Mercado Bitcoin, with a minimum deposit of R$1, initial 0.3% maker and 0.7% taker fees, and a staking service, offers 330+ coins/tokens for trading. The exchange accepts BRL as its only fiat deposit on the platform.

Mercado Bitcoin Information + Regulation

Mercado Bitcoin was founded on June 12, 2013, by brothers Gustavo Chamati and Mauricio Chamati. The exchange operates under the legal name Mercado Bitcoin Serviços Digitais Ltda. and is based in São Paolo, Brazil.

The company's registered address is Alameda Mamoré 687, Suite 303, Room 03, Alphaville Industrial, Barueri, SP, Brazil.

While the exchange supports fiat trading in Brazilian Real (BRL) and offers basic services such as staking for passive income, it lacks advanced investment options, including futures markets, options, NFT marketplaces, and copy trading capabilities.

This makes it better suited for users seeking straightforward spot trading rather than comprehensive digital asset management.

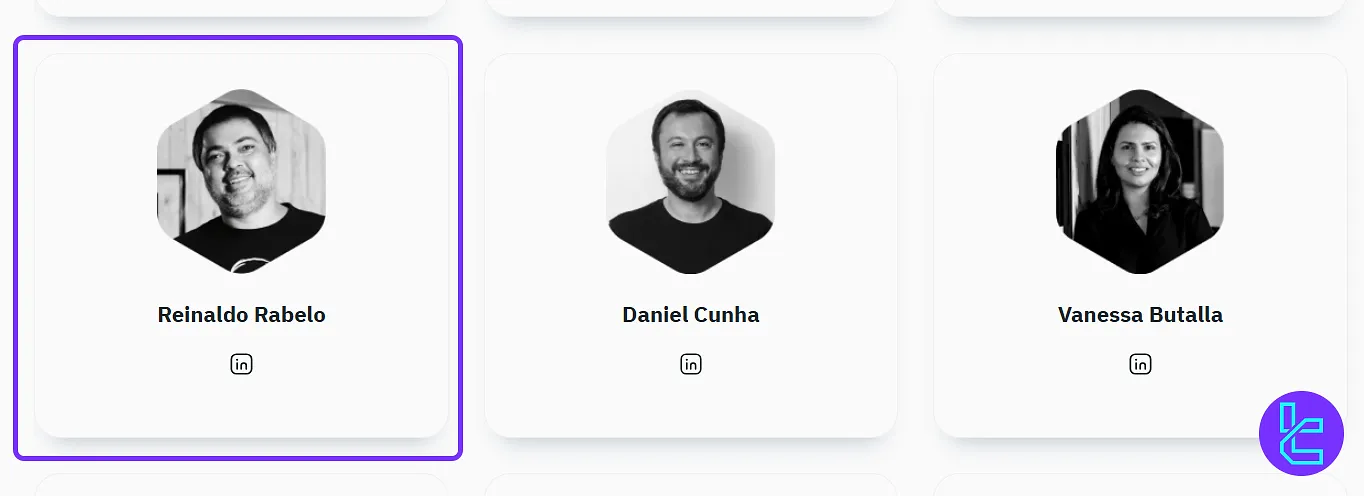

Who is Mercado Bitcoin's CEO?

Mercado Bitcoin’s CEO is Reinaldo Rabelo, a financial market expert with more than 13 years of industry experience. He has been leading the exchange as both CEO and investor, focusing on scaling innovative fintech solutions that merge technology with regulation.

- Previously served as a statutory director at B3, Brazil’s stock exchange, where he managed legal, compliance, and risk operations;

- At Mercado Bitcoin, he played a key role in building disruptive business models and applications for the crypto-financial ecosystem;

- Holds a law degree from the Federal University of Rio de Janeiro and postgraduate specialization in tax law.

- Recognized as an Endeavor Entrepreneur and member of the Brazilian Fintech Association.

Mercado Bitcoin Exchange Summary of Specifications

Mercado Bitcoin offers a range of features based on certain parameters as a crypto exchange:

Exchange | Mercado Bitcoin |

Launch Date | June 12, 2013 |

Levels | Unverified, Verified |

Trading Fees | 0.3% Maker Fee, 0.7% Taker Fee (Lower Cost on Higher Volumes) |

Restricted Countries | Iran, United States, Iraq, Afghanistan, Yemen, Syria |

Supported Coins | 330+ |

Futures Trading | None |

Minimum Deposit | R$1 |

Deposit Methods | Bank Transfers, Crypto Transactions |

Withdrawal Methods | Bank Transfers, Crypto Transactions |

Maximum Leverage | 1x |

Minimum Trade Amount | $1 |

Security Factors | 2FA, Asset Segregation, Cybersecurity Team, Data Reports to ANPD, Annual Audits since 2018 (by EY since 2022) |

