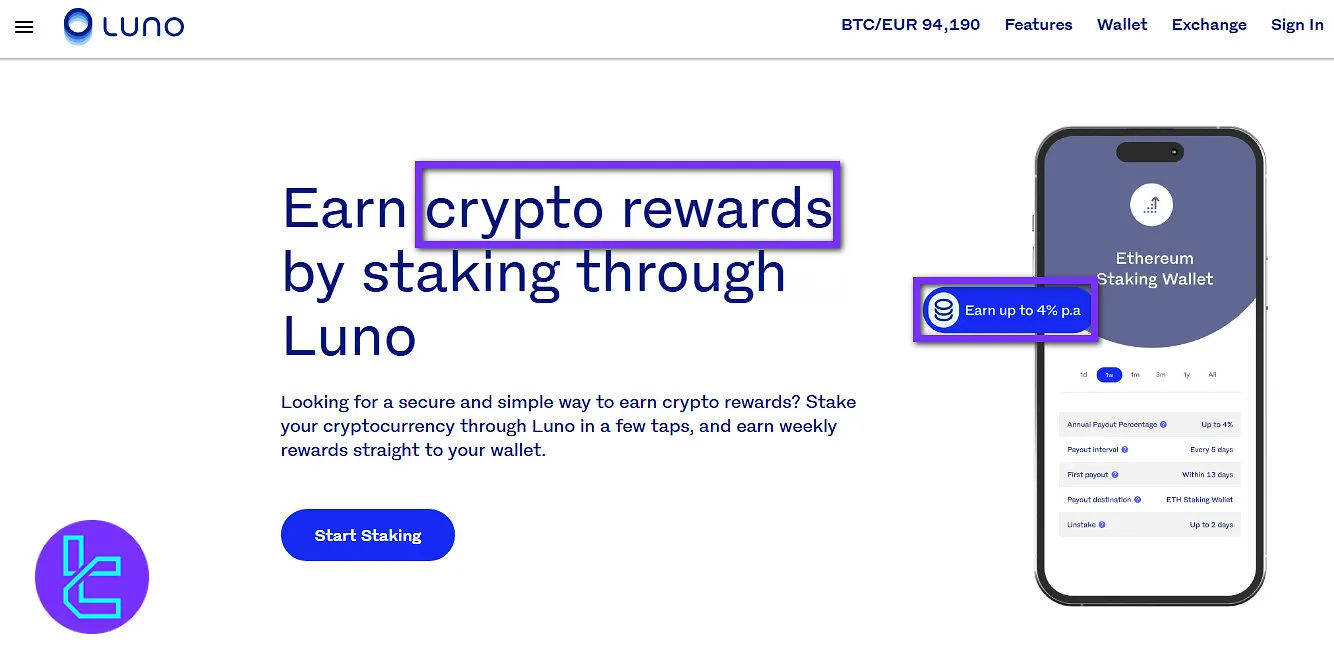

Luno, serving users from over 40 countries, is ranked 12th with a final score of 71.7 on the CCData's ranking of exchanges. With a daily spot trading volume of $15M+, the platform offers staking with up to 4% ARP.

Luno Information + Regulation

Founded in 2013 and headquartered in London, United Kingdom, Luno (legally known as Luno Money Limited) is a crypto exchange with+1M monthly visitors.

As an independent operating subsidiary of Digital Currency Group, with 7 offices in these cities:

- London, United Kingdom

- Cape Town, South Africa

- Johannesburg, South Africa

- Jakarta, Indonesia

- Lagos, Nigeria

- Sydney, Australia

- Kuala Lumpur, Malaysia

Luno CEO

James Lanigan is the current Chief Executive Officer (CEO) of Luno, a global cryptocurrency exchange and investment platform.

With years of leadership experience in the fintech and digital asset space, Lanigan focuses on making cryptocurrencies more accessible, secure, and practical for users worldwide.

According to James Lanigan's LinkedIn, under his guidance, Luno continues to expand its services across emerging and established markets, strengthening its position as a trusted platform for buying, selling, and storing digital assets.

Luno Specifics and Features

Every company operates based on a set of numbers and values. We will take a look at the discussed exchange's parameters in the table below:

Exchange | Luno |

Launch Date | 2013 |

Levels | Level 1, Level 2, Fully Verified |

Trading Fees | From 0.03% to 0.1% |

Restricted Countries | Algeria, Bangladesh, China, Cuba, Egypt, Iran, Iraq, Morocco, Nepal, North Korea, Qatar, Russia, Saudi Arabia, Syria, Tunisia, Ukraine |

Supported Coins | 19 |

Futures Trading | No |

Minimum Deposit | $1 |

Deposit Methods | Bank Transfers, Crypto Transactions |

Withdrawal Methods | Bank Transfers, Crypto Transactions |

Maximum Leverage | 1x |

Minimum Trade Amount | Varies |

Security Factors | Cold Storage, Multi-Signature Wallets, Air-Gapped Systems for Wallet Keys, Proof of Reserves |

