KCEX exchange supports over 85 cryptocurrencies, including BTC, ETH, XRP, and USDT. KCEX offers a trading platform featuring 0% trading fees for spot and futures maker trades and 0.02% for futures takers.

The exchange incorporates advanced security measures like 2FA, cold storage, and multi-signature wallets to ensure user safety.

KCEX Company Information and Regulation Status

KCEX, founded in 2021 and headquartered in Seychelles, has rapidly established itself as a prominent player in the cryptocurrency exchange market.

The company prides itself on offering users a diverse, low-fee, and secure trading experience worldwide.

While KCEX operates globally, it's important to note that the exchange adheres to strict regulatory compliance measures to ensure a safe and transparent trading environment for its users.

KCEX CEO and Founder

As of now, the specific identity of KCEX's CEO or founder is not publicly disclosed. The company maintains a relatively low public profile, and detailed information about its leadership is not readily available in public records or major industry sources.

This lack of transparency is not uncommon among newer or smaller cryptocurrency exchanges.

KCEX Exchange Specifics Table

Here are a table of summary about the crypto exchange and its features; KCEX Specifics Table:

Exchange | KCEX |

Launch Date | 2021 |

Levels | N/A |

Trading Fees | 0% Spot (Taker & Maker) & 0% Futures Maker, 0.02% Futures Taker |

Restricted Countries | Canada, Venezuela, Bangladesh, Pakistan, Afghanistan, Indonesia, Singapore, North Korea, Cuba, Myanmar, Sudan, Syria, Crimea, Mainland China, Hong Kong, Rwanda, Palau |

Supported Coins | BTC, ETH, XRP, LTC, USDT, USDC, BUSD, UNI, LINK, AAVE, DOGE, SHIB and others |

Futures Trading | YES |

Minimum Deposit | Varies bases on the coins & their network |

Deposit Methods | Crypto |

Withdrawal Methods | Crypto |

Maximum Leverage | 1:100 |

Minimum Trade amount | Varied |

Security Factors | 2FA, Cold Storage, SSL, Anti Phishing, Multi-Signature Wallets |

Services | Futures, Spot, Margin Trading |

Customer Support Ways | Live Chat, ticket, Email |

Customer Support Hours | 24/7 |

Fiat Deposit | No |

Affiliate Program | YES |

Orders Execution | Market, Limit |

Native Token | N/A |

This table provides a quick overview of KCEX’s key features, highlighting its competitive fee structure, diverse trading options, and focus on user-friendly experiences coupled with advanced trading tools.

KCEX Advantages and Disadvantages

To help you make a better decision about using the change, this KCEX review examines the advantages and disadvantages; KCEX Pros and cons:

Pros | Cons |

0% maker fees for spot and futures maker trading | No fiat currency support for deposits or withdrawals |

Wide range of cryptocurrencies supported (80+) | Relatively new exchange (established in 2021) |

User-friendly interface suitable for beginners | Limited track record compared to older exchanges |

High leverage options (up to 100x) for futures trading | Not available in all countries due to regulatory restrictions |

While KCEX offers many attractive features, particularly its fee structure and range of trading options, potential users should weigh these against the platform's limitations and relative newness in the market.

KCEX Exchange User Levels and Features

The exchange, unlike many platforms, does not appear to have predefined user levels or tiered account structures commonly seen in exchanges.

Typically, exchanges categorize users based on trading volume or account verification levels, offering different features like lower fees or higher withdrawal limits for higher tiers.

However, KCEX seems to focus more on offering universal access to its trading services, without segmenting users into distinct levels. Verification may still be required for enhanced features, but no clear user hierarchy is outlined at this point.

Fees and Commissions on KCEX

One of KCEX’s most attractive features is its competitive fee structure, which is designed to appeal to casual and high-volume traders; KCEX Fees for Deposits & Withdrawals:

