Clarity Traders is a prop trading firm with 5 tradable markets [Forex, metals, commodities, indices, crypto] and account prices ranging from $50 to $2,817.

Accounts are provided in 7 sizes [$5K, $10K, $25K, $50K, $100K, $200K, $300K, $500K]. Profit payouts are paid via crypto (USDT) transactions.

Clarity Traders Prop Firm Company Overview

Clarity Traders is a U.S.-based proprietary trading firm headquartered in Delaware. This company was founded by Anthony Alvarenga, better known in trading circles as Mamba FX. There's not much information available about the firm, but here's what we found:

- Founded Date: 2022

- Address: 8 The Green Suite B, Dover, Delaware 19901

Table of Features

As a tradition in our reviews, in this section, we are going to provide you with a table containing key specifics of the firm. Here's a quick rundown of what we know about Clarity Traders:

Account Currency | USD |

Minimum Price | $50 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 100% |

Instruments | Forex, Metals, Commodities, Indices, Crypto |

Assets | Not Specified |

Evaluation Steps | 1-Step, 2-Step |

Withdrawal Methods | Crypto (USDT) |

Maximum Fund Size | $500K |

First Profit Target | From 8% |

Max. Daily Loss | From 4% |

Challenge Time Limit | Unlimited |

News Trading | Not Specified |

Maximum Total Drawdown | From 6% |

Trading Platforms | TradeLocker |

Commission Per Round Lot | $7 for Forex symbols None for Other Instruments |

Trustpilot Score | 3.0 out of 5 |

Payout Frequency | Bi-weekly |

Established Country | United States |

Established Year | 2022 |

What Pros and Cons Should You Consider?

When considering Clarity Traders as your prop firm of choice, it's crucial to weigh both the advantages and disadvantages. Here's a balanced look at what the firm brings to the table:

Pros | Cons |

High Profit Share of Up to 100% | Consistency Rule in 1-Phase and Traditional Accounts |

Three Distinct Evaluation Programs | Lack Of Extensive Track Record |

Competitive Challenge Pricing | - |

Diverse Account Sizes | - |

Account Sizes and Purchase Fees

Clarity Traders provides a diverse range of accounts of various sizes. This sets the ground for traders with different amounts of budgets. Here's a breakdown of its pricing and funding structure:

Account Size | $5K | $10K | $25K | $50K | $100K | $200K | $300K | $500K |

1 Phase Price | $59 | $117 | $177 | $349 | $687 | $1,133 | $1,671 | $2,639 |

Traditional Price | $50 | $99 | $149 | $292 | $492 | $949 | $1,399 | $2,214 |

Accelerated Price | $63 | $125 | $189 | $372 | $626 | $1,209 | $1,782 | $2,817 |

Please note that these fees are non-refundable. Furthermore, currently, no scaling program is provided by the prop firm.

This pricing structure allows traders to start with smaller, more affordable challenges and work their way up to larger account sizes as they prove their skills.

How to Create an Account and Verify with Clarity Traders

The Clarity Traders registration process is quick and straightforward. Key steps include email verification, identity data input, and password configuration.

#1 Access the Sign-Up Page

Start by visiting the official Clarity Traders website and selecting “Create Account”. This directs you to the registration page where you’ll begin the setup process.

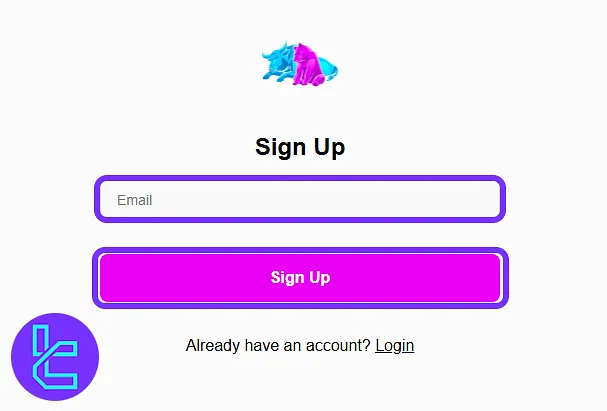

#2 Verify Your Email Address

Enter your valid email and click “Sign Up”. Then, open your inbox and confirm the registration by selecting “Complete Registration” from the email sent by Clarity Traders.

