Paymium supports 10 cryptocurrencies and limit orders with a default maker/taker fee of 0.40%/0.60%.

The exchange offers a €5 bonus and a temporary referral program with commissions of up to 30%; the referral offer is currently inactive, though.

Paymium; An Introduction to the Crypto Exchange

Paymium claims to be the world’s first Bitcoin exchange still operating with more than 230,000 customers.

The company is a founding member of the Labchain consortium coordinated by Caisse des Dépôts. Paymium has acquired a Digital Asset Service Provider license from the French financial authority Autorité des Marchés Financiers (AMF) since 2021. Key features of Paymium:

- Backed by investment funds Newfund and Kima Ventures

- 318,000 BTC in trading volume as of 2021

- CEO and co-founder: Pierre Noizat

- Regulated by AMF under number E2021-011

The platform is a subsidiary of UAB PAYRNET and maintains full compliance with local and European digital asset regulations.

Paymium's commitment to regulatory oversight enhances its credibility, making it a reliable choice for European traders seeking a licensed and secure environment.

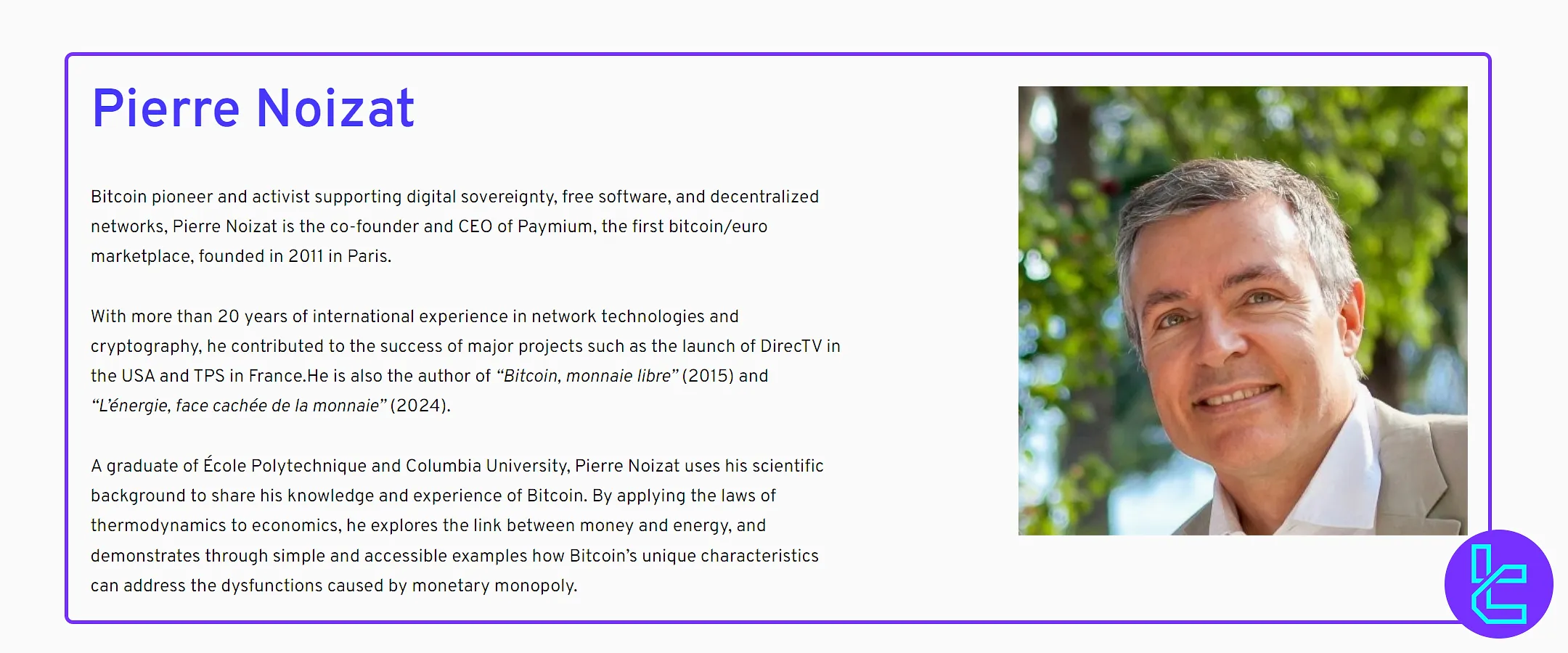

Paymium CEO

Pierre Noizat is the co-founder and CEO of Paymium, Europe’s first bitcoin/euro exchange, established in 2011 in Paris.

With over two decades of experience in cryptography, digital sovereignty, and network technologies, he has played a major role in bridging traditional finance with the emerging crypto ecosystem.

A graduate of École Polytechnique and Columbia University, Noizat combines his academic background with practical innovation, emphasizing Bitcoin’s economic independence and energy principles.

As an author of “Bitcoin, monnaie libre” (2015) and “L’énergie, face cachée de la monnaie” (2024), he advocates for decentralization and transparent monetary systems.

