ZebPay offers access to 300+ cryptocurrencies for OTC and Spot trading with a 0.5% fee.The platform won the 1st prize at CoinAgenda, Las Vegas.

The minimum deposit/withdrawal is AUD 50. The exchange is a member of the India Bharat Web3 Association (BWA) and the Digital Economy Council of Australia (DECA).

ZebPay; An Introduction to the Crypto Exchange

ZebPay was once India’s largest crypto exchange platform. Founded in 2014, the platform has over 6M clients.

Founded by Sandeep Goenka, Saurabh Agarwal, and Mahin Gupta, the company is headquartered in Singapore. It won the 1st prize by BitAngles at CoinAgenda, Las Vegas.

ZebPay has 4 branches with different services and fee structures, including Global, India, Australia, and Singapore. This ZebPay review will explore the global branch’s services.

The company has registration licenses and memberships of multiple financial bodies across the world, including:

- Financial Intelligence Unit (FIU) India

- Digital Economy Council of Australia (DECA)

- Australian Transaction Reports and Analysis Centre (AUSTRAC)

- Bharat Web3 Association (BWA) India

- Monetary Authority of Singapore (MAS): Pending license approval

Thecrypto exchange briefly suspended Indian operations in 2018 following regulatory changes but relaunched in 2020 under the leadership of Rahul Pagidipati.

The relaunch brought notable improvements to the platform, including a stronger emphasis on user security, the launch of a crypto lending program, and promotional zero-fee campaigns for selected trading pairs.

ZebPay has evolved into a globally accessible exchange with an operational footprint in 160+ countries.

ZebPay Exchange CEO

Rahul Pagidipati is the Chairman and CEO of ZebPay, one of India’s largest and oldest Bitcoin exchanges. With over 15 years of leadership across blockchain, healthcare, and finance, he drives ZebPay’s mission to promote responsible crypto adoption through education, trust, and technological innovation.

- Serves as Chairman at ZebPay and Managing Partner at Ayon Capital, leading blockchain investments such as Brave Software (with over 65 million users);

- Co-founded Freedom Health, later acquired by Anthem, achieving $1.8 billion in annual revenue;

- Invested in healthcare unicorns like Oscar Health, Rx Advance, and Rise (acquired by One Medical);

- Holds a JD/MBA from Northwestern University’s Kellogg School of Management and Pritzker School of Law;

- Passionate about building blockchain-powered healthcare ecosystems in India.

ZebPay Table of Specifications

The crypto exchange provides 24/7 services on an international scale. Let’s examine ZebPay’s offerings and key features.

Exchange | ZebPay |

Launch Date | 2014 |

Levels | No Levels |

Trading Fees | 0.5% |

Restricted Countries | Myanmar, Iran, North Korea |

Supported Coins | 300+ |

Futures Trading | No |

Minimum Deposit | AUD 50 |

Deposit Methods | Bank Transfer, Crypto |

Withdrawal Methods | Bank Transfer, Crypto |

Maximum Leverage | 1:1 |

Minimum Trade Size | $5 |

Security Factors | 2 Factor Authentication, Cold Storage, Strong Firewalls, Employee Background Verification, Constant Third-Party Testing, Bug Bounty Program |

Services | Spot Trading, Mobile Trading, OTC Market, API Services |

Customer Support Ways | Ticket, Twitter, Telegram |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

ZebPay Exchange Pros & Cons

In this ZebPay review, we must mention that the company ceased all its services in India in 2018. However, after reaching the Australian and Singaporean markets, it announced its relaunch in India in 2020.

Let’s weigh the crypto exchange’s advantages against its disadvantages before deciding.

Pros | Cons |

User-friendly interface | Limited asset offerings (300+) |

Dedicated mobile app | Higher than average trading fees (0.5%) |

Tiered KYC process | No support for copy trading |

No fees on fiat deposits and withdrawals | Monthly membership fee for inactive accounts |

ZebPay User Levels

The platform offers no fee discounts to its international clients. It hasn’t implemented a tiered user level system. However, Indian traders can use an 8-tier user level system.

ZebPay Exchange Fee Structure

The exchange has implemented a simple fee structure for trading and no-trading costs. Key points about ZebPay fee structure:

