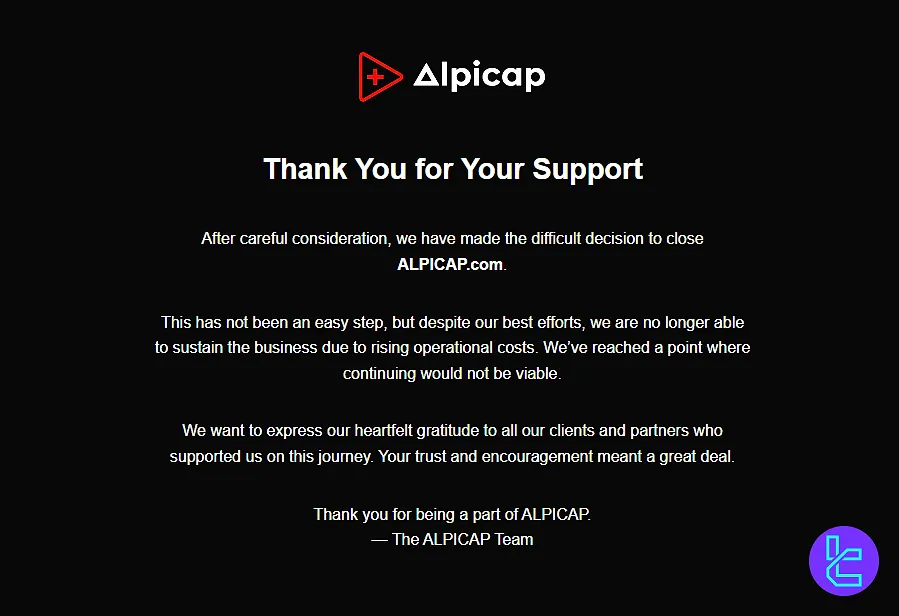

During our latest check on the prop firm's website, we found out that ALPICAP has ceased operations due to "rising operational costs". Here's the current homepage of the site:

ALPICAP is a prop firm with a 2-step evaluation model across all its 5 accounts. These accounts come in $15K, $25K, $50K, $100K, and $200K sizes.

The company gives 30 days for the 1st evaluation phase and 60 days for the second. Also, the minimum trading period is 5 days.

Company Overview: Key Information and Specifics

ALPICAP LTD is a proprietary trading firm founded and headquartered in 12 quai du Seujet, 1201 Geneva, Switzerland. This firm does not reveal much information about its company, just like most competitors.

However, it's worth mentioning that the firm partners with the Eightcap broker to provide trading services. This brokerage is regulated by top-tier financial authorities, including ASIC, CySEC, and FCA.

Summary Of Features

In this section, we will have a bird's eye on key specifications of the prop firm in the form of a table:

Account Currency | USD |

Minimum Price | $99 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Upgradable to 90% |

Instruments | CFDs on Forex, Commodities, Shares, Indices, and Crypto |

Assets | +1,000 |

Evaluation Steps | 2-Step |

Withdrawal Methods | Crypto, Bank Transfer |

Maximum Fund Size | $200K |

First Profit Target | 10% |

Max. Daily Loss | 5% |

Challenge Time Limit | 30 Days for the 1st Phase 60 Days for the 2nd Phase |

News Trading | Allowed |

Maximum Total Drawdown | Upgradable to 12% |

Trading Platforms | Metatrader 4 |

Commission Per Round Lot | Not Specified |

Trustpilot Score | 4.5/5 |

Payout Frequency | Bi-weekly (The first payout is done after 30 days) |

Established Country | Switzerland |

Established Year | 2022 |

Benefits and Drawbacks

Let's face it, no prop firm is perfect. But there's no urge to work with a perfect one. Here's the good and the bad of trading with ALPICAP:

Benefits | Drawbacks |

Customizable Features With Add-Ons Like 90% Profit Split And Increased Drawdown | Minimum 5 trading days requirement |

Wide Range of Trading Instruments | First payout after 30 days |

Leverage Up To 1:100 | Time Limit for Passing The Evaluation |

Partnership With Eightcap | - |

Program Funding and Initial Fees

ALPICAP offers a smorgasbord of account sizes to suit every trader's appetite. In the table below, you will see the price and funding variety:

