![Cup and Handle Pattern Indicator for MetaTrader5 Download - Free - [TF Lab]](https://cdn.tradingfinder.com/image/106634/10-17-en-cup-and-handle-pattern-mt5.webp)

![Cup and Handle Pattern Indicator for MetaTrader5 Download - Free - [TF Lab] 0](https://cdn.tradingfinder.com/image/106634/10-17-en-cup-and-handle-pattern-mt5.webp)

![Cup and Handle Pattern Indicator for MetaTrader5 Download - Free - [TF Lab] 1](https://cdn.tradingfinder.com/image/32402/10-17-en-cup-pattern-mt5-02.avif)

![Cup and Handle Pattern Indicator for MetaTrader5 Download - Free - [TF Lab] 2](https://cdn.tradingfinder.com/image/32408/10-17-en-cup-pattern-mt5-03.avif)

![Cup and Handle Pattern Indicator for MetaTrader5 Download - Free - [TF Lab] 3](https://cdn.tradingfinder.com/image/32412/10-17-en-cup-pattern-mt5-04.avif)

The Cup and Handle Pattern Indicator is part of a series of MetaTrader 5 indicators that can automatically identify the Cup Pattern, a classic chart pattern in technical analysis, without needing to analyze the chart manually.

Forming chart patterns like the Cup Pattern is an excellent opportunity to identify a trend continuation (Trend) or a reversal. Thus, with blue lines, this indicator can identify Cup and Handle patterns on the chart and highlight them for traders.

Indicator Table

|

Indicator Categories:

|

Price Action MT5 Indicators

Chart & Classic MT5 Indicators

Candle Sticks MT5 Indicators

|

|

Platforms:

|

MetaTrader 5 Indicators

|

|

Trading Skills:

|

Intermediate

|

|

Indicator Types:

|

Breakout MT5 Indicators

Reversal MT5 Indicators

|

|

Timeframe:

|

Multi-Timeframe MT5 Indicators

|

|

Trading Style:

|

Day Trading MT5 Indicators

|

|

Trading Instruments:

|

Forex MT5 Indicators

Crypto MT5 Indicators

Stock MT5 Indicators

Commodity MT5 Indicators

Indices MT5 Indicators

Forward MT5 Indicators

Share Stock MT5 Indicators

|

Overview

One way to identify and trade in the direction of the trend or against it in volatile charts is to identify classic patterns such as Head and Shoulders (H&SH) and Ending Wedges. The Cup Pattern is also one of those patterns that, if identified correctly, can present a suitable trading opportunity.