Crypto Deposits | Free |

Fiat Deposits | AUD 40 |

Crypto Withdrawals | Network Fee |

Fiat Withdrawals | AUD 30 |

Trading | 0.5% |

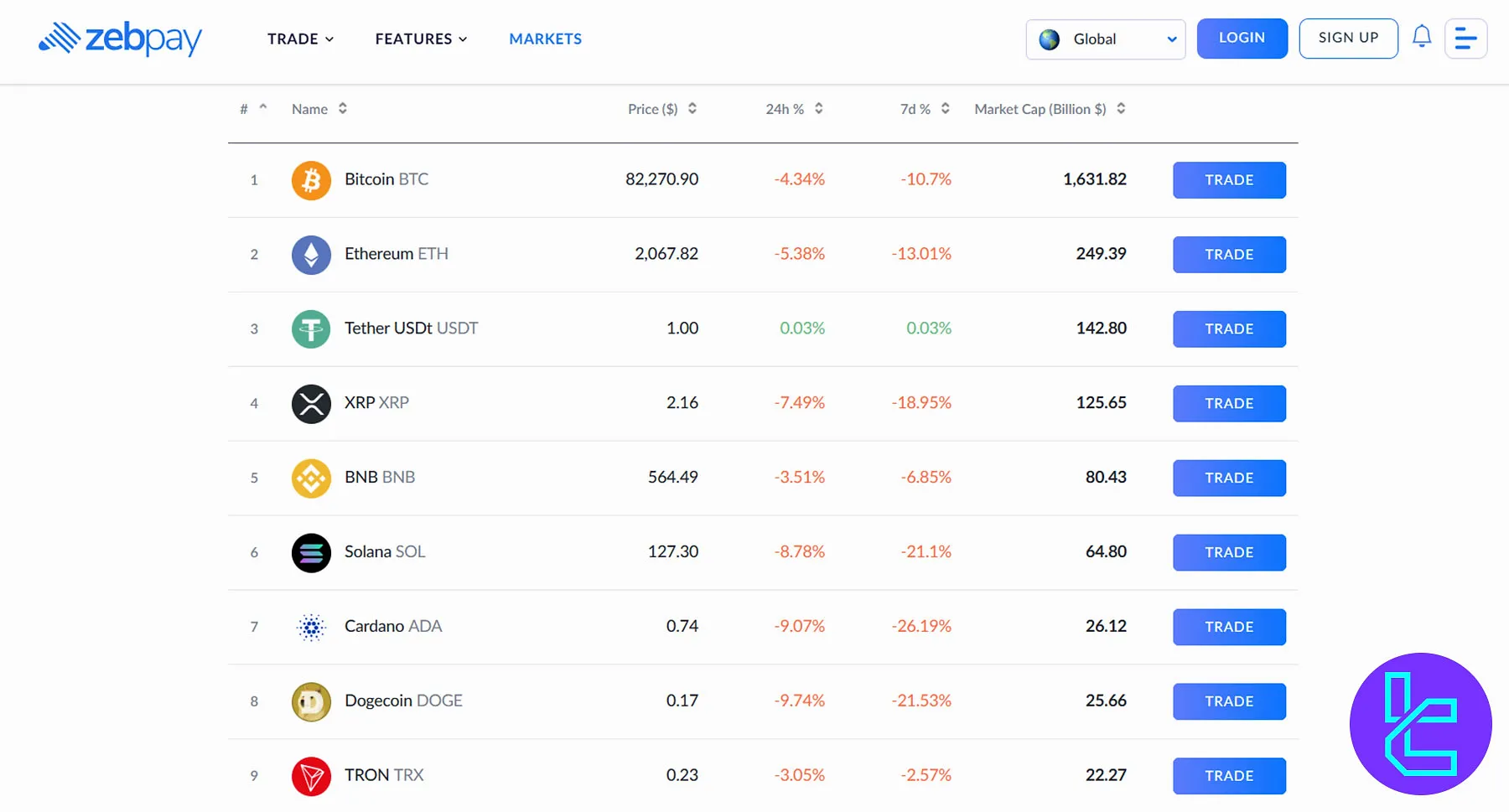

Supported Cryptocurrencies on ZebPay

The platform supports 300+ cryptocurrencies. The exchange lists 22 of the top 30 cryptocurrencies by market capitalization. Popular cryptocurrencies on ZebPay:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

Leveraged Trading

The platform doesn’t offer Margin and Futures markets to its international clients. However, Indians can use a 1:75 leverage for margin trading to maximize their profit potential and trade bigger.

