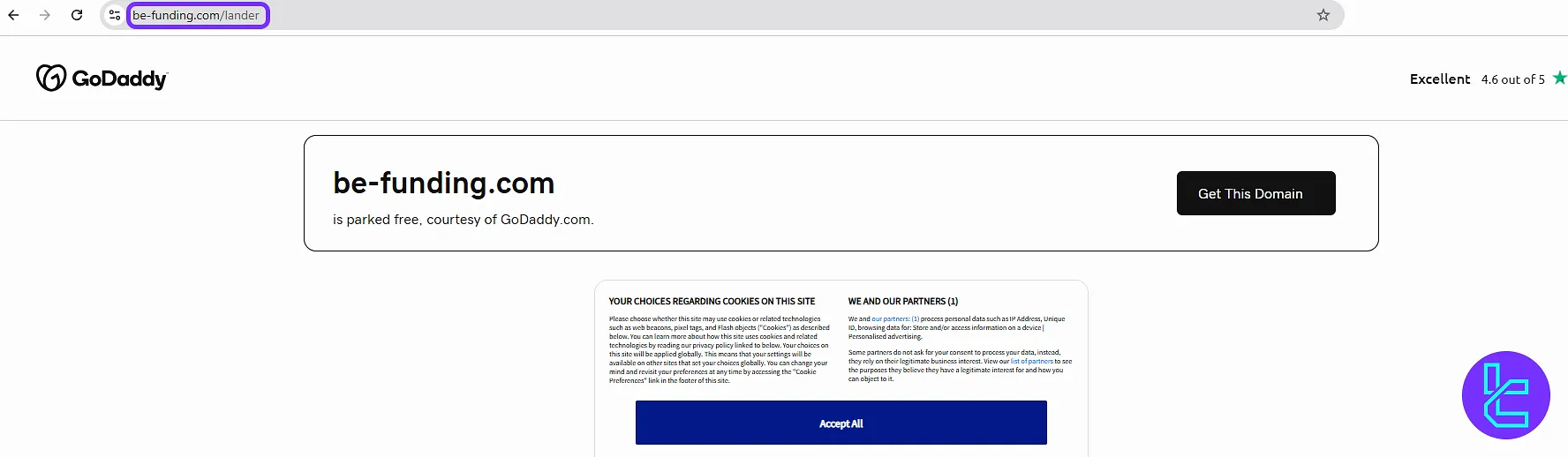

We just visited Be Funding's website again, as part of our regular checks on firms, and faced such a webpage instead of the mentioned prop firm's official website:

As shown in the screenshot above, the company's website is no longer available, and its domain is no longer registered under Be Funding. Based on the available evidence, we can conclude that the prop firm has ceased operations.

