Paribu offers 190+ trading pairs in USDT and TRY markets. While the USDT market is commission-free, trading in the TRY market incurs a Maker fee ranging from 0.01% to 0.25% and a Taker fee ranging from 0.06% to 0.35%.

The platform provides access to soccer teams' fan tokens, such as Fenerbahce and Besiktas.

Paribu; An Introduction to the Crypto Exchange

Paribu is acentralized cryptocurrency exchange headquartered in Turkey that primarily serves the Turkish market.

The platform was launched on February 14, 2017, and shortly after, it became the 16th on the CoinMarketCap-World list, with a volume of 5,800 BTC in December of the same year. Paribu key features:

- Daily Trading Volume of TRY 10B+

- 170+ cryptocurrencies

- No minimum deposit requirements

The platform specializes in fiat-crypto pairs involving Turkish Lira (TRY), making it a convenient entry point for domestic users seeking exposure to digital assets.

Led by founder Yasin Oral and a team of Turkish entrepreneurs, Paribu was established with the mission of simplifying access to cryptocurrency while maintaining a strong commitment to regulatory compliance.

The exchange operates under the oversight of Turkey’s Financial Crimes Investigation Board (MASAK) and has earned local trust through its focus on ease of use, transparency, and consumer safety.

While Paribulacks international licenses (such as FCA or FinCEN), its integration with local financial infrastructure and adherence to national compliance standards make it a dominant player in Turkey’s crypto space.

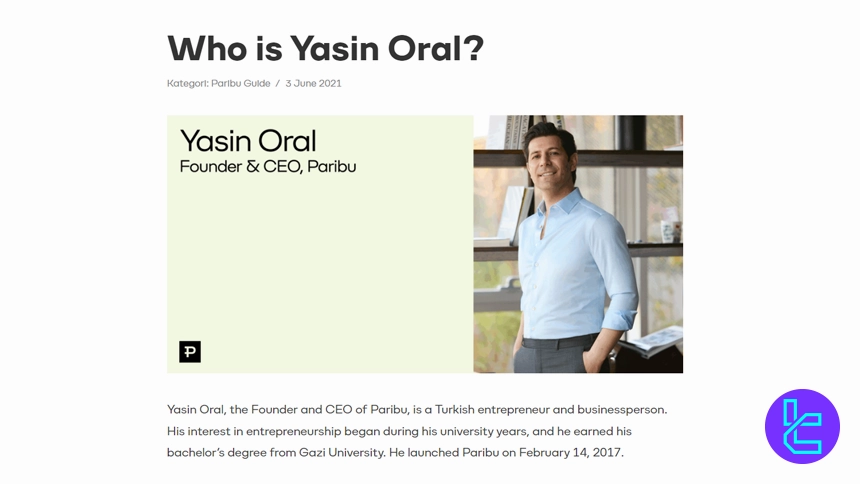

Paribu Exchange CEO

Yasin Oral is the founder and CEO of Paribu, one of Turkey’s leading cryptocurrency exchanges. Under his leadership, Paribu has rapidly expanded, offering an advanced platform that provides users with easy access to a wide range of digital assets. Since its launch in 2017, Yasin has focused on creating a secure and innovative trading environment for Turkish users and beyond.

In his interviews and public appearances, Yasin continues to share his vision for Paribu’s future, emphasizing the platform’s commitment to integrating cutting-edge financial technologies, enhancing user experience, and expanding its global presence. He has also spearheaded initiatives aimed at strengthening the relationship between cryptocurrency and traditional financial systems, positioning Paribu as a key player in the digital economy.

Connect with Oral through the link below:

Paribu Exchange Specific Features

Let’s take a quick look at what Paribu offers and see if it fits among the crypto exchanges.

