Korbit offers 192 Crypto/KRW trading pairs with two fee plans: Basic (0.1%) and Free (0.0% for Makers and 0.2% for Takers). NXC, SK Square, and Nexon own the company. The minimum deposit and minimum trade size are KRW 10,000 and KRW 5,000, respectively.

Founded in 2013 by Kangmo Kim, Louis Jinhwa Kim, and Tony Lyu, Korbit made history by launching the world’s first Bitcoin-KRW trading service in April 2013.

In July 2018, it became the first Korean crypto exchange to obtain ISO 27001 certification, while also securing SOC 1 Type 2 internal control certification.

Korbit; The Exchange's Information and Introduction

Korea Bitcoin Exchange Co., Ltd was established in 2013 as the first cryptocurrency exchange in South Korea by Kangmo Kim, Louis Jinhwa Kim, and Tony Lyu.

The company obtained ISO 27001 certification in July 2018, a first for a Korean crypto exchange. Key features of Korbit:

- Financial aspect internal control global certification final (SOC 1 Type 2)

- Shareholders: NXC, SK Square, and Nexon

- Total Funding: $82.5

Korbit initially launched as a BTC/KRW exchange, but now supports multiple digital assets, including BTC, BTG, BCH, ETH, XRP, LTC, DASH, ZCH, XMR, Augur, Steem, and ETC.

Korbit CEO

Sejin Oh has been leading Korbit, one of South Korea’s pioneering cryptocurrency exchanges, since January 2020. He stepped into the role of Chief Executive Officer after serving as Chief Strategy Officer for nearly a year.

Based on Sejin Oh LinkedIn page, before Korbit, he co-founded Entropy Trading Group, where he acted as Managing Partner from February 2018 to April 2019.

With over six years of experience at Korbit, Sejin has been instrumental in shaping the exchange’s strategy and growth in the competitive crypto market.

Korbit Exchange Specifications

Korbit launched the first NFT marketplace in South Korea in May 2021. Let’s see if the platform has what it takes to be among the crypto exchanges.

Exchange | Korbit |

Launch Date | 2013 |

Levels | N/A |

Trading Fees | 0.1% |

Restricted Countries | Only available to South Korean residents |

Supported Coins | 192 |

Futures Trading | No |

Minimum Deposit | KRW 10,000 |

Deposit Methods | Crypto, Fiat |

Withdrawal Methods | Crypto, Fiat |

Maximum Leverage | 1:1 |

Minimum Trade Size | KRW 5,000 |

Security Factors | Cold Storage, MFA |

Services | Auto Trading, API Trading, Accumulated Purchase |

Customer Support Ways | Phone, Email, Offline Center, Kakao Talk |

Customer Support Hours | Weekdays 09:00 - 18:00 GMT+9 (Closed on weekends and public holidays) |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

Advantages & Disadvantages

While the exchange was called the 3rd biggest crypto exchange in South Korea in 2021, its geo-restrictions are among the biggest letdowns in this Korbit review.

Pros | Cons |

Established reputation since 2013 | Limited international availability |

Easy fiat-to-crypto trading with KRW | No leverage options |

Advanced services like Automated and API trading | Limited customer support hours |

Competitive fees | No English version for its website |

Korbit User Levels

The exchange’s website hasn’t disclosed any information about a comprehensive user level system. However, it offers two commission models, which we’ll discuss in the next topic.

Korbit Exchange Fees & Commissions

The platform offers 2 different fee plans: Free and Basic. Traders can also choose a customized plan between the two.

