Indodax was founded by Oscar Darmawan and William Sutanto. The platform is ISO 9001 and ISO 27001 certified. Fees for USDT markets are Buy Maker 0.2948%, Buy Taker 0.3248%, Sell Maker 0.2948%, and Sell Taker 0.3248%.

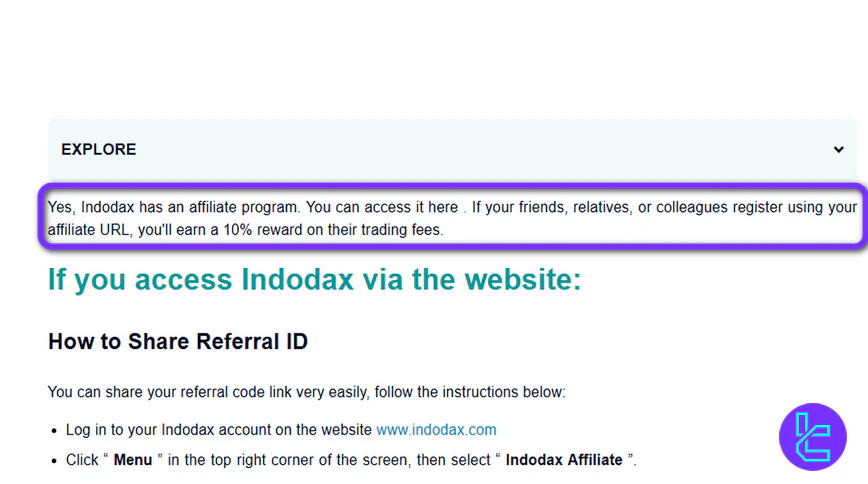

The minimum deposit requirement is IDR 10,000. Indodax exchange offers 10% of referred clients’ trading fees (only for the first 3 months) to its affiliates.

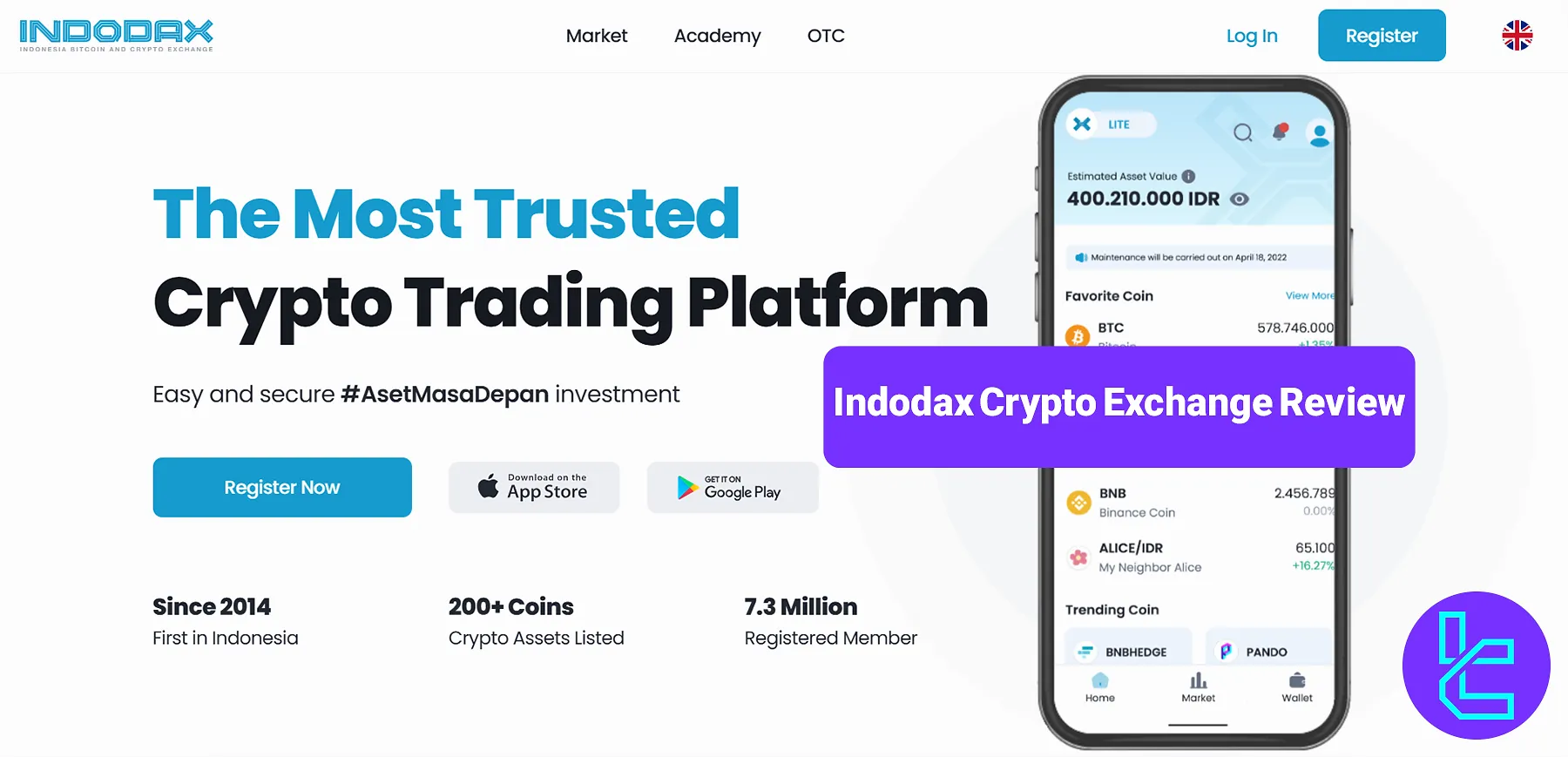

Indodax; Largest Crypto Exchange in Indonesia

Indodax, formerly known as Bitcoin Indonesia or Bitcoin.co.id, was founded in 2014. The platform has over 7.2M members and supports 200+ digital assets. Key features of Indodax:

- ISO certified: ISO 9001 and 27001

- Licensed by BAPPEBTI

- Founded by Oscar Darmawan and William Sutanto

- 10M monthly visitors

Indodax currently supports over 400 cryptocurrencies across IDR spot markets. This includes major assets like Bitcoin and Ethereum, as well as an expanding list of altcoins, meme tokens, and NFT-related assets.

Indodax CEO

William Sutanto is the Co-founder and CEO of Indodax, Indonesia’s leading digital asset exchange. Based in Jakarta, he has over 15 years of experience in blockchain and fintech.

Based on William Sutanto LinkedIn page, he has also co-founded several other ventures, including Tokenomy, Ads.id, Udana, Ayobantu, and Kredibel, and is involved in businesses like Bank Danakarya, Bali Top Changer, Intrajasa, Sakumas, and Lyfe.

He began his career at PT. Bumi Intermedia (2007–2013) as Chief Financial and Technology Officer, overseeing product quality, IT development, and financial management.

In 2013, he co-founded PT. Bitcoin Indonesia, launching Bitcoin.co.id, which evolved into today’s Indodax platform. Initially serving as CTO, he was instrumental in projects such as BitIslands, TokoBitcoin, BitBayar, and Indonesia’s Bitcoin ATM network.

In May 2025, Sutanto became CEO of Indodax, where he continues to lead innovation in Indonesia’s digital asset ecosystem.

Indodax Specific Features

PT Indodax Nasional Indonesia is the country’s largest Crypto Exchange, enabling users to buy, sell, and trade over 200 cryptocurrencies.

Exchange | Indodax |

Launch Date | 2014 |

Levels | Regular, Priority |

Trading Fees | Variable based on your position type |

Restricted Countries | United States, Myanmar, Cote D`Ivoire, Cuba, Iran, Syrian Arab Republic, Belarus, Congo, Democratic Republic of Congo, Iraq, Liberia, Sudan, Zimbabwe, North Korea |

Supported Coins | 200+ |

Futures Trading | No |

Minimum Deposit | IDR 10,000 |

Deposit Methods | Mandiri, BRI, OVO, QRIS, Crypto, Bank Transfer |

Withdrawal Methods | Crypto, Bank Transfer |

Maximum Leverage | 1:1 |

Minimum Trade Size | IDR 10,000 |

Security Factors | Biometric Authentication, Cold Storage, 2FA |

Services | Earn, API Trading, IDR Markets |

Customer Support Ways | Email, Ticket, Live Chat, Tel |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | N/A |

Pros and Cons

When considering Indodax as your crypto exchange of choice, weighing its advantages and disadvantages is essential.

Pros | Cons |

User-friendly trading platform and interface | limited range of supported cryptocurrencies (200+) |

Localized support for Indonesian users | No leverage options |

Partnerships with local Indonesian banks | Recent hack incident |

Earn program | Slow customer support response |

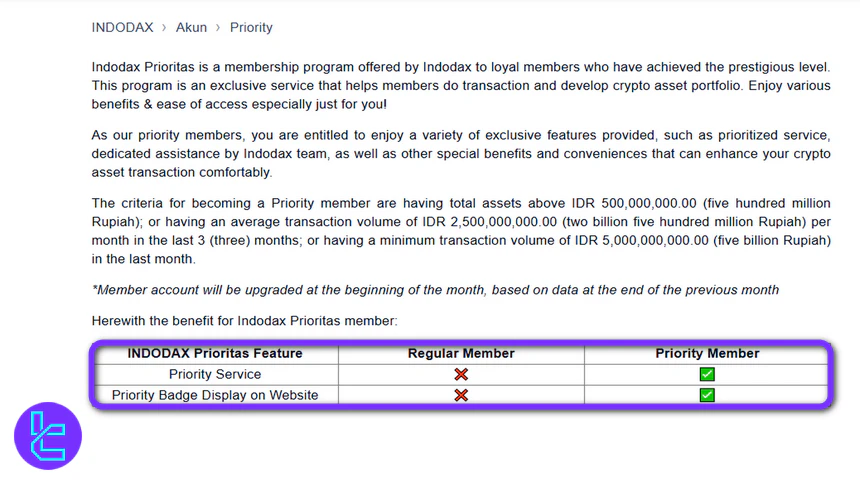

Indodax Exchange User Levels

While the platform doesn’t offer a comprehensive user level system with fee discounts, it has implemented a two-tier membership program: Regular and Priority.

VIP service and an exclusive badge on the user’s profile are the advantages of becoming a priority member, which requires one of the following conditions:

- A trade volume of IDR 7B per month

- Total asset balance of IDR 500M

Indodax accounts are split into two modes within its mobile app:

- Lite Mode: For beginner traders, includes simplified interfaces and recurring buys

- Pro Mode: Advanced charting, stop-limit orders, and full-featured trading tools

Indodax Fees Explained

In this Indodax review, we must mention that starting January 1, 2025, there is an adjustment of costs in the IDR market (0.12%) & USDT market (0.22%) due to the 12% increase in VAT (Value Added Tax).

