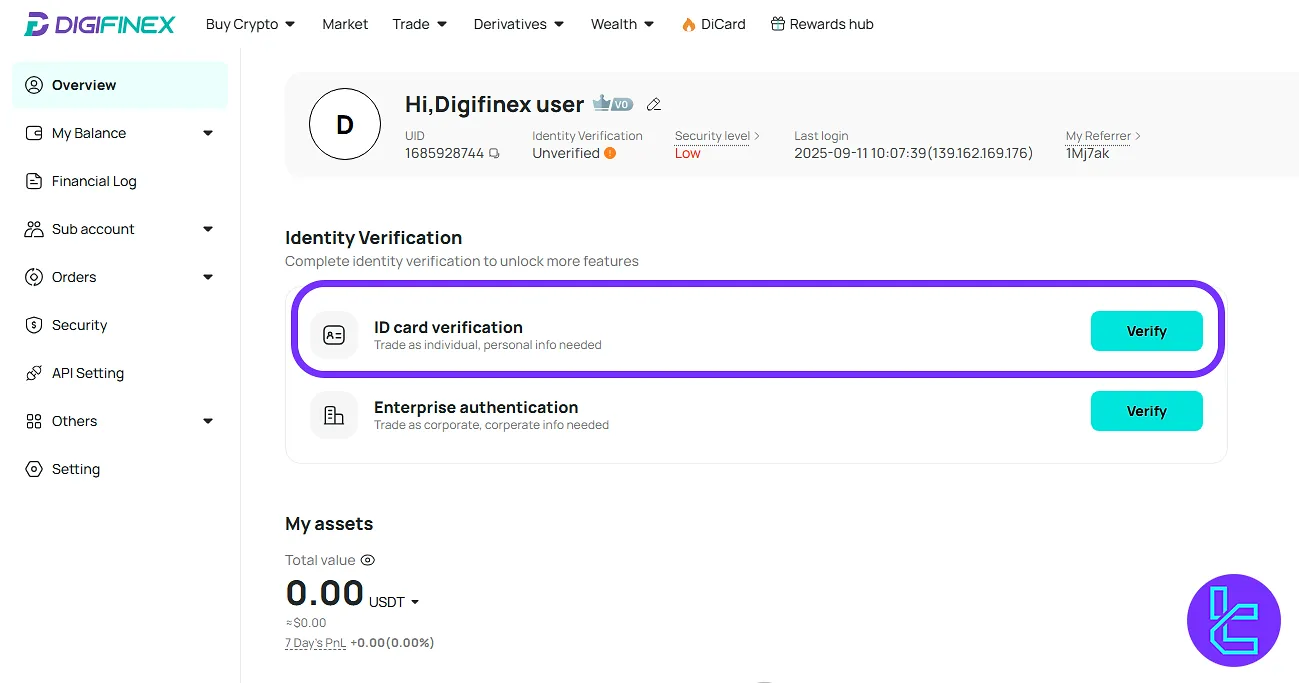

#1 Access Your DigiFinex Account

To initiate the KYC, follow these straightforward steps:

- Log in to your account’s dashboard after finishing DigiFinex registration

- Go to the "Verify" section within your user panel to proceed

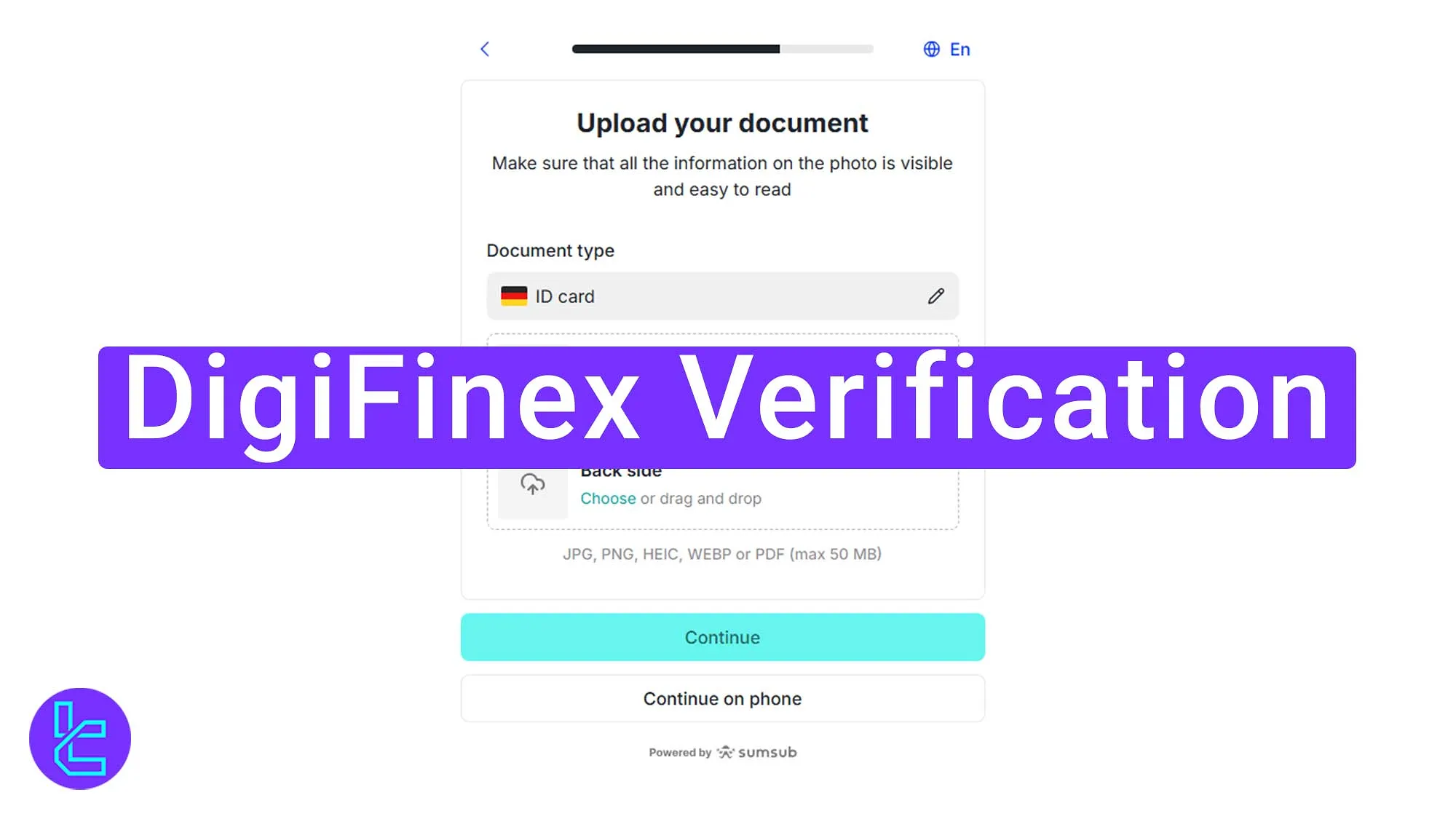

#2 Submitting Your ID Document

Once inside the KYC page, click "Verify" under the ID document section. The platform connects you to the SumSub authentication system, ensuring a secure review.

