Direct Funded Trader offers funded accounts ranging from $5K to $200K with leverage options of up to 1:100.

Up to $1,000 cashback in the challenge phase, $5 commission per lot, and refunds of up to 150% on registration fees are some of the prop firm’s offerings.

Direct Funded Trader: An Introduction to the Prop Firm

Direct Funded Trader is a proprietary trading firm providing retail clients withtrading capital of up to $1M.

The Dubai-based company, under the legal name GFT GROUP LLC, was founded in February 2023 by CEO Arthur Kaziu. Key features of DirectFundedTrader:

- Up to 90% profit split

- Overnight and weekend trading

- Access to the MetaTrader 5 platform

- A $3 cashback per traded lot on the challenge phase

Partnered with Blueberry Markets as its primary broker, the firm’s headquarters is located at Business Center 1, M Floor, The Meydan Hotel, Nad Al Sheba, Dubai.

Direct Funded Trader Table of Specifications

Let’s examine the company’s offerings to see if DirectFundedTrader has what it takes to be among the prop firms.

Account currency | USD |

Minimum price | $27 |

Maximum leverage | 1:100 |

Maximum profit split | 90% |

Instruments | Forex, Indices, Commodities |

Assets | 400+ |

Evaluation steps | 1-Step, 2-step |

Withdrawal methods | Crypto, Rise |

Maximum fund size | $1M |

First profit target | 8% |

Max. daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Yes (only in the Challenge phase) |

Maximum total drawdown | 10% |

Trading platforms | MT5 |

Commission | $5 per lot |

TrustPilot score | 4.2 |

Payout frequency | Bi-Weekly |

Established country | United Arab Emirates |

Direct Funded Trader Prop Firm Pros & Cons

The company offers attractive features, such as up to 150% refund on challenge fees, 1-phase fast funding programs, and multiple payment options. However, like any other prop firm, it also has some flaws.

Pros | Cons |

Scaling up to $1 million | Geo-restrictions |

MT5 support | Lack of educational resources |

Partnership with the Markets broker | Limited support channels |

Bi-weekly payouts | No news trading in the funded phase |

Direct Funded Trader Pricing

In this Direct Funded Trader review, we must mention that the firm offers funded accounts up to $200,000. Note that the max account size for fast funding is $100K. DFT funding models’ prices:

Account Size | Evaluation | Fast Funding Standard | Fast Funding Aggressive |

$5,000 | $31 | - | - |

$10,000 | $27 | - | - |

$15,000 | $100 | $150 | $190 |

$25,000 | $199 | $280 | $320 |

$50,000 | $299 | $350 | $390 |

$100,000 | $479 | $590 | $620 |

$200,000 | $979 | - | - |

Registration and KYC on Direct Funded Trader

To get funded by the firm, you must be at least 18 and not be from one of the prohibited countries, including the UAE, Pakistan, Iran, Vietnam, Myanmar, Albania, and Kosovo. Steps to Direct Funded Trader registration and verification will be reviewed in the following sections.

#1 Access the Sign-Up Section

Visit the official Direct Funded Trader website and click the "Sign Up" button. This leads you to the main sign-up interface.

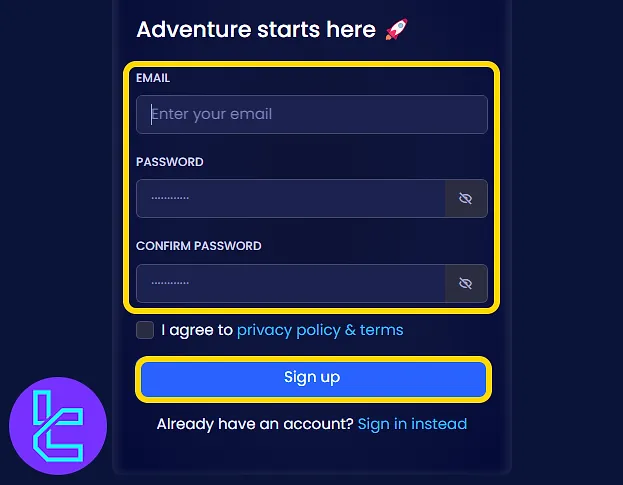

#2 Fill Out the Registration Form

Enter your email address, choose a strong password, and agree to the terms of service. Then, click “Sign Up” to submit your details.

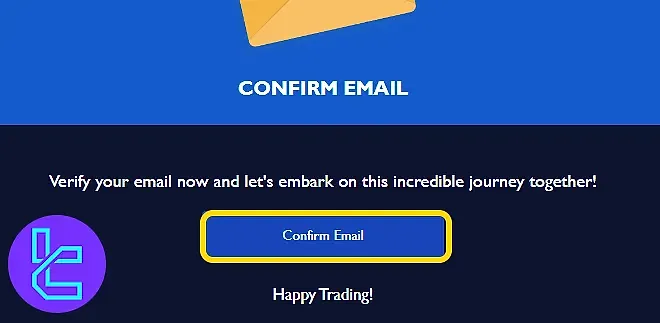

#3 Verify Email & Access Your Dashboard

Check your inbox and confirm your email via the verification link. Once confirmed, return to the site and log in to your trader dashboard instantly.

