HashKey provides Crypto trading with a default Spot maker/taker fee of 0.12%/0.12% and a default Futures maker/taker fee of 0.025%/0.06%. The exchange offers reduced fee through a 10-level VIP program and an additional 5% Spot fee discount for HSK payments.

Hashkey Company Information and Regulations

The company, a prominent blockchain industry player, has launched a licensed cryptocurrency trading platform, reinforcing its commitment to regulatory compliance.

The exchange provides secure trading services, including spot, futures markets, and leveraged trading through two legal entities with various licenses, including:

- HashKey Global licensed by the Bermuda Monetary Authority

- HashKey Exchange regulated by the Hong Kong Securities and Futures Commission (SFC)

In this HashKey review, we will explore the global branch services and features.

The company was founded in 2018 by Tony Chen, co-founder and product director at Hashkey Group. HashKey Group operates globally holding licenses from:

- Japan FSA

- Singapore MAS

- Hong Kong SFC

- Bermuda BMA

- Central Bank of Ireland

- Dubai VARA

Hashkey Exchange Specifics Table

The crypto exchange offers a comprehensive VIP program, Launchpool, and independentcustodial wallets storing clients’ funds segregated.

Exchange | HashKey |

Launch Date | 2018 |

Levels | VIP 0 – VIP 9 |

Trading Fees | From 0.0% |

Restricted Countries | USA, China, Hong Kong, and more |

Supported Coins | 107 |

Futures Trading | Yes |

Minimum Deposit | $1 or 0.0005 BTC |

Deposit Methods | Cards, Crypto |

Withdrawal Methods | Crypto |

Maximum Leverage | 1:10 |

Minimum Trade amount | 1 USDT |

Security Factors | 2FA, Segregated Accounts, Cold Storage, Insurance Coverage, SSL Encryption |

Services | Futures, Spot, Token Launchpool |

Customer Support Ways | Ticket, Live Chat, Email |

Customer Support Hours | 24/7 for Live chat; 08:00 AM to 06:00 PM for Tickets |

Fiat Deposit | USD, HKD |

Affiliate Program | Yes |

Orders Execution | Limit, Market |

Native Token | HSK |

Hashkey's comprehensive API offerings cater to the needs of both retail and institutional traders, providing a robust infrastructure for various trading strategies and requirements.

Hashkey Exchange Pros and Cons

Let's examine the advantages and disadvantages of using Hashkey Exchange:

Pros | Cons |

Regulatory approval and certifications | Limited geographic availability |

HKD and USD transactions | Limited digital asset offerings |

High liquidity across trading pairs | Limited track record compared to established exchanges |

Advanced security features | Fewer advanced trading features for professional traders |

User-friendly interface | - |

Despite some limitations, Hashkey's focus on regulatory compliance and security makes it an attractive option for traders prioritizing safety and reliability in their crypto trading activities.

HashKey User Levels Features

the company offers a tiered VIP user-level system, featuring fee discounts based on 30-Day Spot/Futures Trading Volume. The platform also offers an additional 5% discount to traders who use HSK, platform’s native token, to pay trading fees.

Tier | 30-Day Spot Trading Volume (USDT) | 30-Day Futures Trading Volume (USDT) |

VIP 0 | < 500K | < 1M |

VIP 1 | >= 500K | >= 1M |

VIP 2 | >= 1M | >= 2M |

VIP 3 | >= 4M | >= 8M |

VIP 4 | >= 8M | >= 15M |

VIP 5 | >= 15M | >= 30M |

VIP 6 | >= 30M | >= 50M |

VIP 7 | >= 50M | >= 100M |

VIP 8 | >= 100M | >= 200M |

VIP 9 | >= 200M | >= 400M |

Note: To be eligible for any VIP tier, you only need to meet one of the criteria: 30-Day Spot Trading Volume or 30-Day Futures Trading Volume.

Fees and Commissions on HashKey

As mentioned earlier in this HashKey review, the company has implemented a VIP program offering reduced fees based on trading volume. However, the default fees are as follows:

- Spot Maker / Taker: 0.12% / 0.12%

- Futures Maker / Taker: 0.025% / 0.06%

While the exchange charges no fees on crypto deposits, crypto withdrawals incur a commission based on the asset and the blockchain network.