Indodax costs include a trading fee, tax, and CFX fee. The sum is gathered in an All-in-Fee, as below:

Market | Buy | Sell | ||

Maker | Taker | Maker | Taker | |

IDR | 0.2424% | 0.3424% | 0.2224% | 0.3224% |

USDT | 0.2948% | 0.3248% | 0.2948% | 0.3248% |

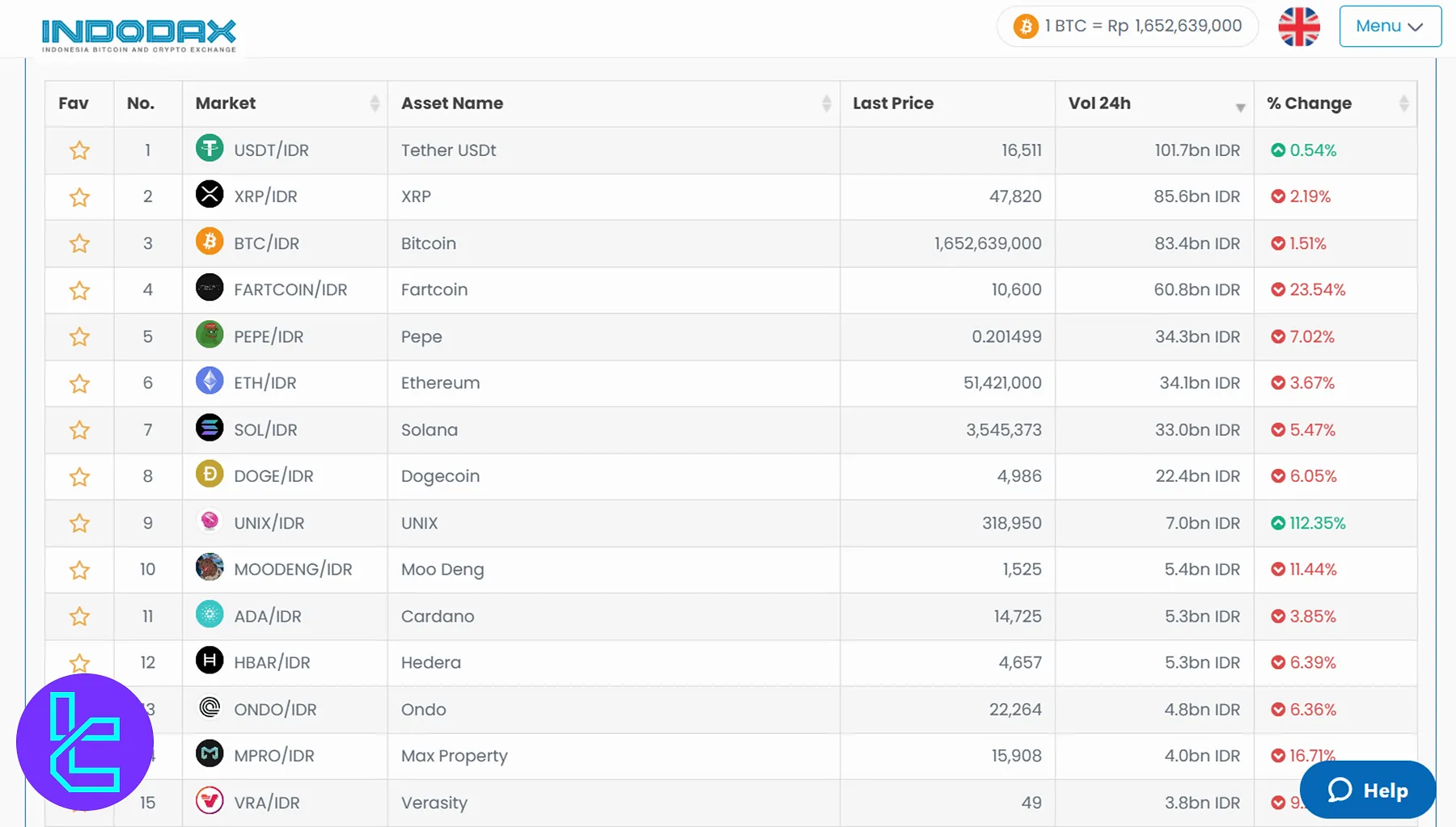

Supported Digital Assets on Indodax

The platform has listed more than 200 digital assets for OTC and Spot trading in two markets: USDT and IDR. Some of the most popular cryptocurrencies available on Indodax:

- BTC

- PEPE

- ETH

- SHIB

- BONK

- LUNC

- SOL

- DOGE

- UNIX

Leveraged Trading on Indodax Exchange

As of 2024, Indodax does not offer leveraged trading or margin trading features. The exchange focuses solely on spot market trading, where users can buy and sell digital assets using their own capital.

Sign Up and Verification

To register and start trading with the platform, you must be at least 17 years old or married. We’ll go through the steps of the Indodax registration in this Indodax review:

#1 Visit the Indodax Official Website

Start by navigating to the official website of the crypto exchange. Once on the homepage, click the “Register” button to begin setting up your new account. Choose the “Create Account” option to proceed to the user onboarding form.

