Crystal Ball Markets copy trading enables beginner traders to select expert traders based on 10 key parameters, including equity, investments, profitability, commission, and rating. Traders can earn passive income by depositing at least $50 to use this feature.

Traders who use the social trading feature of the Crystal Ball Markets broker can copy trading orders from top-performing traders on various instruments, including Forex, indices, commodities, cryptocurrencies, and metals.

How to Use Crystal Ball Markets Social/Copy Trading Feature

Novice traders can copy the trades of professionalsusing Crystal Ball Markets' social trading feature. This enables them to earn passive income while learning the strategies of the top traders.

To begin your social trading journey with this broker, you must follow a few steps. The steps to set up Crystal Ball Markets copy trading:

- Access social/copy trading section Crystal Ball Markets trading platform

- Choose an Expert Traderto copy

- Review account master details

- Copy the account mater’s trades

Before getting started, we suggest you check the table below to learn about the key aspects of this feature in the Crystal Ball Markets Broker.

Parameters | Copy Trading Feature |

Minimum Deposit | $50 |

Copy Fee/Commission | 10% to 15% |

Available Instruments | Forex, Cryptocurrencies, Stocks, Commodities, Indices, metals, energies |

Top Trader Filters | Equity, Investments, Commission, Rating, Investment Period |

Copy Parameters | Copy Volume |

Stop Copy Option | Yes |

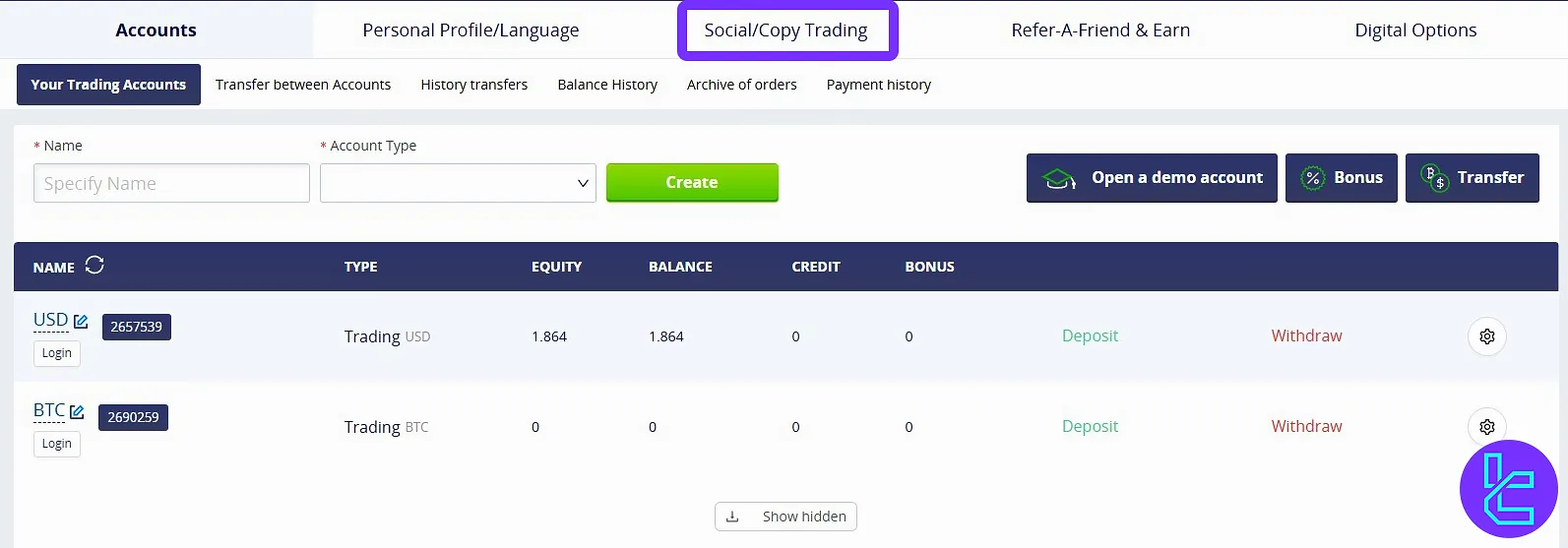

#1 Access your Crystal Ball Markets Social/Copy Trading Section

First, log in to your account and click on the “Social/Copy Trading” Section at the top of your screen.