Services | Staking, Fixed/Variable Digital Income, Loan |

Customer Support Ways | Email, Ticket |

Customer Support Hours | 24/7 |

Fiat Deposit | BRL |

Affiliate Program | None |

Orders Execution | N/A |

Native Token | MBRL |

Notable Pros and Cons

Like any exchange, Mercado Bitcoin has its strengths and weaknesses. This section puts these advantages and disadvantages side-by-side:

Pros | Cons |

Wide Variety of Cryptocurrencies | Limited Fiat Currency Support |

Strong Security Measures | Primarily Portuguese Interface |

24/7 Support | - |

User Levels and Limitations Structure

MB has taken a straightforward model for its limitations based on the account's level of verification. The table below discusses the structure:

Account Verification Status | Unverified | Verified |

Deposit Limit | R$50,000 in A Year | None |

Withdrawal Limit | R$1,000 in 24 Hours | R$50,000 in 24 Hours |

MB Commissions and Spreads

Mercado Bitcoin applies default maker/taker fees of 0.3%/0.7% on spot trades, which places its pricing slightly above the industry average.

The exchange's trading fee structure is relatively straightforward with discounts for high-volume traders. Here's a breakdown of the main fees:

Level | 30-Day Trading Volume | Maker Fee | Taker Fee |

1 | 0 to R$ 10,000 | 0.30% | 0.70% |

2 | R$10,000 to R$50,000 | 0.27% | 0.70% |

3 | R$50,000 to R$100,000 | 0.24% | 0.70% |

4 | R$100,000 to R$200,000 | 0.21% | 0.70% |

5 | R$200,000 to R$500,000 | 0.18% | 0.70% |

6 | R$500,000 to R$1,000,000 | 0.15% | 0.60% |

7 | R$1,000,000 to R$5,000,000 | 0.12% | 0.60% |

8 | R$5,000,000 to R$10,000,000 | 0.09% | 0.60% |

9 | R$10,000,000 to R$20,000,000 | 0.07% | 0.50% |

10 | R$20,000,000 to R$50,000,000 | 0.05% | 0.45% |

11 | R$50,000,000 to R$100,000,000 | 0.03% | 0.40% |

12 | R$100,000,000 to R$200,000,000 | 0.02% | 0.30% |

13 | above R$ 200,000,000 | 0.015% | 0.25% |

Note that there is no cost for crypto-to-crypto trading on this exchange. Also, no other fees/commissions are charged.

The minimum deposit on Mercado Bitcoin is set at R$1, with trading starting from as low as 1 USD.

Note that crypto withdrawals may incur blockchain network costs.

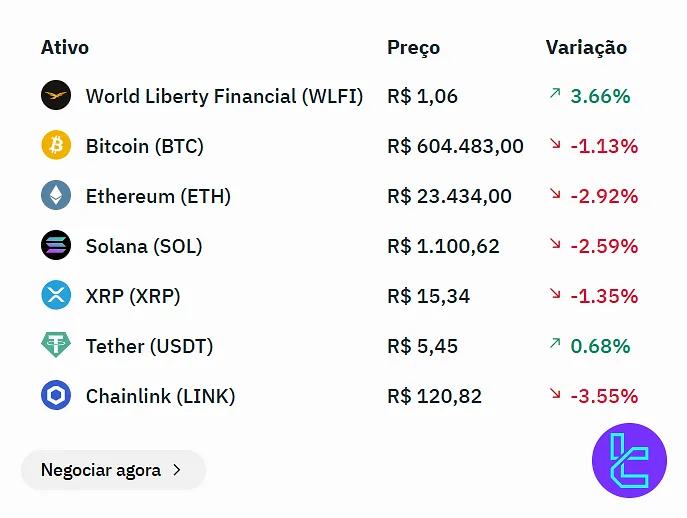

Mercado Available Cryptocurrencies

This exchange offers an impressive selection of over 330 cryptocurrencies for trading. This diverse range includes:

- Bitcoin [BTC]

- Ethereum [ETH]

- Cardano [ADA]

- Coti [COTI]

- Dogecoin [DOGE]

- Fantom [FTM]

- Litecoin [LTC]

- Optimism [OP]

- And so on

Does Mercado Bitcoin Exchange Offer Futures or Margin Trading?

At the time of writing this article, Mercado Bitcoin does not offer futures or margin trading options. The exchange focuses primarily on spot trading and other investment products like staking and fixed-income offerings.

Account Opening and Verification on MB

Creating an account on this crypto exchange involves a few simple steps, ending with identity verification to unlock full access and trading capabilities.

