Ripio, also known as BitPagos offers a comprehensive app with access to a Web3 wallet, DeFi opportunities (Staking ETH, BTC, and USDC), and Ripio Card (with up to 2% cashbacks in UXD, BTC, or ETH).

Ripio exchange has launched and developed its own Blockchain called LaChain and various products, including Capyfi (crypto lending DeFi application) and UXD (a USD-linked stable coin).

Ripio; Exchange History and Regulation

Ripio's journey in the crypto world began in 2013, making it one of the pioneers in the Latin American market.

Founded by Sebastian Serrano, this Argentina-based company has grown exponentially over the years, now boasting over 10 million users.

Key features of Ripio:

- Legal entities in 8 countries, including Argentina, Brazil, Mexico, Colombia, Chile, Uruguay, USA, and Spain

- More than 300 employees

- Registered as Virtual Asset Service Provider (VASP) under No. 36

- Tokenization services

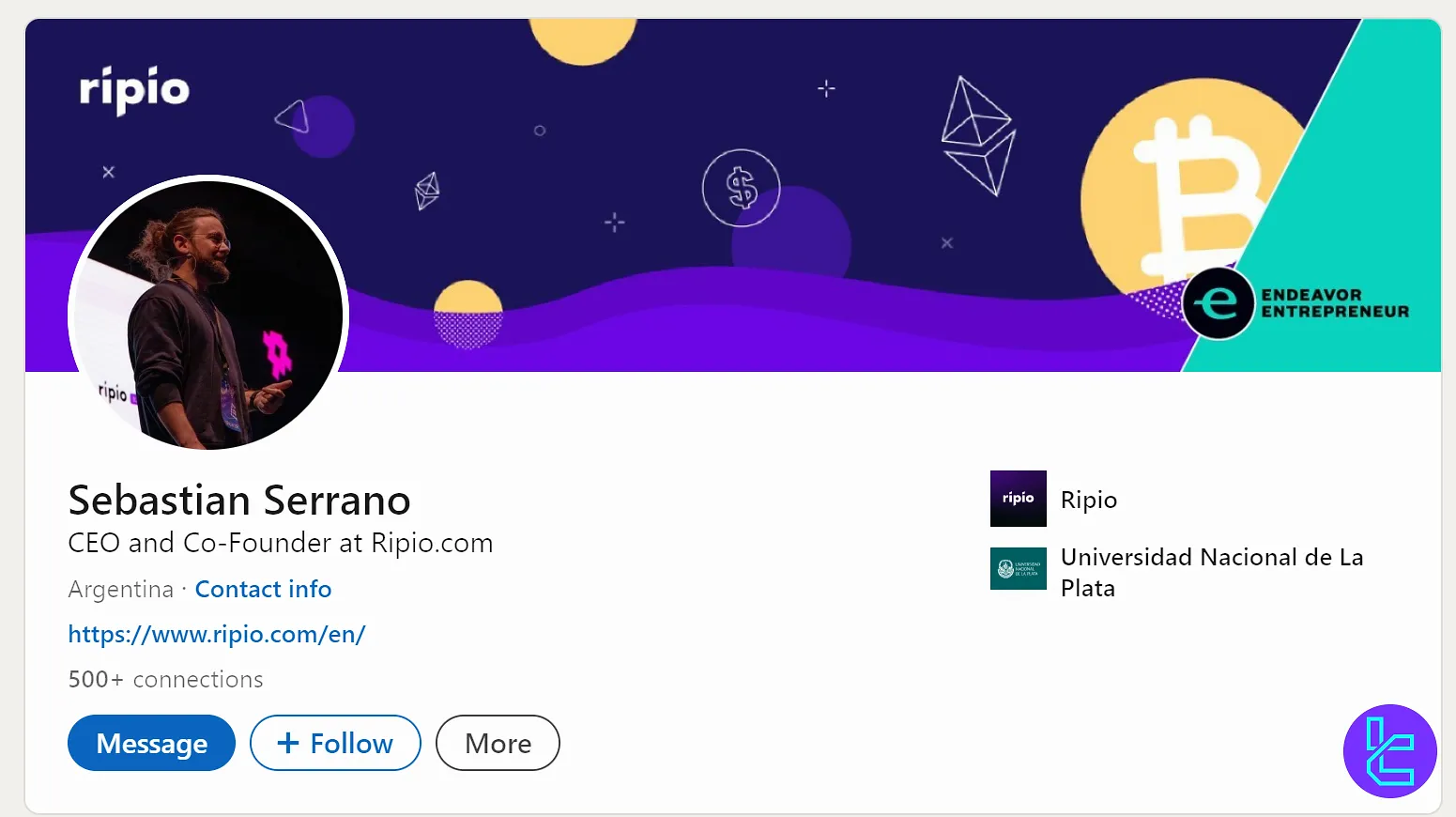

Ripio Exchange CEO Introduction

Sebastián Serrano is the CEO and Co-Founder of Ripio. He is a fintech entrepreneur with a strong technical background who has been instrumental in driving crypto adoption throughout Latin America.

Before founding Ripio, he co-founded devsAr, a web-development firm in Argentina.

Holding a Computer Science degree from Universidad Nacional de La Plata, he continues to lead Ripio’s mission to expand financial access through blockchain technology and decentralized finance (DeFi) solutions.

Ripio Specifications

The Cryptocurrency exchange offers various individual and business services, including OTC Desk and Earn programs. Here’s a table of Ripio’s key features.