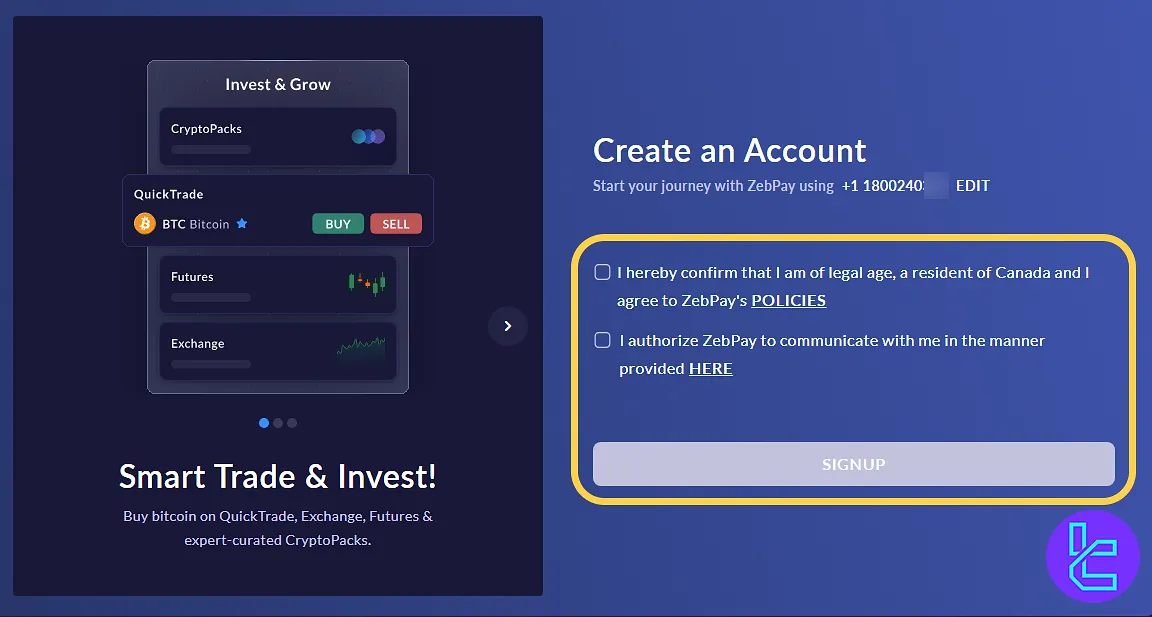

Registration and Verification on ZebPay Exchange

ZebPay uses a 100-point document verification system where each ID type contributes a set score (e.g., passport = 70 points, driver’s license = 40). To access trading features, you must complete a structured onboarding process involving KYC, bank linking, and source of funds declaration. Steps to ZebPay registration:

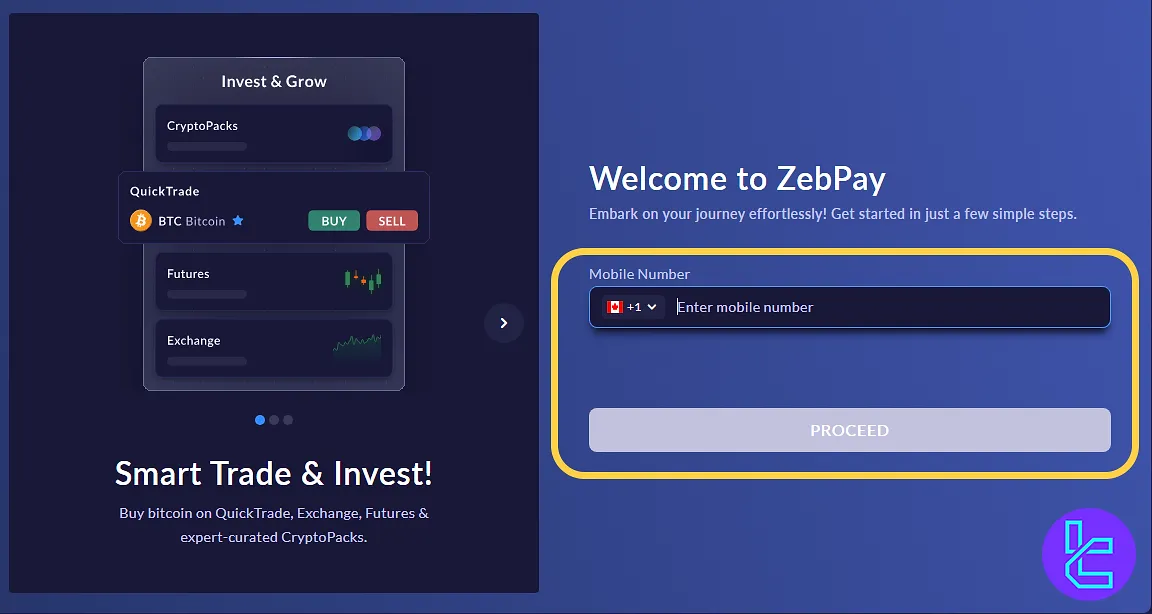

#1 Create Your ZebPay Account

Go to the official ZebPay website and select “Sign Up”.

Enter your mobile number. You'll also need to choose a secure 4-digit PIN for app access.

You are also required to read the platform's policies and terms of use before accepting them.

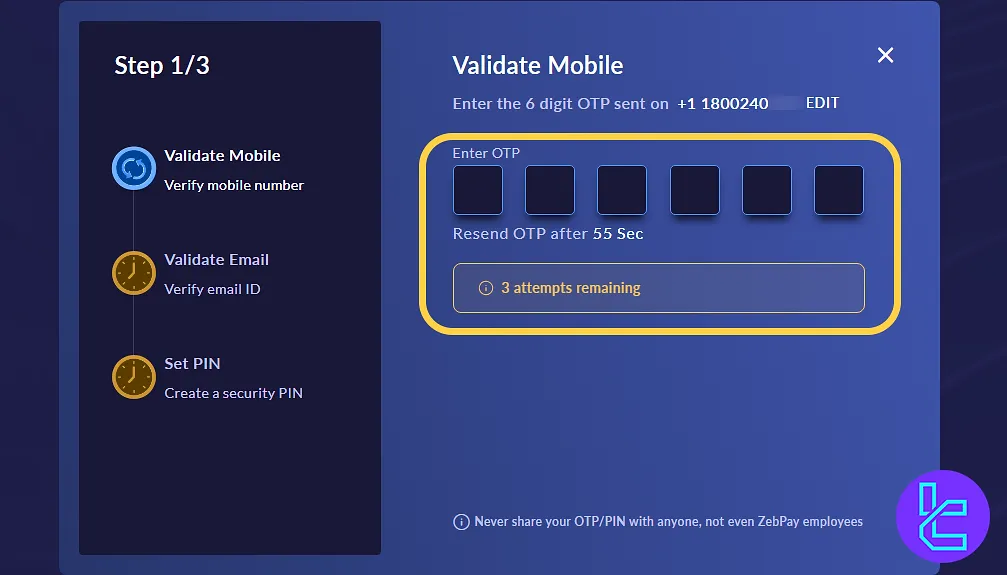

#2 Verify Contact Information

Confirm your email address and mobile number through the verification links or OTPs sent to your devices.