Assets | Type of Network | Deposit Fees | Withdrawal Fees |

USDT | TRC20 | 0 | 1 |

BSC | 0 | 1 | |

ERC20 | 0 | 10 | |

AVAX_CCHAIN | 0 | 0.103 | |

ARB | 0 | 1.21 | |

Polygon | 0 | 0.33 | |

OP | 0 | 0.22 | |

SOL | 0 | 1.35 | |

BTC | BTC | 0 | 0.001 |

BSC | 0 | 0.000015 | |

ETH | ERC20 | 0 | 0.002 |

BSC | 0 | 0.0002 | |

ARB | 0 | 0.0007 | |

OP | 0 | 0.00008 |

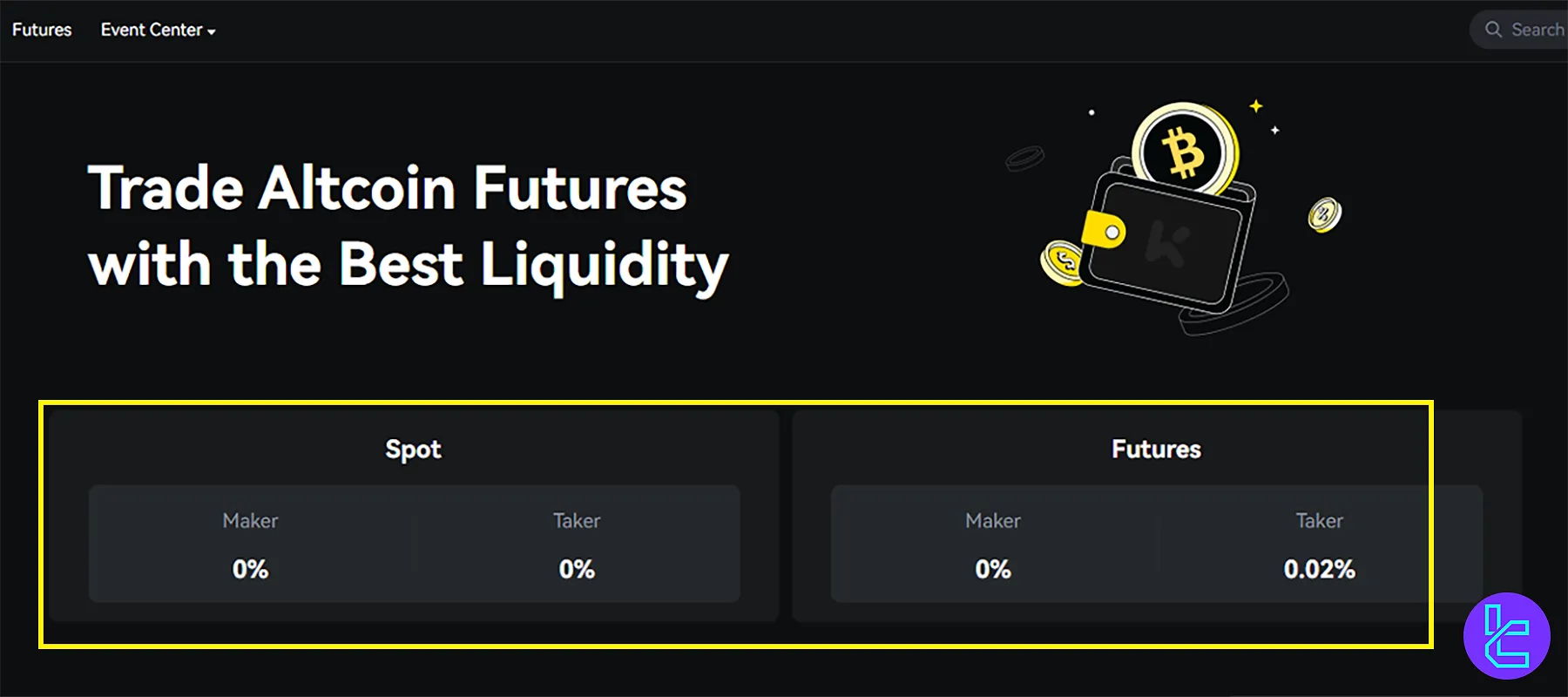

Here are the trading fees shown in the table below:

Trading Type | Maker Fee | Taker Fee |

Spot | 0% | 0% |

Futures | 0% | 0.02% |

It's important to note that while KCEX offers very competitive trading fees, users should always consider the total cost of trading, including potential slippage, especially during periods of high market volatility.

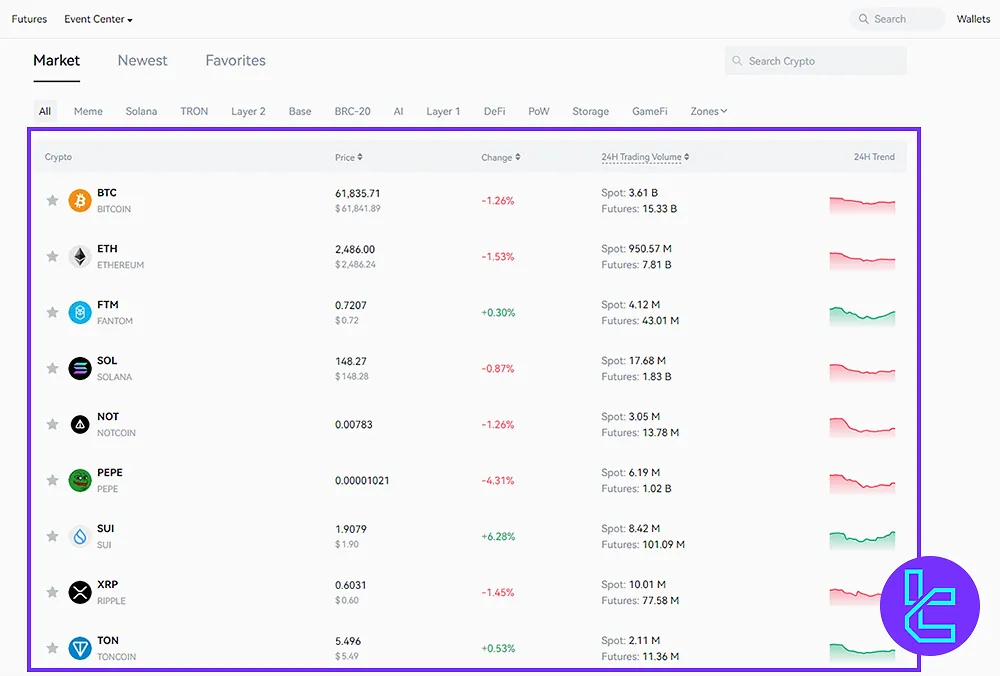

Coins and Assets Offered by the KCEX Exchange

KCEX offers a wide range of cryptocurrencies and digital assets for trading, catering to various investor preferences and strategies.

The platform supports over 670 popular cryptocurrencies, ensuring users access to a wide selection of trading pairs; Coins and assets offered by KCEX:

- Major cryptocurrencies: Bitcoin, Ethereum, Ripple, Litecoin

- Stablecoins: Tether, USD Coin, Binance USD

- Defi tokens: Uniswap, Chainlink, Aave

- Meme coins: Dogecoin, Shiba Inu

- Emerging altcoins and utility tokens

The exchange regularly reviews and adds new cryptocurrencies based on market demand and thorough vetting processes This ensures that users have access to both established and promising new projects in the crypto space.

Traders can begin with as little as 0.01 USDT or 0.0001 BTC. This micro-entry point is ideal for beginners or algorithmic traders testing strategies with minimal capital.

Once you created your portfolio of cryptocurrencies on KCEX, you can use TradingFinder's Crypto Market Watch Mini App to create a watchlist and track the assets' price changes.