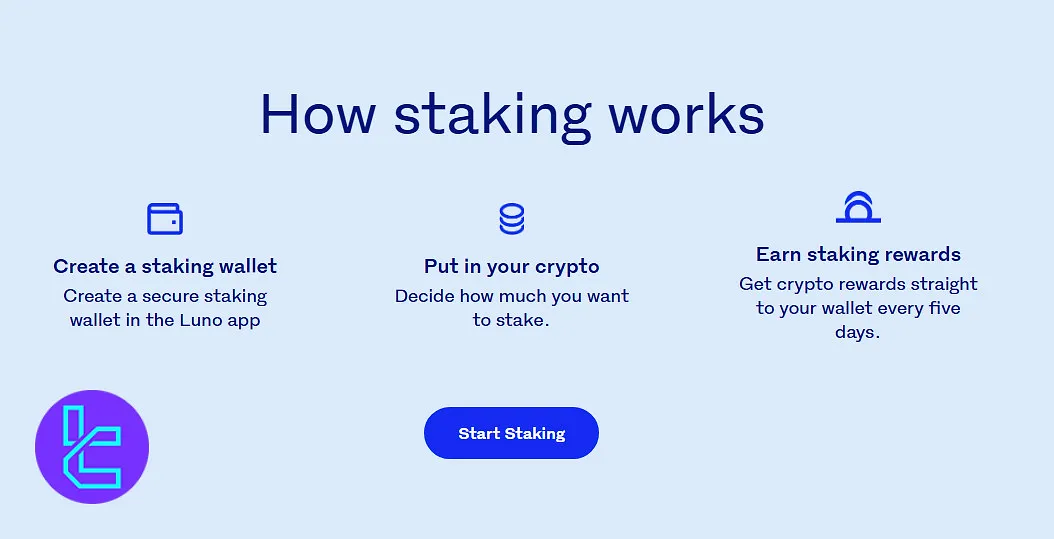

Services | Staking |

Customer Support Ways | Email, Live Chat, Ticket |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | No |

Orders Execution | N/A |

Native Token | No |

Benefits and Drawbacks

Like any cryptocurrency platform, Luno has its strengths and weaknesses, and it's crucial to have them in mind. Look at this table:

Benefits | Drawbacks |

Long Track Record in the Industry | Limited Cryptocurrency Selection Compared to Most Exchanges |

Staking Platform With Up to 4% ARP | No Access to Futures or Margin Trading |

Acceptable Trust Scores on Most Sources | - |

User Verification Levels Specifics

Luno has taken a tier-based approach for verified users on its platform. There are 3 verification levels:

- Level 1: With a 1,000 GBP limitation for the overall deposits and withdrawals;

- Level 2: Puts a £5,000 limit on deposits and withdrawals every month;

- Fully Verified: No limitations of any kind.

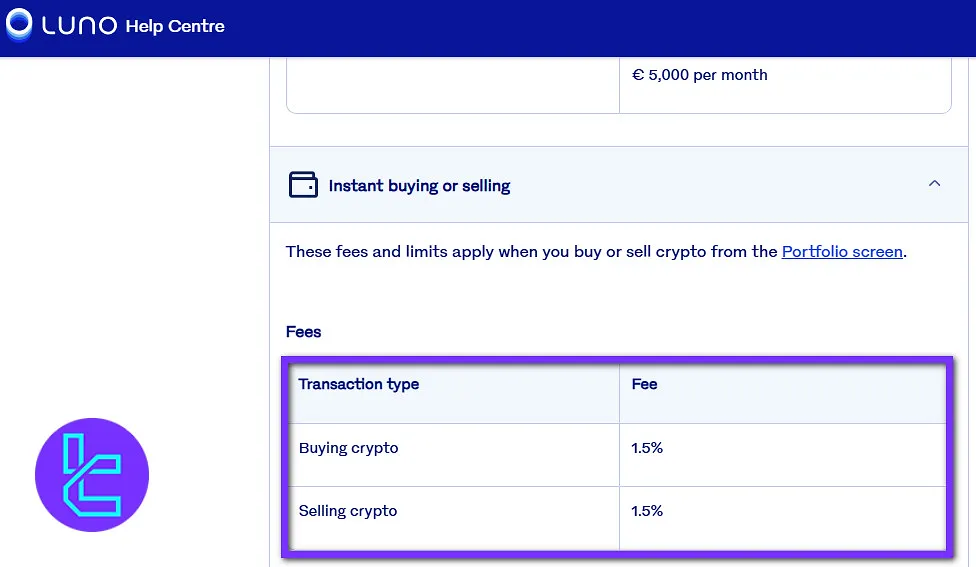

Luno Commissions and Fees

The exchange takes a unique approach for every officially supported region [South Africa, Malaysia, Nigeria, Indonesia, United Kingdom, Europe, Australia, Uganda] regarding fees.

In this section, we will review the conditions in the UK.

Here's the trading commissions tier system that is based on the trading volume in the last 30 days:

Tier | 30-Day Volume | Taker Fee | Maker Fee |

1 | £0 - £250,000 | 0.10% | 0% |

2 | £250,000 - £500,000 | 0.09% | 0% |

3 | £500,000 - £1,000,000 | 0.08% | 0% |

4 | £1,000,000 - £2,000,000 | 0.07% | 0% |

5 | £2,000,000 - £4,000,000 | 0.06% | 0% |

6 | £4,000,000 - £8,000,000 | 0.05% | 0% |

7 | £8,000,000 - £16,000,000 | 0.04% | 0% |

8 | Over £16,000,000 | 0.03% | 0% |

For the UK-verified users, there are no fees in deposits and withdrawals. For instant crypto buying using cards, a 3.5% commission is charged. Furthermore, for buying or selling with wallets, the exchange charges a 1.5% fee.