#3 Submit KYC Documents

Upload both proof of identity (e.g., passport, driver’s license, Aadhaar) and proof of address. Documents are assessed under the 100-point rule—your combination must meet or exceed the threshold.

#4 Declare Financial Background

Disclose your occupation and source of funds—both are mandatory as part of AML compliance and regulatory reporting.

#5 Link Your Bank Account

Provide valid banking details to enable deposits and withdrawals. The account must be in your name and match your submitted ID.

ZebPay Trading Guide

Trading on ZebPay is designed to be simple, fast, and secure. With over 400+ crypto pairs including Bitcoin, Ethereum, and BAT, ZebPay provides users with professional-grade trading tools such as OTC services and API integrations for advanced strategies and automation.

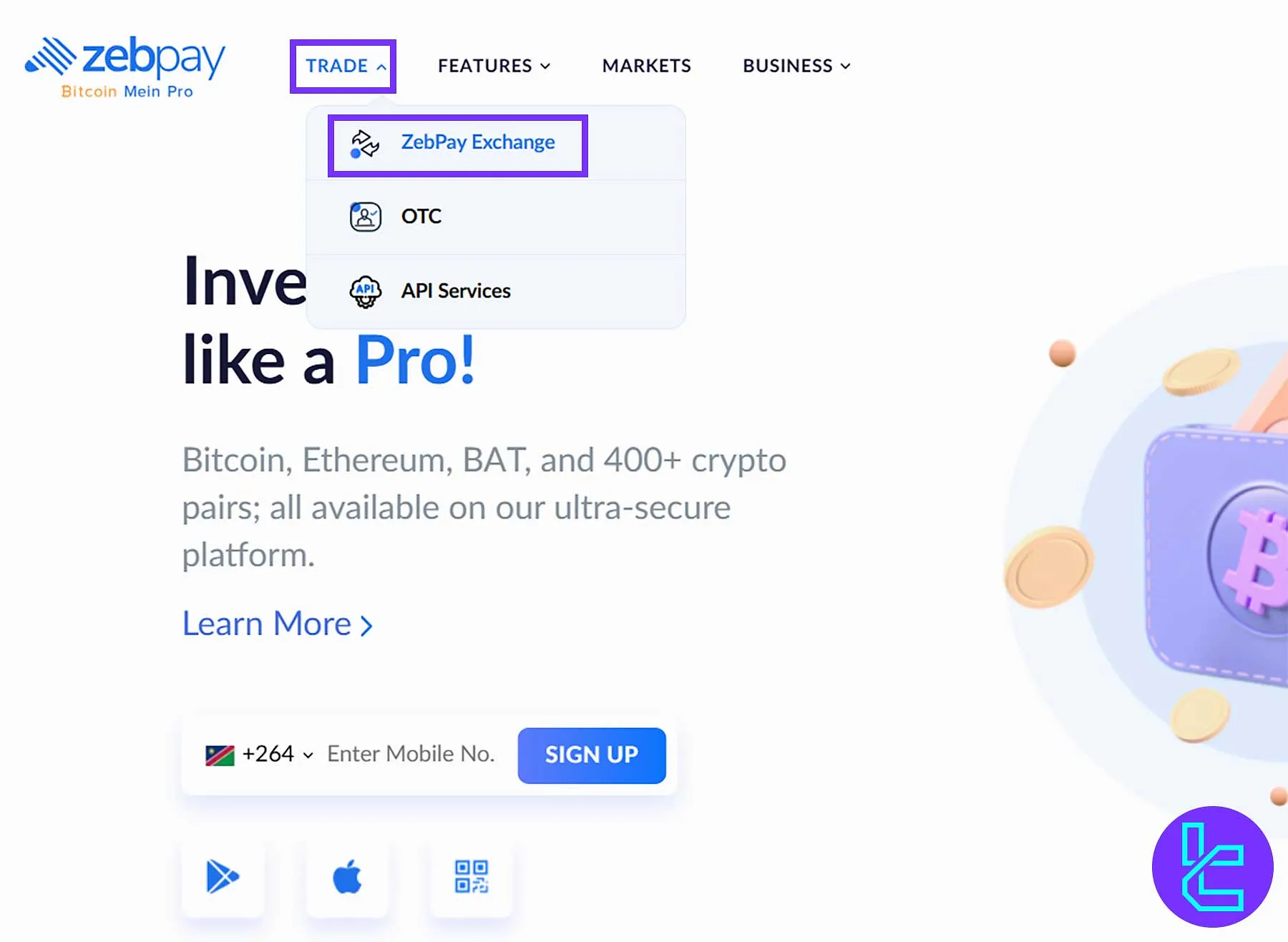

#1 Access the ZebPay Exchange Interface

Start by navigating to the ZebPay Exchange section under the “Trade” menu. This interface enables users to access real-time market data, view order books, and execute trades directly within a secure trading environment.