Exchange | Ripio |

Launch Date | 2013 |

Levels | 8 levels |

Trading Fees | Maker: 0.00% - 0.25% Taker: 0.10% - 0.50% |

Restricted Countries | All countries other than Argentina, Brazil, Mexico, Colombia, Chile, Uruguay, USA, and Spain |

Supported Coins | 54 |

Futures Trading | No |

Minimum Deposit | 100 ARS |

Deposit Methods | Bank Transfers, Mercado Pago, Crypto |

Withdrawal Methods | Bank Transfers, Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | N/A |

Security Factors | Cold Storage, 2FA, Proof of Reserves (PoR), SSL encryption, Cloudflare DDoS Protection |

Services | Visa Crypto Card, Earns, Tokenization, Ripio Trade, LaChain |

Customer Support Ways | Chatbot, Help Center |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | N/A |

Orders Execution | Market |

Native Token | RPC |

Ripio Exchange Advantages and Disadvantages

While Ripio offers a robust set of features and a user-friendly experience, it's important to weigh the advantages against the potential drawbacks. The platform's focus on Latin American markets may limit its appeal to users outside this region.

Pros | Cons |

Regulated in multiple jurisdictions | The website only supports Spanish language |

Innovative products (Crypto Visa Card, DeFi opportunities) | Limited geographical coverage (primarily Latin America) |

Proprietary Blockchain Network (LaChain) | Lack of live chat support |

Strong focus on educational resources | Higher than average trading fees |

Does Ripio Offer User Levels?

The company provide crypto trading with a multi-tier fee structure through its 8 user levels, including:

Level | Trading Volume (USD) |

1 | 0 |

2 | 1,000 |

3 | 5,000 |

4 | 10,000 |

5 | 100,000 |

6 | 500,000 |

7 | 1,500,000 |

8 | 5,000,000 |

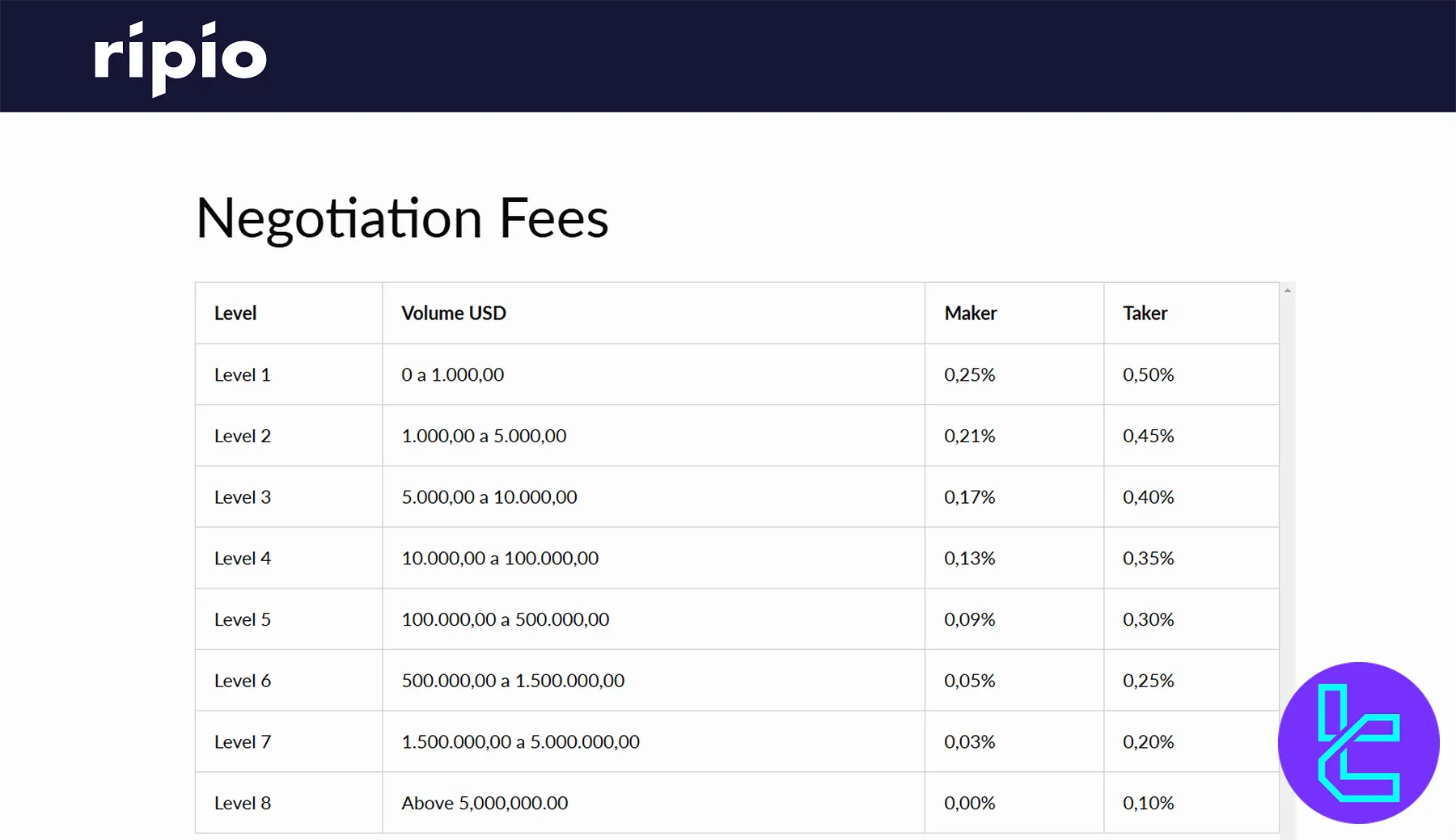

Ripio Trading Fees

Ripio Trade employs a Maker-Taker fee structure, offering volume-based incentives determined by your trading activity over the past month.

Level | Trading Volume (USD) | Maker | Taker |

1 | 0 | 0.25% | 0.50% |

2 | 1,000 | 0.21% | 0.45% |

3 | 5,000 | 0.17% | 0.40% |

4 | 10,000 | 0.13% | 0.35% |

5 | 100,000 | 0.09% | 0.30% |

6 | 500,000 | 0.05% | 0.25% |

7 | 1,500,000 | 0.03% | 0.20% |

8 | 5,000,000 | 0.00% | 0.10% |

The platform’s fee structure is designed to be competitive within the Latin American market. However, they’re higher than average compared to global competitors.

Ripio Exchange Markets

At the time this article is being written, the platform’s market page doesn’t showcase any digital assets. however, according to CoinMarketCap, Ripio supports 54 cryptocurrencies, including:

- PAXG

- SAND

- ALGO

- USDC

- USDT

- BTC

- DAI

- DOGE

- LTC

- ETH

Does Ripio Support Crypto Futures and Margin Trading?

The company acquired the BitcoinTrade platform in January 2021, and integrated it into its own ecosystem in 2023, introducing Ripio Trade.