#1 Start the Registration Process

Visit the exchange’s official website and click on “Create Account” to begin.

#2 Enter Email and Country

Provide a valid email address and select your country of residence from the dropdown list.

#3 Complete Personal Details

Add required information, including:

- Date of birth

- CPF

- Account password

#4 Verify Your Email

Check your inbox and click the confirmation link to activate your account.

#5 Complete the KYC Procedure

To complete your registration, upload the required documents, including:

- Proof of Identity: Passport or ID card

- Proof of Residence: Utility bill or Bank statement

Once verified, you’ll be able to access all platform features.

How to Trade on Mercado Bitcoin

Trading on Mercado Bitcoin begins with a quick registration through the platform’s website or mobile app. The steps are outlined below.

#1 Account Registration

Create an account on the official Mercado Bitcoin website or mobile app.

Provide accurate personal details and complete any required KYC (Know Your Customer) verification to ensure secure trading access.

#2 Funding Your Wallet

Once verified, deposit funds into your account. The platform primarily supports deposits in Brazilian Reais (BRL) through local payment channels such as bank transfers or PIX. This step ensures you have the liquidity needed to place trades.

#3 Exploring the Market

Navigate to the trading dashboard where you’ll find the order book, market depth, and live price feeds.

Mercado Bitcoin offers access to a wide selection of cryptocurrencies, including leading assets like Bitcoin (BTC), Ethereum (ETH), and various altcoins.

#4 Placing Orders

Choose between market orders for instant execution at the best available price, or limit orders to set your preferred entry or exit level.

Advanced traders can also monitor spreads, liquidity zones, and volatility before confirming trades.

#5 Managing Your Portfolio

After execution, your digital assets appear in your Mercado Bitcoin wallet.

From here, you can monitor performance, diversify holdings, or convert between different cryptocurrencies and BRL. Withdrawals are available via bank transfer back to your local account.

Trading Platform Applications

Mercado Bitcoin offers a proprietary trading platform accessible via web browsers and mobile applications for both Android and iOS devices. These apps include all necessary options and trading tools for buying/selling cryptocurrencies. Download Links:

While the apps are stable and support core trading functions, they lack advanced features like Face ID login and integration with TradingView. The platform does support API access and basic advanced orders, but does not allow automated trading via bots.

Security tools such astwo-factor authentication and cold wallet storage are in place, offering moderate protection for user accounts.

