TimeX offers Spot and OTC markets with access to 20+ digital assets. The exchange has partnered with BLOCKCHAIR, Brave, and TrailingCrypto to provide fast and decentralized trading services.

You can trade with 0.5% taker and 0.25% maker fees on this exchange. No fee discount structures exist with TimeX.

TimeX; An Introduction to the Exchange

TimeX, developed by Sydney blockchain company Chrono.tech, brings forward centralized and decentralized technologies for cryptocurrency enthusiasts.

The exchange is regulated by the Australian Transaction Reports and Analysis Centre. It has a team of 30 professionals and offers services across 62 countries. We must mention in this TimeX review that the platform operates within the Ethereum Plasmaecosystem. Key features of TimeX:

- Founded in 2019

- Licensed by AUSTRAC (License No. 100588407)

- 20+ digital assets

TimeX Exchange Specific Features

Timex has a daily trading volume of $21 million. Let’s take a brief look at the crypto exchange’s offerings.

Exchange | TimeX |

Launch Date | 2019 |

Levels | No |

Trading Fees | Taker 0.5% Maker 0.25% |

Restricted Countries | N/A |

Supported Coins | 20+ |

Futures Trading | No |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, ADVCash (Volet), Crypto |

Withdrawal Methods | Bank Wire, ADVCash (Volet), Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | OTC Trading AUD 25,000 |

Security Factors | 2FA |

Services | Spot Trading, OTC Market, PAYMENTX (Automated cryptocurrency payroll solution) |

Customer Support Ways | Email, Telegram Channel |

Customer Support Hours | Response within 24 hours |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | TIME |

TimeX Pros & Cons

The exchange is a decentralized platform that doesn’t hold custody of its clients’ funds. Let’s weigh the platform’s advantages against its disadvantages.

Pros | Cons |

Hybrid architecture combining speed and security | Limited number of trading pairs compared to larger exchanges |

Fiat currency support | No futures or margin trading options |

Strong focus on security and regulatory compliance | Relatively new platform, still building trust and reputation |

Innovative use of Plasma technology | Geo-Restrictions |

TimeX User Levels

The exchange doesn’t offer any user levels or the traditional fee discounts associated with these levels. This is a letdown in this TimeX review for high-volume traders who seek to maximize their profits.

TimeX Exchange Fees and Commissions

The platform charges gas fees for the execution of market orders and any contract calls, including allowance, wrap, withdraw, and transfer. However, the specific rates are only available for the Spot market.

- Taker Fee: 0.5%

- Maker Fee: 0.25%

In addition to these standard fees, users are also responsible for network gas fees when executing market orders or blockchain-level transactions such as transfers, wrapping, or withdrawing tokens.

