![Risk to Reward Ratio (Multiple Orders) Indicator for MT4 - Download - Free - [TFLab]](https://cdn.tradingfinder.com/image/106811/10-33-en-rrr-with-multiple-orders-mt4.webp)

![Risk to Reward Ratio (Multiple Orders) Indicator for MT4 - Download - Free - [TFLab] 0](https://cdn.tradingfinder.com/image/106811/10-33-en-rrr-with-multiple-orders-mt4.webp)

![Risk to Reward Ratio (Multiple Orders) Indicator for MT4 - Download - Free - [TFLab] 1](https://cdn.tradingfinder.com/image/29688/10-33-en-rrr-with-multiple-orders-mt4-02.avif)

![Risk to Reward Ratio (Multiple Orders) Indicator for MT4 - Download - Free - [TFLab] 2](https://cdn.tradingfinder.com/image/29692/10-33-en-rrr-with-multiple-orders-mt4-03.avif)

![Risk to Reward Ratio (Multiple Orders) Indicator for MT4 - Download - Free - [TFLab] 3](https://cdn.tradingfinder.com/image/29698/10-33-en-rrr-with-multiple-orders-mt4-04.avif)

The Risk to Reward Ratio indicator is a tool in MetaTrader 4 indicator that identifies the ratio between the stop loss (SL) and take profit (TP) levels in trades. After opening a trade in MetaTrader and setting the SL and TP, the price difference between these levels and the entry point (Entry) is calculated and displayed as a ratio in the top left corner of the chart.

Traders can use this ratio to manage money and identify their risk-to-reward ratio (profit potential). This MT4 Money management indicator can also be used for multiple trades on different symbols.

Indicator Table

|

Indicator Categories:

|

Money Management MT4 Indicators

Trading Assist MT4 Indicators

Risk Management MT4 Indicators

|

|

Platforms:

|

MetaTrader 4 Indicators

|

|

Trading Skills:

|

Intermediate

|

|

Indicator Types:

|

Entry and Exit MT4 Indicators

|

|

Timeframe:

|

Multi-Timeframe MT4 Indicators

Daily & Weekly Timeframe MT4 Indicators

|

|

Trading Style:

|

Fast Scalper MT4 Indicators

Scalper MT4 Indicators

Swing Trading MT4 Indicators

|

|

Trading Instruments:

|

Share Stocks MT4 Indicators

Indices Market MT4 Indicators

Commodity Market MT4 Indicators

Stock Market MT4 Indicators

Cryptocurrency MT4 Indicators

Forex MT4 Indicators

|

Overview

One of the critical factors for success and profitability in trading is risk management, and every trader must adhere to it. One method for risk management is using an appropriate risk-to-reward ratio, and this tool is handy for traders who struggle with calculating the ratio between stop loss and take profit levels.

Risk to Reward Ratio in Buy Trades

In the image below, you see the price chart of Bitcoin (BTC) in a 15-minute timeframe. A buy trade (BUY) is opened for $54,578, with stop loss and take profit levels set. In buy trades, the take profit is above the entry point, while the stop loss is below it.

The Risk Reward Ratio indicator calculates the price difference between the SL and TP relative to the entry, resulting in a risk-to-reward ratio of 1:2, meaning the trader potentially risks $80 to earn $160.

Risk to Reward Ratio in Sell Trades

In the image below, you see the price chart of Binance Coin (BNB) in a 30-minute timeframe. A sell trade (Sell) is opened for $502, with stop loss and take profit levels set. In sell trades, the take profit is below the entry, while the stop loss is above it.

The Risk Reward Ratio indicator calculates the price difference between SL and TP relative to the entry, showing a risk-to-reward ratio of 1:3, meaning the trader potentially risks $50 to earn $150.