HashKey VIP Spot Trading Fees

Tier | Spot Maker Fee | Spot Taker Fee |

VIP 0 | 0.12% | 0.12% |

VIP 1 | 0.08% | 0.1% |

VIP 2 | 0.08% | 0.09% |

VIP 3 | 0.07% | 0.085% |

VIP 4 | 0.06% | 0.075% |

VIP 5 | 0.04% | 0.065% |

VIP 6 | 0.03% | 0.045% |

VIP 7 | 0% | 0.04% |

VIP 8 | 0% | 0.035% |

VIP 9 | 0% | 0.03% |

HashKey VIP Futures Trading Fees

Note that the 5% discount for paying fees with HSK is not available on Futures trading.

Tier | Futures Maker Fee | Futures Taker Fee |

VIP 0 | 0.025% | 0.06% |

VIP 1 | 0.02% | 0.05% |

VIP 2 | 0.016% | 0.05% |

VIP 3 | 0.014% | 0.045% |

VIP 4 | 0.012% | 0.04% |

VIP 5 | 0.008% | 0.035% |

VIP 6 | 0.004% | 0.035% |

VIP 7 | 0% | 0.03% |

VIP 8 | 0% | 0.025% |

VIP 9 | 0% | 0.02% |

Hashkey's fee structure is designed to encourage high-volume trading and liquidity provision.

