OlympTrade binary options broker allows traders to speculate on price fluctuations on 18 indices from the biggest global economies, including USA, Germany, France, Japan, and more.

S&P 500, NASDAQ, FTSE 100, and Euro Stoxx are some of the most traded OlympTrade indices. The minimum trade amount for these indices is only $1, and traders can fund their account with just $10 and start trading.

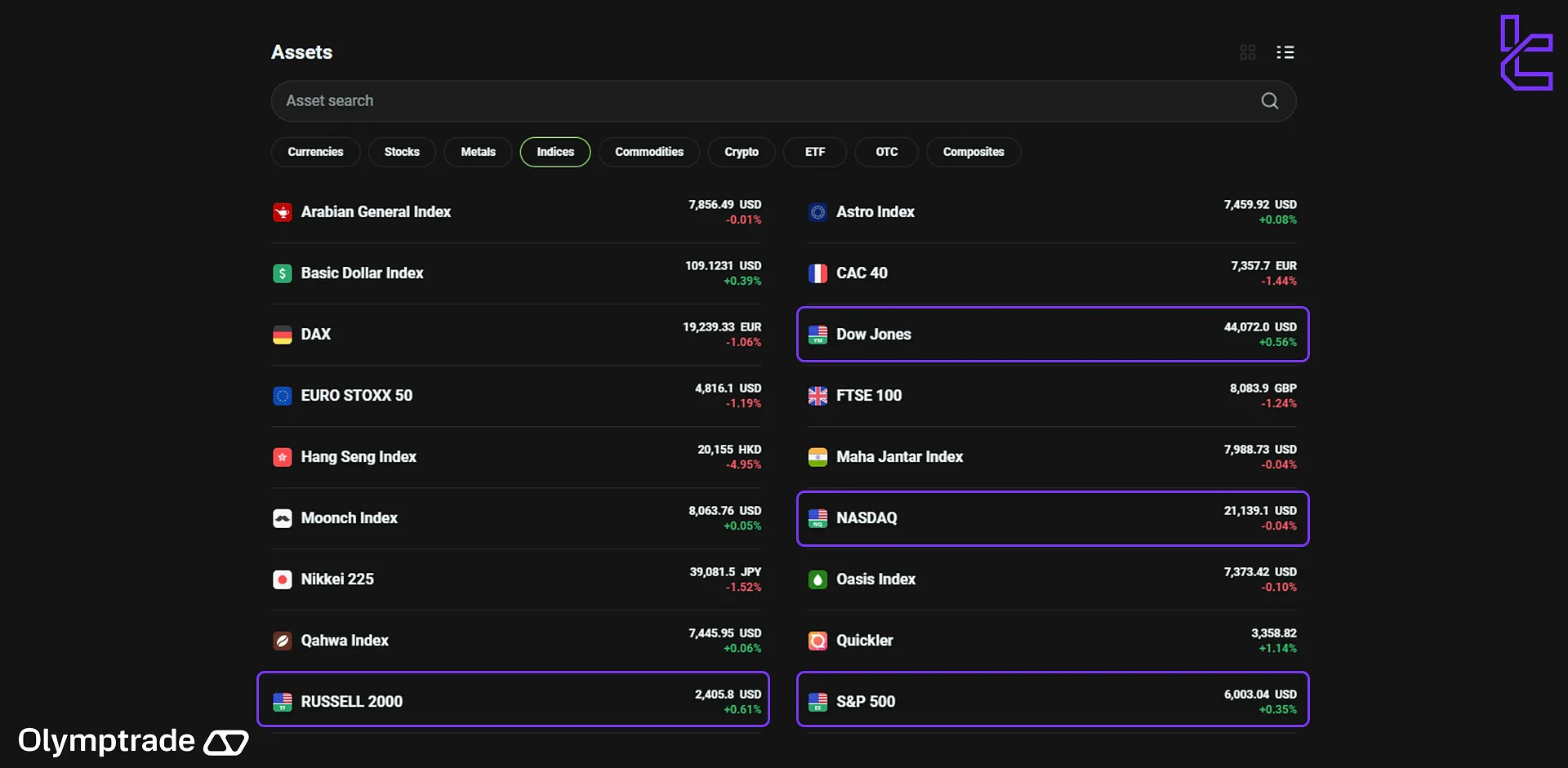

OlympTrade Indices Overview

OlympTrade broker, a renowned online trading platform, offers traders the opportunity to speculate on the performance of various stock market indices. But what exactly are indices, and why should you consider trading them?