#4 Go Through the KYC Process

Note that upon completing the challenge phase, you’ll be required to provide KYC documents, including:

- Proof of identity: Passport or driving license

- Proof of address: bank statement or utility bill

Direct Funded Trader Prop Firm Evaluation Details

The company provides 1-step and 2-step challenges with varying profit targets, drawdown limits, and leverage options.

The firm offers 2 profit split models: 80% and 90%. While the default scheme is 80%, you’ll be eligible for a 90% profit share upon a streak of more than 5 consecutive payouts.

Evaluation Program

The Direct Funded Trader’s 2-Step Evaluation Program is designed for traders seeking a balanced challenge with sustainable profit targets and flexible trading conditions.

Here are the plan parameters:

Features | Evaluation Program (2-step) |

Trading Period | Unlimited |

Max Leverage | 1:100 |

Min Trading Days | 5 / 5 |

Max Daily Loss | 5% / 5% / 5% |

Max Drawdown | 10% / 10% / 10% |

Profit Target | 8% / 5% |

Weekend Position | Yes |

Fast Funding Standard Account

The Fast Funding Standard Account by Direct Funded Trader offers traders an accelerated path to live capital with simplified rules and a single-step evaluation.

Fast Funding Standard Details:

Features | Fast Funding Standard (1-step) |

Trading Period | Unlimited |

Max Leverage | 1:50 |

Min Trading Days | 5 |

Max Daily Loss | 4% / 4% |

Max Drawdown | 7% / 7% |

Profit Target | 10% |

Weekend Position | No |

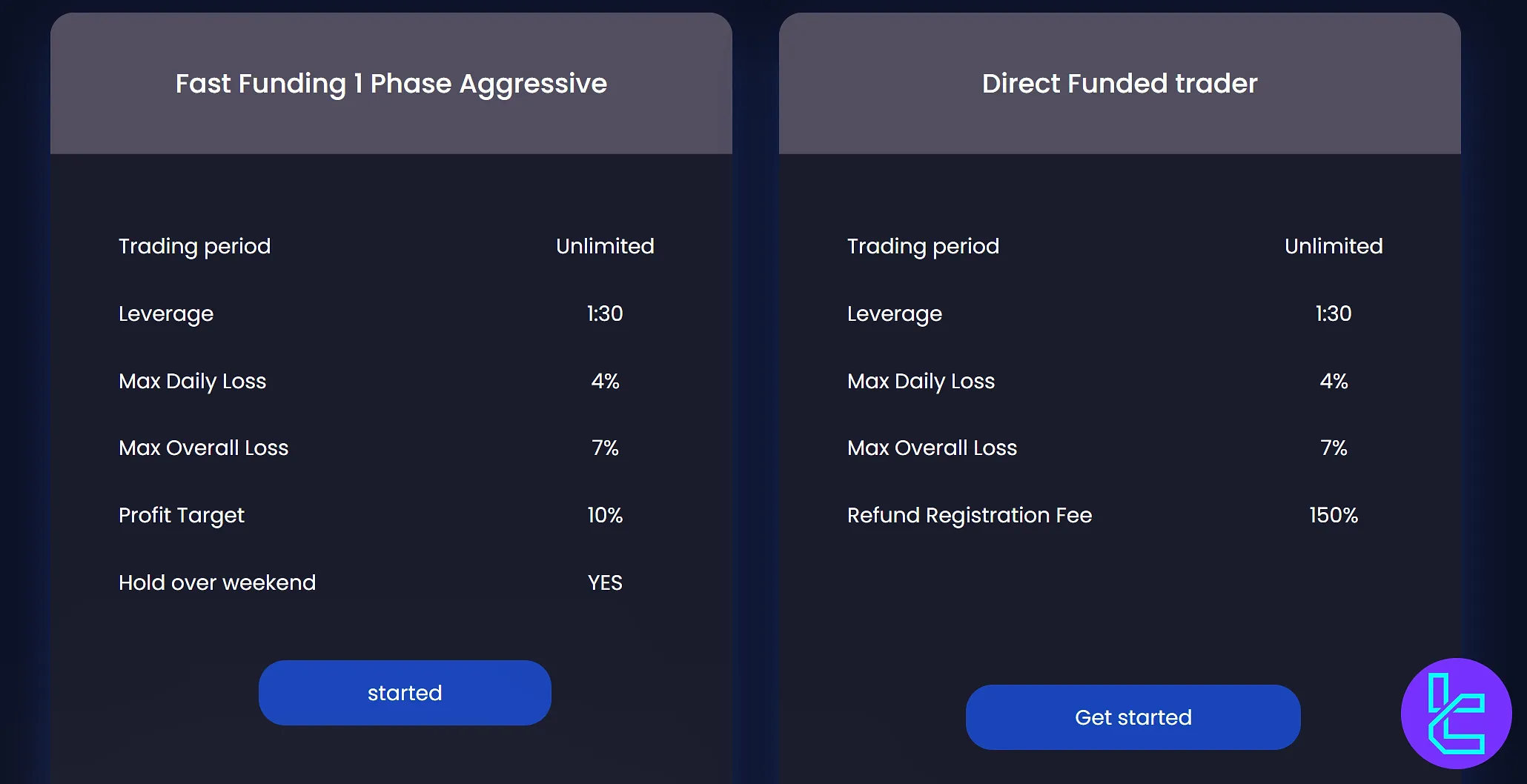

Fast Funding Aggressive Program

The Fast Funding Aggressive Program from Direct Funded Trader is built for traders seeking higher flexibility and weekend exposure under a single-step evaluation model.