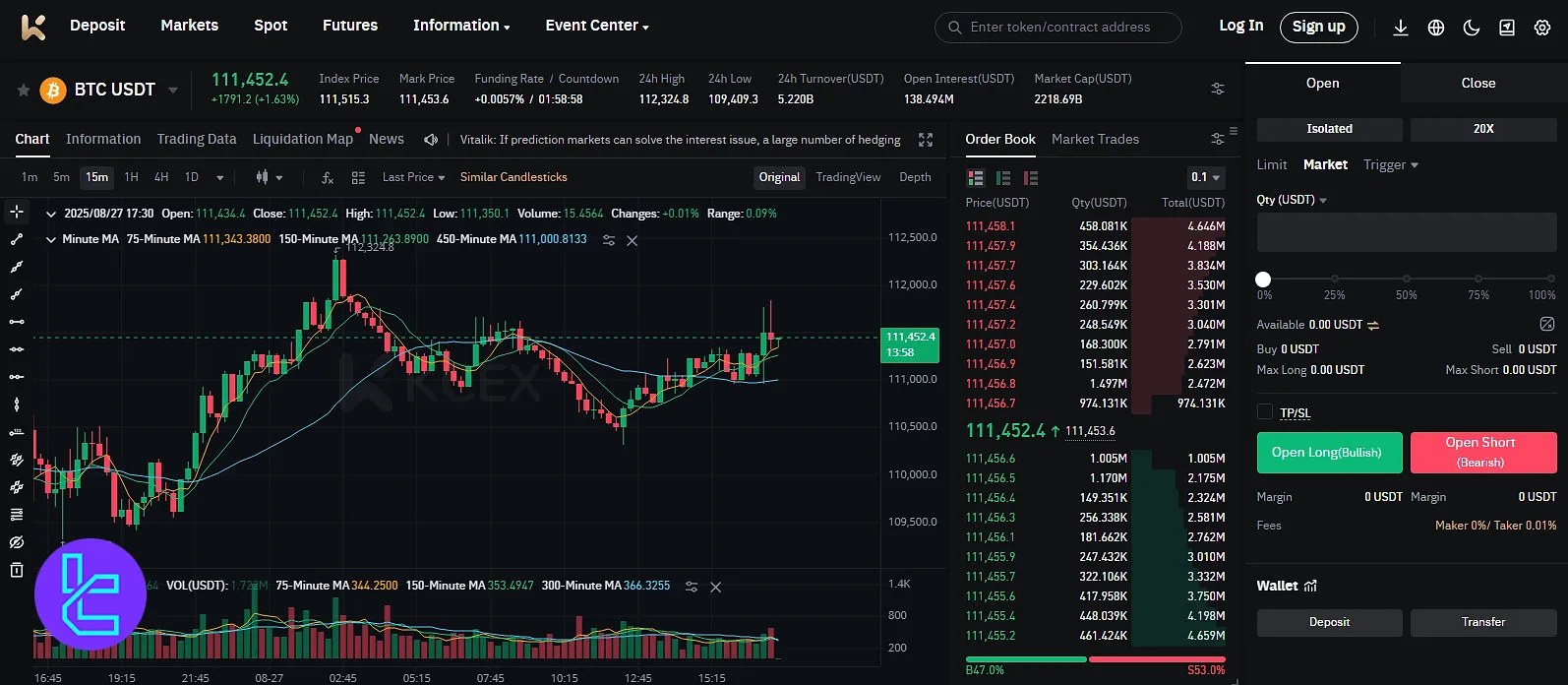

Futures and Margin Trading on the KCEX Exchange

KCEX offers robust futures and margin trading options, allowing users to leverage their positions and potentially amplify their returns; Futures and Margin Trading on KCEX:

- Leverage options: Up to100x leverage available for futures trading

- Contract types: Perpetual contracts and quarterly futures contracts

- Margin modes: Cross-margin and isolated margin

It's crucial to note that while futures and margin trading can offer significant profit potential, they also come with higher risks.

Traders should thoroughly understand these instruments and employ proper risk management strategies before engaging in leveraged trading.

KCEX Registration and Verification Process

Signing up on KCEX is fast and secure, combining streamlined onboarding with robust identity verification to ensure compliance and user protection.

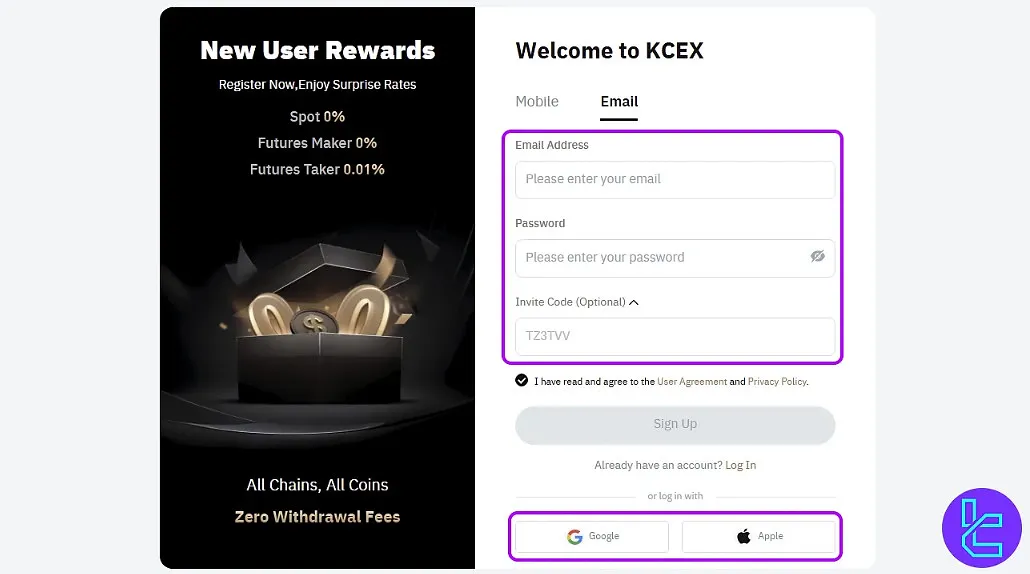

#1 Register Your KCEX Account

Visit the official website and click “Sign Up.”

Choose to register using either your email or mobile number, then set a secure password that aligns with platform requirements.

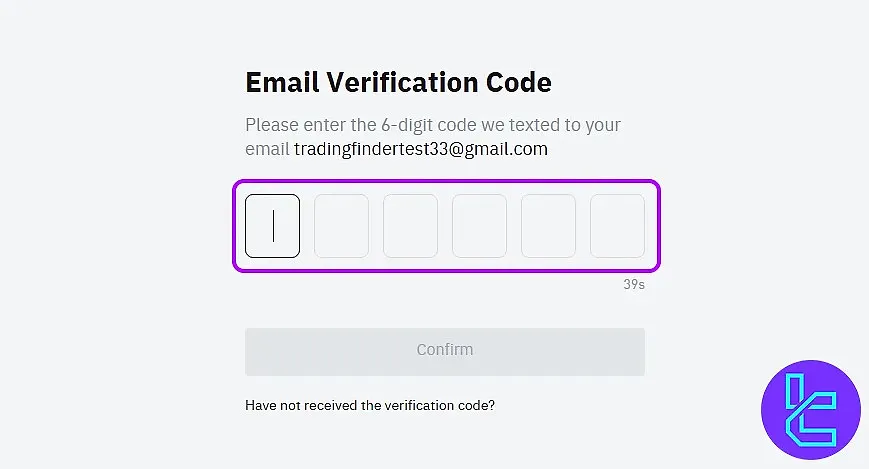

#2 Email/Phone Verification on KCEX

Complete the CAPTCHA to verify you're human, then enter the confirmation code sent to your inbox or phone. Once verified, you'll land on your KCEX dashboard.