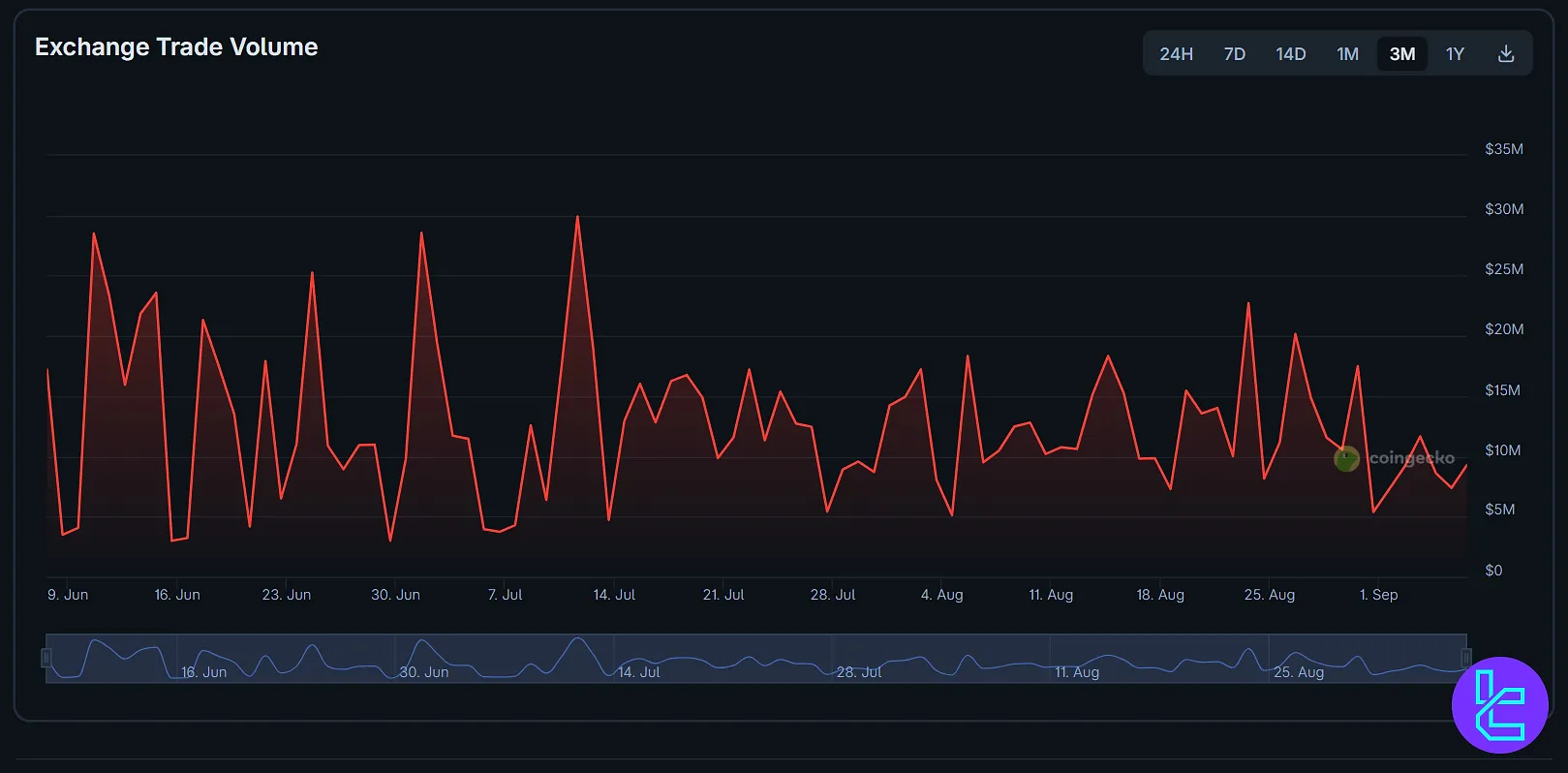

Mercado Bitcoin 3-Month Liquidity

Over the past three months, Mercado Bitcoin’s exchange trade volume has shown sharp fluctuations, ranging between $5M and $35M.

The chart indicates recurring spikes, suggesting short-term liquidity surges likely tied to market events and investor sentiment.

Key insights:

- Peak Activity: Several liquidity surges exceeded $30M, reflecting heightened trading demand during volatile sessions;

- Stability Zones: Periods between spikes often hovered near $10M, showing a baseline liquidity level;

- Recent Trend: Entering September, volumes are consolidating closer to$10M, hinting at reduced speculative activity compared to early summer.

This liquidity profile underscores Mercado Bitcoin’s ability to attract strong trading interest during high-volatility periods while maintaining a consistent operational flow in quieter phases.

Mercado Bitcoin Services Overview

Mercado Bitcoin provides a diverse range of services for retail and institutional users. The table below outlines the key features available on the platform, helping traders quickly assess which tools and investment options are supported:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

MB Security Measures

While the exchange has not experienced any known security breaches, its lack of government regulation and absence of investor protection mechanisms may raise concerns for risk-averse traders. Mercado Bitcoin safety measures:

- Two-Factor Authentication (2FA): More security for users' accounts

- Asset Segregation: User funds are kept separate from operational funds

- Dedicated Cybersecurity Team: Constantly monitoring and improving platform security

- Data Protection: Compliant with Brazilian data protection laws, with regular reports to the National Data Protection Authority (ANPD)

- Annual Audits: Independent audits conducted since 2018, with EY taking over in 2022

The platform implements basic security practices like two-factor authentication and cold wallet storage, but does not offer biometric security (e.g., facial recognition) or a regulatory safety net. As such, users should exercise standard caution while trading.

