During our latest checkout on the prop firm's official website, we found out that the company no longer provides funding plans and accounts to traders; instead, it currently operates only as an educational hub for trading.

These abnormal signs do not end here; It still has some buttons and links on its homepage related to funding accounts, but they do not seem to work at all. Also, apparently it's impossible to create an account on the website at the moment; the registeration page does not work.

Challenge4Trading offers 1-step evaluation plans with up to €50,000 in trading capital for a minimum price of €100.

As advertised by the company, up to 91% of the profit split is receivable.

Challenge4Trading; A prop firm with monthly payouts and challenge refundable fees

Challenge4Trading; A prop firm with monthly payouts and challenge refundable fees

Challenge4Trading: Prop Firm Background

Operated by Adnessy SAS, C4T is registered in France under company number 880561055.

The proprietary trading firm’s goal is to democratize access to large trading capital.

Key features of Challenge4Trading:

- funded accounts with trading capital of up to €50,000

- Up to 91% in profit splits

- Unlimited trading period to achieve profit targets

- Multiple challenge levels catering to different trader experiences

Challenge4Trading Table of Specifications

In C4T, you can access a trading capital of €50,000 with a generous 91% profit split in a minimum period of 1 or 2 days. Let’s take a quick look at what the prop firm has to offer.

Account currency | EUR |

Minimum price | 100 EUR |

Maximum leverage | 1:100 |

Maximum profit split | 91% (with add-ons) |

Instruments | Forex, Commodities, Crypto, Indices |

Assets | N/A |

Evaluation steps | 1-Step |

Withdrawal methods | N/A |

Maximum fund size | €50,000 |

First profit target | 20% |

Max. daily loss | N/A |

Challenge time limit | Unlimited |

News trading | N/A |

Maximum total drawdown | 30% |

Trading platforms | Sirix |

Commission | N/A |

TrustPilot score | 3.8 |

Payout frequency | Bi-weekly (conditions applied) |

Established country | France |

Challenge4Trading Advantages and Disadvantages

The lack of transparency in regard to trading costs, including commissions and spreads, is one of the biggest letdowns of C4T. Let’s weigh the firm’s upsides against its downsides.

Pros | Cons |

Up to 25,000 EUR in cash reward | Uninformative website |

91% profit split | Lack of transparency in regard to the management team |

Unlimited trading period | Limited asset offerings |

Challenge4Trading Prop Firm Pricing

C4T provides access to five different funding plans with various one-time fees. Pricing Details:

