Axe Trader Rules enforce Challenges with varying Daily Loss and Max Drawdown limits, such as 4% and 6%, respectively.

Holding Positions over weekends and News Trading is allowed, but traders must manage Market Gaps and High Volatility.

The First Payout can be requested after 8 Days, with limits of $100 to $1,500, processed in 24-48 Hours every 7 Days.

Axe Trader Rule Topics

As with many platforms, Axe Trader Prop Firm has several important policies traders must follow; Axe Trader Condition Topics:

- Challenge Rules

- Holding Positions Over the Weekend

- News Trading

- Copy Trading

- Payout Rules

- Prohibited Strategies

- Breach Consequences

Axe Trader Challenge Rules

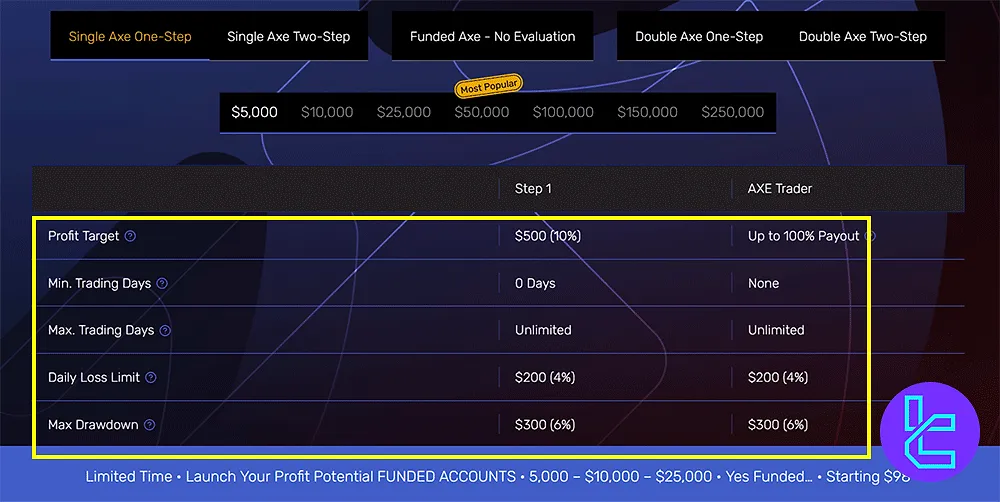

Axe Trader offers different challenge types, each with specific drawdown limits and profit targets; Axe Trader Evaluation Rules:

Challenge Type | Daily Loss Limit | Max Drawdown | Profit Target |

Single Axe One-Step | 4% | 6% | 10% |

Single Axe Two-Step | 5% | 10% | 8% / 5% |

Double Axe One-Step | 4% | 6% | 10% |

Double Axe Two-Step | 5% | 10% | 10% / 5% |

Funded Axe (No Eval) | 3% | 6% | - |

There are no time limits for completing these challenges.

Axe Trader Holding Positions Over the Weekend

Traders are allowed to hold positions over the weekend without restrictions; Axe Over the Weekend Rules:

- Weekend trading does not affect account status;

- Traders should manage risk, as weekend gaps can impact positions.

Axe Trader News Trading

As with many Prof Firms, Axe Trader allows opening positions during news events if pricing data is available; Axe News Trading Considerations:

- High volatility may lead to higher-than-normal slippage;

- Trading reversals may occur if trades exploit price errors;

- Excessive leverage and improper risk management are prohibited.

Axe Trader Copy Trading

Copy trading is permitted, but traders assume full responsibility for any risks associated with it; Axe Copy Trade Rules:

- Axe Trader does not offer trade resets due to copier errors;

- Traders must ensure their strategy aligns with Axe Trader's risk management policies.

Axe Trader Payout Rules

Axe Trader has a structured payout system that ensures fair withdrawals for traders; Axe Withdrawal Conditions:

- First payout request allowed after 8 trading days (excluding weekends;)

- Minimum payout: is $100;

- Maximum payout is $1,500 per week for Evaluation accounts;

- Payouts processes within 24-48 hours (excluding weekends;)

- Requests can be made every 7 days.

Axe Trader Prohibited Strategies

To maintain a fair trading environment, Axe Trader prohibits specific trading strategies; Forbidden Practices on Axe:

- Hedging

- Expert Advisors (EAs)

- Martingale

Traders using these strategies may face account termination or loss of simulated profits.

Axe Trader Breach Consequences

Violating Axe Trader’s rules can result in serious penalties, including loss of payouts and account restrictions; Axe Breach Consequences:

- Implementing consistency rules

- Restricting lot sizes

- Reducing leverage

- Lowering the maximum weekly payout

- Applying a trailing drawdown

- Tagging and reversing news trades

Severe violations may lead to forfeiture of simulated profits and fees paid to the firm.

Writer’s Opinion and Conclusion

Axe Trader Rules allow Copy Trading at traders’ discretion, but no Trade Resets are offered.

Prohibited Strategies like Hedging, Expert Advisors, and Martingale result in Account Termination.

Breach Consequences include Leverage Reduction, Lot Size restrictions, and Trailing Drawdown application.

To learn more about the firm, check out Axe Trader Tutorials.