- Go to the ZebPay website or mobile app;

- Click Trade → ZebPay Exchange from the main menu;

- Browse through supported crypto pairs and live market data;

- Use the OTC or API services options for higher-volume or automated trading.

#2 Adjust Order Details

After selecting your crypto pair, fine-tune your order by setting parameters such as trade size, order type, and price. ZebPay’s interface ensures full transparency with real-time balance and fee details displayed before execution.

- Choose Buy or Sell options based on your position;

- Enter the amount or use quick percentage shortcuts;

- Review order summary and confirm before submitting;

- Monitor execution status in your order history panel.

ZebPay App and Platform

In addition to a web-based trading platform, the exchange has developed a dedicated mobile application for various operating systems, including:

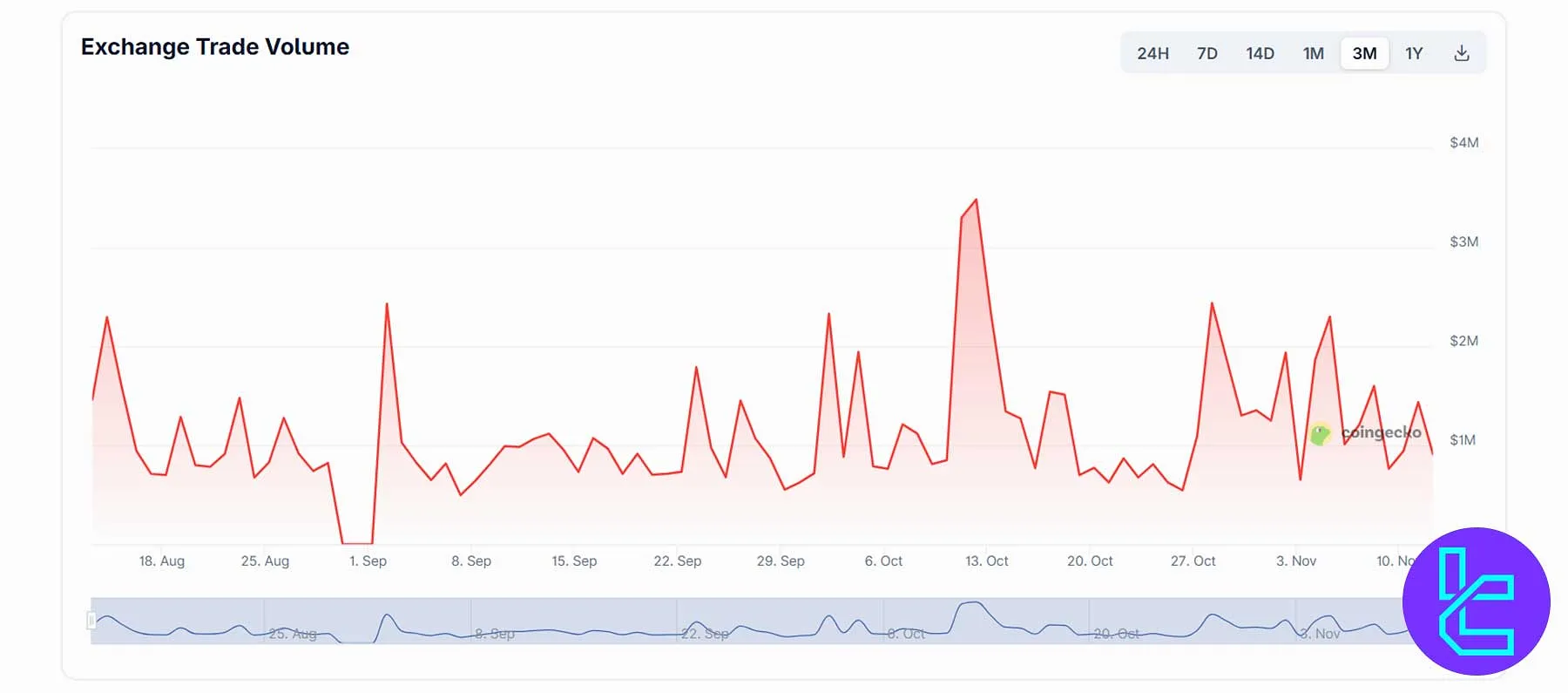

ZebPay Trading Volume

Over the past three months, the exchange has maintained a consistent trading volume averaging between $1 million and $3 million daily, according to ZebPay's CoinGecko profile.

The platform’s liquidity performance reflects its strong market presence and reliability among crypto traders across India, Singapore, and Australia.

- ZebPay’s highest trade volume peaks reached nearly $4 million, driven by increased Bitcoin and Ethereum transactions;

- Trading activity remains steady due to ZebPay’s competitive fee structure and regulated exchange status;

- The exchange provides 24/7 liquidity across key crypto pairs, ensuring accessibility for both retail and institutional traders.

ZebPay Services

ZebPay offers a diverse suite of cryptocurrency trading and investment tools designed for retail and institutional users. With integrations like TradingView and secure API access, ZebPay ensures a seamless and data-driven trading experience while maintaining its reputation as one of India’s most trusted exchanges.

