Built on the solid foundation of Blueberry Markets, a broker with over eight years of experience, Blueberry Funded offers multiple challenge models, bi-weekly payouts, and access to advanced trading platforms.

The prop firm started its work in August 2024 by Dean Hyde and offers 7 challenges with up to $200K fundings.

Blueberry Funded Company Information

Blueberry Funded is a prop firm launched in 2024 and backed by Blueberry Markets, a brokerage brand recognized globally.

The company has leveraged Blueberry Markets’ reputation to expand its funded trading offerings under the registered name in VFSC (Company No. 700697).

With operations spanning over 3 international offices, the firm has successfully onboarded more than 50,000 traders globally.

Traders can select from seven distinct challenges with account sizes ranging from $1,250 to $200,000, while participating in a scaling plan that extends up to $2,000,000.

Payouts are processed bi-weekly with an 80% profit share, and treasury services are provided by BBF Treasury Pty Ltd, adding another layer of operational reliability.

Key highlights of Blueberry Funded prop firm:

- Backed by Blueberry Markets with 8+ years of industry history

- 3+ global office locations

- VFSC registered (Company No. 700697)

- 5 challenge models available

- Account sizes: $1,250 – $200,000

- Prices: $32.5 – $1,100

- Scaling Plan: Up to $2M

- Launch date: August 2024

- Bi-weekly payouts with 80% profit split

- Treasury services via BBF Treasury Pty Ltd

Blueberry Funded CEO

Blueberry Funded is managed by Marcus Fetherston, whose leadership builds on prior experience at PropTrade Tech and Eightcap.

Blueberry Funded Summary of Specification

Blueberry Funded offers a flexible infrastructure for prop traders through multiple challenges, platforms, and payout models.

With competitive pricing and access to over five financial markets, the firm supports diverse strategies and trading styles.

This makes it a practical choice for those who want to invest in Blueberry Funded with clearly defined rules, platforms, and tools.

Account Currency | USD |

Minimum Price | $32.5 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 80% |

Instruments | Forex, Crypto, Metals, Energy, & Index |

Assets | Not Specified |

Evaluation Steps | 1-Step, 2-Step, Rapid, Stock, Synthetic |

Withdrawal Methods | Not Specified |

Maximum Fund Size | $200000 [Up to $2M in Scaling] |

First Profit Target | 5% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Restricted |

Maximum Total Drawdown | 10% |

Trading Platforms | MT4, MT5, DXtrade, TradeLocker |

Commission Per Round Lot | $7 for All Markets ($2 for Stocks) |

Trustpilot Score | 4.1 Out of 5 |

Payout Frequency | Bi-Weekly |

Established Country | Australia |

Established Year | 2024 |

Blueberry Funded Pros and Cons

The structure of Blueberry Funded provides practical tools for prop traders, but it also comes with limitations.

While its trusted parent company and wide asset coverage make it appealing, the absence of promotions or bonus incentives may be a downside for budget-conscious users. Blueberry Funded prop advantages and disadvantages:

Pros | Cons |

Backed by Blueberry Markets with a strong industry reputation | No current bonus or discount offers |

7 challenge types for different trading styles | Limited educational resources beyond the FAQ |

Account sizes and funding scalability up to $600K | Swap fees apply to overnight positions |

Access to four trading platforms, including TradeLocker | The commission charges on all trades |

Bi-weekly payouts with an 80% profit split | No free trial or evaluation mode |

Overall, Blueberry Funded offers a scalable, structured prop firm model, but traders should weigh the costs and lack of extra incentives before deciding to join Blueberry Funded.

Blueberry Funded Fundings and Price

Blueberry Funded offers eight core funding levels, enabling traders to start small or aim for high-capacity accounts. These challenge accounts are non-refundable and vary in pricing based on the capital level and the kind of selected plan.

Each account is designed to provide access to the Blueberry Funded platform with eligibility for scaling and bi-weekly payouts.

Funding Tiers Offered:

- $1,250 from $37.04

- $2,500 from $55.56

- $5,000 from $32.5

- $10,000 from $50

- $25,000 from $100

- $50,000 from $200

- $100,000 from $300

- $200,000 from $1000

Here's a table going through the account sizes and initial fees in detail:

Funding Size | 1 Step Price | 2 Step Price | Rapid Price | Stock Price | Synthetic Price | Instant Elite Price | Instant Lite Price |

$1,250 | N/A | N/A | N/A | N/A | N/A | N/A | $37.04 |

$2,500 | N/A | N/A | N/A | N/A | N/A | $100 | $55.56 |

$5,000 | $40 | $35 | N/A | $32.5 | $35 | $200 | $83.33 |

$10,000 | $75 | $60 | $50 | $65 | $70 | $400 | $125 |

$25,000 | $150 | $125 | $100 | $170 | $170 | $800 | $187.5 |

$50,000 | $275 | $250 | $200 | $325 | $350 | $1,500 | $375 |

$100,000 | $550 | $500 | $300 | $650 | $700 | N/A | $750 |

$200,000 | $1,100 | $1,000 | N/A | N/A | N/A | N/A | N/A |

This funding model supports digital capital funding, allowing users to gradually scale their trading operations, supported by consistent rules and payout cycles.

Blueberry Funded Prop Firm Registration

Opening an account at Blueberry Funded is a simple process divided into three core steps.

Each phase includes essential inputs to help tailor the account according to your trading strategy and style, platform preferences, and desired funding amount.

The process begins on the official website and can be completed in under 10 minutes.

- Click on the “Get Funded” Button on the Main Page

- Provide Information & Complete Billing Address

- Choose Account Information

The entire registration is designed to facilitate both beginners and professional traders who want touse Blueberry Funded in a structured environment.

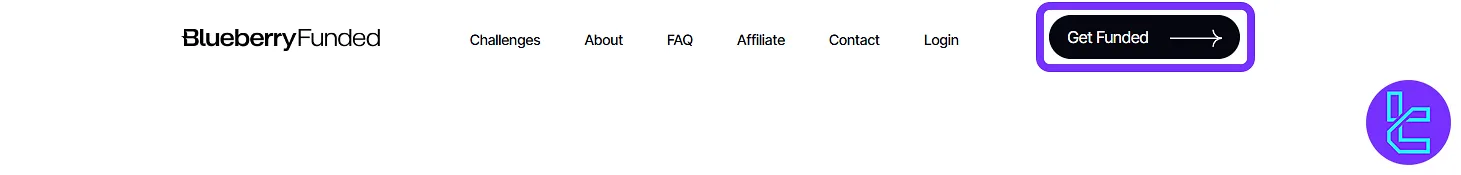

#1 Click on the “Get Funded” Button on the Main Page

To begin your journey, navigate to the official Blueberry Funded homepage and click on the “Get Funded” button.