For sending digital assets, a dynamic cost is applied (XRP's send fee is always 0.03%, though).

No commissions are charged for receiving cryptocurrencies; a nominal fee is charged if you receive "dust," that is, a tiny amount of coins/tokens.

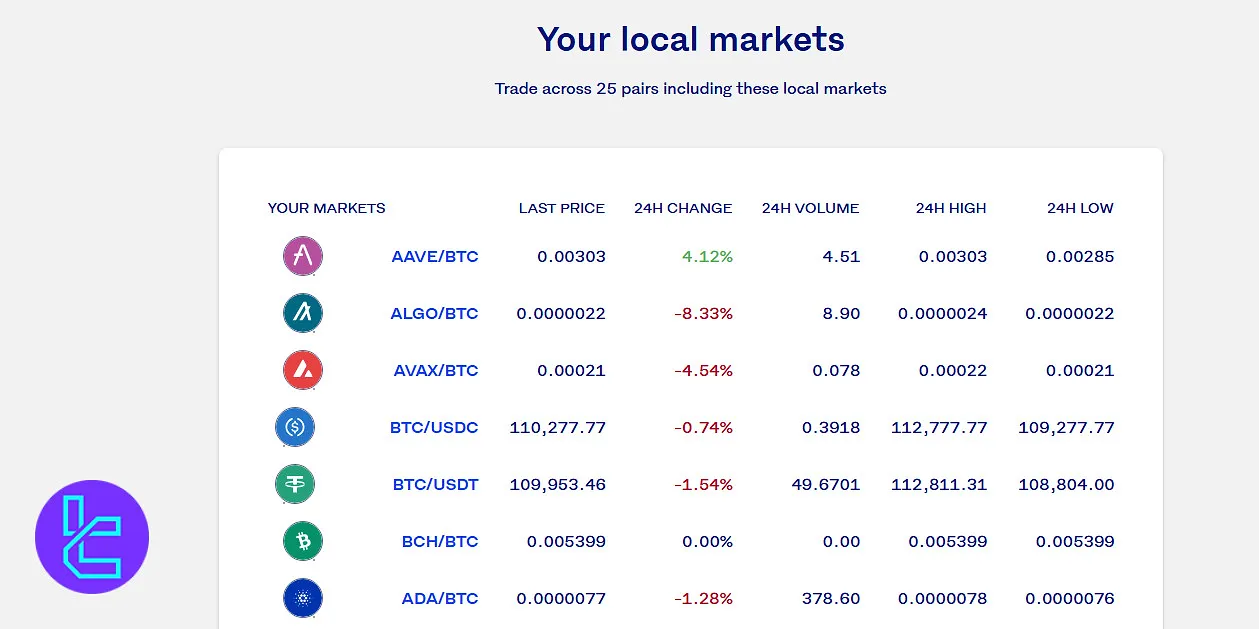

Which Coins/Tokens Are Tradable?

Again, the list of asset offerings depends on the region where you have been verified. In the UK, a limited list of coins/tokens is available:

- Bitcoin [BTC]

- Ethereum [ETH]

- XRP

- Litecoin [LTC]

- Bitcoin Cash [BCH]

- Uniswap [UNI]

- Chainlink [LINK]

- USD Coin [USDC]

- Algorand [ALGO]

- Stellar [XLM]

- Maker [MKR]

- Aave [AAVE]

- Cosmos [ATOM]

- Cardano [ADA]

- Avalanche [AVAX]

- Solana [SOL]

- Curve [CRV]

- Polkadot [DOT]

- Polygon [MATIC]

This list includes 19 cryptocurrencies in total.

Futures Trading and Margin Contracts

Luno does not offer margin or futures trading, making it a spot-only platform. Users seeking leveraged exposure or derivatives contracts must consider other exchanges that provide such products.

How to Get Onboard and Verify

While Luno's sign-up process may be slightly more detailed than some competitors, it’s still straightforward and can be completed in just a few steps. Once verified, users can unlock full access to trading features and higher limits.

#1 Begin the Luno Sign-Up

Visit the official Luno website and click “CREATE ACCOUNT.”

#2 Enter Your Credentials on Luno

Provide your email address and create a strong password, then click “LET’S GO.”

#3 Confirm Your Email in Luno

Check your inbox and click the verification link to activate your account.

#4 Verify Your Mobile Number on Luno

Enter your mobile number, then confirm it using the SMS code sent to your device. At this stage, your Luno account will be partially active with basic features enabled.

