Bulenox offers trading capital of up to $250,000 for Futures trading on 40+ products across 4 different exchanges, including CME, NYMEX, COMEX, and CBOT.

A $50 PROMO code and commissions of up to 15% for affiliates are some of the attractive Bulenox prop firm’s offerings.

Bulenox; An Introduction to the Prop Firm

Bulenox is an American Proprietary trading firm with over two decades of accumulated expertise in the trading domain.

The company has crafted a funding program with the following key features:

- Funded accounts ranging from $10K to $250K

- Monthly fees

- Weekly payouts

- 14-Day trial account

- Rithmic data feed

- 42 Futures

The company is incorporated in the United States, with its registration based in the state of Delaware.

The firm's official domain was registered in January 2021 and is valid until 2026, reflecting four years of digital presence. Though still a relatively young platform, this domain history indicates foundational stability.

Bulenox Specific Features

Bulenox doesn’t offer any refunds, so make sure to carefully check the specification table below before engaging in a contract with the firm.

Account currency | USD |

Minimum price | $125 (Monthly) |

Maximum leverage | 1:1 |

Maximum profit split | 90% (100% for first $10,000) |

Instruments | Futures (Equities, Crypto, FX, Agricultural Products, Energies, Metals, Indices) |

Assets | 42 |

Evaluation steps | 1-Step |

Withdrawal methods | ACH, Wire Transfer, PayPal, Wise |

Maximum fund size | $250,000 |

First profit target | 6% |

Max. daily loss | 4% |

Challenge time limit | Unlimited |

N/A | |

Maximum total drawdown | 6% |

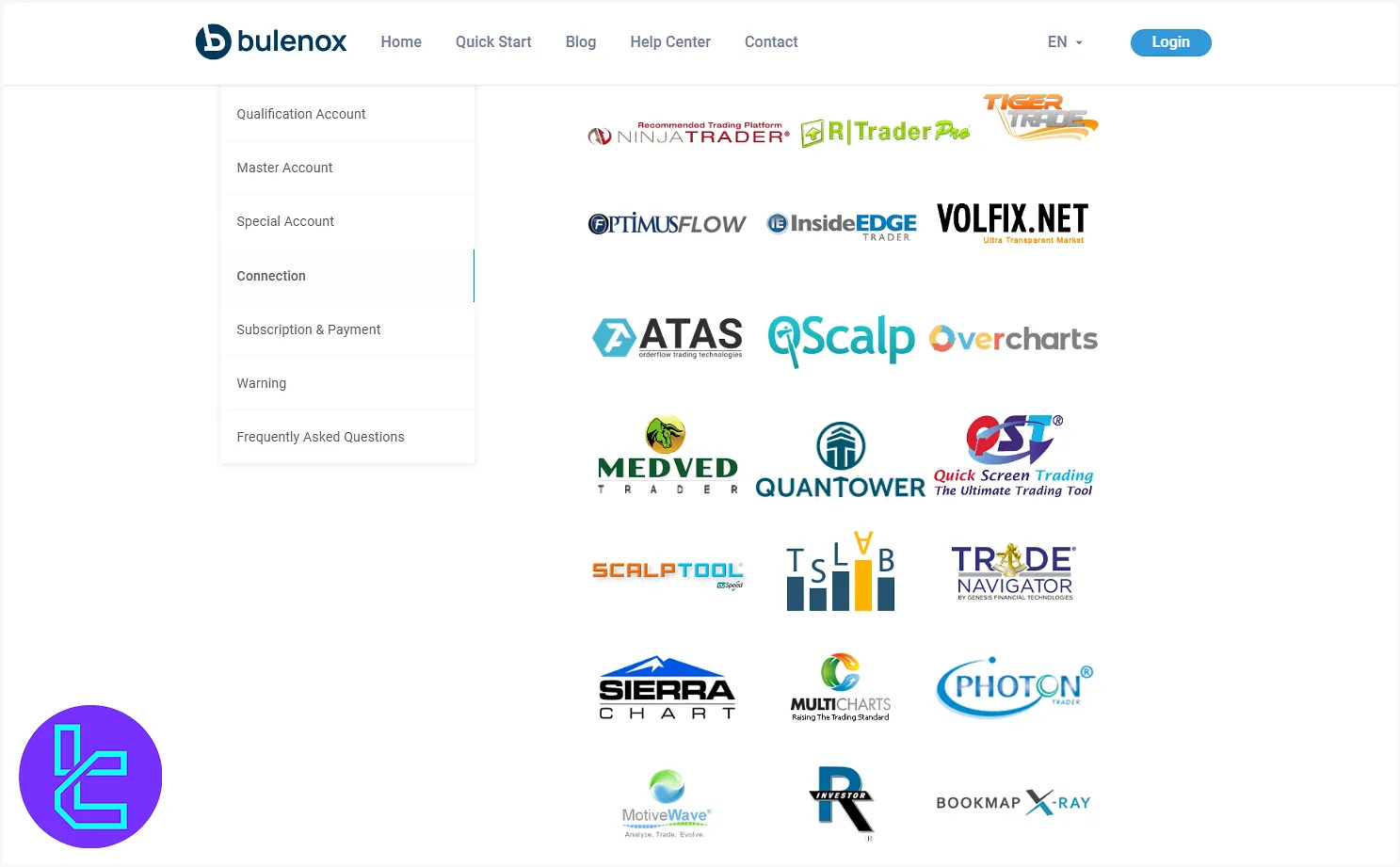

Trading platforms | NinjaTrader, R|Trader Pro, Tiger Trade, Optimus Flow, InsideEdge Trader, VOLFIX.NET, ATAS, QScalp, Overcharts, Medved Trader, Quantower, Quick Screen Trading (QST), ScalpTool, TSLAB, Trade Navigator, Sierra Chart, MultiCharts, Photon Trader, MotiveWave, Investor R, Bookmap X-Ray |