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

ZebPay Security Measures

Robust security is considered one of the advantages in this ZebPay review. The exchange stores 98% of funds in Multi-Sig cold crypto wallets.

- 2 Factor Authentication

- Cold Storage

- Strong Firewalls

- Employee Background Verification

- Constant Third-Party Testing

- Bug Bounty Program: Up to $1,000 in rewards

ZebPay Security Rankings

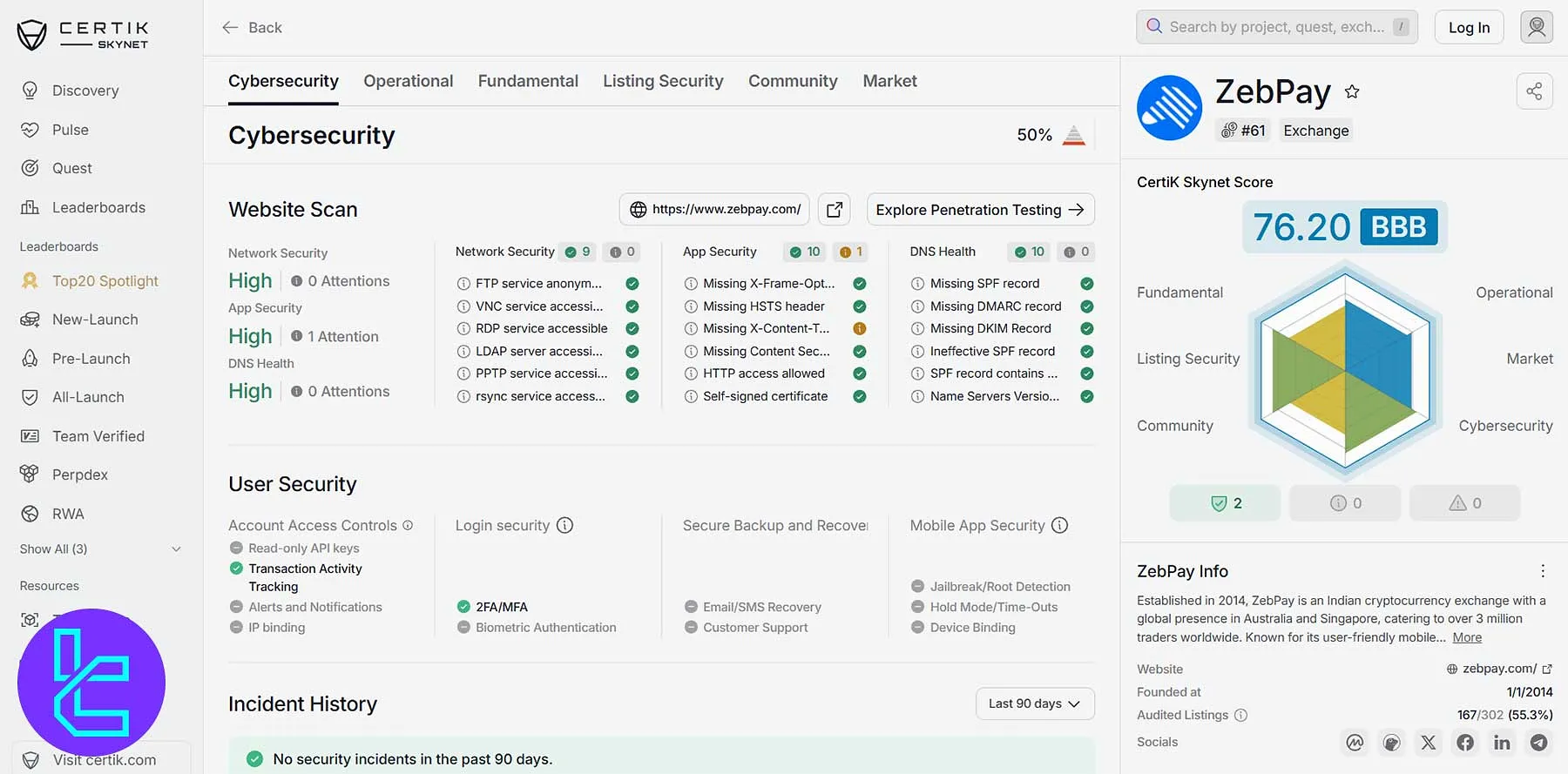

The ZebPay CertiK Skynet profile holds a score of 76.20 (BBB), reflecting a strong cybersecurity posture across key areas like network security, app integrity, and DNS health. The exchange demonstrates proactive risk management with a high security rating across all infrastructure layers and no incidents reported in the past 90 days.

