Capitalcore verification is a simple 4-step process that enables access to deposits, withdrawals, and full trading features.

This identity authentication requires uploading a proof of identity (POI) and proof of address (POA) documents, along with confirming a valid phone number.

After completing the KYC process, traders can use PayPal, Visa, MasterCard, Bitcoin, and Ethereum, and transfer funds from their Classic, Silver, Gold, and VIP accounts.

Capitalcore Verification Process Overview

Once you’ve completed the Capitalcore registration, follow these 4 essential steps to complete identity confirmation on the Capitalcore broker. Capitalcore verification:

- Access the "Account Verification" section;

- Complete personal and contact information;

- Upload identity and address confirmation documents;

- Verify the registered phone number.

Traders should check the table below to provide the necessary documents and information beforehand.

Verification Requirement | Yes/No |

Full Name | Yes |

Country of Residence | Yes |

Date of Birth Entry | Yes |

Phone Number Entry | Yes |

Residential Address Details | Yes |

Phone Number Verification | Yes |

Document Issuing Country | No |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | No |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | No |

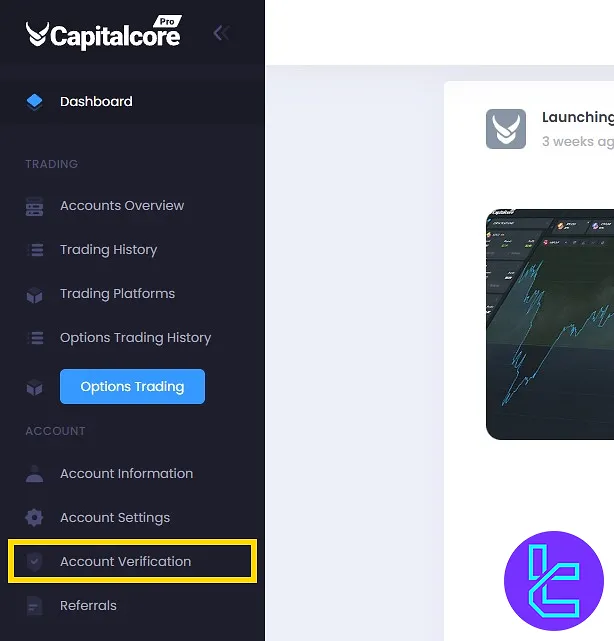

#1 Accessing the Capitalcore Authentication Section

To begin the KYC process:

- Log in to your Capitalcore account;

- On the dashboard, click on the "Account Verification" option located on the left panel.