Commission | Variable based on the instrument (ranging from 0.46 to 2.86) |

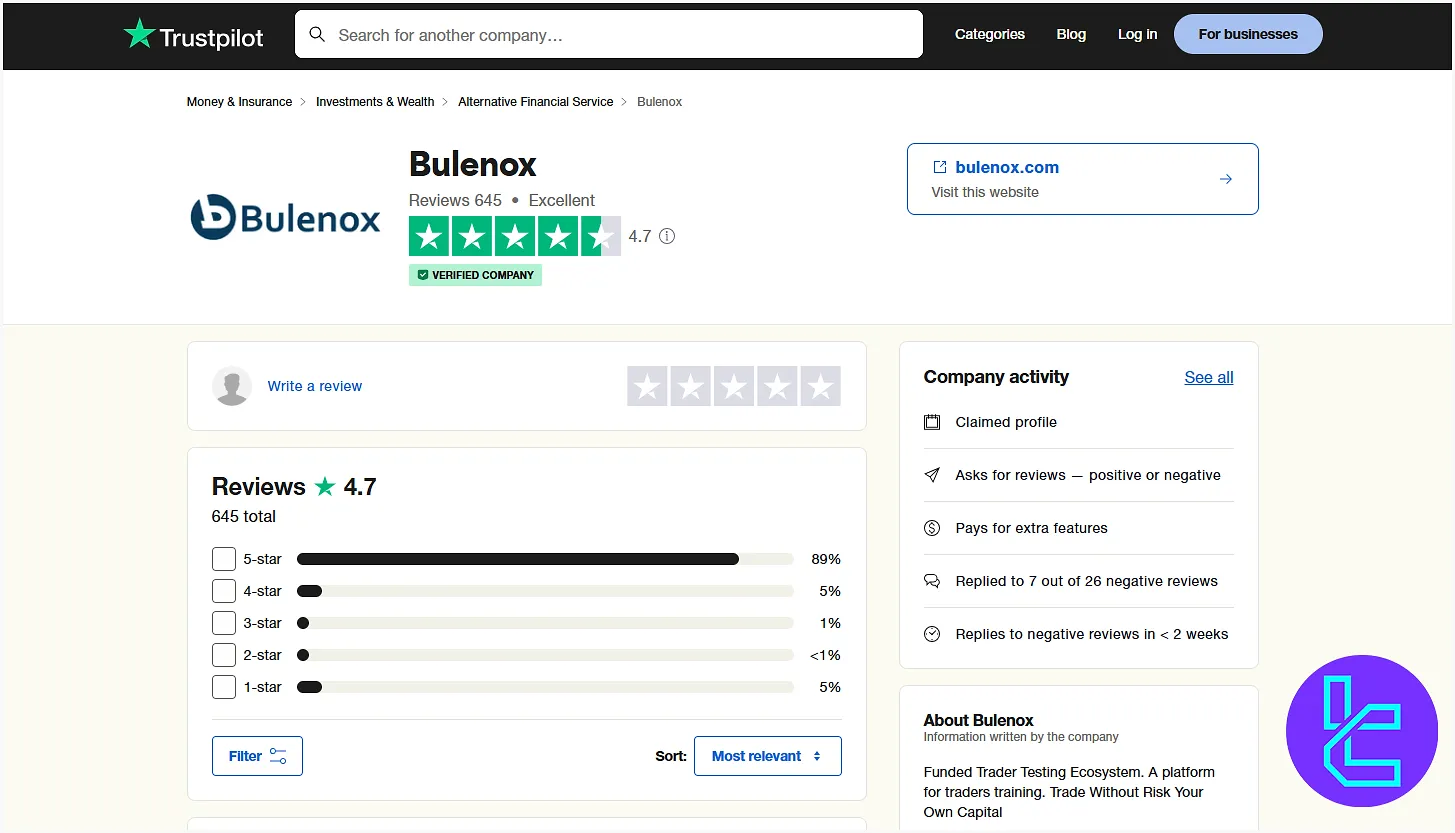

Trustpilot score | 4.7 |

Payout frequency | Weekly |

Established country | The United States |

Bulenox Prop Firm Pros and Cons

Providing Futures contracts and flexibility on various trading strategies, such as Algo / Copy Trading and the use of EAs, are among the firm’s advantages. However, Bulenox, too, has weaknesses.