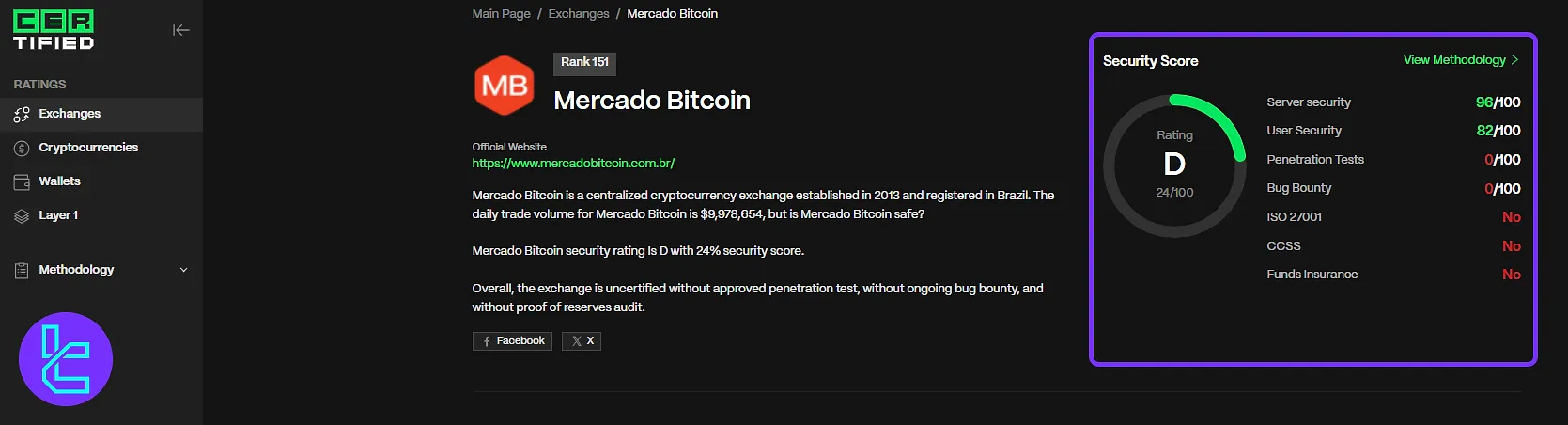

Exchange Security Rankings

According to Mercado Bitcoin CER.live page, Mercado Bitcoin holds a D rating with a 24/100 security score, placing it at rank 151 among global exchanges.

While the platform demonstrates strong server security (96/100) and reliable user security (82/100), it lacks critical protective measures:

- No penetration tests conducted

- No active bug bounty program

- No ISO 27001 certification

- No CCSS compliance

- No funds insurance coverage

This means that, despite having decent infrastructure protection, Mercado Bitcoin remains uncertified, without proof of reserves audit or advanced third-party security validation.