The parameters are demonstrated in the table here:

Features | Fast Funding Aggressive (1-step) |

Trading Period | Unlimited |

Max Leverage | 1:30 |

Min Trading Days | 5 |

Max Daily Loss | 4% / 4% |

Max Drawdown | 7% / 7% |

Profit Target | 10% |

Weekend Position | Yes |

Promotional Programs

Offering various promotions and bonuses, such as PROMO codes and cashback, is one of the upsides of this Direct Funded Trader review.

- 50% Discount: 50% off on 15K to 200K accounts with 80% profit split (CODE: DFT50)

- 35% Discount: 35% off on 5K to 200K accounts with 85% profit split (CODE: DFT35)

- Cashback: $3 rebate per traded lot in the challenge phase

- Affiliate: Up to 20% commission for each new referral

Direct Funded Trader Rules

This section is dedicated to the rules set by the prop firm for traders:

- VPN Usage:Avoid trading from different IP addresses. If you must trade from a different location or use VPS, you will need to provide proof to customer support;

- Hedging: Hedging isallowed, but hedging across multiple accounts is prohibited. Using multiple accounts to place hedged entries is considered an improper strategy;

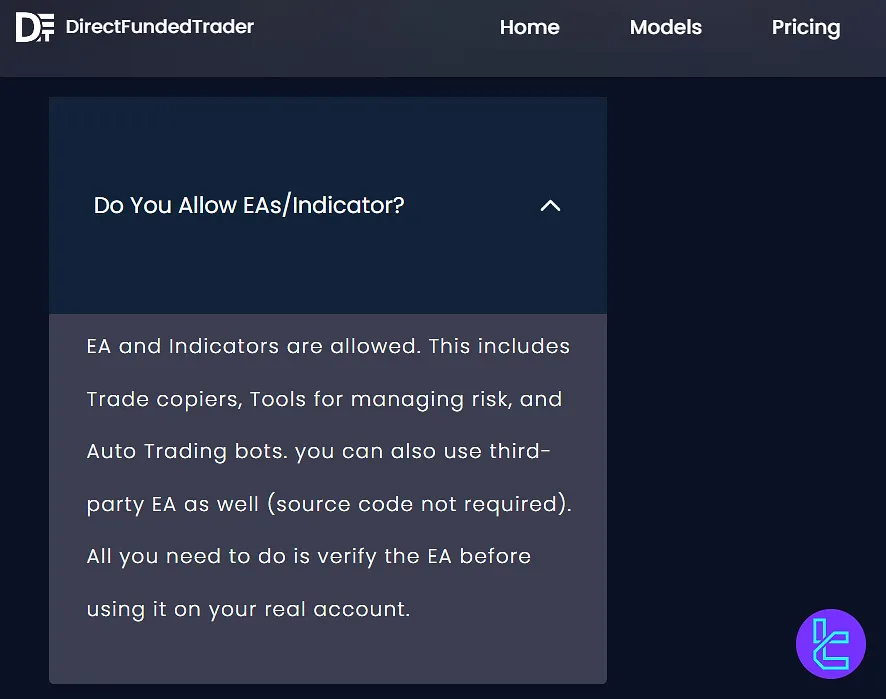

- Expert Advisor (EA): EAs and indicators are permitted, including trade copiers, risk management tools, and auto trading bots. You may use third-party EAs, but they need to be verified before use;

- Martingale and Arbitrage Strategy: Martingale and several arbitrage strategies are prohibited;

- News Trading: During the challenge stage, trading is allowed during news events. On funded accounts, trading during news events or holding positions during news is prohibited;