Order | Free Plan | Basic Plan |

Maker | 0% | 0.1% |

Taker | 0.2% | 0.1% |

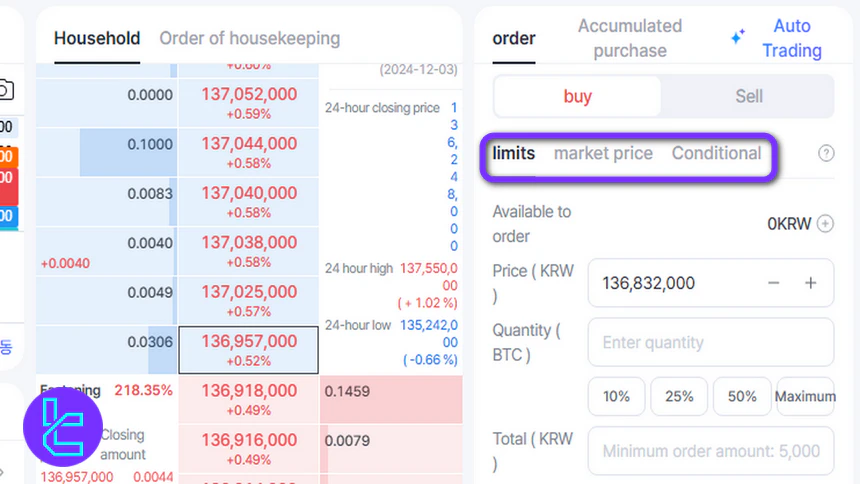

The maximum and minimum order amounts are KRW 1B and KRW 5K, respectively.