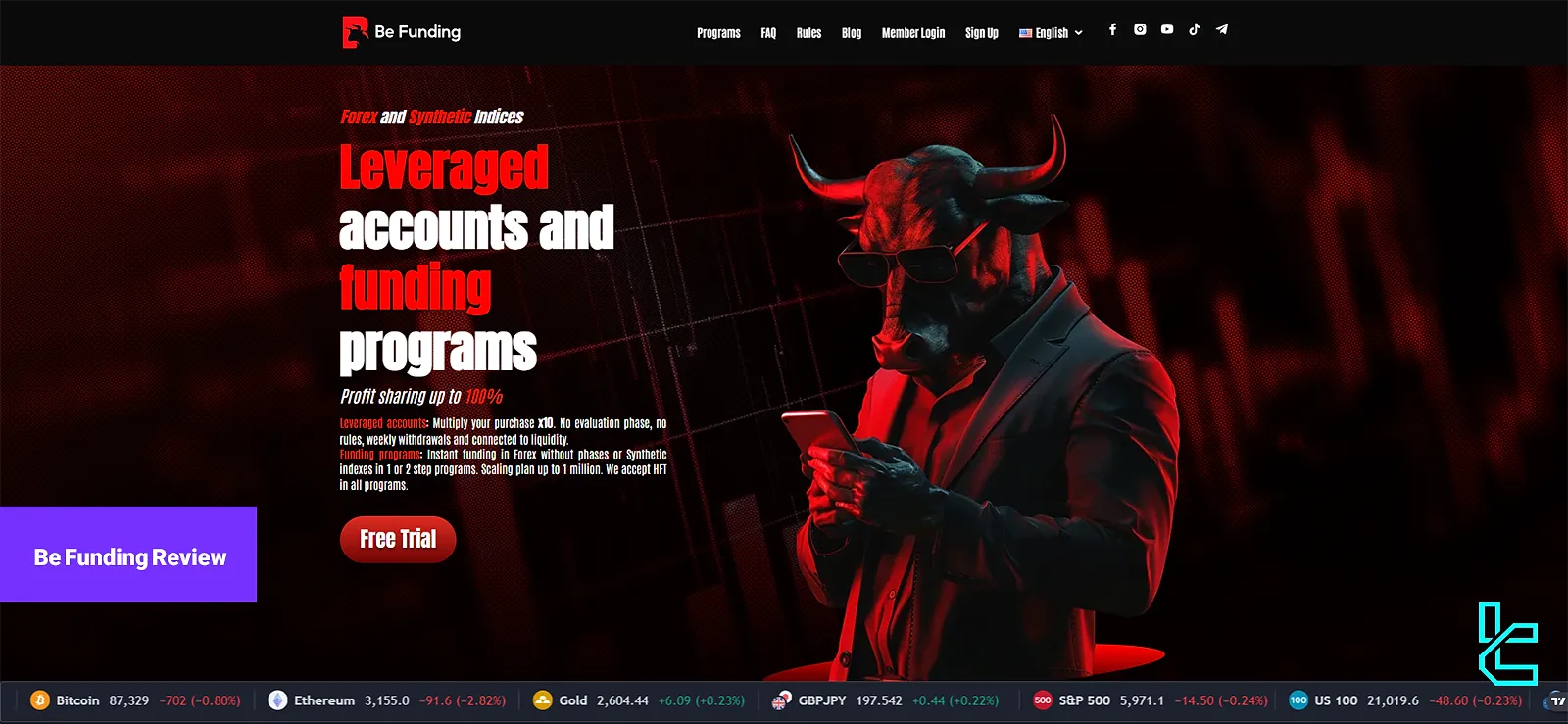

Be Funding is a proprietary trading platform recognized for its trader-friendly pricing and attractive conditions.

With a low entry challenge fee of $70 and the potential for up to 100% profit splits in leveraged accounts, the firm caters to both aspiring and experienced traders.

Programs like theSynthetic Indices 1-phase feature an 8% profit target and a maximum daily loss limit of 5%.

Maximum leverage is capped at 1:10, ensuring a controlled trading environment while allowing significant market exposure.

Be Funding offers funding programs that extend up to $500,000 and emphasizes trading in Forex and Synthetic Indices, including major assets like EUR/USD and S&P 500.

Company Overview

Be Funding (Be Solutions FZC) has emerged in the competitive landscape of proprietary trading firms as a registered entity in the United Arab Emirates, Block B Office-B36-044, SRTI Park, Sharjah. Here's what we've gleaned about Be Funding:

- Founded: Recent entrant to the prop trading scene

- Unique Selling Point: Both 1-step and 2-step evaluation programs

- Target Market: Aspiring and experienced traders seeking substantial trading capital

Be Funding's relative obscurity doesn't necessarily reflect its potential. Many traders are drawn to newer firms for their often innovative approaches and competitive offerings.

However, this newness also means that prospective traders should approach the prop firm with a healthy dose of caution and due diligence.