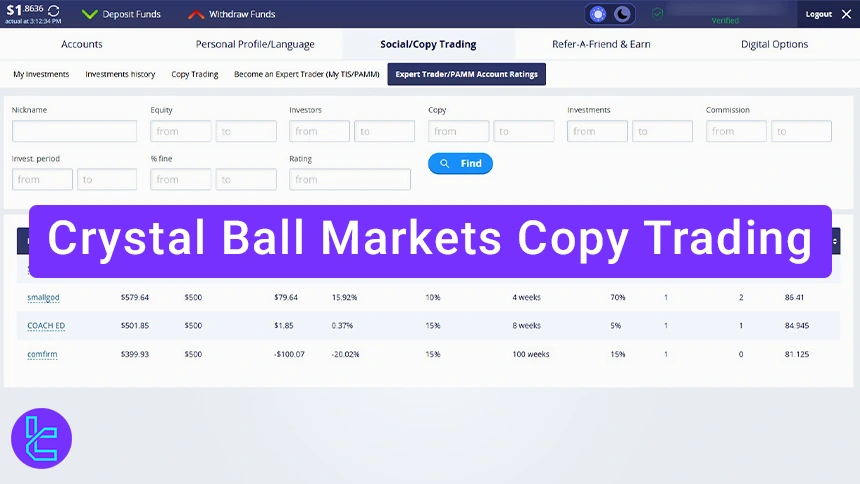

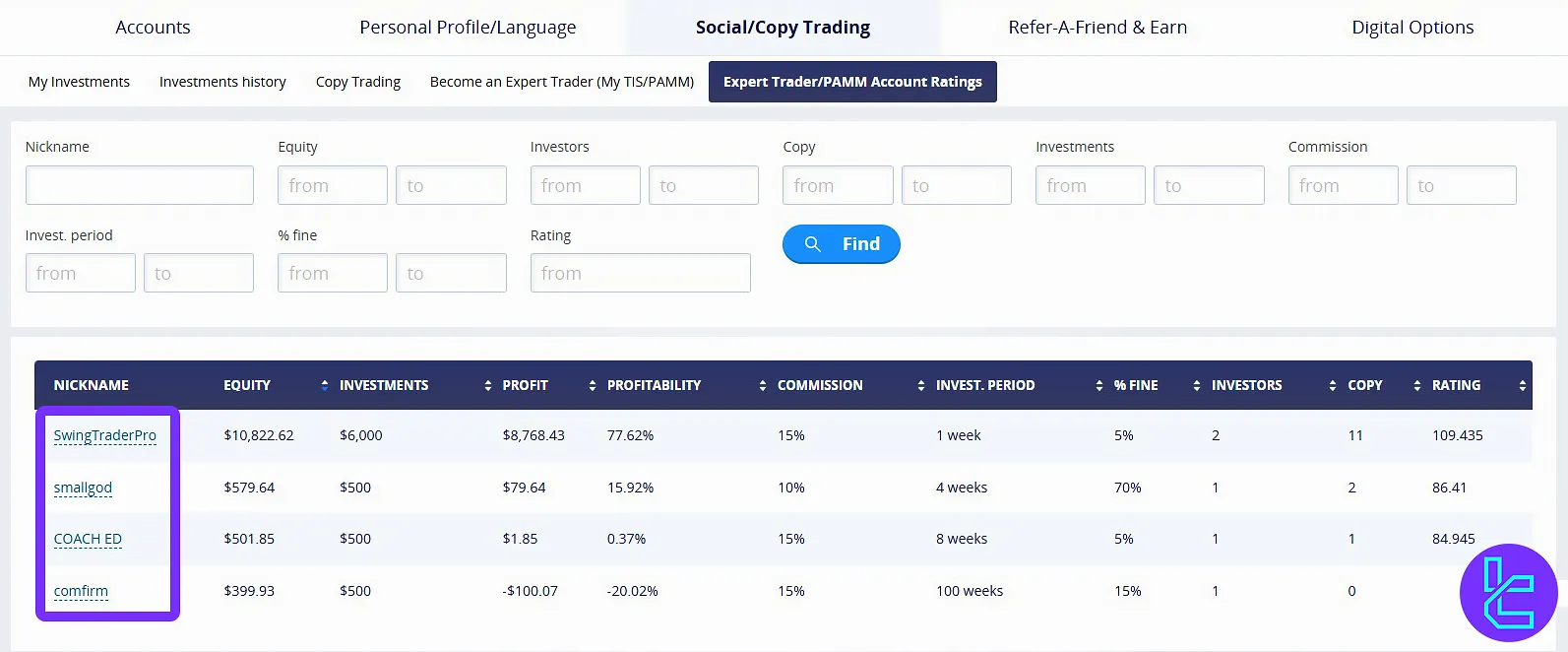

#2 Choose an Expert Trader to Copy

In the social trading tab, use parameters such as nickname, equity, number of investors, commission, rating, etc., to find an Expert Trader who is suitable for your needs.

You can also choose from the account masters in the table below.