Exchange | Paribu |

Launch Date | 2017 |

Levels | 10 Levels |

Trading Fees | Maker: 0.01% - 0.25% Taker: 0.06% - 0.35% |

Restricted Countries | N/A |

Supported Coins | 170+ |

Futures Trading | No |

Minimum Deposit | None |

Deposit Methods | Papara, Bank Transfer, Crypto |

Withdrawal Methods | Crypto, Bank Transfer |

Maximum Leverage | 1:1 |

Minimum Trade Size | TRY 10 |

Security Factors | 2FA, Transaction Code |

Services | Soccer fan tokens, Mobile trading, USDT/TRY markets |

Customer Support Ways | Phone, Ticket, Twitter |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | N/A |

Orders Execution | Market |

Native Token | No |

Paribu Advantages and Disadvantages

The exchange sponsors İKSV Alt Kat and Istanbul Blockchain Women. In this section of the Paribu review, we’ll provide a balanced overview of the platform’s strengths and areas for improvement.

Pros | Cons |

User-Friendly Platform | Primarily focused on Turkish users with no English support |

Mobile trading | Limited security factors |

TRY deposits and withdrawals | No Futures or Margin trading |

Fee discounts through a comprehensive tiered user level structure | No live chat support |

Paribu User Levels

Paribu offers a tiered system with 10 levels providing commission discounts based on monthly buying and selling volume.