Specifications Summary

Let's break down the key specifications that define Be Funding's offering:

Account currency | USD |

Minimum price | $70 |

Maximum leverage | 1:10 |

Maximum profit split | 100% (in leveraged account) |

Instruments | Forex, Indices |

Assets | EUR/USD, S&P 500, Dow Jones, GBP/USD and more |

Evaluation steps | 1-step, 2-step |

Trading platform | MTR |

Withdrawal methods | Cryptocurrencies, Stablecoins |

Maximum fund size | $500K |

First profit target | 5% |

Max. daily loss | 5% |

Challenge time limit | No limits |

News trading | Allowed |

Maximum total drawdown | 10% |

Commission per round lot | N/A |

Trustpilot score | 2.6 |

Payout frequency | 14 | 7 |

Established country | UAE |

Established year | N/A |

This snapshot gives us a glimpse into Be Funding's competitive edge - a diverse range of evaluation options and an attractive profit split. But as always, the devil's in the details, which we'll explore further.

Pros & Cons of Be Funding

Every prop firm has its strengths and weaknesses. Here's how Be Funding stacks up:

Pros | Cons |

Flexible evaluation options (1-step, 2-step, Instant) | Limited track record as a new firm |

Attractive profit split (up to 100%) | Fewer user reviews compared to established firms |

Forex and Synthetic Indices trading available | Limited educational resources |

Competitive challenge fees | - |

While Be Funding shows promise with its flexible programs and generous profit split, its newness in the market means traders should proceed with caution and conduct thorough research before committing.

Funding & Prices

The funding amount and the prices vary based on the program type. In fact, there are 4 types of challenges with different phases:

- Synthetic Indices

- Forex

- Synthetic Indices

- Forex – Synthetic Indices

Synthetic Indices

Here is the Synthetic Indices program and its costs:

Capital | Price for Synthetic Indices – 1 phase |

$2K | $70 |

$5K | $100 |

$10K | $200 |

$25K | $350 |

$50K | $600 |

$75K | $900 |

$100K | $1100 |

$150K | $1600 |

Forex

The prop firm has a different approach to setting prices in the Forex challenge type:

Funding | Price for Forex – Instant funding |

$10K | $120 |

$15K | $190 |

$25K | $290 |

$50K | $390 |

$100K | $590 |

$200K | $990 |

$300K | $1890 |

$500K | $3690 |

Synthetic Indices

Here is what you need to know about the Synthetic Indices challenge and its prices:

Capital | Price (2-phase) |

$5K | $75 |

$10K | $145 |

$25K | $245 |

$50K | $445 |

$100K | $845 |

Forex – Synthetic Indices

Here is the Forex – Synthetic Indices with different conditions:

Capital | Price (1-phase) |

$5K | $300 |

$10K | $500 |

$25K | $1000 |

$50K | $1,500 |

$100K | $2,500 |

$200K | $2,000 |

The diverse range of options allows traders to choose a program that best fits their trading style and financial capacity. The pricing structure appears competitive, especially for those seeking higher funding amounts.