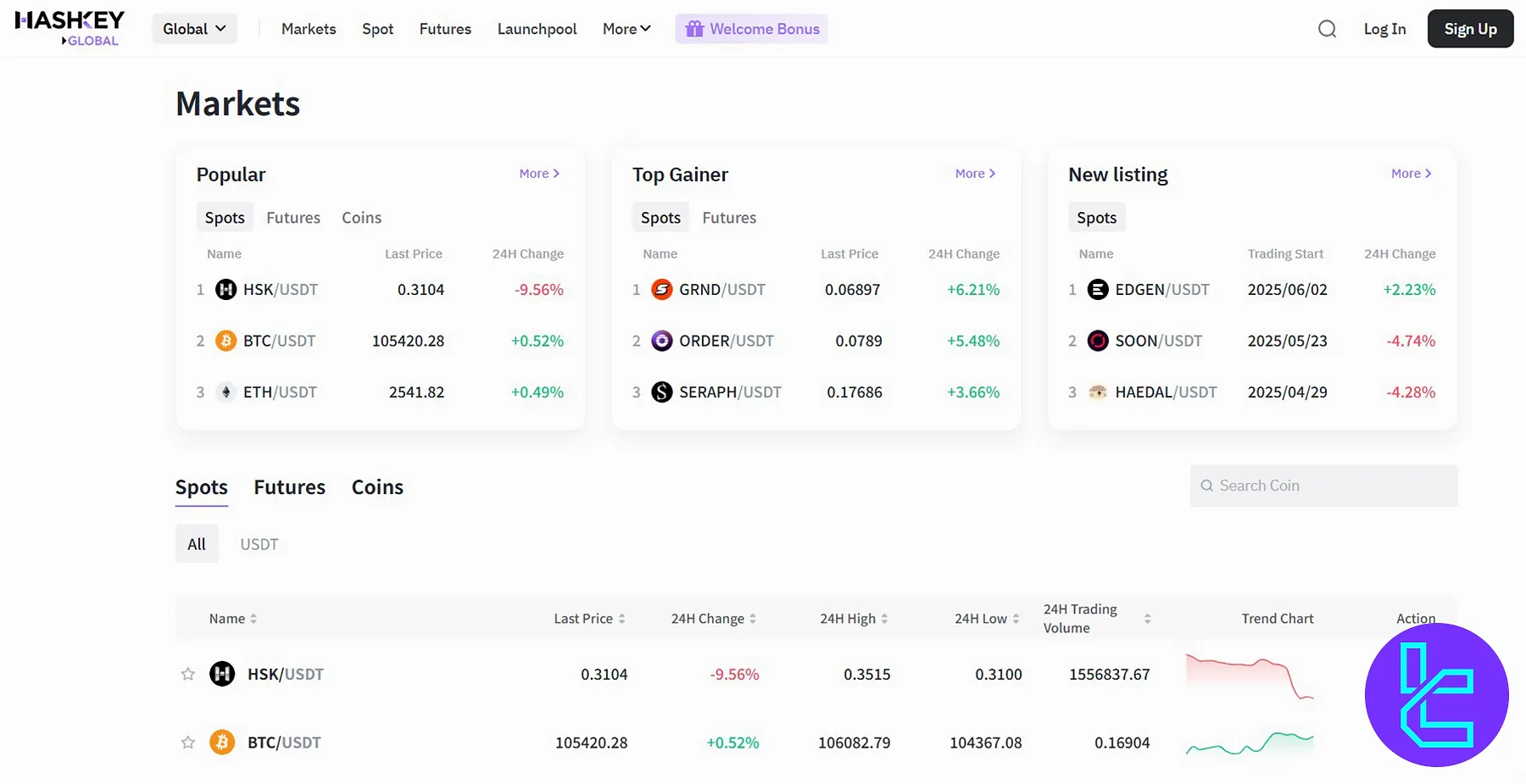

Coins and Assets Offered by HashKey Exchange

The company provides its users with a limited list of 107 cryptocurrencies and spot trading pairs. Here's an overview of the assets offered:

- Major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

- Popular altcoins: Litecoin (LTC)

- DeFi tokens: Uniswap (UNI), Aave (AAVE), Compound (COMP)

- Stablecoins: USD Coin (USDC)

- Platform-specific tokens: Hashkey Token (HSK)

Futures and Margin Trading on HashKey Exchange

Futures and margin trading on the exchange allows users to engage in leveraged trading, amplifying potential returns by borrowing capital to increase their position size. The exchange offers a Futures market with the following features:

- 53 Crypto/USDT trading pairs

- Leverage options of up to 1:10

- Perpetual (no expiry date) and Delivery (with an expiry date) contracts

- Advanced tools like stop-loss orders and take-profit orders

On HashKey Exchange, the leverage available is set to 1:10. This means that for every $1in their account, traders can control up to $10 in positions. While this leverage can enhance profit potential, it also heightens the risk of substantial losses if trades do not perform as expected.