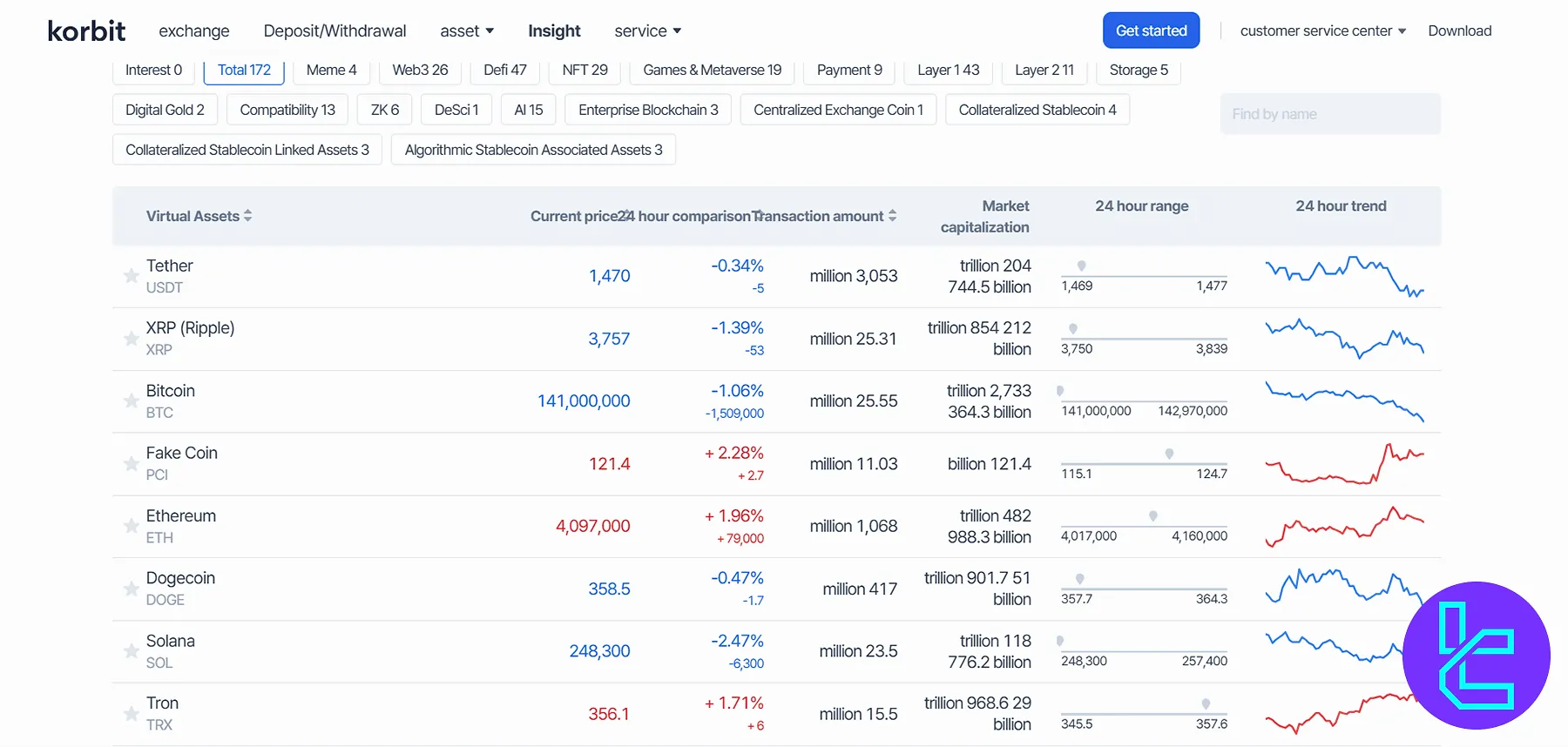

Korbit Digital Assets

The exchange only offers KRW/Crypto trading pairs with access to 192 cryptocurrencies, such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Chainlink (LINK)

- Bitcoin Cash (BCH)

- EOS (EOS)

- Stellar (XLM)

- Cardano (ADA)

- Tron (TRX)

- Tether (USDT)

Leveraged Trading

Korbit does not offer leveraged trading or margin trading services. The exchange focuses on spot trading, providing users with a straightforward and less risky trading environment.

Korbit Exchange Account Opening and KYC

Korbit offers trading access exclusively to South Korean residents aged 19 and above, with registration available solely via its dedicated mobile app. To begin trading on this regulated crypto exchange, follow these core steps:

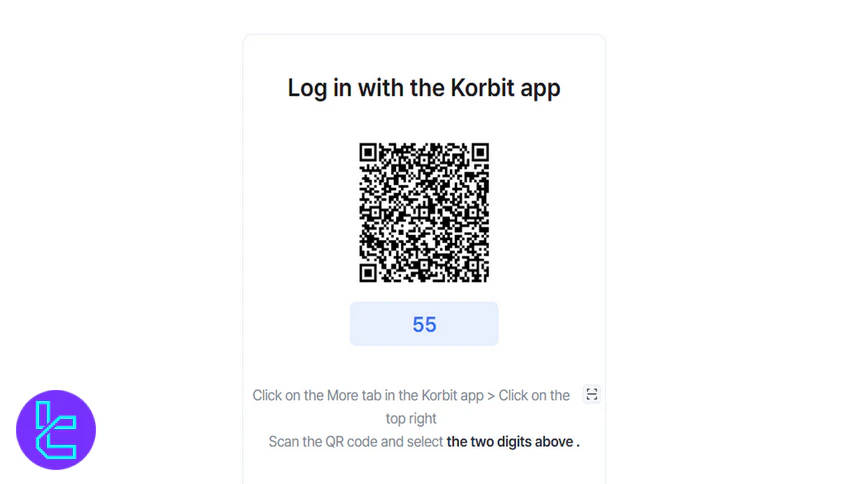

#1 Get the Korbit App

Begin by installing the Korbit application on your mobile device from the official app store. Registration and identity verification can only be done through the app interface.

#2 Submit Basic Information

Launch the app and complete the account registration form using your legal name, contact information, and email address. Make sure all entries match your government-issued documents.

#3 Upload Required Verification Documents

For full access, you'll need to verify your identity by uploading a resident registration card or driver’s license, along with a bank account statement registered in your own name. Once verified, your Korbit trading account will be activated.

Korbit Trading Guide

After completing the registration and identity verification steps, you’re ready to start trading on Korbit. Follow the steps below to start trading efficiently and securely on Korbit:

