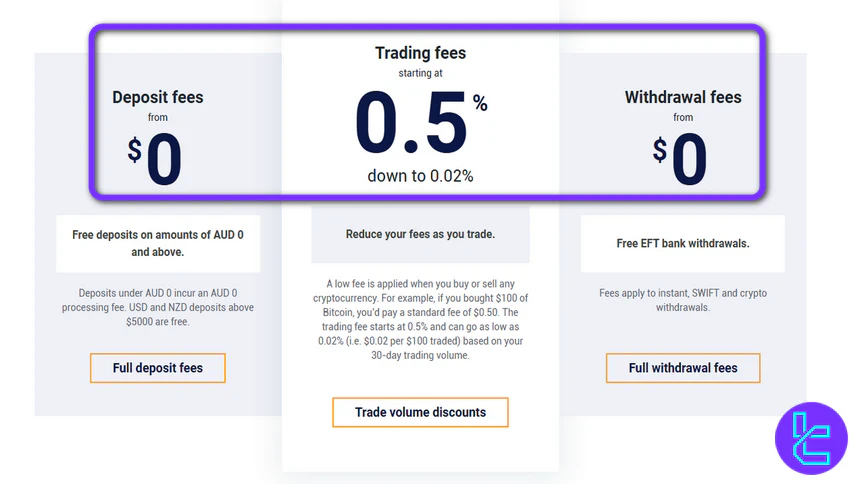

Independent Reserve employs a fee discount system with 28 levels, with commissions starting from 0.5% down to 0.02% for traders with $200M+ 30-day trading volume.

Launched in 2013, the platform now serves a global user base of 400,000+ clients, supports 32 cryptocurrencies, and provides access to leveraged trading with a maximum leverage of 5x.

Besides, the exchange provides leveraged trading with access to maximum leverage of 5x.

Independent Reserve Information + Regulation

Independent Reserve is a cryptocurrency exchange founded in 2013 in Sydney, Australia. The brainchild of Adam Tepper, Adrian Przelozny, and Lasanka Perera, the platform is now led by Adrian Przelozny as Group CEO.

Currently, the company with the legal name "Independent Reserve Pty. Ltd." serves 400,000+ clients. This platform is registered as a Digital Currency Exchange (DCE) with the Australian Transaction Reports and Analysis Centre (AUSTRAC) under the code DCE-100461150-001.

It is also regulated by the Australian Securities & Investments Commission (ASIC). The company is headquartered at Level 26, 44 Market Street, Sydney, 2000, New South Wales, Australia.

In Singapore, it holds a Major Payment Institution license issued by the Monetary Authority of Singapore (MAS), becoming the first crypto exchange to receive such approval under the Payment Services Act.

Independent Reserve CEO

Independent Reserve is led by Adrian Przelozny, a well-known figure in Australia’s cryptocurrency industry. As the Founder and CEO, he has been running the exchange since 2013, building it into one of the country’s most trusted and security-focused trading platforms.

Przelozny also serves as a Director at Blockchain Australia, where he actively advocates for the broader adoption of digital assets nationwide.

With more than 12 years of leadership at Independent Reserve, he has played a key role in shaping Australia’s crypto landscape.

Based on Adrian Przelozny LinkedIn Profile, alongside this, he has been the CEO of bitcoin.com.au since 2022, overseeing one of the simplest on-ramps for buying crypto in Australia.

His experience across both platforms highlights a long-term commitment to developing secure, transparent, and user-friendly crypto services.

Independent Reserve Crypto Exchange Key Specifications

As it happens in every other crypto exchange review article on this website, here is a table summarizing the discussed platform's features and offerings:

Exchange | Independent Reserve |

Launch Date | 2013 |

Levels | None |

Trading Fees | 0.5% Down to 0.02% |

Restricted Countries | United States, China, Turkey, Iran, North Korea, Afghanistan, Syria, etc. |

Supported Coins | 32 |

Futures Trading | None |

Minimum Deposit | $1 |

Deposit Methods | Bank Transfers, Crypto Transactions |

Withdrawal Methods | Bank Transfers, Crypto Transactions |

Maximum Leverage | 5x |

Minimum Trade Amount | N/A |

Security Factors | 2FA, 1:1 Reserves, Audits, Segregated Funds, Cold Storage, Multi-Layer Encryption of Hot Wallet Private Keys, Browser Whitelisting |

Services | Leveraged Trading, AutoTrader, OTC Desk |

Customer Support Ways | Ticket, Email |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | None |

Notable Pros and Cons

Here are some of the most important and critical benefits and drawbacks of trading with Independent Reserve. Look at the table below:

Pros | Cons |

Registered with AUSTRAC | No Futures Trading Available |

Various Security and Safety Measures | Relatively Low Number of Tradable Coins/Tokens |

Fiat Currency Support | Relatively High Trading Fees |

Does Independent Reserve Employ Any User Level Systems?