Paymium Table of Specifications

Let's break down the key specifications of Paymium to give you a clearer picture of what this Crypto exchange offers:

Exchange | Paymium |

Launch Date | 2011 |

Levels | 9 levels |

Trading Fees | Variable based on the order type |

Restricted Countries | Afghanistan, the Democratic Republic of the Congo, Cuba, Eritrea, Ethiopia, Iran, Iraq, Kenya, North Korea, Lebanon, Libya, Nigeria, Sudan, Syria |

Supported Coins | 10 |

Futures Trading | No |

Minimum Deposit | €5 |

Deposit Methods | EUR SEPA Transfer, Crypto |

Withdrawal Methods | EUR SEPA Transfer, Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | €5 |

Security Factors | 2FA, Cold Storage |

Services | OTC Desk, P2P Trading, Mobile Trading, Recurring Buy Plan, BTC Family Plan |

Customer Support Ways | Email, Ticket |

Customer Support Hours | Monday to Friday from 10am to 6pm |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | BCIO |

Paymium Exchange Pros & Cons

Previously known as “Bitcoin Central”, the exchange offers an OTC desk for transactions over €50,000 and a €5 discount on the first crypto purchase. However, to have a balanced view, we must weigh Paymium’s advantages against its disadvantages.

Pros | Cons |

Regulated by the French financial authority (AMF) | Limited cryptocurrency selection |

User-friendly interface | Dormant fees for accounts inactive for more than 3 years |

Dedicated account manager for large-scale transactions | Mandatory KYC |

Support for EUR CoinVertible (EURCV) | No leverage options |

Paymium User Levels

In this Paymium review, we must mention that the exchange has implemented a 9-level fee structure with volume-based fee reductions for Limit orders.

As monthly trading volume increases, users progress through the tiers, unlocking lower maker and taker fees:

30-Day Trading Volume (EUR) | Maker Fee | Taker Fee |

0 – 10K | 0.40% | 0.60% |

10K – 500K | 0.25% | 0.40% |

50K – 100K | 0.15% | 0.30% |

100K – 1M | 0.12% | 0.25% |

1M – 20M | 0.08% | 0.18% |

20M – 100M | 0.05% | 0.15% |

100M – 300M | 0.02% | 0.10% |

300M – 500M | 0.00% | 0.08% |

500M+ | 0.00% | 0.05% |

These reductions apply only to limit orders. Market orders are charged separately at a flat rate of 1.49%.

Paymium Trading and Non-Trading Costs

The exchange charges no inactivity fees effective as January 1, 2025 (except for accounts inactive for more than 3 years).

The commission forcard payments can be up to 3.5%. Key points about Paymium fee structure:

Transactions | Commission |

Market orders | 1.49% |

USDC and EURCV pairs | 0.90% |

EURCV/EUR trading | 0.90% |

BTC maintenance for more than 3 years of inactivity | 5% annual rate |

Limit orders maker | From 0.00% to 0.40% |

Limit orders taker | From 0.05% to 0.60% |

Paymium Minimum Deposit and Trade Size

Paymium offers a low barrier to entry with:

- Minimum deposit: €5 or 0.0001 BTC

- Minimum trade size: €5 equivalent

This makes the platform accessible for users with limited capital, suitable for first-time crypto investors or micro-portfolio trading strategies.

Paymium Exchange Tradable Digital Assets

While Paymium may not offer the extensive list of cryptocurrencies found on some larger exchanges, it provides a solid selection of established digital assets. Here's a rundown of the cryptocurrencies currently supported on the platform:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Basic Attention Token (BAT)

- BCIO (Paymium utility token)

- DAI (DAI)

- Euro CoinVertible (EURCV)

- USD Coin (USDC)

Does Paymium Support Futures Trading?

For traders interested in leveraged positions and futures markets, it's important to note that the exchange does not offer futures trading at the time of writing this Paymium review. The platform focuses primarily on spot trading, particularly in the BTC/EUR pair.

Paymium Registration and KYC

The Paymium registration process takes less than 10 minutes and ensures secure access to one of Europe’s most regulated crypto exchanges. Traders must provide verified email, phone, and identity details to complete the onboarding process.

#1 Start the Sign-Up Process

Go to the official Paymium homepage and click “Sign Up” to begin your account registration.

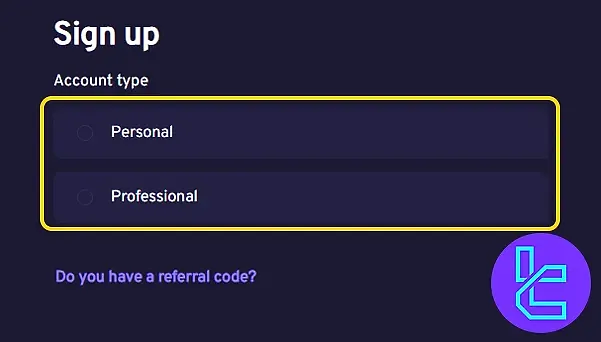

#2 Select Your Account Type

Choose whether you want a personal or professional account, depending on your trading status and verification scope.