User Level | 30D Trading Volume (TRY) |

1 | 0 – 50K |

2 | 50K – 100K |

3 | 100K – 1M |

4 | 1M – 5M |

5 | 5M – 25M |

6 | 25M – 50M |

7 | 50M – 100M |

8 | 100M – 500M |

9 | 500M – 1B |

10 | 1B+ |

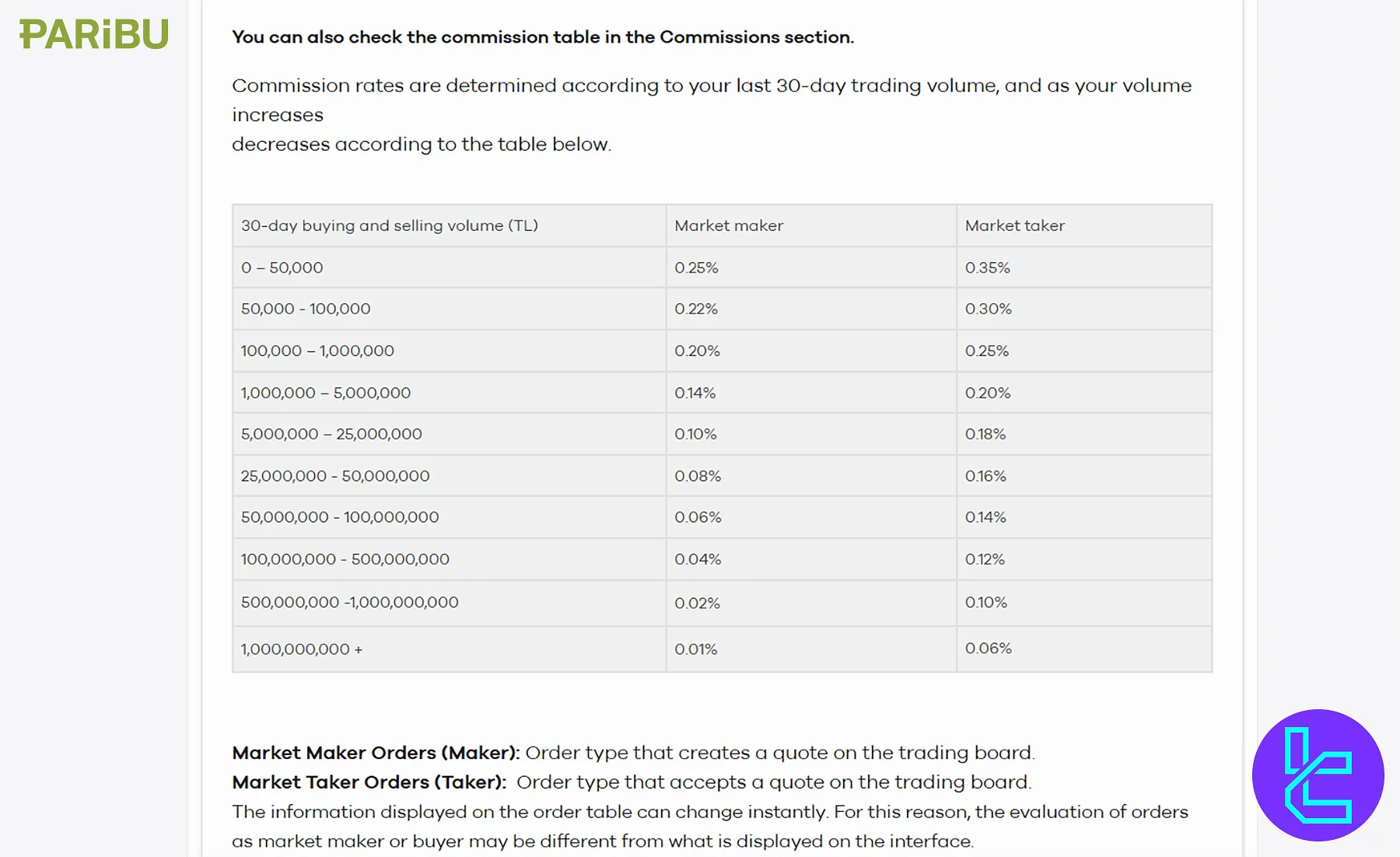

Paribu Trading and Non-Trading Costs

The exchange charges commissions in cryptocurrency for Buy transactions and TRY for Sell transactions.

The default rates are 0.25% for makers and 0.35% for takers. However, the platform offers fee discounts based on the trading volume, which is one of the advantages of this Paribu review.

30-Day Trading Volume (TRY) | Maker Fee | Taker Fee |

0 – 50K | 0.25% | 0.35% |

50K – 100K | 0.22% | 0.30% |

100K – 1M | 0.20% | 0.25% |

1M – 5M | 0.14% | 0.20% |

5M – 25M | 0.10% | 0.18% |

25M – 50M | 0.08% | 0.16% |

50M – 100M | 0.06% | 0.14% |

100M – 500M | 0.04% | 0.12% |

500M – 1B | 0.02% | 0.10% |

1B+ | 0.01% | 0.06% |

Note that USDT trading pairs incur no commissions. The platform also charges no commission for deposits (except for Papara transactions). Crypto withdrawal fees vary based on the asset you’re transferring and the blockchain network.

This structure favors high-volume traders and aligns with Paribu’s goal of incentivizing long-term usage and liquidity provisioning.

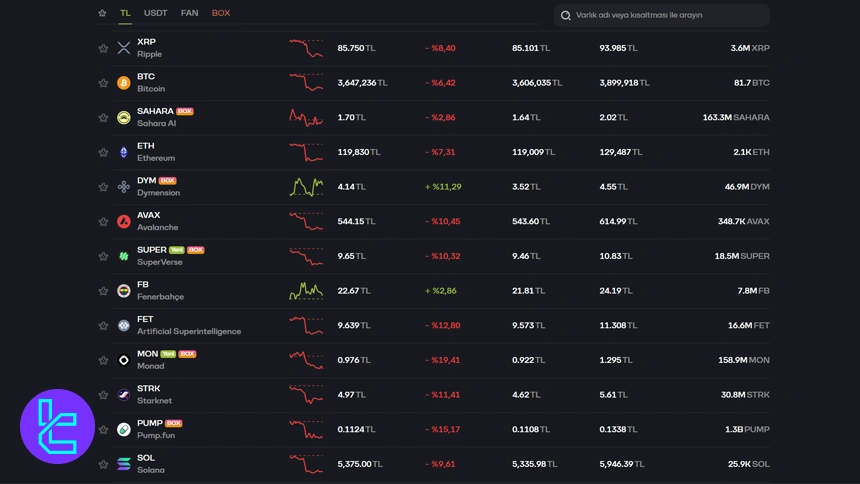

Paribu Exchange Listed Cryptocurrencies

The platform has listed a wide array of 170+ cryptocurrencies and 190+ trading pairs in two markets: USDT and TRY. Some of the most popular digital assets available on Paribu:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Pepe (PEPE)

Paribu also offers access to sports fan tokens, especially Fenerbahce Token and Besiktas Token.

Margin and Futures Trading

At the time of writing this Paribu review, the exchange does not offer access to Margin or Futures markets. The platform focuses on Spot trading to cater to users seeking straightforward buy/sell transactions without leverage.

Users looking for diversified market types may find its offering limited, though its focus on high-liquidity TRY/crypto and USDT/cryptopairs remains effective for most basic trading strategies.