Account Balance | Price |

€2,000 | €100 |

€5,000 | €250 |

€10,000 | €500 |

€20,000 | €1,000 |

€50,000 | €2,500 |

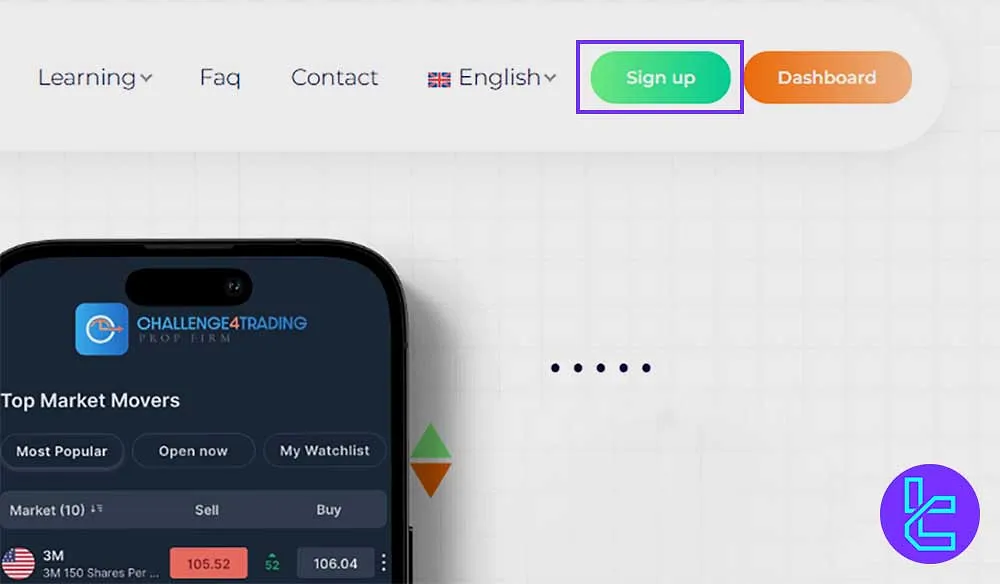

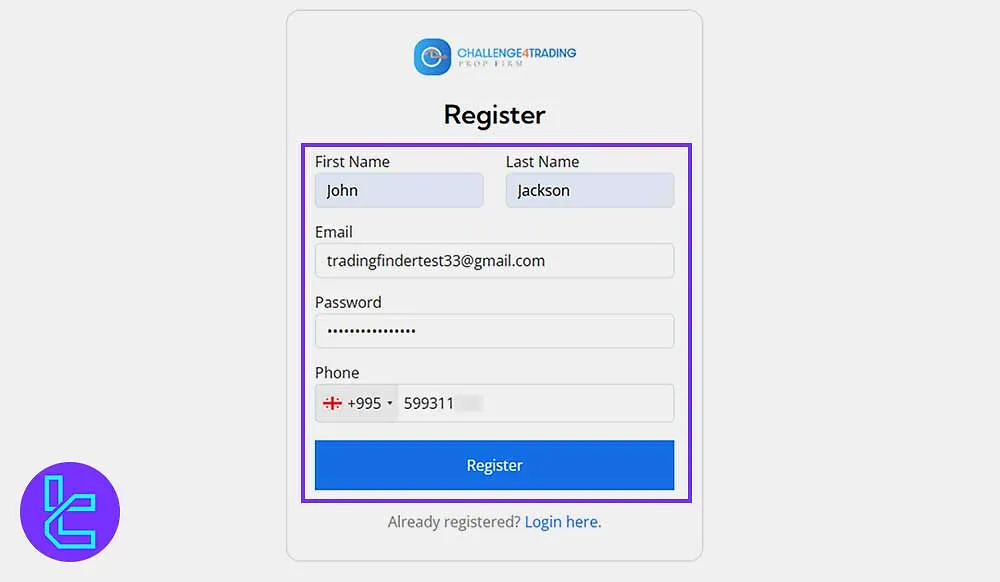

Challenge4Trading Registration and Verification

You must create an account and then purchase a challenge to get started with C4T. Upon completing the evaluation phase, you’ll be required to complete the KYC procedure. Steps to Challenge4Trading registration are explained in this section.

#1 Visit the Official Signup Page

Head to the Challenge4Trading homepage and click on the “Sign Up” button. Alternatively, scroll through the landing page and select “Open an Account” to be redirected to the registration form.

#2 Fill in Basic Information

Complete the signup form by entering:

- First Name and Last Name

- Email Address

- Mobile Number

- Password (must include uppercase, lowercase, numbers, and symbols)

Then, click Register to finalize the initial registration process.

#3 Complete the KYC

To pass through the process of verifying your identity, provide proof of identity, proof of address, and proof of payout method (Credit card and SWIFT).