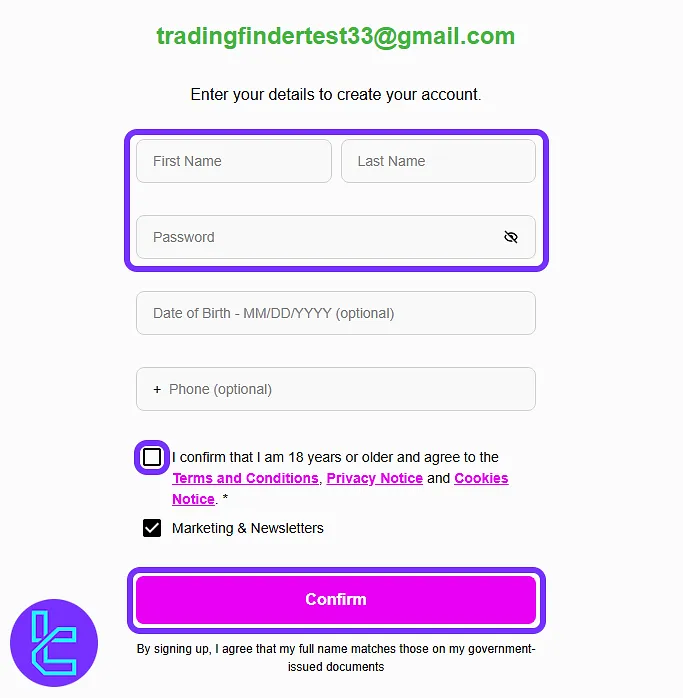

#3 Complete Account Details

Fill in your first and last name, set a secure password, and agree to the terms of service. Optional fields such as date of birth and phone number can also be added for a more complete profile.

Once submitted, you’ll gain immediate access to your Clarity Traders account dashboard.

#4 Submit KYC After Challenge Completion

Once you pass the evaluation phase, upload the required identity verification documents to activate your funded trading account.

Evaluation Programs and Challenge Parameters

Clarity Traders offers three different evaluation paths for aspiring funded traders.

Traders can choose the challenge that best fits their trading style and experience level. The 1-Phase option is great for confident traders who want to prove themselves quickly, while the 2-Step challenges allow for a more gradual approach to reaching funded status.

These programs will be investigated in the sections below.

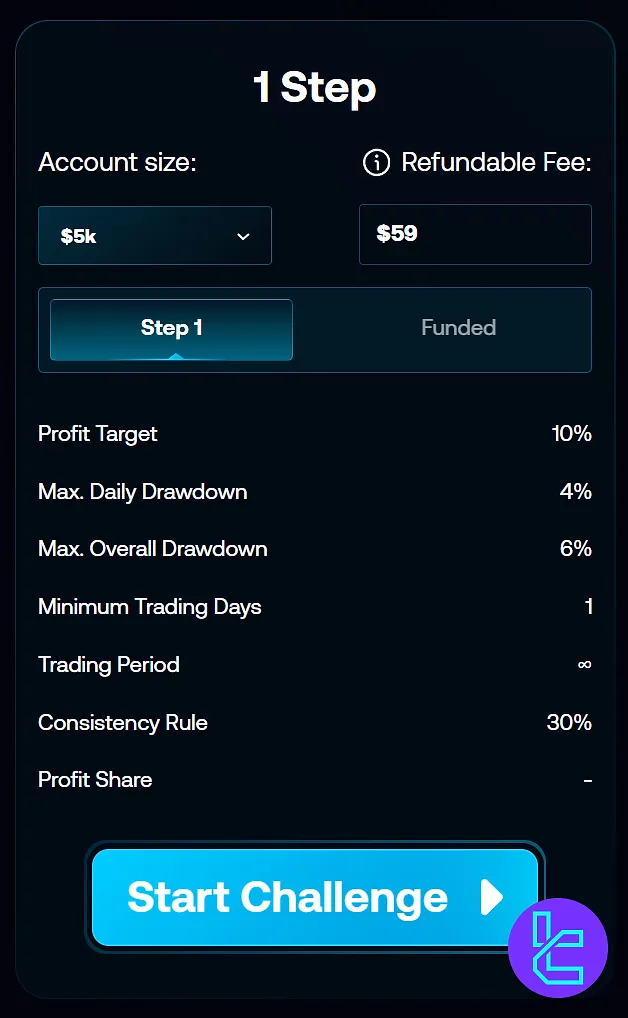

One-Step Program

The Clarity Traders 1-Step Evaluation Program is designed to provide traders with a fast and transparent path to a funded account.