This exchange does not employ any tiered user level structure or similar models for its clients. However, there is a fee discount system based on the trading volume, which will be examined in the next section.

Trading Fees and Other Commissions

Independent Reserve offers a fee structure based on 30-day trading volume, starting at 0.5% and decreasing to 0.02% for high-volume traders. Trading Commission Levels:

30D Trading Volume (AUD) | Fees |

0 | 0.50% |

50,000 | 0.48% |

100,000 | 0.46% |

200,000 | 0.44% |

300,000 | 0.42% |

400,000 | 0.40% |

500,000 | 0.38% |

600,000 | 0.36% |

800,000 | 0.34% |

1,000,000 | 0.32% |

1,200,000 | 0.30% |

1,400,000 | 0.28% |

1,600,000 | 0.26% |

1,800,000 | 0.24% |

2,000,000 | 0.22% |

2,500,000 | 0.20% |

3,000,000 | 0.18% |

3,500,000 | 0.16% |

4,000,000 | 0.14% |

4,500,000 | 0.12% |

5,000,000 | 0.10% |

10,000,000 | 0.08% |

15,000,000 | 0.07% |

30,000,000 | 0.06% |

50,000,000 | 0.05% |

100,000,000 | 0.04% |

150,000,000 | 0.03% |

200,000,000 | 0.02% |

Also, the exchange charges a fee for deposits and withdrawals in most cases. However, crypto deposits are free at any case.

Available Trading Symbols on Independent Reserve

This exchange offers a curated selection of over 30 cryptocurrencies, focusing on established and reputable projects. The available cryptocurrencies include:

- Bitcoin [BTC]

- Ethereum [ETH]

- Ripple [XRP]

- Litecoin [LTC]

- Tron [TRX]

- Bitcoin Cash [BCH]

- Maker [MKR]

- The Graph [GRT]

- The Sandbox [SAND]

- And more

The platform supports trading against four fiat currencies: AUD, NZD, SGD, and USD - making it particularly accessible to users in Australia, New Zealand, and Singapore.

For institutional and high-net-worth clients, Independent Reserve also provides over-the-counter (OTC) trading services with deep liquidity and personalized execution.

Futures Market and Margin Trading

At the time of writing this review, Independent Reserve offers a certain feature called "Leveraged Trading", which is the same as margin trading.

It enables traders to earn amplified profits at the risk of amplified losses. The maximum leverage available on the platform is 5x.

You can trade these pairs with leverage:

- BTC/AUD

- ETH/AUD

- XRP/AUD

- DOGE/AUD

- SOL/AUD

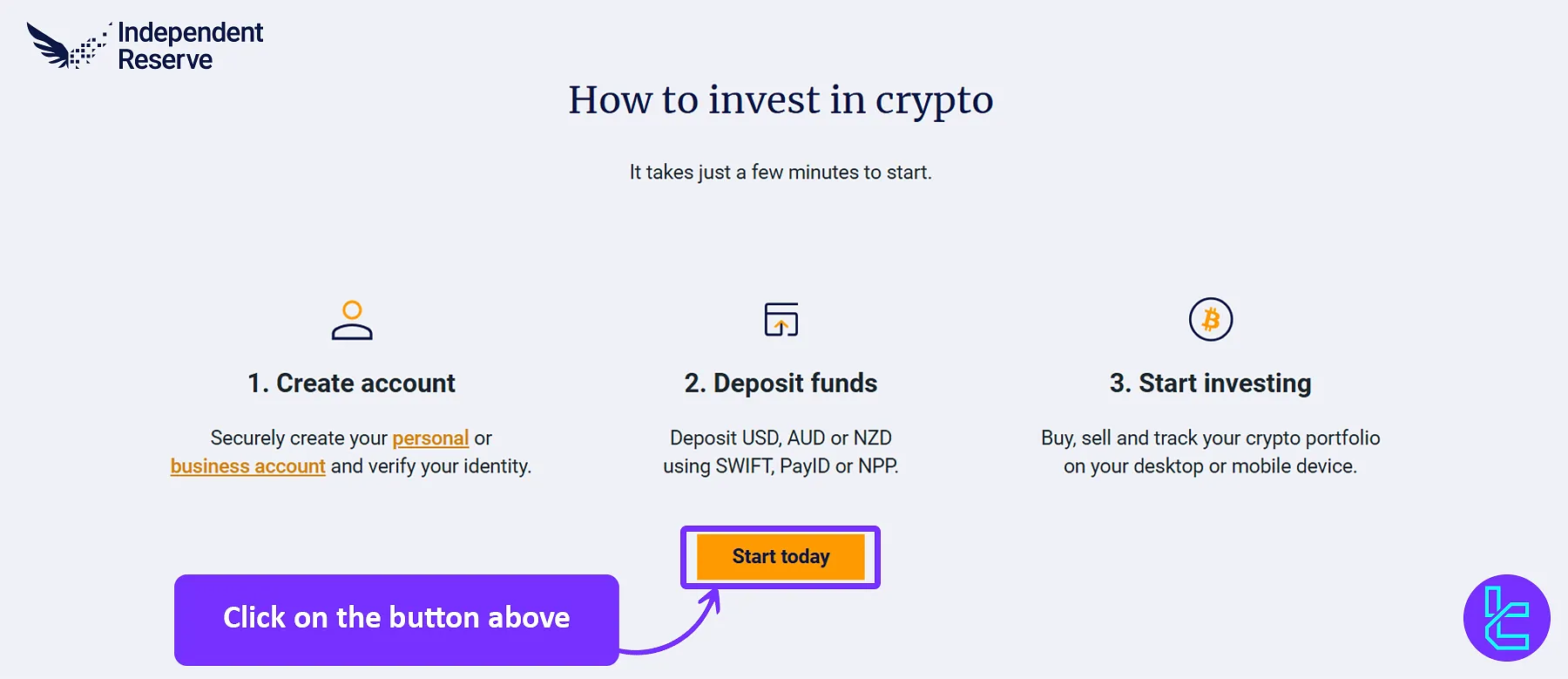

Account Opening and Identity Authorization Tutorial

Creating an account with Independent Reserve is a simple process that is not complex. However, the verification takes some time and will be processed in 24 hours.

The steps of Independent Reserve registration:

#1 Visit the Independent Reserve Official Website

To begin the registration process, visit the official website of the platform. Once you're on the homepage, look for the "Start today" or "Create your account" button and click on it to start signing up.

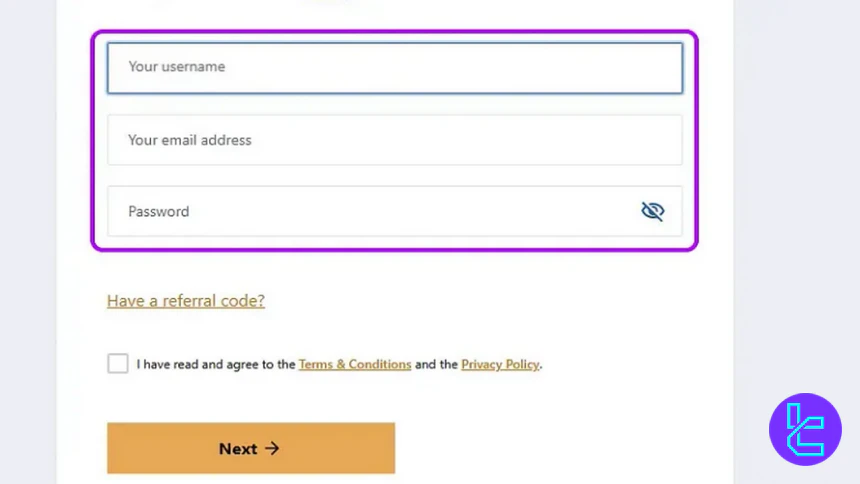

#2 Create a Username and Set Your Password on Independent Reserve

Next, you'll be prompted to create a username, provide your email address, and set a strong password. Make sure your password follows the platform’s required conditions, such as including a mix of letters, numbers, and special characters, to ensure account security.

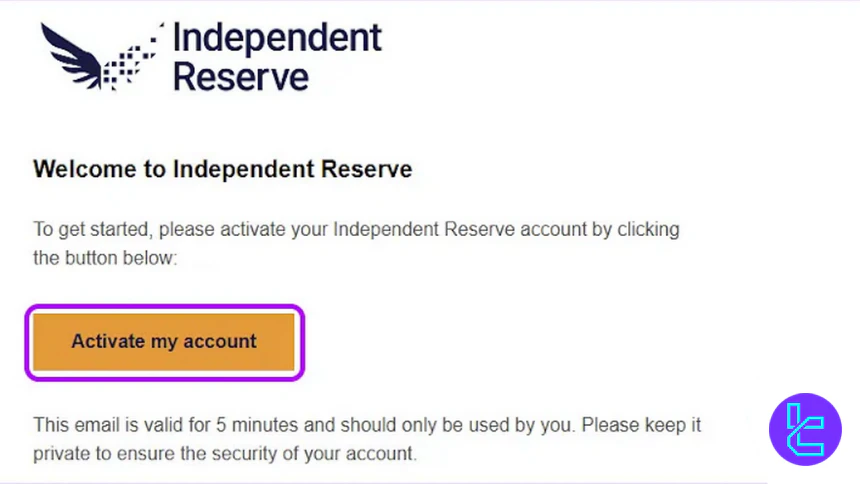

#3 Submit the Verification Code sent by Independent Reserve

After submitting your information, you'll receive a verification code sent to your email address. Enter this code into the platform to confirm your email and complete the registration process.