This action redirects you to the registration interface, where the process begins. This step initiates your access to Blueberry Funded challenges, pricing tiers, and account configuration options.

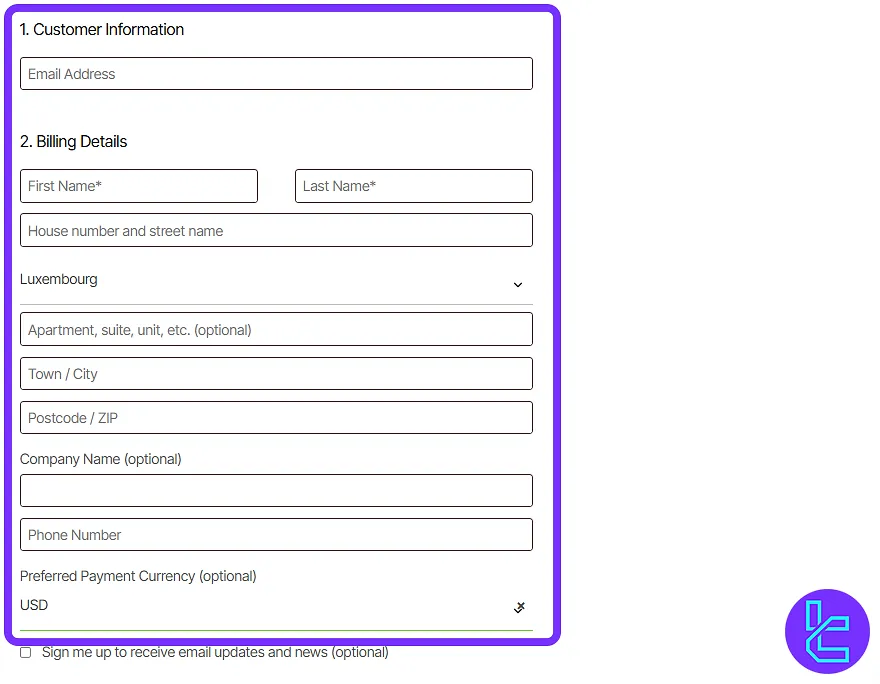

#2 Provide Information & Complete Billing Address

Once redirected, users need to fill out basic information and complete their billing details.

This ensures accurate invoicing and seamless transaction processing. Payment method selection occurs at the end of this section.

Required Information:

- Email Address

- First and Last Name

- House Number & Street Name

- Complete Address

- Company Name (Optional)

- Phone Number

- Preferred Payment Currency (Optional)

- Choose Payment Method

This step is essential to validate the account and proceed to the trading configuration stage.

#3 Choose Account Information

In the final step, traders can customize their account based on capital level, platform, and optional features.

This is where you choose your Blueberry Funded challenge, funding amount, and trading platform from a list of supported options.

Selections to Make:

- Challenge Type (1 Step, 2 Step, etc.)

- Account Size ($5K to $200K)

- Trading Platform (MT4, MT5, DXtrade, TradeLocker)

- Optional Add-ons (if applicable)

Once selected, proceed to payment and begin your funded trading challenge.

Blueberry Funded Firm Challenges

Blueberry Funded offers five distinct challenge models to support different types of traders from fast-trackers to long-term strategists.

These include the 1-Step and 2-Step Evaluation, the Rapid challenge for quicker access, and Stock and Synthetic challenges for more specialized traders.

Also, there are two instant funding plans [Instant Elite, Instant Lite] available.

Each challenge has its own rules regarding minimum trading days; Blueberry Funded challenges:

Parameters/Challenges | 1 Step | 2 Step | Rapid | Stock | Synthetic | Instant Elite | Instant Lite |

Profit Target | 10% | Phase 1: 10% -Phase 2: 5% | 5% | Phase 1: 10% -Phase 2: 6% | Phase 1: 10% -Phase 2: 5% | N/A | N/A |

Max Total Drawdown | 6% | 10% | 4% | 8% | 10% | 4% | 4% |

Max Daily Drawdown | 4% | 5% | 3% | 4% | 4% | N/A | 2% |

Profit Split | 80% | 80% | 80% | 80% | 80% | 80% | 80% |

Time Limit | Unlimited | Unlimited | 7 Days | Unlimited | Unlimited | Unlimited | Unlimited |

Leverage | 1:30 | 1:50 | 1:30 | 1:10 | 1:30 | 1:30 | 1:30 |

Payout | 14 Days | 14 Days | 14 Days | 14 Days | 14 Days | 14 Days | 14 Days |

Prohibited Strategies | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

This variety ensures that every trader can use Blueberry Funded in a way that aligns with their unique goals and trading styles.

The scaling model applies across all challenges and provides growth opportunities up to $2M in funded capital.