Paribu Exchange Registration and Verification

Before creating an account on Paribu, it’s important to note that KYC procedures differ for Turkish citizens and foreign nationals. Both groups must verify their identity to gain full access to trading and withdrawal features.

#1 Start the Registration

Visit the official Paribu website and click on “Hesap oluştur” (Create Account). Fill in the registration form using:

- A valid Turkish mobile number (+90)

- Password

#2 Verify Contact Information

Check your inbox and SMS messages to verify both your email address and mobile number as part of account activation.

#3 Access Account Settings

Once logged in, navigate to your account settings and select the option “Kimlik bilgilerinizi güncelleyin” (Update your identity information).

#4 Choose Your Citizenship Type

Click on “C. vatandaşı” if you're a Turkish citizen, or choose “Diğer ülke vatandaşları” for foreign residents.

#5 Submit Identity Documents

Upload a valid form of identification:

- Turkish citizens must provide a Turkish National ID card;

- Foreign nationals must submit an ID document with a valid 99-series identification number.

Once your documents are submitted, the verification process will begin. After approval, your account will be fully enabled for trading and withdrawals.

How to Buy and Sell Cryptocurrency on Paribu

Purchasing cryptocurrency on Paribu is quick and straightforward. Just follow the steps outlined in the following sections.

Buying Cryptocurrency

Here's how to buy crypto:

- Navigate to the “Buy/Sell Easily” Section: Start by selecting the “Buy/Sell Easily” option on Paribu’s platform;

- Choose the “Buy” Option: After entering the buy section, click the “Buy” button for your desired cryptocurrency;

- Set Your Amount: Enter the amount in Turkish Lira (TRY) that you wish to invest;

- Confirm Your Purchase: Hit the “Buy” button again to complete your transaction.

Selling Cryptocurrency

The selling procedure is similar to the buying one:

- Go to the “Buy/Sell Easily” Section: Just like buying, start by selecting the “Buy/Sell Easily” option;

- Select the “Sell” Option: Once in the section, choose the “Sell” button for the cryptocurrency you wish to sell;

- Enter the Amount: Specify how much cryptocurrency you want to sell;

- Complete the Sale: Click the “Sell” button to finalize the transaction.

Trading Volume Analysis

The trading volume on Paribu Exchange has demonstrated notable fluctuations over the past few months, reflecting varying levels of market activity. The graph illustrates the changing trade volumes, with peaks corresponding to specific periods of heightened activity.

According to the Paribu CoinGecko profile, in the period leading up to early October, trading volumes saw a consistent rise, peaking dramatically during certain high-demand days. These spikes indicate moments of significant trading events, which could be tied to market reactions to major news or other influential factors in the cryptocurrency space.

After the mid-October surge, the trading volume experienced a relative decline, settling into a more consistent pattern, though with smaller fluctuations, reflecting typical market behavior during quieter trading periods.

Most recently, towards the end of November, there has been another noticeable rise in trading volume, suggesting either a renewed market interest or the influence of significant market events that drove more traders to participate. This is consistent with the exchange's ability to adapt to the fast-moving cryptocurrency market, with traders showing resilience during both volatile and stable periods.

These trends highlight the dynamic nature of Paribu Exchange's market activity, and understanding these volumes is essential for assessing market sentiment and potential future movements.

Paribu Services

This exchange is not the best option when it comes to additional services besides trading. Here's a summary:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Paribu App and Trading Platform

The exchange offers a dedicated mobile application and a web-based trading platform with 3 types of orders: Limit, Market, and Condition. Paribu App Download Links:

Paribu’s platform experience is optimized for accessibility and simplicity. Its mobile apps (iOS & Android) receive favorable ratings, offering all essential trading features, including:

- Basic charting with indicators

- 2FA and mobile push confirmations

- API access for automation

While there is no desktop application, the web platform is fully responsive and functional. However, Paribu lacks integration with advanced charting systems like TradingView and does not support Face ID or voice-based authentication.

Is Paribu Exchange Secure?

The platform operates without official certification and lacks an approved penetration test to assess its cybersecurity resilience.

Additionally, Paribu does not run a continuous bug bounty program to incentivize security researchers to identify vulnerabilities.