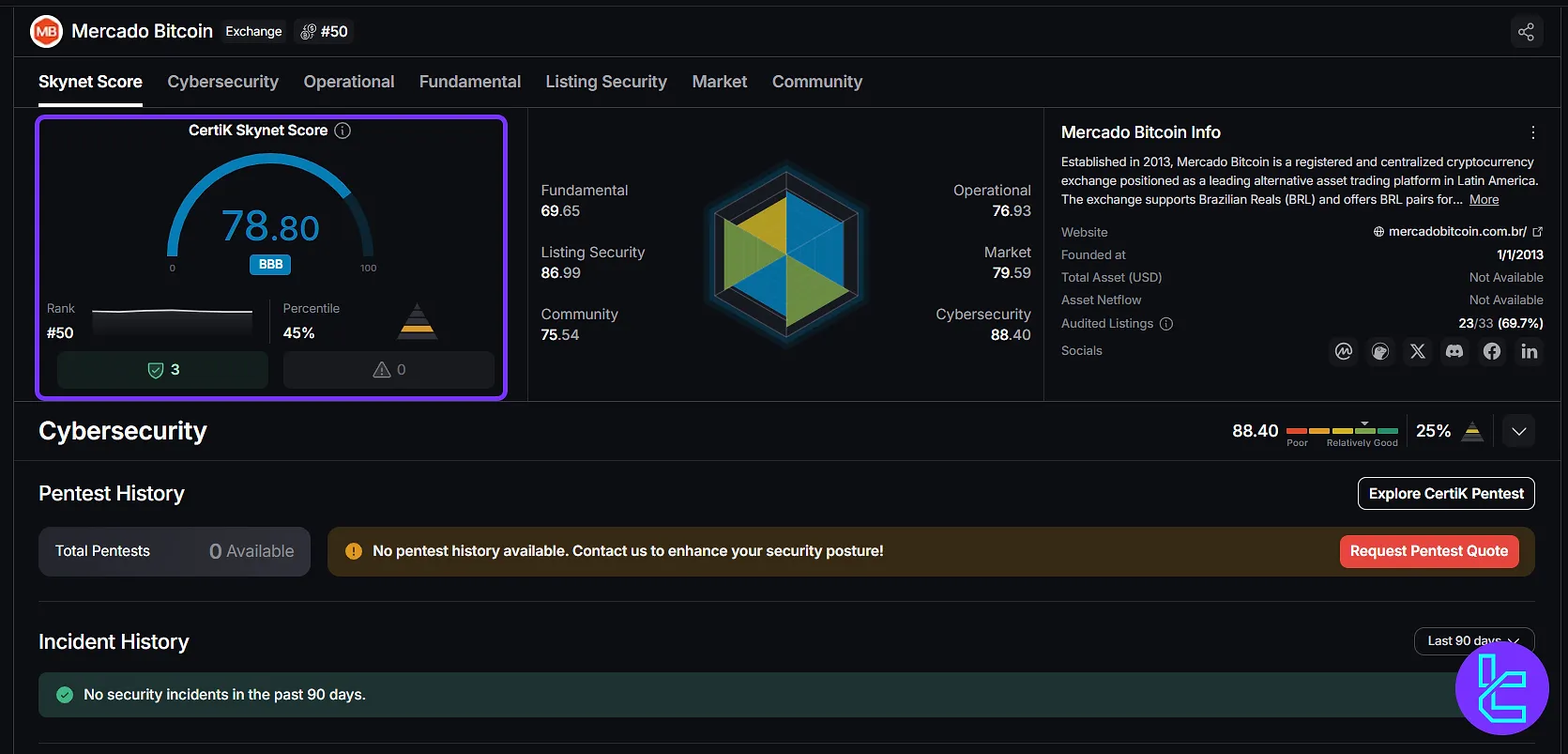

On CertiK’s Skynet platform, Mercado Bitcoin secures a BBB rating with a score of 78.8, ranking #50 globally and placing in the 45th percentile among exchanges.

The exchange demonstrates strong cybersecurity (88.4) and listing security (86.99), along with balanced operational and community scores.

Key insights from CertiK’s evaluation:

- Cybersecurity Score: 88.40 (Relatively Good)

- Operational Score: 76.93

- Market Score: 79.59

- Community Score: 75.54

- Fundamental Score: 69.65

- No pentest history available

- No security incidents in the past 90 days

Overall, while Mercado Bitcoin maintains a solid security posture with no recent breaches, the lack of penetration testing history remains a notable gap.

The table below summarizes the ratings and evaluations of Mercado Bitcoin on both websites:

Category | Metric | Value |

Overall Score | 78.8 / 100 (BBB) – Rank #50 | |

Operational | 76.93 | |

Market | 79.59 | |

Cybersecurity | 88.40 | |

Fundamental | 69.65 | |

Listing Security | 86.99 | |

Community | 75.54 | |

Pentest History | No Pentest History Available | |

Incident History | No Incidents in the Past 90 Days | |

CER.live Security Score | Overall Score | 24 / 100 (D) – Rank #151 |

Server Security | 96 / 100 | |

User Security | 82 / 100 | |

Penetration Tests | 0 / 100 | |

Bug Bounty | 0 / 100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

Mercado Bitcoin Exchange Funding Options

The exchange supports 2 main payment methods for deposits and withdrawals:

- Bank Transfers: Pix, TED, and other options

- Cryptocurrency Transactions: Direct deposits and withdrawals via blockchain

Note that only the Brazilian Real is supported for fiat deposits on the platform.