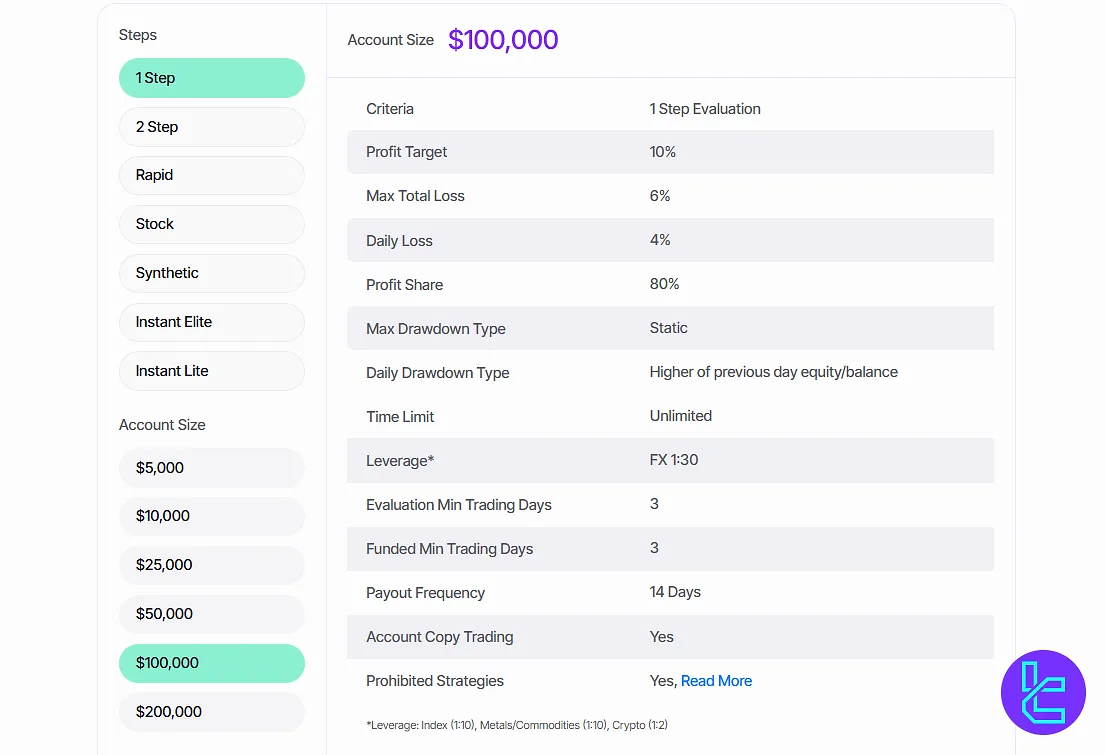

1 Step Evaluation

Blueberry Funded’s 1 Step Evaluation offers traders a streamlined path to funding with competitive trading conditions and a flexible framework.

Participants must achieve a 10% profit target while maintaining strict risk parameters—4% maximum daily drawdown and 6% total drawdown.

The program provides an 80% profit split, 1:30 leverage, and no time limit for meeting objectives. Payouts are processed every 14 days.

Here's an overview table:

Parameters/Challenge | 1 Step |

Profit Target | 10% |

Max Total Drawdown | 6% |

Max Daily Drawdown | 4% |

Profit Split | 80% |

Time Limit | Unlimited |

Leverage | 1:30 |

Payout | 14 Days |

Prohibited Strategies | Yes |

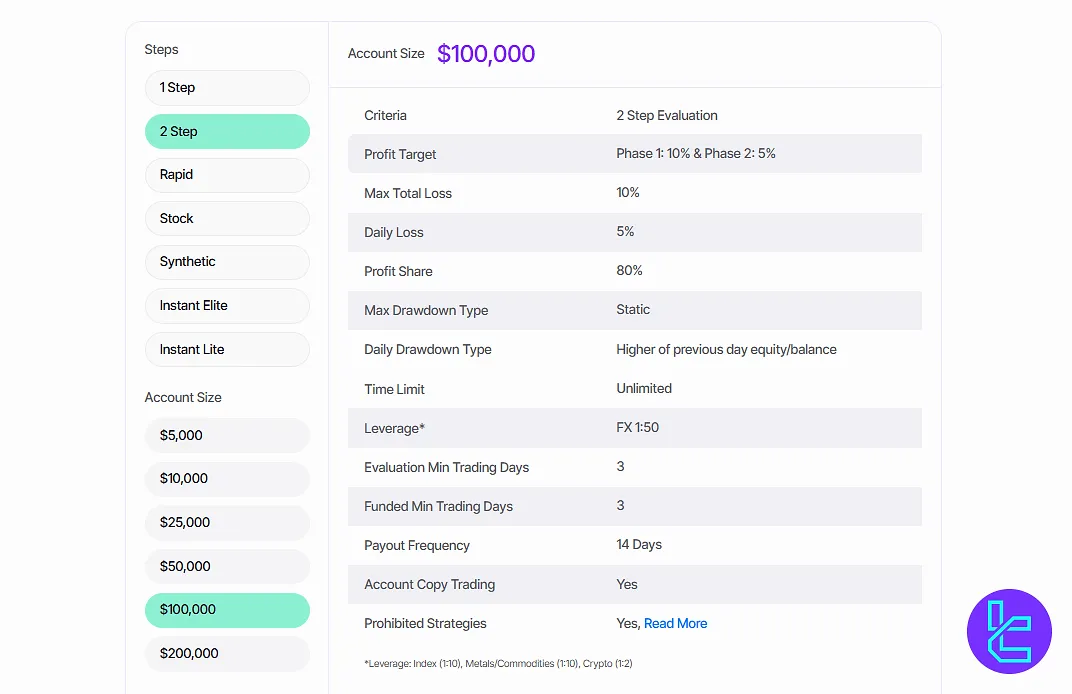

2 Step Program

The program consists of two distinct phases—Phase 1 with a 10% profit target and Phase 2 with a 5% target—each with no set time limit, allowing traders to progress at their own pace.

The table below summarizes all details:

Parameters/Challenge | 2 Step |

Profit Target | Phase 1: 10% -Phase 2: 5% |

Max Total Drawdown | 10% |

Max Daily Drawdown | 5% |

Profit Split | 80% |

Time Limit | Unlimited |

Leverage | 1:50 |

Payout | 14 Days |

Prohibited Strategies | Yes |

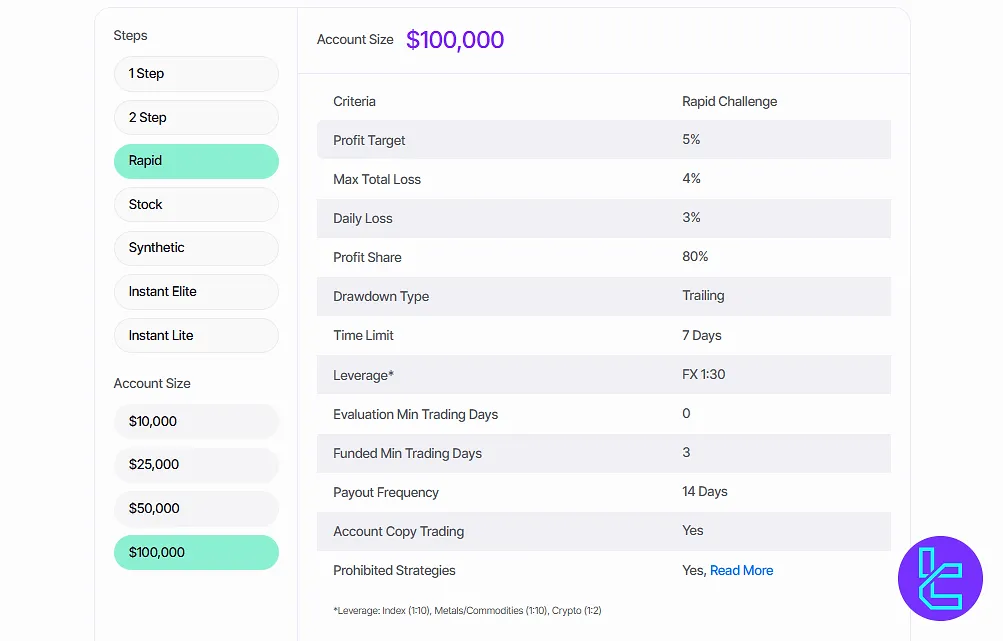

Rapid Model

In this program, participants must achieve a 5% profit target within a strict 7-day window, while maintaining disciplined risk management limits—maximum total drawdown of 4% and maximum daily drawdown of 3%.