#5 Unlock Full Account Access by Luno KYC

To increase deposit and withdrawal limits and access advanced trading features:

- Submit personal identification details

- Upload a valid government-issued ID

- Provide proof of address if required

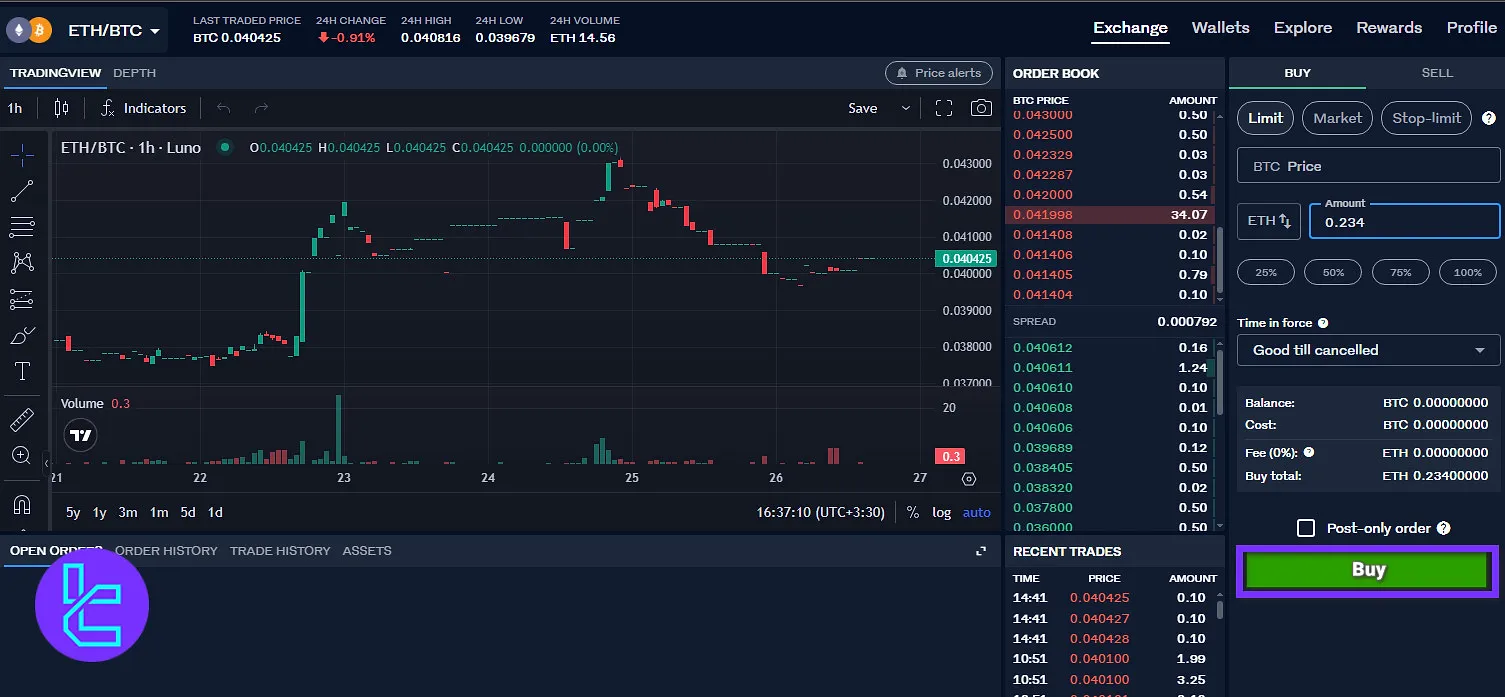

How to Trade on Luno

Trading on Luno is straightforward and intuitive. After the registration process, follow these steps:

#1 Enter the Trading Page

On the Luno homepage, select “Exchange” and in the new page select “View Exchange” to access the trading interface.

