Poloniex has listed 400+ cryptocurrencies offering access to Spot and Margin markets with leverage options of up to 1:3.

The exchange rewards new clients with a welcome bonus of up to 600 USDT. Staking with APY of up to 100% and Futures copy trading with profits of up to 90% are some attractive features of Poloniex.

Poloniex; An Introduction to the Exchange

Founded in early 2013 by Tristan D'Agosta, the exchange was first acquired by Circle Internet Financial Ltd. in 2018 for $400M.

In 2019, as the platform continued to grow, Justin Sun, founder of TRON, took an interest in it and acquired the firm. Key features of Poloniex:

- Crypto spot, margin, and futures

- P2P coin swap

- SunSwap: Exchange protocol for TRC20 tokens

Poloniex Exchange Specific Features

The crypto exchange offers a wide range of services, from Grid Bots and Futures copy trading to leverage options of up to 1:100. Let’s take a quick look at Poloniex’s offerings:

Exchange | Poloniex |

Launch Date | 2014 |

Levels | VIP 0 – VIP 9 |

Trading Fees | Spot Maker/Taker 0.2%/0.2% Futures Maker/Taker 0.015%/0.050% |

Restricted Countries | Afghanistan, Burma, China, Crimea, Cuba, Congo, Iran, Iraq, Ivory Coast, Libya, Mali, North Korea, Palestine, Somalia, Sudan, Syria, Yemen, Zimbabwe, the United States |

Supported Coins | 400+ |

Futures Trading | Yes |

Minimum Deposit | Mercuryo $29 Simplex $50 |

Deposit Methods | Crypto, Simplex, Mercuryo |

Withdrawal Methods | Crypto, Mercuryo |

Maximum Leverage | 1:100 |

Minimum Trade Size | Variable based on the coin |

Security Factors | CCXT Audit, HackenProof Bug Bounty Program, Two-Factor Authentication (2FA), Passkey, Cold Storage, Data Encryption |

Services | Spot Market, Margin/Futures Trading, Poloniex Earn, P2P Buy/Sell, Grid Bots, Futures Copy Trading |

Customer Support Ways | Email, Ticket, Live Chat, Twitter |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market, Limit |

Native Token | No |

Poloniex Upsides and Downsides

While competitive fees and attractive rewards (600 USDT welcome bonus) are considered advantages in this Poloniex review, the track record of security breaches is a letdown.