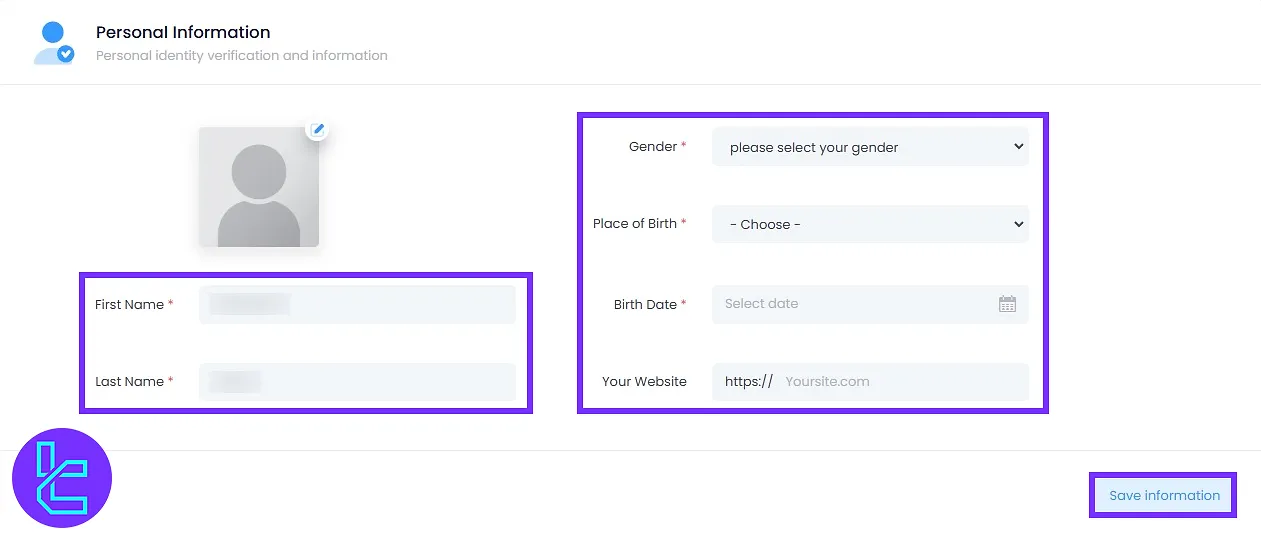

#2 Completing Personal and Contact Information

On the "Personal Information" page, enter your personal details, such as:

- Full name

- Date of birth

- Place of birth

- Gender

Then, click "Save Information".

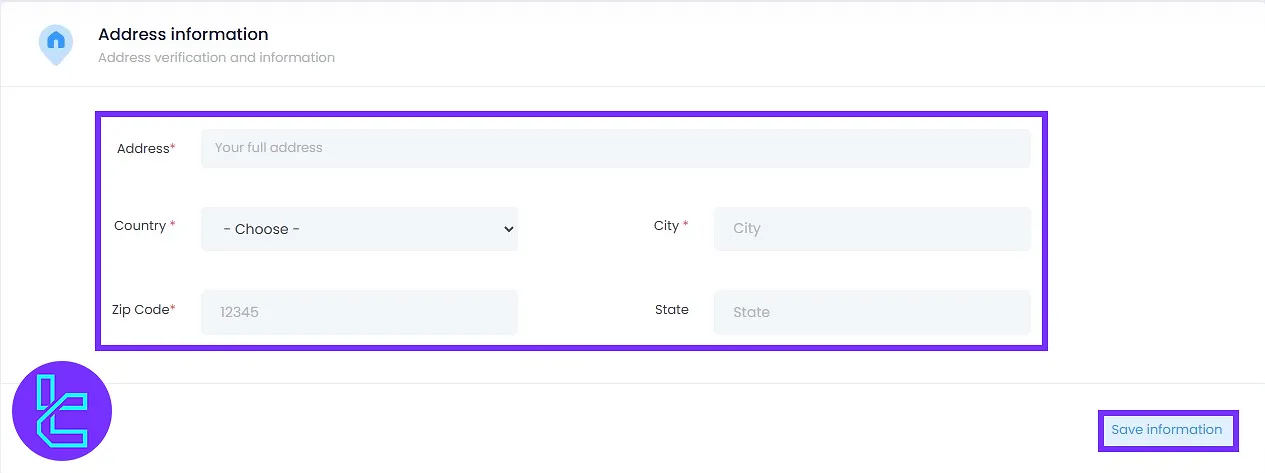

Next, provide your residential address and postal code in this binary broker. Then, select your account type (individual or corporate). Once completed, click "Save Information" again.