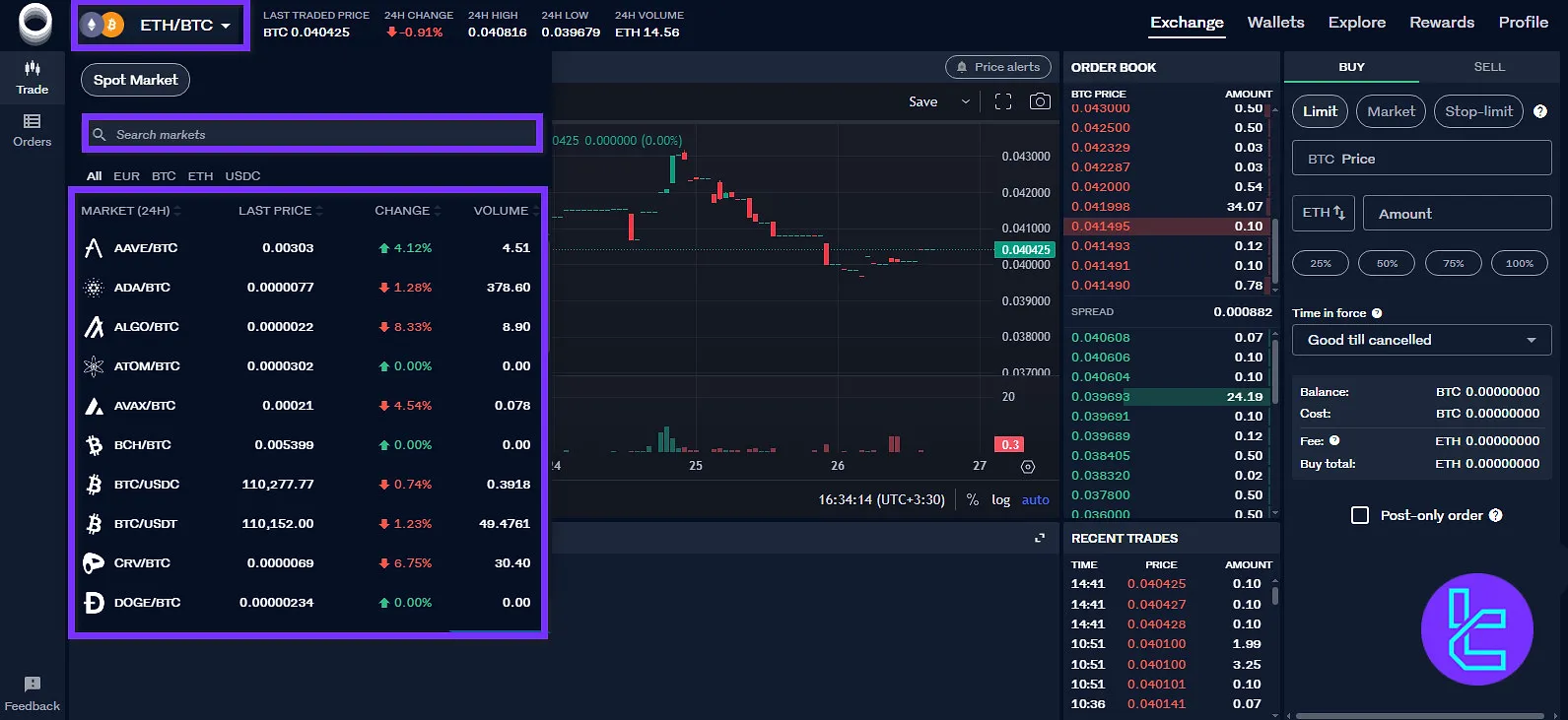

#2 Select the Trading Pair

Click on the current trading pair displayed on the left side of the screen. From the search box, choose the pair you wish to trade.

#3 Choose the Order Type

Select your preferred order type on the right side of the page. Luno supports limit and market and stop-limit orders.

#4 Specify the Order Volume

Enter the quantity of cryptocurrency you want to buy or sell in the volume field located below the order types.

#5 Enter the Trade

Carefully review your order details, then click “Buy” or “Sell” to execute your trade.

Luno Trading Platform; Features and Specifics

This exchange provides a useful terminal accessible via web and mobile applications, similar to many of its competitors. Here are the access links:

The platform has received a 4.2/5 score on the App Store, based on more than 3.6K user reviews.

Luno Trading Volume

Based on Luno's CoinGecko page, over the past three months, the exchange's trading volume has shown notable fluctuations. From early June until the beginning of July, activity remained relatively modest, generally moving between $5M and $20M.

However, from July 9 onward, volumes picked up sharply, with multiple spikes pushing activity into higher ranges.

The strongest surge was recorded on July 18, when daily trading volume reached close to $60M, marking the peak for the observed period.

Afterward, volume became more volatile, moving up and down frequently, and mostly fluctuating between $10M and $40M throughout August.

Despite the choppiness, these levels suggest increased market engagement compared to June’s quieter trading phase.

Luno Services

Many traders are curious to know if Luno exchange offers their favorite trading service or not:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