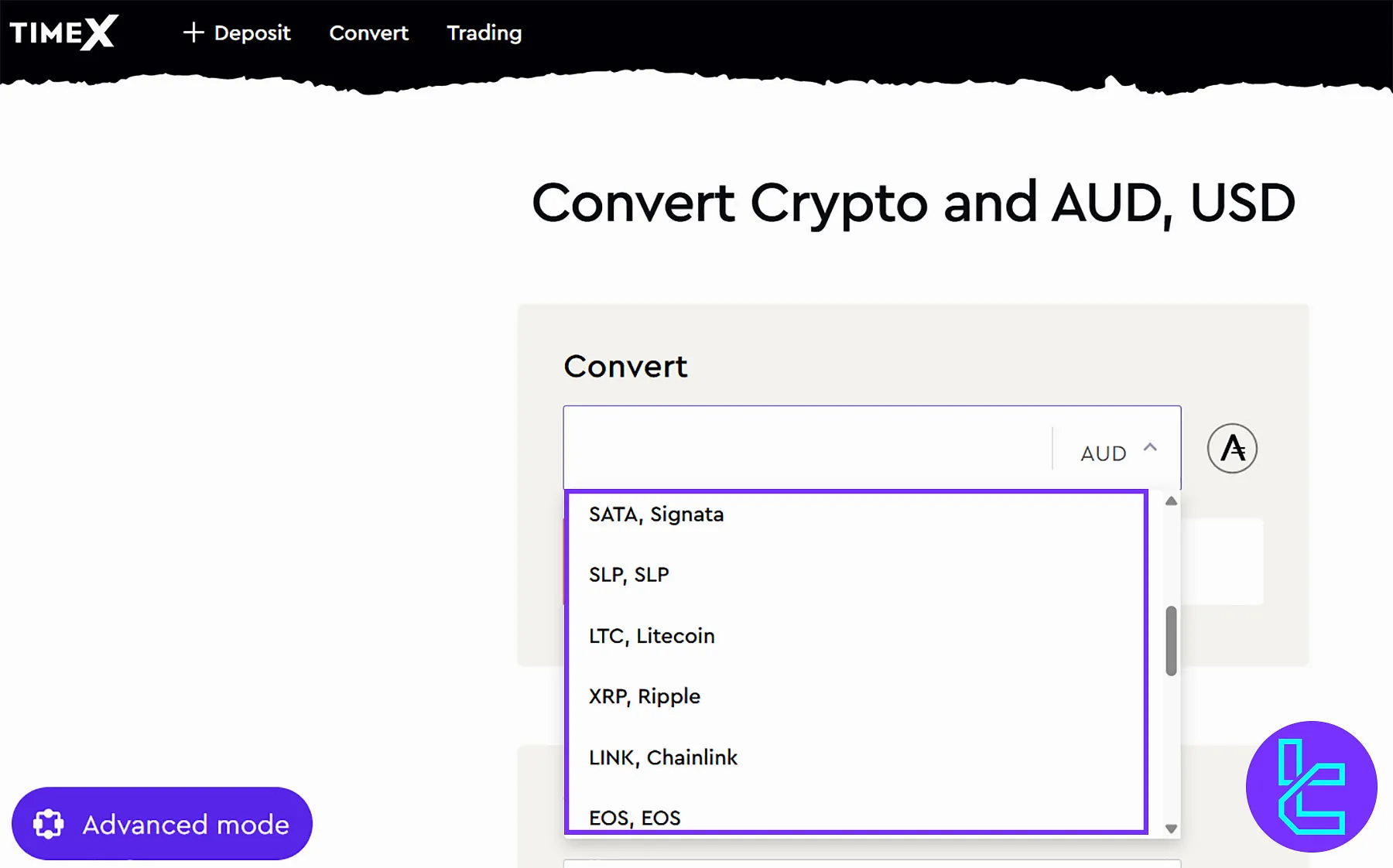

Listed Cryptocurrencies

Limited digital asset coverage is one of the letdowns in this TimeX review. The platform only supports 20+ cryptocurrencies, including:

- TIME

- BTC

- ETH

- USDT

- SATA

- SLP

- LTC

- XRP

- LINK

- EOS

- AMPL

- SHPING

- SLP

- CGU

- QTC

- SMG

- KOKU

- FBX

- QMALL

- RSI

- DUDE

Does TimeX Offer Futures Trading?

The exchange does not offer futures trading or any form of leveraged trading. This decision aligns with the exchange's focus on providing a safer trading environment for its users.

TimeX's approach prioritizes spot trading, which enables users to buy and sell cryptocurrencies at their current market price, eliminating the added complexity and risk associated with futures contracts or leverage.

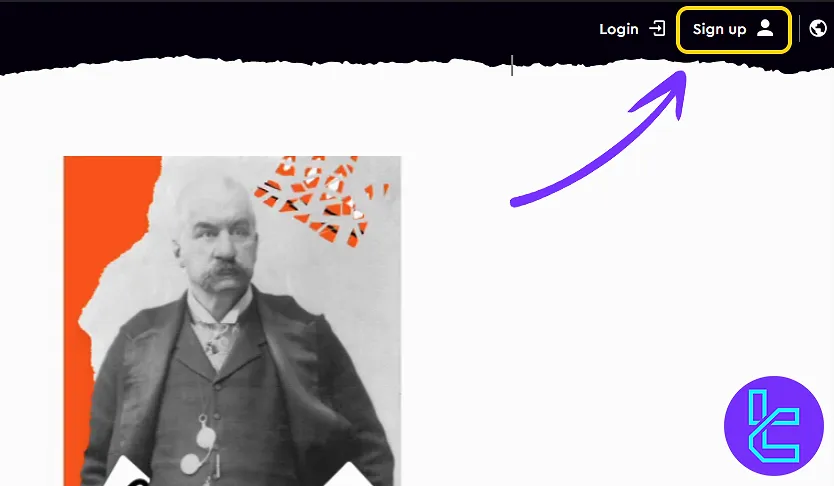

Account Opening and Verification

Opening an account on TimeX is a straightforward process designed to balance user convenience with regulatory requirements.