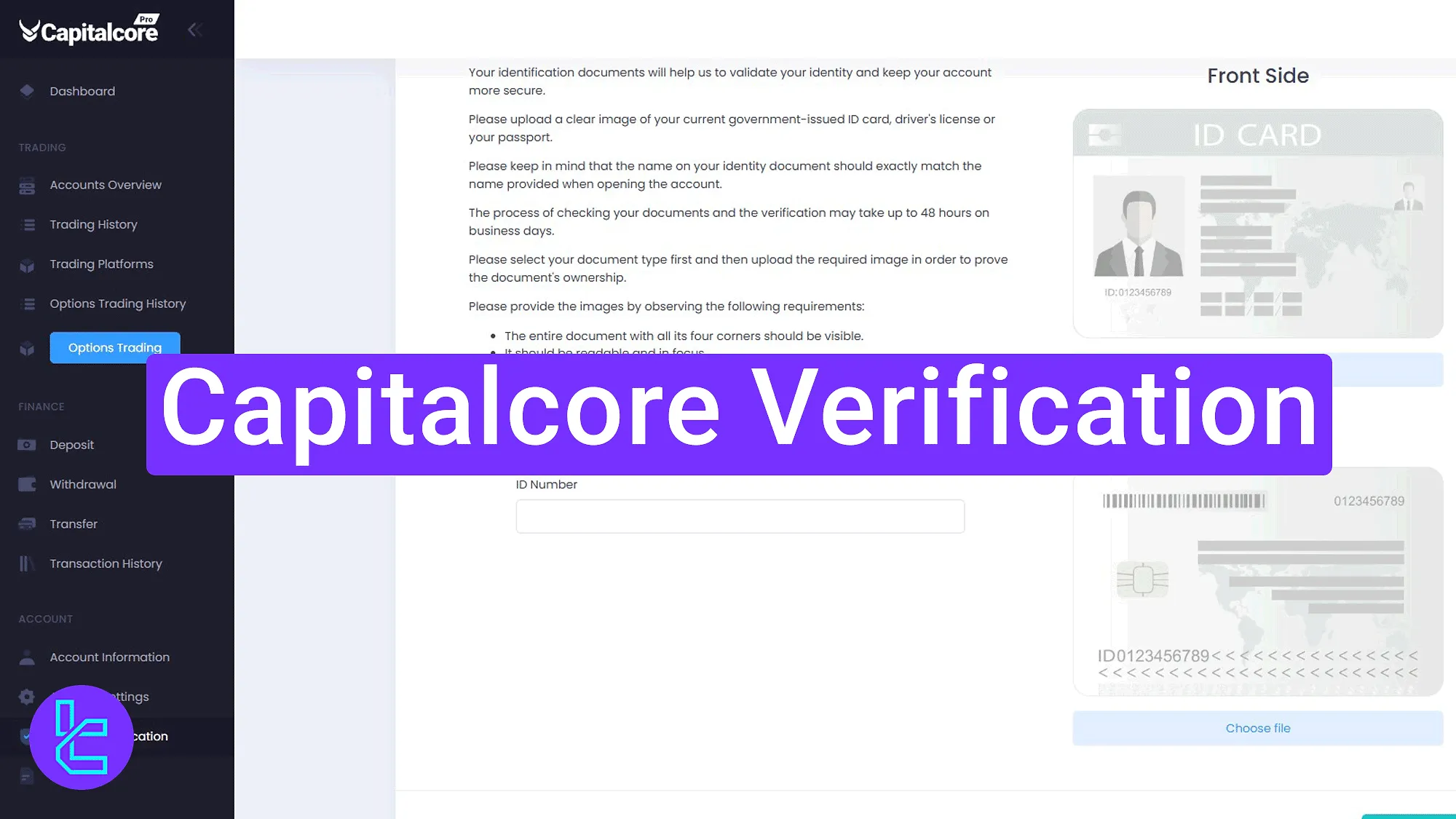

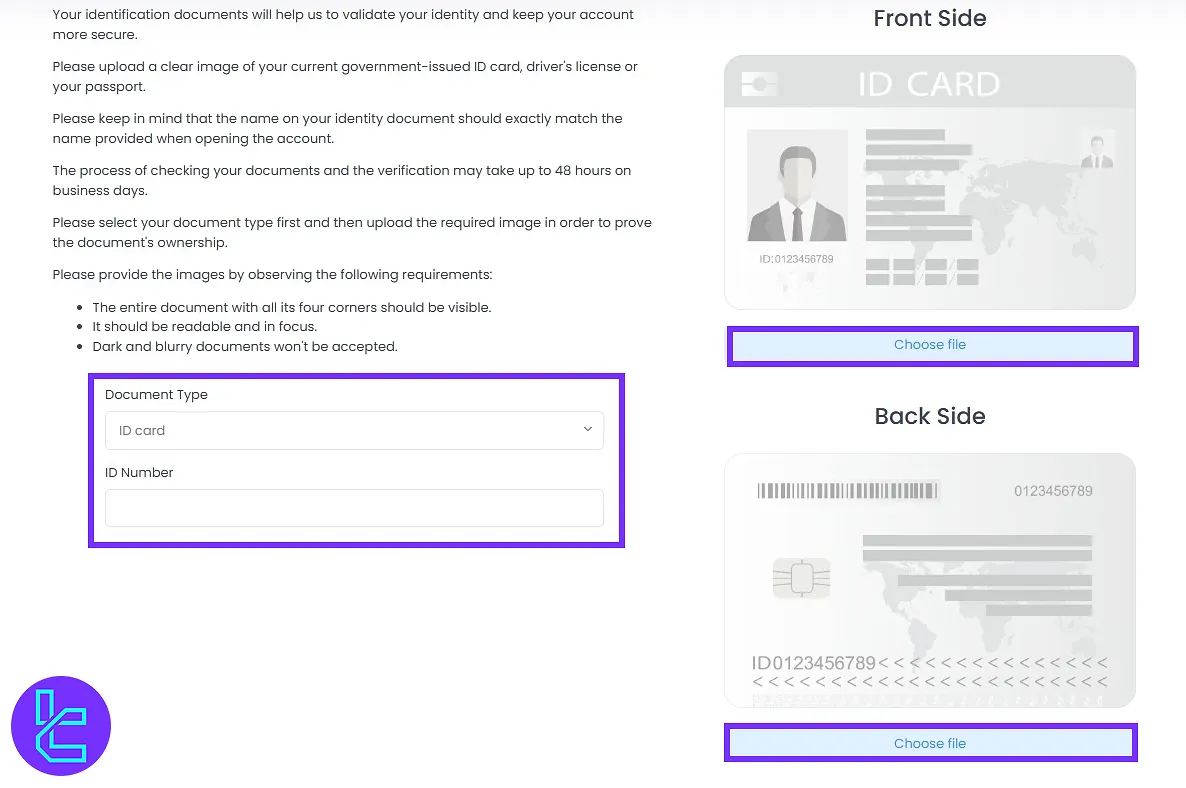

#3 Uploading Identity and Address Confirmation Documents

Return to the "Account Verification" section where document upload options will be available. Now, follow these steps:

- Select the document type (passport, national ID, or driver’s license);

- Enter the document number;

- Upload clear images of both the front and back sides of the ID document.