Pros | Cons |

Wide range of cryptocurrencies (400+) | Complex interface for beginners |

Futures and Margin trading | Geo-restrictions |

VIP service and 24/7 support | History of security breaches |

Innovative products like Poloniex Earn and SunSwap | Weak regulatory framework |

Poloniex User Levels

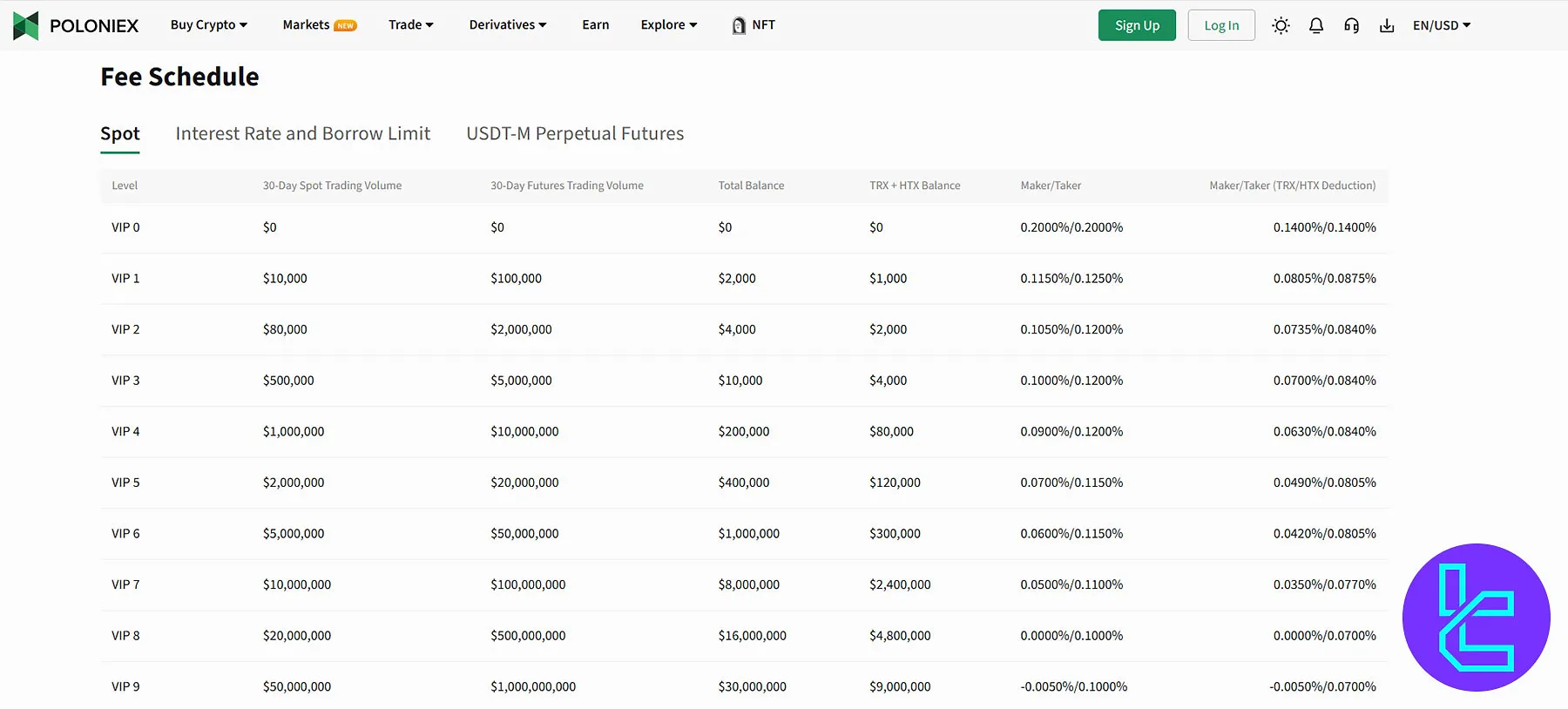

The exchange has implemented a tiered user level system with 10 levels, offering fee reductions based on 30-day trading volume, TRX + HTX balance, and account balance.

Level | 30-Day Spot Trading Volume | 30-Day Futures Trading Volume | Total Balance | TRX + HTX Balance |

VIP 0 | $0 | $0 | $0 | $0 |

VIP 1 | $10K | $100K | $2K | $1K |

VIP 2 | $80K | $2M | $4K | $2K |

VIP 3 | $500K | $5M | $10K | $4K |

VIP 4 | $1M | $10M | $200K | $80K |

VIP 5 | $2M | $20M | $400K | $120K |

VIP 6 | $5M | $50M | $1M | $300K |

VIP 7 | $10M | $100M | $8M | $2.4M |

VIP 8 | $20M | $500M | $16M | $4.8M |

VIP 9 | $50M | $1B | $30M | $9M |

To be eligible for the TRX + HTX balance fee discount, you must hold TRX and/or HTX in your spot account.

Poloniex Exchange Trading and Non-Trading Costs

The platform’s default fees for spot and futures trading are 0.2%/0.2% and 0.0150%/0.0500%, respectively. However, users are eligible for fee discounts based on their VIP level.

Level | Spot Maker/Taker | Spot Maker/Taker (TRX/HTX Deduction) | Futures Maker/Taker |