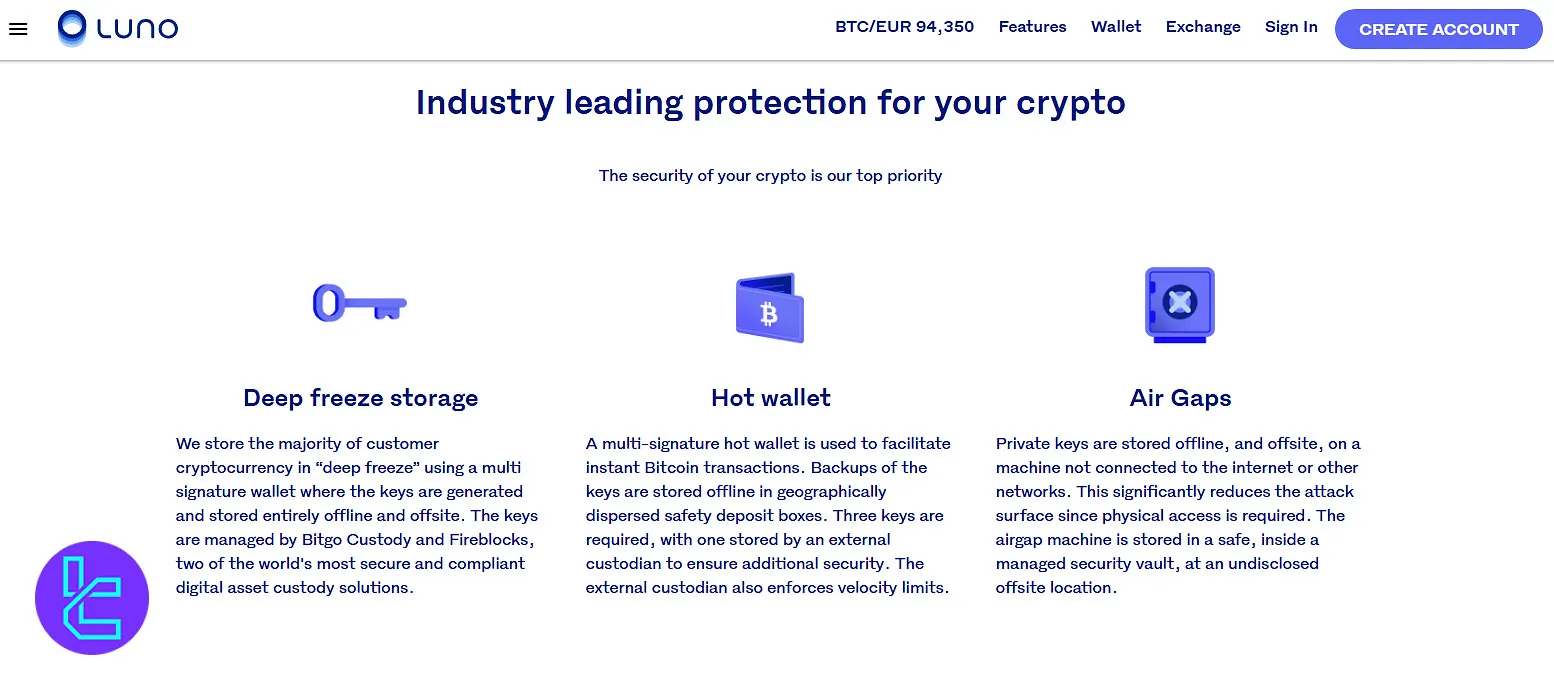

Security Measurements and Users' Safety

Security is something that Luno claims to be good at; the exchange has implemented several measures to protect user funds and data:

- Cold Storage: The majority of user funds (95%) are stored in deep-freeze, multi-signature wallets, which are kept offline to prevent unauthorized access;

- Two-Factor Authentication (2FA): All users are encouraged to enable 2FA for an additional layer of account security;

- Proof of Reserves: Possible for every user to view their relevant shares;

- Air-gapped Systems: Private keys are stored in air-gapped systems, further isolating them from potential online threats.

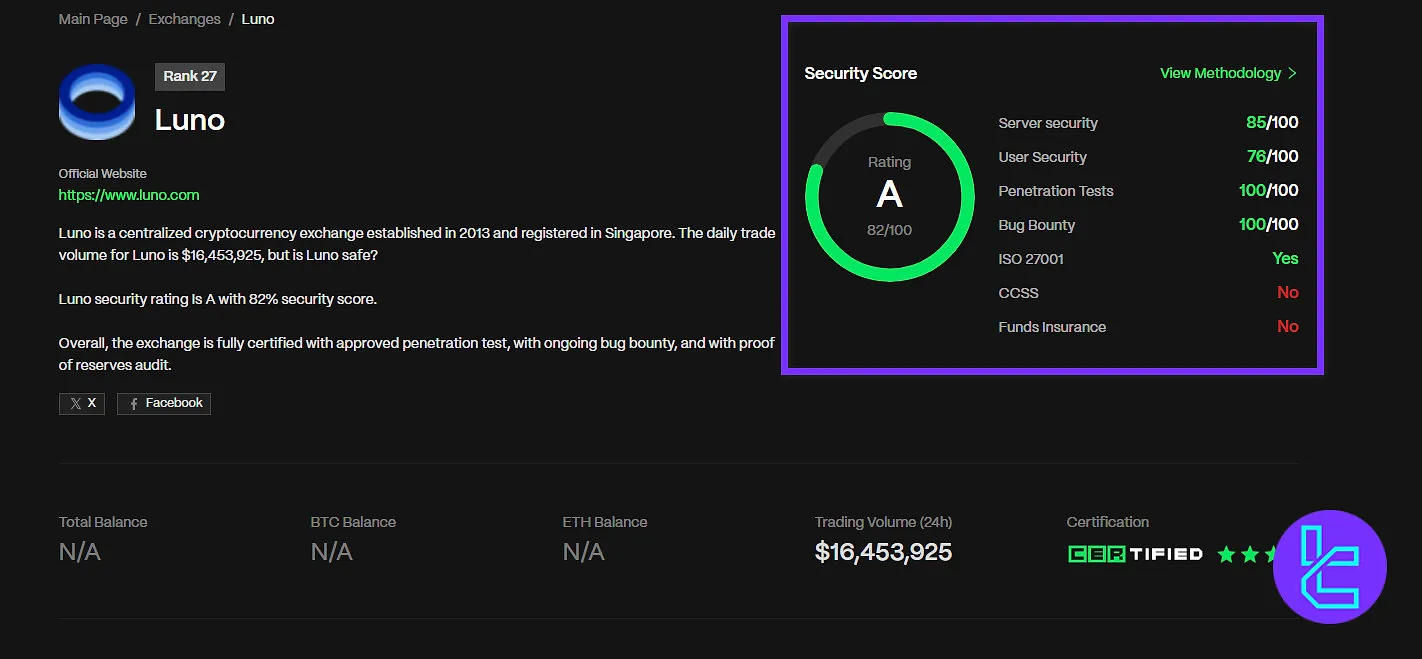

Luno Security Rankings

Luno CER.live security review highlights a strong overall performance, earning an impressive 82% (A) rating.