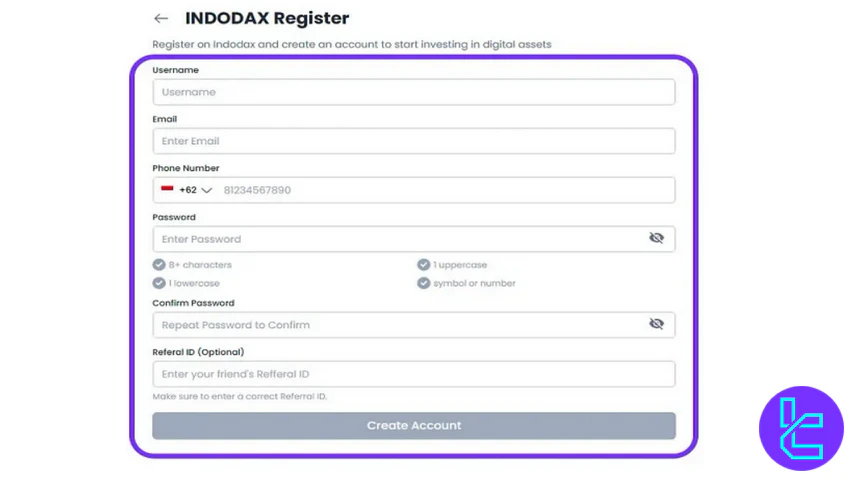

#2 Complete the Indodax Registration Form

Enter your basic personal details, such as your name, email address, password, and phone number.

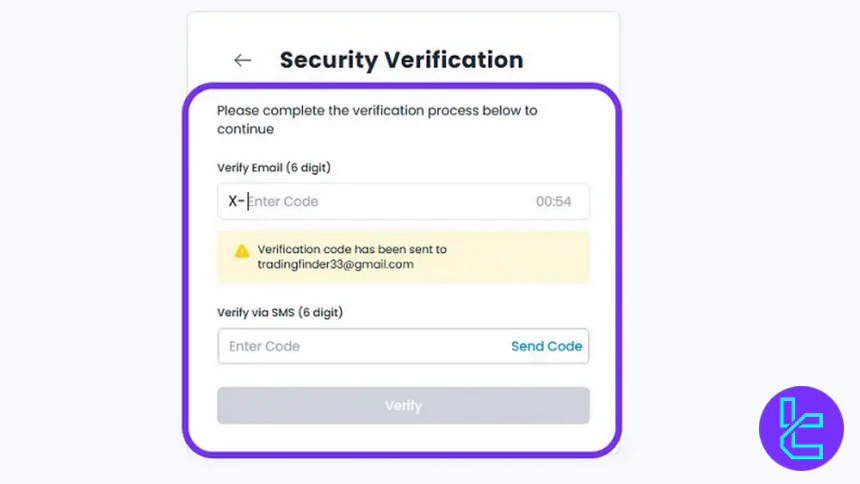

#3 Verify Email and Phone Number on Indodax

Check your inbox and phone for verification codes. Confirm both your email address and mobile number to activate your account.

#4 Complete Face Detection in Indodax

Use your device’s camera to undergo real-time face detection, a standard part of KYC to confirm your identity.

#5 Upload Required Documents on Indodax Website

Submit the following verification documents to complete your KYC process:

- e-KTP for Indonesian citizens

- Passport for international users

- Recent utility bill or bank statement showing your name and address

Indodax Trading Guide

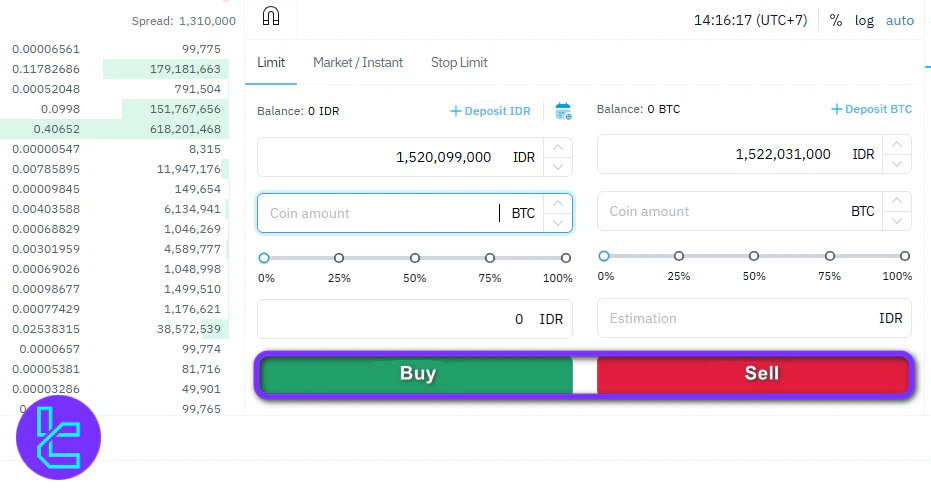

To start trading on the Indodax platform, follow these steps after completing your registration and identity verification process:

#1 Access the Trading Interface

Begin by logging into your account, and then click on the “Market” option located at the top of the homepage. This will take you to the market section where all cryptocurrencies are displayed.

#2 Select a Trading Market

A full list of available markets will open, giving you the option to choose the cryptocurrency pair that you prefer to trade.