An index is a statistical measure of the performance of a group of stocks representing a particular market or sector. For instance, the S&P 500 represents the performance of the 500 largest companies listed on U.S. stock exchanges. By trading indices, you're betting on the overall direction of a market rather than individual stocks.

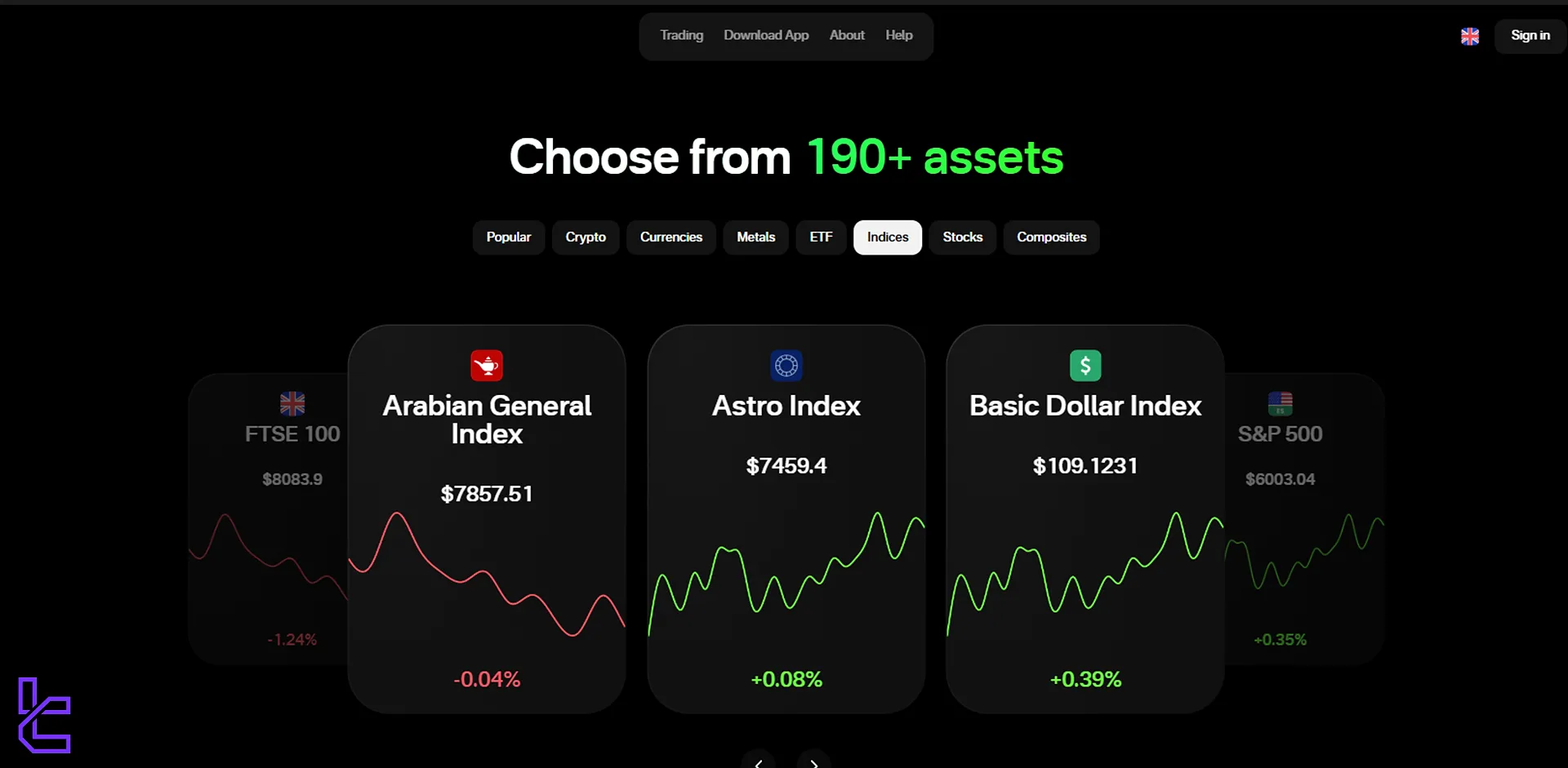

OlympTrade provides access to a wide range of global indices, allowing traders to capitalize on market movements without the owning the underlying assets. Let’s review the OlympTrade indices available to traders.