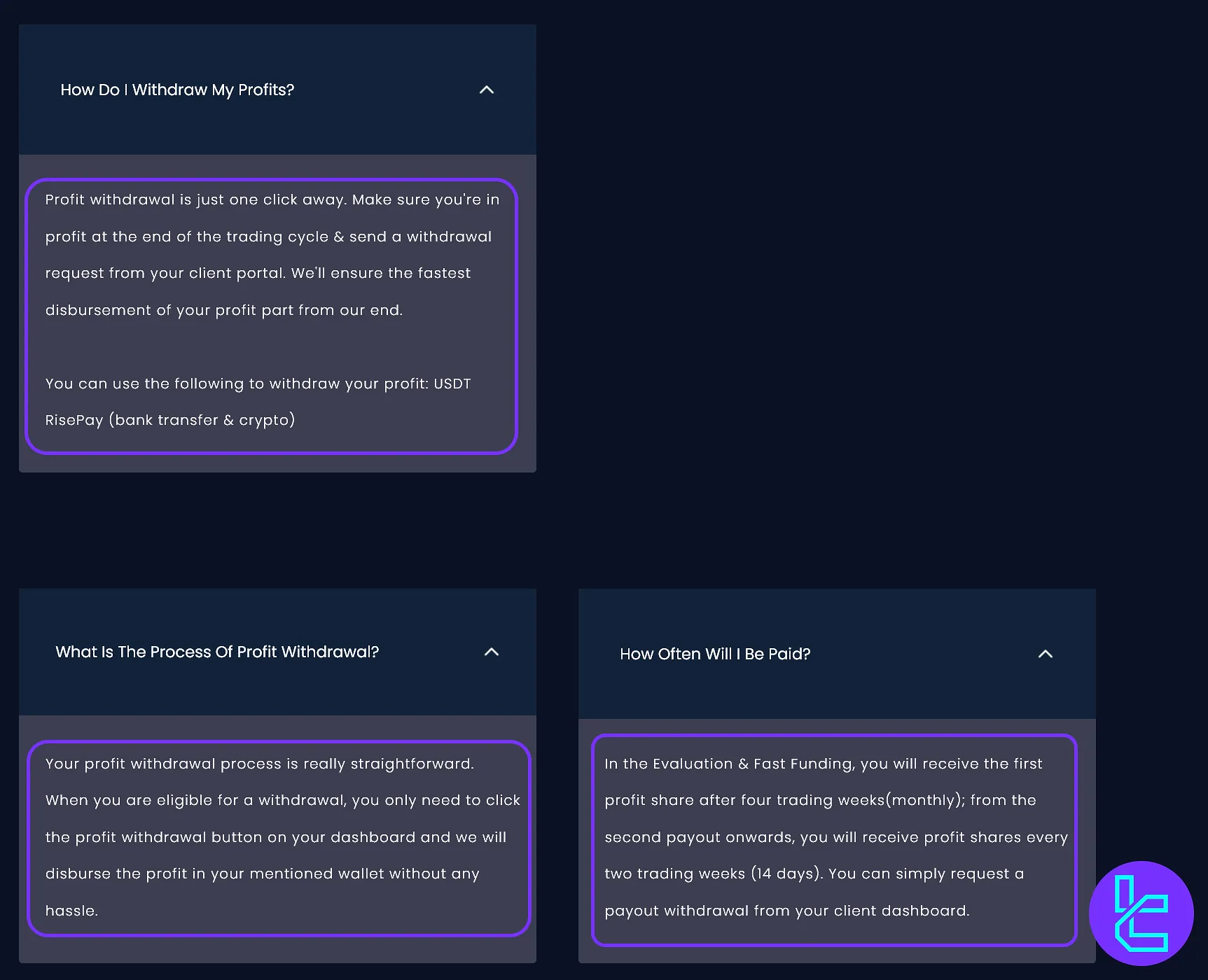

- Payouts: Direct Funded Trader offers bi-weekly payouts via USDT RisePay (bank transfer or crypto), with the first payout after four trading weeks and a simple one-click withdrawal process through the client dashboard.

VPN Usage

It is highly recommended that you do not trade from varying IP addresses.

If you find yourself in a situation where you are trading from a different location or using a Virtual Private Server (VPS), it is essential that you provide verification to Direct Funded Trader's customer support to confirm your actions.

Hedging

While hedging is allowed, using multiple accounts to hedge is strictly forbidden. This type of behavior does not align with proper trading strategies and is not permitted. For instance, you cannot place hedging trades between two accounts.

Expert Advisors (EA)

Expert Advisors and trading indicators are fully permitted. This includes trade copy tools, risk management solutions, and automated trading bots.

Furthermore, you may also use third-party EAs, but it is crucial to verify the EA before applying it to your live trading account.

