SpectroCoin offers the trading of more than 50 cryptocurrencies to over 1 million users. The support is available 24/7 via 4 channels [live chat, email, phone, ticket].

This cryptocurrency exchange has received a trust score of 3.7 out of 5 on the Trustpilot website.

SpectroCoin Company Information & Regulation

SpectroCoin started operating on Feb 1, 2013, by Mantas Mockevičius and Vytautas Karalevicius.

Let's review the other key points of the company:

- Legal Name: Spectro Finance, OÜ

- Address: Narva mnt 7b-509, Tallinn 10117, Estonia

- Registration Number: 14608294

Like many other cryptocurrency exchanges in the industry, this one is not regulated by any financial authority worldwide.

Notable Specifics

We provide a table with all the essential features and specifics of a company in every review, and it's the same with SpectroCoin:

Exchange | SpectroCoin |

Launch Date | Feb 1st, 2013 |

Levels | Unverified, Verified |

Trading Fees | 1% + Payer Fee |

Restricted Countries | United States, Iran, Iraq, Afghanistan, Cuba, Libya, and so on |

Supported Coins | +50 |

Futures Trading | No |

Minimum Deposit | 0.001 EUR |

Deposit Methods | Crypto, Bank Transfer, VISA, MasterCard, SWIFT, Bankera, Pacific Private Bank, Skrill, Neteller, Volet.com |

Withdrawal Methods | Crypto, Bank Transfer, Bankera, Pacific Private Bank, Amazon Gift Card, Volet.com |

Maximum Leverage | 1:1 |

Minimum Trade Amount | Varies |

Security Factors | Bug Bounty Program, 2FA |

Services | Crypto-backed Loans, SpectroCoin Debit Card, Personal Dedicated IBAN |

Customer Support Ways | Live Chat, Email, Phone, Ticket |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Not Specified |

Native Token | N/A |

Important Benefits and Drawbacks

There are no perfect platforms in the cryptocurrency world. Knowing about the weaknesses helps us have a balanced perspective. Advantages and Disadvantages of SpectroCoin:

Benefits | Drawbacks |

24/7 Support | Narrow Range of Cryptocurrencies |

Crypto-Backed Loans | Limited Advanced Trading Features |

SpectroCoin Debit Card | - |

Are There Various User Levels in SpectroCoin?

SpectroCoin keeps things simple when it comes to user levels. Unlike some other exchanges that determine different levels based on the verification done by the user, this exchange provides its services in 2 levels: Unverified and Verified.

Once you verify your account on the platform, you can access all features and services without any limitations.

SpectroCoin Exchange Commissions and Costs

Based on our investigations of the website's pages, the company chargesa 1% "Merchant Service" fee for each order. This is in addition to a Payer fee, the amount of which depends on the used blockchain.

The fees for withdrawals and deposits are mentioned on the site, which will be discussed later in the article.

You can use a crypto profit calculator tool to estimate your profits/losses in a trade by entering fees.

Available Cryptocurrencies for Trading

SpectroCoin is not the best option when it comes to the list of available digital assets; it provides only over 50 coins and tokens:

- Bitcoin [BTC]

- Ethereum [ETH]

- Litecoin [LTC]

- Ripple [XRP]

- Cardano [ADA]

- Dogecoin [DOGE]

- Tether [USDT]

- USD Coin [USDC]

- Binance Coin [BNB]

- Chainlink [LINK]

- And so on

Note that this list will change in the future and the number might become larger or smaller. You can use a crypto converter tool to see your cryptocurrencies' price based on other digital assets.

Futures and Margin Trading in the Exchange

At the time of writing this article, SpectroCoin doesn't provide any advanced trading options such as margin or futures market trading, and it's focused only on OTC trading.

If you are looking for the mentioned options, you need to take a look at other exchanges.