Table of Additional Details:

Parameters/Challenge | Rapid |

Profit Target | 5% |

Max Total Drawdown | 4% |

Max Daily Drawdown | 3% |

Profit Split | 80% |

Time Limit | 7 Days |

Leverage | 1:30 |

Payout | 14 Days |

Prohibited Strategies | Yes |

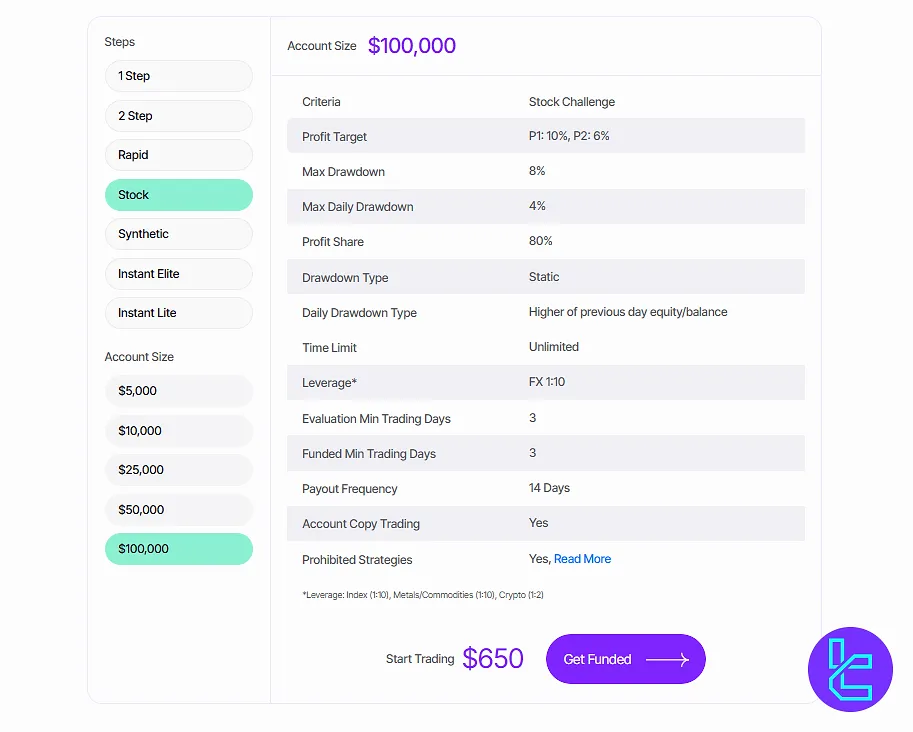

Stock Plan

With an unlimited trading period, traders in the Stock account progress through a two-phase evaluation, requiring a 10% profit target in Phase 1 and 6% in Phase 2.

Additional parameters are outlined in the following table:

Parameters/Challenge | Stock |

Profit Target | Phase 1: 10% -Phase 2: 6% |

Max Total Drawdown | 8% |

Max Daily Drawdown | 4% |

Profit Split | 80% |

Time Limit | Unlimited |

Leverage | 1:10 |

Payout | 14 Days |

Prohibited Strategies | Yes |

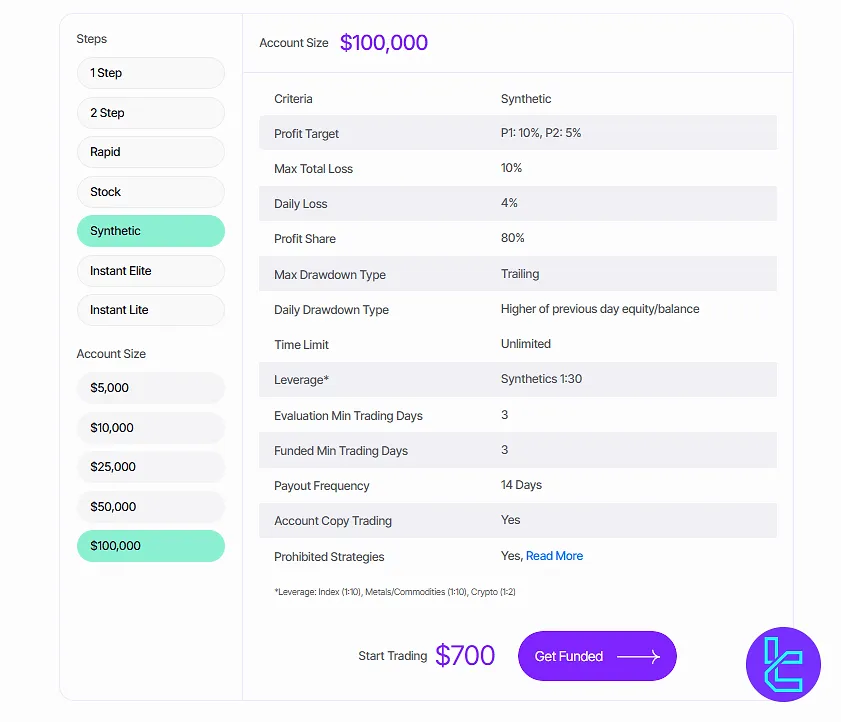

Synthetic Account

In Phase 1, participants must achieve a 10% profit target, followed by 5% in Phase 2. Risk parameters include a 10% maximum total drawdown and a 4% maximum daily drawdown, ensuring disciplined risk management.

More details are provided in the table below:

Parameters/Challenges | Synthetic |

Profit Target | Phase 1: 10% -Phase 2: 5% |

Max Total Drawdown | 10% |

Max Daily Drawdown | 4% |

Profit Split | 80% |

Time Limit | Unlimited |

Leverage | 1:30 |

Payout | 14 Days |

Prohibited Strategies | Yes |

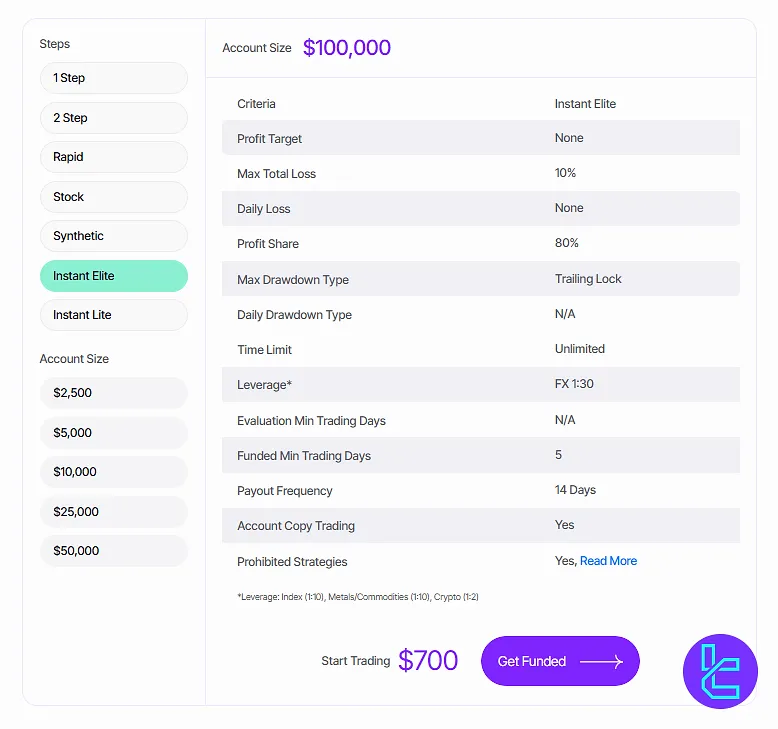

Instant Elite Model

The Instant Elite Program by Blueberry Funded offers traders immediate access to funded accounts without a profit target requirement. With a 4% maximum total drawdown and no daily drawdown limit, traders can operate with greater flexibility.

All of the program's parameters are mentioned here:

Parameters/Challenges | Instant Elite |

Profit Target | N/A |

Max Total Drawdown | 4% |

Max Daily Drawdown | N/A |

Profit Split | 80% |

Time Limit | Unlimited |

Leverage | 1:30 |

Payout | 14 Days |

Prohibited Strategies | Yes |

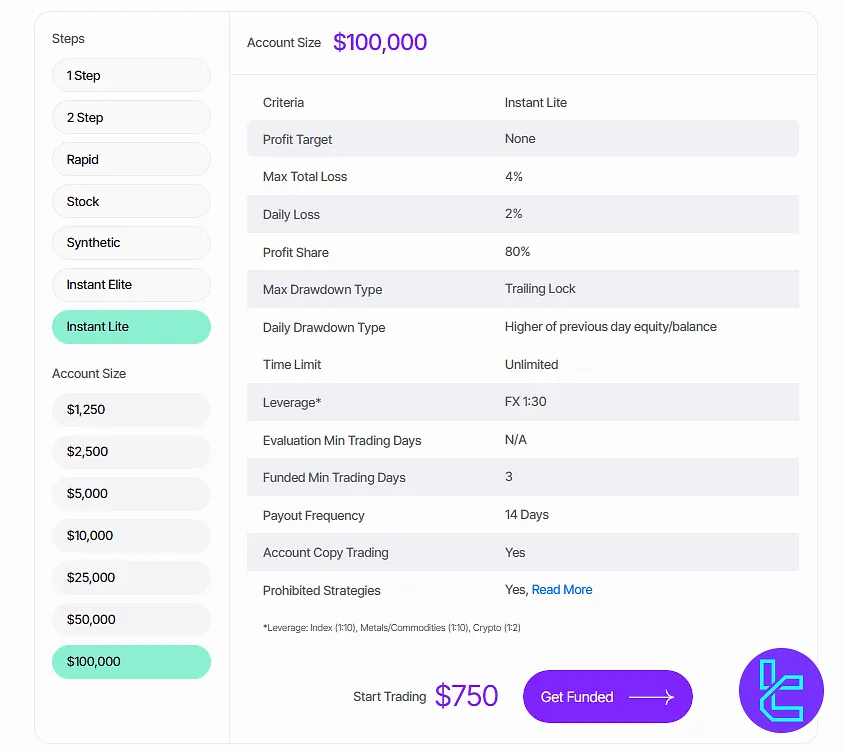

Instant Lite Funding

With this plan, traders enjoy an 80% profit split, 1:30 leverage, and no trading time limit, all in addition to instant access to funds.

Here's a table of model details:

Parameters/Challenges | Instant Lite |

Profit Target | N/A |

Max Total Drawdown | 4% |

Max Daily Drawdown | 2% |

Profit Split | 80% |

Time Limit | Unlimited |

Leverage | 1:30 |

Payout | 14 Days |

Prohibited Strategies | Yes |

Bonus & Discounts

Currently, Blueberry Funded does not offer any bonuses or discounts for new or returning traders.

This includes no seasonal promotions, referral codes, or cashback incentives. The firm maintains a flat pricing structure across all accounts.

Blueberry Funded Rules

Blueberry Funded operates under a straightforward and transparent rule set.

Key rules include maintaining maximum daily and overall drawdowns, adhering to minimum trading days (where applicable), and avoiding strategies like martingale or arbitrage. Key points of Blueberry Funded most important rules:

- Hedging is permitted only within a single trading account; cross-account or multi-user hedging is considered a major violation and leads to account termination;

- Expert Advisors (EAs) are allowed, but strategies such as HFT, arbitrage, news scalping, and reverse hedging are banned;

- Gambling-based strategies, including Martingale and excessive scalping, result in disqualification;

- Trading around major economic news events is restricted no trades can be opened or closed within two minutes before or after a red folder release;

- Traders can request payouts after 14 days by meeting profit and day requirements, with a 7-day option available via the 7-Day Payout Add-On.

Hedging Policy

Blueberry Funded permits traders to hedge positions within the same trading account. This means a trader may hold both buy and sell positions simultaneously on a single instrument as part of a risk management approach.

However, the firm strictly prohibits any hedging activity involving multiple accounts or coordination between separate users.

These practices compromise the fairness of the trading environment and may distort platform metrics.

If cross-account hedging is detected, the involved accounts will be closed immediately, and any profits derived from the activity may be forfeited.

This enforcement is part of Blueberry Funded’s commitment to a transparent and equitable trading model for all participants.