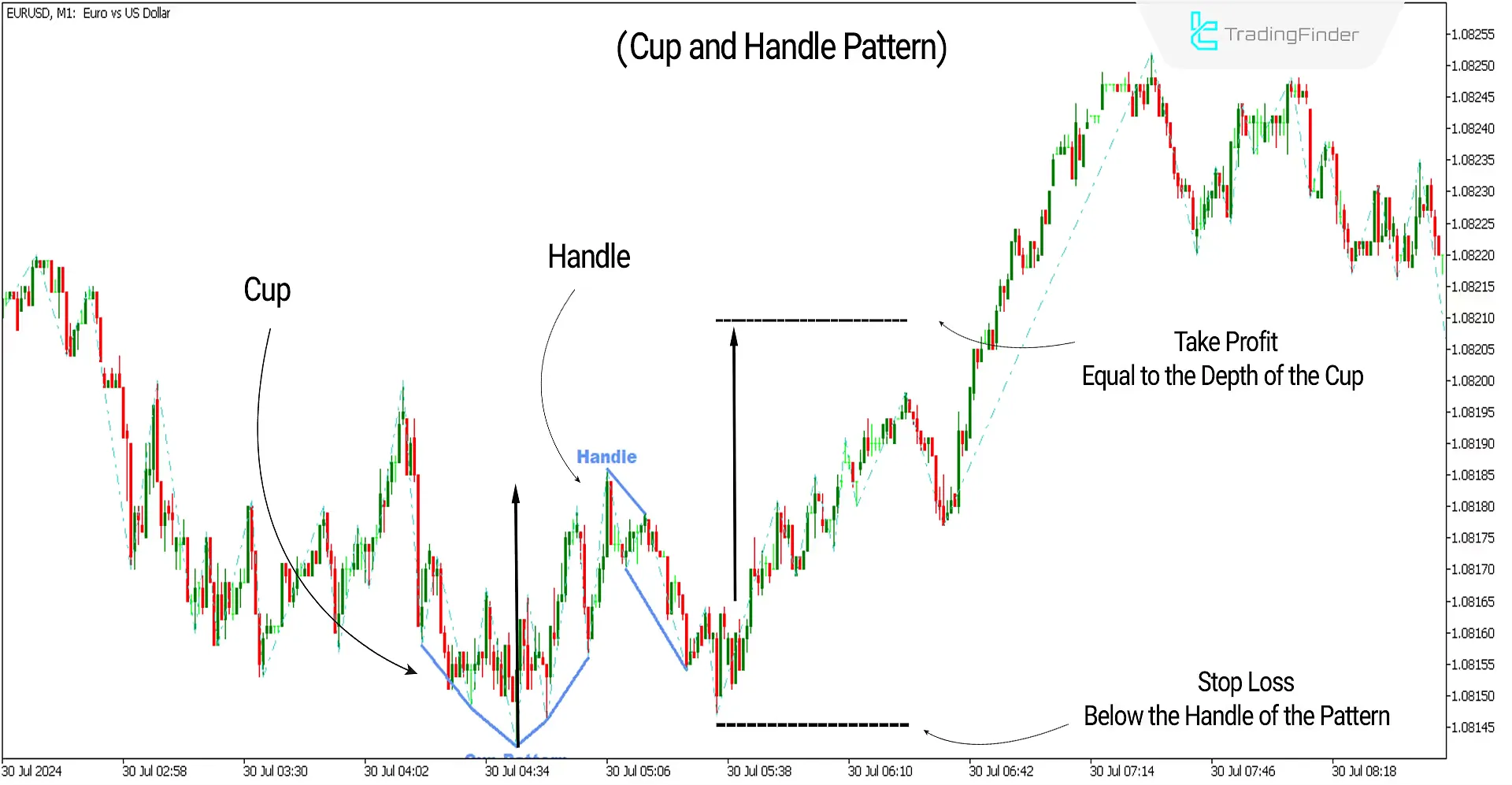

Buy Signal Conditions

The chart below shows the EUR/USD currency pair in a 1-minute timeframe. On July 30th, after a downward move, the indicator identified a Cup Pattern, which could indicate a trend reversal. After identifying and breaking the Handle, you can enter Buy Positions.

Take Profit and Stop Loss for the Cup and Handle Pattern

In this pattern, the stop loss can be set slightly below the Handle. To determine the Take Profit, consider the depth of the cup and add this distance to the breakout level.