Pros | Cons |

Generous profit split (up to 90%) | Limited educational resources |

Flexible trading rules and regulations | Only two funding plans |

Wide range of account sizes | Limited trading time (23 hours a day) |

100% payout on profits up to $10,000 | Taxing on profits |

Bulenox Challenge Fees

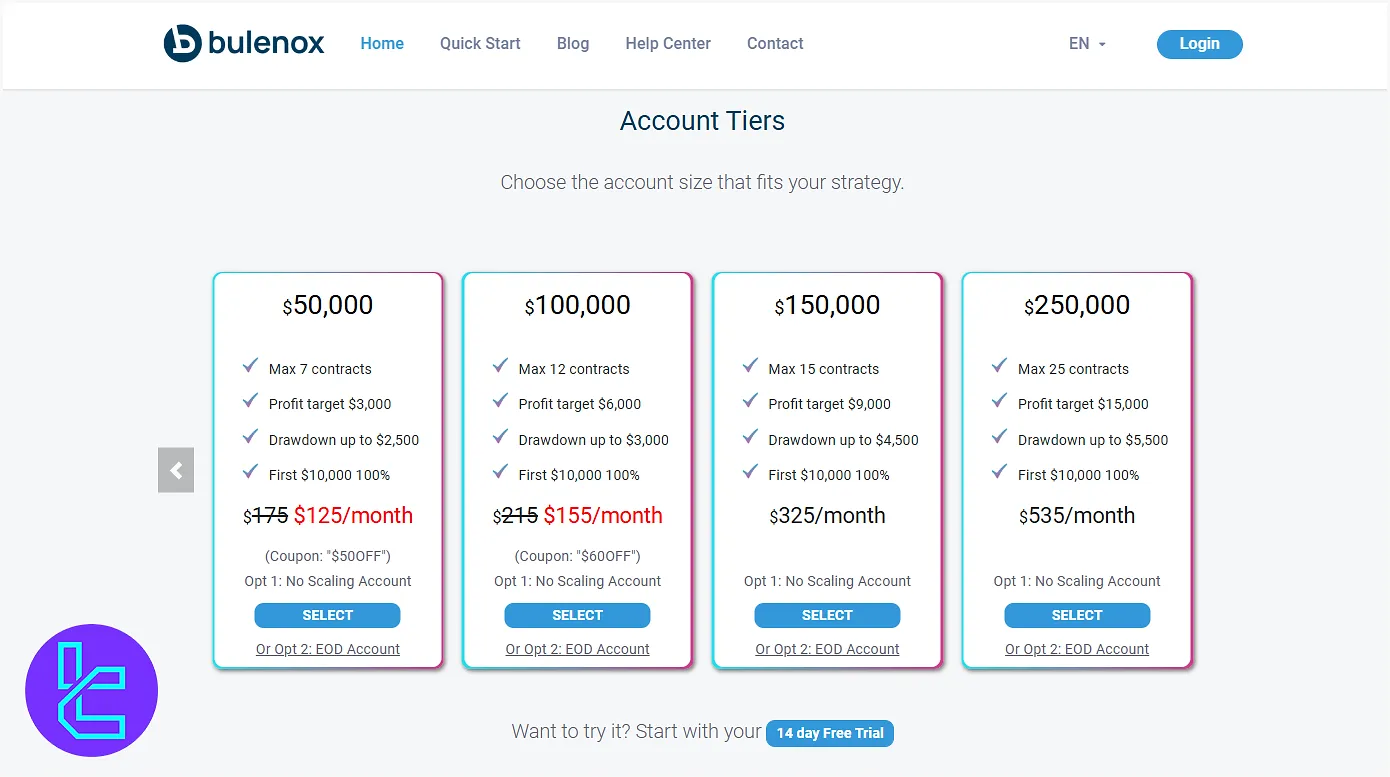

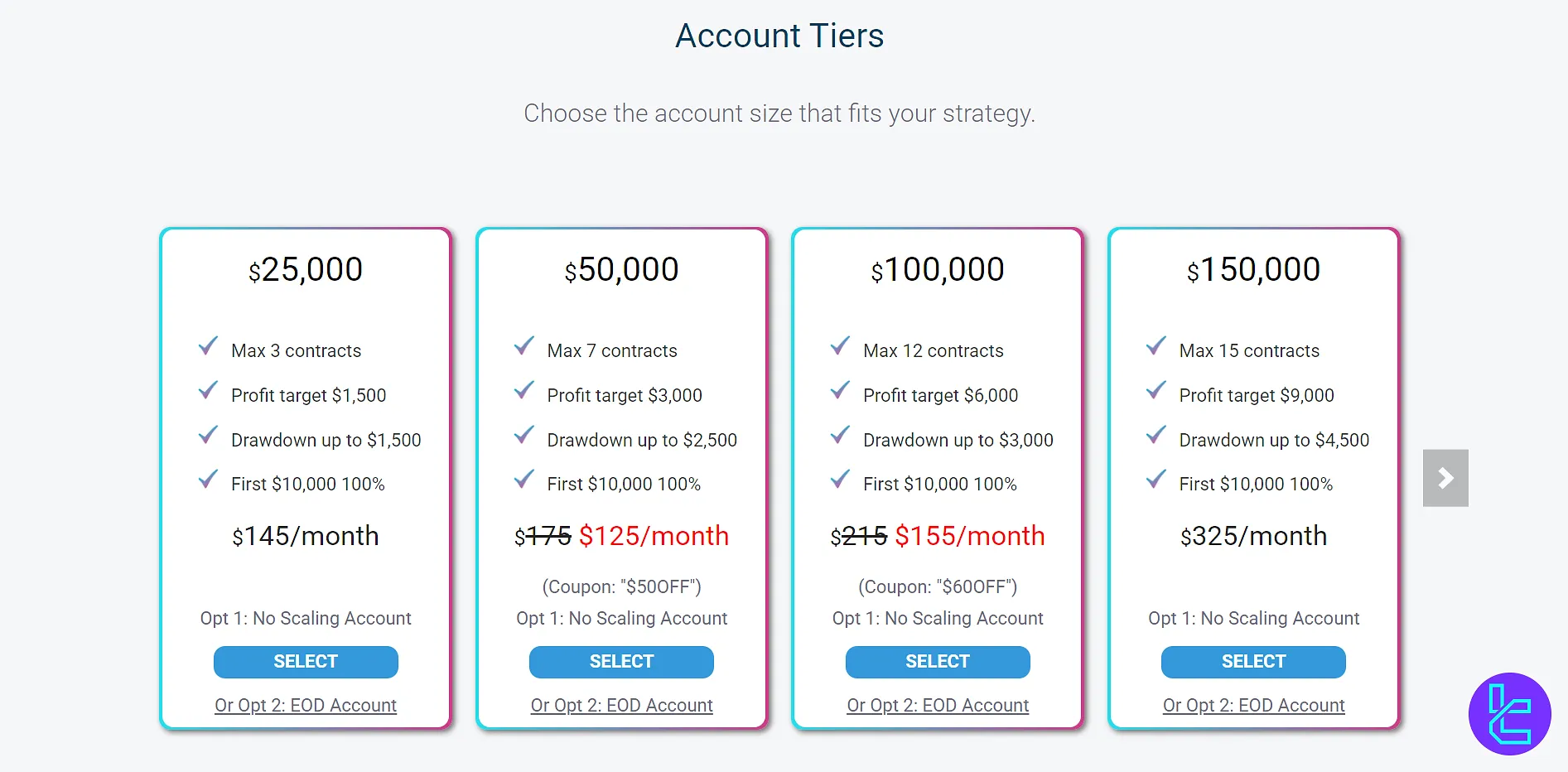

The firm offers 6 different funding plans at various prices. After exploring the plans, we can say that the Bulenox prices are competitive and even lower than average.