Challenge4Trading Evaluation Parameters

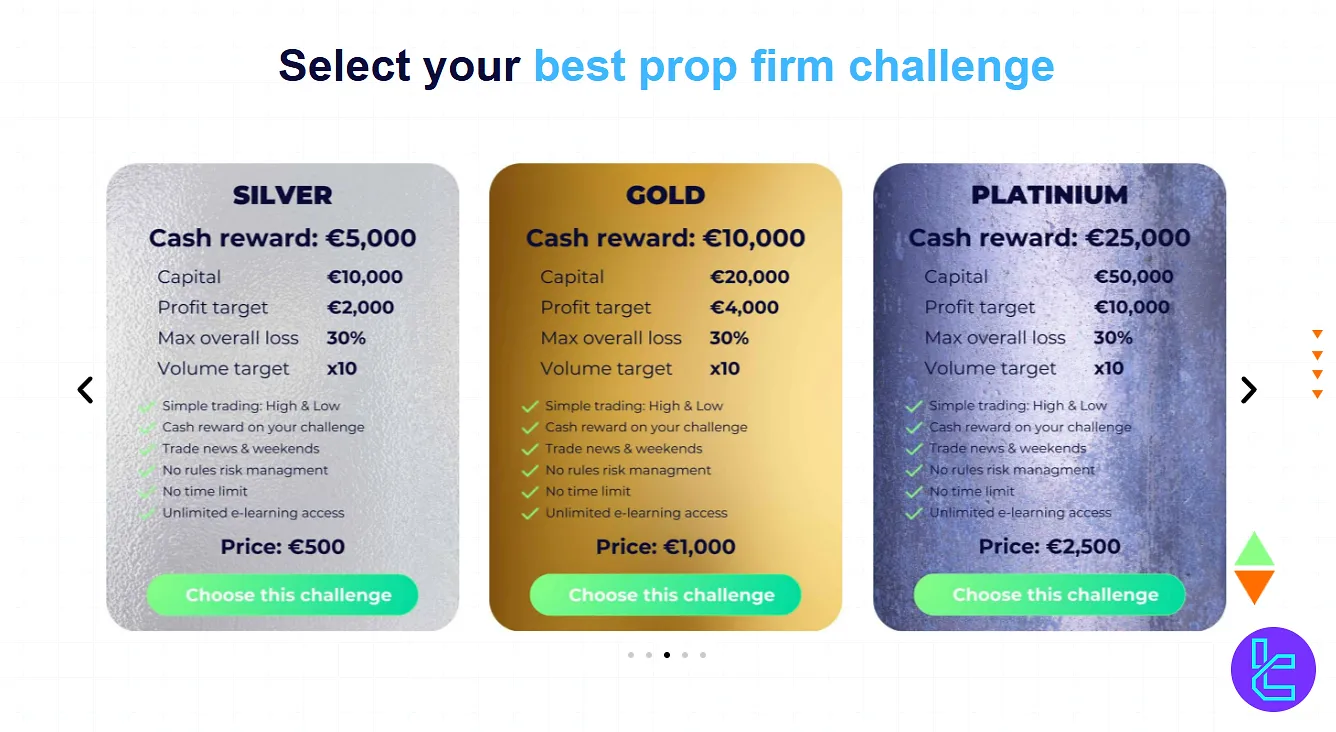

We must discuss the details of the evaluation programs in this Challenge4Trading review.

To be precise, the prop firm offers five distinct plans with various cash rewards and similar evaluation parameters:

| Plan | Funding Size | Cash Reward | Volume Target | Profit Target | Max. Overall Loss | Time Limit |

| Basic | €2,000 | €1,000 | €20,000 | 20% | 30% | None |

| Bronze | €5,000 | €2,500 | €50,000 | |||

| Silver | €10,000 | €5,000 | €100,000 | |||

| Gold | €20,000 | €10,000 | €200,000 | |||

| Platinium | €50,000 | €25,000 | €500,000 |

The prop firm's website lacks integrity in the account details information; however, apparently, the only evaluation model currently available is the 1-step model mentioned in the plans above.

Challenge4Trading Prop Firm Promotions

Prop firms often offer discounts on their challenge prices, either pre-applied or available through promo codes accessible across the web. However, this is not the case with C4T, as there are no promotional offers ordiscounts with this prop firm.

C4T Rules

The prop firm's website does not disclose any details about the trading rules and conditions. This is not good practice taken by Challenge4Trading.

What Trading Platforms Are Available on Challenge4Trading?

While C4T doesn’t support advanced and popular trading platforms like MetaTrader and TradingView, it offers the Sirix trading platform.

The platform features advanced charting tools and a comprehensive social trading service. Sirix is available in various versions, including:

Challenge4Trading Prop Firm Financial Instruments

While C4T doesn’t clearly disclose the available trading instruments on its website, theSirix platform is mainly designed for trading the following markets:

- Forex pairs

- Crypto Assets

- Indices

- Commodities

Challenge4Trading Payment and Payout Methods

To cater to its global clientele, the firm offers flexible payment and payout options. Note that the deposits and withdrawals are subject to commissions by the payment service provider. The minimum

Payment | Visa, MasterCard, Bank Transfer, Crypto (USDT, BTC, ETH) |

Withdrawal | Bank Transfer, Crypto |

While traders can request payouts on a bi-weekly basis, they must meet a profit target requirement of 1% to be eligible for profit withdrawals.

Challenge4Trading Trading Fees and Commissions

C4T doesn’t disclose the trading costs, such as commissions, spreads, and swaps, on its website, which leads us to believe that the fees are above the industry average.