The platform only supports buying, selling, converting, and spot trading of digital assets.

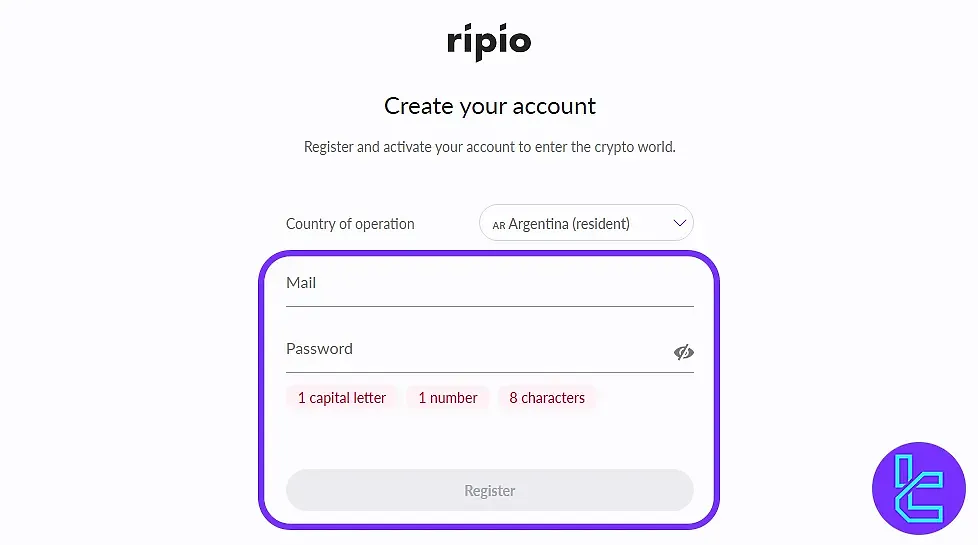

Ripio Exchange Sign Up and KYC

Registration with Ripio is a straightforward process, but it does involve a comprehensive Know Your Customer (KYC) verification to comply with regulatory requirements.

#1 Visit the Official Ripio Platform

Go to the Ripio website and click on the "Register" button. Make sure you are on the official domain to ensure account security before proceeding with your registration.

#2 Provide Basic Account Details

Enter your country of residence and a valid email address, then create a secure password that meets Ripio’s complexity standards. These details are required to comply with KYC policies and enable account protection.

#3 Confirm Your Email Address

Access your inbox and open the verification email from Ripio. Click "Confirm My Email" to finalize the process and activate your trading account. You can now access your dashboard and begin trading supported cryptocurrencies instantly.

#4 Verify Your Identity

Go through the KYC process via the "Profile" section of the website by providingproof of ID and proof of residence.

Note that at the time of writing this Ripio review, only clients from LATAM and the United States can verify their accounts.

How to Trade Cryptocurrencies on Ripio

Ripio Exchange provides an intuitive environment for beginners and experienced users to buy and sell cryptocurrencies quickly and securely.

#1 Create and Verify Your Ripio Account

Start by visiting the official Ripio Exchange website or mobile app to register a new account. Provide your email address, set a secure password, and confirm your identity through Ripio’s verification process.

#2 Deposit Funds into Your Account

After verification, go to the “Wallet” section and select your preferred payment method to add funds.

#3 Buy Cryptocurrency

Navigate to the “Buy/Sell” tab and choose the cryptocurrency you want to purchase, such as Bitcoin, Ethereum, or USDT. Enter the desired amount, review the live exchange rate, and confirm the order.

#4 Sell Cryptocurrency

To sell, open the “Buy/Sell” section again and select “Sell”. Choose the asset and amount, confirm the market rate, and complete the transaction.