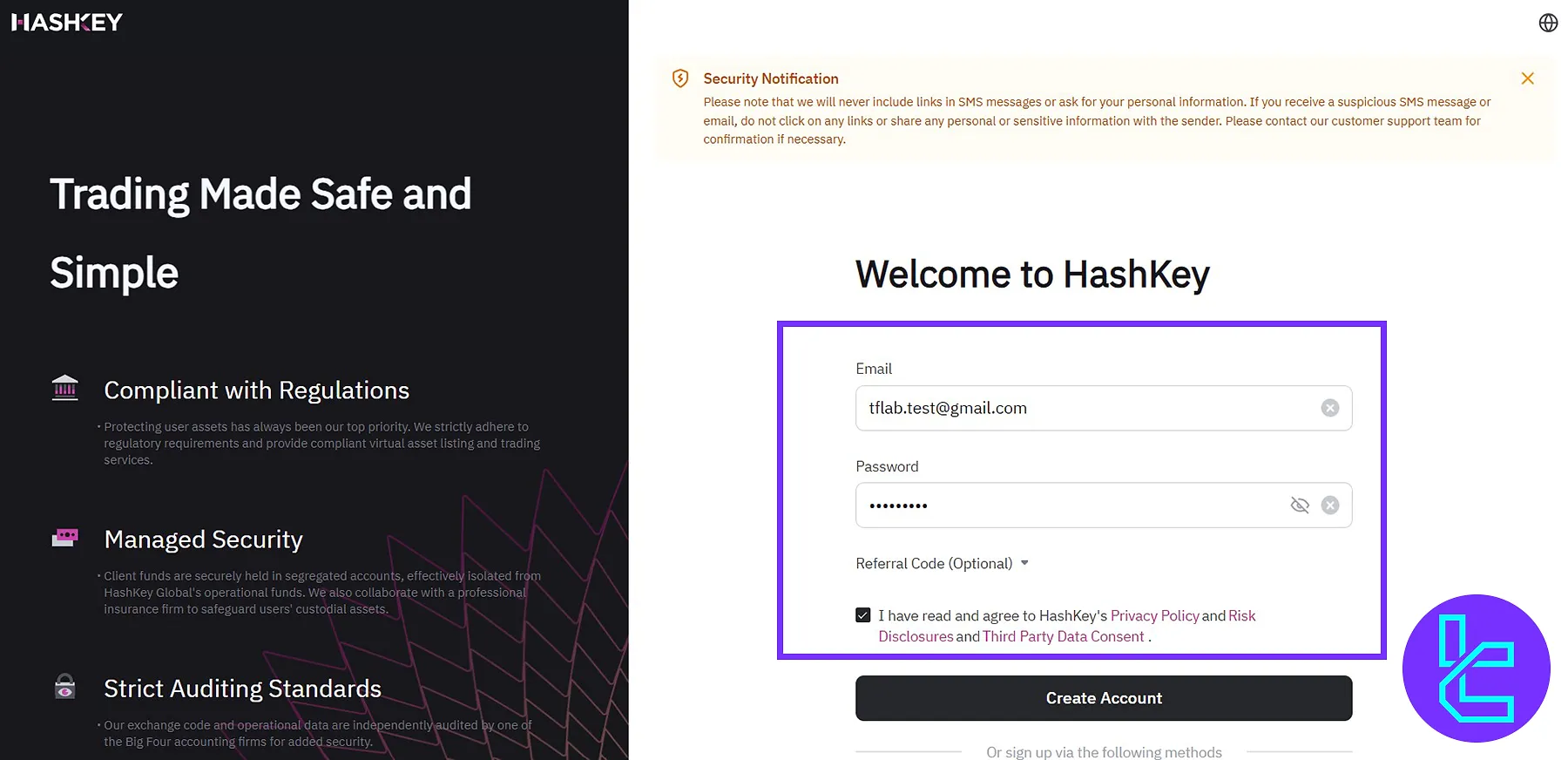

Registration and Verification on HashKey Exchange: Complete Guide

To access digital asset trading on Hashkey Exchange, users must register and complete KYC verification. This ensures compliance with financial regulations and platform security standards.

#1 Create Your Account

Visit the official HashKey Exchange platform, initiate the sign-up process, and set a secure password using your email.

#2 Email Confirmation

Verify your email address by entering the one-time code sent to your inbox.

#3 KYC Identity Verification

Access the Identity Verification section from your profile. Provide personal details, complete a live facial recognition (Liveness check), and upload the following documents:

- Proof of Identity: Passport or Driver’s license

- Proof of Address: Utility bill or Bank statement

Once verified, you’ll gain full access to trading tools, market data, and supported digital asset pairs on the HashKey platform.

Platforms and Applications

Hashkey Exchange offers a range of platforms and applications to cater to different user preferences:

- Web-based trading platform: A comprehensive, browser-based interface for desktop users

- Mobile apps: iOS and Android applications for on-the-go trading

- API access: REST API, Websocket API, and FIX Protocol for algorithmic and high-frequency trading

- TradingView integration: Advanced charting and analysis tools

These diverse options ensure traders can access HashKey's services through their preferred method, whether casual investors or professional traders requiring advanced tools. Here are the download links to the exchange’s mobile app:

TradingFinder has developed various TradingView indicators that you can use for free.

HashKey exchange Security & Safety Measures

The company’s commitment to the security and safety of its users' assets and personal information is evident in its 100% hot wallet insurance fund and other security measures, including:

- Two-factor authentication (2FA) for account access

- Cold storage for 90% of user funds

- Regular security audits and penetration tests by Big 4 firms

- SSL encryption for all data transmissions

- Segregated user accounts

- Insurance coverage for digital assets

There have been no reports of security breaches on the exchange track record. In addition to the strong regulatory framework, HashKey succeeds in providing a safe and reliable platform.