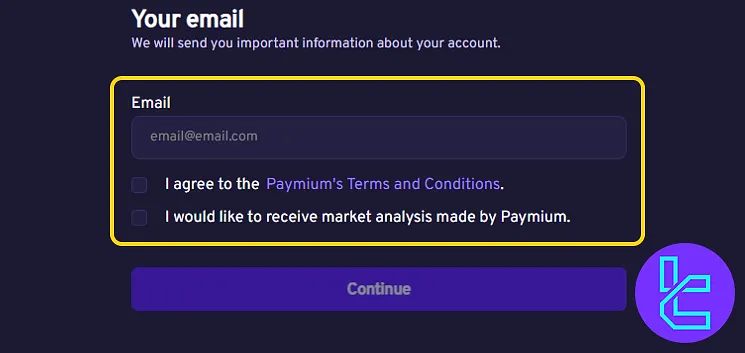

#3 Enter Email & Consent

Submit a valid email address, accept the terms of service, and optionally subscribe to market insights.

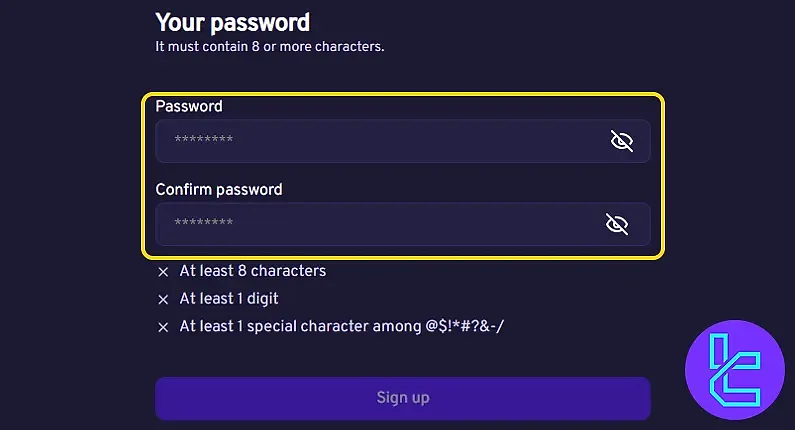

#4 Set Your Password

Create a strong password using a mix of uppercase, lowercase, numbers, and symbols (minimum 8 characters).

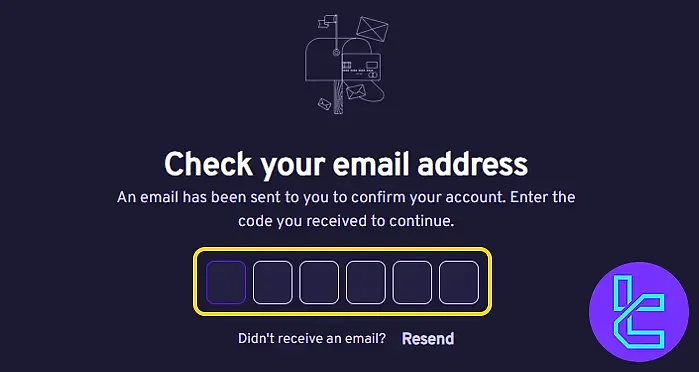

#5 Confirm Email Ownership

Retrieve the verification code sent to your inbox and enter it on the site to validate your email.

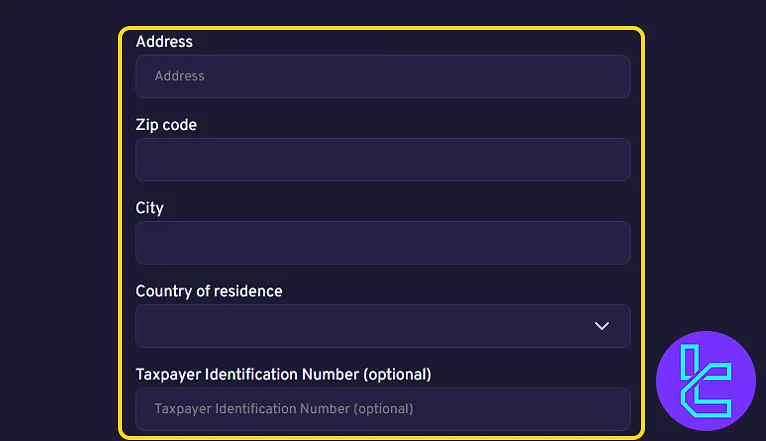

#6 Submit Personal & Address Details

Enter your legal name as it appears on official documents, along with your residential address (manual entry is available).

#7 Verify Your Phone Number

Provide a valid mobile number and enter the verification code sent via SMS to finalize registration.

#8 Complete the KYC Procedure

In compliance with KYC and AML policies, upload supporting documents, including:

- Proof of ID: Passport or Driver's license

- Proof of Residence: Utility bill, Tax notice, or Rent receipt

How to Buy/Sell Crypto on Paymium

Purchasing digital assets with a credit card on Paymium is quick and accessible on both desktop and mobile.