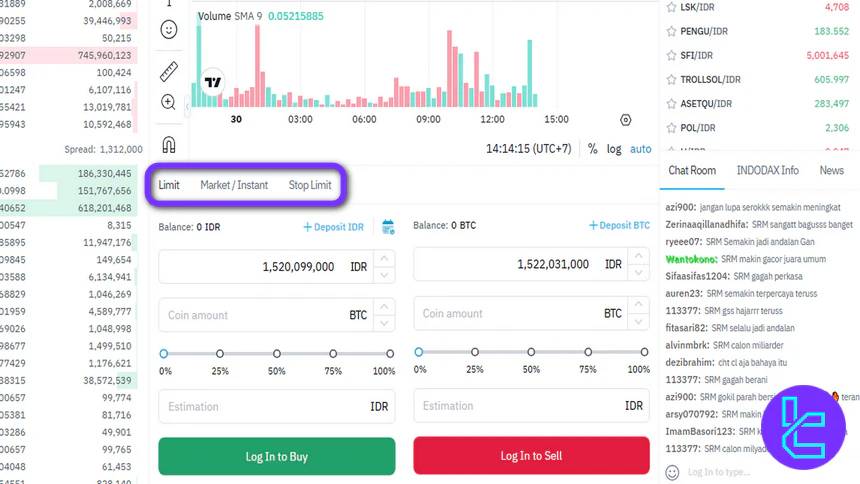

#3 Choose an Order Type

Indodax offers several order types for traders. From the order panel, choose the type of order that best fits your strategy, such as an instant (market) order or a limit order.

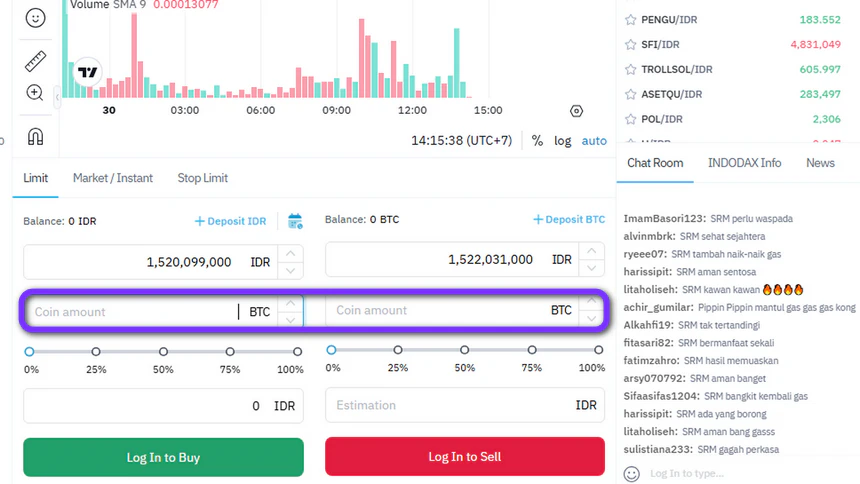

#4 Specify the Trade Amount

Type in the amount of the cryptocurrency you wish to buy or sell in the designated amount field. Make sure the value reflects the exact trade size you plan to execute on the platform.

#5 Finalize the Order

When everything looks correct, click on “Buy” or “Sell” to submit your order. Before confirming the transaction, take a moment to double-check both the selected trading pair and the amount you have entered.

Indodax Trading Platform

The exchange offers a proprietary Web Trader and a dedicated mobile application integrated with TradingView charts. Indodax application download links:

To access additional analytical tools, you can visit TradingFinder’s list of TradingView indicators.

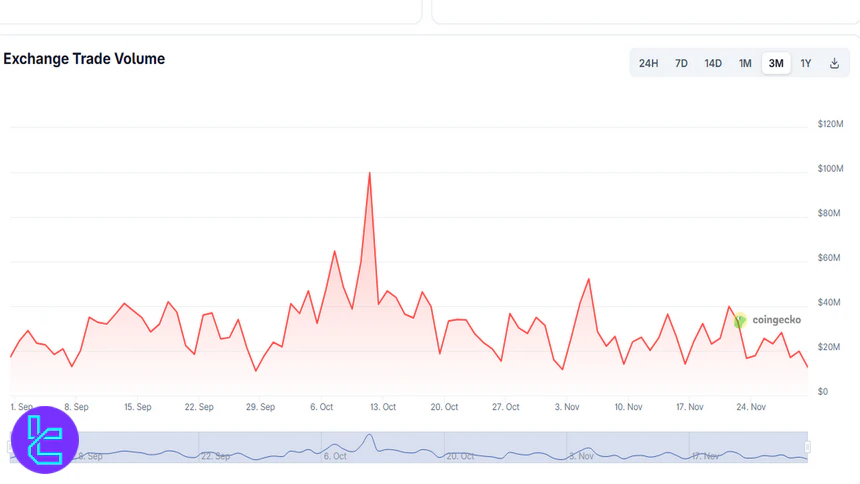

Indodax Trading Volume

According to the Indodax CoinGecko chart, over the past three months, Indodax has shown a dynamic trading volume pattern, marked by multiple short-term spikes and a few major surges in activity.

The chart indicates a significant volume peak in mid-October, followed by consistent fluctuations ranging mostly between the lower and mid-range levels.

While the exchange does not maintain a strictly linear trend, its recurring volume bursts suggest active market participation and steady liquidity throughout the period. This overall pattern reflects a healthy level of trader engagement on the platform.