#4 Independent Reserve KYC

Now, you have your account opened on the platform. For the activation and identity verification, you will need to provide additional details like country of residence, identity information as shown in your ID, home address, and more. Also, you must submit the required documents.

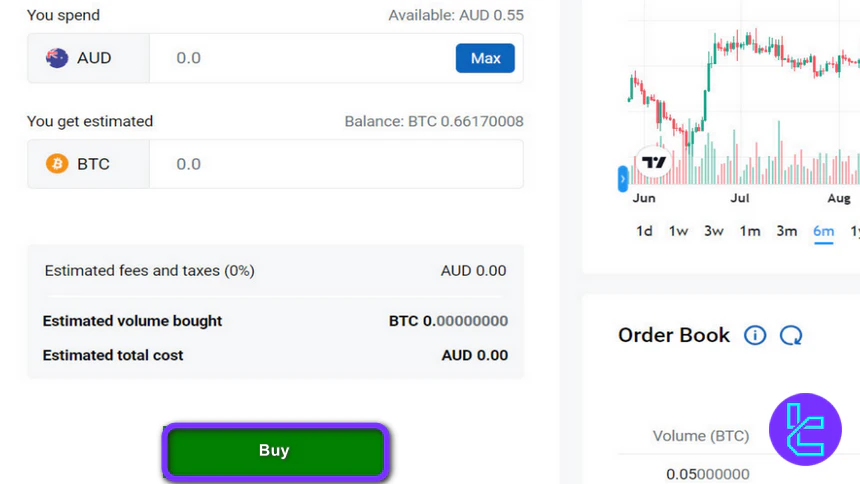

Independent Reserve Trading Guide

To start trading on the Independent Reserve platform, follow these steps once your registration and identity verification are complete:

#1 Access the Trading Interface

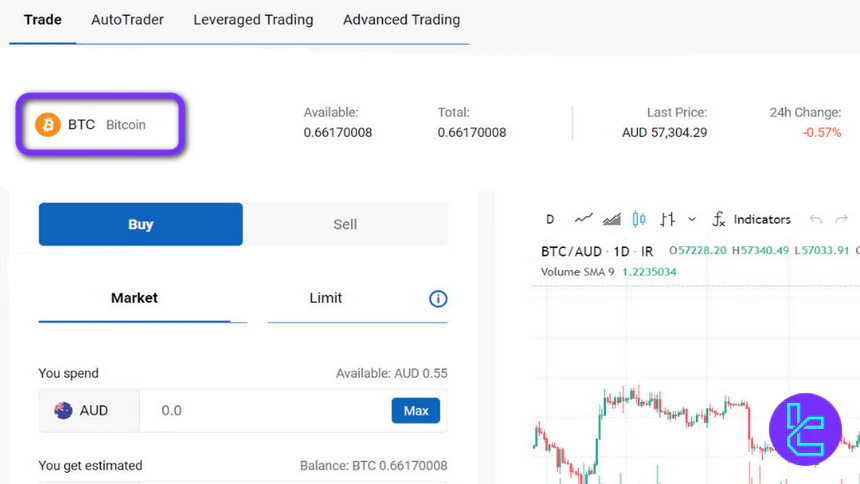

First of all, sign in to your account and then click on the “Trade” button at the top of the main page to find your way to the exchange page.

#2 Select a Trading Market

In the upper-left corner, click the currently displayed trading pair. A list of available markets will appear, allowing you to choose another pair

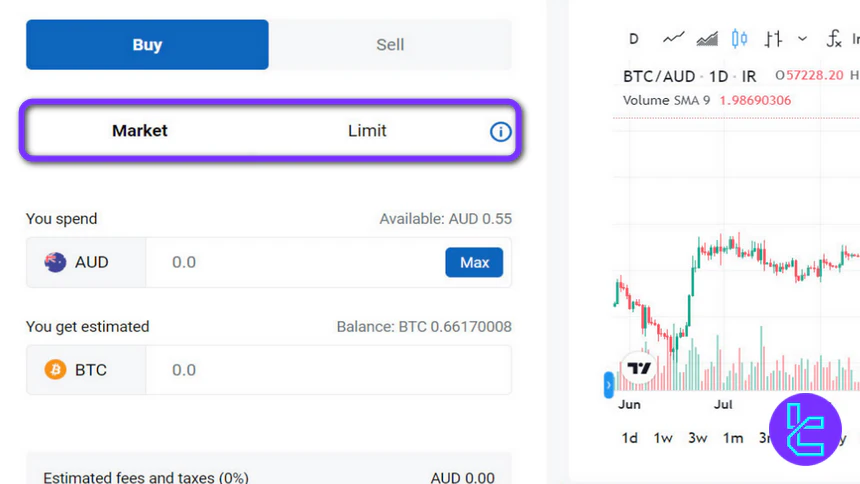

#3 Choose an Order Type

Independent Reserve supports different order types for execution. From the order panel on the left side, pick the type of order that matches your trading approach: market or limit.