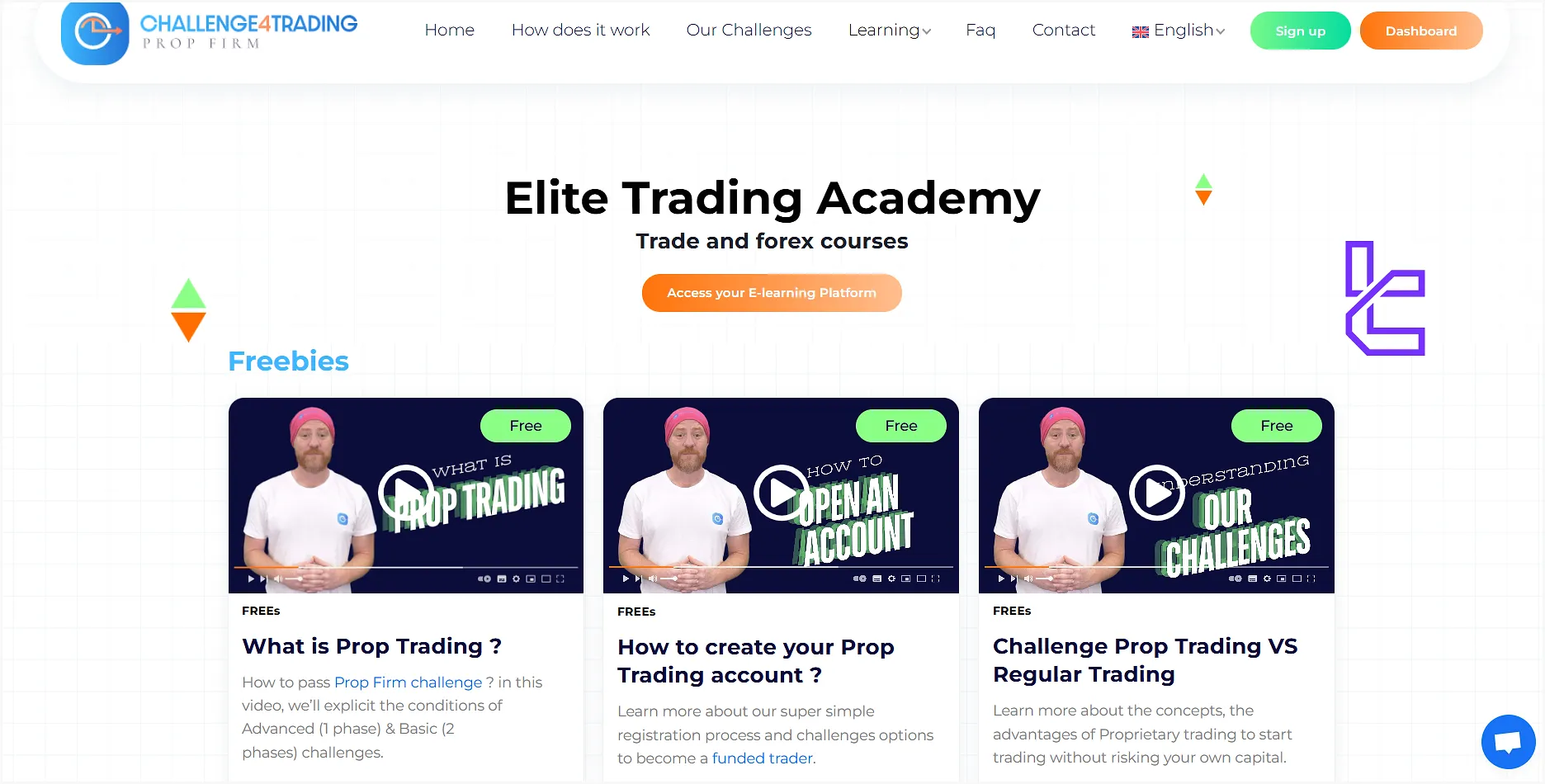

Challenge4Trading Prop Firm Educational Resources

We must highlight the firm’s dedication to trader’s education in this Challenge4Trading review.

C4T offers a comprehensive blog and an Elite Trading Academy, covering topics like trading strategies and technical analysis.

- Blog: Covering all topics and markets, including market news, Forex basics, trading strategies, and indicators

- Elite Trading Academy: Free and premium Trade & Forex courses as videos

You can also check the vast resources of TradingFinder on Forex education to expand your knowledge of the market.