MB Trust Ratings

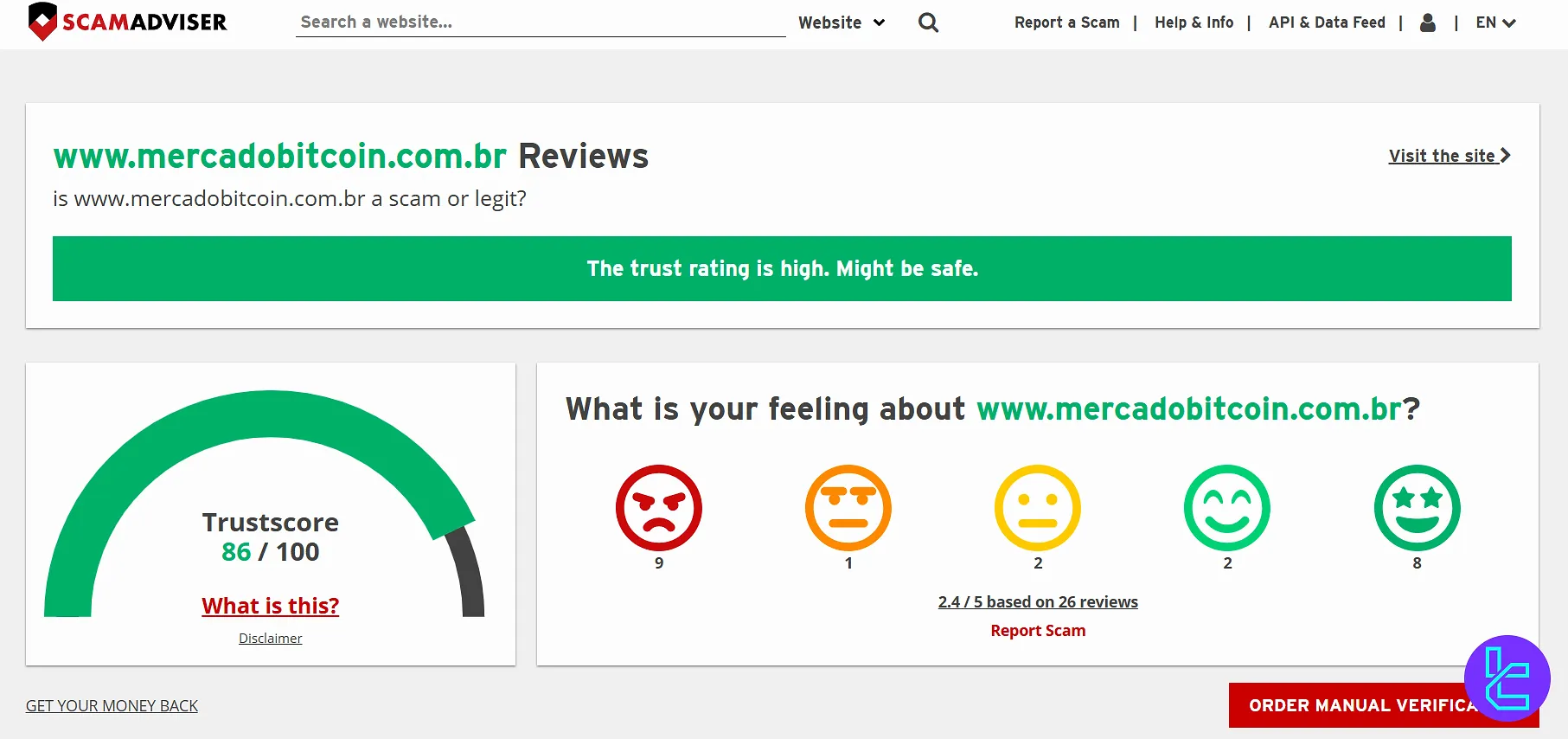

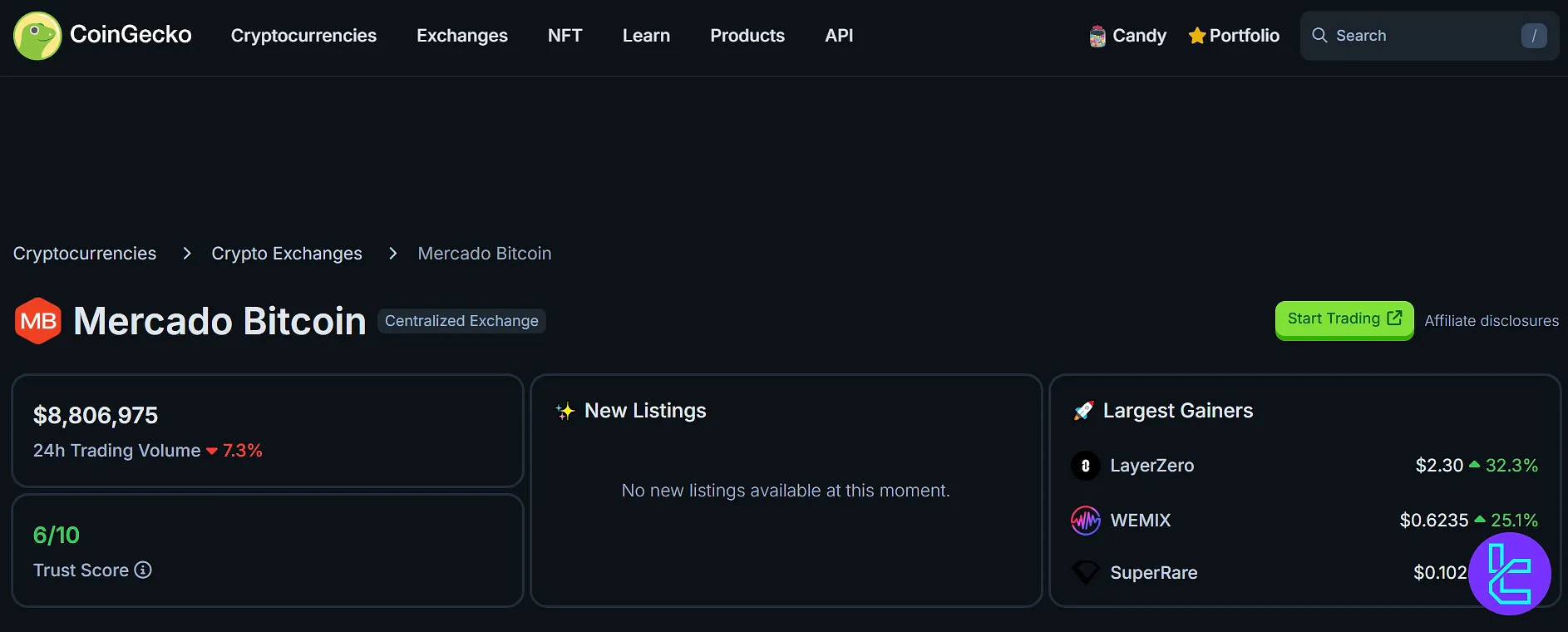

Mercado Bitcoin CoinGecko and other sources show generally positive evaluations. Here's an overview:

- Trustpilot: 2.2/5 (based on 10+ reviews)

- ScamAdviser: 86/100 Trustscore

- CoinGecko: 6/10

User scores on Trustpilot are not reliable since the number is too low.