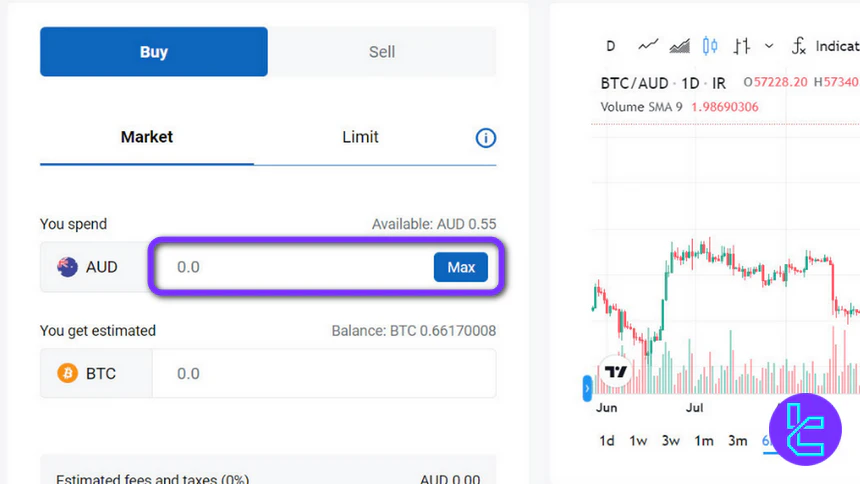

#4 Specify the Trade Amount

Enter the quantity of the cryptocurrency you want to buy or sell in the amount field. Ensure the number matches the trade size you want to execute.

#5 Finalize the Order

Click on “Buy” or “Sell” to place your order. Take a moment to verify that both the selected trading pair and the amount entered are correct before confirming the transaction.

Independent Reserve Platforms and Applications

The exchange offers a proprietary trading platform designed for both desktop and mobile use:

- Web-Based Platform: A sleek, intuitive interface with useful trading tools accessible from any modern web browser

- Mobile App: Available for iOS and Android devices, offering full trading functionality on the go

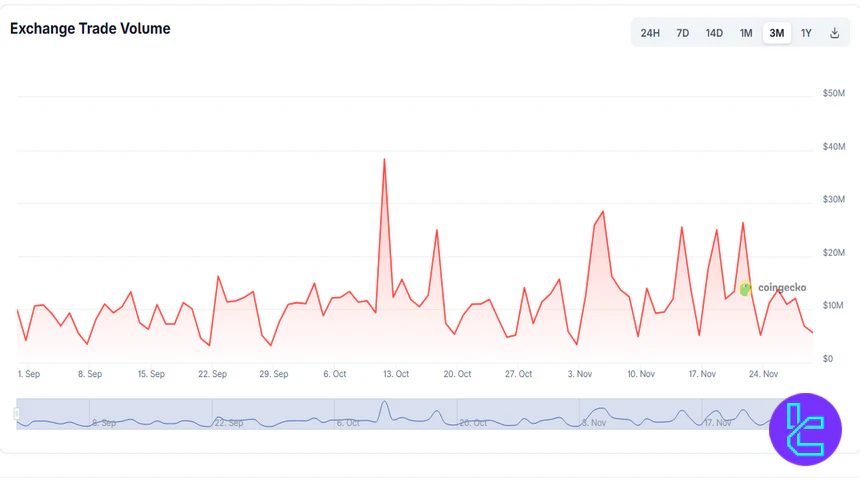

Independent Reserve Trading Volume

Independent Reserve has maintained a consistent level of trading activity over the past three months, showing frequent volume spikes driven by increased market participation.

Based on the Independent Reserve CoinGecko chart, daily trading volume generally fluctuates between lower ranges, while notable surges push activity toward higher levels during periods of heightened volatility.

This pattern reflects a stable user base actively engaging with the platform, supported by Independent Reserve’s reputation as a reliable exchange with timely execution and transparent trading conditions.

Independent Reserve Services

It’s time to see which of the popular trading services are available on the Independent Reserve exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

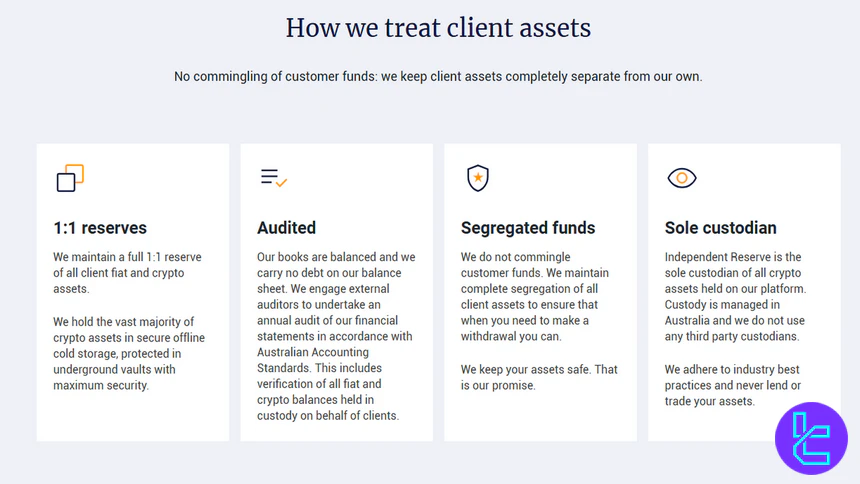

Exchange Safety; Is It Secure Enough?