Here are the details:

Stage | Evaluation | Funded |

Min. Trading Days | 1 | N/A |

Min. Daily Loss | 4% | |

Max. Total Drawdown | 6% | |

Profit Target | 10% | N/A |

Consistency Rule | 30% | |

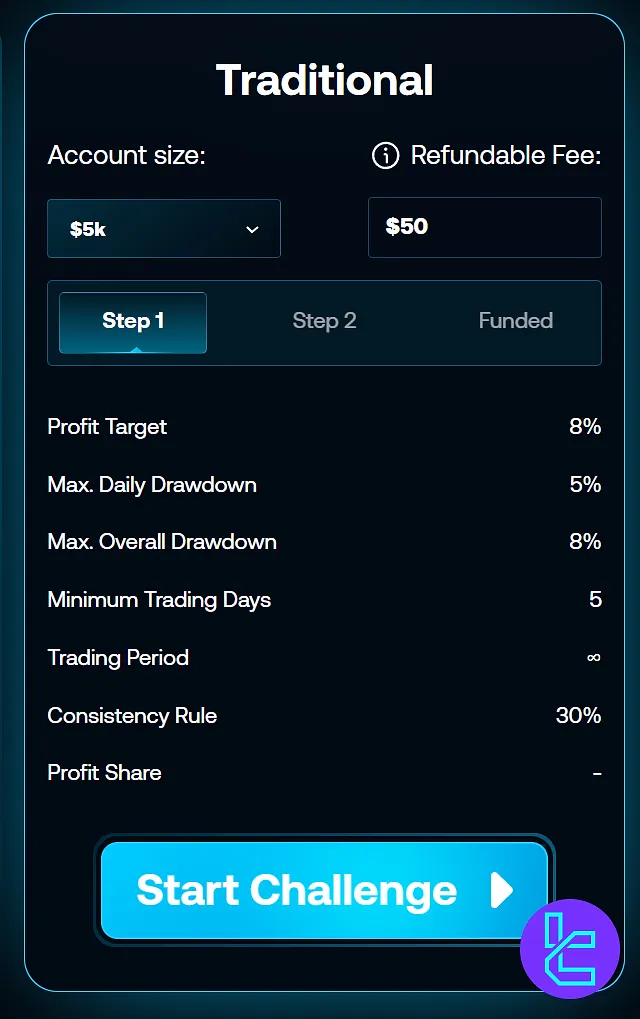

Traditional Evaluation

The Clarity Traders Traditional Evaluation Plan follows a structured 2-step assessment model designed to evaluate both profitability and discipline before granting access to a funded account.

Clarity Traders Traditional Program Parameters:

Stage | Stage 1 | Stage 2 | Funded |

Min. Trading Days | 5 | N/A | |

Min. Daily Loss | 5% | ||

Max. Total Drawdown | 8% | 10% | |

Profit Target | 8% | 5% | N/A |

Consistency Rule | 30% | - | |

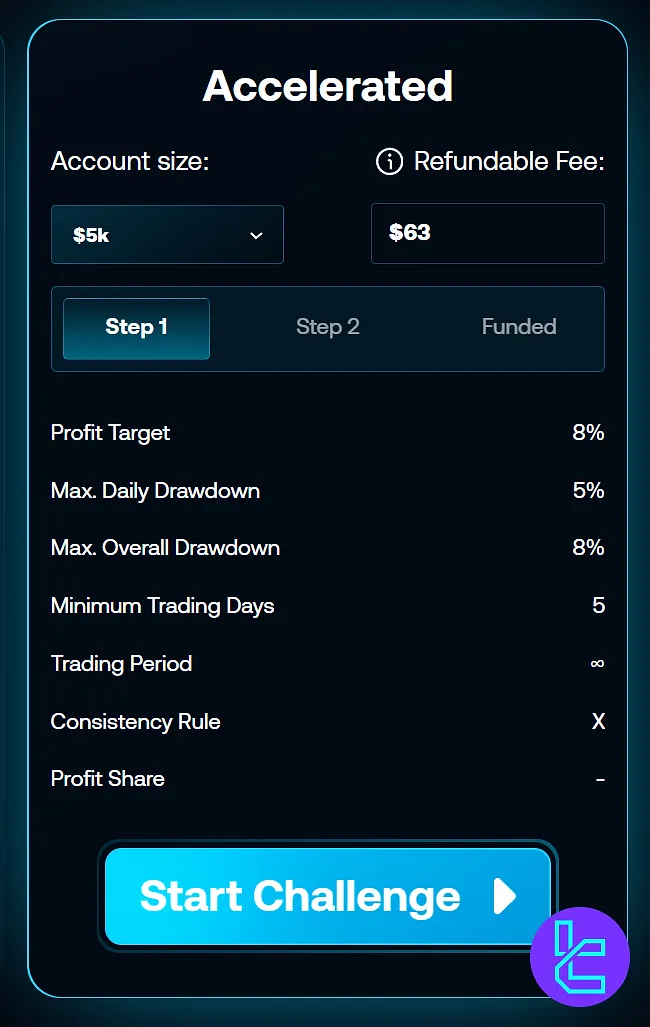

Accelerated Evaluation

The third program, titled "Accelerated", is the same as "Traditional", except that it does not have a consistency rule.

The parameters are outlined in the table below:

Stage | Stage 1 | Stage 2 | Funded |

Min. Trading Days | 5 | N/A | |

Min. Daily Loss | 5% | ||

Max. Total Drawdown | 8% | 10% | |

Profit Target | 8% | 5% | N/A |

Does Clarity Traders Come With Any Bonuses And Promotions?

As per our thorough and extensive investigations, Clarity Traders does not offer any specific bonuses or promotions.

This is not uncommon for prop firms in the industry. Instead, they provide discount codes via official sources or on third-party websites. Therefore, look up any of these and check them out.

Currently, they provide a 25% discount on all challenges via this code: SUMMER25. However, this offer is valid for June.

Clarity Traders Rules

Every prop firm has a set of trading rules that must be considered before traders begin. Clarty Traders Rules:

- VPN Usage: The use of VPNs or VPSs is strictly prohibited;

- Hedging: Hedging within a single trading accountis allowed; however, hedging across multiple accounts simultaneously is not permitted;

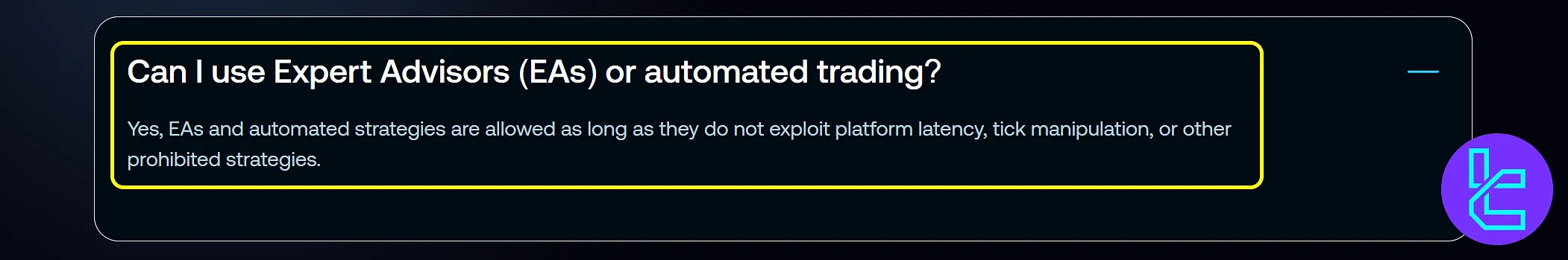

- Expert Advisors (EA): The use of Expert Advisors (EAs) and bots is allowed during both the challenge and funded account stages at Clarity Traders;

- Martingale and Arbitrage: Both Martingale and Arbitrage strategies are allowed;

- News Trading: Trading during news events is prohibited for both Traditional (Two-Phase) and One-Phase challenges;

- Payouts: Payouts at Clarity Traders are processed in USDT (ERC-20) and can be requested directly from the dashboard once the trader reaches the funded stage.

VPN Usage

At Clarity Traders, VPNs and Virtual Private Servers (VPSs) are not permitted during the Funded Account Challenge.

This rule is in place to ensure that all participants are trading under the same conditions, maintaining a level playing field for everyone involved.