Ripio Apps and Platforms

The ecosystem offers a web-based platform alongside a comprehensive mobile application, which provides access to crypto trading, crypto card visa (with up to 2% cashback), earn programs, and a dedicated Web3 wallet for your digital assets. Ripio App download links:

Ripio Exchange Services

Check out the exchange's additional services and products in the table here:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

| No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

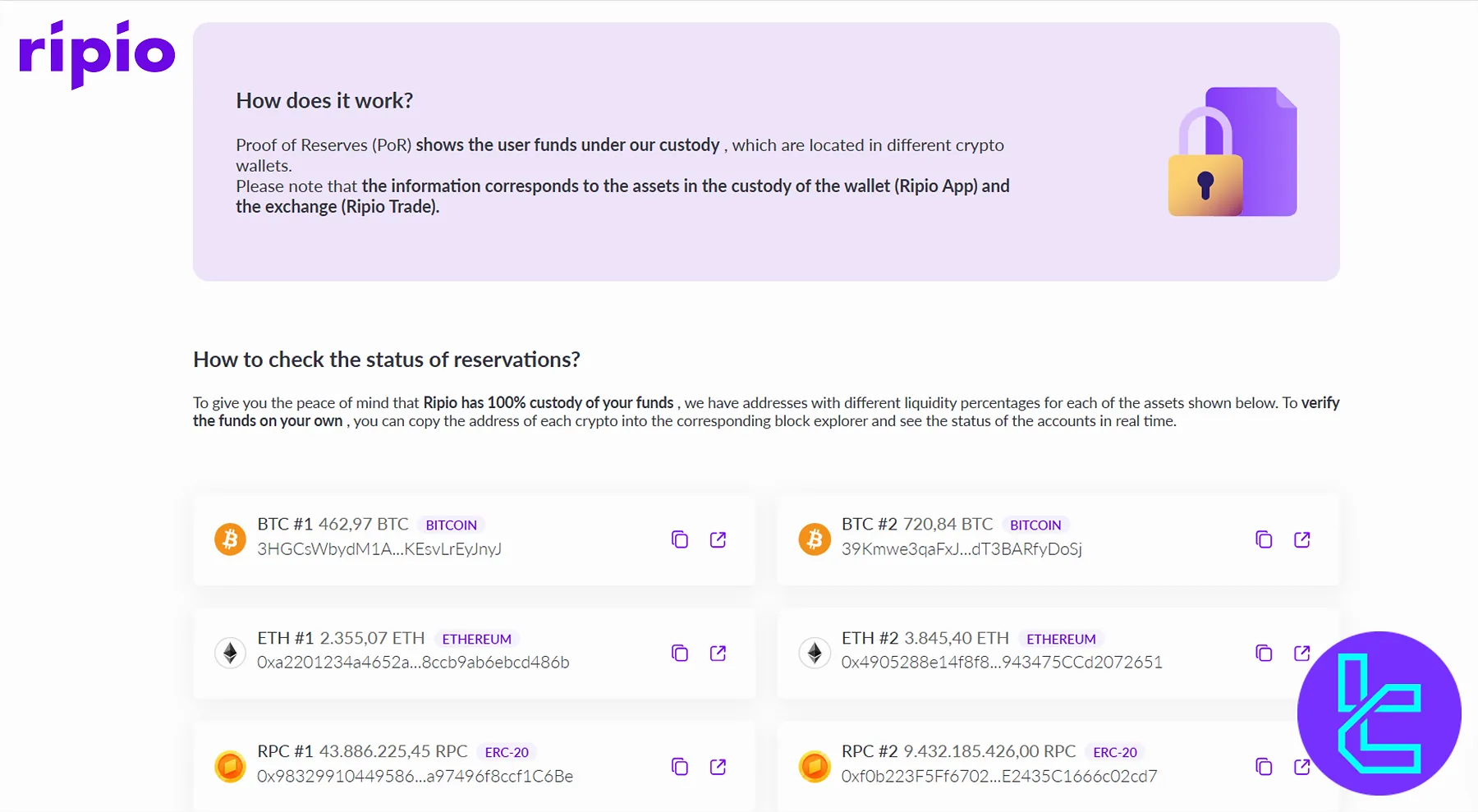

Safety and Security

In addition to a strong regulatory framework (registered in 8 countries, including US) that we mentioned earlier in this Ripio review, the exchange has implemented various security measures to ensure users’ data and funds safety, including:

- Clod Storage: holding 95% of funds in offline wallets

- 2FA: Two factor authentication for accessing accounts

- Proof of Reserve (PoR): Showcasing all the user funds under the platform’s custody

- SSL encryption

- Cloudflare DDoS Protection

- Biometric login for mobile users

The exchange has a clean track record with no known hacks.