Indodax Services

In the table below, you can check the availability of trading services on the Indodax exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

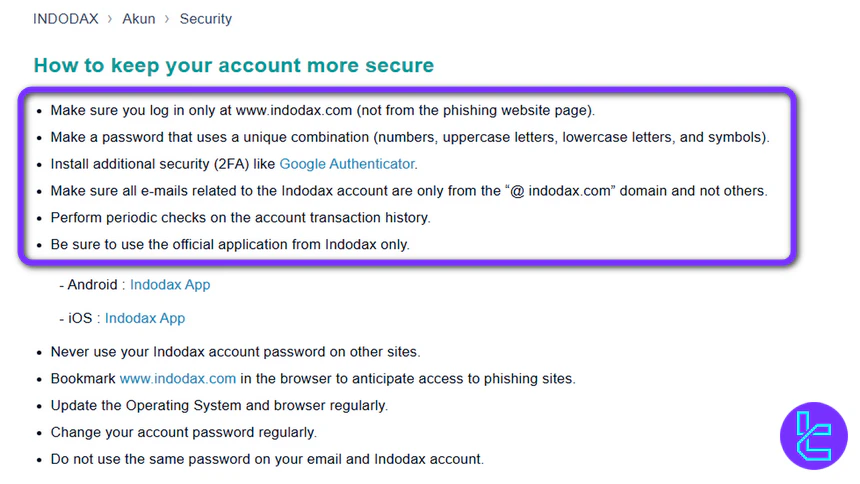

Indodax Security & Safety

The exchange prioritizes the security of its users' funds and data, implementing various measures to protect against cyber threats. However, in 2024, Indodax was hacked, according to CoinTelegraph:

- Major hack in 2024 resulted in a loss of $22 million;

- Attacks on the platform’s hot wallets containing Bitcoin, Ethereum, TRX, MATIC, and other cryptocurrencies;

- The Indodax web platform and the mobile application went offline during the maintenance procedure.

Despite the incident, we can say in this Indodax review that the platform implements decent security measures to protect users’ funds, including:

- Two Factor Authentication (2FA)

- Cold storage

- Biometric authentication

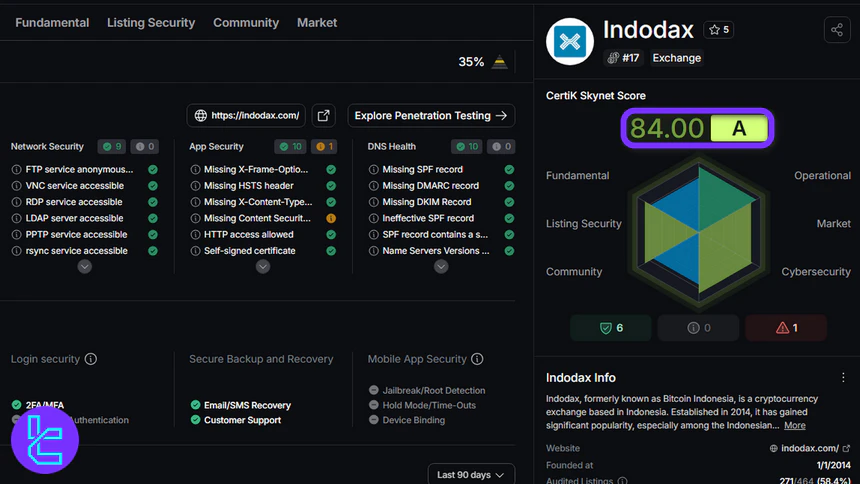

Indodax Security Rankings

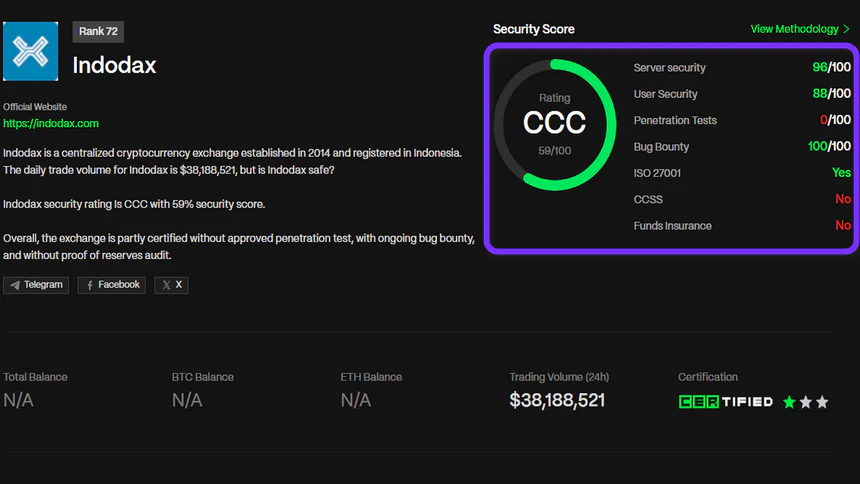

Indodax’s security profile presents a nuanced picture, combining strong technical protections with several areas that still require improvement. Based on the Indodax CertiK Skynet assessment, the exchange achieves an impressive 84/100 (A) overall rating.

This reflects particularly strong performance in Operational Security (93.30), Listing Security (87.78), and Cybersecurity (86.94), three pillars that directly influence user safety and platform reliability.

Even the Market and Fundamental metrics remain solid, indicating stable infrastructure and consistent exchange operations.

However, data from the Indodax CER.live review introduces a more cautious perspective.