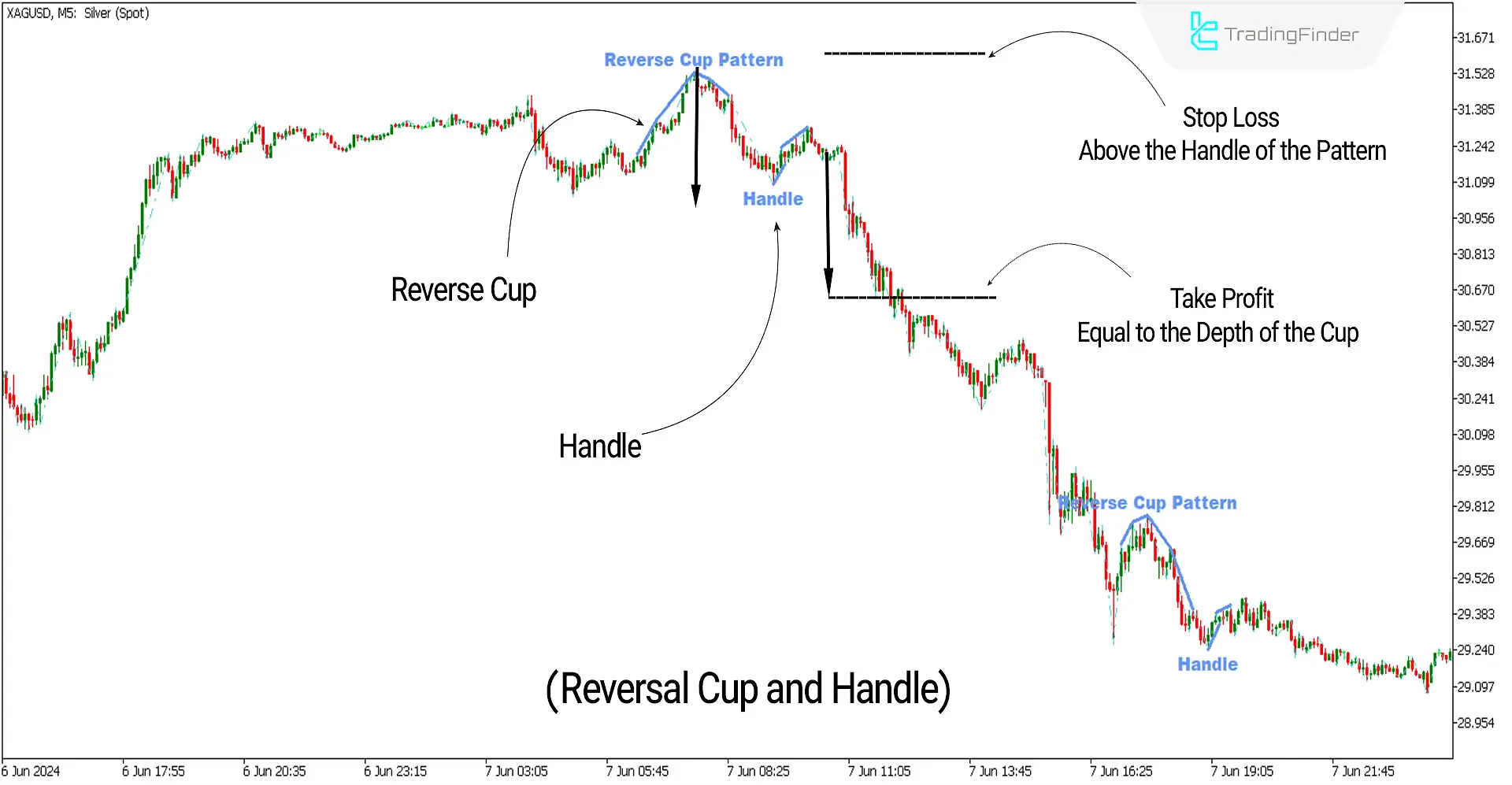

Sell Signal Conditions

The chart below shows the XAG/USD (Silver) price in a 5-minute timeframe. On June 7th, after an upward move, the indicator identified a Reverse Cup Pattern, which could indicate a trend reversal. After identifying and breaking the Handle, you can enter Sell Positions.

Take Profit and Stop Loss for the Reversal Cup and Handle Pattern

In this pattern, the stop loss can be set slightly above the Handle. To determine the Take Profit, consider the depth of the cup and add this distance to the breakout level.

