![Vacuum Block (ICT) indicator for MT5 Download - free - [TradingFinder]](https://cdn.tradingfinder.com/image/127405/4-16-en-vacuum-block-mt5-1.webp)

![Vacuum Block (ICT) indicator for MT5 Download - free - [TradingFinder] 0](https://cdn.tradingfinder.com/image/127405/4-16-en-vacuum-block-mt5-1.webp)

![Vacuum Block (ICT) indicator for MT5 Download - free - [TradingFinder] 1](https://cdn.tradingfinder.com/image/127416/4-16-en-vacuum-block-mt5-4.webp)

![Vacuum Block (ICT) indicator for MT5 Download - free - [TradingFinder] 2](https://cdn.tradingfinder.com/image/127417/4-16-en-vacuum-block-mt5-3.webp)

![Vacuum Block (ICT) indicator for MT5 Download - free - [TradingFinder] 3](https://cdn.tradingfinder.com/image/127419/4-16-en-vacuum-block-mt5-2.webp)

The Vacuum Block indicator identifies price gaps in market analysis caused by inactivity or intense buy and sell pressure during high-volatility periods.

These zones often emerge in response to significant economic or political events, and due to inactive orders and the absence of necessary liquidity, prices revert to these areas. Vacuum blocks are categorized into bullish and bearish types and marked with orange.

Indicator Table

|

Indicator Categories:

|

Smart Money MT5 Indicators

Liquidity Indicators MT5 Indicators

ICT MT5 Indicators

|

|

Platforms:

|

MetaTrader 5 Indicators

|

|

Trading Skills:

|

Intermediate

|

|

Indicator Types:

|

Reversal MT5 Indicators

|

|

Timeframe:

|

Multi-Timeframe MT5 Indicators

|

|

Trading Style:

|

Day Trading MT5 Indicators

|

|

Trading Instruments:

|

Forex MT5 Indicators

Crypto MT5 Indicators

Stock MT5 Indicators

Commodity MT5 Indicators

Forward MT5 Indicators

Share Stock MT5 Indicators

|

Overview of the Indicator

A vacuum block represents a type of price gap that forms due to the difference between the previous day's closing price and the new day's opening price, creating a liquidity void. This concept means no trading occurs within this price range, resulting in a space without liquidity. Traders typically anticipate that the price will return to fill the gap and then move towards higher or lower levels.

Indicator in an Uptrend

On a 15-minute chart of the AUD/CHF currency pair, the price returns to this zone after a price gap forms to activate orders and absorb liquidity. This price action indicates the market's tendency to fill gaps and continue the prior trend. In these cases, traders seek buy confirmations on smaller time frames for entry.

Indicator in a Downtrend

A bearish vacuum block forms when the opening price of a new candlestick is lower than the closing price of the previous one. On an hourly chart of the EUR/USD currency pair, after a gap forms, the price returns to the liquidity void (marked in orange) to gather liquidity and then resumes its downward trend.

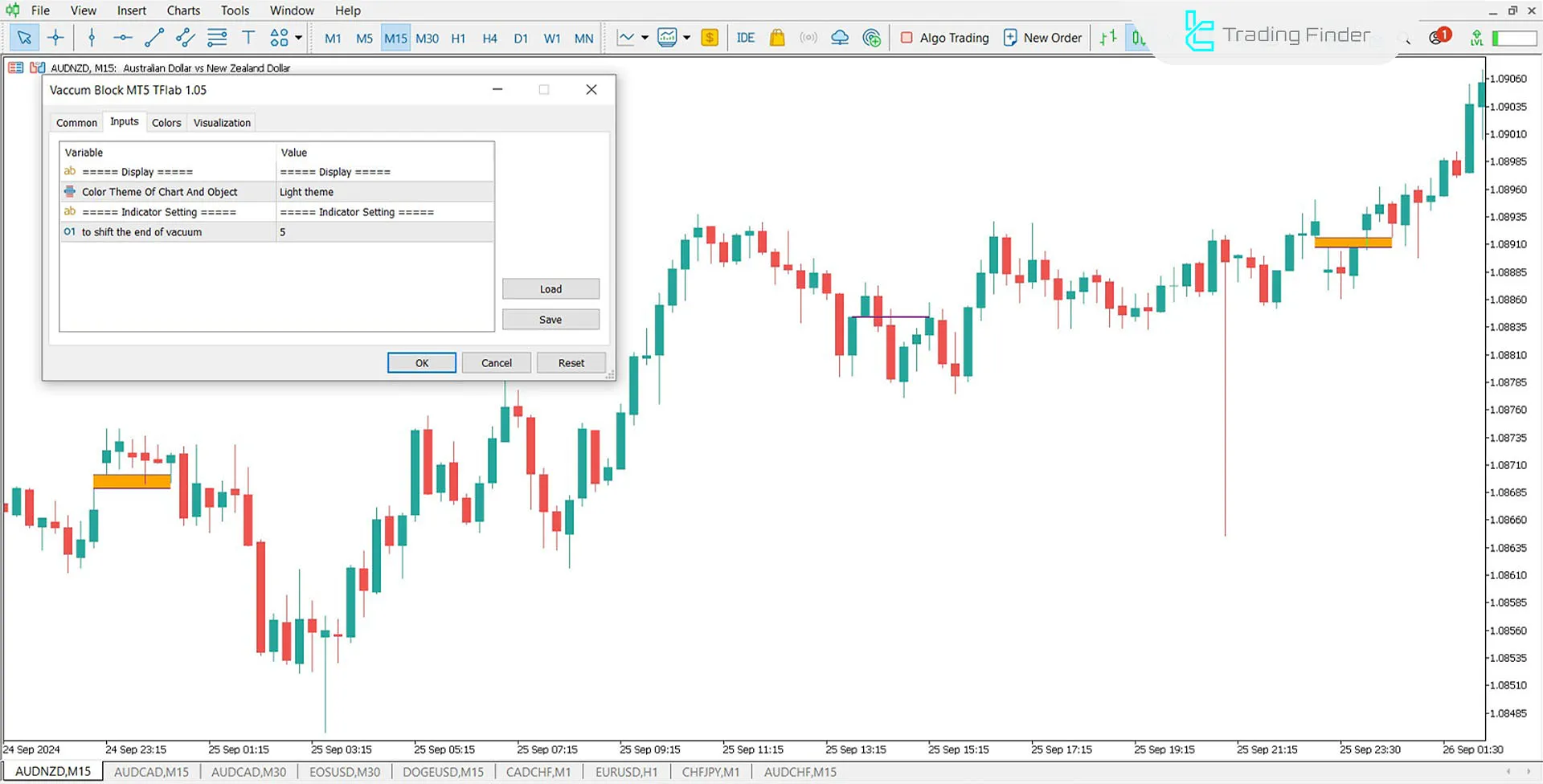

Indicator Settings

- Color theme of chart and object: Background color of the chart;

- To shift the end of the vacuum: Number of displayed vacuum block zones, with a default value of 5.

Conclusion

The vacuum block theory is a vital concept in trading that focuses on analyzing price gaps in the market. By identifying vacuum blocks and predicting market reactions to these gaps, traders can execute trades with a high probability of success, involving defined risk and significant profit potential.

However, risk management and proper stop loss and take profit levels are crucial for successful trading with vacuum blocks. These measures help traders mitigate potential risks and maximize profits.

What is a vacuum block?

A type of price gap forms due to the difference between the previous day's closing price and the current day's opening price, helping to identify liquidity voids.

Can vacuum blocks be used in all time frames?

Yes, the vacuum block indicator is multi-time, allowing traders to use different time frames to identify entry and exit points.