We must mention in this Bulenox review that the fees are recurring, and traders must repay the account price each month until the Master phase is reached.

Account Balance | Monthly Fee |

$25K | $145 |

$50K | $125 |

$100K | $155 |

$150K | $325 |

$250K | $535 |

Bulenox Account Opening and KYC

The journey from qualification to funded trading is straightforward with Bulenox. You’ll need to fill out a registration form and later provide KYC documents and sign a contract upon reaching the Master account.

Note that you can have unlimited Qualifications and 11 Master accounts, but they must be under the same Rithmic User ID.

#1 Choose Your Funding Plan

Visit the official website and browse available funded account plans. Select the one that matches your trading style and click “Select.”

#2 Complete the Registration Form

Fill in thesign-up form with your personal details, including full name, email address, and desired password. This grants access to your client portal.

#3 Make Your Payment

Proceed to the payment gateway to pay for your selected plan using supported methods (credit/debit card or crypto, if applicable).

#4 Verify Identity and Address

Upload proof of identity (ID card or passport) and proof of residence (utility bill or bank statement) to meet KYC/AML compliance and unlock your funded account.

Bulenox Funding Plans Details and Parameters

The firm offers only two funding plans, each in two models: Trailing Drawdown and EOD (End of Day) Drawdown. While TD has no daily loss limits, the EOD account has a daily drawdown, which varies based on the account size.

Bulenox 1-Step Plan

Other than the daily loss limit, the rules are almost the same in both EOD and TD models. The table below outlines the details regarding the account structure:

Conditions | Value |

Profit Target | 6% |

Max. Daily Loss | From $500 to $4,500 (only on EOD Accounts) |

Max. Drawdown | From 2.2% to 6% |

Max Number of Contracts | From 3 to 25 mini |

Profit Share | 90% (100% for the first $10,000) |

Account resets are available if the max. drawdown is hit:

- Free with each renewal

- Immediate Reset: $78

Bulenox Discount Coupon

The company frequently offers promotional discounts to make its services more accessible.

- “$50 OFF:” A $50 discount, exclusive to $50K accounts

- “$60 OFF:” A $60 discount, exclusive to $100K accounts

- Affiliate: Up to 15% commission for referring new clients

Bulenox Rules

The company's website is not helpful when it comes to the trading rules for passing challenges. To be precise, Bulenox does not explicitly permit or prohibit any trading strategies, bots, etc.

Instead, it has stated on its website that no restrictions are in place for using any trade copiers, algorithms, strategies, and bots. Besides, it has a section dedicated to withdrawal rules.