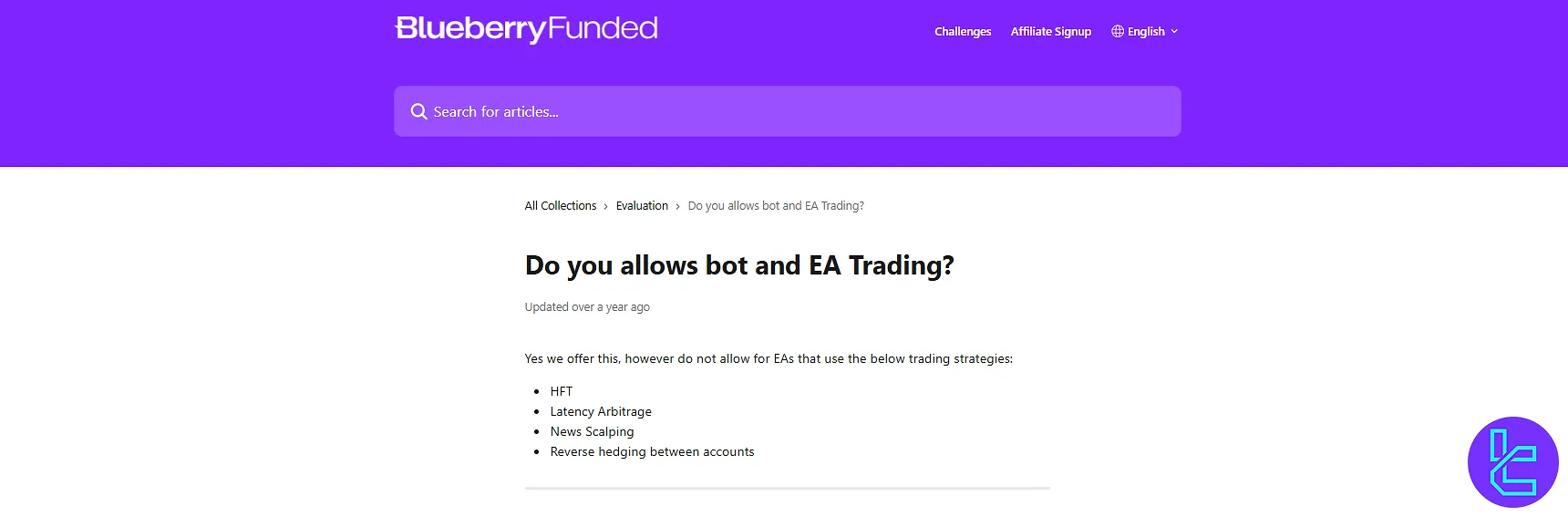

Expert Advisor (EA) Usage

Blueberry Funded allows the use of automated trading systems or Expert Advisors (EAs) under specific conditions.

Traders may operate EAs, provided they do not employ prohibited strategies, which include:

- High-Frequency Trading (HFT)

- Latency Arbitrage

- News-Based Scalping

- Reverse Hedging Across Accounts

Traders are responsible for monitoring their EAs to ensure compliance. Violations of these restrictions may lead to disqualification or permanent account action.

Anti-Gambling Policy

Blueberry Funded enforces a zero-tolerance policy toward gambling-style trading. Any attempt to bypass risk controls or game the evaluation system will result in disqualification. The following behaviors are explicitly prohibited:

- Excessive Scalping: When 50 percent or more of a trader’s positions are held for less than one minute, including tick scalping or high-frequency bursts;

- Martingale Strategy: Progressively increasing position sizes after losses, either in the same instrument or in correlated assets, in an attempt to recover drawdowns.

Traders found engaging in such activities will be removed from the evaluation process and may face permanent restrictions.

News Trading Restrictions

News trading is not allowed on evaluation or earning accounts at Blueberry Funded. The firm enforces a time-based restriction to maintain a fair and stable trading environment during periods of elevated volatility.

No trades may be opened, closed, or modified within the following time window:

- Two minutes before and two minutes after the release of any high-impact economic event (red folder news) as defined by ForexFactory.

This restriction includes market orders, pending orders, take profit and stop loss triggers, and any trade adjustments, even if the trade was placed before the event.

Payout

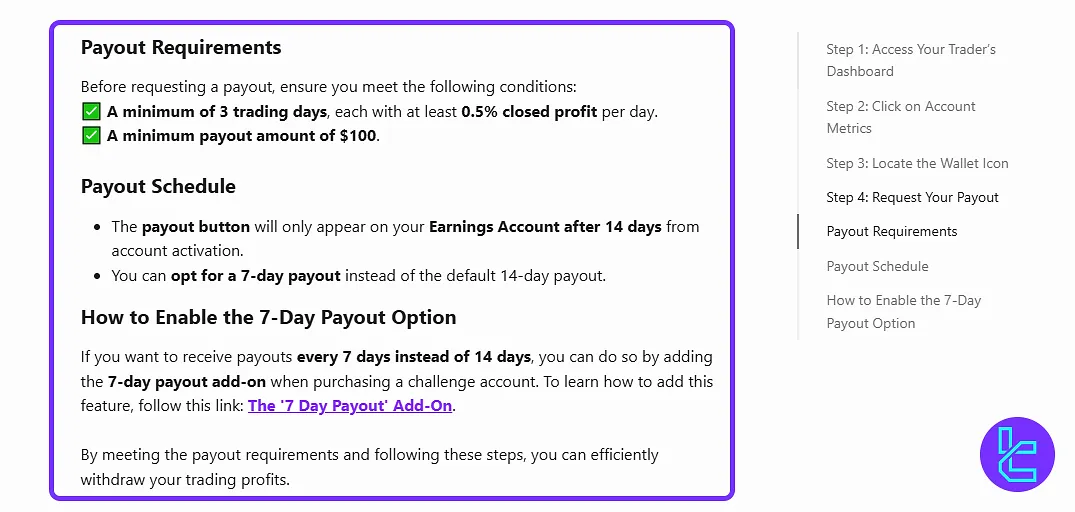

To qualify for a payout, traders must complete a minimum of three trading days, each generating at least 0.5% closed profit, and meet the minimum payout threshold of $100.

The payout feature becomes available fourteen days after account activation, allowing traders to request withdrawals once the conditions are met.

Those seeking faster access to their earnings can opt for a seven-day payout cycle by purchasing the 7-Day Payout Add-On when opening their challenge account.