Follow the steps below to get started.

For Computer Users

Open the trading interface and select "Swap". Enter the euro amount you wish to invest, then choose "Credit Card" as your payment method. Pick your preferred cryptocurrency and review the automatic price estimate before confirming the "Swap".

For Mobile Users

Tap the menu icon (three horizontal lines) at the top right of the screen. Choose "Buy or Sell", type in the desired amount in euros, and select "Credit Card" just below. After choosing your crypto asset, review the displayed estimate and finalize by clicking "Swap".

Paymium Exchange App and Trading Platform

We must mention in this Paymium review that the exchange offers both web-based and mobile trading platforms with access to TradingView charts and tools.

TradingFinder has developed a wide range of TradingView indicators that you can use for free.

There is no copy trading, no P2P exchange, and no PAMM or social trading tools integrated into the platform.

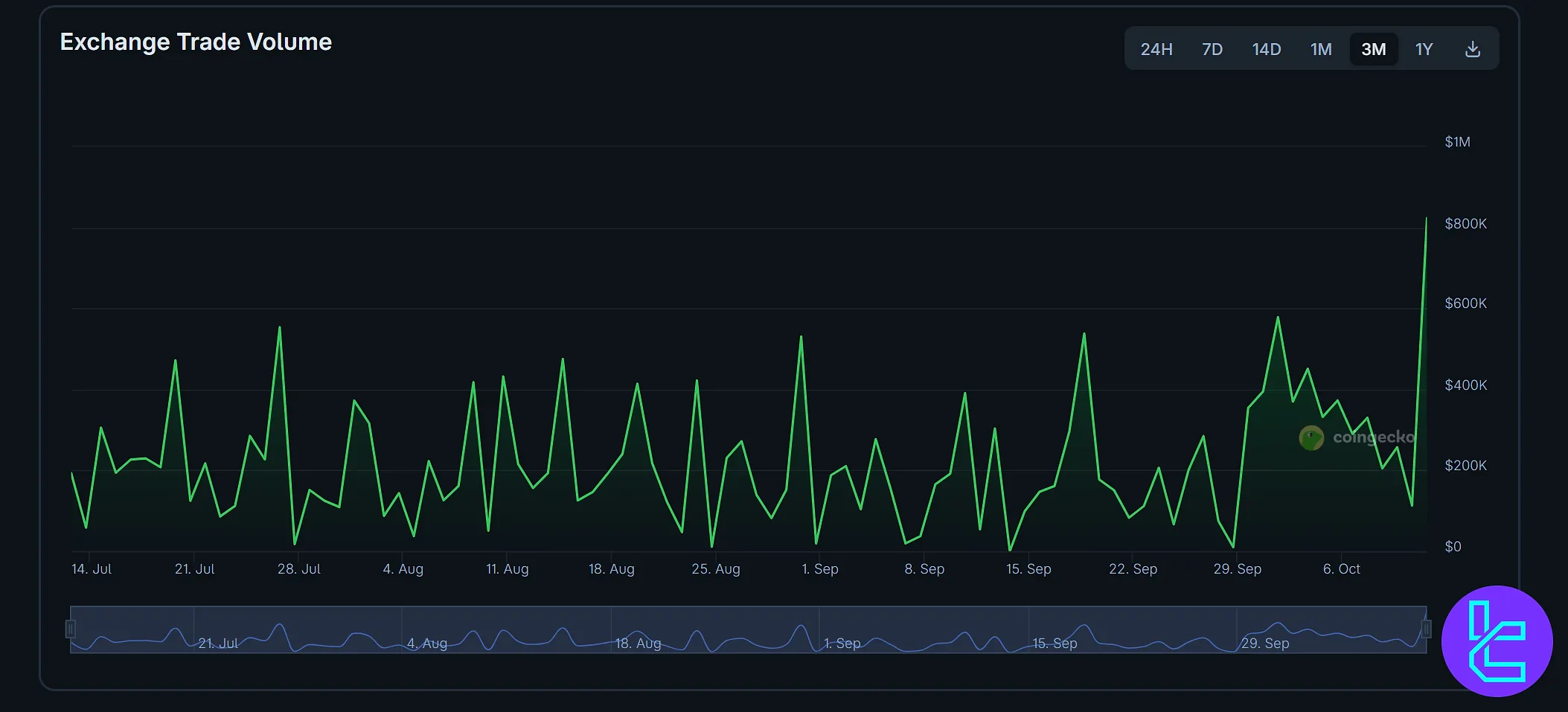

Paymium Exchange Trading Volume Analysis

Over the past three months, Paymium’s trading volume has shown consistent volatility, reflecting active participation and liquidity across its markets.

Based on Paymium CoinGecko profile, daily volumes fluctuated between $100K and $900K, with visible peaks in late July, early September, and early October.

The graph illustrates recurring weekly surges, suggesting periodic trading cycles likely tied to Bitcoin and Ethereum price movements. The volume reached its quarterly high near $800K in October, highlighting renewed trader engagement following a short-term decline in mid-September.