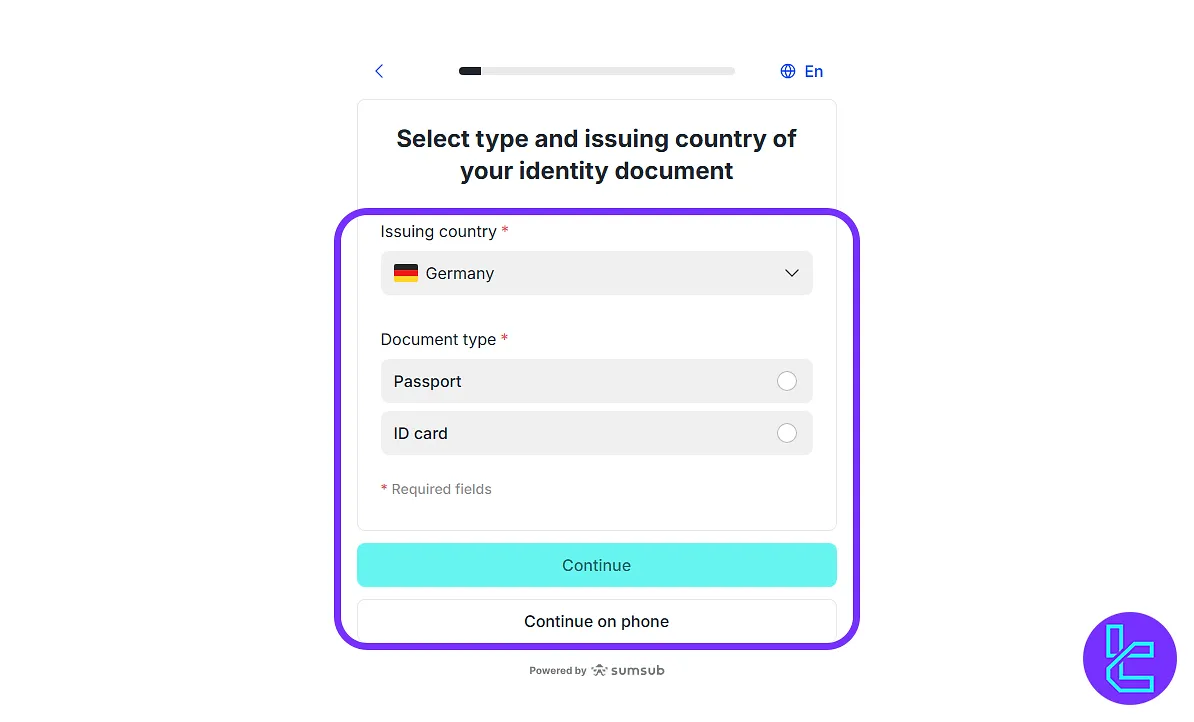

Select "Continue", then choose whether to continue on your phone or computer.

To continue this DigiFinex tutorial, choose your country of residence, click "Continue", then select your issuing country and the document type (Passport or ID card). Upload your ID card and click "Continue"; your document will now go under review.

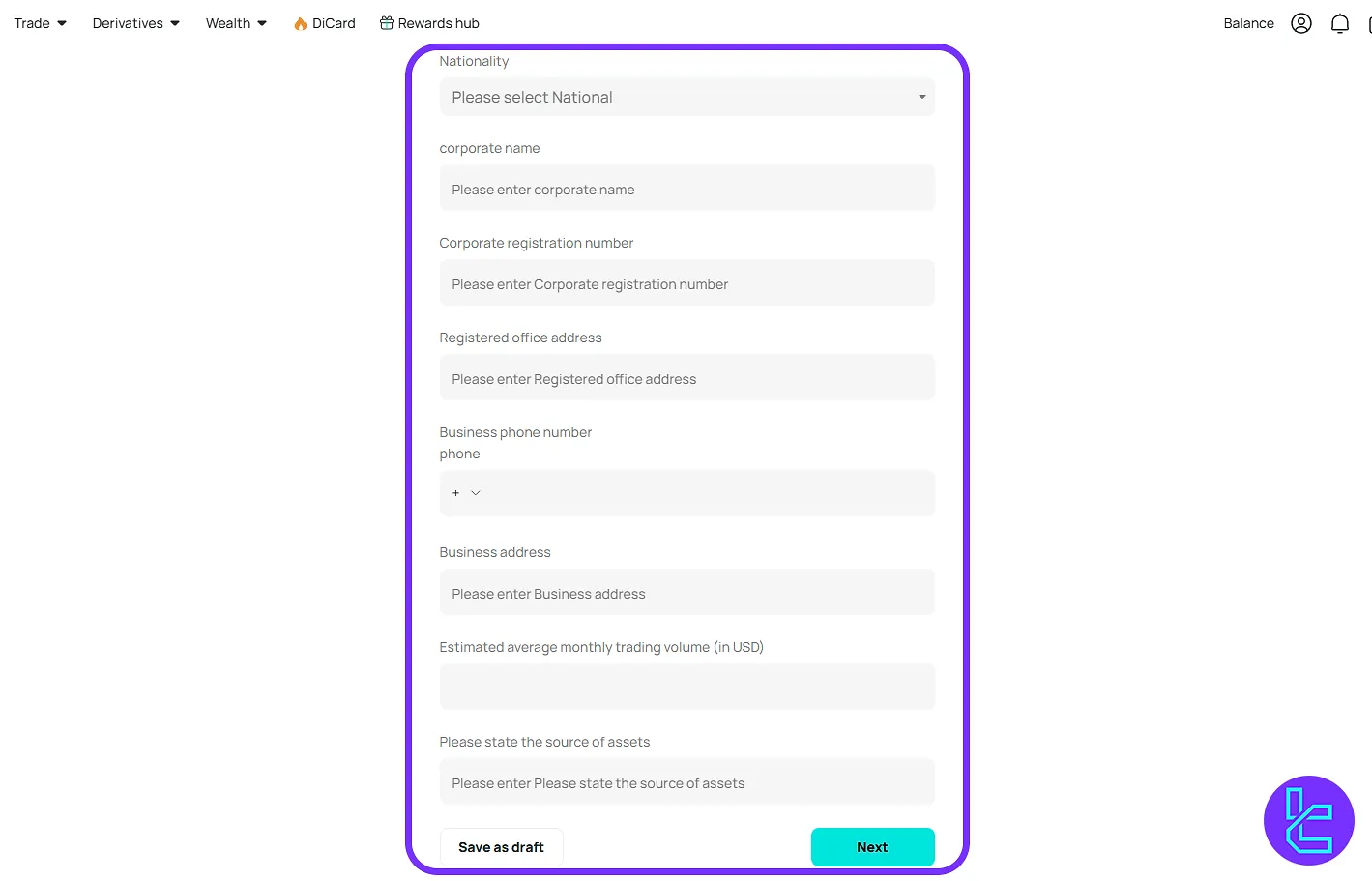

#3 Complete Personal Details

For business users, the Enterprise Authentication section verifies company credentials. For individuals, you should enter your personal details. Click to start and fill out the following:

- Nationality

- full name

- ID number

- Full address

- Mobile phone number

- Estimated monthly trading volume (in USD)

- Source of assets

After filling in all the details, click "Next" to continue.