Funding | Price |

$15K | $99 |

$25K | $149 |

$50K | $299 |

$100K | $499 |

$200K | $977 |

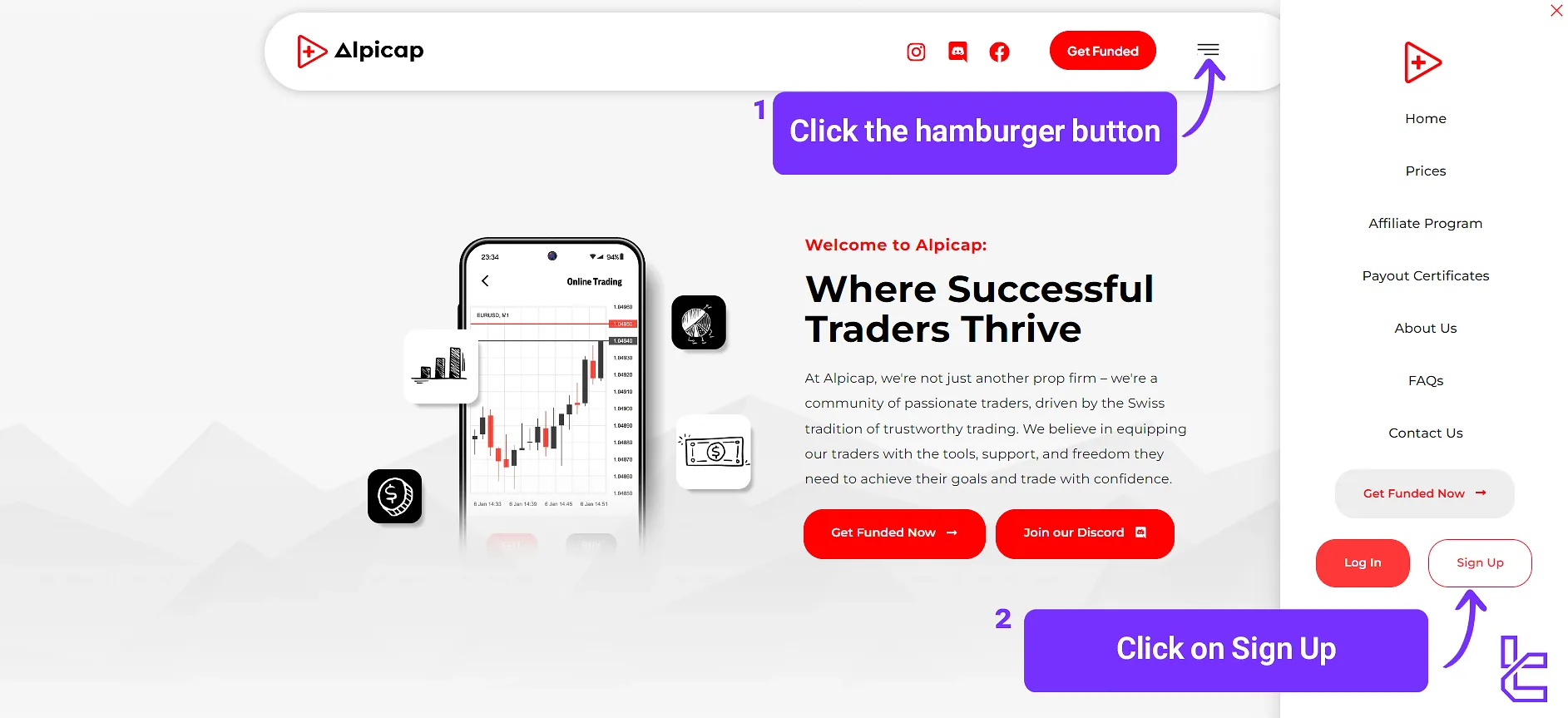

Register and Verify on ALPICAP

Ready to start working with ALPICAP as a trader? In this section, we will have a quick guide on registration with this prop firm:

- Visit the official website of the company;

- Click the hamburger button at the top right of the page, then click "Sign Up";

- Choose your account size and the trading platform;

- Fill the required details in the "Billing Info" form;

- Enter the discount code if you have any;

- Click "Create Order" and pay for the account.

Now, your account is ready. For verification, submit the required proof of identity and proof of address documents.

Evaluation Stages and Challenge Rules

Alright, let's talk about ALPICAP's evaluation process. It's not a walk in the park, but it might be worth it for you. The firm's evaluation is done only on a two-step model with these rules:

Max. Daily Loss | 5% |

Max. Total Drawdown | Upgradable to 12% |

Leverage | 1:100 |

Profit Split | Upgradable to 90% |

Min. Trading Days | 5 |

Profit Target (Phase 1 - Phase 2) | 10-5% |

Time Limit (Phase 1 - Phase 2) | 30-60 Days |

Bonuses And Promotions: Does ALPICAP Offer Anything?

While the firm does not offer any bonuses or promotions like those found in Forex brokers, there are some discount codes available online. We found one: NEW50 for a 50% discount on accounts for new clients.

Which Trading Platforms Are Employed by ALPICAP?

When it comes to trading platforms, the firm keeps it classic with Eightcap's MetaTrader 4. It's like the Swiss Army knife of trading platforms – reliable, versatile, and loved by traders worldwide. Key Features of MT4 in ALPICAP:

- Flexibility in trading systems

- Automated trading with Expert Advisors

- More than 2,700 free and paid indicators, built-in and custom

- A reliable platform for all trading needs

Tradable Instruments and Available Markets

We investigated the prop firm's website and found nothing related to the trading symbols, but they should be the same as those in the Eightcap broker:

- Forex CFDs

- Commodity CFDs

- Index CFDs

- Share CFDs

- Crypto CFDs

MT4 in ALPICAP provides over 1,000 tradable instruments.