Hedging

Hedging is allowed within a single trading account, meaning you can take opposing positions within the same account. However, it is strictly forbidden to hold opposing positions across different accounts simultaneously.

Expert Advisors (EA)

The use of Expert Advisors (EAs) and automated bots is fully allowed during both the challenge and live funded account stages at Clarity Traders.

Martingale and Arbitrage

Both Martingale and Arbitrage strategies are permissible within the Clarity Traders platform.

News Trading

Trading during high-impact news events is restricted on both the Traditional (Two-Phase) and One-Phase challenges. Specifically:

- All positions must be closed at least 2 minutes before the news event;

- No new positions may be opened or held for at least 2 minutes after the news event.

Payouts

Clarity Traders allows traders to request payouts once they reach the Funded Stage, ensuring that all account guidelines and trading rules have been met.

Payouts are streamlined to provide traders with fast and secure access to their profits, maintaining full transparency through each transaction.

All payments are processed in USDT (ERC-20), giving traders a stable and widely accepted digital settlement option.

Withdrawal requests can be made directly from the trader’s personal dashboard, allowing for complete control and visibility over the payout process.

This structure not only ensures operational efficiency but also reinforces Clarity Traders’ commitment to delivering a professional and reliable funding experience for its clients.

Available Trading Platforms

While specific data on Clarity Traders' trading platforms is limited, we found out that this prop trading firm offers its services through the TradeLocker platform. It introduces itself as "Next-Gen", which has integrated TradingView for a better experience with charts.

TradingFinder has developed a wide range of TradingView indicators that are available for free.

Which Symbols Can I Trade On Clarity Traders?

Clarity Traders does a good job of providing diverse trading instruments. Here's a breakdown of the available asset classes:

- Forex Market: Popular and minor currency pairs

- Cryptocurrencies: [BTC], [ETH], [LTC], and [BCH]

- Metals: Gold and Silver

- Commodities: WTI, BRENT & NGAS

- Indices: Global indices

Payment Options

Clarity Traders offers a typical approach to payments, similar to most of its peers. These are the payment options available with the firm:

- Credit/Debit Cards

- Cryptocurrencies

The only option for payouts is crypto, which is limited to USDT. Based on our chat with the support team, the minimum payout amount is $100, and payments are made ona bi-weekly basis.

No further details are available for payment methods.

Commissions and Costs in Trading Different Symbols

Understanding the fee structure is crucial when choosing a prop firm. Clarity Traders tries to provide transparent information regarding trading commissions:

- 7 USD per lot for trading Forex pairs

- No trading fees for trading other symbols

The firm offers useful data on trading fees, but there's no information available about the spreads or costs in other operations and sections.

Education Resources and Guides

This is a section where Clarity Traders lags behind compared to some of the other firms in the industry. It offers limited educational content via these channels:

- FAQ: A page with questions and answers about platforms, challenges, getting started with the firm, etc.

- YouTube Channel: A few videos on Forex trading tips and making profits

Since a prop firm's main purpose is not to educate traders, this lack of guides and helpful articles cannot necessarily be a drawback.

You can use TradingFinder's comprehensive Forex education section for additional learning materials.