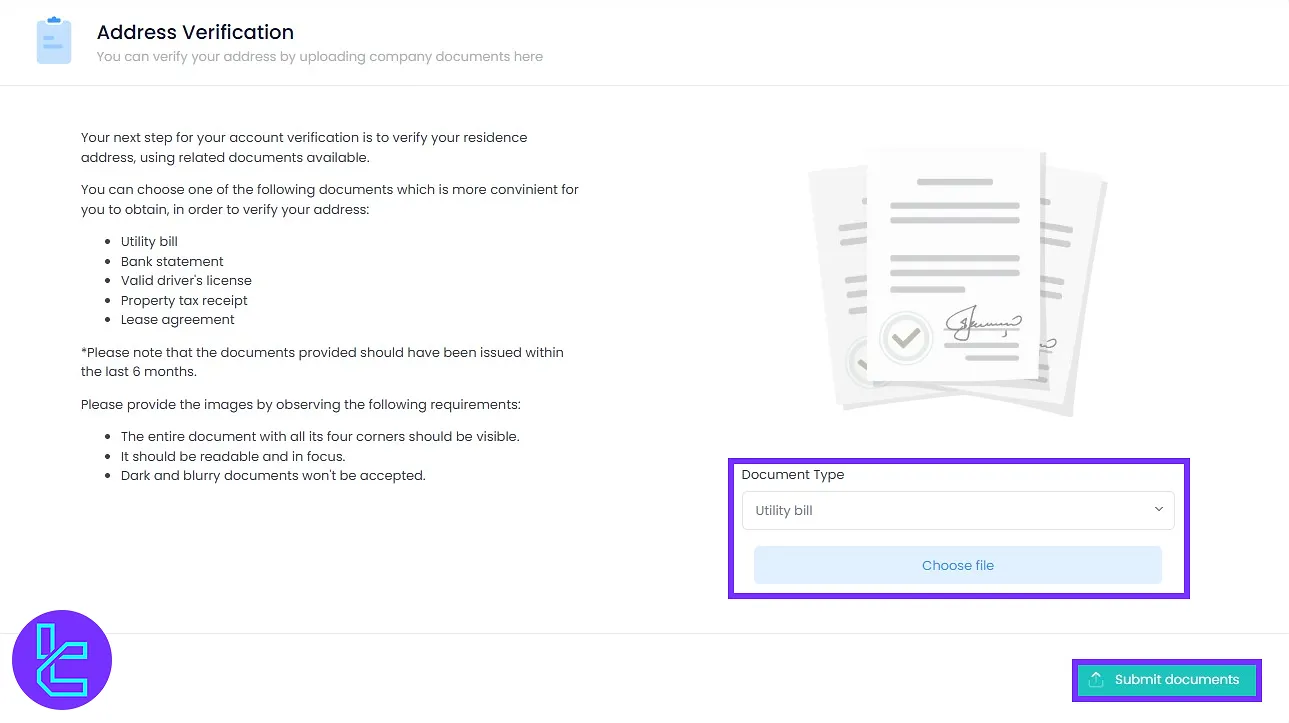

Next, upload a valid proof of address document dated within the last 6 months. Available options include:

- Utility bills

- Bank statements

- Valid driver’s license

- Property tax receipt

- Lease agreement

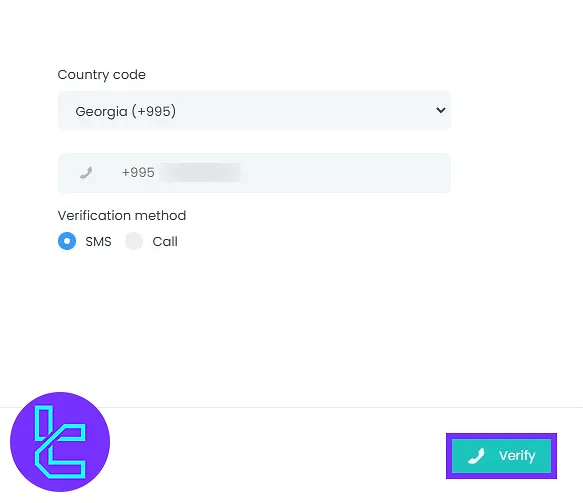

#4 Verifying the Registered Phone Number

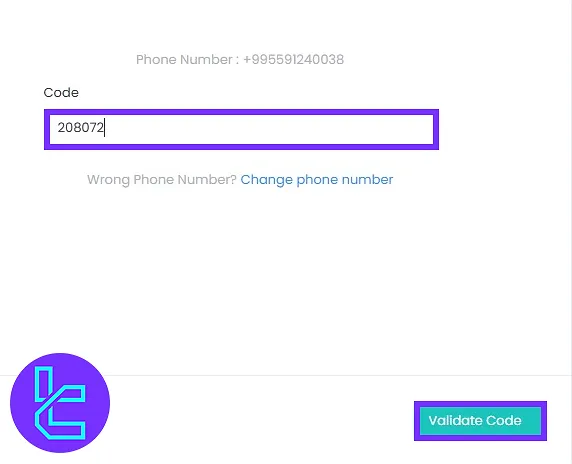

In the final step, enter your mobile phone number and choose a verification method (call or SMS). Click "Verify" to receive a verification code.

Enter the code in the provided field, then click "Validate Code" to complete phone authentication.

To check your document review status, go back to the "Account Verification" menu on your dashboard.

Capitalcore KYC Procedure vs Other Binary Brokers

Here's a table comparing Capitalcore verification and other brokers.

Verification Requirement | Capitalcore Broker | |||

Full Name | Yes | Yes | No | Yes |

Country of Residence | Yes | Yes | Yes | No |

Date of Birth Entry | Yes | Yes | No | Yes |

Phone Number Entry | Yes | Yes | Yes | Yes |

Residential Address Details | Yes | Yes | Yes | No |

Phone Number Verification | Yes | No | No | No |

Document Issuing Country | No | No | No | No |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | No | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | No | No | No | No |

Utility Bill (for POA) | Yes | No | Yes | No |

Bank Statement (for POA) | Yes | No | Yes | No |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | No | No |

Financial Status Questionnaire | No | No | No | No |

Trading Knowledge Questionnaire | No | No | No | No |

Restricted Countries | No | Yes | Yes | Yes |

TF Expert Suggestion

The Capitalcore verification process takes under 10 minutes, and documents are often reviewed and approved within a few minutes.

Traders can Now that you have a fully verified account, you can explore Capitalcore deposit and withdrawal methods to manage your account funds.

More detailed instructions are available on the Capitalcore tutorial page.