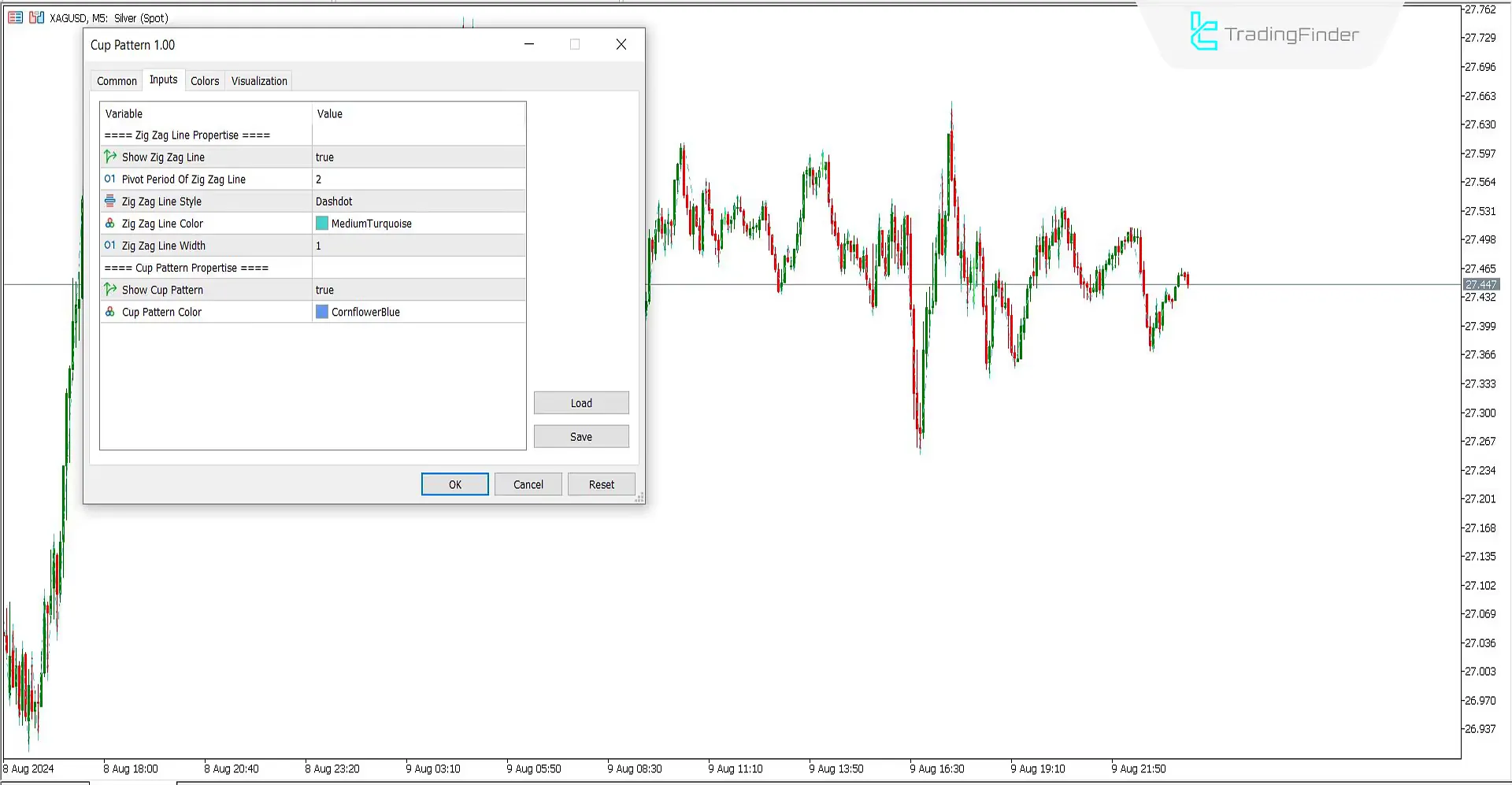

Cup and Handle Indicator Settings

- Zig Zag Line Properties

- Show Zig Zag Line: Set to true to display the Zig Zag line.

- Pivot Period Of Zig Zag Line: The Zig Zag line period is set to 2.

- Zig Zag Line Style: Displayed as a Dashdot line.

- Zig Zag Line Color: Blue, customizable.

- Zig Zag Line Width: Set to 1.

- Cup Pattern Properties

- Show Cup Pattern: Set to true to display the pattern.

- Cup Pattern Color: Dark Blue.

Conclusion

The Cup and Handle Pattern Indicator can be identified on many price charts and symbols, and it can be turned into trading opportunities. To better use this Classic pattern, you can combine the identified patterns with other tools and trading signals, such as divergences in MACD and RSI (Relative Strength Index).

Can the Cup and Handle pattern signals alone identify the price trend?

No, like all technical patterns, the Cup and Handle pattern may sometimes provide false signals. Therefore, it is recommended that other technical analysis tools be used for confirmation.

What are the disadvantages of the Cup and Handle pattern?

This pattern may sometimes not provide reliable signals, so attention should be paid to the trading volume around the handle breakout area.