HashKey Exchange Payment Methods

HashKey Exchange supports Crypto transfers, in addition to HKD and USD payments. While there are no specific data about fiat payment methods on the platform, here are what we know about crypto transfers on HashKey:

- No deposit fees

- Minimum deposit and withdrawal variable based on the digital asset (ETH min deposit/withdrawal: 0.01/0.04 on the Ethereum network)

- Variable withdrawal fees, for example:

Digital Asset | Blockchain Network | Withdrawal Fee |

ETH | ETH | 0.0023 |

USDT | Tron | 1 |

BTC | BTC | 0.0005 |

BNB | BinanceSmart | 0.002 |

DOGE | Dogecoin | 8 |

DOGS | TON | 200 |

HSK | HashKey | 0.1 |

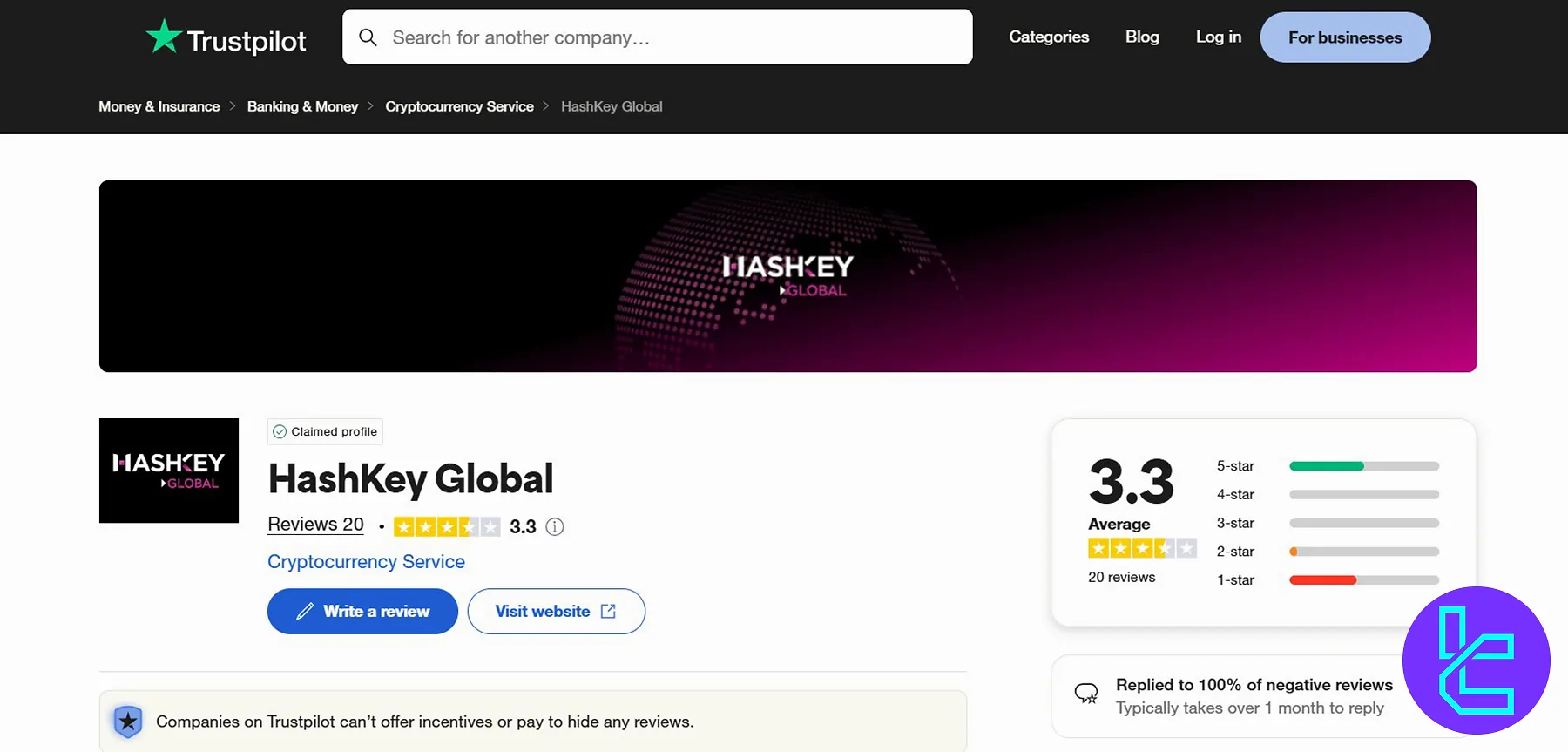

HashKey Exchange Trust Scores and Evaluations

The Exchange has garnered an average trust score from users on Trustpilot and an excellent score from experts on CoinGecko.

- HashKey Trustpilot: 3.3 out of 5 based on 20 comments

- CoinGecko: 9 out of 10

While 50% of HashKey reviews on TP are positive (5-star), the rest are negative (1-star and 2-star). The exchange has replied to all the negative comments with an average reply time of over 1 month.

While the company is relatively new compared to some established exchanges, its focus on regulatory compliance and security has helped it build a reputation as a trustworthy platform in the cryptocurrency space.

HashKey Features

Let’s see if HashKey offers especial crypto services, such as copy trading and crypto staking.

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pools | No |

Crypto Cards | No |

HashKey exchange Support

Hashkey Exchange provides comprehensive support to its users through various channels:

- Email support: contact@global.hashkey.com

- Live chat: Available 24/7 for urgent matters

- Ticket system: For submitting and tracking support requests

Hashkey's multi-channel support system ensures users can get assistance whenever needed, enhancing the overall trading experience.

Copy Trading Services and Investment Options on Hashkey Exchange

The lack of Crypto staking services is one of the biggest letdowns in this HashKey review. While the exchange primarily focuses on spot and futures trading, it offers an affiliate program for passive income enthusiasts with the following features:

- Referral: Up to 50 USDT in trial funds per referred client

- Referral Pro: Extra launchpool airdrops and higher commission rebates

Restricted Countries List

HashKey Global restricts its services in certain jurisdictions to comply with legal and regulatory requirements. In particular, it does not provide services to users in the United States, Mainland China, the Hong Kong Special Administrative Region, and Additional countries, including:

- Afghanistan

- American Samoa

- Anguilla

- Antarctica

- Bangladesh

- Belarus

- Central African Republic

- Congo

- Cuba

- Eswatini

- Faroe Islands

- Guinea-Bissau

- Guam

- Haiti

- Iran

- Iraq

- Israel

- Lebanon

- Libya

- Mali

- Myanmar

- Nicaragua

- North Korea

- Pakistan

- Russia

- Somalia

- Sudan

- Syria

- Tunisia

- United States of America

- Yemen

- Zimbabwe

Users from these regions may face limitations or cannot access Hashkey's services. Potential users should check the most up-to-date information on Hashkey's website or contact customer support for specific details about their country's eligibility.

HashKey Comparison Table

The table below provide a good sense of HashKey’s standing in the crypto world in comparison with other exchanges:

Features | HashKey Exchange | |||

Number of Assets | 107 | 400+ | 1,200+ | 200+ |

Maximum Leverage | 1:10 | 1:125 | 1:100 | 1:1 |

Minimum Deposit | $1 | $1 | 0.0005 BTC | N/A |

Spot Maker Fee | 0.00% - 0.12% | 0.02% - 0.1% | -0.005% - 0.1% | From 0.2% |

Spot Taker Fee | 0.03% - 0.12% | 0.04% - 0.1% | 0.025% - 0.1% | From 0.2% |

Mandatory KYC | Yes | Yes | No | Yes |

Futures Trading | Yes | Yes | Yes | No |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | No |

Writer's Opinion and Conclusion

HashKey has listed 107 cryptocurrrencies for OTC, Spot, and Futures trading in the USDT market. HashKey Group is regulated by multiple authorities, including Japan FSA, Singapore MAS, and Hong Kong SFC, supporting HKD and USD fiat payments.

The exchange has a 9/10 CoinGecko score and a 3.3/5 rating on Trustpilot.