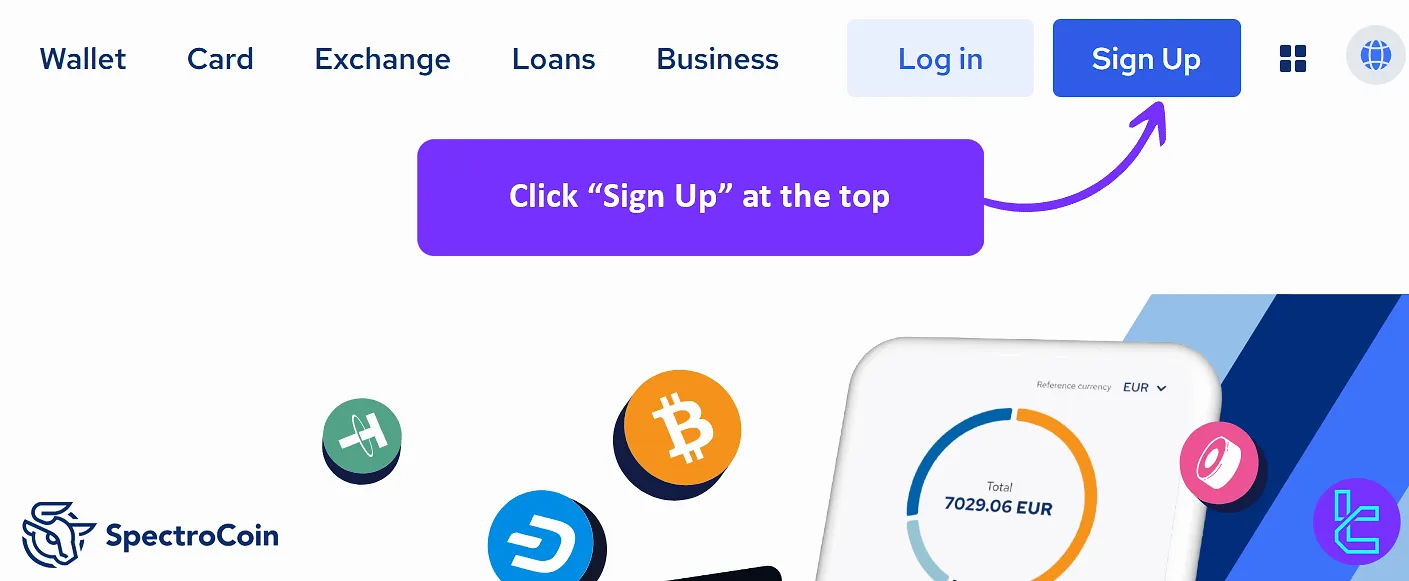

SpectroCoin Registration and Verification Guide

You will need to create an account in order to start trading on the exchange. The registration/verificaiton is explained in 3 phases here.

#1 Go to the Website

Head to the official site of the exchange and click on the "Sign Up" button, which is shown in the screenshot below:

#2 Sign-Up Form

Enter the required details as instructed here:

- Fill in your email;

- Choose your country;

- Agree to the terms and conditions.

You can also use your Google, Facebook, or Apple account.

After that, check your inbox for a verification email and click on the provided link.

Finally, create a strong password according to the conditions and repeat it. Now, your account is created on the exchange.

#3 Identity Verification

To completely verify your account and access the platform without any limitations, you will need to do these:

- Fill out a questionnaire;

- Submit your ID;

- Take a selfie;

- Confirm your phone number.

Platform Applications with Links

SpectroCoin takes the same approach as many other exchanges in this regard and provides access to a proprietary platform via a mobile app and the web. Traders can use all the features of the exchange, including the wallet, card, loan, and more, on the application in a more convenient way. Download it through the links below:

Is SpectroCoin a Secure & Safe Exchange?

The company has created a bug bounty program in order to maintain the security of the platform and patch its vulnerabilities as much as possible.

The reward is determined based on the severity of the reported bug:

Severity of the Reported Bug | Reward |

Critical | $4,000-$15,000 |

High | $1,000-$4,000 |

Medium | $200-$1,000 |

Low | Up to $200 |

The reward could be increased based on the quality of the description, the proof of concept, and the fix (if included). You can report the bug via this email address: technical@spectrocoin.com.

Also, SpectroCoin offers 2FA, which is very common among exchanges, to add an extra layer of security to your account. Other Key Safety Protocols and Facts:

- Cold wallet storage for the majority of user funds

- No third-party withdrawals allowed

- Zero history of successful hacking incidents

However, the exchange does not provide an investor protection fund or insurance against losses.

Deposit and Withdrawal Methods

This exchange provides a high variety in payment methods with over 10 options. In the table below, we will provide them with specifics.

Here are the deposit options:

Payment Method | Fee | Min. Deposit |

Bank Transfer | None | €0.01 |

VISA | 2.99% | €10 |

MasterCard | 2.99% | €10 |

SWIFT | 0.25% | €0.01 |

Bankera | None | €0.01 |

Pacific Private Bank | None | €50 |

Skrill | 5.5% | €1 |

Neteller | 5.5% | €1 |

Volet.com | 0.5% | €1 |

You can read about the withdrawal methods in this table:

Payment Option | Fee | Min. Withdrawal |

Bank Transfer | None | €5 |

Bankera | None | €5 |

Pacific Private Bank | 0.2% | €50 |

Skrill | 4% | €3 |

Amazon Gift Card | 2% | €10 |

Volet.com | 0.5% | €1 |

Also, cryptocurrency transfers are available for both deposits and withdrawals on the exchange.