Payouts

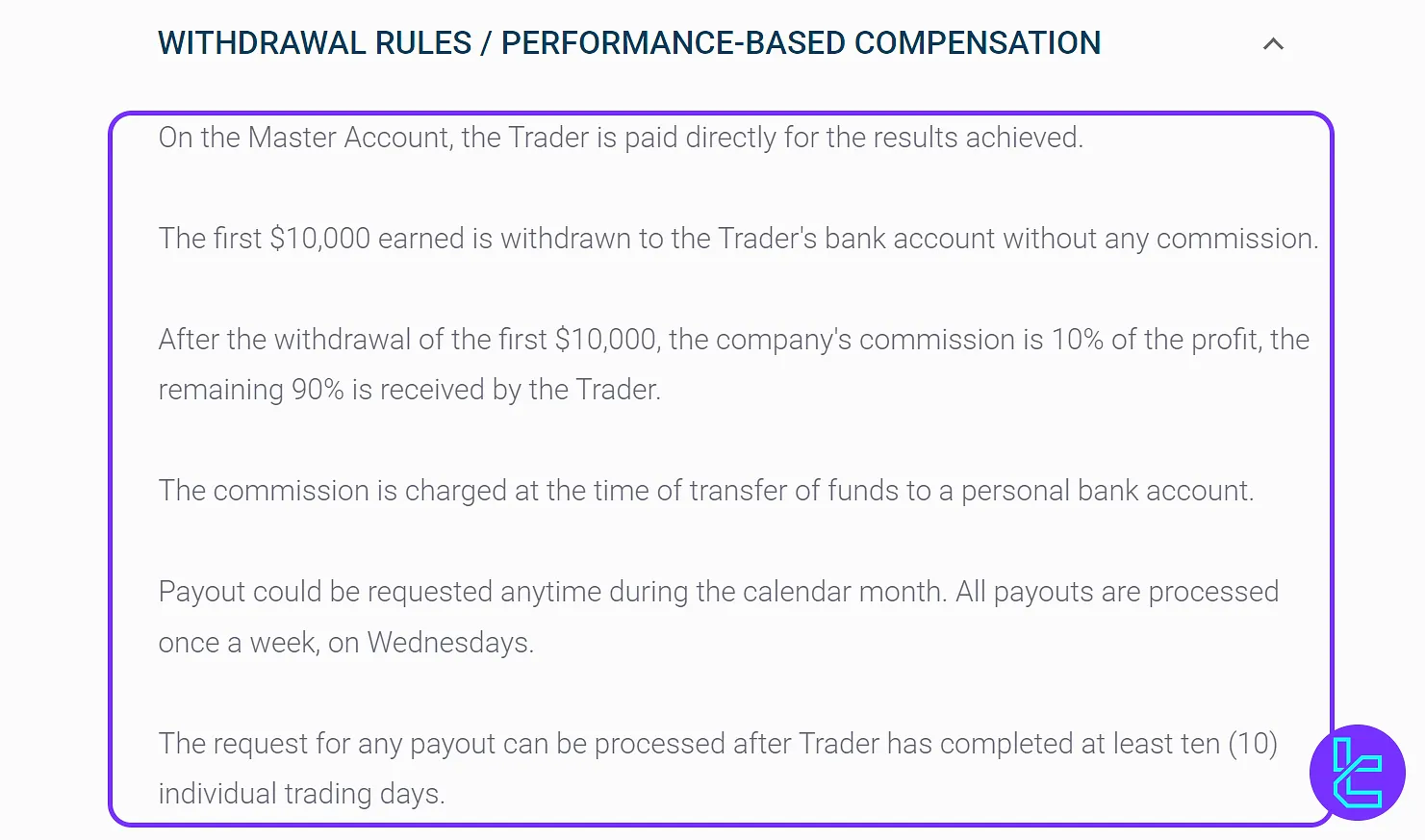

Bulenox prop firm rewards traders through a structured and transparent payout model directly linked to performance on the Master Account.

The first $10,000 in profit can be withdrawn with zero commission, while profits beyond that threshold are subject to a 10% company fee, allowing traders to retain 90% of their earnings.

Withdrawals can be requested anytime during the month and are processed weekly, every Wednesday.

To maintain fairness, Bulenox requires at least ten active trading days before the first payout and applies a 40% consistency rule, ensuring no single trading day contributes more than 40% of the total profits eligible for withdrawal.

The minimum withdrawal is $1,000, with early-stage caps based on account size, ranging from $1,000 for $25K accounts to $2,500 for $250K accounts.

Additionally, Bulenox enforces a reserve threshold to maintain account stability, from $1,600 on a $25K account up to $5,500 on a $250K account.

Withdrawals are available via ACH, Wire Transfer, PayPal, or Wise, and traders operating Master Accounts are classified as independent contractors for tax purposes.

Bulenox Prop Firm Trading Platforms

The company offers access to live data on CME, CBOT, NYMEX, and COMEX exchanges through the Rithmic data feed.

While the Rithmic membership for individual accounts is free, professional traders must pay a monthly fee of $112 per exchange to access the feed. The company also supports 20+ trading platforms, including:

- NinjaTrader

- R|Trader Pro

- Tiger Trade

- Optimus Flow

- InsideEdge Trader

- NET

- ATAS

- QScalp

- Overcharts

- Medved Trader

- Quantower

- Quick Screen Trading (QST)

Traders can trade with the NinjaTrader platform on mobile devices using NinjaTrader 8 with servers located in Chicago and New York.

What Markets Can I Trade on Bulenox?

We must discuss the available markets in this Bulenox review. The firm focuses on providing Futures products (40+) from across various exchanges, including CME, NYMEX, COMEX, and CBOT.