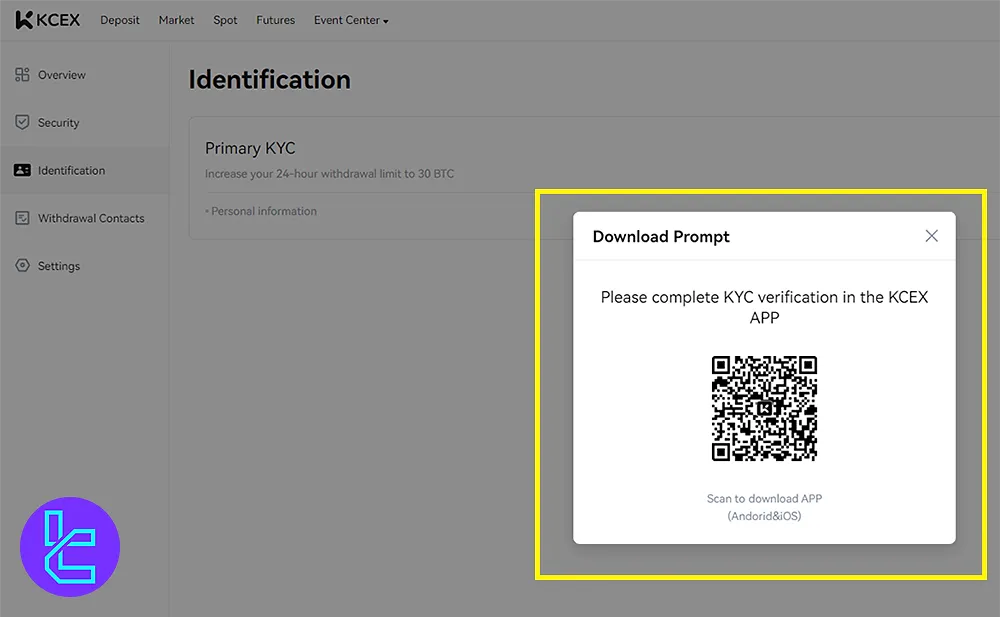

#3 Complete KCEX's KYC

Access the identification section within your dashboard. Download the KCEX app to proceed. Follow the instructions by submitting your personal information and uploading required documents, including:

- Proof of Identity (e.g., passport, ID card)

- Proof of Address (e.g., utility bill, bank statement)

Remember, while basic registration doesn't require KYC, completing the verification process unlocks higher withdrawal limits and adds an extra layer of security to your account.

How to Trade on KCEX?

Starting to trade on the KCEX exchange is easier than you think. Simply follow these instructions:

#1 Select Spot

Log in to your account and select “Spot” from the homepage menu.

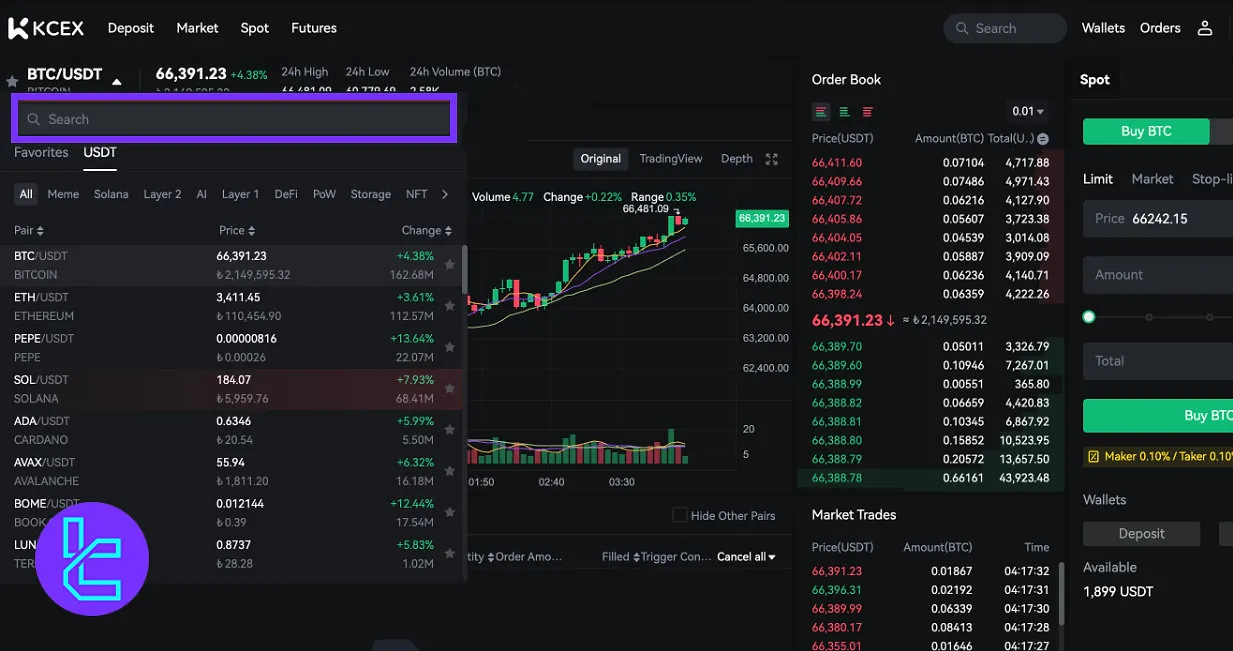

#2 Select a Coin

From the crypto list on the left, search and select the coin you wish to trade.