VIP 0 | 0.2000%/0.2000% | 0.1400%/0.1400% | 0.0150%/0.0500% |

VIP 1 | 0.1150%/0.1250% | 0.0805%/0.0875% | 0.0130%/0.0480% |

VIP 2 | 0.1050%/0.1200% | 0.0735%/0.0840% | 0.0100%/0.0450% |

VIP 3 | 0.1000%/0.1200% | 0.0700%/0.0840% | 0.0080%/0.0420% |

VIP 4 | 0.0900%/0.1200% | 0.0630%/0.0840% | 0.0050%/0.0380% |

VIP 5 | 0.0700%/0.1150% | 0.0490%/0.0805% | 0.0000%/0.0340% |

VIP 6 | 0.0600%/0.1150% | 0.0420%/0.0805% | -0.0150%/0.0300% |

VIP 7 | 0.0500%/0.1100% | 0.0350%/0.0770% | -0.0150%/0.0250% |

VIP 8 | 0.0000%/0.1000% | 0.0000%/0.0700% | -0.0150%/0.0230% |

VIP 9 | -0.0050%/0.1000% | -0.0050%/0.0700% | -0.0150%/0.0210% |

Note: The negative fees are charged to your account as a rebate.

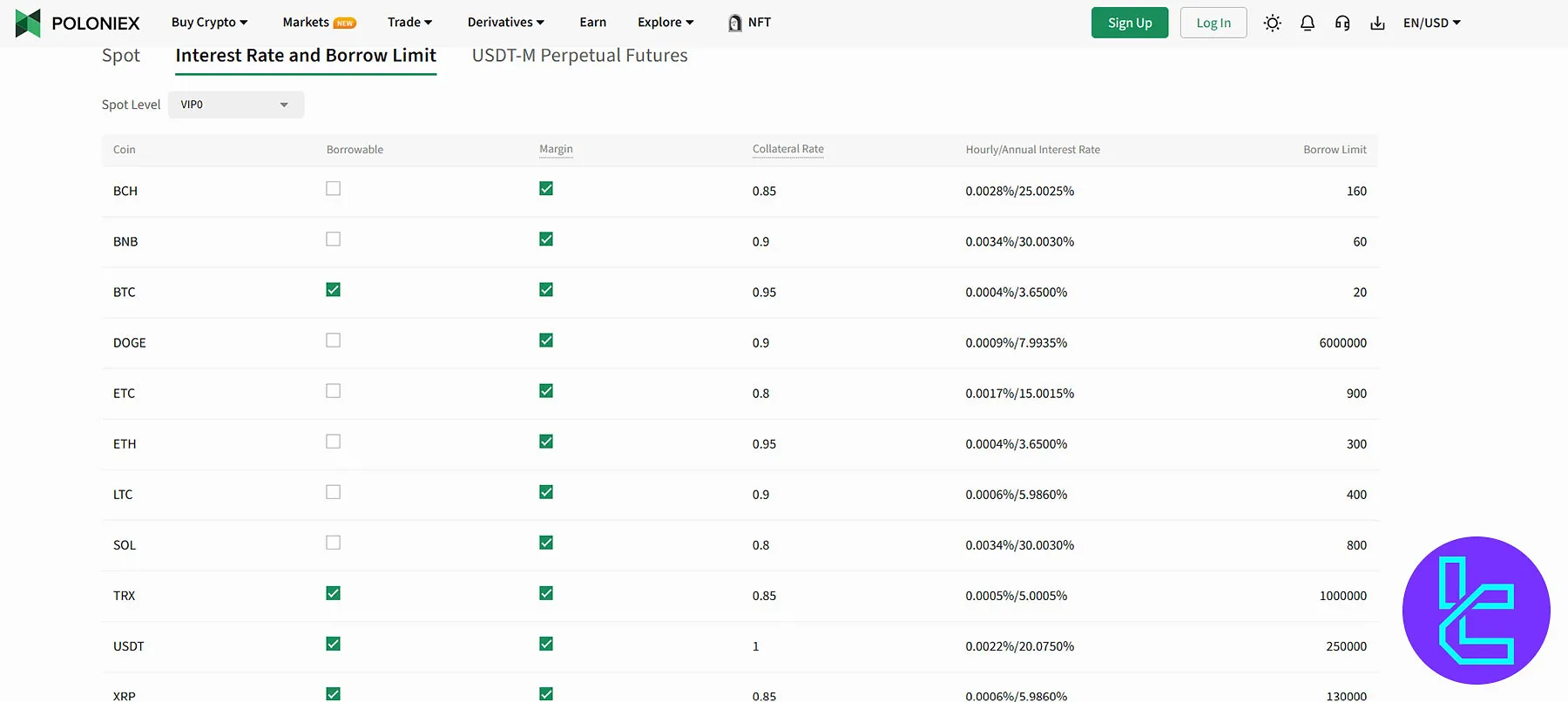

Poloniex also charges interest rates on borrowed funds and margin funds, which are reduced based on the VIP level. Note that interest rates vary based on the asset (e.g., BCH, BNB, BTC, DOGE, ETC, ETH, LTC, SOL, TRX, USDT, and XRP).