Indodax receives a 59% (CCC) rating. While the exchange scores high in server-level and user-level protections (96/100 and 88/100), it falls short in critical verification layers such as penetration testing (0/100) and CCSS compliance, which are essential for modern crypto-exchange resilience.

The presence of ISO 27001 certification and a full bug bounty score (100/100) demonstrates commitment to structured security standards, yet the absence of funds insurance remains an important consideration for risk-averse users.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 84.00 / 100 (A) |

Fundamental | 77.75 | |

Operational | 93.30 | |

Listing Security | 87.78 | |

Market | 84.72 | |

Community | 74.29 | |

Cybersecurity | 86.94 | |

CER.live Score | Overall Score | 59% (CCC) |

Server Security | 96/100 | |

User Security | 88/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | No |

Supported Payment Methods

Indodax exchange allows Crypto and Fiat (Indonesian Rupiah) deposits and withdrawals.

While IDR withdrawals can only be made through bank transfers, users have a wide selection of methods to charge their accounts, including:

- E-wallets: OVO

- Virtual accounts: Mandiri and BRI

- Bank transfers

- QRIS (QR code-based payments)

User Satisfaction

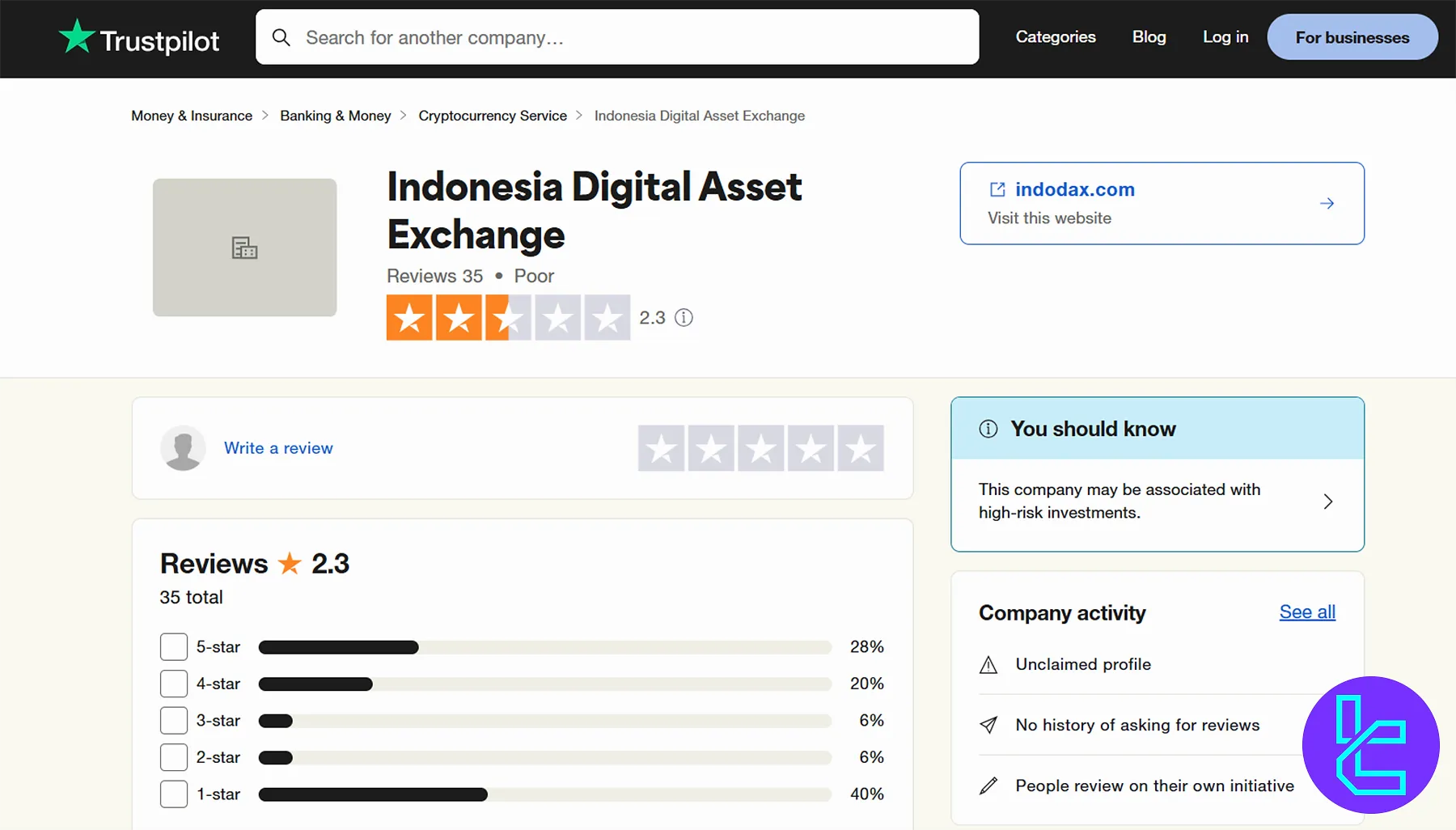

Despite being the largest crypto exchange in Indonesia, the platform has garnered mixed user reviews.

TrustPilot | 2.3/5 based on 35 comments |

Reviews.io | 3.3/5 based on 6 reviews |

While 48% of comments on the Indodax TrustPilot profile are positive (4-star and 5-star),46% are negative (1-star and 2-star).