Furthermore, there is no publicly available proof of reserves audit, leaving users without transparent verification of the exchange’s asset holdings and liquidity. Paribu security measures:

- Two Factor Authentication (2FA)

- Cold Storage

- Code Transactions: Face ID, touch ID, or pin code to verify transactions

Paribu is regulated by MASAK, Turkey’s Financial Crimes Investigation Board, ensuring compliance with national AML and KYC standards. However, it lacks global tier-1 regulatory licenses (such as from the FCA or FinCEN) anddoes notprovide user asset insurance.

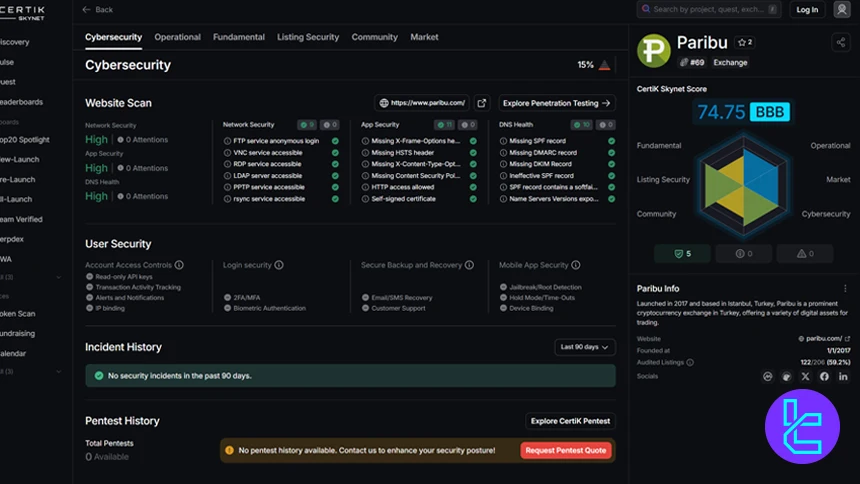

Security Rankings

The Paribu CertiK Skynet evaluation page shows a score of 74.75, securing a BBB rating. This score reflects the platform’s commitment to strong cybersecurity practices, operational integrity, and secure user experiences.

Key Highlights:

- Cybersecurity Score: High with no significant security incidents in the past 90 days;

- Website Scan: All critical areas, including DNS health and network security, have passed with no current issues;

- User Security: Features like 2FA/MFA and biometric authentication provide robust user protection;

- Incident History: No security incidents have occurred within the past 90 days, further demonstrating Paribu's commitment to safety.

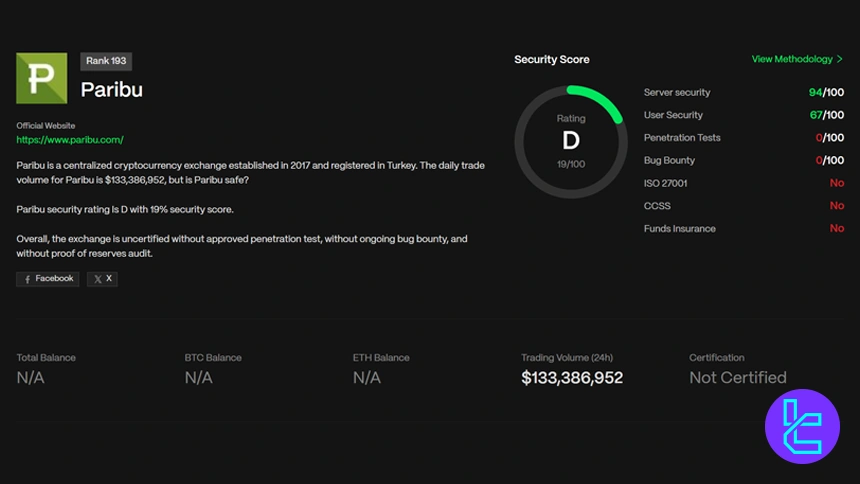

On the other hand, the Paribu CER.live profile ranks 193rd on CER.live. The exchange has a daily trading volume of $133,386,952, but its security rating stands at a low D, with only 19/100 on the CER.live security score.