Available Digital Assets on Poloniex

The exchange has listed 400+ crypto assets for buying, P2P buy/sell, spot, and margin trading in BTC, TRX, USDT, USDC, and USDD markets. Popular digital assets on Poloniex:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Cardano (ADA)

- Polkadot (DOT)

- Doge Coin (DOGE)

- Tron (TRX)

- Solana (SOL)

- Litecoin (LTC)

- Binance Coin (BNB)

- Chainlink (LINK)

Poloniex Margin and Futures Trading

The platform provides access to Margin and Futures markets with leverage options of up to 1:3 and 1:100, respectively.

While Margin trading is available in USDT, BTC, and TRX markets, Perpetual Futures contracts are only available on Crypto/USDT pairs, including:

- BTC/USDT

- 1000PEPE/USDT

- 1000SHIB/USDT

- ETH/USDT

- BNB/USDT

- SOL/USDT

- BCH/USDT

- XRP/USDT

- AVAX/USDT

- TRX/USDT

- LTC/USDT

- DOGE/USDT

- APT/USDT

Poloniex Exchange Registration and KYC

The platform has implemented 2 KYC levels with different withdrawal limits: $10,000 per day for level 1 and $500,000 per day for level 2. Level 1 accounts don’t have access to Margin trading. Steps to Poloniex registration:

- Visit the Poloniex website and click "Sign Up";

- Enter your email address and set a strong password;

- Provide the verification code sent to your email.

Now you have a level 1 account. However, you must complete the KYC verification procedure on the Poloniex mobile app to increase your withdrawal limit. Fill out the personal information form and provide supporting documents, including:

- Selfie

- ID card or passport

Poloniex App and Trading Platform

The exchange has developed a comprehensive proprietary trading platform in web and mobile versions. The platform is integrated with TradingView, providing robust charting tools.

The platform supports various order types, including Limit, Market, Trigger, Stop-Limit, Stop-Market, and Trailing Stop.

TradingFinder has developed a wide range of advanced TradingView indicators that you can use for free.

Poloniex Exchange Security

According to BSCN, in November 2023, Poloniex suffered a $126 million hack, losing $56M in ETH, $48M in TRX, and $18M in BTC. Justin Sun offered a 5% bounty (~$6.5M) for fund return within 7 days, else law enforcement would be involved.