Overall, Paymium’s trading activity remains steady with increasing momentum toward the end of the quarter, indicating potential growth in both user base and transactional depth.

Paymium Services

This section goes through the additional services offered by the reviewed platform:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

| No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Paymium Safety and Security

Paymium is registered as a DASP with AMF and offers various safety protocols to secure client funds, including:

- Over 90% of client assets stored in cold wallets

- Storing private keys on offline devices

- 2 factor authentication

- Encrypted SSL connections and strong password enforcement

While Paymium is licensed by the French AMF, it is not tier-1 regulated and does not offer an investor compensation fund. Still, its track record shows no known security breaches to date.

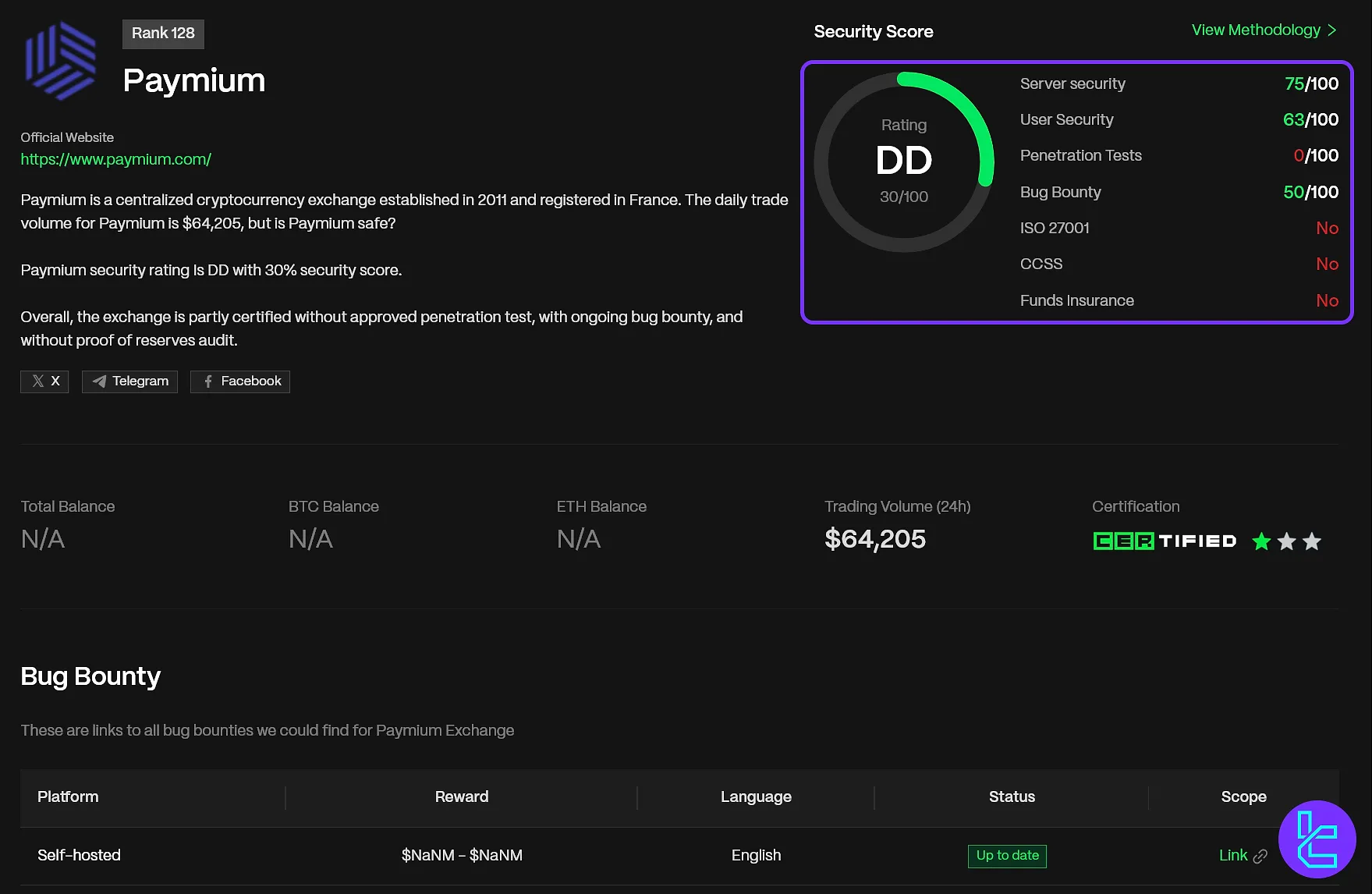

Security Rankings

The exchange holds a DD security rating with an overall 30% safety score, as reported by the Paymium CER.live page. The exchange demonstrates moderate server security (75/100) and user protection (63/100), yet critical gaps exist in its penetration testing (0/100) and funds insurance, both of which remain unverified.

While Paymium operates with an active bug bounty program (50/100), it lacks key compliance certifications such as ISO 27001 and CCSS. The absence of a proof-of-reserves audit further limits its transparency in safeguarding user assets.

