QuantTekel rules are established to cover news trading restrictions, position holding over weekends, leverage limits, maximum exposure, and breach cases.

News trading is permitted under specific conditions, but weekend trading is prohibited.

QuantTekel Rules Overview

Like many of the Prop Firms, QuantTekel (formerly AscendX Capital) enforces several trading rules designed to maintain stability within the trading environment; QuantTekel Restriction Topics:

- News Trading

- Weekend Positions

- Leverage Limits

- Maximum Exposure

- Breach Cases

QuantTekel News Trading Rule

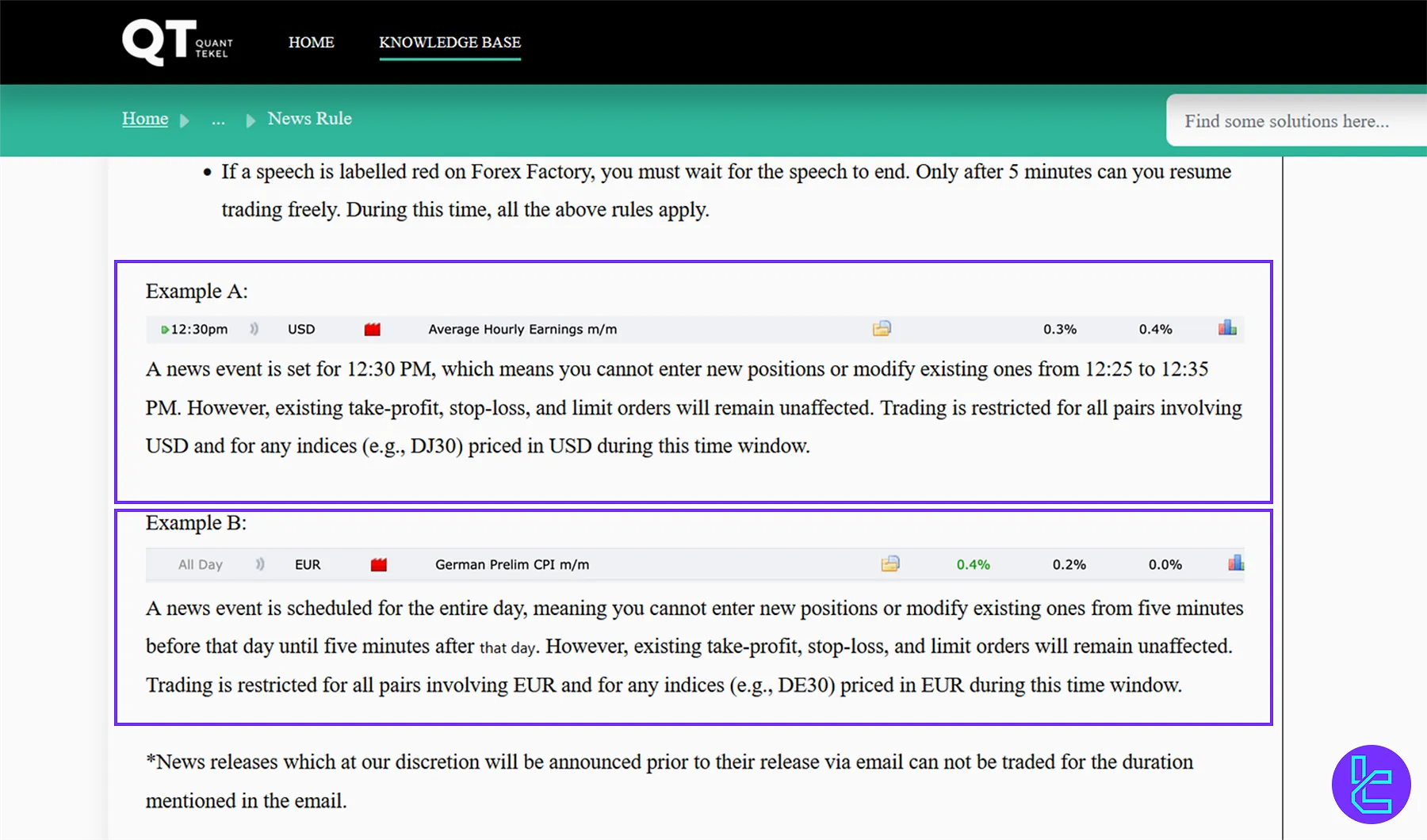

To minimize volatility risks, QuantTekel imposes restrictions on news trading; QuantTekel News Rules:

- Timing Restriction: No manual trade actions5 minutes before or after high-impact news releases;

- Permissible Orders: Pre-set limit orders with SL & TP are allowed if placed 5+ minutes before the news;

- Prohibited Actions: Nomanual trading, modifying SL/TP, or order changes during restricted periods;

- Affected News: Includes CPI, FOMC, NFP, PMI, and all red folder news impacting specific currencies;

- Violations & Enforcement: Soft breach for violations; Forex Factory (MT5 time) is the news reference source.

