Per our latest investigations, the prop firm's website does not seem to operate anymore; when we tried to reach it, instead of facing DeiFunded's webpage, we were redirected to another URL, and this page was loaded up:

DeiFunded provides trading capital through its 2-step challenge accounts, ranging from $5,000 to $200,000, for a refundable fee starting from $59. The prop firm provides access to Forex and Metals markets via the MetaTrader 5 platform.

DeiFunded (An Introduction to the Company)

DeiFunded is a business name registered with the Australian Securities and Investments Commission (ASIC) on 24 October 2023 under the mother company FINEXMARKETS PTY LIMITED.

The company is led by the CEO Shane Healy and is located at “L 45 680 George St, Sydney NSW 2000, Australia” with the registry number “ABN 18666253229”. Key features of DeiFunded:

- Funding programs for traders of all experience levels

- Atwo-phase evaluation process to identify skilled traders

- Access to substantial capital, ranging from $5,000 to $200,000

- 80% - 90% profit split

- A comprehensive scaling plan for $100K+ accounts up to $400,000

DeiFunded Prop Firm Specifications

DeiFunded offers a robust prop trading program with several distinctive features, including 20% - 30% scaling plans, an affiliate program, and various markets to trade.

Account currency | USD |

Minimum price | $59 |

Maximum leverage | 1:100 |

Maximum profit split | Up to 90% |

Instruments | Forex, Metals, Commodities |

Assets | N/A |

Evaluation steps | Verification (Phase 1), Evaluation (Phase 2) |

Withdrawal methods | Credit/Debit Cards, Crypto |

Maximum fund size | $400,000 |

First profit target | 8% |

Max. daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Yes |

Maximum total drawdown | 10% |

Trading platforms | MT5 |

Commission | N/A |

TrustPilot score | 2.1 |

Payout frequency | Bi-Weekly |

Established country | Australia |

DeiFunded Upsides & Downsides

When considering DeiFunded as your prop firm, it's essential to weigh both the advantages and potential drawbacks.

Pros | Cons |

High profit split (up to 90%) | Lack of online chat support |

Unlimited time for evaluation | Only one evaluation program (2-Step) |

Refunds on challenge fees | Relatively new firm with less established track record |

Opportunity to increase account size | Low trust score |

DeiFunded Prop Firm Funding Plans and Prices

DeiFunded offers a range of funded accounts at different prices to accommodate traders at various budget levels and capital requirements.

Account Size | Price |

$5K | $59 |

$10K | $129 |

$25K | $229 |

$50K | $329 |

$100K | $469 |

$200K | $899 |

DeiFunded Account Opening and KYC Verification

At the time of writing this article, the website’s billing page became unresponsive. However, the DeiFunded sign up is a simple process followed by a straightforward KYC verification upon requesting the first payout.

- Visit the firm’s website at “https://deifunded.com/;”

- Click “Get Funded” and choose your preferred account size;

- Fill out the billing form using personal details like full name, phone number, and address;

- Pay for the challenge account;

- Provide proof of identity (Passport or driving license) and proof of residence (Utility bill or bank statement.)