#4 Add Representatives and Users

This section ensures that every key entity in the business is verified. There are three roles to complete:

- Legal Representative: Add first and last name and ID number; Upload the front and back sides of the ID card and click "Confirm";

- Actual Controller: Add first and last name and ID number; Upload the front and back sides of the ID card and click "Confirm";

- Account User:Add the same details as above and click "confirm".

Each document must not exceed 5 MB. Optionally, you may add more details and click "Next".

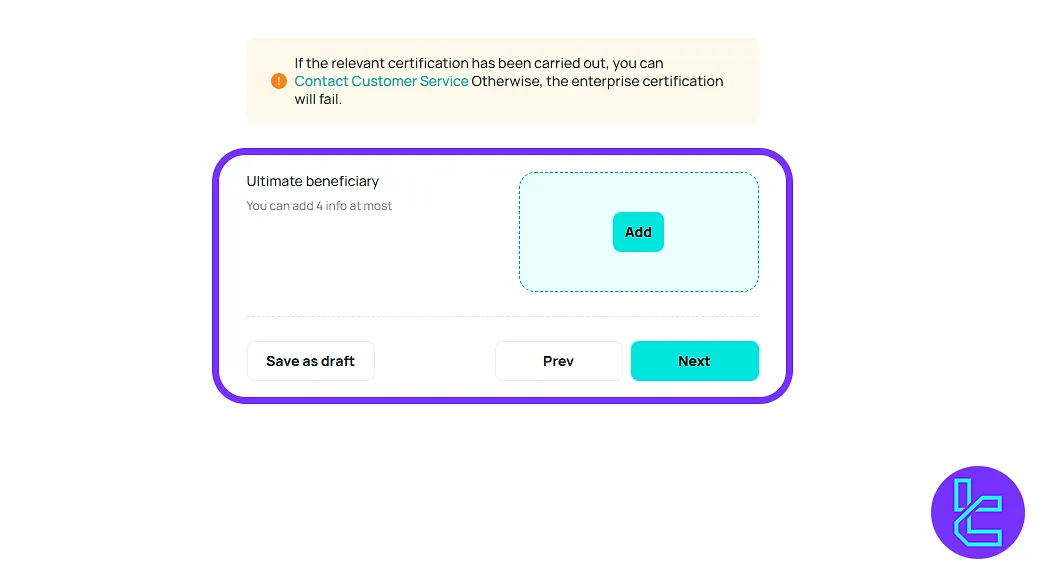

#5 Upload UBO Documents

The final step of DigiFinex KYC requires verifying the "Ultimate Beneficial Owner" (UBO). Click "Add" underUBO Document Authentication.

Confirm your country of residence, select the document type (Passport or ID card), and upload it.

Ensure all information is visible and that the total size is no more than 50 MB. After submission, your documents will be reviewed. You'll receive an email once authentication is complete.

Comparison of Identity Authentication Processes Between DigiFinex and Other Major Exchanges

The table below highlights the essential documents and main steps needed to complete KYC on DigiFinex. It also offers a side-by-side comparison of how leading cryptocurrency platforms handle user identity authentication.

Verification Requirement | DigiFinexExchange | |||

Full Name | Yes | Yes | No | Yes |

Country of Residence | Yes | Yes | Yes | Yes |

Date of Birth Entry | Yes | Yes | No | No |

Phone Number Entry | No | No | No | No |

Residential Address Details | Yes | Yes | No | Yes |

Phone Number Verification | No | No | No | No |

Document Issuing Country | Yes | No | Yes | No |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | No | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | No | No | Yes | No |

Utility Bill (for POA) | Yes | No | Yes | No |

Bank Statement (for POA) | Yes | No | Yes | No |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | Yes | Yes | Yes | Yes |

Financial Status Questionnaire | No | No | No | No |

Trading Knowledge Questionnaire | No | No | No | No |

Restricted Countries | No | Yes | Yes | Yes |

TF Expert Suggestion

The DigiFinex verification process typically takes about 8 minutes to complete, assuming your identification documents are ready. After submission, your account is usually reviewed and approved promptly.

Once your account is approved, you can fund it using various DigiFinex deposit methods. Deposits are available through cryptocurrency and select fiat methods (including Visa and MasterCard via third-party services).