Martingale and Arbitrage Strategies

Specific trading strategies are outright banned. These include:

- High-Frequency Trading (whether manual or bot-driven)

- Arbitrage (including reverse, hedge, and latency strategies)

- Scalping (including tick and grid trading)

- Martingale strategies

- One-sided betting

- Copy trading from other traders (note: copying trades from your account is allowed, but copying from others is not)

Should any of these strategies be detected in your account, the violation will result in immediate termination without prior warning.

News Trading

Direct Funded Trader has different rules for news trading during the challenge and funded phases.

During the Challenge Phase

You are allowed to trade during news events, but the company strongly recommends avoiding it due to the increased slippage and volatility that typically accompany these events.

During the Funded Phase

Trading during news events or holding trades during such events is not allowed. All positions must be closed at least five minutes before the release of high-impact news. Any new trades must only be opened five minutes after the event concludes.

Restricted News Events

Below are some of the key news events that fall within the restricted time window of five minutes before and after the event:

- Federal Reserve Interest Rate

- FOMC Minutes

- Consumer Price Index (CPI)

- Non-Farm Payrolls

- Unemployment Rate

- Gross Domestic Product (GDP) Growth Rate

- Crude Oil Inventories

- Interest Rate Announcements from Major Central Banks (BoE, ECB, BoC, etc.)

Violating the news trading restriction will result in the disqualification of your challenge.

Payouts

Direct Funded Trader ensures a fast and transparent payout experience for its traders. Once you’re in profit at the end of your trading cycle, simply submit a withdrawal request from your client dashboard.

The firm guarantees quick disbursement of profits using USDT RisePay, supporting both bank transfer and crypto methods.

The profit withdrawal process is simple and hassle-free. When eligible, traders just need to click the profit withdrawal button within their dashboard, and Direct Funded Trader transfers the profit directly to the wallet specified by the trader.

In both Evaluation and Fast Funding models, traders receive their first payout after four trading weeks.

Following that, payouts are available every two trading weeks (14 days), ensuring steady access to earned profits. All withdrawals are processed quickly through the secure client dashboard.

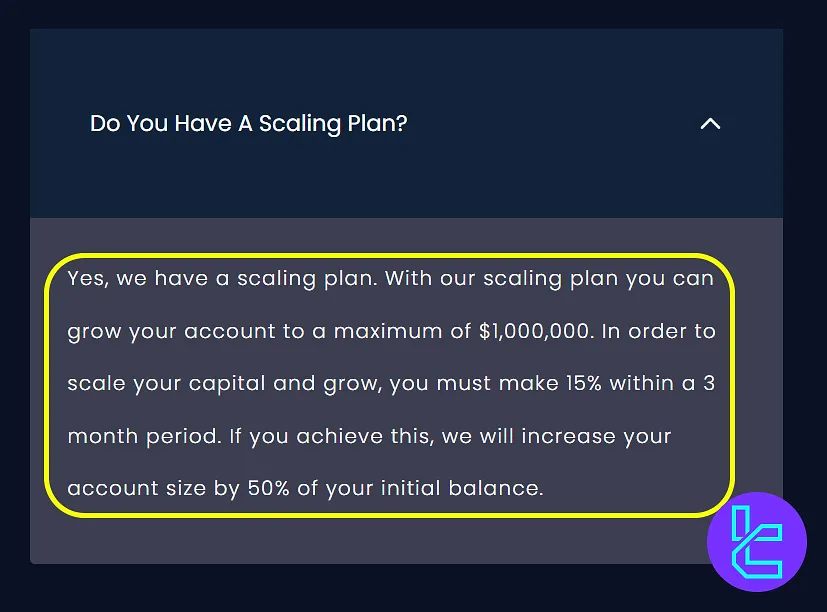

Direct Funded Trader Scaling Plan

A scaling plan is available for traders who aim to expand their capital allocation. Accounts can grow up to a $1,000,000 balance through performance-based progression. To qualify for scaling, traders must generate a 15% return within any 3-month trading period. Upon meeting this condition, the account balance is increased by 50% of the trader’s initial equity.

Direct Funded Trader Platforms

The prop firm has partnered with the Markets broker to provide access to the advanced MetaTrader 5 platform. DFT’s dashboard also indicates that the Trade Locker platform will soon be added to the firm’s offerings. MT5 download links:

While the MT5 platform has 38 built-in indicators, you can access additional complex analytical tools for free on TradingFinder’s list of MT5 indicators.

What Markets Can I Trade?