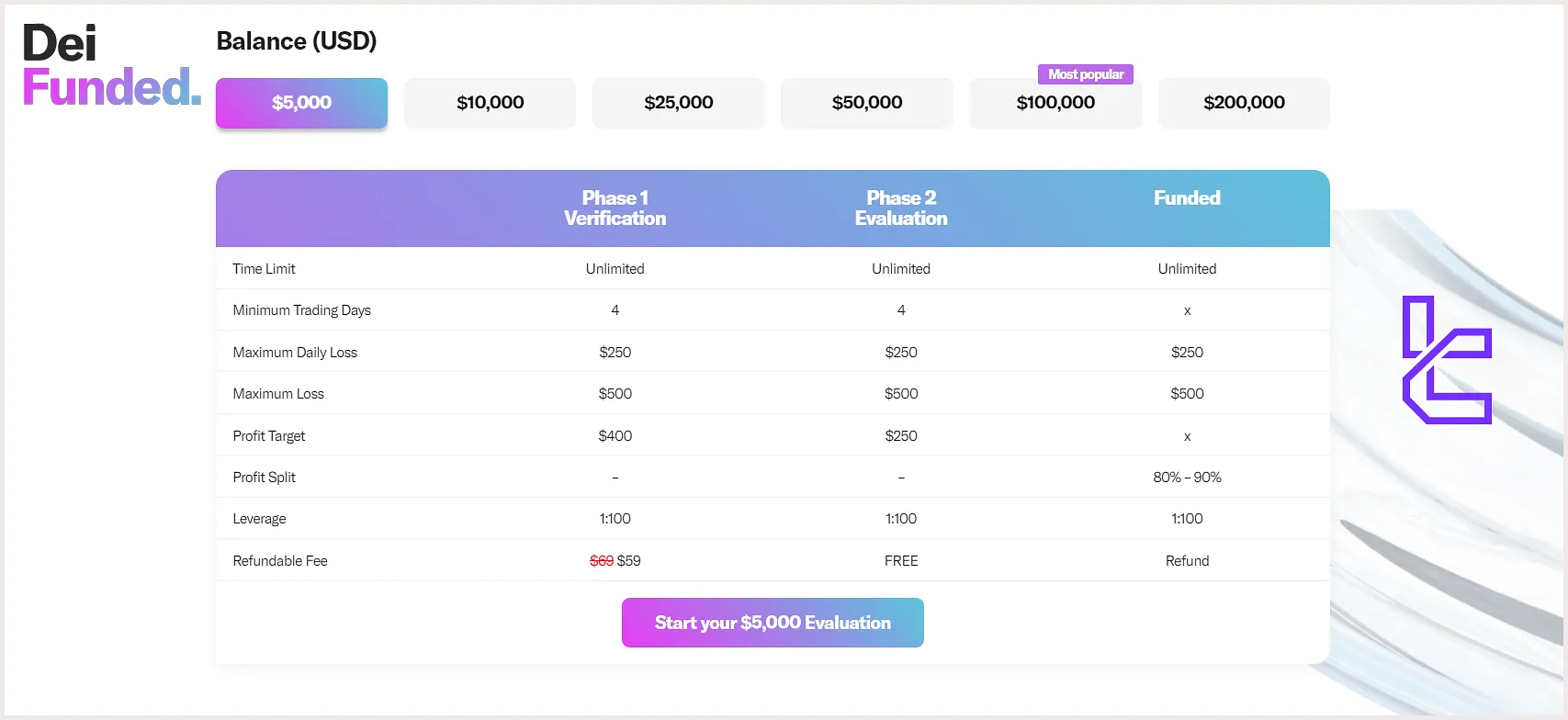

DeiFunded Prop Firm Challenge Accounts (Rules and Conditions)

Challenge rules are the most important subjects in all DeiFunded reviews. The firm 2-step evaluation accounts come with specific rules and conditions designed to identify disciplined and profitable traders.

Conditions | Verification (Phase 1) | Evaluation (Phase 2) | Funded |

Time Limit | Unlimited | Unlimited | Unlimited |

Min Trading Days | 4 | 4 | - |

Max Daily Loss | 5% | 5% | 5% |

Max Drawdown | 10% | 10% | 10% |

Profit Target | 8% | 5% | - |

Profit Split | - | - | 80% - 90% |

Leverage | 1:100 | 1:100 | 1:100 |

Does DeiFunded Offer Promotions and Discount Codes?

DeiFunded occasionally offers promotions and discount codes to attract new traders and reward existing ones. Here’s a list of current promotions on DeiFunded:

- BOGO: Purchase any evaluation plan and receive a similar one for free;

- Seasonal Discounts: A 15% discount is applied to all funded accounts;

- Affiliate: Refer new clients and earn up to 20% commission in a tiered reward structure.