Security is a top priority for Independent Reserve, and the exchange employs multiple layers of protection:

- Two-Factor Authentication (2FA)

- 1:1 Reserves (fully backed customer assets)

- Regular third-party audits

- Segregated client funds

- Cold storage for the majority of crypto assets

- Multi-layer encryption for hot wallet private keys

- Browser whitelisting for added account security

- Bug Bounty

This crypto platform has taken more security measures than most other exchanges in the industry.

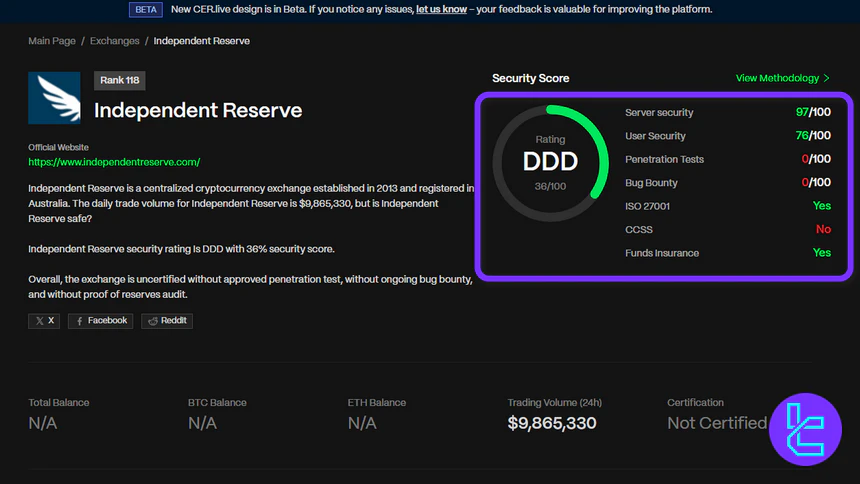

Independent Reserve Security Rankings

Independent Reserve’s security profile on CER.live presents a mixed picture, highlighting strong technical safeguards but notable gaps in certain advanced security practices.

According to the Independent Reserve CER.live review, the exchange achieves a 36% (DDD) overall score.

While its server and user security ratings are solid, some categories, such as penetration testing and bug bounty programs, receive the lowest possible score, indicating areas that require improvement. Below is a breakdown of the platform’s security results:

Overall Score | 36% (DDD) |

Server Security | 97/100 |

User Security | 76/100 |

Penetration Tests | 0/100 |

Bug Bounty | 0/100 |

ISO 27001 | Yes |

CCSS | No |

Funds Insurance | Yes |

Payment Methods for Deposits and Withdrawals

Independent Reserve supports a variety of options for deposits and withdrawals. We will briefly review the selection here:

- Cryptocurrency: Direct deposits and withdrawals for supported cryptocurrencies

- Fiat Currencies: Withdrawal to bank accounts (AUD, USD, NZD, SGD), Electronic Funds Transfer (for depositing AUD), Osko (AUD deposits), SWIFT (international wire transfers for deposits)

AUD withdrawals are free of charge. For non-AUD withdrawals, a fee of $20.00 applies. Cryptocurrency withdrawals also have specific fees: Bitcoin (XBT) withdrawals incur a fee of 0.0001 XBT, while Ether (ETH) withdrawals carry a fee of 0.001 ETH.

Additionally, withdrawals through the Airbridge™ API are free.