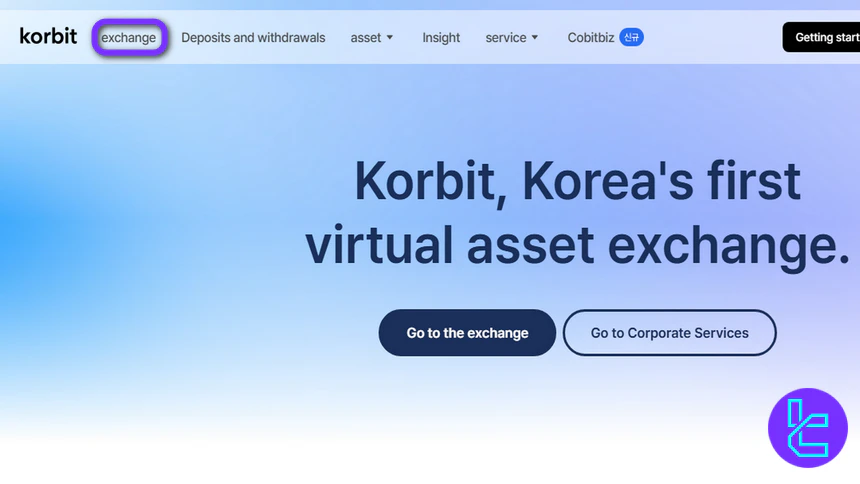

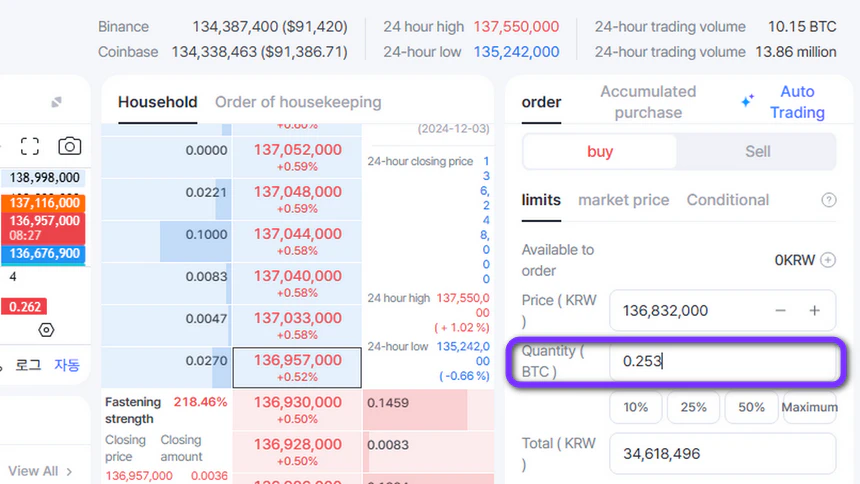

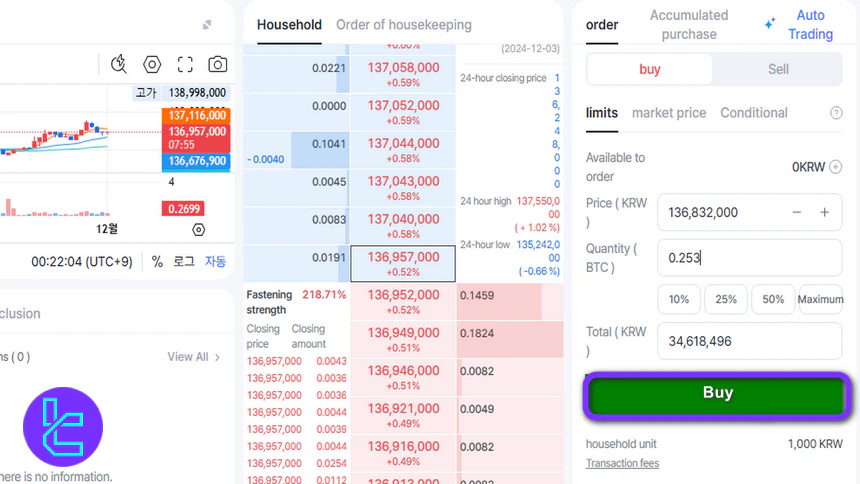

#1 Access the Trading Interface

Sign in to your Korbit account and click the “Exchange” button at the top of the homepage to open the trading platform.