DeiFunded Prop Firm Trading Platform Offerings

The firm has partnered with Kubera Capital Markets broker and offers the robust MetaTrader 5 in collaboration with this company. MT5 is available across various devices, including:

TradingFinder has developed a wide range of MT5 indicators that you can use for free.

DeiFunded Trading Assets

While the firm doesn’t specifically mention its markets, due to the partnership with Kubera Capital Markets, we can assume that it offers almost every instrument available on the broker, from the Forex market to Commodities.

- Forex: Major, minor, and exotic currency pairs

- Metals: Precious metals like silver and gold

- Commodities: Energies and agricultural products

DeiFunded Payment and Payout Methods

Exploring payment options should be included in all DeiFunded reviews. The firm’s offerings revolve around two main options, including:

- Credit/Debit Cards

- Crypto

DeiFunded Trading Costs

The firm doesn’t disclose its trading costs on its website, including commissions and spreads. However, it offers to check the instruments and spreads via an MT5 demo account with the following credentials.

- Broker Name: Kubera Capital Markets

- Account Name: 2100161112

- Password: DeiFunded_test1

- Server: Kubera Capital Markets Ltd

DeiFunded Prop Firm Educational Materials

Dei Funded doesn’t recognize the importance of trader education, and the only offering it has in this regard is a free e-book named “Young Millionaires: Mastering the Art of Proprietary Trading”, covering various topics, including:

- Prop trading basics

- Skill developments

- Trading tools

- Successful strategies

- Diversification and growth

Check our dedicated Forex education section to familiarize yourself with the market and its trading conditions.

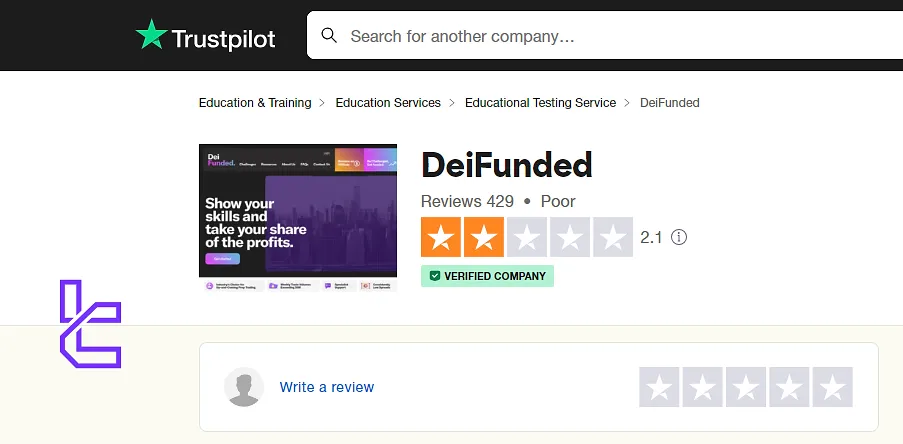

DeiFunded Trust Scores

User satisfaction is one of the first topics you should check when exploring DeiFunded reviews. Due to its lack of experience, the firm has only a profile on TrustPilot.

However, the DeiFunded TrustPilotwas rated as a poor prop firm with a score of 2.1 out of 5.0.

How to Reach DeiFunded Prop Firm Support?

The firm also lacks proper customer support. Its main offerings are email and a ticket system with a response time of up to 24 hours. DeiFunded support channels:

support@deifunded.com | |

Ticket | Available on the “Contact Us” page |

Discord |

DeiFunded on Social Media Platforms

While the firm has pages on various platforms, its activity has almost completely stopped since around March 2024. Here’s a list of DeiFunded social links.

Expert Suggestions

DeiFunded provides funded accounts with a maximum initial capital of $200K for a price of up to $899. The challenge accounts have no time limit and offer a bi-weekly payout frequency.

Despite the DeiFunded prop firm’s strong regulatory status (ASIC) and various promotion programs (e.g., BOGO, and up to 20% commissions for affiliates,) the lack of proper support (no live chat feature), and reported withdrawal issues have caused numerous negative DeiFunded reviews on TrustPilot and a poor score of 2.1.