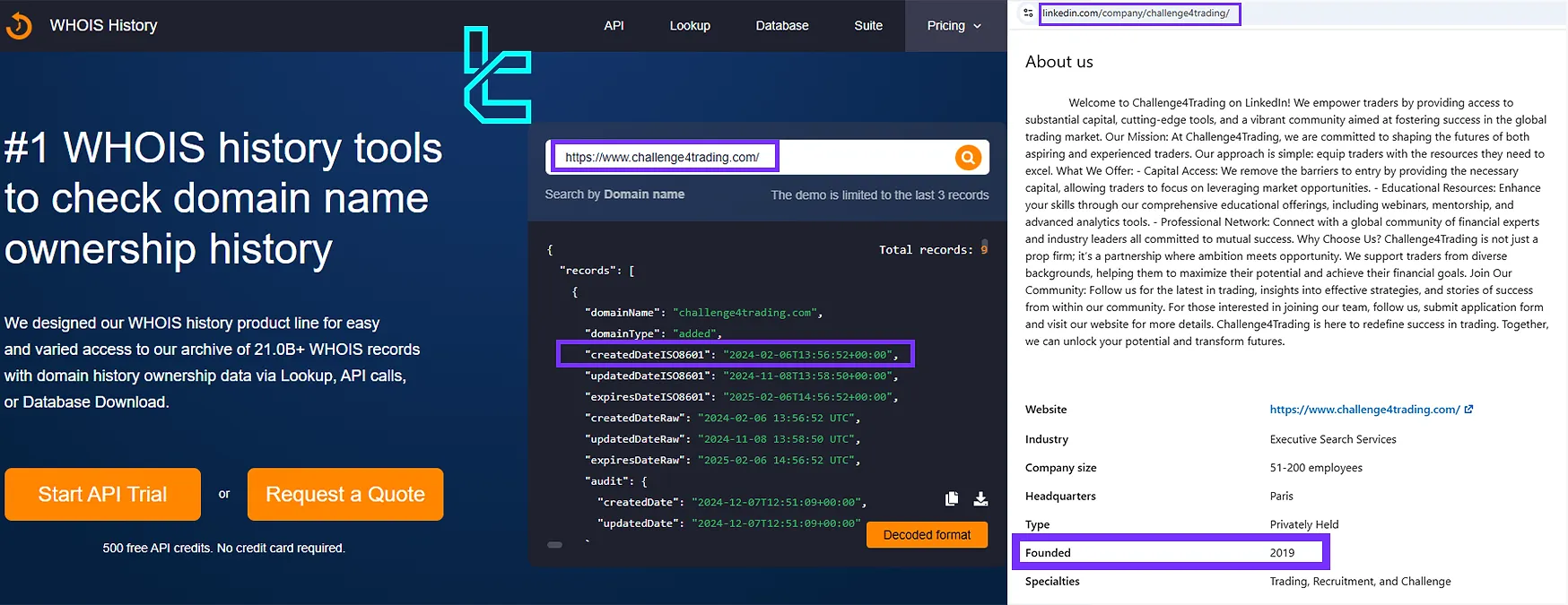

Challenge4Trading Trust Score

While the firm claims that it was founded in 2019 on its LinkedIn profile, the “challenge4trading.com” domain was created just recently in 2024. The conflicting data can be a warning for potential clients.