Further adding to its credibility, Ripio has been verified by three of the Big Four accounting firms (EY, PwC, and KPMG), and it holds a SOC 2 Type II security certification. The exchange also adheres to Argentina’s data protection framework (AAIP), reinforcing its commitment to privacy compliance.

Ripio Funding and Withdrawals

The platform supports buying and selling crypto via fiat or digital assets.

You can either transfer cryptocurrencies to your Ripio wallet or charge it via ARS using the following methods:

- Bank Transfer

- Mercado Pago (one of the biggest payment platforms in Latin America)

Note that the minimum crypto purchase is 1400 ARS and it’s associated with a 0.5% commission.

Deposit fees vary by method: bank transfers are free, while Mercado Pago incurs a 3.0% charge. Crypto-to-crypto conversions are free, while crypto-to-fiat conversions (e.g., to Argentine pesos) carry a 0.5% fee. Withdrawals to bank accounts are free.

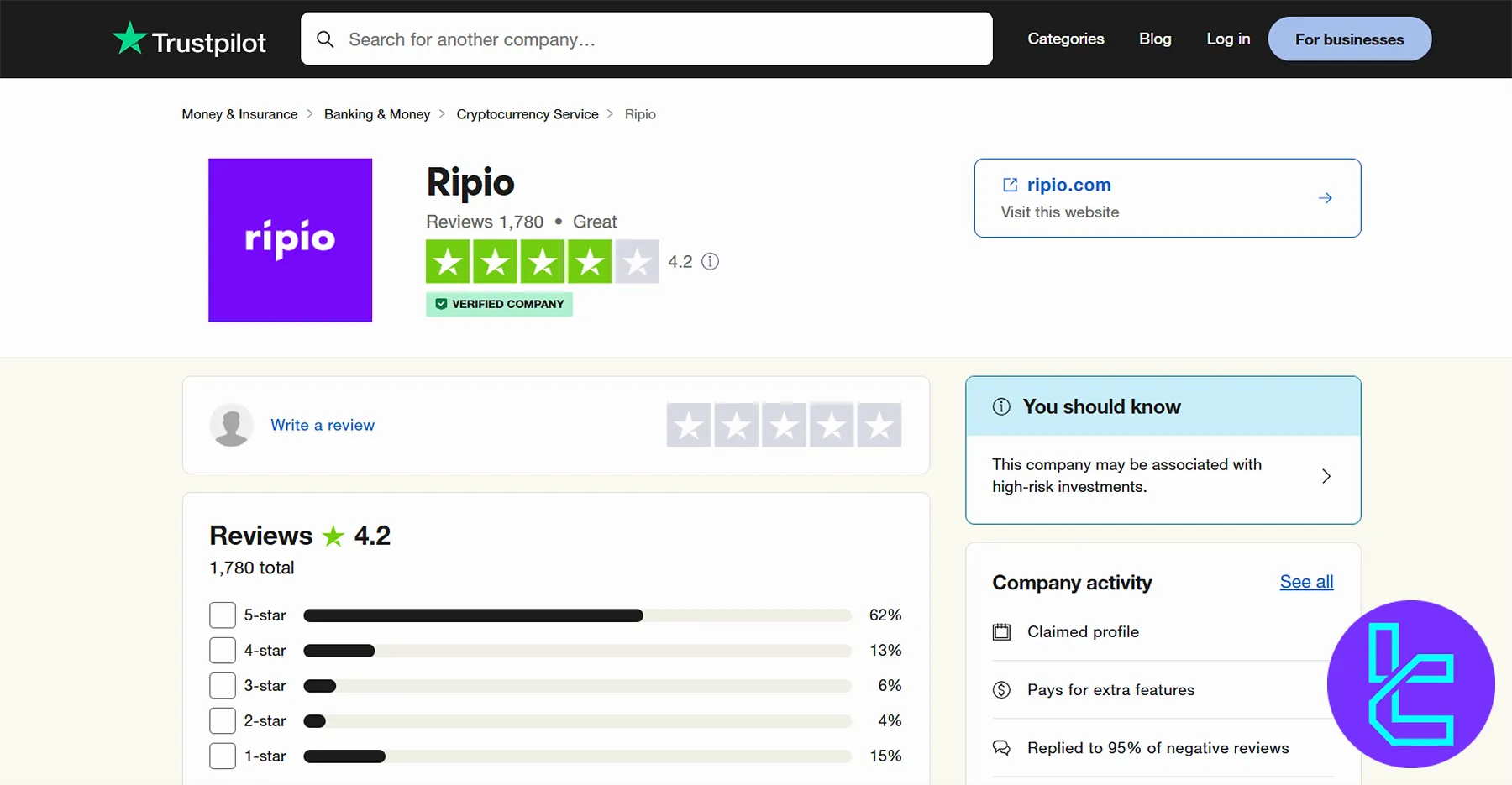

Ripio User Satisfaction

Ripio reviews on reputable websites like Trustpilot help potential customers to get a feel of what’s waiting for them on the platform.

There are 1,780 comments on Ripio’s Trustpilot profile, gaining the broker a great score of 4.2 out of 5.

Ripio Features

You can see the additional features provided by the exchange at a glance here:

Staking | Yes |

Yield Farming | No |

No | |

Liquidity Pool | No |

Crypto Cards | Yes |

Ripio Bonuses

Per our latest investigations on the official website and other related sources, this exchange does not currently offer any bonuses and promotional offers to its users.

How to Reach Ripio Customer Support?

Also known as BitPagos, the exchange offers a comprehensive help center and a chatbot on its website, and doesn’t provide any more contact details for retail clients. However, its App Store profile has contact details, including:

spain@ripio.com | |

Phone Number | +34 665768760 |

Address (US branch) | 427 N Tatnall St Ste 20464, Wilmington Delaware 19801, United States |

Does Ripio Exchange Offer Any Growth Plans or Copy Trading?

While the exchange doesn’t provide a Crypto copy trading software, it offers an Earn program.