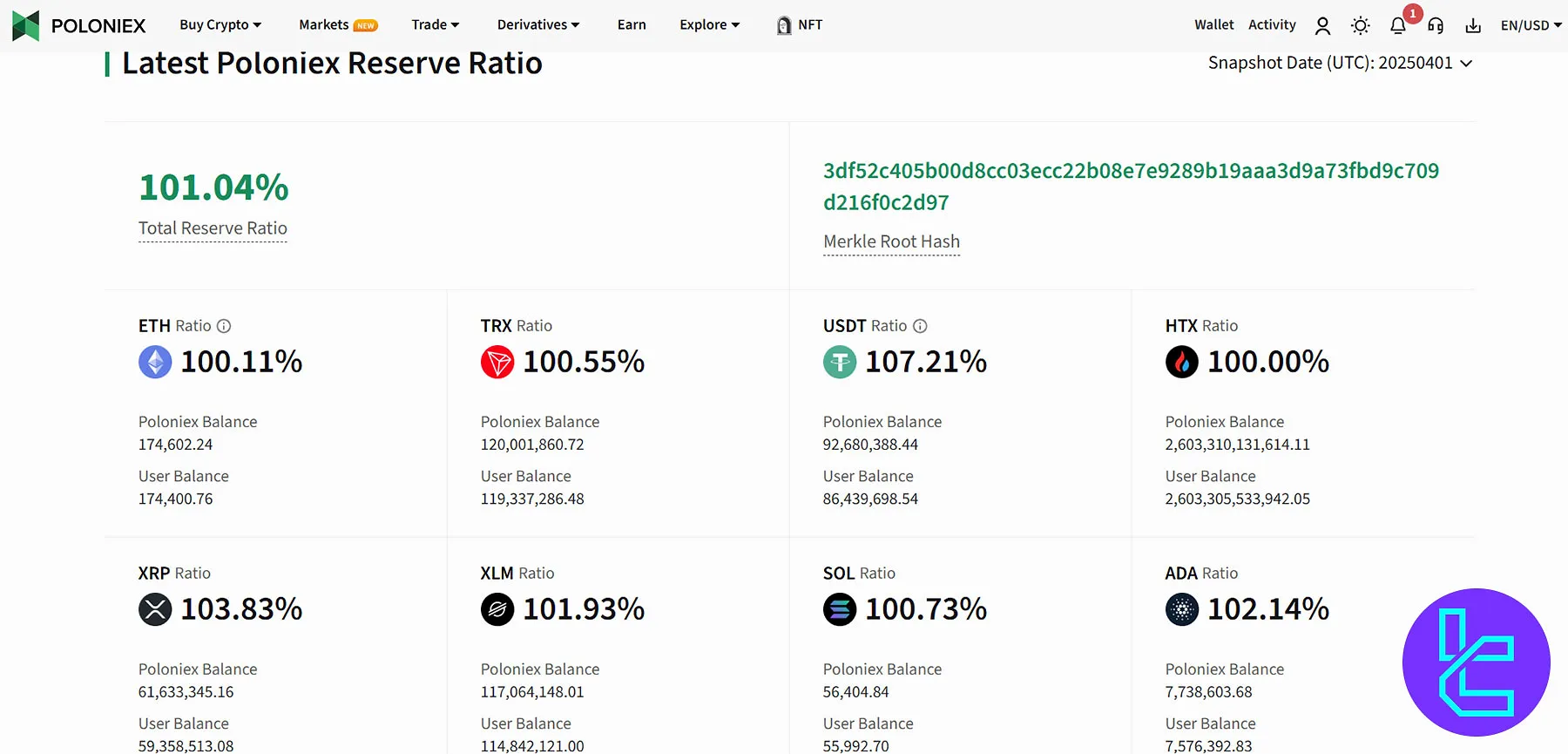

Following the significant security breach, Poloniex has implemented robust security measures, including:

- Partnership with CCXT for secure API connection

- Merkle tree-based 100% proof of reserves

- HackenProof bug bounty program with rewards of up to $5,000

- Regular security audits by 3rd party firms

- Cold wallet storage for storing clients’ funds

- Two-factor authentication (2FA) for account access and withdrawal

- Passkey for secure login via fingerprint or face ID

- Whitelist for secure wallet addresses

Poloniex Payment Methods

The platform supports crypto deposits and withdrawals. It also allows for crypto buy (USD, EUR, GBP, CAD, JPY, TRY, and more) and sell (EUR, USD, and GBP) through Mercuryo and Simplex 3rd party providers.

- Mercuryo: MasterCard, VISA, and Bank Transfer (fee: 3.95%)

- Simplex: VISA and MasterCard (fee: 3.5% - 5%)

Note that crypto purchases via fiat currencies are limited to seven digital assets, including BTC, ETH, XRP, USDT, USDC, LTC, and TRX.