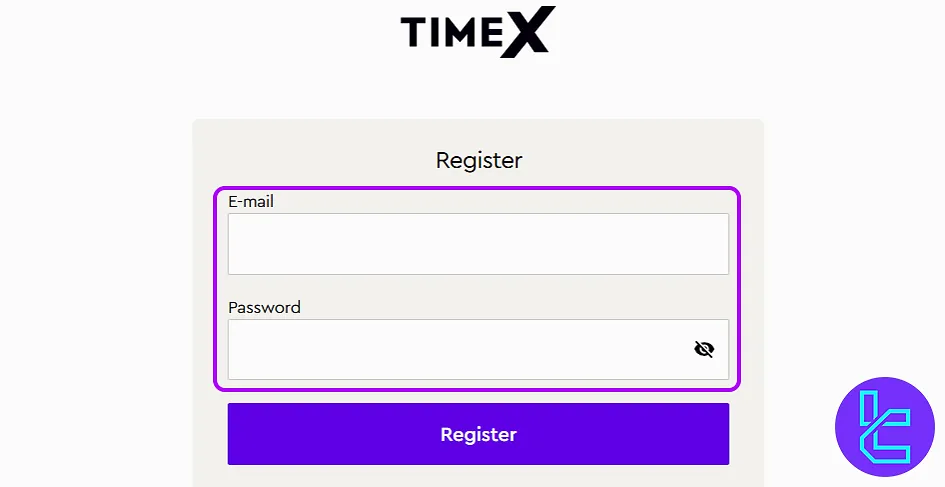

#1 Access the Registration Page

Go to the official TimeX homepage and click “Sign up”. You’ll be directed to the registration section where you can start creating your account.

#2 Enter Account Details

Provide your email address and set a strong password with mixed characters. Alternatively, sign up via Google, Facebook, Apple, or Telegram for one-click access.

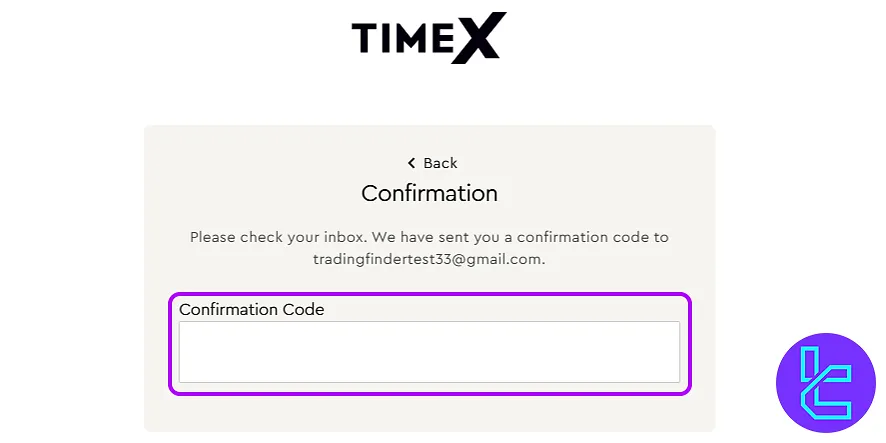

#3 Verify Your Email

Check your inbox for a verification email from TimeX. Click the confirmation link or enter the provided code to activate your trading account within minutes.

#4 Verify Your Identity

Complete the Know Your Customer (KYC) verification process:

- Level 1 (Up to 1 BTC daily): Email and phone verification

- Level 2 (Up to 5 BTC daily): Additional personal information

- Level 3 (Up to 10 BTC daily): Proof of residential address

- Level 4 (Up to 20 BTC daily): ID documents (passport or driving license)