Key security factors such as penetration tests, ongoing bug bounty programs, and ISO 27001 certification are not present, leading to its uncertified status. Despite its solid trading volume, users may want to consider the lack of advanced security measures when evaluating Paribu for their trading needs.

The table below summarizes the ratings and rankings on the two websites mentioned:

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 74.73 / 100 (BBB) |

Operational | 74.75 | |

Market | 78.89 | |

Cybersecurity | 82.00 | |

Fundamental | 60.29 | |

Listing Security | 88.64 | |

Community | 64.67 | |

CER.live Security Score | Overall Score | 19% (D) |

Server Security | 94/100 | |

User Security | 67/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 0/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

Paribu Payment Methods

The exchange supports TRY and Crypto transactions with no minimum deposit requirement. Paribu TRY payment options:

- Bank Transfers: TL deposit and withdrawal with Akbank, Yapı Kredi Bank, Ziraat Bank, and Vakıfbank at any time (processing hours for other banks: only at working hours)

- Pre-Paid Card: Papara

Note that deposits and withdrawals via Papara have a lower limit of TRY 10.

Paribu does not support international fiat currencies or bank card payments. Turkish Lira is the only fiat currency accepted. This domestic focus simplifies onboarding for local users but may limit access for international traders.

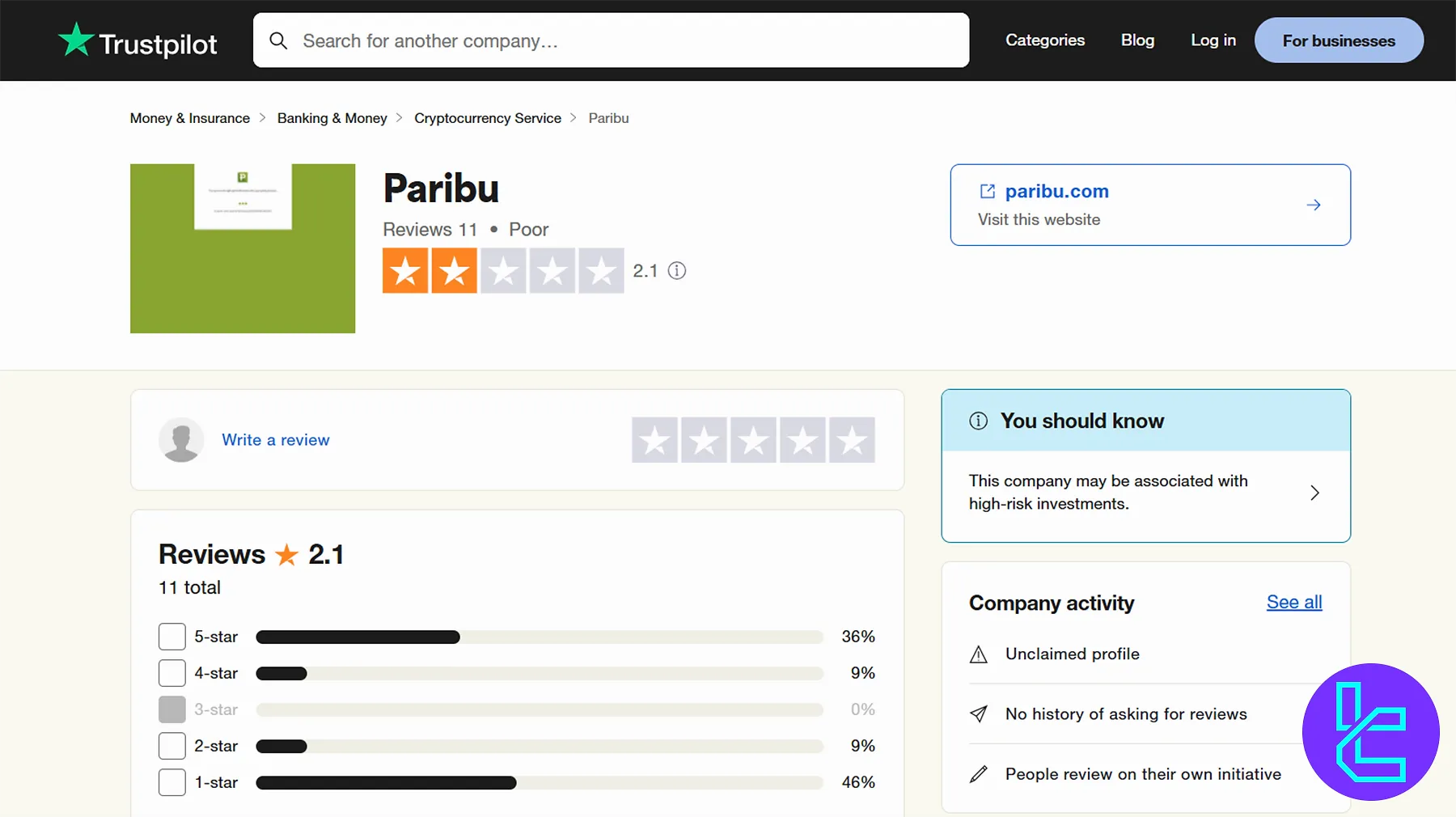

Paribu Trust Score

There are not many Paribu reviews online. The platform’s profile on TrustPilot has 11 comments, mostly negative, resulting in a poor score of 2.1 out of 5.