- Cryptocurrency: Micro contracts on Bitcoin and ETH

- Forex Market: 11 currencies, including Australian Dollar and British Pound

- Equity Indexes: Micro E-mini S&P 500, E-mini Russell 2000, and 5 more

- Agriculture: Corn, 3 Soybean products, Wheat, and 4 more

- Energies: WTI, Micro Crude Oil, NGas, and 4 more

- Metals: Gold, Copper, Silver, and Platinum

- Indices: E-mini Dow ($5) and Micro E-mini Dow Jones Index

Note that the only available instruments on the $10K account are Micro S&P, Nasdaq, Russel, and Dow.

Bulenox Funding and Withdrawal Methods

The prop firm offers flexible funding and withdrawal options to suit traders' preferences, including:

- Payment: Credit/Debit Cards, PayPal, and Crypto

- Payout: ACH, Wire Transfer, PayPal, and Wise

Bulenox Trading Fees Explained

The firm offers an exclusive All In Rate for each financial instrument, ranging from 0.46 to 2.86. Trading fees for some of the most popular products on Bulenox:

Product | All In Rate |

Micro Bitcoin | 2.76 |

E-mini S&P 500 | 2.09 |

Euro FX | 2.36 |

Canadian Dollar | 2.36 |

Crude Oil | 2.26 |

Gold | 2.31 |

Micro E-mini Dow Jones | 0.61 |

Bulenox Educational Resources

The firm doesn’t offer any dedicated educational section on its website. However, it provides comprehensive market analysis on various products through its blog.

Bulenox Prop Firm User Satisfaction

The company has garnered positive feedback from its user base. There are 645 reviews on Bulenox’s Trustpilot profile, gaining it an excellent score of 4.7 out of 5.

Users have highlighted the transparent and straightforward approach, clear rules, and reliable payouts.

Bulenox Support Channels

The firm provides support 24/5 through various channels, including a Ticket system, live chat, and a comprehensive Help Center.

Here are the contact channels for the support service:

Support Method | Availability |

Live Chat | Yes (available on the official website) |

Yes (through support@bulenox.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes (through the “Contact” page) |