Indodax Features

Let's check if there are any advanced features on the exchange; Indodax Features:

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

Indodax Bonus

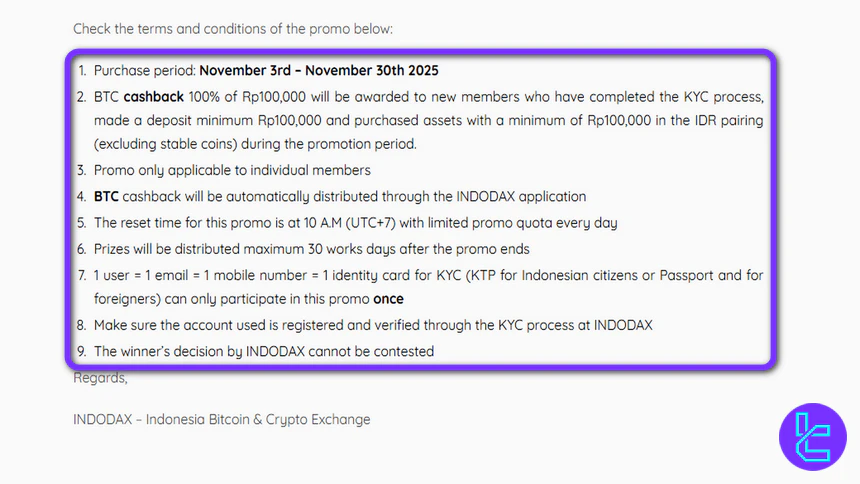

Indodax offers attractive incentives for both new and existing users, designed to make trading more rewarding. These include a referral program for inviting friends and a first-trade cashback bonus for newcomers. Both bonuses are easy to claim and integrated directly within the Indodax platform.

Bonus Type | Requirements | Reward / Incentive | Notes |

Referral / Affiliate Program | Invite friends to register and trade with your referral link | 10% of friends’ trading fees | Rewards updated daily; friend must be “active” |

First-Trade Cashback Bonus | KYC completed, deposit Rp100,000, purchase crypto assets Rp100,000 in IDR pairing (excluding stablecoins) | 100% cashback of Rp100,000 in BTC | Limited daily quota, one account per individual, prize distribution within 30 days |

Referral / Affiliate Program

Indodax users can earn a 10% reward on trading fees whenever their friends, colleagues, or relatives register and trade using their referral link. The program is straightforward:

- Log in to your Indodax account;

- Click on “Menu” and then “Indodax Affiliate”;

- Copy your referral ID or referral link and share it;

- Track total rewards and invited friends directly through the My Rewards and Invited Friends menus. Rewards are updated daily for the past 100 days.

You will receive rewards only when your invited friend is active, meaning their account is verified, and they have completed at least one crypto transaction.

First-Trade Cashback Bonus

For newcomers, Indodax makes the first trade more exciting with a BTC cashback bonus:

- Complete the KYC verification process;

- Deposit at least Rp100,000;

- Purchase crypto assets worth Rp100,000 in the IDR pairing (excluding stablecoins);

- Receive 100% cashback of Rp100,000 in BTC automatically through the Indodax app.

Customer Support

Indodax boasts 24/7 support through various channels, including a call center and an online chat feature.

support@indodax.com | |

Tel | (021) 5065 8888 |

Tel (Priority members only) | (021) 5036 8888 |

Ticket | Through the “Contact Us” page |

Live Chat | Available on the official website |

Does Indodax Offer Copy Trading or Investment Plans?

The exchange does not offer copy trading or social trading features. However, it provides a comprehensive Earn program dedicated to staking cryptocurrencies. Key features of Indodax Earn:

- Over IDR 467B total staking

- More than IDR 28B in interests

- 71,971 participants

A list of available coins in the platform’s staking service with their annual percentage yields:

Digital Asset | APY |

ETH | 3.12% |

IDRX | 3.42% |

BNB | 0.39% |

SOL | 5.40% |

DOT | 10.43% |

POL | 2.58% |

ADA | 1.76% |

Restricted Jurisdictions on Indodax Exchange

The platform's General Terms and Conditions (GTC) outline specific restrictions on user eligibility. Indodax does not accept users who are citizens of:

- United States

- Myanmar

- Cote D'Ivoire

- Cuba

- Iran

- Syrian Arab Republic

- Belarus

- Congo

- Democratic Republic of Congo

- Iraq

- Liberia

- Sudan

- Zimbabwe

- North Korea

Indodax Comparison Table

Let's compare Indodax services and features with its competitors; Indodax Comparison:

Features | Indodax Exchange | |||

Number of Assets | 200+ | 400+ | 1300+ | 700+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:200 |

Minimum Deposit | IDR 10,000 | $1 | N/A | 1 USDT |

Spot Maker Fee | 0.2948% USDT | 0.02% - 0.1% | 0.005% - 0.1% | 0.0126% - 0.2% |

Spot Taker Fee | 0.3248% USDT | 0.04% - 0.1% | 0.015% - 0.1% | 0.0218% - 0.2% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | No |

Staking | Yes | Yes | No | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's opinion and conclusion

Indodax provides access to 200+ digital assets in USDT and IDR markets without leverage options. The platform supports IDR deposits through OVO, Mandiri, and BRI.

Despite implementing various security factors, such as Biometric Authentication, the Indodax exchange was hacked in 2024 and has a poor TrustPilot score of 2.3.