While 45% of comments on Paribu TrustPilot are positive (4-star and 5-star), 55% are negative (1-star and 2-star).

However, the experts in CoinGecko have rated the exchange with an acceptable score of 7/10.

Paribu Crypto Services

The exchange focuses on crypto spot trading and doesn't offer crypto staking, liquidity pools, crypto cards, or copy trading.

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

Paribu Bonus: Does the Exchange Have Any Active Promotions?

This crypto trading platform has a history of offering promotions and bonus programs to its new and existing clients. However, at the time of writing this article, there is no active bonus offered by Paribu.

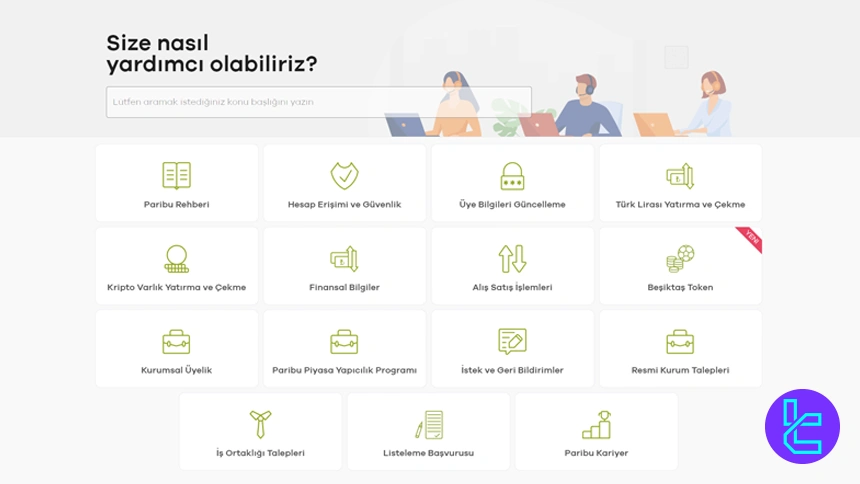

Paribu Exchange Customer Support

The platform boasts 24/7 support through various channels, including a ticket system, a Twitter account, and a call center. However, lacking a live chat feature is one of the biggest letdowns in this Paribu review.

Ticket | Available on the official website |

Phone | 08503036000 |

The phone support unit's working hours are between 09:00 AM and 09:00 PM Turkish time (GMT+3).

Does Paribu Offer a Copy Trading Feature or Investment Plans?

The exchange does not offer crypto copy trading software or structured investment plans. However, users can engage in long-term investments through spot trading.

This limitation may deter investors seeking non-trading earning options or automated portfolio management. Advanced traders looking for features like social trading, bot integration, or portfolio mirroring will need to explore alternative platforms with broader service offerings.