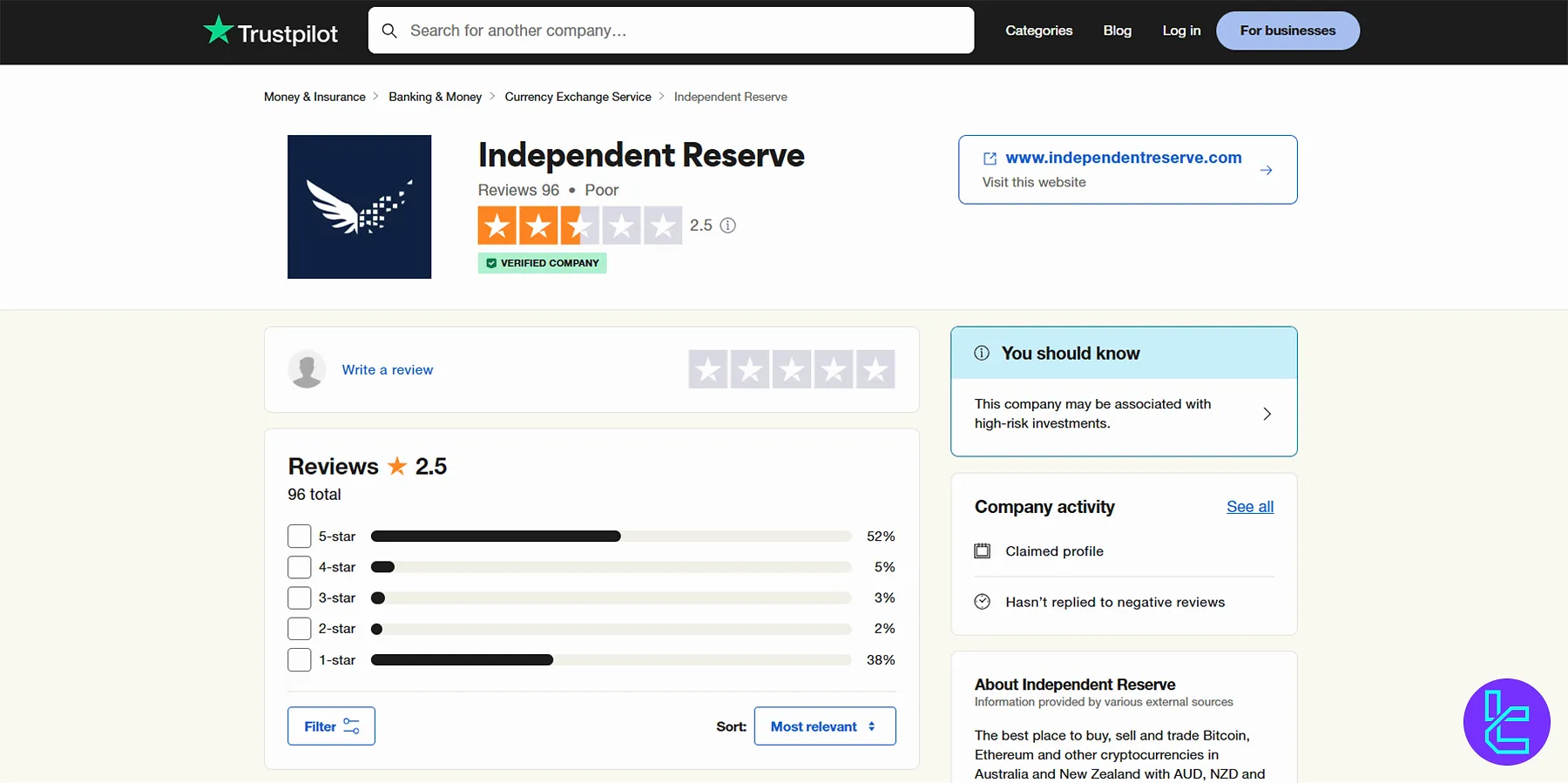

Independent Reserve Trust Evaluations and Scores

Trust scores from various platforms such as Trustpilot, ScamAdviser, and CoinGecko provide insight into user experiences and overall reputation:

- Trustpilot: 2.5/5 stars (based on 90+ reviews)

- ScamAdviser: 100/100 Trustscore, 2.5/5 user reviews score (95+ ratings)

- CoinGecko: 7/10 Trust Score

The high ScamAdviser Trustscore and solid CoinGecko rating suggest that Independent Reserve is a legitimate andtrustworthy platform overall.

Independent Reserve Features

Let's check the availability of advanced features on the exchange; Independent Reserve Features:

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | Yes |

Independent Reserve Promotions

Independent Reserve currently offers a very limited set of bonuses, with the Referral Program being the only active promotion available on the platform:

Bonus Type | Availability | Reward |

Referral Program | Yes | $20 worth of Bitcoin |

Referral Program

Independent Reserve’s Referral Program allows existing users (Referrers) to earn rewards by inviting new customers (Referees) to the platform.

When a Referee signs up using a Referrer’s unique referral code or link, completes account verification (FastTrack or full verification), deposits funds, and executes a trade, both parties receive $20 worth of Bitcoin.

Specifications:

- Referrers and Referees in New Zealand receive NZ$20, while those in other eligible jurisdictions receive A$20;

- There is no minimum trade amount required;

- Bitcoin is credited automatically at the prevailing market rate at the time of distribution.

This program is designed for active traders who can grow their network, generating an additional passive income stream through referrals.

The Referral Program runs indefinitely, subject to modification or termination by Independent Reserve at any time. Fraudulent activity will result in the reversal of any credited payments.

Independent Reserve Exchange Support

Customer support options on the discussed exchange include:

- Email: support@independentreserve.com

- Ticket System: Only available to registered clients

The company claims to offer customer services on a 24/7 basis. However, the lack of live chat or phone support may be a drawback for users who prefer immediate assistance.