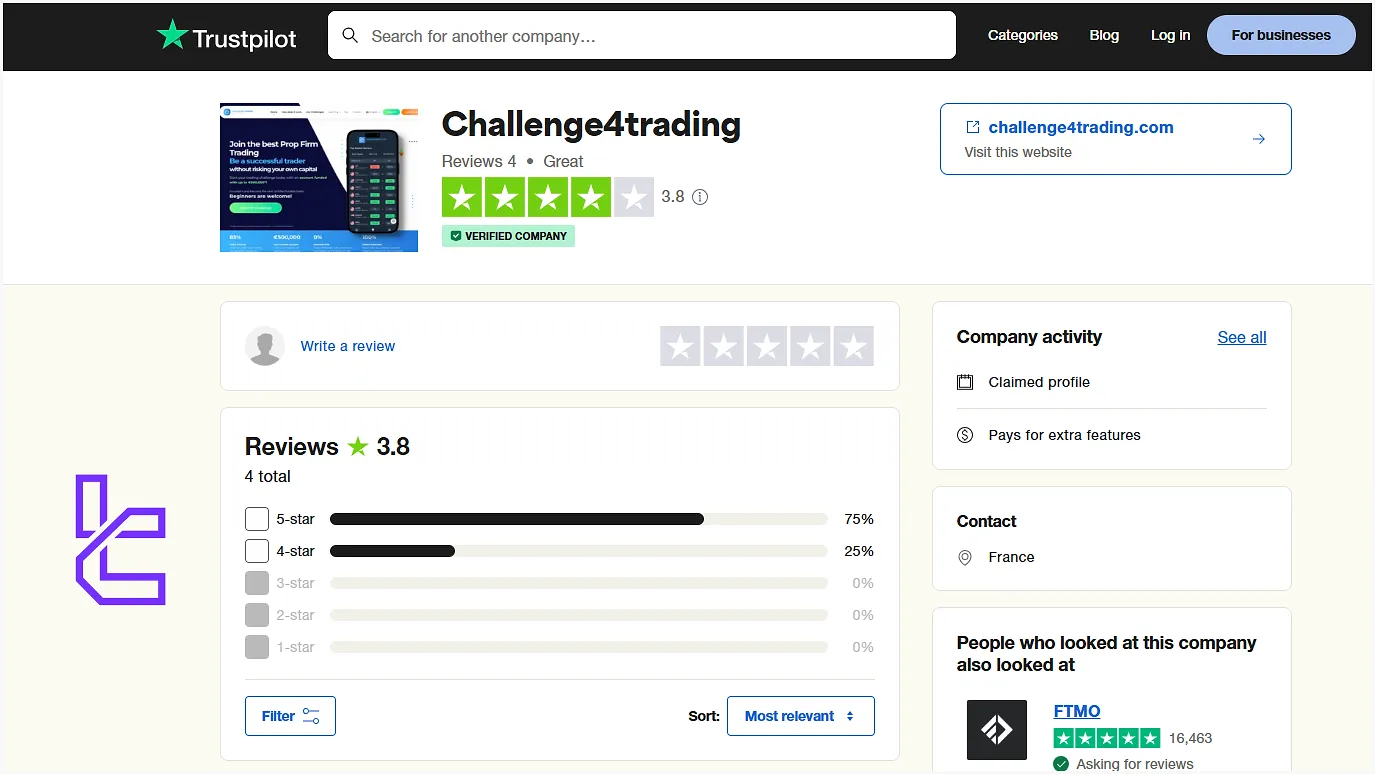

There are not also many C4T reviews on websites like Forex Peace Army and Reviews.io. Among the reputable sources, only TrustPilot has listed the firm. 4 usershave rated the Challenge4Trading TrustPilot profile, resulting in a great score of 3.8/5.

Challenge4Trading Customer Support

The lack of 24/7 support is another weakness of the C4T proprietary trading firm. The support is available on weekdays through various channels, including:

support@challenge4trading.com | |

Tel | +33 1 89 71 58 87 |

Live Chat | Available on the official website |

Ticket | Through the “Contact Form” |

Challenge4Trading Prop Firm on Social Media

C4T maintains an active presence on social media platforms, announcing new changes and special offers.

- Challenge4Trading Discord

- Challenge4Trading Facebook

- Twitter (X)

- YouTube

Challenge4Trading Compared to Other Firms

This section compares the discussed prop firm to other competing companies in the industry:

Parameters | C4T Prop Firm | Breakout Prop Firm | BrightFunded Prop Firm | Crypto Fund Trader Prop Firm |

Minimum Challenge Price | 100 EUR | $50 | €55 | $55 |

Maximum Fund Size | €50,000 | $2,000,000 | Infinite | $200,000 |

Evaluation steps | 1-Step | 1-Step, 2-Step | 2-Step | 1-phase, 2-phase |

Profit Share | 91% | 90% | 100% | 80% |

Max Daily Drawdown | None | 4% | 5% | 4% |

Max Drawdown | 30% | 6% | 8% | 6% |

First Profit Target | 20% | 5% | 10% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:5 | 1:100 | 1:100 |

Payout Frequency | Bi-weekly (conditions applied) | Bi-weekly | 14 Days | 2 Times a Month |

Number of Trading Assets | N/A | 100+ | 150+ | 200+ |

Trading Platforms | Sirix | Proprietary platform | cTrader, DXTrade | Metatrader 5, CFT Platform, and Crypto Futures |

Expert Suggestions

Challenge4Trading provides funded accounts, ranging from €2,000 to €50,000, through its 1-step evaluation programs with up to 91% profit split and bi-weekly payouts.

While the cash rewards are attractive (up to 25,000 EUR), the lack of support for advanced platforms (only offers Sirix) and transparency in regard to commissions and spreads are the Challenge4Trading prop firm’s biggest weaknesses.