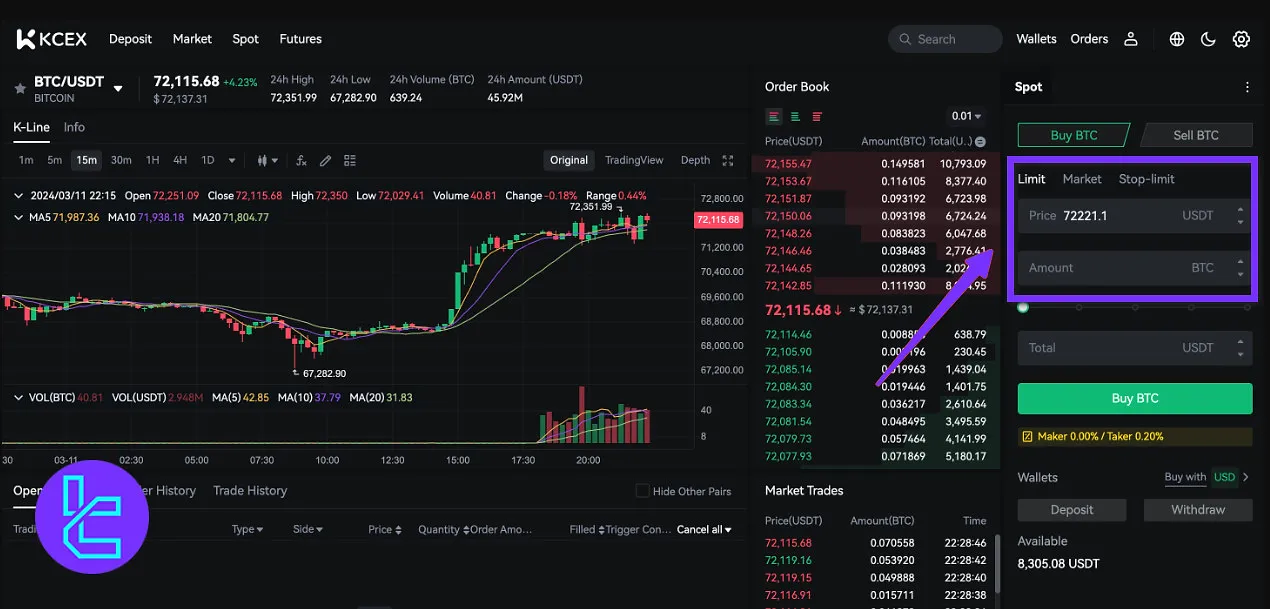

#3 Choose Order Type

In the trading panel, choose your preferred order type limit order or market order. Then, enter the desired price and amount.

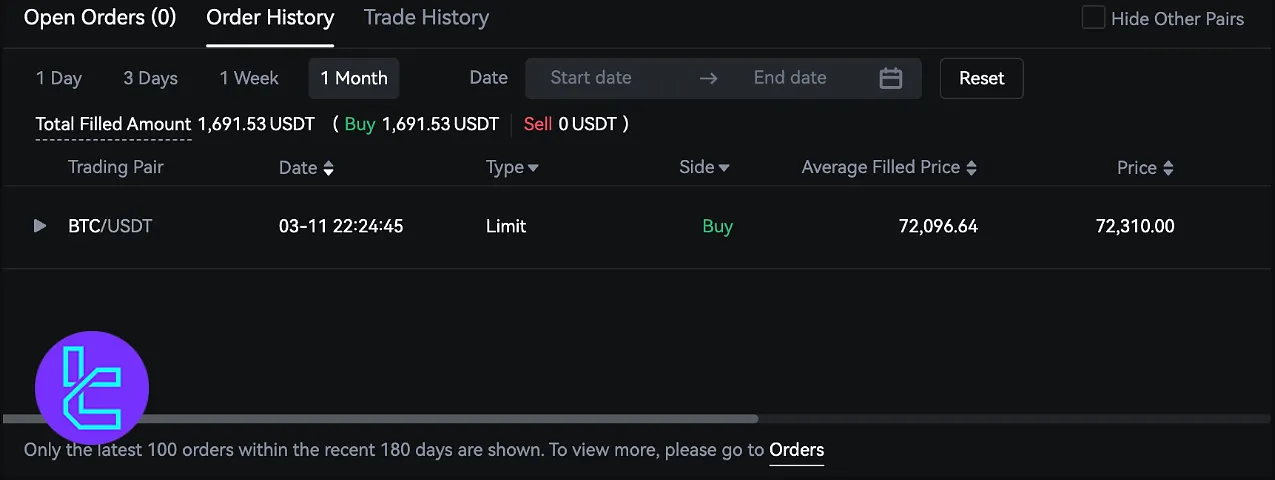

#4 Review Your Trade

Once the order is placed, you can track your active positions and review past trades at the bottom of the page.

Platforms and Applications Available on the KCEX exchange

KCEX offers a variety of platforms and applications to cater to different user preferences and trading styles; KCEX trading platforms:

| Platform | Features |

| Web Trading Platform | User-friendly interface with advanced charting tools |

Accessible from any modern web browser | |

Supports both basic and advanced trading features | |

| Mobile Applications | For Android and iOS |

Offers full trading functionality on the go | |

Push notifications for price alerts and order updates |

The exchange also provides access to TradingView charts through its platforms.

Note that TradingFinder has developed multiple advanced TradingView indicators that you can use for free.

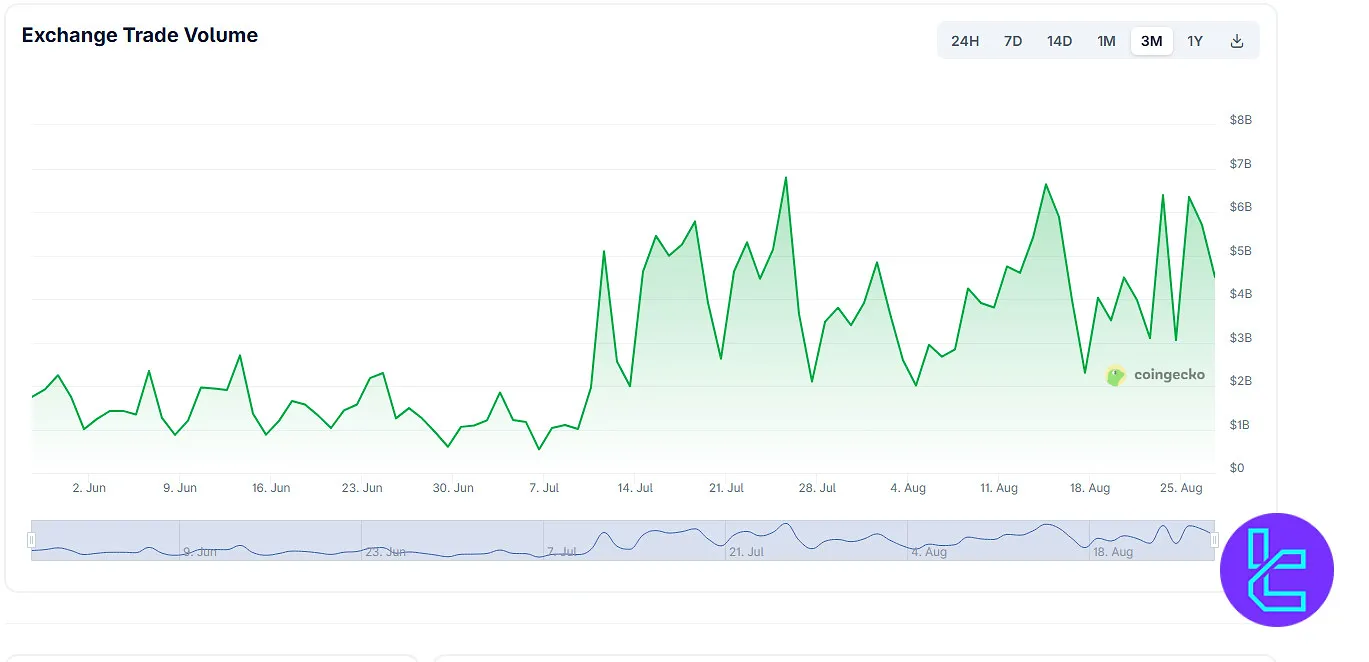

KCEX Trading Volume

KCEX has seen a significant surge in its trading activity over the past three months. According to data from KCEX CoinGecko, daily trade volume, which was hovering around the $500 million to $1 billion range in early June 2025, started climbing sharply in mid-July.