In summary, Paymium shows a partially certified structure, with basic security mechanisms but without full institutional protection or advanced testing validation.

The table below summarizes the evaluation mentioned above:

Category | Metric | Value |

CER.live Security Score | Overall Score | 30% (DD) |

Server Security | 75/100 | |

User Security | 63/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 50/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

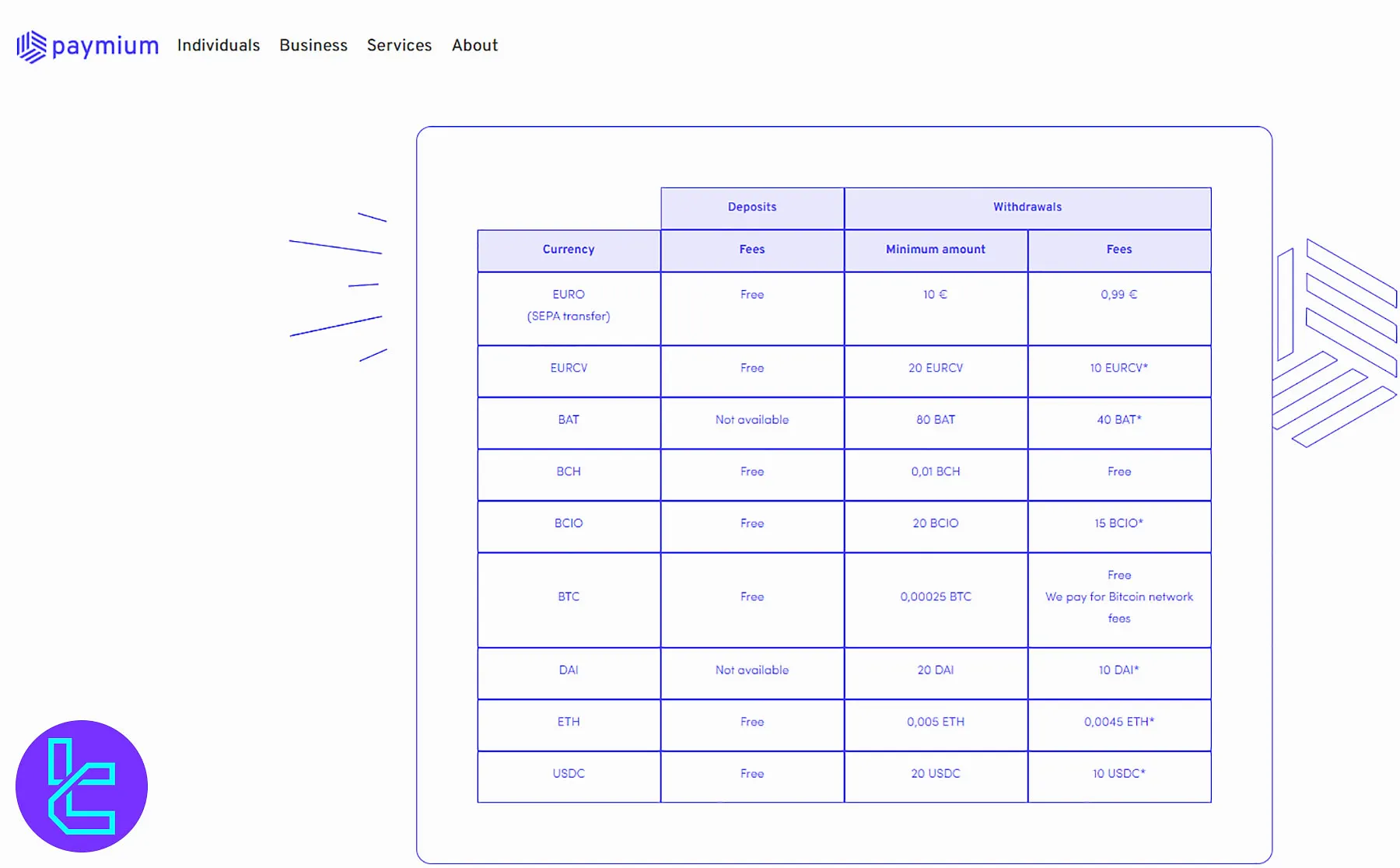

Paymium Deposit and Withdrawal Methods

The exchange accepts fiat and crypto transactions. It processes EUR payments via SEPA transfers and Credit/Debit cards. Available cryptocurrencies for payments on Paymium:

- EURCV

- BAT (only withdrawal)

- BCH

- BCIO

- BTC

- DAI (only withdrawal)

- ETH

- USDC

The minimum EUR withdrawal amount is €10 with a €0.99 fee. Crypto withdrawal fees vary based on the asset and the blockchain network.

Paymium Trust Scores

While the Paymium Trustpilot profile has a great score, the CoinGecko experts has rated the platform as a poor exchange.

Trustpilot | 4.4 out of 5 based on 77 reviews |

Reviews.io | 1.6 out of 5 based on 27 comments |

CoinGecko | 4 out of 10 |

86% of Paymium reviews on Trustpilot are positive (4-star and 5-star) and only 13% of them are negative.