FAQ | No |

Help Center | Yes (no search bar) |

No | |

Messenger | No |

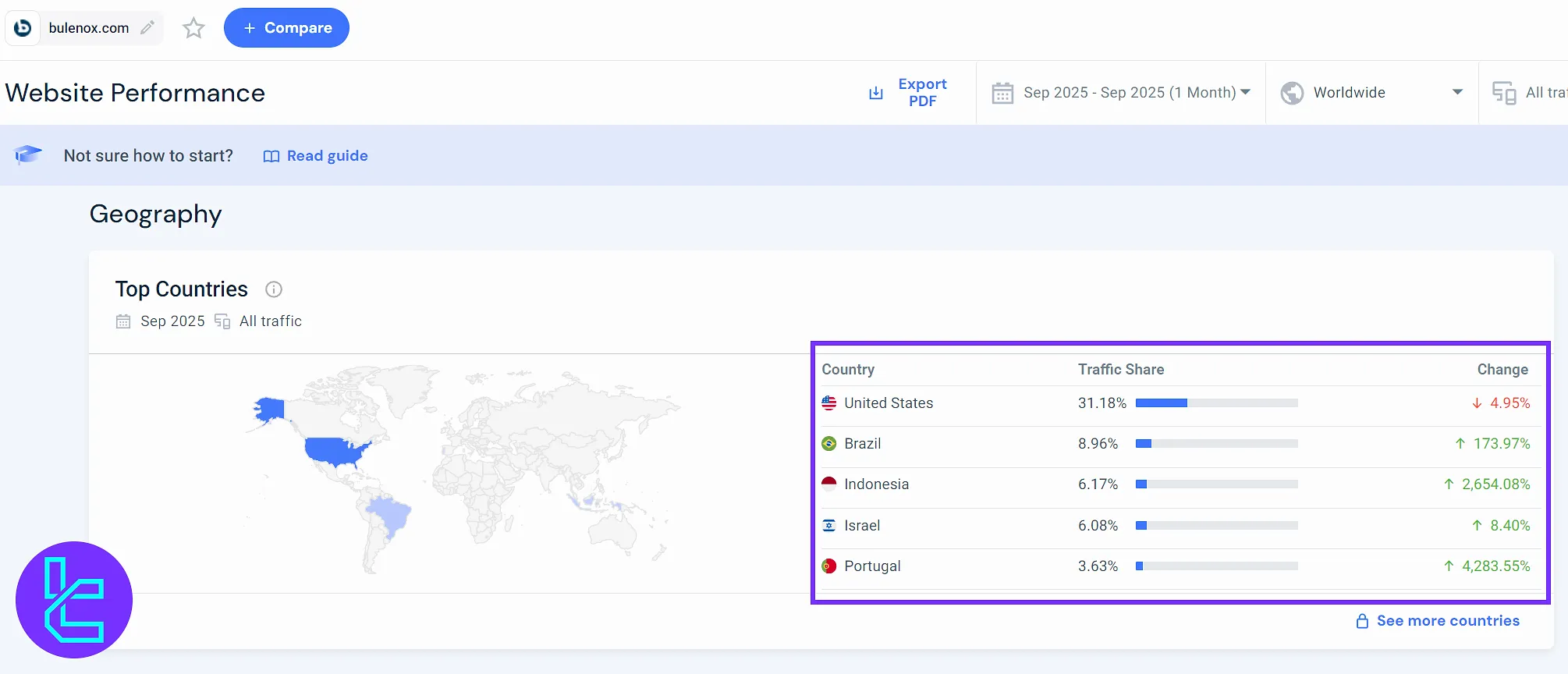

Bulenox User Regions Demography

According to Similarweb’s 2025 analytics, Bulenox’s user base is primarily concentrated across North America, Europe, and South Asia, reflecting its expanding presence in both established and emerging prop trading markets.

The United States accounts for the largest share of users, followed by India, the United Kingdom, Canada, and Brazil.

This regional distribution highlights the firm’s balanced global footprint, with strong engagement from both retail and institutional-level traders.

Recent traffic data also shows consistent month-over-month growth in South Asia (+19.4%) and Latin America (+12.8%), supported by Bulenox’s localized educational content and multilingual trader support.

The firm’s community-driven growth model continues to attract experienced traders seeking fast funding access, transparent evaluations, and stable payout reliability across all regions.

Bulenox Prop Firm on Social Media

Maintaining an active presence on social platforms showcases the firm’s commitment to keeping in contact with its community of clients. Unfortunately, Bulenox doesn’t have any profiles on social media, or at least its website hasn’t provided a link.

Table of Comparison Between Bulenox and Other Prop Firms

The reviewed company is evaluated against some of the best competitors in the industry in the table below:

Parameters | Bulenox Prop Firm | Crypto Fund Trader Prop Firm | For Traders Prop Firm | Blue Guardian Prop Firm |

Minimum Challenge Price | $125 | $55 | $49 | $67 |

Maximum Fund Size | $250,000 | $200,000 | $1,500,000 | $2,000,000 |

Evaluation steps | One-Step | 1-phase, 2-phase | 1-Step, 2-Step | 1-phase, 2-phase, 3-phase |

Profit Share | 90% (100% for first $10,000) | 80% | 90% | Up to 90% |

Max Daily Drawdown | 4% | 4% | 4% | 4% |

Max Drawdown | 6% | 6% | 8% | 10% |

First Profit Target | 6% | 8% | 6% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:1 | 1:100 | 1:125 | 1:100 |

Payout Frequency | Weekly | 2 Times a Month | 14 Days | 14 Days |

Number of Trading Assets | 42 | 200+ | 130 | N/A |

Trading Platforms | NinjaTrader, R|Trader Pro, Tiger Trade, Optimus Flow, InsideEdge Trader, VOLFIX.NET, ATAS, QScalp, Overcharts, Medved Trader, Quantower, Quick Screen Trading (QST), ScalpTool, TSLAB, Trade Navigator, Sierra Chart, MultiCharts, Photon Trader, MotiveWave, Investor R, Bookmap X-Ray | Metatrader 5, CFT Platform and Crypto Futures | DXTrade, TradeLocker, cTrader | MatchTrader, Tradelocker, MT5 |

Expert Suggestions

Bulenox provides access to Futures trading on Forex, Crypto, Metals, and 4 other asset classes for a minimum monthly fee of $125.

The firm offers these services through multiple platforms, including NinjaTrader, and R|Trader Pro.

Weekly payouts, a profit split of up to 90%, and a Trustpilot score of 4.7/5 are the Bulenox prop firm’s strength points.

However, limited trading hours (23 hours a day) and the lack of presence on social media are considered its main weaknesses.