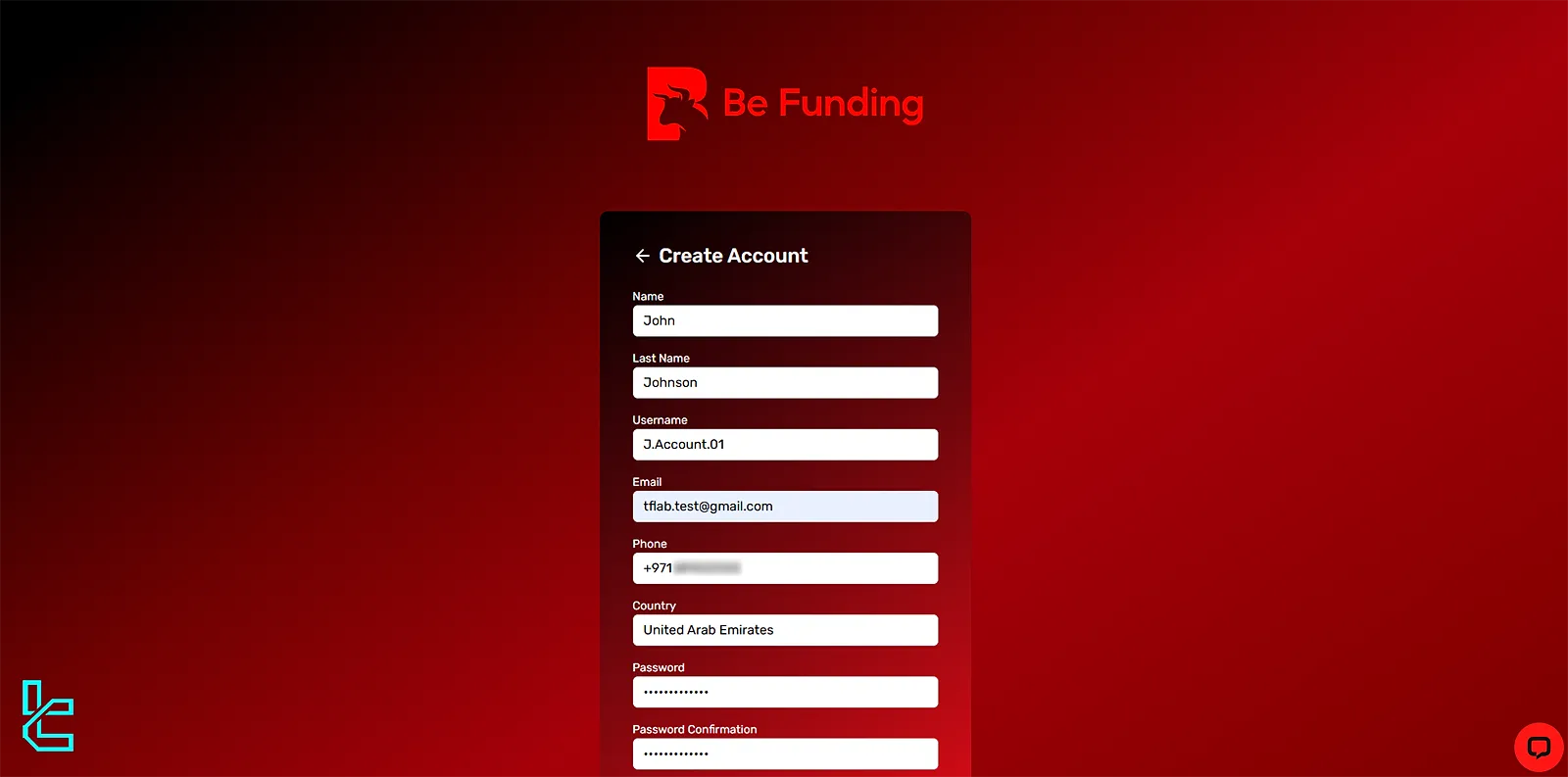

Registration & Verification

Signing up with Be Funding prop firm involves a straightforward process, but there are important verification steps to be aware of:

- Head to the official website and click on Sign Up;

- Fill in the registration form with your personal details and set a username and password;

- Answer the Captcha;

- Agree to the terms/conditions and that you are not a US citizen;

- Activate your account by the email sent to your Inbox.

Verification Requirements (for withdrawals):

- Identity verification (government-issued ID)

- Address verification (utility bill or bank statement)

- The signing of the trader agreement document

It's crucial to note that while you can start trading immediately after payment, verification is mandatory for withdrawals. This is a standard practice in the industry to ensure compliance with financial regulations and prevent fraud.

Be Funding’s Evaluation Steps

As many prop firms, Be Funding offers a variety of evaluation processes to suit different traders:

Program | Profit Target | Max Daily Loss | Max Total Loss |

Synthetic Indices 1-phase | 8% | 5% | 10% |

Forex – Instant funding | - | 5% | 8% |

Synthetic Indices 2-phase | 10% / 5% | 5% | 10% |

Forex – Synthetic Indices (1-phase) | 8% | 5% | 10% |

Each program has its own set of rules, profit targets, and drawdown limits. Traders should carefully review the specifics of their chosen program before starting the evaluation.