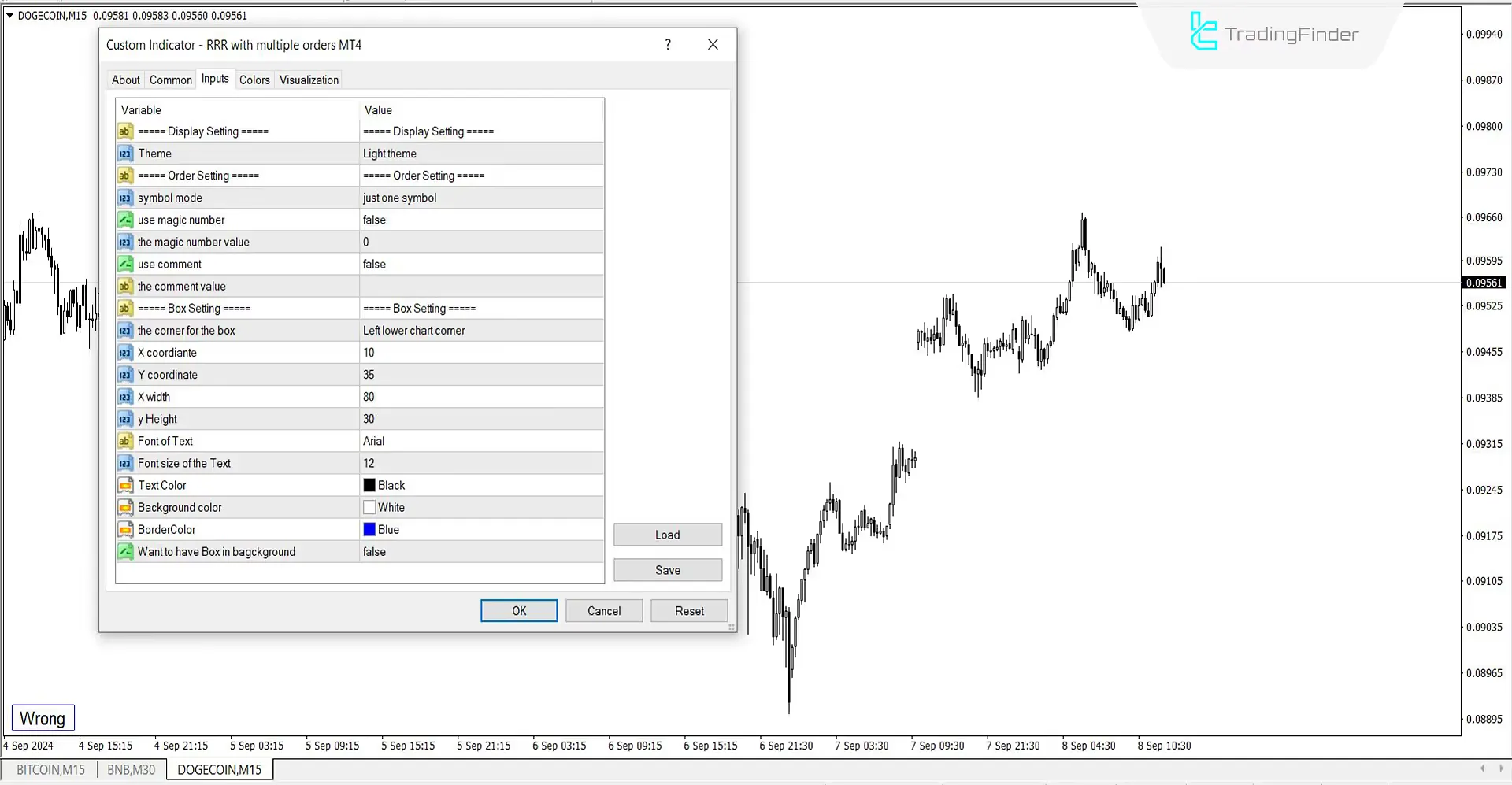

Indicator Settings

Display Setting

- Theme: Customize chart theme to either light or dark

- Order Setting

- symbol mode: Select just one symbol for use on a single trading symbol

- use magic number: Set false to disable magic number usage

- the magic number value: Input the value for the magic number

- use comment: Create a comment for the magic number

- the comment value: Set the value for the comment

Box Setting

- the corner for the box: Display the box in the bottom left corner

- X coordinate: Set the horizontal distance to 10

- Y coordinate: Set the vertical distance to 35

- X width: Set the box width to 80

- Y height: Set the box height to 80

- Font of Text: Set the font of the text inside the box

- Font size of the Text: Set the text size

- Text Color: Set the text color to black

- Background color: Set the background color to white

- BorderColor: Set the border color to blue

- Want to have Box in background: Set to false to avoid displaying the box in the foreground

Summary

Using risk and capital management tools is essential for all financial market traders. Before initiating trades, traders should assess their risk for each trade and enter with the appropriate volume.

Depending on their trading strategies, professional traders can utilize risk-to-reward ratios of 2 or higher. This indicator automatically calculates and displays the profit-to-loss ratio on the price chart.

In which markets can the Risk to Reward Indicator be used?

This indicator is essential for all traders with different trading strategies across all financial markets.

Can the Risk to Reward Indicator be used for multiple orders?

Yes, it can be used for multiple open trades on different symbols simultaneously.