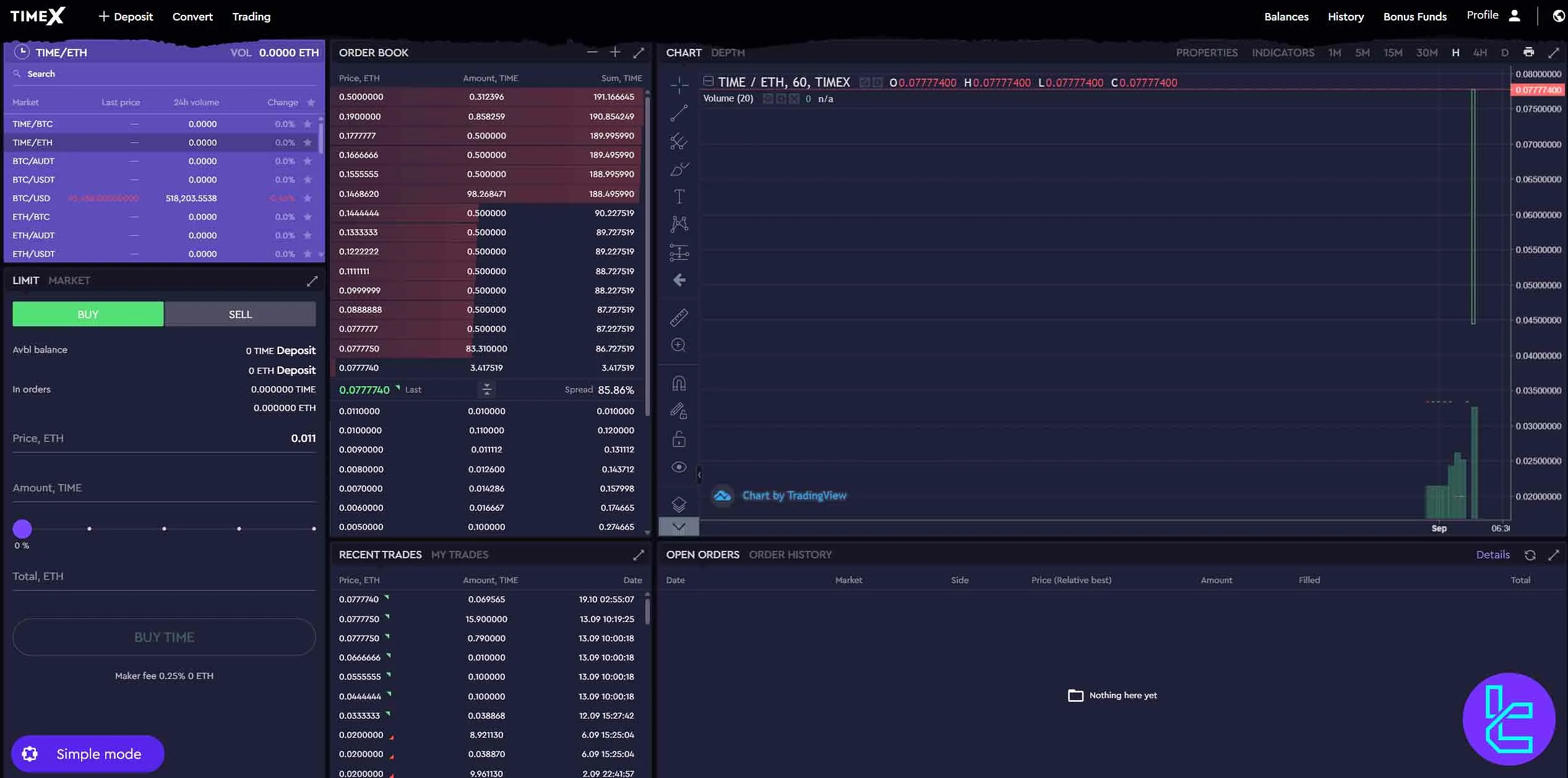

TimeX Trading Guide: How to Buy and Sell Crypto

TimeX allows users to move easily between fiat and digital assets. Australian clients can deposit funds through local bank transfers, which convert automatically into AUDT for trading. International users can rely on ADVCash, and traders who already hold bitcoin or other cryptocurrencies may deposit them directly for spot trading.

The platform supports two purchase modes. "Simple Mode" offers fast, order-book-free conversions for beginners, while "Advanced Mode" provides a full trading interface for experienced users. Simple Mode actions start from the "Balances" page, and the "Trading" section enables advanced execution. TimeX also provides dedicated guidance for buying crypto via Australian bank transfers or ADVCash.

Selling assets mirrors the same flow. Users can convert their crypto into AUDT or USD through Simple Mode, then withdraw AUD to Australian bank accounts or send USD to debit cards using ADVCash. Any payment method used during purchase is already configured for withdrawals.

TimeX Exchange App and Platform

The exchange doesn’t offer any mobile applications (one of the biggest letdowns in this TimeX review) and only supports a web-based trading platform. The platform is integrated with TradingView charts and tools.

Despite the lack of an application, TimeX compensates with powerful API access that enables advanced users and developers to:

- Automate trading strategies;

- Engage in arbitrage and high-frequency trading;

- Connect TimeX accounts to external trading terminals.