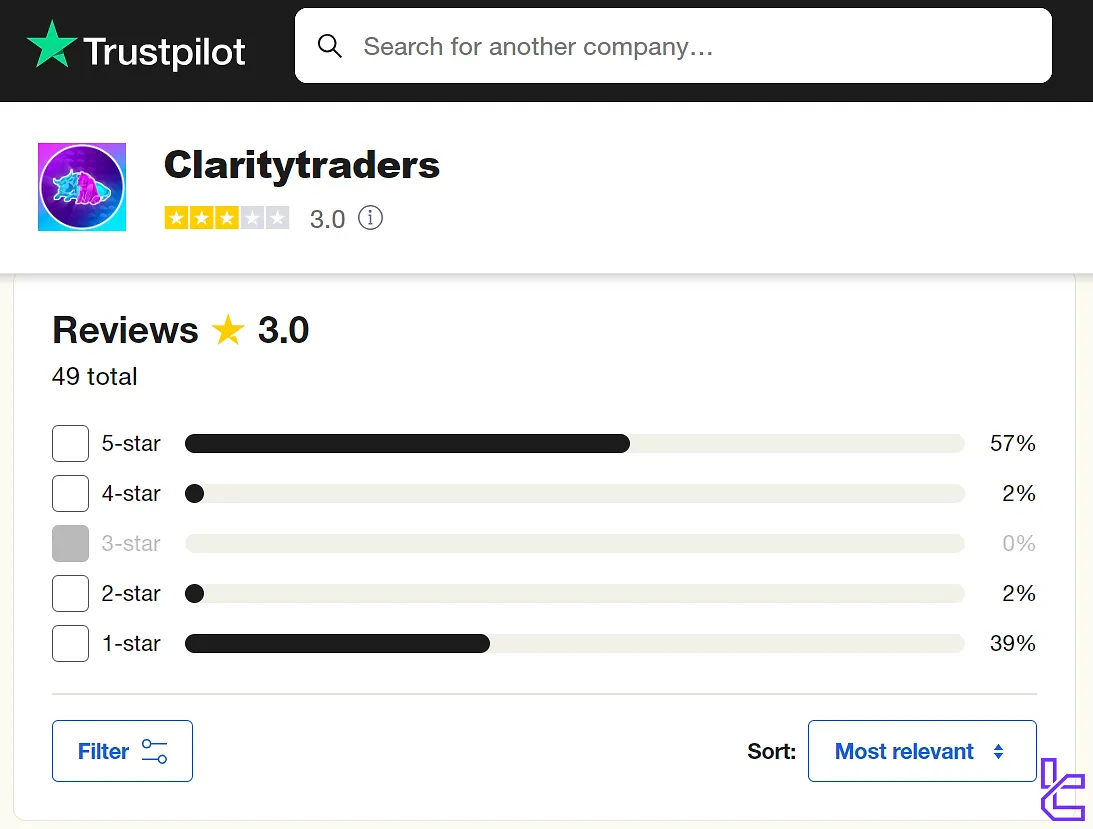

Clarity Traders Reviews and Trust Scores

Trust scores can tell us whether a firm is reliable and reputable, and they're available on several websites, including Trustpilot. Information on the Clarity Traders Trustpilot profile:

- Rated 3.0 out of 5

- More than 40 reviews

- Around 55% of the scores are 5-star

- No replies to negative reviews from the firm

It's important to note that online reviews can be subjective and may not represent every trader's experience. The 3.0 rating indicates room for improvement, but also suggests that some traders have had positive experiences with the firm.

How and When to Contact Customer Services in Clarity Traders

Clarity Traders offers three common channels for customer support, aiming to assist traders with their queries and concerns. You have 3 options for contacting the support team:

Support Method | Availability |

Live Chat | Yes (Provides real-time assistance via the website) |

Similar usage as with the ticket system via support@claritytraders.com | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes (On the website for detailed issue reporting) |

FAQ | Yes (without a Search option) |

Help Center | No |

No | |

Messenger | No |

The firm states that the support team is available to assist clients 24/7.