By the end of July, KCEX volumes frequently exceeded $5 billion, reaching peaks of nearly $7 billion on its busiest days in August.

This steady growth highlights KCEX’s rising adoption among traders and increasing liquidity across its markets.

The trend indicates that the exchange has successfully positioned itself as a competitive player in the industry, especially during the second half of the summer.

KCEX Services

Using the table below, you can check the availability of trading services in KCEX exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | No |

P2P Trading | No |

OTC Trading | No |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

KCEX Security & Safety Measures

The exchange prioritizes the security of user funds and personal information, implementing a multi-layered approach to protect against potential threats; KCEX Securities:

- Two-Factor Authentication (2FA): Mandatory for all withdrawals and optional for logins

- Cold Storage: The majority of user funds stored in offline, multi-signature wallets

- SSL Encryption: All data transmitted to and from the platform is encrypted

- Anti-Phishing Measures: Customizable anti-phishing codes for emails

- Hack History: No known security breaches to date

While KCEX employs robust security measures, users are encouraged to practice good security hygiene, such as using strong, unique passwords and enabling all available security features on their accounts.

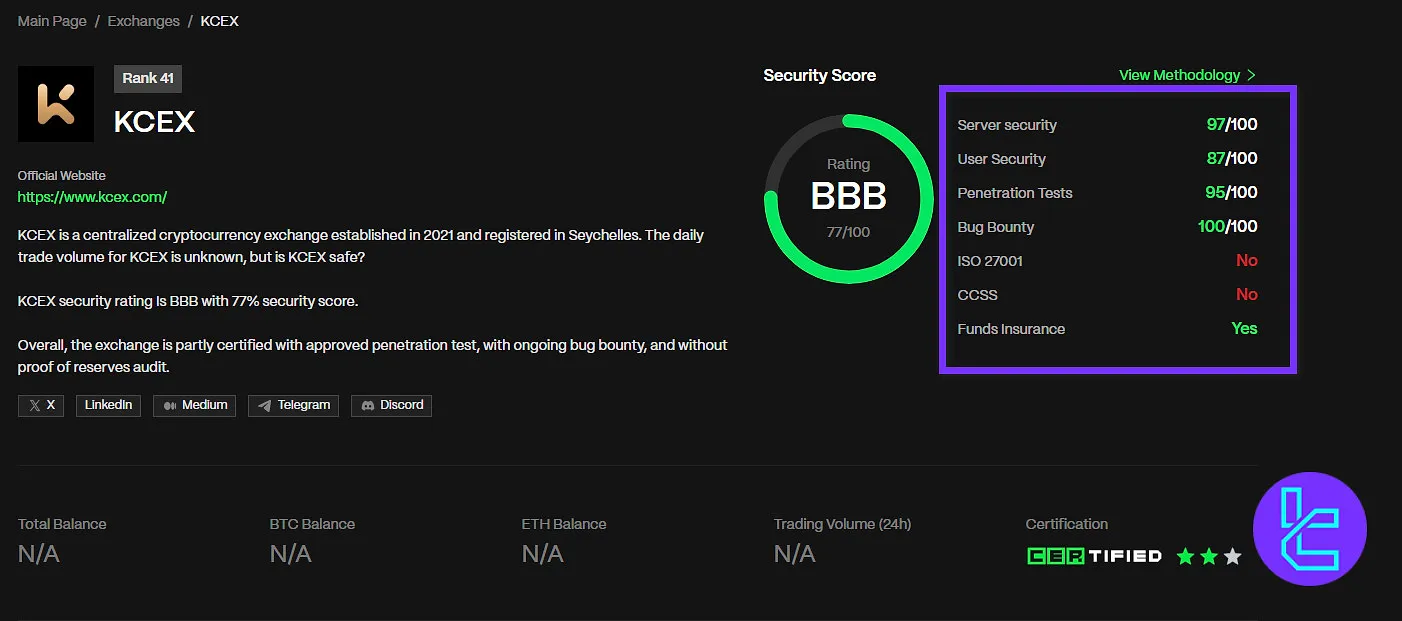

KCEX Security Rankings

KCEX has undergone an independent security evaluation by CER.live, receiving an overall score of 77% (BBB rating).

Based on KCEX CER.live, The exchange demonstrates strong technical safeguards with a 97/100 server security rating, 87/100 user security rating, and 95/100 penetration test score. KCEX also runs a bug bounty program (100/100) to encourage external security audits.

However, the platform does not hold ISO 27001 or CCSS certifications, though it does provide an added layer of protection with funds insurance.

Overall Score | 77% (BBB) |

Server Security | 97/100 |

User Security | 87/100 |

Penetration Tests | 95/100 |

Bug Bounty | 100/100 |

ISO 27001 | No |

CCSS | No |

Funds Insurance | Yes |

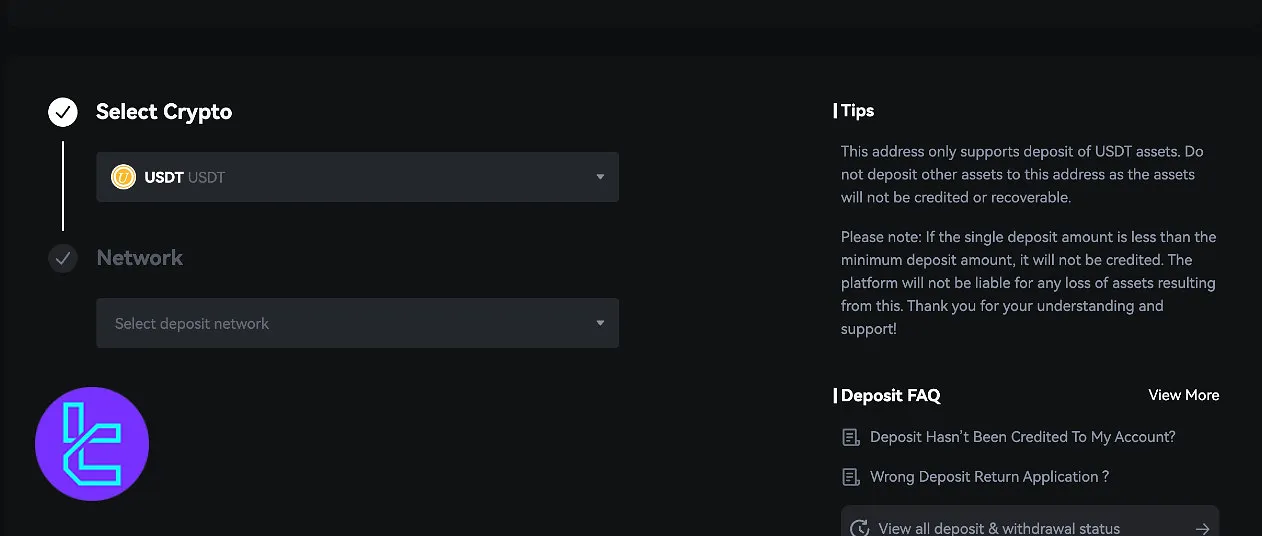

KCEX’s Payment Methods

The Exchange focuses on cryptocurrency transactions, offering a seamless experience for users who prefer to trade directly with digital assets.