Through the partnership with the Markets broker, DFT provides 400+ trading instruments across 3 major asset classes, including:

- Forex: From major pairs to exotic crosses

- Indices: Global stock indices

- Commodities: Precious metals, energies, and agricultural products

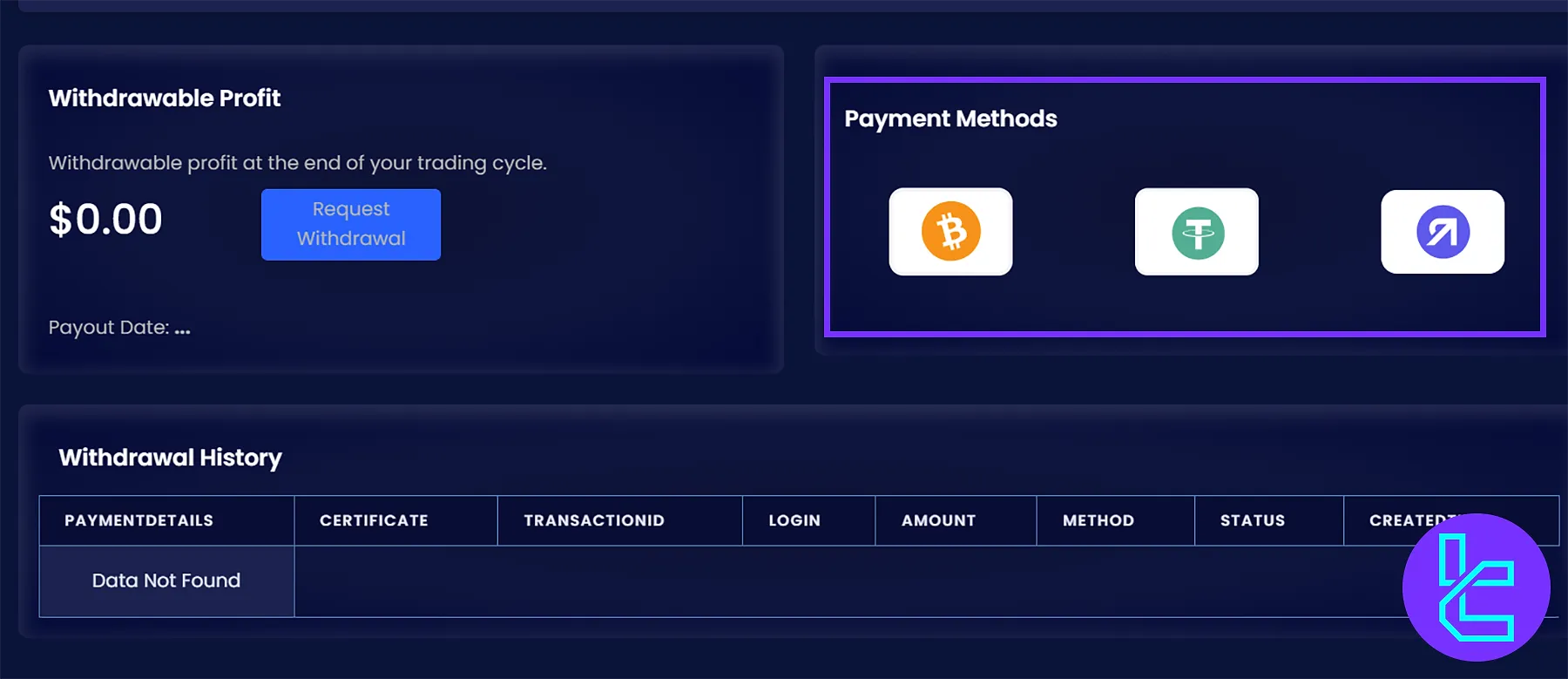

DFT Payout and Payment Options

The firm claims it supports various payment options, including Cryptocurrencies, G Pay, Apple Pay, Credit/Debit Cards, and Bank Wire.

However, while you’re in the client area, the only methods for purchasing challenges are Cards and Cryptocurrencies (NowPayments). Direct Funded Trader withdrawal options:

- Crypto: BTC and USDT

- Rise: Fiat and Crypto

Payouts are typically processed bi-weekly, except for the first one, which must be 30 days after the first trade on the funded account.

Direct Funded Trader Prop Firm Trading Fees

The company has implemented a simple fee structure consisting mainly of spreads and commissions.

- Raw spreads from 0.0 pips

- A $5 commission per traded lot

DFT offers up to 150% refunds on challenge fees and unlimited free retries. Only accounts with positive final balances that have not breached the firm’s loss limits are eligible for retries.

DFT Educational Offerings

One of the biggest letdowns in this Direct Funded Trader review is the lack of educational resources. While the firm lacks educational content, it has provided a news calendar accessible through the client’s dashboard.

Check TradingFinder’s Forex education section for comprehensive tutorials on the market and its trading conditions.