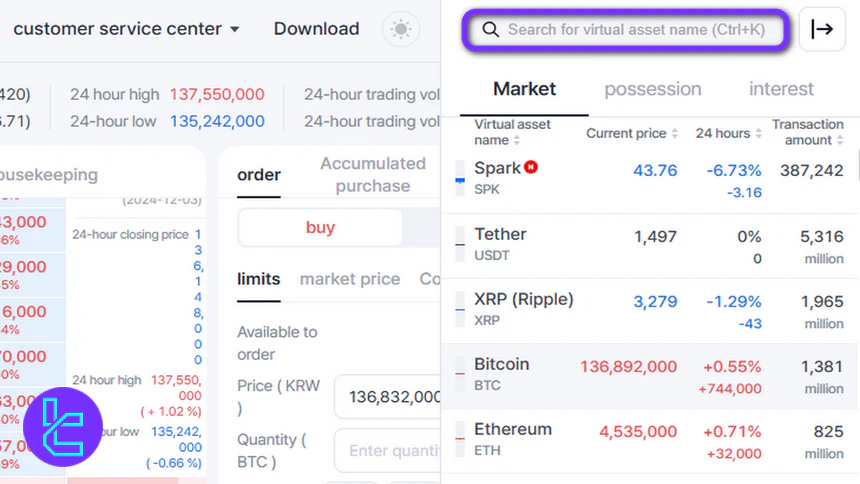

#2 Select a Trading Market

In the top-right corner, you can enter the trading pair you are looking for in the search box, or find it from the list below it.

#3 Choose the Order Type

Korbit offers different order types, including limit, market, and conditional orders. You can choose an order type from the right-side menu.

#4 Specify the Trade Amount

Enter the number of coins or tokens you want to buy or sell in the amount field. Make sure the figure matches your intended trade size.

#5 Finalize the Order

Click “Buy” or “Sell” to place your trade. Double-check the trading pair and trade amount before confirming to ensure everything is correct.

Trading Platform

The exchange has developed a web-based trading platform and a dedicated mobile app available across various operating systems, including:

- Korbit Android

- Korbit iOS (The application’s profile on the Apple App Store is unreachable)

The exchange provides access to TradingView charts. Check TradingFinder’s list of TradingView indicators for additional analytical tools.

Korbit Trading Volume

Based on the Korbit CoinGecko chart, over the past three months, from early September to the end of November, Korbit’s trading activity has remained relatively stable, with daily volumes typically ranging between $5 million and $25 million.

Notably, on October 11, the platform experienced a peak trading volume of $110 million, highlighting occasional spikes in trading interest among its user base.

Korbit Services

To find out about the trading services available on the Korbit exchange, pay attention to the table below:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

No | |

Launchpad | No |

NFT Marketplace | Yes |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

Is Korbit Exchange Secure?

The platform has acquired four types of international standard certifications (ISO). It also has implemented various other security factors, including:

- Cold Wallet Storage

- Multi-Factor Authentication (MFA)