it's important to note that KCEX does not directly support fiat currency deposits or withdrawals through traditional banking methods.

Users looking to trade with fiat currencies may need to use the P2P trading option or third-party services to convert their fiat to cryptocurrency before trading on the platform.

The exchange’s Trust Scores and Evaluations

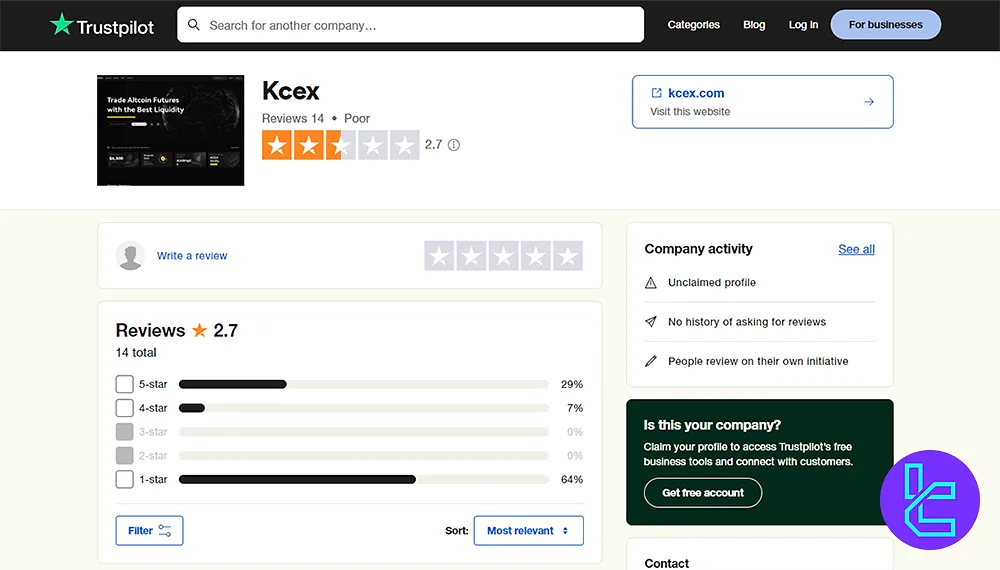

The KCEX Trustpilot profile presents a concerning snapshot of customer satisfaction. With an overall rating of 2.7 stars out of 5 based on just 14 reviews, KCEX is rated as “Poor.”

The majority of feedback consists of 1-star reviews, indicating significant customer dissatisfaction, which could stem from issues such as service quality, reliability, or customer support.

However, despite the negative outlook, a few users have given 5-star ratings, suggesting that some have had positive experiences with the platform.

Note that the small number of reviews may not be fully representative of the platform’s user base.

KCEX Features

Let's check out the availability of the advanced features on the exchange; KCEX Features:

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

KCEX Bonus

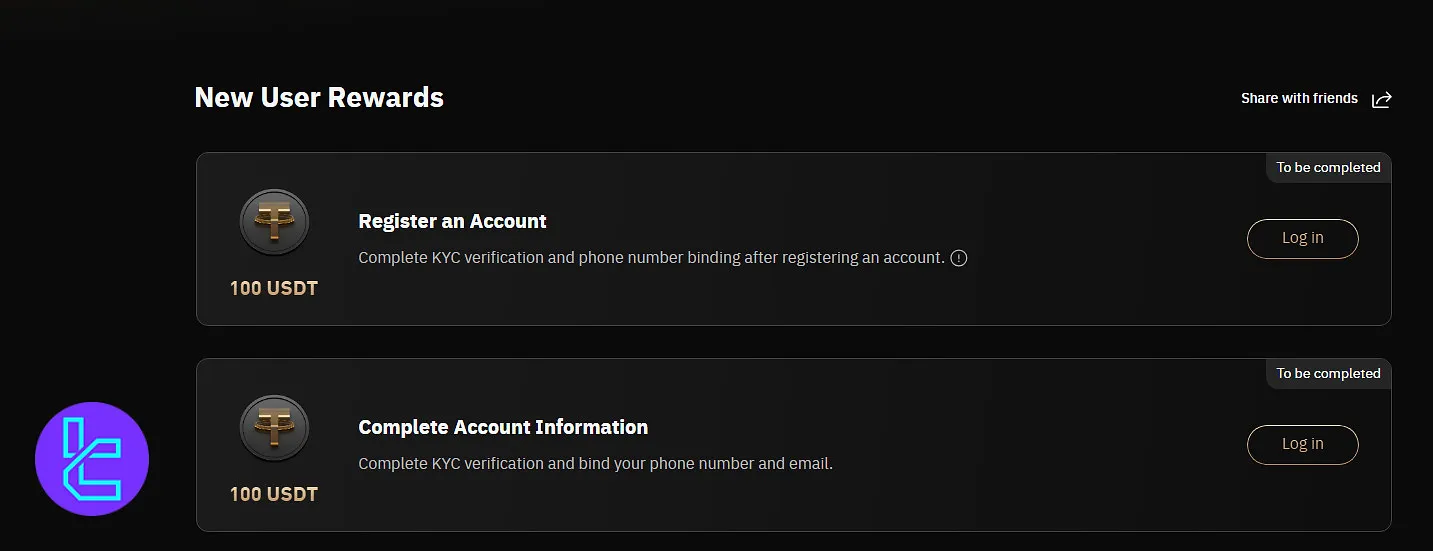

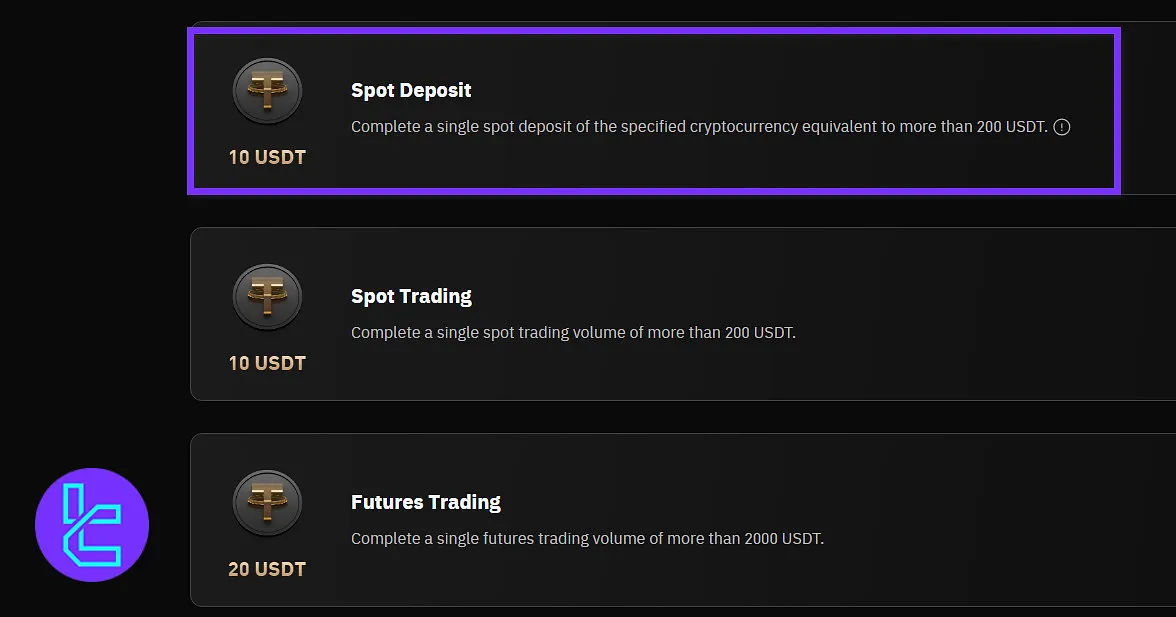

KCEX offers a variety of bonuses and promotions to attract new users and reward active traders. Here's an overview of the current bonus offerings:

Bonus Type | Details | Rewards |

Sign-Up Bonus | Available for new users who register with a referral code and complete tasks such as KYC, first deposit, and first trade | Up to $470 USDT in rewards |

Deposit Boost | 10% bonus on the first deposit | Deposit ≥ 100 USDT = 10 USDT Deposit ≥ 500 USDT = 50 USDT Deposit ≥ 1,000 USDT = 100 USDT Deposit ≥ 5,000 USDT = 500 USDT Deposit ≥ 10,000 USDT= 1,000 USDT |

Referral Program | Users can refer friends with a code (e.g., BONUS100) to earn bonuses and commissions | Up to $3,200 USDT in welcome bonuses - 20% commission from referred users’ trading fees |

Sign-Up Bonus

By registering with a referral code, new users can claim up to $470 USDT in rewards. These rewards are typically unlocked by completing tasks such as:

- Completing identity verification (KYC)

- Making the first deposit

- Executing the first trade

Deposit Boost

KCEX provides a 10% bonus on your first deposit, with rewards structured as follows:

- Deposit ≥ 100 USDT = Get 10 USDT

- Deposit ≥ 500 USDT = Get 50 USDT

- Deposit ≥ 1,000 USDT = Get 100 USDT

- Deposit ≥ 5,000 USDT = Get 500 USDT

- Deposit ≥ 10,000 USDT = Get 1,000 USDT

Referral Program

Users can earn commissions by referring others to KCEX. For example, using the referral code "BONUS100" allows users to:

- Claim up to $3,200 USDT in welcome bonuses

- Earn 20% commission from the trading fees of referred users

KCEX support working time and contact info

The Exchange provides customer support to assist users with their queries and concerns; KCEX Support Services:

Contact Methods | Working Time | Access |

24/7 (responds within 24 to 48 hours) | support@kcex.com | |

Ticket | 24/7 (responds within 24 to 48 hours) | Help Center |

Live chat | 24/7 | On the website |

KCEX also maintains a comprehensive FAQ section and knowledge base on its website, which can help users find quick answers to common questions and issues.

For more complex problems or account-specific inquiries, users are encouraged to open a support ticket for personalized assistance.

Copy Trading Services and Investment Options on KCEX

While the KCEX exchange doesn't currently offer traditional copy trading services or staking options, it still presents a robust trading environment for users.

The absence of these features may limit certain trading strategies, especially for novice traders looking to mirror successful investors or earn passive income through staking.

However, KCEX compensates with other functionalities. The platform offers competitive spot and futures trading with zero fees for makers and minimal taker fees, which can be appealing for active traders.

Additionally, KCEX provides access to various cryptocurrencies, enabling users to diversify their portfolios.

KCEX Exchange List of Restricted Countries

KCEX, like many crypto exchanges, operates under certain regulatory constraints and may restrict access to its services in some countries.

The exact list of restricted countries may change over time due to evolving regulations; KCEX Restricted Countries:

- North Korea

- Palau

- Rwanda

- Cuba

- Myanmar

- Sudan

- Syria

- Crimea

- Mainland China

- Hong Kong

- Indonesia

- Singapore

- Venezuela

- Bangladesh

- Pakistan

- Afghanistan

- Canada

- United States

KCEX Comparison Table

Let's do a quick comparison between KCEX services and features and its rivals; KCEX Comparison:

Features | KCEX Exchange | |||

Number of Assets | 670+ | 400+ | 1300+ | 700+ |

Maximum Leverage | 1:100 | 1:125 | 1:100 | 1:200 |

Minimum Deposit | 0.01 USDT | $1 | N/A | 1 USDT |

Spot Maker Fee | 0% | 0.02% - 0.1% | 0.005% - 0.1% | 0.0126% - 0.2% |

Spot Taker Fee | 0% | 0.04% - 0.1% | 0.015% - 0.1% | 0.0218% - 0.2% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | No | Yes | Yes | No |

Staking | No | Yes | No | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer’s opinion and conclusion

KCEX delivers notable advantages, such as a zero-fee model for makers, support for 85+ cryptocurrencies, and robust trading functionalities like margin trading with 100x leverage.

Withdrawal fees vary based on network and coin, such as 1 USDT for TRC20 and 0.001 BTC for Bitcoin transactions, which could impact frequent traders.

Restrictions in several countries, including Canada and Singapore, might deter some users.