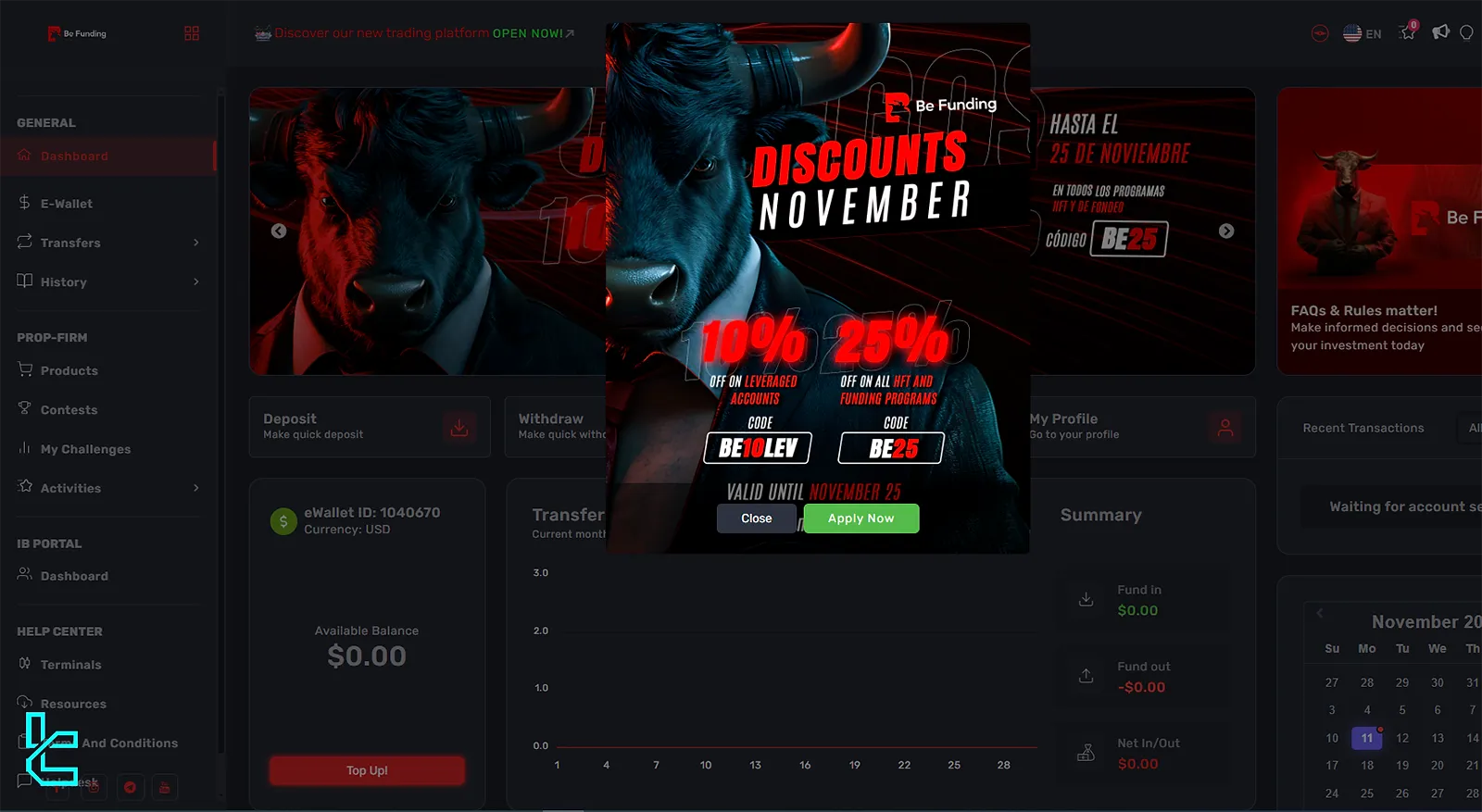

Bonuses and Discounts

Be Funding sweetens the deal with some attractive bonuses and discounts:

- 10% off on leveraged accounts: Use codeB10LEV to get a 10% discount on leveraged account challenges;

- 25% off on HFT and funding programs: Apply codeBE25 for a significant 25% discount on High-Frequency Trading and other funding programs.