TimeX Services Overview

Here's a table summarizing all of the services provided by the reviewed exchange:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

| No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Security Measures

As mentioned, TimeX operates as a non-custodial platform offering high security for client funds. However, to add an extra layer of protection to user accounts, the exchange supports Two-FactorAuthentication (2FA).

The platform doesn't have a history of any successful hacking incidents, but it lacks an investor protection fund.

Payment Options

The exchange accepts fiat and crypto transactions. It supports USD and AUD as fiat currencies. Available fiat methods on TimeX:

- Volet (formerly known as ADVCash)

- Bank Wire

At the time of writing this TimeX review, there are no minimum deposit or withdrawal limits.

User Experience

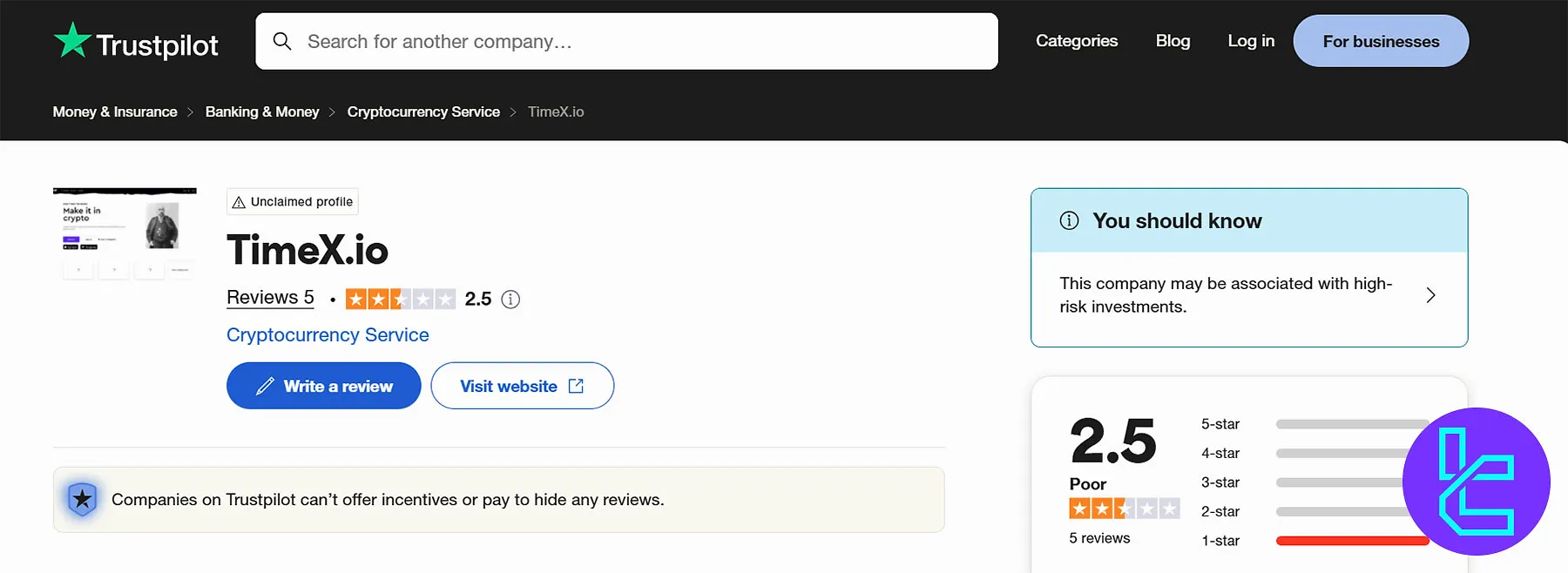

There are not many ratings on online platforms for the exchange. The TimeX Trustpilot profile features five reviews, all of which are 1-star, resulting in a poor 2.5 out of 5 score.

TimeX Features

For a brief overview of the features and services offered by the platform, look at the table below:

No | |

Yield Farming | No |

No | |

Liquidity Pool | No |

Crypto Cards | No |

TimeX Bonus: Does the Exchange Have Any Promotional Offers?

Based on the gathered data through our investigations, we found out that currently, TimeX does not have any active bonuses and promotions for its users. This page will be updated in case of any changes.

TimeX Exchange Support Channels

The platform provides customer support through email and a Telegram community. All support requests are processed within 24 hours. TimeX contact information:

- Email: help@chrono.tech

- Tech Telegram Channel: @timexio

Investment and Growth Plans

TimeX does not offer specific investment or growth plans. It doesn’t support crypto staking features. Instead, the platform focuses on providing a secure and efficient spot trading environment.