Direct Funded Trader Client Experience

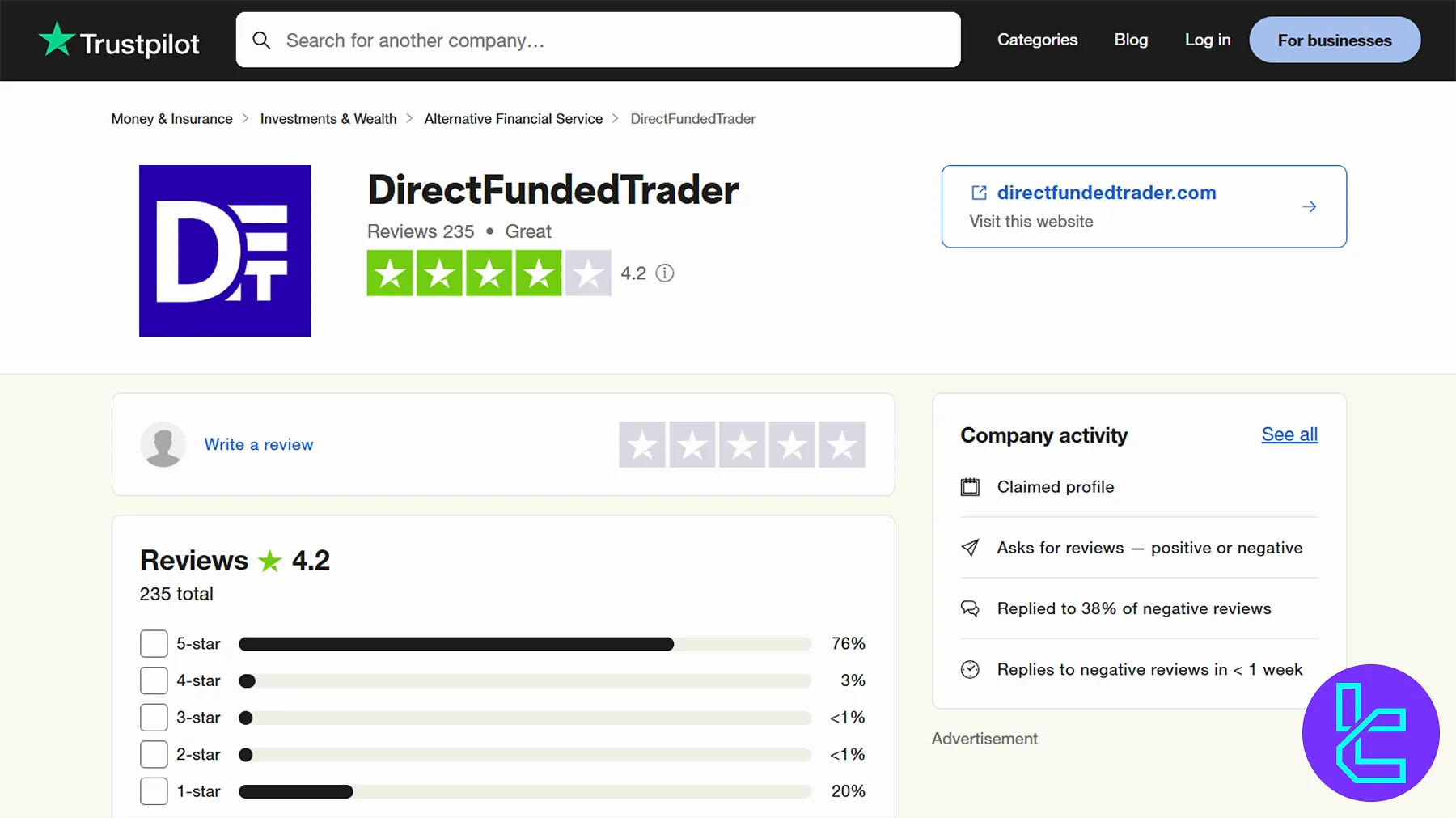

DFT has performed very well in the eyes of traders. There are 235 reviews on the DirectFundedTrader TrustPilot profile, resulting in a great 4.2 score out of 5.

79% of DFT reviews on TrustPilot are positive (4-star and 5-star). Less than 21% of them are negative (1-star and 2-star).

Direct Funded Trader Prop Firm Support Channels

The company has yet to fully develop its live chat feature, but it will be available soon. At the time of writing this Direct Funded Trader review, support is only available through email.