The platform demonstrates robust technical safeguards, with server security rated 85/100 and a perfect score on penetration tests and bug bounty programs (100/100), reflecting its proactive approach to identifying and mitigating vulnerabilities.

While user security is slightly lower at 76/100, Luno maintains formal standards such as ISO 27001 certification, though it currently lacks CCSS compliance and funds insurance.

Overall, the review suggests that Luno offers a secure environment for trading, backed by rigorous testing and recognized security standards.

Overall Score | 82% (A) |

Server Security | 85/100 |

User Security | 76/100 |

Penetration Tests | 100/100 |

Bug Bounty | 100/100 |

ISO 27001 | Yes |

CCSS | No |

Funds Insurance | No |

Payment Options on Luno Exchange

The company offers various payment methods depending on the user's residence region, but in most countries, these are the choices:

- Bank Transfers: For making fiat deposits & withdrawals;

- Crypto Transactions: Via digital wallets.

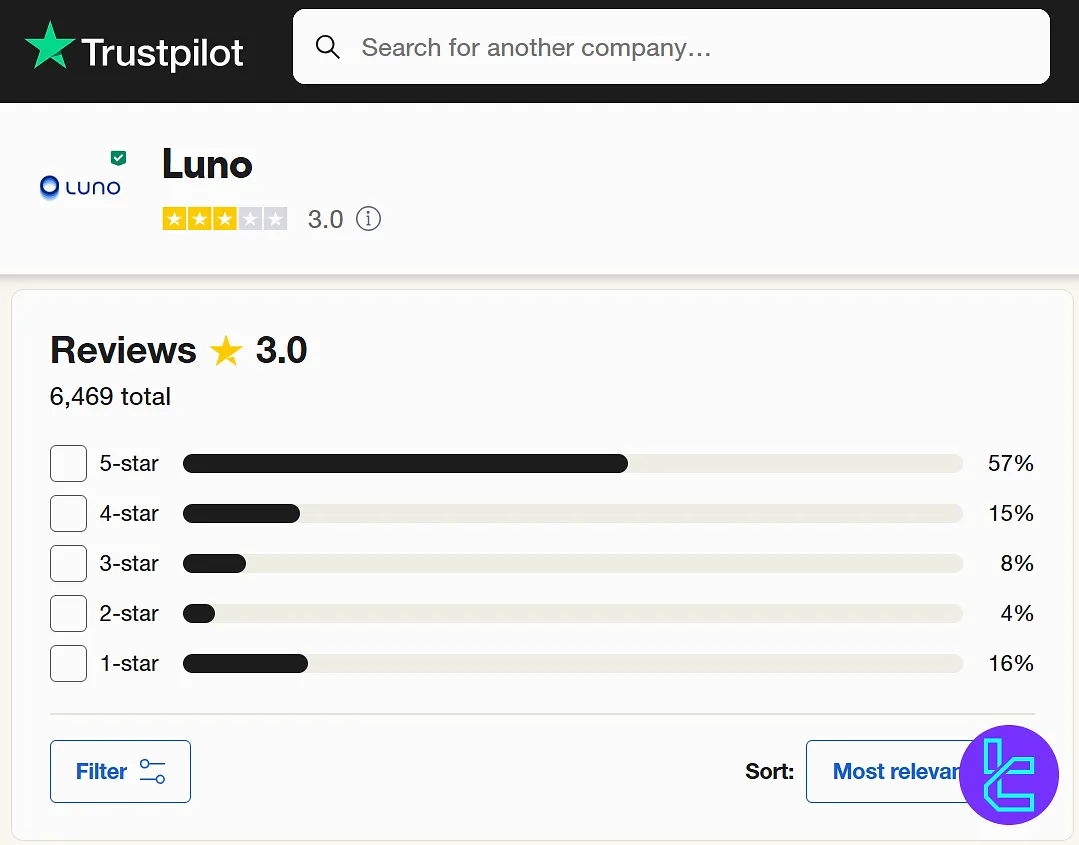

Trust Scores and User Reviewsare

The Luno REVIEWS.io shows a weak score based on the user opinions, with the exchange having been rated 1.9 out of 5. Here are other ratings:

- Trustpilot: 3.0/5 stars based on over 6,400 reviews;

- ScamAdivser: 85/100 Trustscore, with +6,500 user ratings averaging 3.0/5 stars;

- CoinGecko: 9/10 trust score;

- io: 2.4/5 stars based on over 25 reviews.

Despite some negative reviews, the exchange's high trust score on CoinGecko and ScamAdvisor suggests that the platform maintains good operational standards within the industry.