- World class 24-H security systems

Korbit Security Rankings

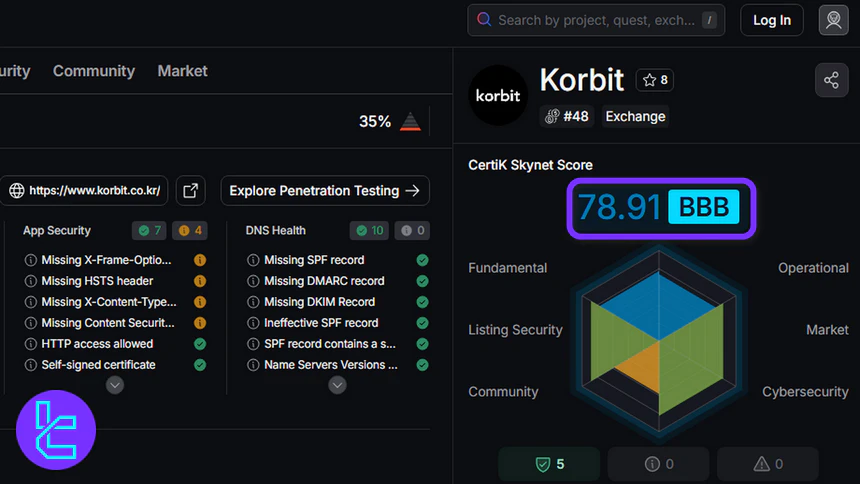

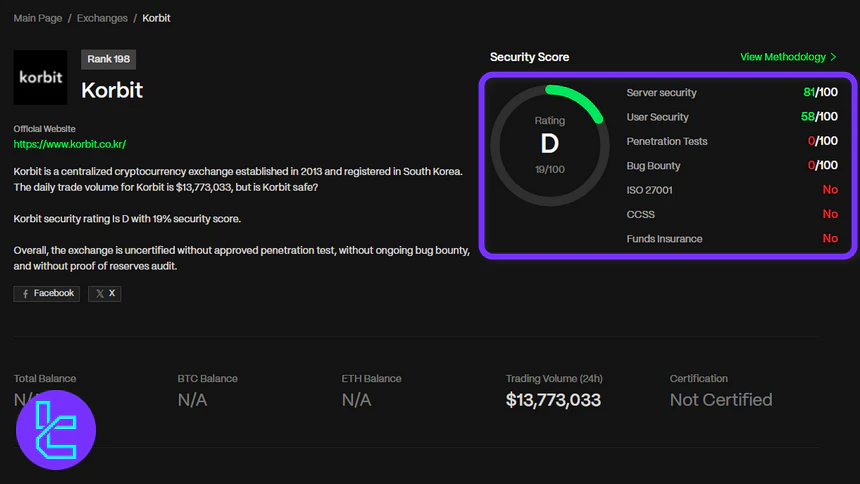

Korbit’s security profile presents a mixed picture across different evaluation platforms.

According to the Koribt CertiK Skynet review, the exchange achieves an overall score of 78.91/100 (BBB), performing strongest in Listing Security (88.39) and Market integrity (83.47), while scoring lower in Community trust (58.32) and Operational measures (74.03).

In contrast, CER.live assigns Korbit a much lower overall rating of 19% (D), reflecting weaknesses in penetration testing, bug bounty programs, and compliance certifications such as ISO 27001 and CCSS.

Based on the Korbit CER.live review, while server security is relatively solid at 81/100, user protection measures lag behind, and the platform does not currently offer insurance for deposited funds.

This combination highlights Korbit’s solid technical infrastructure but signals room for improvement in broader security practices and user protection.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 78.91 / 100 (BBB) |

Fundamental | 77.24 | |

Operational | 74.03 | |

Listing Security | 88.39 | |

Market | 83.47 | |

Community | 58.32 | |

Cybersecurity | 82.64 | |

CER.live Score | Overall Score | 19% (D) |

Server Security | 81/100 | |

User Security | 58/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 0/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

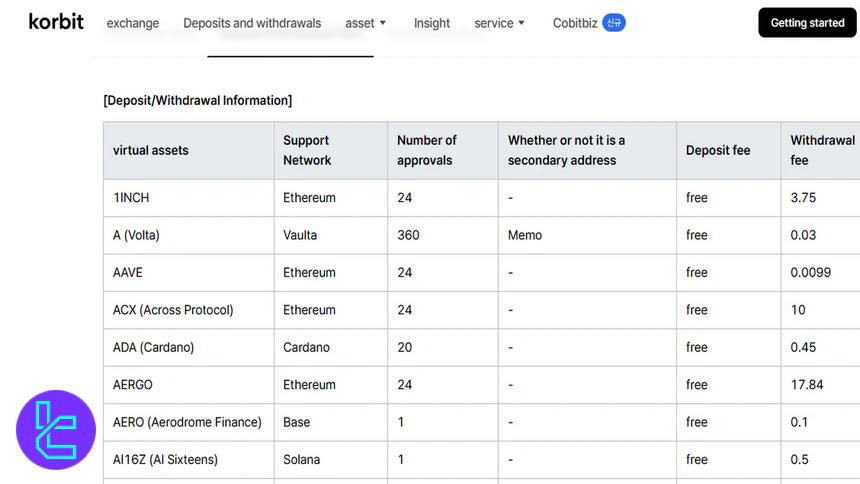

Deposit and Withdrawal Methods

Korbit supports Crypto transactions and KRW payments. To make fiat transactions, you must provide a bank account in your name. Key points about Korbit fiat payments:

- Minimum withdrawal amount: KRW 2,000

- Withdrawal fee: KRW 1,000

Trust Scores

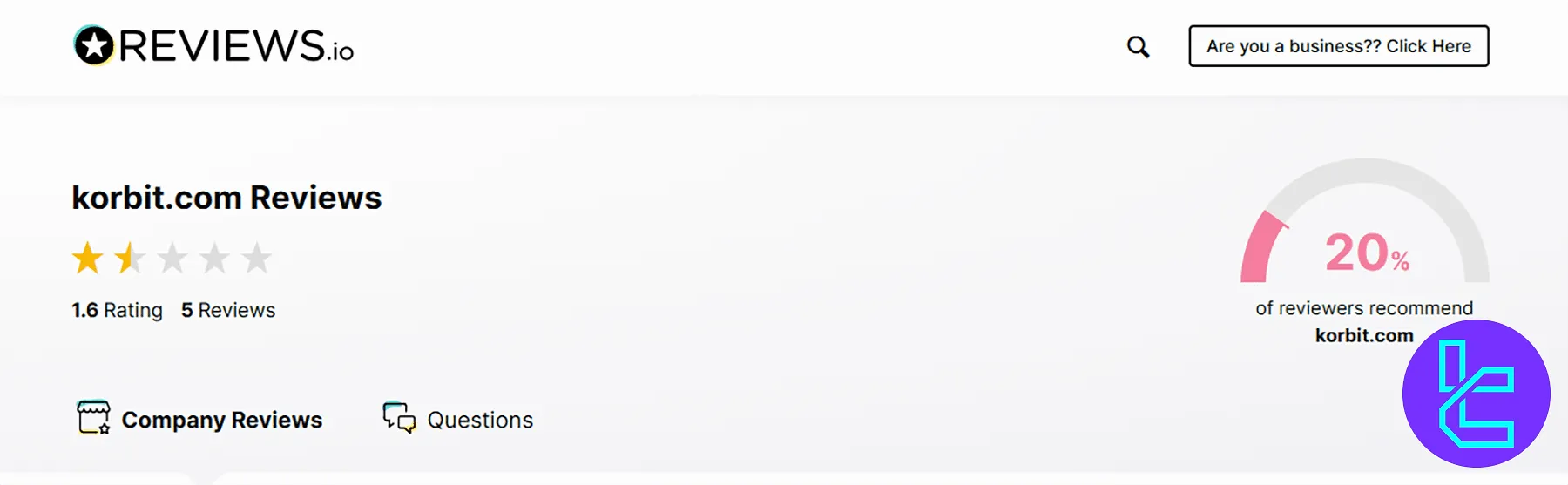

There are no Korbit reviews on reputable platforms like TrustPilot and Forex Peace Army. However, there are 5 ratings Korbit Reviews.io profile, resulting in a 1.6/5 score.

CoinGecko has rated the platform as a reliable crypto exchange with a 7 out of 10 score.

Korbit Features

Let's see what advanced features the exchange has to offer; Korbit Features:

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

Korbit Bonus

Korbit offers a set of reward programs designed to incentivize active users and holders of virtual assets. These include the Daily Rewards Service, available to verified members, and Premium Benefits through the THE VIP program for high-value traders:

Program | Eligibility | Rewards / Benefits | Notes |

Daily Rewards | Verified individual members, 19+, holding ≥ 500,000 KRW in virtual assets | Virtual assets (ADA, TRX, DOT, BNB) daily; 7-day consecutive participation doubles rewards; unclaimed rewards for up to 6 days can be collected | Not a financial investment; taxed above 50,000 KRW |

The VIP Program | High-value traders: ≥ 3B KRW monthly transactions or ≥ 200M KRW balance | Fee reductions, dedicated API, priority deposits/withdrawals, 1:1 support, event invitations, early news | Requires application and verification; continuous VIP status depends on maintaining eligibility |