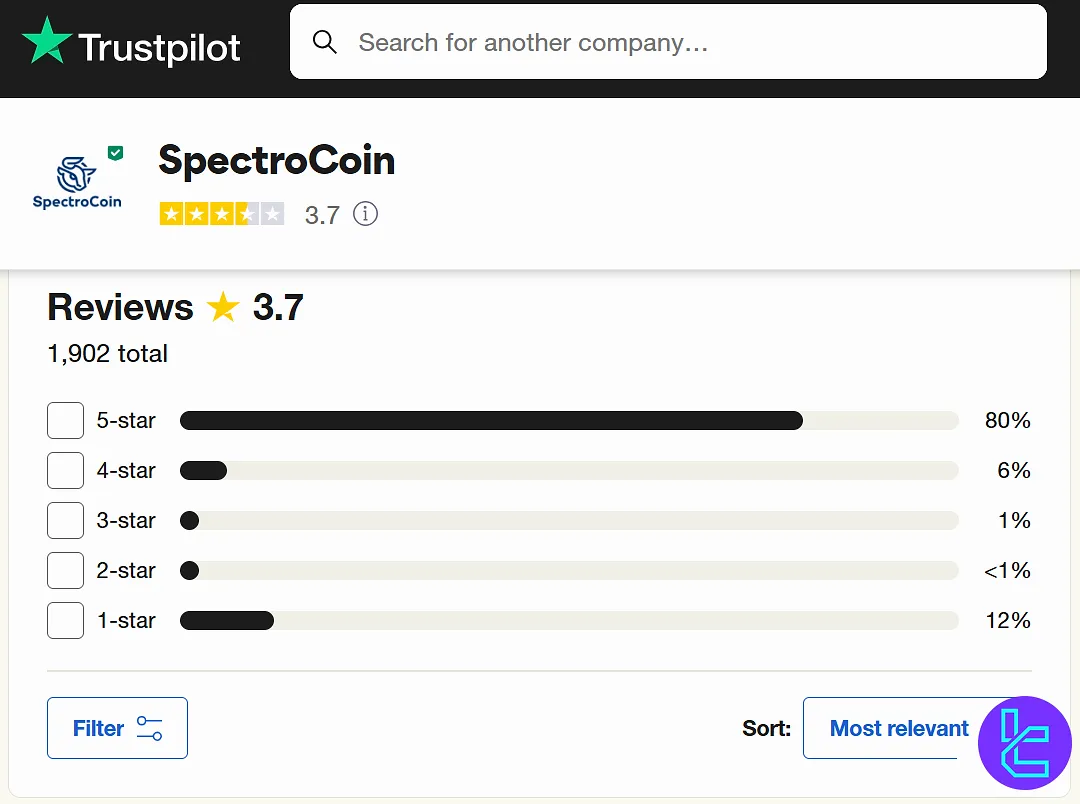

Trust Scores of SpectroCoin

Reviewing user scores and the evaluations of an exchange by reputable sources such as the Trustpilot and ScamAdviser is essential when choosing one. SpectroCoin has received generally acceptable reviews from users:

- Trustpilot: 3.7 out of 5 based on over 1,900 reviews with 80% 5-star scores;

- ScamAdviser: 86/100 trust score, 3.6/5 based on +1940 user reviews.

The trust score on the latter was given by the website's algorithm based on the gathered data about www. spectrocoin.com on the internet.

SpectroCoin Features

Here's a table noting the additional products and services provided by the discussed exchange:

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | Yes |

SpectroCoin Support Dept. Contact Options and Schedule

This exchange offers a typical and common set of 4 support contact options to its users:

- Live Chat: Accessible via the website;

- Email: helpdesk@spectrocoin.com;

- Phone Number: +372 683 8000;

- Ticket: On the "Contact" page in the website.

The company states that the support agents are available 24/7 through live chat and most languages are supported.

Are Copy Trading and Other Passive Income Options Available?

SpectroCoin does not currently provide copy trading or specific passive income options. For those specifically seeking passive income opportunities, it's worth exploring other platforms.

Restricted Regions and Countries

SpectroCoin operates globally but, like many cryptocurrency platforms, faces restrictions in certain jurisdictions due to regulatory requirements or international sanctions.

The platform maintains a list of Supported Countries where its full range of services is available, and these countries are excluded:

- United States

- Afghanistan

- China

- Iran

- Iraq

- Pakistan

- Syria

- Libya

- Cuba

- Sudan

- And more

SpectroCoin Compared to Major Exchanges

This part of the article is about a comparison between SpectroCoin and some of the top crypto exchanges:

Parameters | SpectroCoin Exchange | |||

Number of Assets | 50+ | 700+ | +2,800 | 400+ |

Maximum Leverage | 1x | 200x | 200x | 125x |

Minimum Deposit | 0.001 EUR | 1 USDT | $1 | $1 |

Spot Maker Fee | 1% + Payer Fee | 0.0126% - 0.2% | 0.05% | 0.02% - 0.1% |

Spot Taker Fee | 1% + Payer Fee | 0.0218% - 0.2% | 0.05% | 0.04% - 0.1% |

Mandatory KYC | Yes | Yes | No | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion And Conclusion

SpectroCoin, a cryptocurrency exchange, has a bug bounty program for keeping up the security with 4 severity levels [low, medium, high, critical] to reward users up to $15,000.

The company goes by the legal name Spectro Finance, OÜ under the registration name 14608294.