Support Method | Availability |

Live Chat | No |

Yes (via support@directfundedtrader.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes (through the chat feature on the website) |

FAQ | Yes (the search option does not work properly) |

Help Center | No |

No | |

Messenger | No |

Direct Funded Trader Prop Firm User Regions

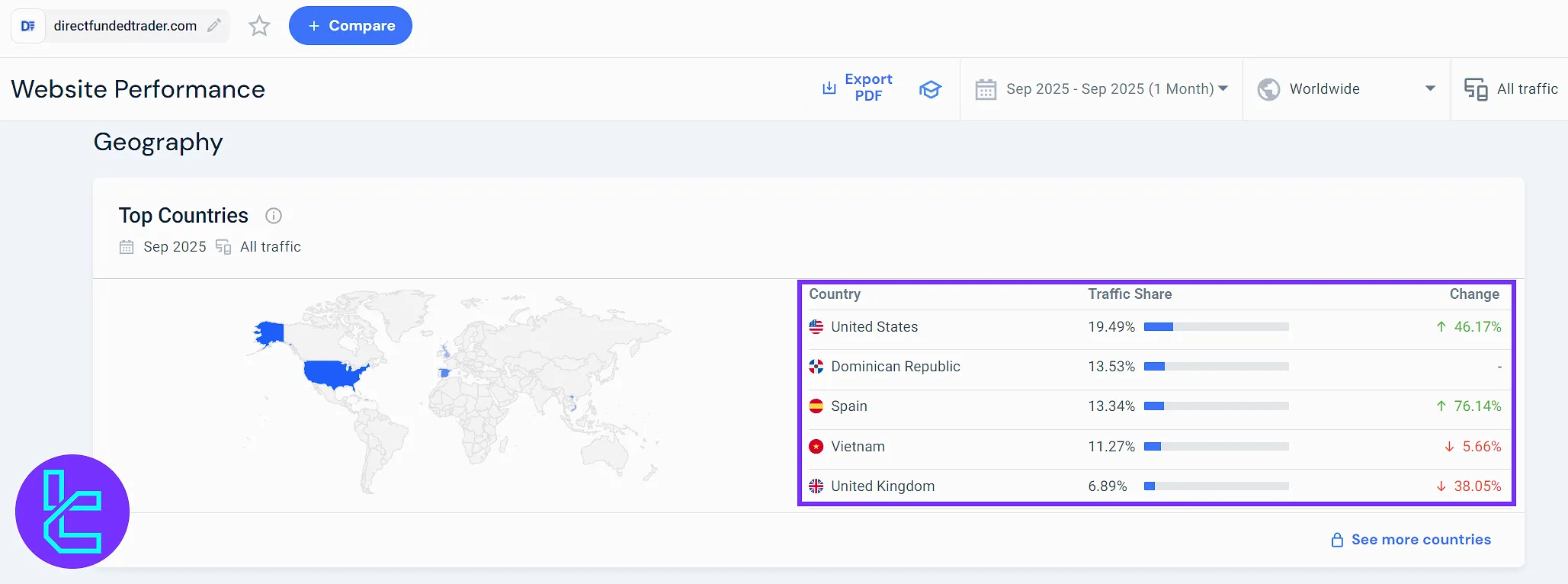

According to Similarweb’s September 2025 analytics, Direct Funded Trader’s user base is widely distributed across the Americas and Europe, with the United States leading at 19.49% of total web traffic, showing a 46.17% increase from the previous period.

The Dominican Republic (13.53%) and Spain (13.34%) follow closely, indicating strong engagement from both Latin American and European traders.

Additional traffic originates from Vietnam (11.27%) and the United Kingdom (6.89%), reflecting the firm’s growing visibility across diverse trading regions. This balanced regional mix highlights Direct Funded Trader’s expanding international footprint and its appeal among traders seeking accessible funding programs and transparent trading conditions.

DFT Social Media Profiles

The firm has an active Discord community with 3,595 members. It also has profiles on various social platforms, including:

Social Media | Members/Subscribers |

Over 3.5K | |

Over 11.5K | |

Over 27K | |

Over 1.1K |

DFT Compared to Other Prop Firms

Here's a comprehensive comparison between Direct Funded Trader and its competitors:

Parameters | Direct Funded Trader Prop Firm | Crypto Fund Trader Prop Firm | For Traders Prop Firm | FundedNext Prop Firm |

Minimum Challenge Price | $27 | $55 | $49 | $32 |

Maximum Fund Size | $1,000,000 | $200,000 | $1,500,000 | $4,000,000 |

Evaluation steps | 1-Step, 2-step | 1-phase, 2-phase | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | Up to 90% | 80% | 90% | 95% |

Max Daily Drawdown | 5% | 4% | 4% | 5% |

Max Drawdown | 10% | 6% | 8% | 10% |

First Profit Target | 8% | 8% | 6% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | N/A | 1:100 | 1:125 | 1:100 |

Payout Frequency | 10 Days | 2 Times a Month | 14 Days | From 5 Days |

Number of Trading Assets | 400+ | 200+ | 130 | 78 |

Trading Platforms | MT5 | Metatrader 5, CFT Platform and Crypto Futures | DXTrade, TradeLocker, cTrader | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

Direct Funded Trader provides trading capital of up to $1M. The prop firm supports the MT5 platform with access to 400+ trading instruments through a partnership with the Markets broker.

DFT has a Trustpilot score of 4.2/5. It offers bi-weekly payouts via Rise and Crypto methods.