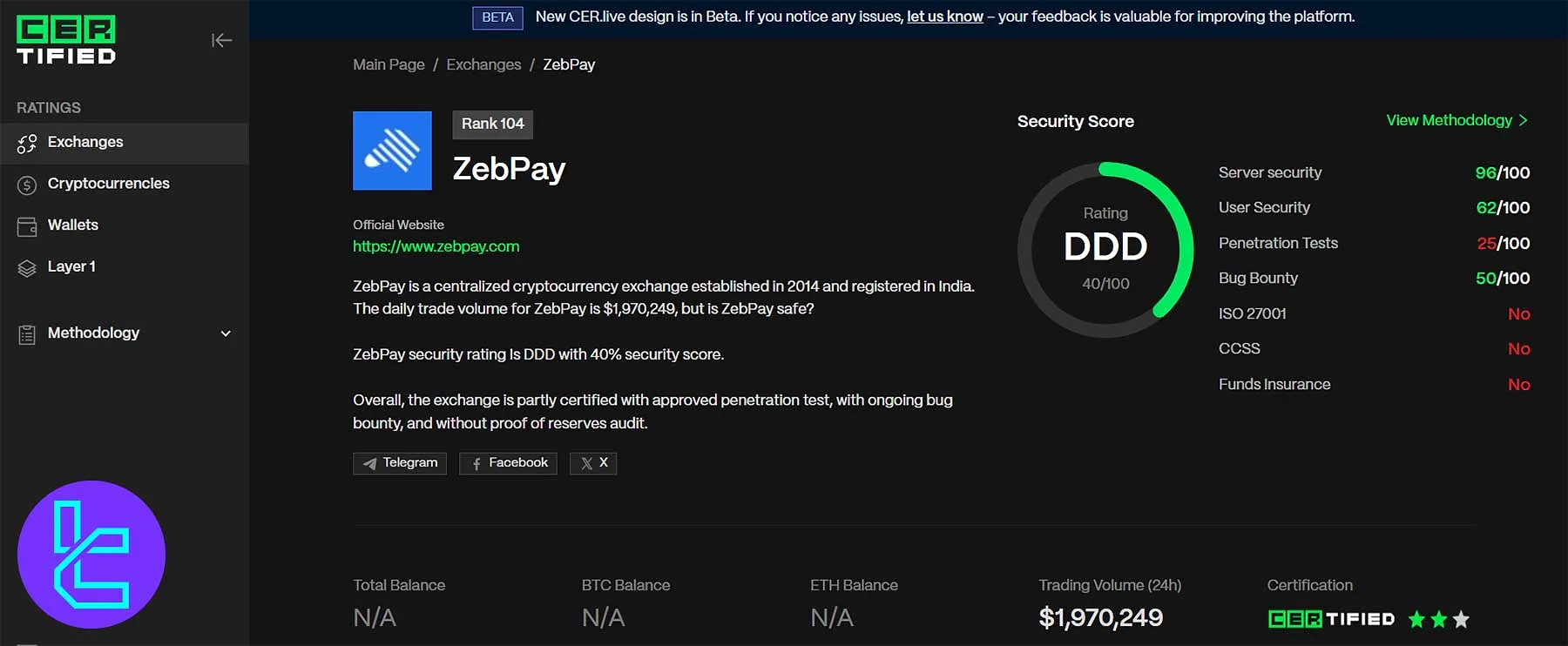

ZebPay on CER.live ranks #104 globally with a DDD security score (40/100). The platform’s strengths lie in server security (96/100) and user protection (62/100), supported by active penetration testing and a bug bounty program (50/100).

While ZebPay remains partly certified, it continues improving its audit transparency and certification coverage. Despite missing ISO and CCSS certifications, the exchange’s ongoing enhancements indicate a commitment to maintaining trust and compliance.

Category | Metric | Value |

Certik Skynet Score | Overall Score | 76.20 (BBB) |

Operational | 73.57 | |

Market | 78.80 | |

Cybersecurity | 84.88 | |

Fundamental | 67.49 | |

Listing Security | 86.46 | |

Community | 65.93 | |

CER.live Security Score | Overall Score | 44% (DDD) |

Server Security | 96/100 | |

User Security | 62/100 | |

Penetration Tests | 25/100 | |

Bug Bounty | 50/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

ZebPay Exchange Deposit and Withdrawal Methods

The platform allows international clients to deposit and withdraw AUD and Crypto. The minimum deposit/withdrawal amount is AUD 50. The only available method for fiat transactions is Bank Transfer.

While crypto deposits are free of charge, digital asset withdrawals incur a network fee, which varies depending on the asset.