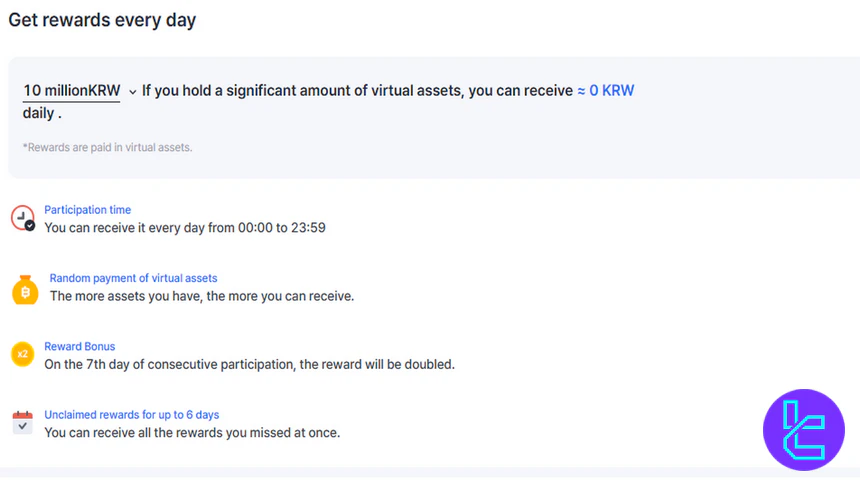

Daily Rewards Service

Korbit’s Daily Rewards Service allows users to earn virtual asset rewards every day based on the value of their holdings.

Participation is open daily from 00:00 to 23:59, and rewards are credited in virtual assets such as Cardano (ADA), Tron (TRX), Polkadot (DOT), and Binance Coin (BNB).

Key Features:

- Random Rewards: The more assets you hold, the higher your potential reward;

- Reward Bonus: On the 7th consecutive day of participation, your reward is doubled;

- Unclaimed Rewards: Missed rewards for up to 6 days can be collected at once;

- Eligibility: Individual members over 19 who have completed customer verification and hold at least 500,000 KRW in virtual assets;

- Tax and Limits: Rewards exceeding 50,000 KRW are subject to a 22% tax.

Premium Benefits – THE VIP

THE VIP program is designed for high-value traders and offers exclusive perks to enhance the trading experience.

Benefits include:

- Fee Benefits: Special reduced trading fees for VIP members;

- Dedicated API Services: Higher rate limits for efficient trading;

- Priority Deposits & Withdrawals: Faster processing in case of delays;

- 1:1 Dedicated Service: Personalized support for queries and issues;

- Invitations to Special Events and Seminars: Access to exclusive Korbit-hosted events;

- Key News Updates: Early access to Korbit announcements and market news.

Application Criteria:

- Total transaction amount of KRW 3 billion or more in the past month across Korbit or other exchanges;

- Or holding a combined balance of KRW 200 million or more in Korbit or other exchanges.

Korbit Exchange Support Channels

The company provides online and offline support on weekdays from 09:00 to 18:00 GMT+9 (Closed on weekends and public holidays) through various channels, including:

info@korbit.co.kr | |

Phone | 1661-9707 |

Kakao Talk | Online 1:1 consultation |

Offline (office address) | 4th floor, 7, Teheran-ro 5-gil, Gangnam-gu, Seoul (Yeoksam-dong, KG Tower) |

To visit Korbit’s office in Seoul, South Korea, you must make an appointment beforehand through its official website.

Copy Trading and Growth Plans on Korbit

While the platform doesn’t offer copy trading services or investment plans, it provides access to Auto Trading features and API trading. The API document allows traders to devise customized Expert Advisors (EAs).

Korbit Auto Trading service provides access to two types of trading strategies and bots, including:

- Grid Bot: Arbitrage by placing orders at regular intervals

- Unlimited Grid Bot: Continuous arbitrage trading based on the valuation of virtual assets

Prohibited Countries on Korbit Exchange

The exchange focuses on providing crypto services in the Korean market with KRW trading pairs. Only Korean residents above 19 can use the platform’s services.

Korbit Comparison Table

Let's examine the differences between Korbit features and those of other exchanges; Korbit Comparison:

Parameters | Korbit Exchange | |||

Number of Assets | 192 | 700+ | 2500+ | 10000+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:125 |

Minimum Deposit | KRW 10,000 | Varies by Cryptocurrency | Varies by Payment Method | $15 |

Trading Fees | 0.1% | 0.02% | From -0.005% Maker, 0.025 Taker | 0.1% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | N/A | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Korbit allows Korean residents to buy and sell cryptocurrencies, such as BTC, ETH, and USDT, for KRW.

The minimum fiat withdrawal is KRW 2,000 with a KRW 1,000 fee per request. The exchange has a good trust score of 7/10 on CoinGecko.