Through its wallet and the “DeFi Opportunities” section, Ripio enables investors to earn passive income on their digital assets, such as USDC, ETH, and BTC with the following protocols:

- Capyfi

- Paxos

- Compound

- AAVE

- Yern

The platform displays live APYs (Annual Percentage Yields), helping users compare yields across protocols. Unlike fixed-term staking, Ripio Earn allows full withdrawal flexibility, so users maintain control over their assets at all times.

A small daily service fee applies based on the chosen asset and protocol. For example, ETH staked on AAVE incurs a 0.00074% daily fee. Despite these charges, Ripio Earn remains a simplified gateway to DeFi for users who may not be familiar with complex Web3 tools.

Restricted Countries

Ripio's services are primarily focused on Latin American countries, with some expansion into other regions. Here's a breakdown of their current operational status and available countries:

- Argentina

- Brazil

- Mexico

- Uruguay

- Colombia

- Chile

- United States

- Spain

Note that all countries not explicitly listed as available are considered restricted. While users from other jurisdictions can open an account, they can’t verify it or use the platform.

Table of Comparison Between Ripio and Main Competitors

You can compare the exchange with some of the prominent players in the industry by checking out this table:

Parameters | Ripio Exchange | |||

Number of Assets | 54 | 700+ | 1300+ | 400+ |

Maximum Leverage | 1x | 1:200 | 1:100 | 125x |

Minimum Deposit | 100 ARS | 1 USDT | N/A | $1 |

Spot Maker Fee | 0% - 0.25% | 0.0126% - 0.2% | 0.005% - 0.1% | 0.02% - 0.1% |

Spot Taker Fee | 0.1% - 0.5% | 0.0218% - 0.2% | 0.015% - 0.1% | 0.04% - 0.1% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | Yes |

Staking | Yes | Yes | No | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Ripio with a focus on LATAM region provides Crypto Spot trading, Buy/Sell, and Convert services in 8 countries, including US and Spain.

The exchange allows for ARS deposits via bank transfer or Mercado Pago with a minimum purchase amount requirement of 1400 ARS.

While the broker has great TrustPilot score of 4.2, the lack of phone/online support and Futures/Margin trading services are the biggest weaknesses in this Ripio review.