ZebPay Exchange Trust Scores

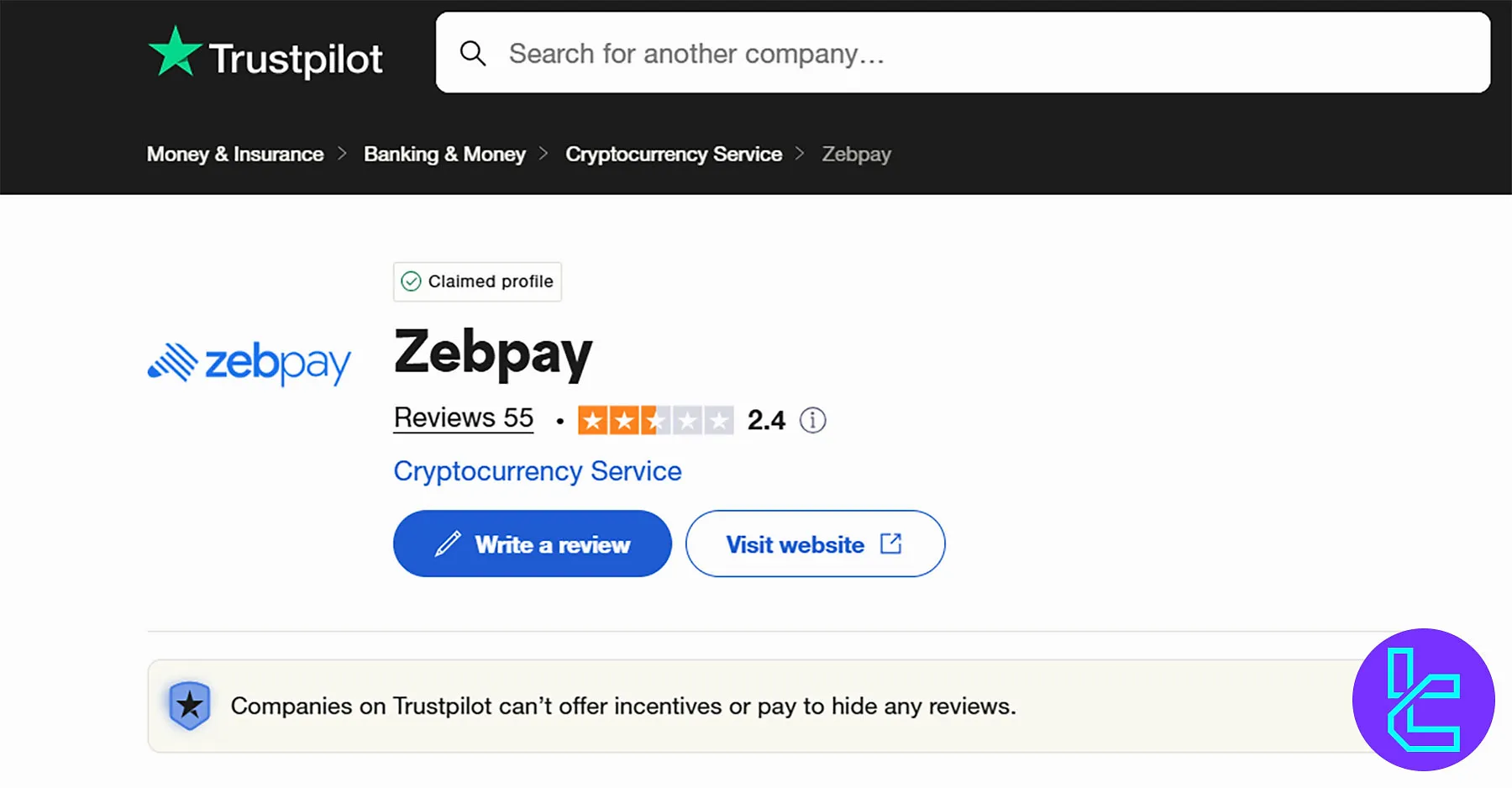

While CoinGecko experts haven’t rated the platform, there are 55 ZebPay reviews on Trustpilot. The resulting 2.4/5 score indicates that users consider the exchange lower than average.

72% of comments on the ZebPay Trustpilot profile are negative (1-star and 2-star), and only 26% are positive (4-star and 5-star).

ZebPay Features

The table below demonstrates the exchange's additional products at a glance:

Yes | |

Yield Farming | No |

No | |

Launchpool | No |

Crypto Cards | No |

ZebPay Promotions

The exchange doesn't offer any active promotional campaigns at the time of writing this ZebPay review. Even the referral program is not active.

Client Support

The lack of live chat support is a big letdown in this ZebPay review. The exchange provides 24/7 assistance, mainly through a ticket system and social media.

- Ticket: Through the “Support Center”

- ZebPay X (Twitter) Support

- Telegram Support: https://t.me/ZebPayOfficialChat

Investment and Growth Plans on ZebPay Exchange

While the platform doesn’t provide crypto copy trading software, it offers multiple investment and growth plans, from Lending to Crypto Packs.

- Lend: Fixed annual returns of up to 8.5% on 8 cryptocurrencies, including BTC, ETH, BNB, POL, ADA, ATOM, SOL, and USDT

- Crypto Packs: Bundles of crypto assets designed by professional traders

Restricted Countries

Citizens and/or residents of certain countries, including those on the Financial Action Task Force (FATF) blacklist can’t use ZebPay services, including:

- Iran

- North Korea

- Myanmar

ZebPay in Comparison to Other Exchanges

Some of the best crypto platforms in the industry are compared with ZebPay in the table here:

Parameters | ZebPay Exchange | MEXC Exchange | Bitunix Exchange | Toobit Exchange |

Number of Assets | 300+ | 2800+ | 300+ | 100+ |

Maximum Leverage | 1x | 1:200 | 1:125 | 1:150 |

Minimum Deposit | $1 | $1 | $10 | $5 |

Spot Maker Fee | 0.5% | 0.05% | 0.01% - 0.08% | 0.008% - 0.2% |

Spot Taker Fee | 0.5% | 0.05% | 0.01% - 0.1% | 0.05% - 0.2% |

Mandatory KYC | Yes | Yes | No | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | No |

Staking | No | Yes | No | No |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

ZebPay is a crypto exchange that accepts fiat deposits (fee: AUD 40) and withdrawals (fee: AUD 30). The exchange offers up to 150 USDT per year to its affiliates. It has a score of 2.4 out of 5 on Trustpilot.