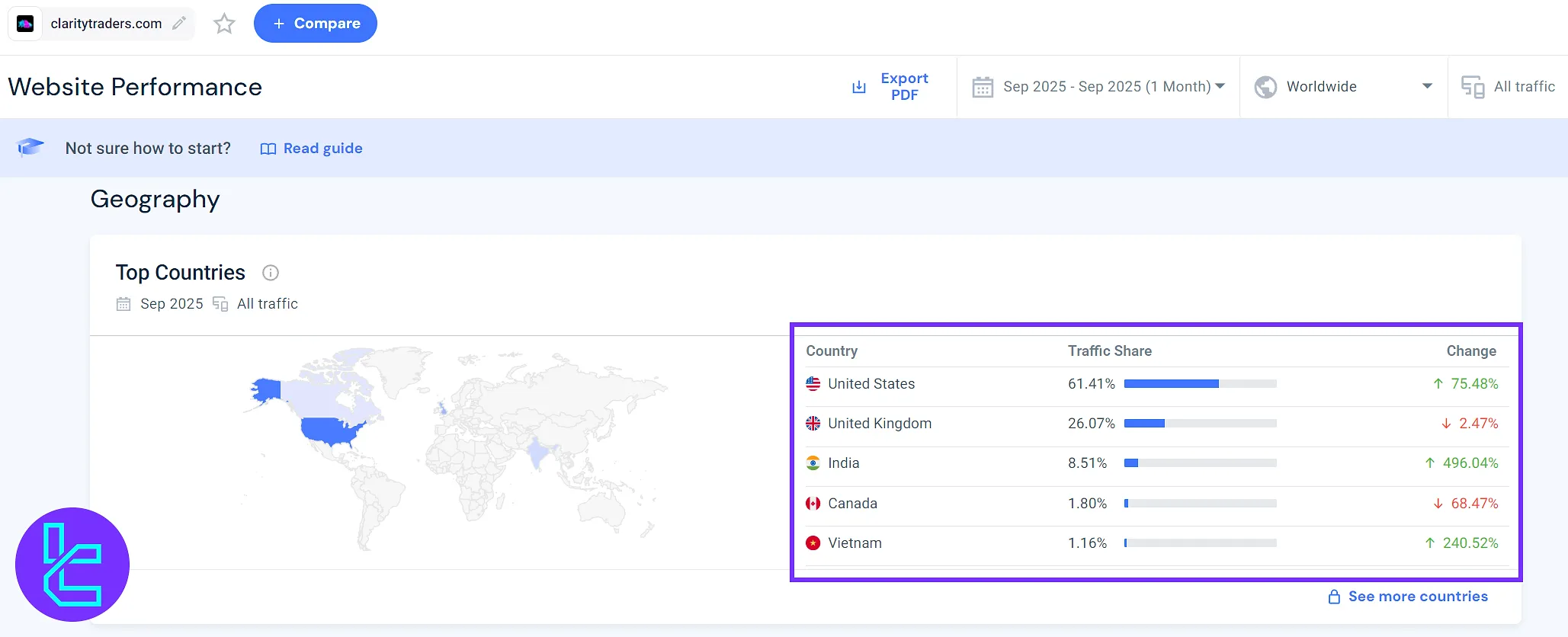

Clarity Traders Prop Firm User Regions and Countries

According to Similarweb’s September 2025 analytics, Clarity Traders’ audience is predominantly based in the United States,which accounts for 61.41% of total website traffic, marking a strong 75.48% growth over the previous period.

The United Kingdom follows with 26.07%, while India ranks third with 8.51%, showing an impressive surge of 496.04%, reflecting the firm’s rising visibility across Asian trading communities.

Additional user traffic originates from Canada (1.80%) and Vietnam (1.16%), highlighting Clarity Traders’ gradually expanding global presence.

The combination of strong North American engagement and rapidly increasing Asian interest positions the firm as a growing player within the international prop trading ecosystem.

Presence On Social Media

Clarity Traders' social media presence appears to be minimal, which is unlikely for companies operating in the financial industry. In the list below, we provide links to each account:

Social Media | Members/Subscribers |

Over 34.2K | |

Over 1.2K |

While a strong social media presence isn't necessarily indicative of a prop firm's quality, it can provide valuable insights and foster community trust.

Traders interested in Clarity Traders may need to rely more heavily on direct communication with the firm and independent research for information.

Clarity Traders Compared to Other Prop Firms

The table below will evaluate how CT stands out against some of its peers:

Parameters | Clarity Traders Prop Firm | Crypto Fund Trader Prop Firm | For Traders Prop Firm | FundedNext Prop Firm |

Minimum Challenge Price | $50 | $55 | $49 | $32 |

Maximum Fund Size | $500K | $200,000 | $1,500,000 | $4,000,000 |

Evaluation steps | 1-Step, 2-Step | 1-phase, 2-phase | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 100% | 80% | 90% | 95% |

Max Daily Drawdown | 4% | 4% | 4% | 5% |

Max Drawdown | 6% | 6% | 8% | 10% |

First Profit Target | 8% | 8% | 6% | 8% |

Challenge Time Limit | Unlimited | 5 Days | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:125 | 1:100 |

Payout Frequency | Bi-Weekly | 2 Times a Month | 14 Days | Varies |

Number of Trading Assets | N/A | 200+ | 130 | 78 |

Trading Platforms | TradeLocker | Metatrader 5, CFT Platform and Crypto Futures | DXTrade, TradeLocker, cTrader | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

Clarity Traders is a financial company founded by Anthony Alvarenga, otherwise known as Mamba FX. It has received a 3/5 trust score on the Trustpilot platform.

The mentioned rating is based on more than 40 reviews, and approximately 55% of them are 5-star.