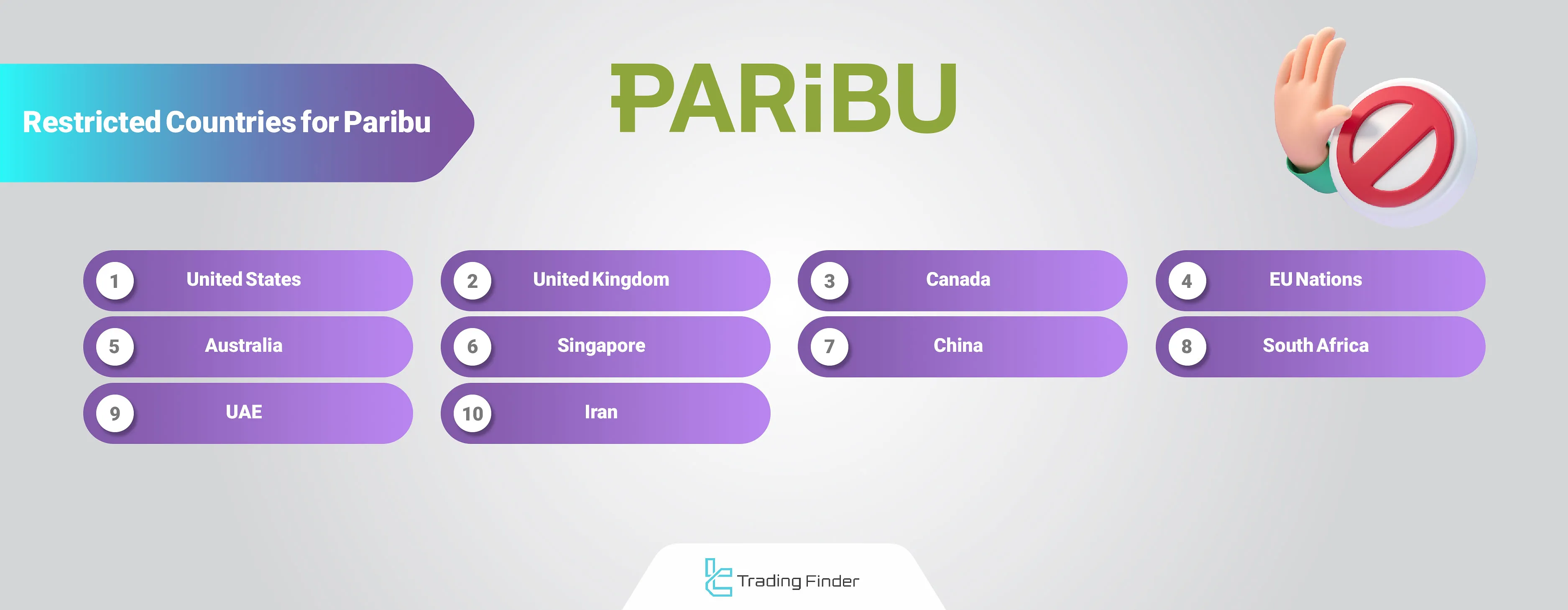

Paribu Exchange Restricted Countries

The platform serves Turkish users or other nationalities with a Turkish Foreign ID Number. To register an account with Paribu, you also need a +90 phone number.

The exchange is not accessible in over 100 countries, including:

- United States

- United Kingdom

- Canada

- EU nations

- Australia, Singapore, South Africa, UAE, Iran, and others

Paribu adheres to local compliance via MASAK but lacks legal presence in other jurisdictions. Non-Turkish users are effectively excluded unless they possess local residency credentials.

Paribo Comparison Table

Let's check Paribo exchange's standing in the crypto trading world in comparison with other platforms:

Features | Paribu Exchange | LBank Exchange | Gate.io Exchange | Kucoin Exchange |

Number of Assets | 170+ | 700+ | 2800+ | 700+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:100 |

Minimum Deposit | None | Varies by Cryptocurrency | Varies by Payment Method | $1 |

Spot Maker Fee | 0.01% - 0.25% | 0.02% | From -0.005% | From 0.005% |

Spot Taker Fee | 0.06% - 0.35% | 0.02% | From 0.025% | From 0.025% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | No |

Writer’s Opinion and Conclusion

Paribu provides access to Spot trading on 170+ cryptocurrencies with a minimum trade size of TRY 10.

The exchange accepts TRY transactions via Bank Transfers and Papara cards. It has a poor TrustPilot score of 2.1 out of 5.