These discounts can substantially reduce the entry cost, making Be Funding's programs more accessible to a wider range of traders.

Trading Platforms and Apps

Be Funding keeps it simple when it comes to trading platforms, focusing solely on the MTR. This platform is a specialized online trading platform developed by Match-Trader (also referred to as MTR), designed primarily for brokers and financial institutions offering forex, cryptocurrency, and CFD trading services.

What Instruments & Symbols Can I Trade on Be Funding prop firm?

Be Funding offers a focused selection of trading instruments, catering primarily to the forex market andsynthetic indices traders:

- Forex: Major, minor, and exotic currency pairs

- Synthetic Indices: Volatility indices and other synthetic markets

While the range might seem limited compared to firms offering stocks or commodities, this specialization allows Be Funding to provide deep liquidity and competitive spreads in these specific markets.

Payment Methods

Be Funding embraces both traditional and modern payment solutions:

Deposits | Withdrawals |

Cryptocurrencies (various coins) | Cryptocurrencies |

Stablecoins | Stablecoins |

Visa and Mastercard | - |

The inclusion of cryptocurrency options is a nod to the evolving financial landscape, offering traders more flexibility in how they fund their accounts and receive profits.

Commission & Cost Structure

Be Funding's trading fee structure is not explicitly detailed, but here's what we can infer:

- Challenge fees appear to cover most costs associated with trading;

- No clear information on additional commissions or spreads.

The lack of transparent information about additional costs is a point of concern. Prospective traders should reach out to Be Funding prop firm directly for a clear breakdown of any hidden fees or costs beyond the initial challenge fee.

Does Be Funding Offer Vast Educational Resources?

Unfortunately, Be Funding's educational offerings appear to be limited compared to some competitors:

- Blog: Trading insights and company updates

- FAQs: Basic information about the firm's programs and policies

This lack of extensive educational resources could be a drawback for newer traders or those looking to continuously improve their skills.

Check TradingFinder's Forex education section for comprehensive tutorials about the market and its trading conditions.