Copy Trading and Passive Income Options

Based on our investigations, Independent Reserve does not offer a copy trading service with such title. However, a feature named "AutoTrader" is provided which works in a similar way to copy trading platforms; you can use automated crypto trading strategies offered in the library and earn profits.

There are no additional commissions for implementing these strategies. Also, strategies do not have a expiry time.

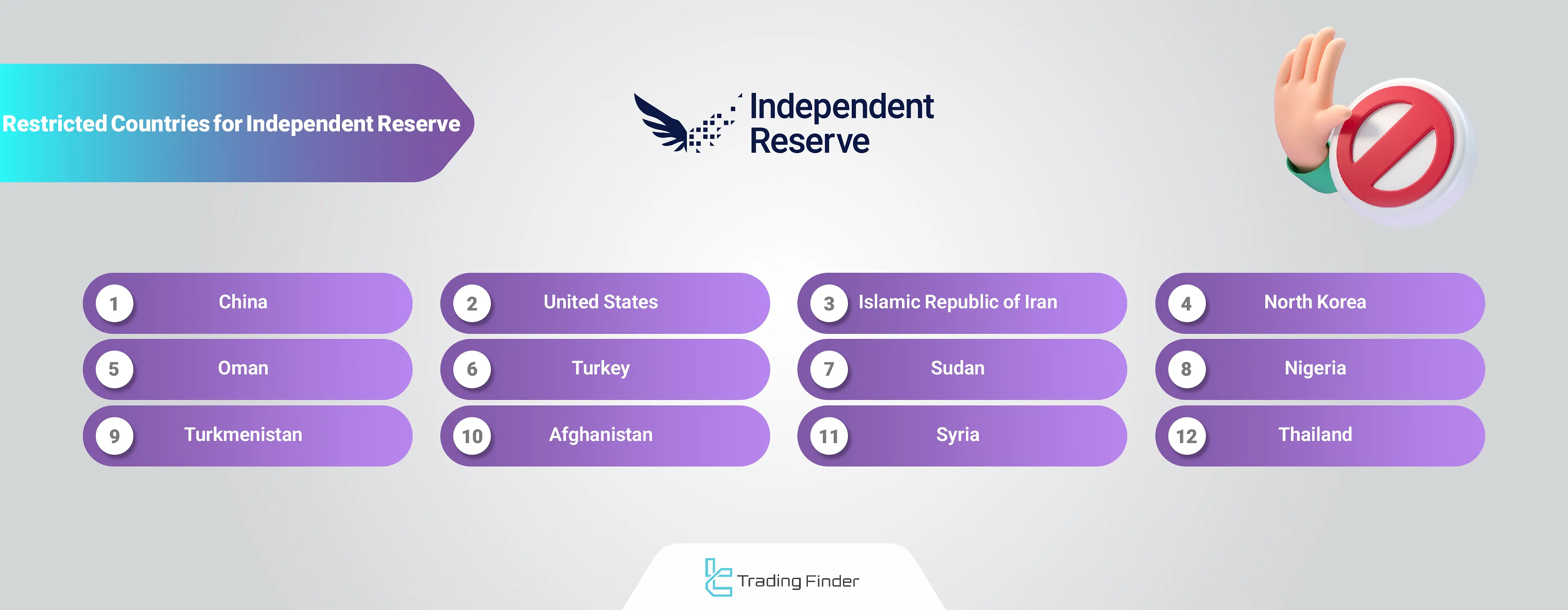

Banned Countries and Regions of Independent Reserve

The exchange operates globally and accepts clients from most countries. However, some countries are restricted because of the international sanctions or local regulations. The list includes, but is not limited to:

- China

- United States

- Iran

- North Korea

- Oman

- Turkey

- Sudan

- Nigeria

- Turkmenistan

- Afghanistan

- Syria

- Thailand

Independent Reserve Comparison Table

Let's compare Independent Reserve features with its rivals; Independent Reserve Comparison:

Features | Independent Reserve Exchange | |||

Number of Assets | 32 | 400+ | 1300+ | 700+ |

Maximum Leverage | 5x | 1:125 | 1:100 | 1:200 |

Minimum Deposit | $1 | $1 | N/A | 1 USDT |

Spot Maker Fee | 0.5% Down to 0.02% | 0.02% - 0.1% | 0.005% - 0.1% | 0.0126% - 0.2% |

Spot Taker Fee | 0.5% Down to 0.02% | 0.04% - 0.1% | 0.015% - 0.1% | 0.0218% - 0.2% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | None | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | No |

Staking | Yes | Yes | No | Yes |

Copy Trading | N/A | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Independent Reserve, serving over 400,000 traders across the globe, has a ISO 27001 certification and is a member of the Digital Economy Council of Australia.

This exchange's website has received a DDD evaluation rating with an overall score of 36% from CER.live in terms of the domain's security, lacking a bug bounty program and penetration tests.