Paymium Crypto Products

The exchange focuses on spot trading and doesn't offer crypto staking, liquidity pools, crypto cards, or copy trading.

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

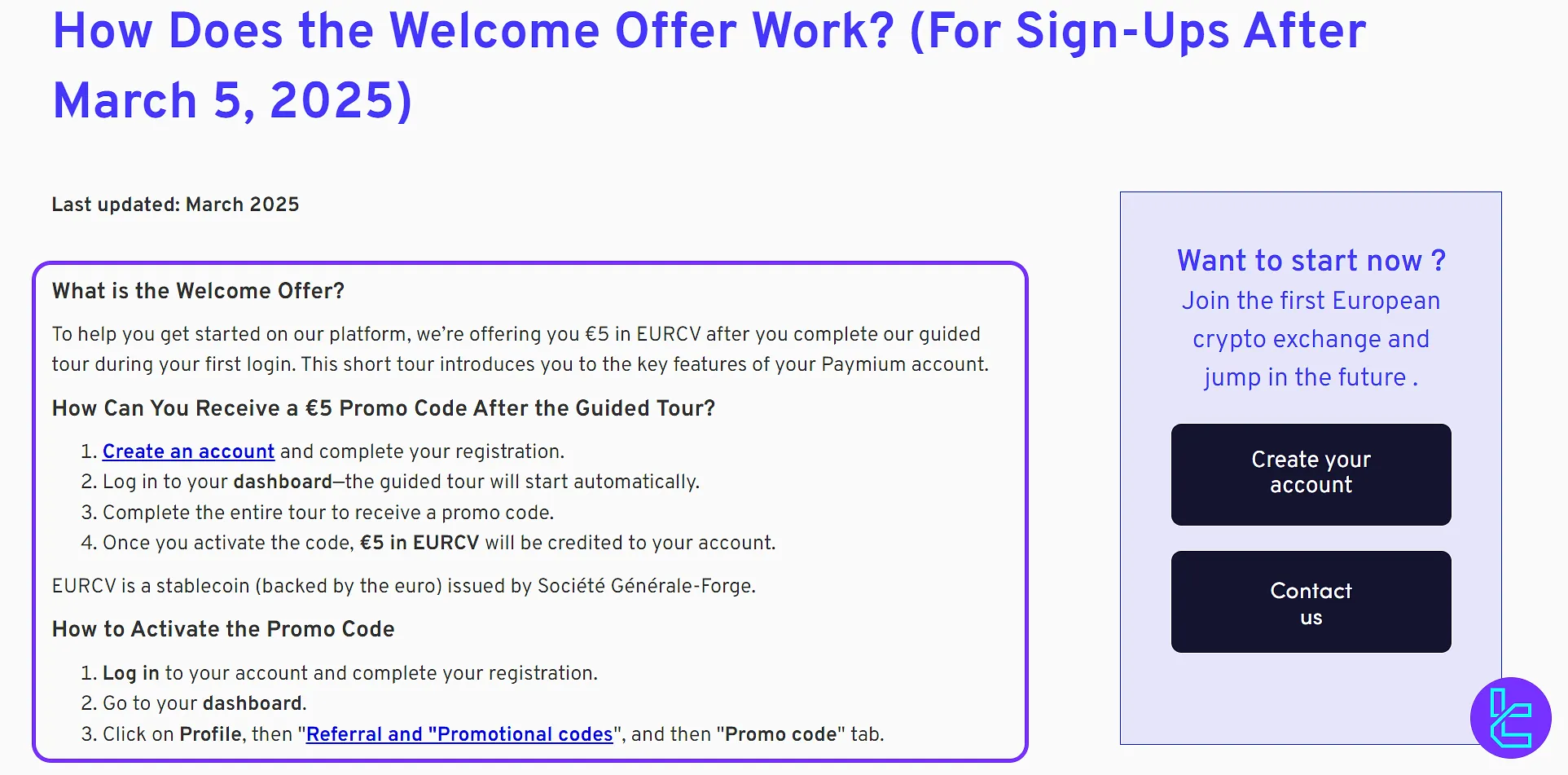

Paymium Exchange Bonus Programs

Based on our investigations, the exchange currently offers only one promotional offer:

Bonus | Description |

€5 Welcome Bonus in EURCV | Paymium rewards new users with €5 in EURCV, a euro-backed stablecoin issued by Société Générale-Forge, after completing the guided tour. |

Welcome Bonus

Paymium rewards new users with a €5 promo code in EURCV once they complete a short guided tour after registration.

This tour introduces traders to Paymium’s key features and trading dashboard, making the onboarding process both educational and rewarding.

How to Claim Your €5 Bonus:

- Create an account and finish your registration;

- Log in to your dashboard to begin the guided tour automatically;

- Complete the full tour to unlock your promo code;

- Once activated, €5 in EURCV (a euro-backed stablecoin by Société Générale-Forge) is instantly credited to your account.

Paymium Exchange Support Channels

The company provides client assistance from Monday to Friday from 10am to 6pm through various channels, including email and a ticket system.