Blueberry Funded Account Scaling Overview

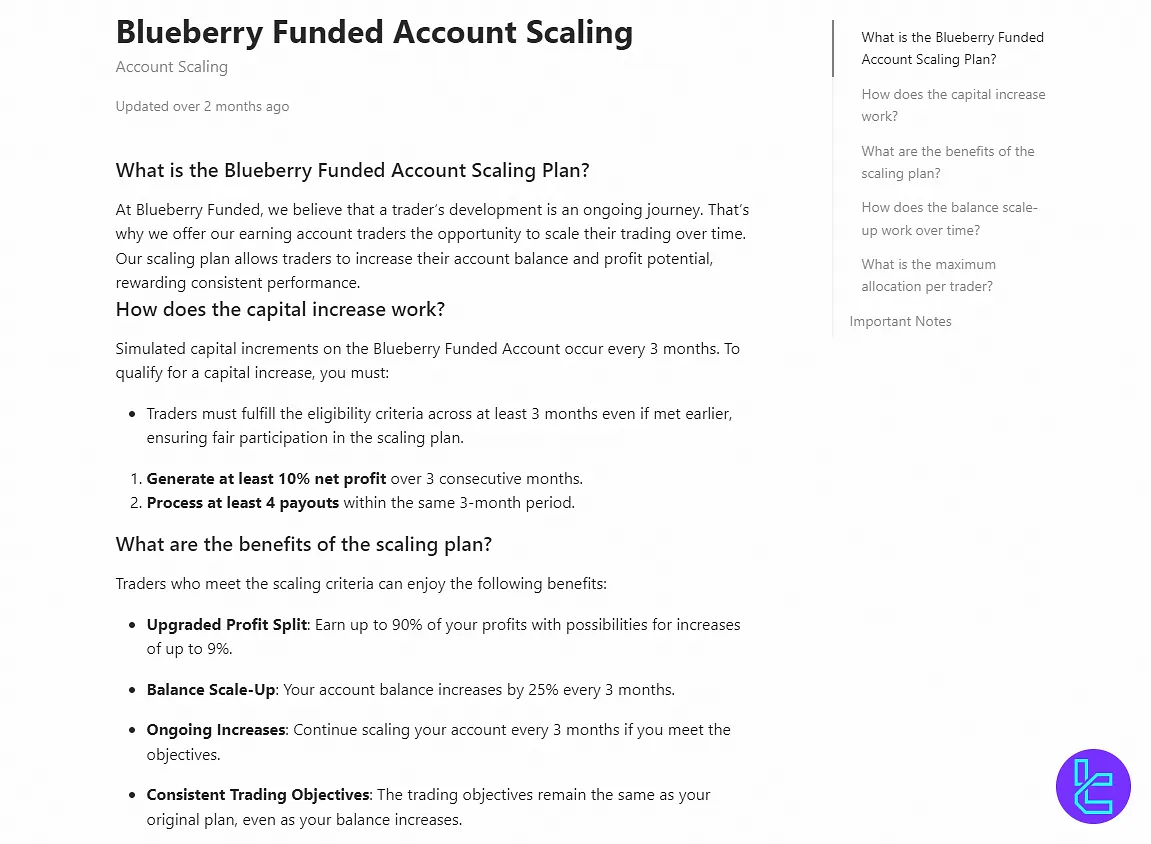

The scaling framework at Blueberry Funded is designed to progressively expand a trader’s simulated capital in recognition of sustained, high-quality performance.

By meeting clearly defined benchmarks, participants can periodically grow their account size, enhance profit potential, and maintain the same trading objectives throughout the process.

Capital Growth Process

Scaling evaluations occur on fixed three-month cycles, regardless of when performance targets are reached. To qualify for a capital increase, traders must:

- Achieve a minimum 10% net profit across the three-month period;

- Complete at least four payouts within the same timeframe;

- Fulfill all eligibility criteria consistently over the full cycle.

Scaling Plan Benefits

Participants meeting the requirements gain access to:

- Enhanced Profit Share: Profit splits can increase up to 90%, with potential incremental rises of up to9%;

- Account Balance Increases: Balances grow by 25% every qualifying cycle;

- Continuous Scaling: Eligible traders can continue scaling at each three-month interval;

- Unchanged Trading Rules: Original trading parameters remain in place despite higher balances;

- Maximum Allocation: Account balances can scale up to $2 million per trader.

Illustrative 24-Month Progression

Assuming consistent eligibility, a $200,000 account could scale as follows:

Time Elapsed | Starting Balance | Scaled Balance |

0 months | $200,000 | $200,000 |

3 months | $200,000 | $250,000 |

6 months | $250,000 | $300,000 |

9 months | $300,000 | $350,000 |

12 months | $350,000 | $400,000 |

15 months | $400,000 | $450,000 |

18 months | $450,000 | $500,000 |

21 months | $500,000 | $550,000 |

24 months | $550,000 | $600,000 |

Key Considerations:

- All traders, regardless of early performance, must complete the three-month evaluation cycle before scaling;

- The structure ensures fairness, uniform timelines, and measurable benchmarks;

- Tools and guidance are available for monitoring progress toward qualification.

Blueberry Funded Firm Trading Platforms

Blueberry Funded provides access to four industry-recognized trading platforms, allowing traders to operate in diverse environments. Blueberry Funded prop firm trading platforms:

- MetaTrader 4

- MetaTrader 5

- DXtrade

- TradeLocker

Each platform integrates seamlessly with the firm’s funding infrastructure, offering real-time data, risk metrics, and trade execution.

How Many Assets are Available to Trade in Blueberry Funded?

The firm supports five main asset classes and ensures that traders have enough instruments to construct meaningful portfolios or apply scalping, swing, and ICT intraday strategies.

Available Markets:

- Forex Market (Major, Minor, Exotic pairs)

- Cryptocurrencies (Bitcoin, Ethereum, and others)

- Metals (Gold, Silver, Platinum)

- Energy (WTI, Brent, Natural Gas)

- Indices (US30, NAS100, SPX500, etc.)

Blueberry Funded Leverage

Under the Blueberry Funded programs, traders can access tailored leverage limits based on the asset class and evaluation model.

Forex pairs are offered with leverage of 1:30 in the 1-Step Evaluation and 1:50 in the 2-Step Evaluation.

Metals and commodities trade at 1:10, indices also at 1:10, while cryptocurrencies are capped at 1:2, ensuring controlled exposure and risk management across all markets.

Blueberry Funded Fees

Blueberry Funded operates on a transparent, non-refundable fee structure tied to the chosen account size. Key fee details:

- Non-refundable challenge fees based on account size

- $7 commission per lot on all assets except stocks

- $2 commission per lot specifically for stocks

- Raw spreads from as low as 0.1 pips

- Swap fees applied to overnight positions

Blueberry Funded Education

Educational support from Blueberry Funded is currently limited to its Help Center and FAQ section. These resources cover frequently asked questions related to funding, platform usage, and rule interpretation.

Although there are no webinars or structured courses, the available content is sufficient for understanding the Blueberry Funded platform and navigating its features.

Blueberry Funded Firm Trust Scores

Blueberry Funded has maintained relatively high satisfaction ratings across major review platforms. On Blueberry Funded Trustpilot, the firm holds a 4.1 out of 5 rating based on over 600 user reviews.

Additionally, PropFirmMatch users rate the firm at 4.0/5, reflecting steady confidence from active traders.

These scores highlight the reliability and transparency of the platform, confirming its status as a leading Blueberry Funded firm with global recognition and community engagement.

Blueberry Funded Customer Support

Support for Blueberry Funded traders is responsive and multi-channel. The firm provides access to real-time communication tools and asynchronous messaging platforms.