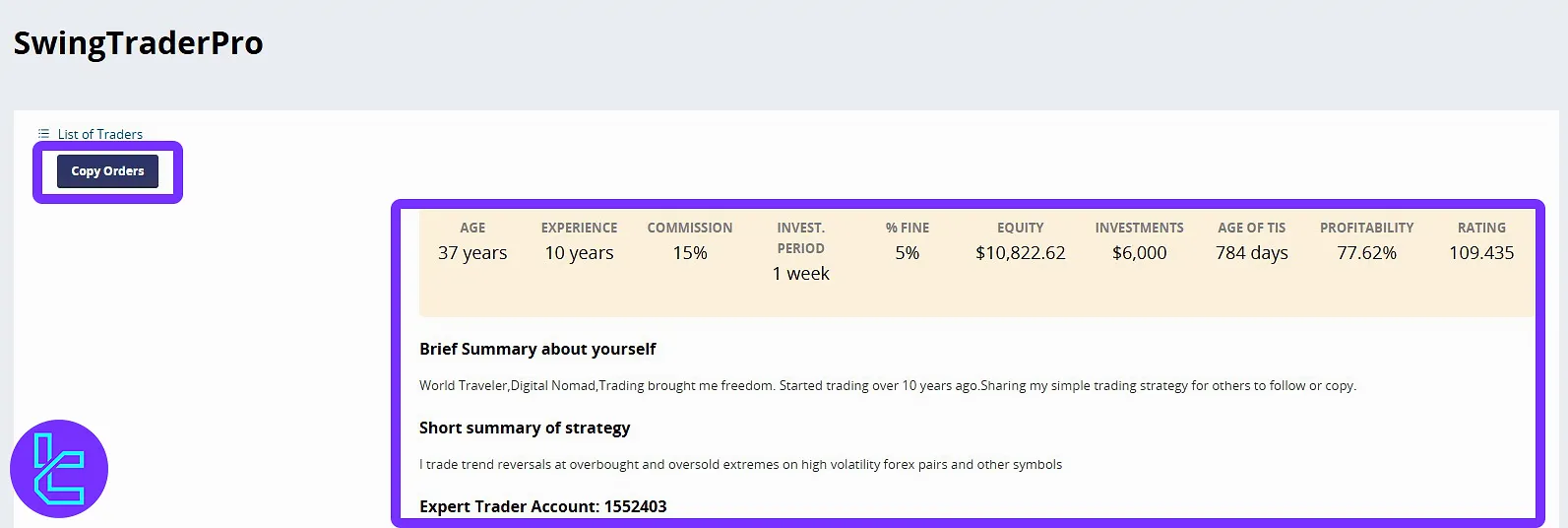

#3 Review Account Master Details

Click on your preferred Expert Trader to open its profile. You can see information such as age, experience, commission, investment period, equity, and profitability alongside a summary of the account master and his trading strategy.

#4 Copy the Account Mater’s Trades

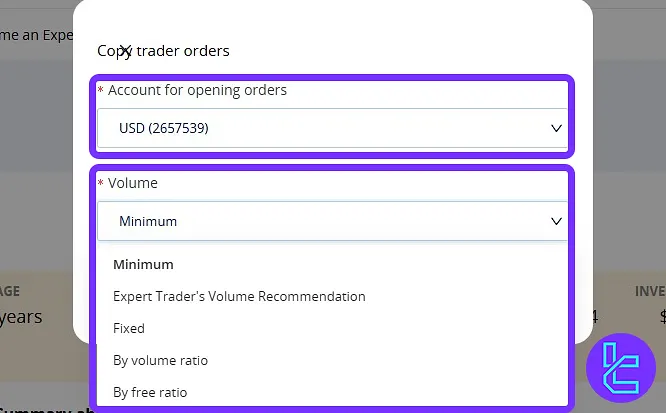

If you believe this trader suits your investment needs, you can proceed by clicking the “Copy Orders” button. Now, select the account you want to use to copy trades. Then, choose the desired trade volume for execution.

Once you’ve set these options, click “Copy Orders”, and the system will begin copying that trader’s trades for you.

In the Copy Trading tab, you can also manage the list of traders you follow. If at any point you wish to stop copying someone’s trades, click on “Detach” button to stop following them.

Parameters | Crystal Ball Markets Broker | |||

Minimum Deposit | $50 | $5 | $10 | $250 |

Copy Fee/Commission | 10 to 15% | $0.5 on every trade | N/A | From 1% to 2.5% |

Available Instruments | Forex, Cryptocurrencies, Stocks, Commodities, Indices, metals, energies | Forex, Cryptocurrencies, Stocks, Commodities, Indices | Forex, Metals, Commodities, Stocks, Indices, ETFs, Cryptocurrencies, Composites, OTC | Forex, Cryptocurrencies, Stocks, Commodities, Indices |

Top Trader Filters | Equity, Investments, Commission, Rating, Investment Period | Number of Traders, Profitability Rate, Total Profit Amount | Trade Duration, Traded Symbol | Profit, Winrate, Total Number of Trades |

Copy Parameters | Copy Volume | Minimum and Maximum Copy Amount, Copy in Proportion, Stop Balance | No | Minimum and Maximum Copy Amount, Copy in Proportion |

Stop Copy Option | Yes | Yes | Yes | Yes |

TF Expert Suggestion

The Crystal Ball Markets copy trading feature is a valuable tool, but you should be aware that most Expert Traders charge a 10–15% commission for allowing you to copy their trades.

Now, that you are familiar with social trading process on this broker you must fund your account using Crystal Ball Markets deposit and withdrawal methods that we have reviewed on the Crystal Ball Markets tutorial page.