Luno Features

Let's check the availability of the advanced feature in the exchange; Luno Features:

Feature | Availability |

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Card | No |

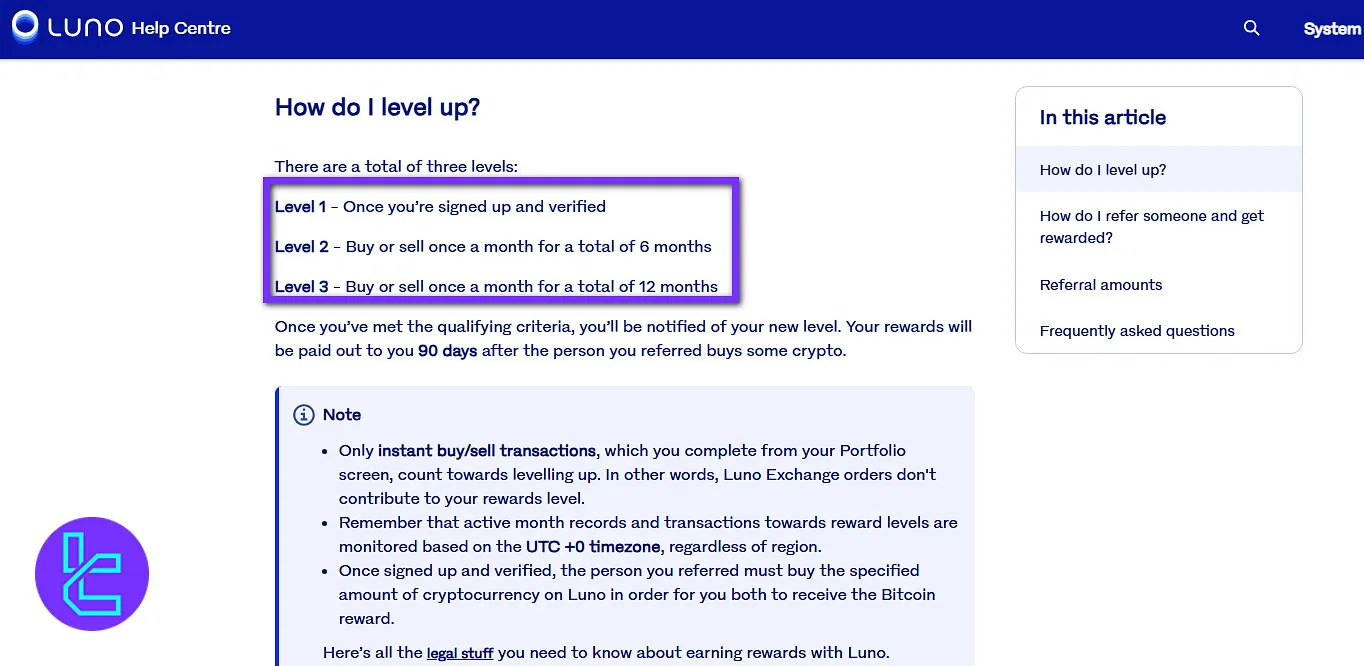

Luno Bonus

Here are the current bonuses available for Luno’s users:

Program | Description |

Referral Program | Invite friends to Luno using a referral code, and both parties may receive Bitcoin rewards once the referral completes their first trade |

Loyalty and Earn Program | Stake eligible cryptocurrencies (e.g., ETH) and earn weekly rewards credited to your staking wallet |

Referral Program

Luno’s referral system rewards both the referrer and the referred user. Bonuses often start around $25 BTC for each successful referral and can increase depending on transaction volume and activity levels.

There’s also a tiered “Rewards Level” system: the more monthly activity you have (e.g., buying or selling crypto), the higher your referral reward from $25, to $35, and up to $50 BTC per referral.

Loyalty and Earn Programs

Beyond referral perks, Luno runs “Earn” and loyalty programs. These may include bonus crypto for ongoing trading, staking, or participation in promotional campaigns.

Additionally, periodic discount events and exclusive promo codes may offer fee reductions or additional crypto bonuses, though these are often limited-time and campaign-based.

Support Channels and Working Schedule

Luno offers several support channels to assist users:

- Live Chat: Available for registered users

- Email: support@luno.com

- Ticket System: Accessible for everyone on the website

- Help Center: Comprehensive FAQ and educational resources

Based on the available information, this exchange's support team is available around the clock, 7 days a week.

Copy Trading and Passive Earning Ways

At the time of writing this article, Luno doesn’t provide any options for copy trading, but enables access to a staking platform, which makes passive earning possible. Up to 4% ARP is offered through this service.

Is Luno Available to Users from All Regions?

This company's services are available in over 40 countries, but due to regulatory constraints, the platform is restricted in several jurisdictions; Here's a complete list, as provided by the exchange itself:

- Algeria

- Bangladesh

- China

- Cuba

- Egypt

- Iran

- Iraq

- Morocco

- Nepal

- North Korea

- Qatar

- Russia

- Saudi Arabia

- Syria

- Tunisia

- Ukraine

Luno in Comparison with Others

Here is a comprehensive overview of the exchange offerings compared to its rivals; Luno Comparison:

Parameters | Luno Exchange | |||

Number of Assets | 19 | 400+ | 700+ | 10000+ |

Maximum Leverage | 1:1 | 1:125 | 1:200 | 1:125 |

Minimum Deposit | $1 | $1 | $1 | $15 |

Spot Maker Fee | 0% | 0.02% - 0.1% | From 0.02% | 0.10% |

Spot Taker Fee | 0.03% to 0.1% | 0.04% - 0.1% | From 0.02% | 0.10% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Luno has received a trust score of 9/10 from the CoinGecko website based on its algorithms. On the other hand, more than 6,400 users have given it an average score of 3.0/5 on Trustpilot.

Moreover, "ScamAdivser" gives a85/100 "Trustscore" to the mentioned exchange.