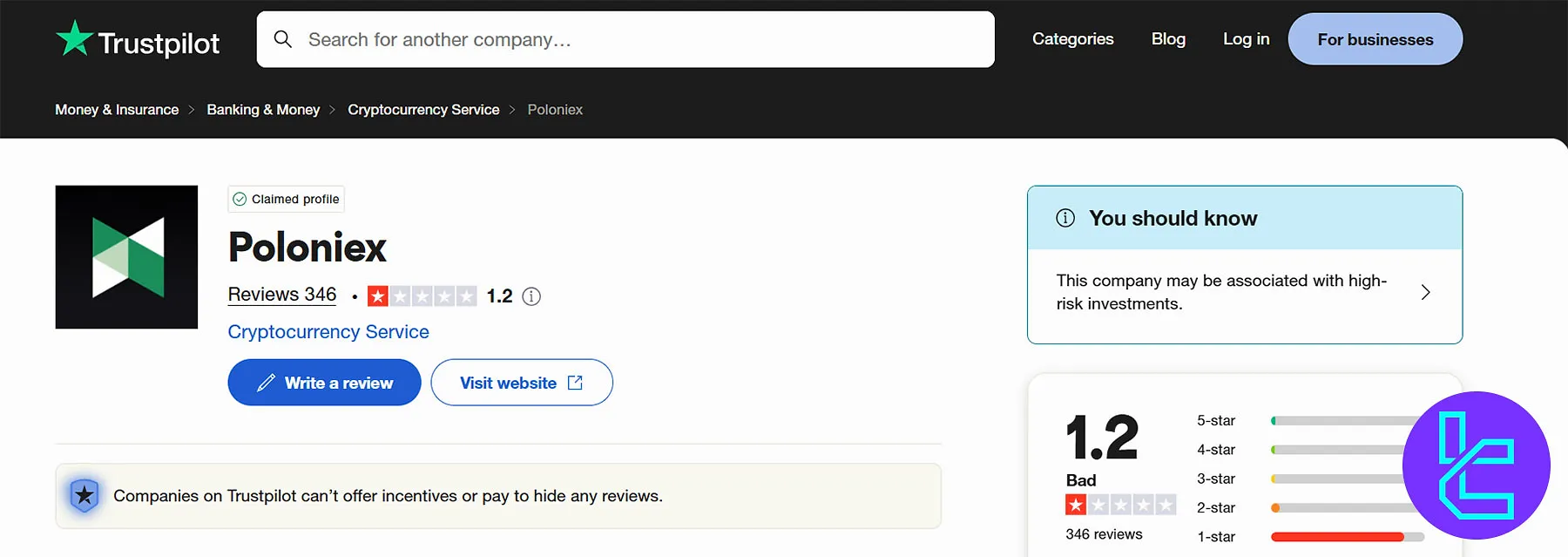

Poloniex Trust Scores

The exchange has a weak standing among users and market experts. There are 346 Poloniex reviews on Trustpilot, most of which are negative, complaining about wallet freezes, poor customer support, and high spreads.

Trustpilot | 1.2/5 |

CoinGecko | 4/10 |

While 93% of comments on the Poloniex Trustpilot profile are negative (1-star and 2-star), only 5% are positive (4-star and 5-star).

Support Channels

Poloniex Exchange provides 24/7 assistance through a comprehensive help center offering access to various channels, including:

- Ticket: Through the “Request Help” option in the “Help Center”

- Live Chat: Available on the website and app

- Email: support@poloniex.com

- Poloniex Twitter Support

Investment and Growth Plans

Poloniex Earn, trading grids, and crypto copy trading software are some of the advantages in this Poloniex review.

- Earn Program: Staking opportunities on 100+ cryptocurrencies (e.g., USDT, ETH, TRX, HTX, and XRP) with APY of up to 100%

- Copy Trading: Futures copy trading with 30+ strategy providers and with profits of up to 90%

- Trading Bot: Grid trading strategy on margin and futures markets with profit/grid ratios of up to 0.13% and 0.57%, respectively

Poloniex Red Flag Countries

The exchange maintains a list of restricted countries consisting of jurisdictions with weak AML regulations, higher rates of financial crime, and political instability or sanctions. Poloniex restricted regions:

- Afghanistan

- Burma

- China

- Crimea

- Cuba

- Congo

- Iran

- Iraq

- Ivory Coast

- Libya

- Mali

- North Korea

- Palestine

- Somalia

- Sudan

- Syria

- Yemen

- Zimbabwe

- United States

Writer's Opinion and Conclusion

Poloniex provides Futures trading on 13 cryptocurrencies with leverage options of up to 1:100 in the USDT market. The default Futures maker and taker fees are 0.0150% and 0.0500%. The exchange has a poor score of 1.2 out of 5 on Trustpilot.