Mercado Bitcoin Products

While the exchange provides services, such as staking, liquidity pool, and fixed-income products, it doesn't offer a copy trading feature.

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | Yes |

Crypto Cards | Yes |

Mercado Bitcoin Bonus

The exchange has three promotional offers for its clients, which reward users in exchange for opening an account and referals. The table below provides an overview:

Bonus Type | Condition | Reward |

Welcome Bonus | Open a New Account After Jan 15, 2025 | R$25 Credited |

Referral Bonus | Invite a Friend with a Verified Account and Min. R$250 Investment | BTC bonus for Both + Up to R$15,000 for Top Referrers |

R$25 for New Accounts

According to the exchange's official website, Mercado Bitcoin hsa a R$25 starting bonus for new account openings on the platform.

The promotion, officially called "COMECE A INVESTIR NO MB", is valid for those opening accounts after January 15th, 2025.

Referral Program

Mercado Bitcoin turns referrals into real rewards, giving both you and your friends Bitcoin bonuses.

With every successful referral, you unlock BTC incentives and even the chance to win high-value prizes.

How It Works

- Share your link: Access your profile in the MB app, copy your referral link, and share it;

- Your friend invests: Once your friend opens a Verified Account and invests at least R$250 in any crypto (except BRL1 and Digital Fixed Income daily liquidity), the program activates;

- You both earn: Each referral grants BTC bonuses directly to both accounts.

Bonus Structure

- Investments between R$250 and R$2,499.99 reward R$20 in BTC for both

- Investments between R$2,500 and R$4,999.99 reward R$30 in BTC for both

- Investments above R$5,000 reward R$40 in BTC for both

Extra Rewards

Beyond standard bonuses, top referrers can earn up to R$15,000 in additional Bitcoin prizes, based on the number of successful referrals.

Mercado Bitcoin Exchange Support

This exchange offers customer assistance services through the following channels:

- Email: imprensa@mercadobitcoin.com.br

- Ticket System: On the website

We couldn't find a live chat option or any related information provided on the website during our investigation. The support department is available 24/7.

Copy Trading and Other Investment Options

Mercado Bitcoin allows users to participate in crypto staking, enabling passive income through supported coins. However, it does not offer yield farming or copy trading features.

- Staking: Users can stake certain cryptocurrencies [ETH, SOL, CHZ] to earn rewards, with yields up to 21% APY;

- Fixed/Variable-Income Products: The platform offers digital asset-based investments with varying terms and returns;

- Crypto-Backed Lending: Users can use their crypto assets as collateral to borrow funds.

This positions the exchange as a viable option for users interested in basic long-term earning tools but not for those seeking diversified passive income strategies.

List of Countries Restricted by Mercado Bitcoin

Per our investigations of the website and its registration process, this exchange requires traders to have a CPF (Physical Persons Register) in Brazil, which is attributed to Brazilians and residents in the country.

Therefore, only traders resident in Brazil are eligible to open an account with the exchange.

Comparison of Mercado Bitcoin with Other Exchanges

Let's check Mercado Bitcoin's standing in the crypto trading world in comparison with other platforms:

Features | Mercado Bitcoin Exchange | Binance Exchange | Bybit Exchange | OKX Exchange |

Number of Assets | 330+ | 400+ | 1300+ | 7800+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:12 |

Minimum Deposit | R$1 | $1 | Varies by Cryptocurrency | N/A |

Spot Maker Fee | 0.015% - 0.3% | 0.02% - 0.1% | 0.005% - 0.1% | -0.01% - 0.14% |

Spot Taker Fee | 0.25% - 0.7% | 0.04% - 0.1% | 0.015% - 0.1% | 0.03% - 0.23% |

Mandatory KYC | No | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion And Conclusion

Mercado Bitcoin, going through annual audits and keeping user assets segregated from company's funds, provides its support services through 2 channels [ticket, email]. The ScamAdviser website has given a 86/100 Trustscore to the platform's website. "CoinGecko" evaluates the platform as a 6/10.