Support Method | Availability |

Live Chat | Yes (on the official website) |

No | |

Phone Call | No |

Discord | No |

Telegram | Yes |

Ticket | No |

FAQ | Yes |

Help Center | Yes |

Yes | |

Messenger | No |

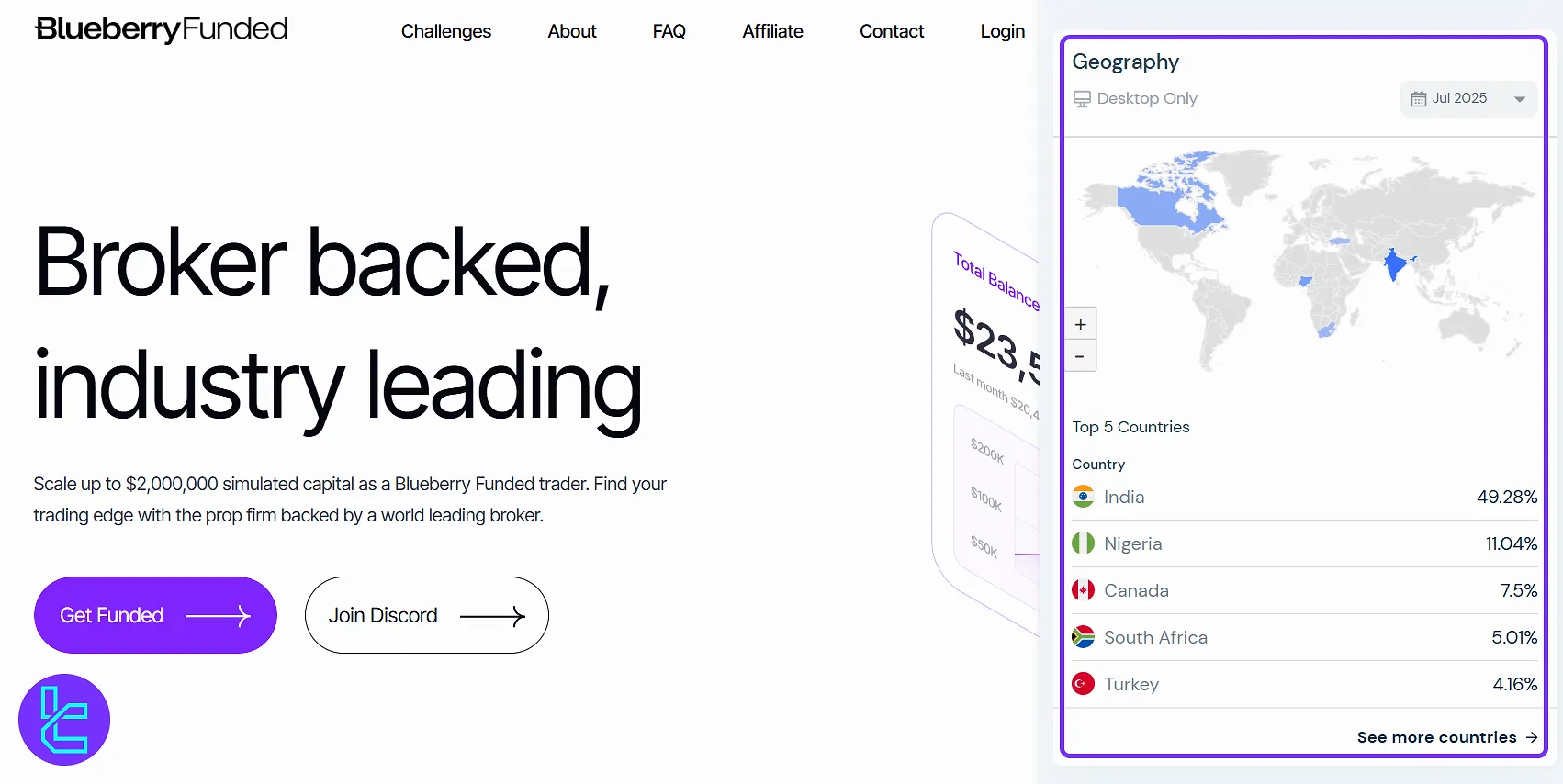

Blueberry Funded Variety of User Regions

Blueberry Funded attracts a diverse trader base spanning multiple continents, with notable concentrations in emerging and developed markets alike. As of July 2025, the platform’s largest user segment originates from India, accounting for 49.28% of its desktop traffic.

Other significant regions include Nigeria (11.04%), Canada (7.5%), South Africa (5.01%), and Turkey (4.16%), reflecting its broad global reach and appeal across different trading environments.

Blueberry Funded on Social Media

Blueberry Funded maintains an active presence across multiple social media platforms to keep its trader community engaged.

These platforms also serve as announcement channels for any platform updates, payout schedules, or service modifications. Blueberry Funded social platforms:

| Social Media Channel | Members/Subscribers |

| ~13.9K | |

| Discord | ~28.7K |

| X (formerly Twitter) | ~21.4K |

This network enables users to go to Blueberry Funded social channels for support, education, and community interaction.

Comparison of Blueberry Funded with Other Prop Firms

Below is a comparison between Blueberry Funded and three prominent competitors, highlighting how it stacks up in terms of pricing, scaling, and platform options.

Parameters | Blueberry Funded Prop | |||

Minimum Challenge Price | $35 | $49 | €55 | $32 |

Maximum Fund Size | $200000 [Up to $2M in Scaling] | $1,500,000 | Infinite | $4,000,000 |

Evaluation steps | 1-Step, 2-Step | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step |

Profit Share | 80% | 90% | 100% | 95% |

Max Daily Drawdown | 5% | 4% | 5% | 5% |

Max Drawdown | 10% | 8% | 8% | 10% |

First Profit Target | 5% | 6% | 10% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:125 | 1:100 | 1:100 |

Payout Frequency | 14 Days | 14 Days | 14 Days | From 5 Days |

Number of Trading Assets | Not Specified | 130 | 150+ | 78 |

Trading Platforms | MT4, MT5, DXtrade, TradeLocker | DXTrade, TradeLocker, cTrader | cTrader, DXTrade | MT4, MT5, cTrader, MatchTarder |

This positions Blueberry Funded as acost-effective prop firm with fast payouts and multi-platform access.

Conclusion

Blueberry Funded, backed by Blueberry Markets, offers prop traders access to MT4, MT5, TradeLocker, and DXtrade across forex, crypto, metals, indices, and energy markets. It offers bi-weekly payouts, a clear 80% profit split, and challenge accounts scaling up to $2M.