Payment Methods for Payouts and Prices

When it comes to paying for your ALPICAP account or withdrawing your profits, they keep it simple and secure. Here's the lowdown on your options:

- Bank Transfer: More processing time but a familiar method

- Crypto: For the digital natives and privacy enthusiasts

Commissions And Costs

When it comes to commissions and costs, ALPICAP does not provide much data, especially in trading. Based on our investigations, the only piece of information on the website that is related to fees is the initial price for challenges, and this was discussed before in this review.

Does ALPICAP Offer Any Educational Resources?

This prop firm doesn't believe in the benefits of educating its clients, as there is no content with such a purpose on the website. The only section that can be considered educational is the FAQ page, which contains answers to common questions about the firm's services.

You can access comprehensive learning materials through TradingFinder's Forex education section.

Trust Scores

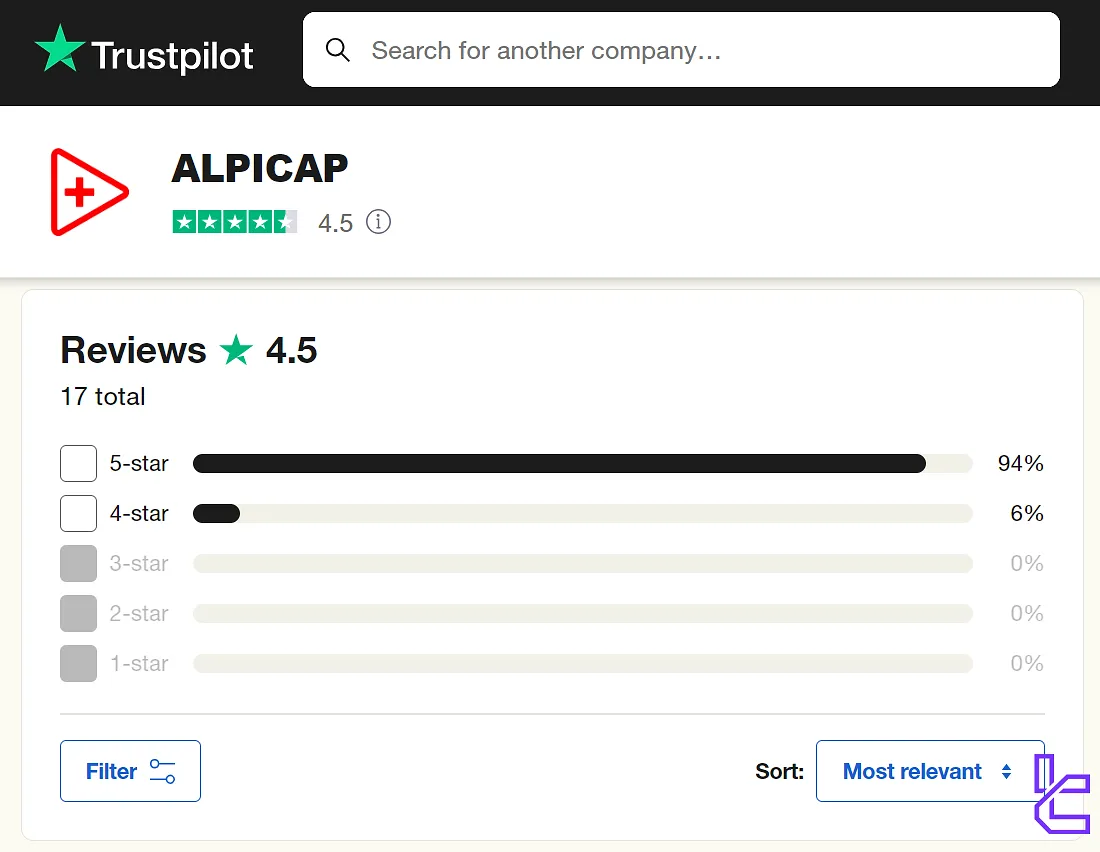

Trust is crucial in the world of prop trading, and there are websites such as Trustpilot that assess this parameter. Let's examine the ALPICAP Trustpilot profile and its score:

- Rating: 4.5 out of 5

- Number of all reviews: +15

- Percentage of 5-Star ratings: +90%

Unfortunately, the number of reviews is too low; therefore, we cannot verify the reliability of this trust score. Also, there are no reviews on other sources. This can be because the firm is still young in the industry.

Customer Support: Contact Methods and Working Hours

ALPICAP is a company that tries to provide decent support services for its clients since the team is available 24/7. You can contact them via these options:

- Email: support@alpicap.com

- Live Chat: On the website

- Ticket: Via the website

Channels on Social Media Platforms

In today's digital age, a strong social media presence is crucial for building trust and engaging with the trading community. Social Network Pages of ALPICAP:

- Discord

Expert Suggestions

ALPICAP partners with Eightcap, a regulated brokerage, to provide its trading services. "ScamAdviser", an evaluation platform, has given the prop firm's website a trustscore of 56/100.

Furthermore, users on "Trustpilot" have given a 4.5/5 score. The number of reviews is less than 20.