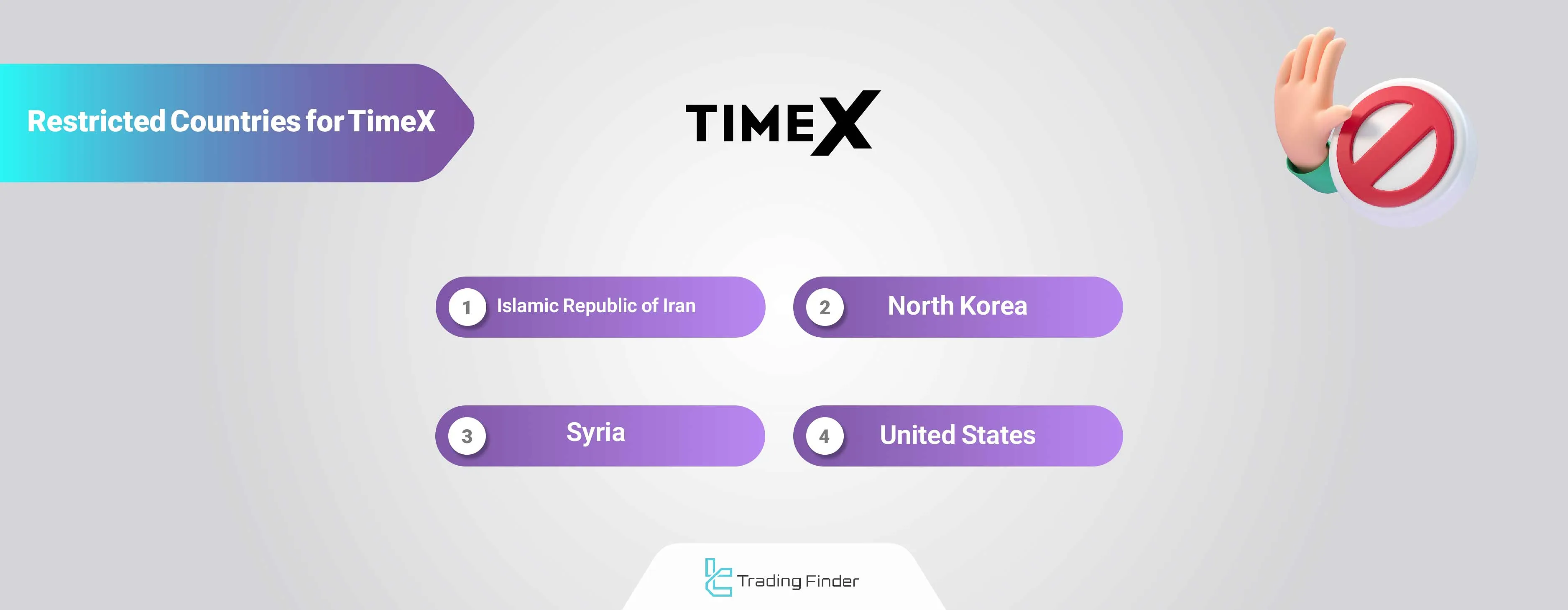

TimeX Exchange Restricted Countries

While the company hosts users from 62 countries, its main base of operation is Australia. The specific red-flag countries are not disclosed on the TimeX website.

However, in accordance with AUSTRAC regulations, the services may not be available these countries:

- North Korea

- Iran

- Syria

- United States

Table of Comparison Between TimeX and Other Exchanges

The table below compares TimeX with other platforms:

Parameters | TimeX Exchange | |||

Number of Assets | 20+ | 800+ | 1300+ | 400+ |

Maximum Leverage | 1x | 125x | 100x | 125x |

Minimum Deposit | $0 | $1 | N/A | $1 |

Spot Maker Fee | 0.25% | 0.005% - 0.1% | 0.005% - 0.1% | 0.02% - 0.1% |

Spot Taker Fee | 0.5% | 0.02% - 0.1% | 0.015% - 0.1% | 0.04% - 0.1% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | No | No | No | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

TimeX supports Cryptocurrency trading with AUD and USD fiat currencies, charging a 0.5% taker fee and a 0.25% maker fee. The exchange has a poor score of 2.5 out of 5 on Trustpilot.

You can trade 20+ tokens and coins on the reviewed platform. TimeX offers 2 interface modes [Simple, Advanced] for purchasing cryptocurrency assets.