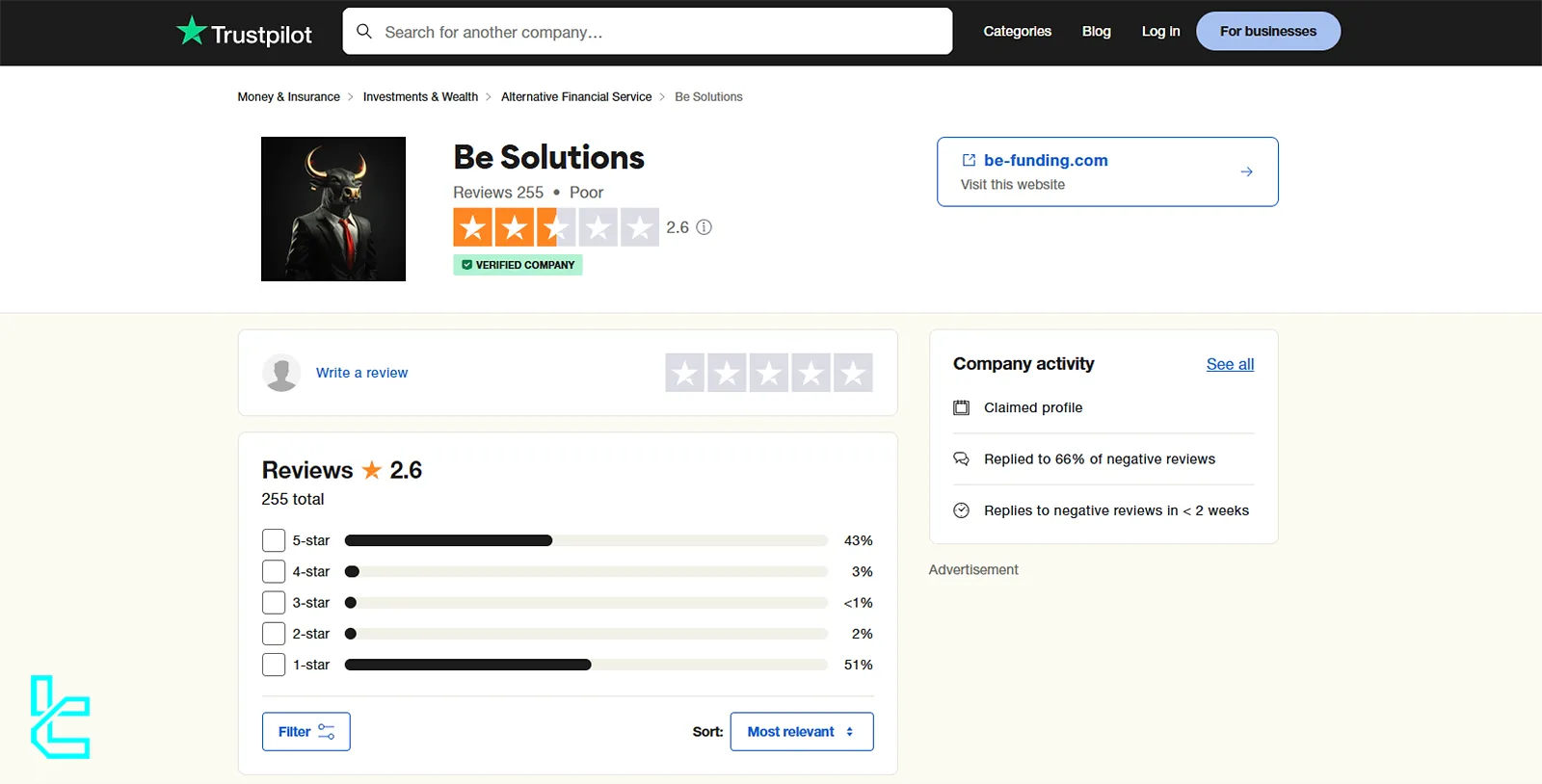

Trust Scores on Trustpilot

The Be Funding Trustpilot profile has received mixed reviews, raising some concerns:

- Current Trustpilot score: 2.6 out of 5 (considered poor)

- A limited number of reviews, possibly due to the firm's newness

- Mixed feedback, with some traders reporting positive experiences and others expressing frustration

- Common complaints about withdrawal issues and customer support

While a low Trustpilot score is worrying, it's important to approach these reviews with context. New firms often struggle with initial reviews, and scores can improve over time.

Nevertheless, this low rating suggests that potential traders should proceed with caution and perhaps start with smaller investments.

Customer Support and Response Time

Be Funding offers some channels for customer support:

- Live Chat

- Ticket System

While these support options are standard in the industry, the effectiveness and responsiveness of Be Funding's support team remain to be seen, especially given the mixed reviews on Trustpilot.

Be Funding’s Social Media Channels

The firm maintains a presence on several social media platforms:

- Telegram

- YouTube

An active social media presence can be a good sign, indicating transparency and community engagement. However, the quality and frequency of content on these platforms would need to be assessed to determine their true value to traders.

Expert Suggestions

In conclusion, Be Funding, While its specialization in Forex and Synthetic Indices provides focus, its newer status and limited educational resources warrant caution.

Of course, the absence of a challenge time limit and the inclusion of news trading enhance its flexibility.

Though theTrustpilot score of 2.6 indicates room for improvement in customer support and withdrawals, Be Funding's overall structure and pricing competitiveness position It as a relatively good choice for traders.