You can find all the symbols mentioned in this article on the OlympTrade trading platform by watching the video below.

U.S. Indices in OlympTrade

U.S. indices are among the most popular and widely traded on OlympTrade. Here's a quick overview of the U.S. indices available:

- S&P 500: Tracks 500 large-cap U.S. stocks;

- Dow Jones Industrial Average (DJIA): Represents 30 blue-chip companies;

- NASDAQ: Focuses on technology and growth stocks;

- Russell 2000: measures the performance of 2,000 small companies in the Russell 3,000 index.

These indices offer insights into different aspects of the U.S. economy. For example, the NASDAQ is often seen as a barometer for the tech sector, while the Dow Jones is considered a gauge of industrial sector performance.

European Indices on OlympTrade

European indices allow traders to gain exposure to the continent's diverse economies. Some key European indices on OlympTrade include:

Index Symbol | Description |

FTSE 100 | Represents the 100 largest companies on the London Stock Exchange |

DAX | Tracks 30 major German companies |

CAC 40 | Comprises 40 of the largest French stocks |

EURO STOXX 50 | Composed of 50 stocks in 11 countries |

OlympTrade index trading with European indices can be particularly interesting during economic or political events affecting the region, such as Brexit or European Central Bank decisions.

East Asia Indices on OlympTrade

East Asian markets play a crucial role in the global economy, and OlympTrade offers several indices from this region:

- Nikkei 225: Japan's leading stock market index

- Hang Seng Index: Represents the Hong Kong stock market

These indices can provide valuable opportunities, especially for traders interested in the dynamic Asian economies and their impact on global markets.

Other OlympTrade Indices

OlympTrade broker indices don’t stop at U.S., European, and Asian stock markets. The Platform also offers less well-known indices, including:

- Astro Index

- Arabian General Index

- Basic Dollar Index

- Moonch Index

- Qahwa Index

- Maha Jantar Index

- Oasis Index

- Quickler

These specialized indices can be excellent tools for traders looking to capitalize on specific market trends or hedge against portfolio risks.

Best Trading Strategies for OlympTrade Indices

Successful OlympTrade index trading requires a solid strategy. Here are some popular approaches:

- Trend Following: Identify and trade in the direction of long-term trends;

- Breakout Trading: Capitalize on significant price movements breaking through support or resistance levels;

- News Trading: Take advantage of market reactions to major economic or political news;

- Correlation Trading: Exploit relationships between different indices or indices and other assets.

Remember, finding a strategy that suits your trading style and risk tolerance is the key to success. Always practice on a demo account before risking real money.

Is Index Trading Available in Other Binary Brokers?

Yes, most brokers support famous indices, allowing traders to speculate on the future price of many stocks at the same time.

Broker | OlympTrade Broker | |||

FTSE 100 | Yes | Yes | Yes | Yes |

DAX | Yes | Yes | Yes | Yes |

CAC 40 | Yes | Yes | Yes | Yes |

Euro Stoxx 50 | Yes | Yes | Yes | Yes |

Nikkei 225 | Yes | Yes | Yes | Yes |

Hang Seng | Yes | Yes | Yes | Yes |

S&P 500 | Yes | Yes | Yes | Yes |

Dow Jones | Yes | Yes | Yes | Yes |

Nasdaq 100 | Yes | Yes | Yes | Yes |

TF Expert Suggestion

OlympTrade offers trading services for over 190 assets, including 18 indices. However, non-US market indices (e.g., Astro index, CAC 40, Hang Seng index) are traded with higher spreads, which heavily affect traders' profitability.

To access all of these tradable instruments, you must familiarize yourself with the OlympTrade dashboard, which we have written about on the OlympTrade tutorial page.