QuantTekel Maximum Exposure Rule

The firm enforces maximum exposure limits to control risk; Maximum Exposure Rules in QuantTekel:

- Exposure Limit: Total exposure must not exceed 2% of balance/equity; per position limit is 1.5%;

- Gambling Rule: The "all or nothing" approach is strictly prohibited in trading;

- Consequences: Soft breach & profit forfeiture for violating exposure limits.

QuantTekel Weekend Trade Rules

As with many Prop Firms, weekend trading is prohibited under QuantTekel’s policies; QuantTekel Weekend Trading Limits:

- Weekend Trading: Not allowed; trading follows standard Forex market hours;

- Holding Positions: Allowed over weekends, but subject to market gaps and swap fees;

- Risk & Fees: Swap fees triple over weekends; check broker policies for specifics.

QuantTekel Leverage Rules

Leverage limits are implemented to protect traders from excessive market exposure; QuantTekel’s Leverage Policy:

- Standard Leverage: Up to1:30 for major forex pairs

- Indices & Commodities: Up to 1:15

- Crypto: up to1:1

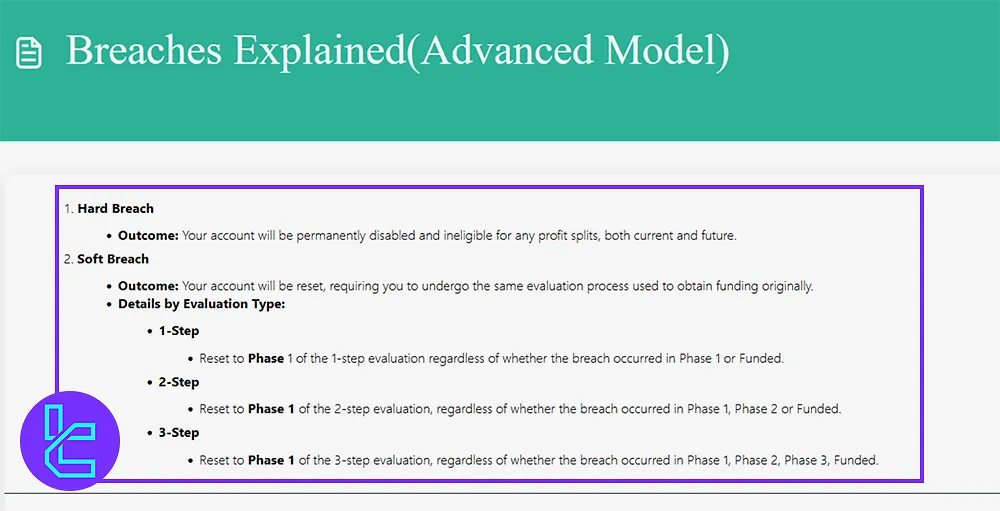

QuantTekel Breach Cases

QuantTekel classifies breaches into soft breaches (warnings) and hard breaches (serious violations leading to account closure; QuantTekel Breaches:

Breach Type | Result |

Hard Breach | Permanent account termination; no eligibility for current or future profit splits. |

Soft Breach | Account reset; trader must restart the evaluation process from the beginning. |

1-Step Model | Reset to Phase 1, regardless of whether the violation occurred in Phase 1 or Funded stage. |

2-Step Model | Reset to Phase 1, even if the breach happened in Phase 1, Phase 2, or Funded stage. |

3-Step Model | Reset to Phase 1, regardless of whether the violation occurred in Phase 1, Phase 2, Phase 3, or Funded stage. |

A hard breach leads to permanent disqualification, while a soft breach requires restarting the evaluation process from the first phase.

Writer’s Opinion and Conclusion

QuantTekel rules enforce leverage up to 1:30 in Forex, 1:15 for commodities, and No Leverage for Crypto.

Breach cases are divided into soft breaches, which result in warnings, and hard breaches, which may lead to account termination.

If you feel comfortable with these rules, click the registration button below. You can also check QuantTekel Tutorials for more articles.