- Email: support@paymium.com

- Ticket: Through the client dashboard

Does Paymium Offer Growth or Investment Plans?

Offering a recurring buy plan and the BTC family investment plan is one of the upsides in this Paymium review.

- Recurring Buy Plan: Automated and regular purchases of Bitcoin

- Bitcoin Family Plan: Bitcoin savings dedicated to children under 18

- Referral Program: Up to 30% in commissions for affiliates

Note that the referral program is temporary and it’s not always available.

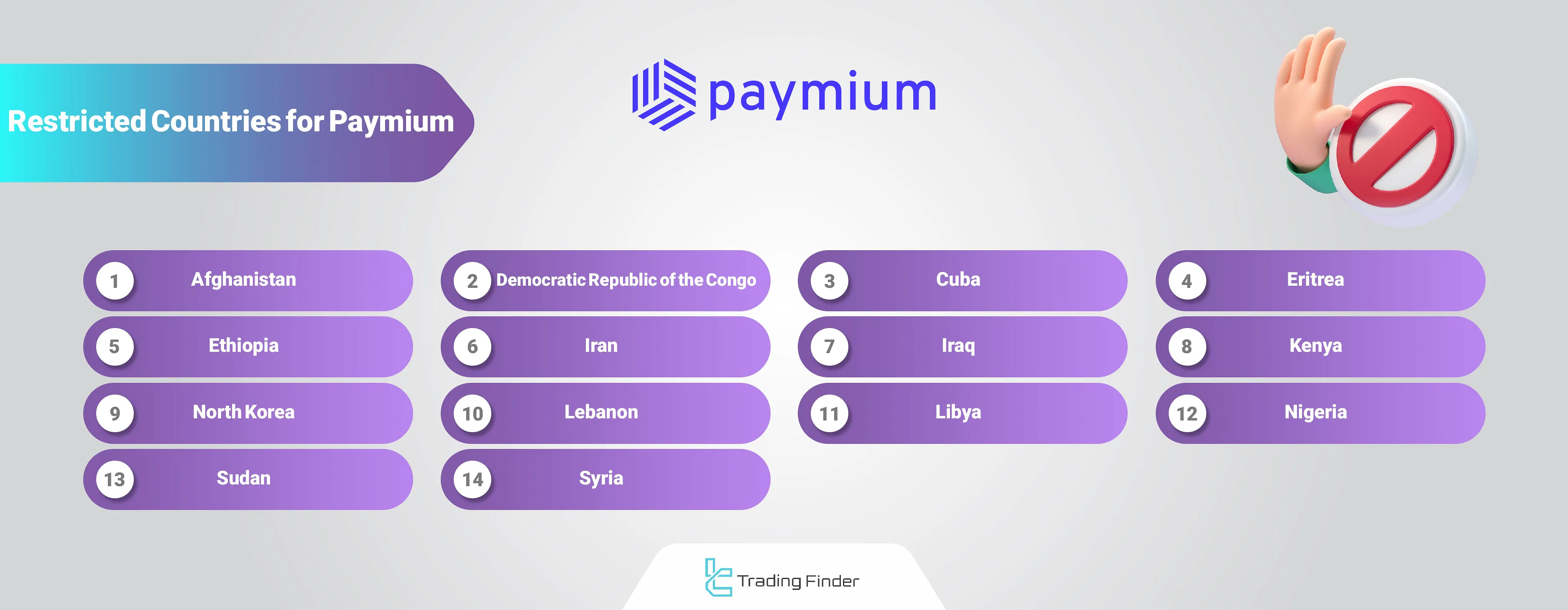

Restricted Countries on Paymium Exchange

As a regulated European exchange, Paymium offers services in Europe and some other regions like the United States, Singapore, and South Africa. However, the company has geographical restrictions, including:

- Afghanistan

- the Democratic Republic of the Congo

- Cuba

- Eritrea

- Ethiopia

- Iran

- Iraq

- Kenya

- North Korea

- Lebanon

- Libya

- Nigeria

- Sudan

- Syria

Paymium vs Other Exchanges

Here's a comprehensive comparison between Paymium's services and those of other platforms:

Features | Paymium Exchange | Bitget Exchange | MEXC Exchange | BingX Exchange |

Number of Assets | 10 | 10000+ | 2800+ | 800+ |

Maximum Leverage | 1:1 | 1:125 | 1:200 | 1:125 |

Minimum Deposit | €5 | $15 | $1 | $1 |

Spot Maker Fee | 0.00% - 0.40% | 0.10% | 0.05% | 0.005% - 0.1% |

Spot Taker Fee | 0.05% - 0.60% | 0.10% | 0.05% | 0.02% - 0.1% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer’s Opinion and Conclusion

Paymium supports market orders with a standard fee of 1.49%. Transactions in stablecoins and EURCV/EUR trading pair have a commission of 0.90%.

The exchange accepts SEPA and Credit Card payments with fees of €0.99 and 3.5%, respectively. The platform has a score of 4.4/5 on Trustpilot.